Blank Sf 3107 2 PDF Template

The SF 3107-2 form plays a critical role in the retirement planning of U.S. federal employees, especially those contemplating the financial well-being of their spouses after their departure. Its primary purpose is to document the retiring employee's choice regarding the provision of a survivor annuity to their current spouse, which carries significant implications for both parties involved. The form is divided into three parts, where the first is completed by the retiring employee to declare their survivor annuity election, the second part requires the explicit consent of the current spouse to the election made, and the third part is to be completed by a notary public or an authorized individual to attest to the spouse's consent. This form underscores the law's mandate that a married retiring employee must elect to provide a survivor annuity for their spouse unless the spouse consents to waive such entitlement. Furthermore, the options elected and consented to have long-term effects, impacting the spouse’s health benefits coverage, eligibility for the Federal Long Term Care Insurance Program (FLTCIP), and potential financial security. Additionally, the form reflects the complex interplay between such elections and court orders pertaining to former spouses, thereby influencing the final survivor benefits arrangement. Consequently, the SF 3107-2 form is not just a bureaucratic requirement but a critical tool in safeguarding the financial future and rights of federal employees' spouses.

Preview - Sf 3107 2 Form

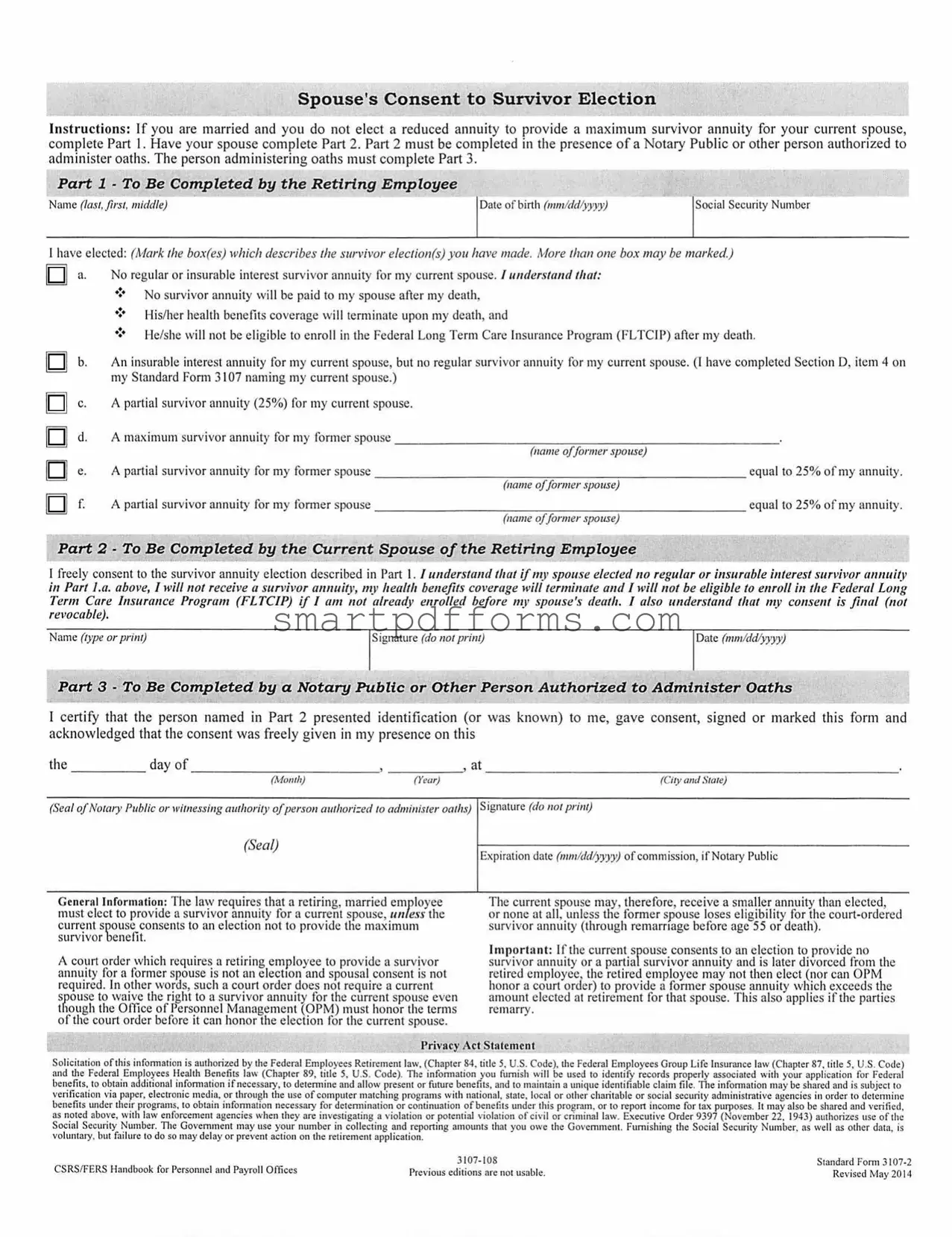

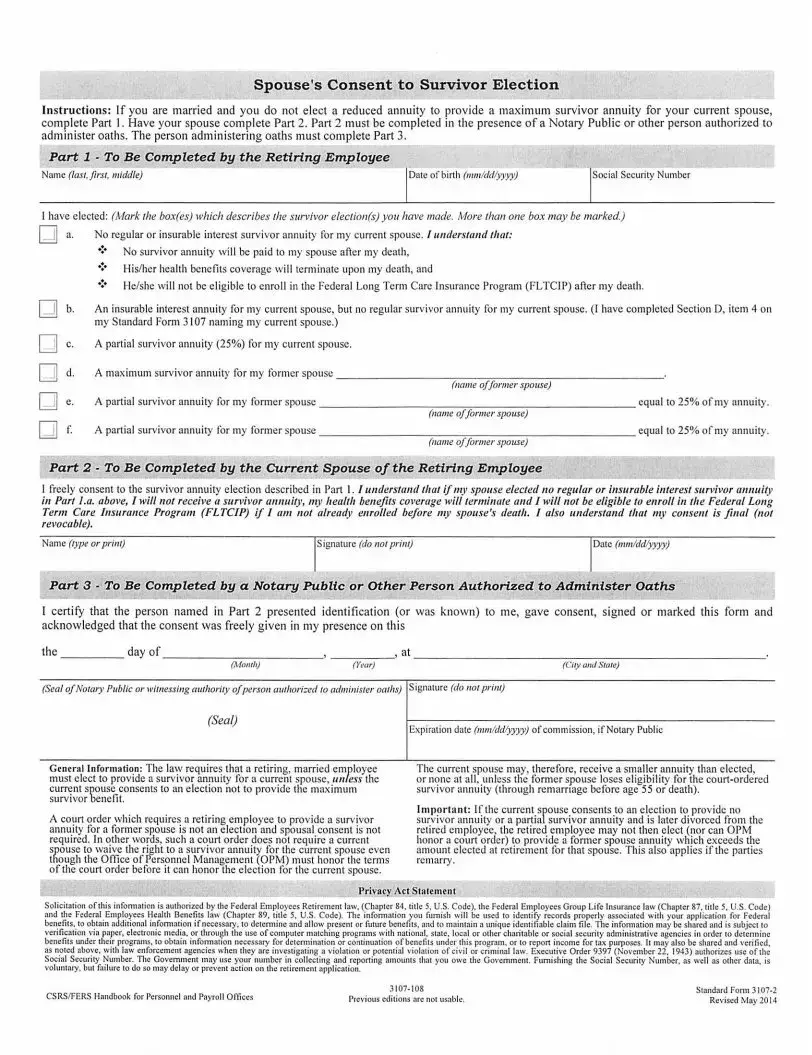

Spouse's Consent to Survivor Election

Instructions: If you are married and you do not elect a red uced annuity to provide a maximum survivor annuity for your current spouse, complete Part 1. Have your spouse complete Part 2. Part 2 must be completed in the presence of a Notary Public or other person authorized to administer oaths. The person administering oaths must complete Part 3.

Part 1 - To Be Completed by the Retiring Employee

Name (last.first. middle) |

Date of birth (111111/ddlyyYJ~ |

Social Security Number |

1 have elected: (Mark the box(es) which describes the survivor election(s) you have made. More than one box may be marked.)

Q a.

□d.

D e.

No regular or insurable interest survivor annuity for my current spouse. / understand that:

•!• No survivor annuity \viii be paid to 111y spouse after my death,

❖His/her health benefits coverage will term inate upon my death, and

❖He/she will not be eligible to enroll in the Federal Long Term Care Insurance Program ( l'LTCIP) after my death.

An insurable interest annuity for my current spouse, but no regular survivor annuity for my current spouse. (1have completed Section D, item 4 on my Standard Form 3 107 naming my current spouse.)

A partial survivor annuity (25%) for my current spouse.

A maximum survivor annuity for my fo rmer spouse |

|

|

(11ame offormer spouse) |

Apartial survivor annuity for my forme r spouse

□ f. A partial survivor annuity for my former spouse |

. , |

, |

|

(name offormer spouse) |

|

Part 2 - To Be Completed by the Current Spouse of the Retiring Employee

1 freely consent to the survivor annuity elect ion described in Part 1. / understand that if nu• spouse elected 110 regular or insurable interest survivor a111111i~)• in Part I.a. above, I will not recei ve a survivor annuity, my health benefits coverage will terminate and I will not be eligible to enroll in the Federal Long Term Care Insurance Program (FLTCIP) if I am not already enrolled bef ore my spouse's death. I also understand tlwt my consent is final (not revocable).

Name (rype or print) |

Signature (do not prim) |

Date (mm/ddlyyyy) |

Part 3 · To Be Completed by a Notary Public or Other Person Authorized to Administer Oaths

I certify that the person named in Part 2 presented identification (or was known) to me, gave consent, signed or marked this form and acknowledged that the consent was freely given in my presence on this

the _____ day of ________ ____,

(Mo111hJ |

(Year) |

(Ci1y atul S1a1e) |

(Seal ofNotary P11blic or witnessing awhority ofperson authori=ed to administer oaths)

(Seal)

Signature (do 1101 print)

Expiration date (111111/ddlyyyy) of commission, if Notary Public

Genera l Information: The law requires that a retiring, married employee must elect to provide a survivor annuity for a current spouse, unless the current spouse consents to an e lection not to provide the maximum survivor benefi t.

A court order which requires a retiring emp loyee to provide a survivor annuity for a former spouse is not an elecllon and spousal consent is not required. In other words, such a court order does not require a current spouse to waive the right to a survivor annuity for the current spouse even though the Office of Personnel Management (OPM) must honor the terms o f the court order be fore it can honor the election for the current spouse.

The current spouse may, therefore, receive a smaller annuity than elected, or none at all, un less the former spouse loses eligibility fo r the

Importan t: l f the current sf ouse consents to an election to provide no survivor annu ity or a partia survivor annuity and is later divorced from the retired employee1 the retired employee may not then e lect (nor can O PM honor a court oroer) to provide a fo rmer spouse annuity which exceeds the amount e lected at retirement for that spouse. This also applies if the parties remarry.

Privacy Act Statement

Solici1a1io11 of this infonnation is authorized by the Federal Employees Retirement law. (Chapter 84. title 5. U.S. Code), the Federal Employees Group Life Insurance law (Chapter 87. title 5, U.S. Code) and the Federal Employees Health Benefits law (Chapter 89, title 5. U.S. Code). 11,e infonnation you fumish will be used 10 identify records properly associated with your application for Federal

benefits. 10 obtain additional infonnalion ifnecessary, to dctcm1ine and allow present or future benefi1s, :rnd to maintain a unique identifiable claim fi le. The infonnation may be shared and is subject 10 vcrifica1ion via paper, electronic media, or throu~h the use of computer matching programs with national. slate, loc,11 or other charitable or social security administrative agencies in order to dctcnninc benefits under their programs. to obtain infonnnuon necessary for dctcnnination or continuation of benefits under this progr:un. or to repon income for tax purposes. It may also be shared :md \'Crificd, as noted abo\'e. with law enforcement agencies when they arc in\'cstigating a violation or potenlial violn1ion of civil or criminal law. Executive Order 9397 (November 22, 1943) authorizes use of the Social Security Number. 111c Govenunent may use your number in collecting and reponing amounts that you owe the Government. Furnishing the Social Security Number. as well as other data, is voluntary, but fai lure to do so may delay or prevent ac1ion on the rct ircmenl applicalion.

CSRS/FERS Handbook for Personnel nncl Payroll OfTices |

3 |

Standard Fonn |

Previous editions .uc not usnblc. |

Revised May 20 I4 |

Form Data

| Fact Name | Detail |

|---|---|

| Form Purpose | The SF 3107-2 form is designed for the spouse of a retiring employee to consent to the Survivor Election made by the employee. |

| Notarization Requirement | Part 2 of the form must be completed in the presence of a Notary Public or another authorized person. |

| Spousal Consent | If a retiring employee chooses not to provide a maximum survivor annuity for their current spouse, the spouse's consent is required on this form. |

| Governing Law | This process is governed by the Federal Employees Retirement Law, the Federal Employees Group Life Insurance Law, and the Federal Employees Health Benefits Law, detailed in chapters 84, 87, and 89 of title 5, U.S. Code, respectively. |

Instructions on Utilizing Sf 3107 2

Filling out the SF 3107-2 form is an essential step for retiring employees who have made specific survivorship annuity elections that do not provide for a maximum survivor annuity for their current spouse. This document serves as an acknowledgement and consent from the current spouse regarding the retirement benefits election made by the retiring employee. Here’s a simplified breakdown of how to properly complete this form:

- Part 1: To be filled out by the retiring employee. Enter your last name, first name, and middle initial in the space provided. Next, input your date of birth in the MM/DD/YYYY format, followed by your Social Security Number.

- In the section that follows, check the box that corresponds with the survivor election you have made. Options include not electing a survivor annuity for your current spouse, which has implications on their health benefits and eligibility for the Federal Long Term Care Insurance Program (FLTCIP) after your death. If applicable, fill in the name(s) of any former spouses for whom you have elected a partial or full survivor annuity.

- Part 2: This section should be completed by the current spouse of the retiring employee. The spouse must type or print their name, then sign and date the form, acknowledging their understanding and consent to the survivor annuity election described in Part 1. The importance of this section lies in its legal implications; it signifies that the spouse understands they may not receive a survivor annuity, health benefits, or eligibility for FLTCIP under certain conditions.

- Part 3: This part needs to be completed in the presence of a Notary Public or another person authorized to administer oaths. The Notary will verify the identity of the spouse, confirm their consent and understanding of the form's contents, and witness their signature. The Notary or authorized individual must then fill in the date, their location at the time of notarization, and provide their seal and signature. If the Notary has an expiration date for their commission, it must be noted here.

After completing the SF 3107-2 form, the next steps involve submitting this document as part of the retirement application package. It's important to check the retirement application instructions or contact the corresponding personnel or payroll office to ensure all necessary documents are included and correctly filled out. Prompt and accurate completion of the SF 3107-2 and associated documentation will facilitate a smoother transition into retirement and ensure that the retiring employee's elected benefits are appropriately processed and managed.

Obtain Answers on Sf 3107 2

-

What is the purpose of the SF 3107-2 form?

The SF 3107-2 form, also known as the Spouse's Consent to Survivor Election form, is a document used by retiring federal employees who are married and who choose not to elect a reduced annuity to provide a maximum survivor annuity for their current spouse. The form serves to document the spouse's consent to this election choice. Its completion is necessary to comply with federal regulations that mandate a retiring, married employee to provide for a survivor annuity for their current spouse unless the spouse consents otherwise. This consent process ensures that the retiring employee's decisions regarding survivor benefits are acknowledged and agreed upon by their spouse, protecting the interests of both parties.

-

Who needs to complete the SF 3107-2 form?

The SF 3107-2 form must be completed by married retiring federal employees who decide not to provide a full survivor benefit (maximum survivor annuity) for their current spouse. Specifically, the form is broken down into parts that involve different respondents:

- Part 1 is filled out by the retiring employee, detailing the survivor election made.

- Part 2 must be completed by the retiring employee's current spouse, indicating their awareness and consent to the election.

- Part 3 requires the signature and seal of a Notary Public or another individual authorized to administer oaths after witnessing the signing by the spouse.

-

What are the implications for the spouse if they consent to the retirement election chosen by the retiring employee as documented in the SF 3107-2 form?

If a spouse consents to the retirement election indicated in Part 1 of the SF 3107-2 form, several implications affect them directly. Firstly, if the retiring employee elects not to provide any regular or insurable interest survivor annuity for the current spouse, it means that no survivor annuity will be paid to the spouse upon the retiree's death. Additionally, the spouse's health benefits coverage will terminate upon the retiree's death, and the spouse will not be eligible to enroll in the Federal Long Term Care Insurance Program (FLTCIP) after the death of the retiree, unless already enrolled before. These conditions underscore the significance of the spouse's consent, highlighting the importance of both parties' understanding and agreement on the retirement election made.

-

Can a spouse revoke their consent once they have signed the SF 3107-2 form?

No, once the spouse has provided their consent by signing Part 2 of the SF 3107-2 form, this consent is considered final and is not revocable. This rule underscores the importance of the spouse fully understanding the implications of their consent, including the effect on their future benefits and entitlements following the retiring employee's decisions regarding survivor annuity. Therefore, this decision should be made carefully, considering all potential future scenarios.

-

Is it necessary for the form to be notarized, and if so, why?

Yes, the SF 3107-2 form requires notarization (or certification by another person authorized to administer oaths) as detailed in Part 3 of the form. This step is crucial as it serves to legally verify the identity of the spouse providing consent, ensuring that the signatory is indeed the retiree's spouse and that the consent was given freely and without coercion. Notarization adds a layer of legal authenticity and protection for all parties involved, by formally acknowledging the spouse's consent in a manner that adheres to legal standards, thus reinforcing the integrity of the process.

Common mistakes

Filling out the SF 3107-2 form requires attention to detail and understanding of the implications of the choices made. Unfortunately, there are common mistakes individuals make when completing the form. Recognizing these can help ensure the process goes smoothly and your intentions are clearly communicated.

Not fully understanding the terms: Regular survivor annuity and insurable interest annuity are terms that have significant implications for your spouse's financial security and benefits after your death. Overlooking these can result in unintended consequences.

Incomplete Part 2 by the spouse: The spouse's signature and consent are mandatory when electing not to provide the maximum survivor benefit. Missing details, like the date or signature, can invalidate the consent.

Failure to have Part 3 properly completed: This section requires a Notary Public or another authorized person to witness the spouse's consent. Incorrect or missing information, including the seal, can lead to the form being rejected.

Not considering future changes: If a divorce occurs after retirement, the form's initial elects can restrict later adjustments to survivor benefits. This oversight can cause unintended financial restrictions for a former spouse.

Ignoring the Privacy Act Statement: This statement outlines the use of personal information provided on the form. Not acknowledging or understanding this part may lead to surprises regarding how personal information is utilized.

To ensure the form serves its purpose without issues, aim to avoid these pitfalls through careful review and understanding of the form's requirements and implications.

Documents used along the form

When preparing for retirement, various forms and documents accompany the SF 3107-2, Spouse's Consent to Survivor Election. These documents are crucial in ensuring a smooth transition into retirement, particularly for federal employees and their families. Understanding each document's purpose can help streamline the retirement process.

- SF 2801 - Application for Immediate Retirement (Civil Service Retirement System - CSRS): This form is used by employees covered under the Civil Service Retirement System (CSRS) to apply for retirement benefits.

- SF 3107 - Application for Immediate Retirement (Federal Employees Retirement System - FERS): Similar to SF 2801 but for employees under the Federal Employees Retirement System (FERS), this form is filled out to initiate the retirement process.

- SF 2818 - Continuation of Life Insurance Coverage: This document lets retiring employees elect to continue their life insurance coverage into retirement.

- RI 76-21 - Assignment of Federal Employee's Group Life Insurance (FEGLI): If an employee wishes to assign their life insurance coverage to another party, such as a relative or trust, this form is used.

- W-4P - Withholding Certificate for Pension or Annuity Payments: To specify the amount of federal income tax to be withheld from retirement payments, retirees fill out this form.

- SF 2821 - Agency Certification of Insurance Status: This form is completed by the employing agency to certify an employee's life insurance coverage status at retirement.

- SF 2817 - Life Insurance Election: Employees use this form to elect life insurance coverage levels under the Federal Employees' Group Life Insurance (FEGLI) program.

- TSP-70 - Request for Full Withdrawal: For employees who have contributed to the Thrift Savings Plan (TSP), this form is used to request a full withdrawal of TSP funds upon retirement.

Filling out and submitting these forms, along with the SF 3107-2, are critical steps in securing a federal employee's retirement benefits and insurance coverage. Each document plays a specific role in ensuring the retiree and their family's future financial security.

Similar forms

The SF 3107-2 form, utilized in the context of retirement planning and benefits for federal employees, bears similarities with several other documents particularly because of its focus on beneficiary designations, consent requirements, and notarization processes. Here are documents that share these attributes:

- W-4P Form, the Withholding Certificate for Pension or Annuity Payments, requires personal information and decisions on withholding preferences. Like the SF 3107-2, it directly impacts financial planning for retirement.

- Designation of Beneficiary Form (Federal Employees' Group Life Insurance), which allows federal employees to name beneficiaries for their life insurance proceeds. Both this and the SF 3107-2 involve declaring how benefits should be handled after the death of an employee.

- Thrift Savings Plan (TSP-3) Designation of Beneficiary, lets participants in the Thrift Savings Plan designate who will receive their account in the event of their death, similar to how SF 3107-2 manages survivor annuity preferences.

- Power of Attorney, though more general in its application, requires notarization like Part 3 of the SF 3107-2. Both documents must be executed with a notary or other official witness to ensure their legality and validity.

- Health Care Proxy or Advance Directive, which designates a decision-maker for health care when one cannot make decisions themselves. Like the spouse’s consent in SF 3107-2, these documents often need clear, witnessed consent to take effect.

- Divorce Decree or Separation Agreement, in cases where these affect or dictate the distribution of retirement benefits and survivor benefits. Similar to SF 3107-2, court orders can influence or stipulate how benefits should be designated, overriding earlier designations in some instances without requiring consent.

Each document, while unique in its application, overlaps with the SF 3107-2 form through the themes of beneficiary designations, informed consent, and the legal implications of these selections on an individual’s future financial and health-related benefits.

Dos and Don'ts

Filling out the SF 3107-2 Form, notably significant for retiring employees and their spouses, demands meticulous attention. Here are several do's and don'ts to consider:

Do's- Read instructions carefully: Before filling out the form, meticulously review all the instructions to comprehend the requirements fully.

- Complete Part 1 accurately: If you are the retiring employee, ensure all details, from your name to your survivor election, are correctly filled in.

- Understand the implications: Realize the consequences of the elections made, such as the impact on survivor annuity and health benefits.

- Ensure spouse's consent: For Part 2, if you are the current spouse, acknowledge the election made by your spouse by giving your consent freely.

- Use a Notary Public for Part 3: This section must be completed in the presence of a Notary Public or an authorized person to administer oaths, confirming the identity and consent of the current spouse.

- Check for completeness and accuracy: Before submission, review the entire form to ensure all parts are complete and accurately reflect the elections made and the consent of the spouse.

- Don't rush through the form: Take your time to fill out each section correctly to avoid mistakes that could affect your or your spouse's benefits.

- Don't leave sections blank: Ensure no section applicable to your situation is left incomplete. Unfilled sections can lead to processing delays.

- Don't overlook the consent: The retiring employee's current spouse must understand the importance of their consent and the fact that it is not revocable once given.

- Don't forget to use black ink: For clarity and official purposes, fill out the form using black ink to ensure that all information is legible and copies clearly.

- Don't sign without a Notary Public for Part 3: The current spouse’s signature in Part 2 must be done in the presence of a Notary Public or authorized official for legal validity.

- Don't submit without reviewing: Double-check all entered information and make sure the form is fully completed to prevent any delays or issues with processing.

Misconceptions

There are several misconceptions surrounding the SF 3107-2 form, which is crucial for married federal employees undergoing retirement processing. Understanding these misconceptions can help in making informed decisions about survivor benefits.

- Spousal Consent Is Always Optional: It's widely believed that the SF 3107-2 form and the spouse's consent it involves can be skipped or deemed optional. In reality, completing and obtaining consent through this form is a legal requirement for married federal employees who choose not to provide the maximum survivor annuity for their spouse. If the employee elects against the maximum benefit, the spouse must consent to this decision in writing.

- The Form Is Only Relevant for Current Spouses: While the form primarily focuses on the consent of a current spouse, it also includes provisions for former spouses. Specifically, an employee can elect a survivor annuity for a former spouse, but this does not absolve the requirement for the current spouse's consent if reducing or waiving the survivor annuity.

- Notarization Is Optional: A common misconception is that the notarization of the spouse's consent is optional or can be completed by any witness. In fact, Part 2 of the form must be completed in the presence of a Notary Public or another person authorized to administer oaths, who must also complete Part 3. This process is not merely a formality but a legal necessity to validate the spouse's consent.

- Consent Once Given Can Be Revoked: Another misunderstanding is that once the consenting spouse signs Part 2 of the form, this decision can be revoked at a later date. On the contrary, once the consent is given and the form is submitted, the decision is final and cannot be changed or revoked by the spouse.

- Form Is Only a Formality and Does Not Impact Benefits: Some might mistakenly believe that the SF 3107-2 is just paperwork that doesn't have real consequences. This is incorrect, as the choices made and consent given directly impact the survivor benefits allocated. If a spouse consents to a reduced annuity or no annuity, this decision affects their eligibility for survivor annuity, health benefits, and enrollment in the Federal Long Term Care Insurance Program after the employee's death.

Understanding the significance and requirements of the SF 3107-2 form is essential for retiring federal employees and their spouses to ensure informed decisions are made regarding survivor benefits.

Key takeaways

When dealing with the SF 3107-2 form, it's crucial for federal employees contemplating retirement and their spouses to understand the implications of the choices being made regarding survivor benefits. These notes aim to clarify the process, ensuring informed decisions that best suit family needs and legal requirements.

- Understanding Spousal Consent: If a federal employee decides against providing a maximum survivor annuity for their current spouse, the SF 3107-2 form requires the explicit consent of the spouse. This formality affirms that the spouse understands the implications, including the potential loss of survivor annuity, health benefits termination upon the employee's death, and ineligibility for the Federal Long Term Care Insurance Program.

- Completion Requirements: Part 1 of the form is filled out by the retiring employee, where they indicate their election regarding the survivor annuity. It’s essential for the retiring employee to clearly mark their choice to ensure their spouse is fully informed before giving consent.

- Notarization Is Mandatory: For the consent to be valid, Part 2, completed by the spouse, must be witnessed by a Notary Public or another authorized individual. This step is critical as it adds a level of legal verification to the spouse’s consent, underscoring the seriousness of the decision.

- Irrevocability of Consent: Spouses should note that once consent is given and processed, it is final and cannot be revoked. This underscores the importance of understanding all implications and discussing options thoroughly before making a decision.

- Court Orders and Survivor Annuity: It is important to recognize that a court order requiring a retiring employee to provide a survivor annuity for a former spouse does not necessitate spousal consent and takes precedence. However, the current spouse’s potential survivor annuity might be reduced or nullified unless the former spouse loses eligibility.

- Privacy and Use of Information: The form’s Privacy Act Statement clarifies the authority under which the information is collected, its intended uses, and possible sharing for verification or law enforcement purposes. Providing accurate information is not only a legal requirement but also essential for the correct processing of retirement benefits.

Given these points, it's clear that completing the SF 3107-2 form with accuracy and due diligence is pivotal. Both the retiring employee and their spouse must fully grasp the long-term implications of their survivor benefit elections. Making well-informed decisions will safeguard their interests and ensure compliance with federal retirement policies.

Popular PDF Forms

When Must a Competent Person Conduct an Inspection of a Sling - Equipped with a remarks section for inspectors to provide additional context or notes, enhancing the utility and comprehensiveness of the record.

Golds Gy - Get informed right from the start with a notice to all purchasers, emphasizing the importance of reading the contract thoroughly.

What Is a Test Requisition - The form accommodates a wide range of tests from basic urinalysis to comprehensive metabolic profiles, ensuring a thorough patient examination.