Blank Sf 3107 PDF Template

The revision of Standard Form (SF) 3107, Application for Immediate Retirement, Federal Employees Retirement System (FERS), marks a notable update in the retirement process for federal employees. As of January 1997, with updates informed by Public Law 104-134, this form has introduced necessary adjustments to accommodate direct deposit requirements for all federal retirees and survivors through Electronic Funds Transfer (EFT). This inclusion ensures compliance with the law, mandating that retirees either opt for direct deposit into a checking or savings account or certify the absence of such accounts. Alongside the form, a revised informational pamphlet, "Applying for Immediate Retirement Under the Federal Employees Retirement System" (SF 3113), provides essential guidance to applicants. It covers critical aspects like eligibility, continuation of health benefits and life insurance, application procedures, payment details, and information on survivor benefits, aiming to smooth the transition into retirement. The outdated editions of both the form and pamphlet are replaced to reflect these changes, ensuring that applicants have up-to-date resources for their retirement planning. Furthermore, these materials are obtainable through the General Services Administration's (GSA) Federal Supply Service, indicating an organized effort to make the application process as accessible as possible. This comprehensive approach underscores the dedication to facilitating a seamless move for federal employees into their retirement phase, backed by thorough preparation and informed decision-making.

Preview - Sf 3107 Form

Application for Immediate Retirement

Federal Employees Retirement System

Federal Employees Retirement System

This application is for you if you are a Federal employee covered by the Federal Employees Retirement System (FERS) and you wish to apply for retirement with an immediate annuity. You should use this application if you want to apply for an annuity which will begin within 30 days of your separation from Federal service.

Do not use this application to apply for a deferred annuity. A deferred annuity begins more than 30 days after the date of final separation. If you want to apply for a deferred annuity, call the Office of Personnel Management (OPM) on

You should have received an informational pamphlet SF 3113, Applying for Immediate Retirement Under the Federal Employees Retirement System, with this application. If you did not receive the pamphlet you should get a copy from your employing agency or from our website at

Retirement benefits and retirement processing are complicated. Read the information in the pamphlet carefully. When you decide to retire, give your agency advance notice so it can be sure your records are complete and it can carry out its responsibilities in processing the paperwork associated with your retirement.

Give your completed application to the personnel office of your employing agency. They will forward your application to your agency payroll office and then to the Office of Personnel Management for processing. If you have any questions, ask your employing office for assistance.

You must apply separately for any benefits payable from the Thrift Savings Plan and the Social Security Administration.

If your address changes after your application has been forwarded to the Office of Personnel Management, call us on

Instructions for Completing Application

Type or print clearly. If you need more space in any section, use |

Item 4: Indicate whether or not you have performed active duty |

||

a plain piece of paper with your name, date of birth, and Social |

that terminated under honorable conditions in the |

||

Security Number written at the top. If you do not know an |

armed services or other uniformed services of the |

||

answer write "unknown." If you are unsure of information (for |

United States including the following: |

||

example, if you do not know an exact date), answer to the best |

a. |

Army, Navy, Marine Corps, Air Force or Coast |

|

of your ability, followed by a question mark (?). |

|||

|

Guard of United States; |

||

|

|

||

The following additional information should help you to answer |

b. |

Regular Corps or Reserved Corps of the Public |

|

those questions on the application which are not entirely |

|

Health Service after June 30, 1960; |

|

c. |

Commissioned Officer of the National Oceanic |

||

|

|||

Section A - Identifying Information |

|

and Atmospheric Administration after June 30, |

|

Item 2: List other names under which you have been employed |

|

1961 or a predecessor entity in function; |

|

in the Federal government (such as a maiden name). |

d. |

Cadet at the U.S. Military Academy, U.S. Air |

|

This will help us to locate and identify records |

|||

maintained under these names. |

|

Force Academy, U.S. Coast Guard Academy, or |

|

|

|

midshipman at the U.S. Naval Academy. |

|

Item 3: Enter the address to which correspondence should be |

e. |

Excluding the National Guard, active service in the |

|

mailed. Do not enter the bank address where your |

|||

payments will be deposited here; see Section H of the |

|

reserve components of the uniformed services, |

|

application form for payment information. |

|

including active duty for training, is military |

|

Item 4: Give a telephone number where you can be reached |

|

service. Service as a National Guard member does |

|

|

not meet the definition of military service for |

||

after you retire and the best time to reach you during |

|

purposes of civil service retirement, except when |

|

business hours. |

|

the member is ordered to active duty in the service |

|

Section B - Federal Service |

|

of the United States or performs |

|

|

Guard duty (as such term is defined in section |

||

Item 2: Enter the date of final separation for retirement. (Leave |

|

101(d) of title 10) if the National Guard duty |

|

|

interrupts creditable civilian service under |

||

blank if applying for disability retirement and not |

|

||

|

subchapter I of chapter 84 of title 5, and is |

||

separated.) Please note that if you are currently serving |

|

||

|

followed by reemployment in accordance with |

||

in more than one appointive or elective position in the |

|

||

|

chapter 43 of title 38 that occurs on or after August |

||

Federal Government, you must separate from all such |

|

||

|

1, 1990. |

||

positions before you can qualify for an immediate |

|

||

retirement. |

|

|

|

CSRS/FERS Handbook for Personnel and Payroll Offices

Previous editions are not usable. |

Standard Form 3107 |

Revised May 2014 |

If you have performed such service, complete and attach Schedule A, furnishing the requested information for each period of active duty.

To receive FERS credit for military service performed on or after January 1, 1957, you must pay a deposit. The amount of the deposit is:

For service performed through 12/31/98 (3% of your military basic pay).

For service performed from 1/1/99 through 12/31/99 (3.25% of your military basic pay).

For service performed from 1/1/00 through 12/31/00 (3.4% of your military basic pay).

For service performed from 1/1/01 to the present (3% of your military basic pay).

You must pay the deposit to your agency while you are still employed. You may not pay OPM after you retire.

If you are entitled to have part of your retirement computed under CSRS rules, military service performed prior to your transfer to FERS comes under CSRS deposit rules. These rules are as follows:

The CSRS deposit is 7 percent of your military basic pay.

If you were first employed in a civilian position subject to CSRS coverage before October 1, 1982, you do not pay the deposit and you are eligible for a Social Security benefit at age 62, the CSRS part of your annuity will be recomputed at age 62 to delete credit for the

If you were first employed in a civilian position subject to CSRS coverage on or after October 1, 1982, you will not receive any credit for

CSRS military service deposits must also be paid to your agency while you are still employed.

The law gives an alternate method to compute the military deposit if an employee served on active duty, and such service interrupted creditable civilian service under subchapter I of chapter 84 of title 5, and was followed by reemployment in accordance with chapter 43 of title 38 that occurs on or after August 1, 1990. The employee pays no more than the amount of retirement contributions that would have been withheld from basic pay during civilian service if the employee had not performed the period of military service.

Item 5: If you are receiving, or have applied for, military retired pay or benefits from the Department of Veterans Affairs in lieu of military retired pay, answer "yes" to Item 5, then complete and attach Schedule

This information is needed to assure correct credit for military service. With limited exceptions, you must waive your military retired pay to receive credit for your military service in your FERS annuity.

You may receive credit in your FERS annuity for your military service without waiving your military retired pay if you are entitled to military retired pay awarded for:

reserve service under Chapter 1223, title 10, U.S. Code (formerly Chapter 67, title 10); or

a disability incurred in combat with an enemy of the United States; or caused by an instrumentality of war in the line of duty during a period of war as defined by Section 1101 of title 38.

Attach a copy of your retirement order from your military service to this application. If applicable, also attach a copy of your military service's determination that your military disability retirement was service connected and incurred in combat as described, or caused by an instrumentality of war as described. Only your military service branch can make this determination; the Department of Veterans Affairs cannot make this determination. If you do not have verification of the type and conditions of your military retirement, you should get the verification from the retirement service organization of your military service before you retire from your civilian position.

If you are waiving military retired pay for FERS retirement purposes, your agency can help you prepare your request for waiver. Attaching a copy of your waiver request and the military finance center's acknowledgment (if available) to your application may help us to process your claim more quickly. (Even if you have already waived your military retired pay to receive benefits from the Department of Veterans Affairs, you also need to file a waiver for FERS.)

Obtain counseling from the military before waiving military retired pay for FERS retirement if you receive or may receive Combat Related Special Compensation (CRSC) or concurrent receipt of military retired pay and veterans compensation.

Reminder: Even if you have waived military retired pay or qualify for one of the exceptions to waiver, you must pay a military deposit for your military service performed after 1956 to receive credit for the service in your FERS annuity, and the military deposit must be paid to your employing agency before you retire.

Section C - Marital Information

Item 2: Indicate whether you have a living former spouse to whom a court order awards a survivor annuity or a portion of your retirement benefits based on your Federal employment. If you answer "yes," you must submit a certified copy of the court order and any attachments or amendments.

Section D - Annuity Election

(See pages

Read the information about survivor benefits found in the pamphlet, Applying for Immediate Retirement Under FERS, before completing Section D.

Survivor elections terminate upon the death of the person elected. An election of a survivor annuity for a current spouse in box 1 or 2 also terminates upon a divorce from that spouse. An election of a survivor annuity for a former spouse in box 5 also terminates if that former spouse remarries before age 55, unless the annuitant and the former spouse were married for 30 years or more. You must notify us when one of those events terminating a survivor election occurs. Also notify us if a former spouse who is entitled to a survivor annuity under a court order acceptable for processing becomes ineligible for the former spouse annuity because of a reason specified in the court order or because of a remarriage prior to age 55.

2 |

Standard Form 3107 |

Revised May 2014 |

Please note that, in accordance with the law, both a survivor |

You may elect to provide a survivor annuity for more |

||||

annuity election made at retirement and a survivor annuity |

than one former spouse. The total of the survivor |

||||

election made before a divorce, terminate upon death or |

annuities must equal either 25% or 50% of your |

||||

divorce and the annuitant must make a new election (reelection) |

unreduced annuity. |

||||

within 2 years after the terminating event to provide a survivor |

If you are married, you must have your spouse's consent |

||||

annuity for a spouse acquired after retirement or for a former |

|||||

spouse. Continuing a survivor reduction, by itself, is not |

to choose this option, because any benefit elected for a |

||||

effective to reelect a survivor annuity for a spouse married after |

former spouse limits what can be elected for your |

||||

retirement or for a former spouse. |

|

|

current spouse. (Complete and attach SF |

||

Box 4: If you initial Box 4, a person selected by you, |

Spouse's Consent to Survivor Election, to your |

||||

application.) The maximum combined survivor benefits |

|||||

|

who has an insurable interest in you, will receive |

||||

|

that can be elected for your current and former spouse(s) |

||||

|

a survivor annuity upon your death. Insurable |

||||

|

is 50% of your benefit. |

||||

|

interest exists if the person named may reasonably |

||||

|

|

||||

|

expect to derive financial benefit from your |

Section E - Insurance Information |

|||

|

continued life. A disabled child or a former |

||||

|

Item 1b: Indicate whether there is a court order or |

||||

|

spouse are persons who might have an insurable |

||||

|

interest in you. |

|

|

administrative order currently in effect that |

|

|

If you choose an insurable interest survivor |

requires you to provide health benefits coverage |

|||

|

for your child(ren). If you answer "yes", you must |

||||

|

annuity, the survivor annuity will be 55 percent of |

submit a copy of the court order or administrative |

|||

|

your annuity after your annuity has been reduced |

order. |

|||

|

to provide this benefit. The table below shows the |

|

|||

|

reduction percentages. |

|

|

Section F - Other Claim Information |

|

|

Any employee who is not retiring for disability |

||||

|

Item 1: If you have applied for, or have ever received, workers' |

||||

|

and who can prove good health may elect a |

||||

|

compensation from the Office of Workers' |

||||

|

reduced annuity to provide a survivor annuity for |

||||

|

Compensation Programs, U.S. Department of Labor, |

||||

|

a person having an insurable interest in the |

||||

|

because of a |

||||

|

retiree. |

|

|

||

|

|

|

"yes" box and complete Schedule C. |

||

|

|

|

|

||

|

You may elect this insurable interest survivor annuity |

In Schedule C you should provide the following |

|||

|

in addition to a regular survivor annuity for a current or |

||||

|

information: |

||||

|

former spouse. If you elect an insurable interest annuity |

||||

|

|

||||

|

for your current spouse, you must both jointly waive |

1. If you are receiving or have received |

|||

|

the current spouse annuity. Generally, an insurable |

compensation, enter your compensation claim |

|||

|

interest annuity cannot be cancelled. However, if you |

number(s), the beginning and ending dates of each |

|||

|

elect an insurable interest annuity for your current |

period for which compensation was paid, and |

|||

|

spouse because a former spouse is entitled to the |

whether the benefits were a scheduled award, |

|||

|

regular survivor annuity (under a court order acceptable |

disability or other type of compensation. |

|||

|

for processing or based on your election of that |

2. If you have applied for, but are not receiving |

|||

|

survivor benefit for the former spouse), you can |

||||

|

convert the insurable interest election for your current |

benefits, indicate whether your claim is pending |

|||

|

spouse to a current spouse annuity within two (2) years |

or has been denied and the claim numbers |

|||

|

of the former spouse losing entitlement to the regular |

applicable. |

|||

|

survivor annuity. |

|

|

3. Indicate whether you agree to notify us if the |

|

|

If you choose an insurable interest annuity, the amount |

||||

|

status of your workers' compensation claim |

||||

|

of the reduction in your annuity will depend upon the |

changes and whether or not you authorize the |

|||

|

difference between your age and the age of the person |

Office of Personnel Management and/or the |

|||

|

named as survivor annuitant, as shown in the table |

Office of Workers' Compensation Programs to |

|||

|

below. |

|

|

collect any overpayment if we find that you |

|

|

Age of the Person Named |

Reduction |

|

were paid, but not eligible for, both compensation |

|

|

in Relation to That of |

in Annuity |

|

and annuity benefits covering the same period of |

|

|

|

time. Without this authorization from you, we |

|||

|

Retiring Employee |

of Retiring |

|

||

|

|

will not pay your annuity until we can confirm |

|||

|

|

Employee |

|

||

|

|

|

that OWCP is not paying you compensation. |

||

|

Older, same age, or less than 5 years younger |

10% |

|

The information requested regarding benefits from |

|

|

|

|

|

the Office of Workers' Compensation Programs is |

|

|

5 but less than 10 years younger |

15% |

|

||

|

|

needed because the law prohibits the dual compen- |

|||

|

10 but less than 15 years younger |

20% |

|

sation which would exist if you received both a |

|

|

|

FERS annuity and compensation for total or partial |

|||

|

|

|

|

||

|

|

|

|

disability under the Federal Employees' Compen- |

|

|

15 but less than 20 years younger |

25% |

|

||

|

|

|

|

sation Act. |

|

|

20 but less than 25 years younger |

30% |

|

||

|

|

Section G - Information About Children |

|||

|

|

|

|

||

|

25 but less than 30 years younger |

35% |

|

||

|

|

Complete Section G by providing the names and dates of birth |

|||

|

|

|

|

||

|

30 or more years younger |

40% |

|

of your unmarried dependent children under the age of 22. Also |

|

|

|

|

|

list any child who is over age 22 and incapable of |

|

Box 5: If you initial box 5, your former spouse(s) will receive a |

because of mental or physical disability incurred before age 18. |

||||

Check the box headed "disabled" by the name of each child to |

|||||

|

survivor annuity upon your death. The maximum |

||||

|

whom this applies. Information about your children in your |

||||

|

survivor annuity payable to your former spouse(s) is |

||||

|

annuity claim file may help to expedite the processing of claims |

||||

|

50% of your unreduced annuity. Your annuity will be |

||||

|

for survivor benefits in the event of your death. |

||||

|

reduced 5% or 10% according to the total benefit you |

||||

|

|

||||

|

want to provide. |

3 |

Standard Form 3107 |

||

|

|

Revised May 2014 |

|||

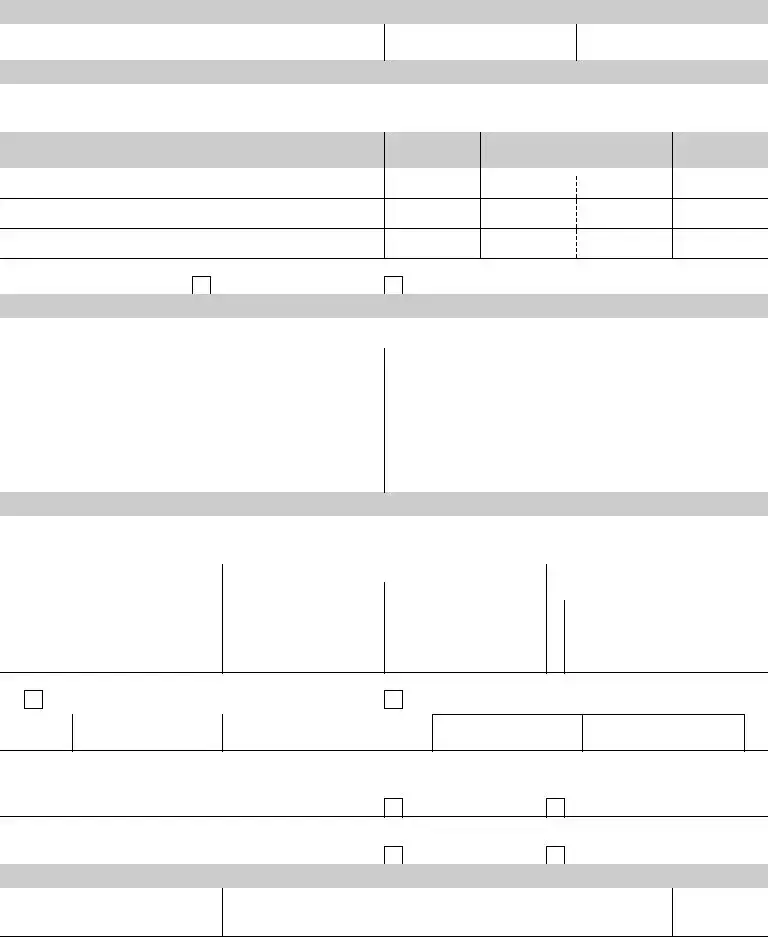

Section H - Payment Instructions

Complete in all cases. The US Department of the Treasury pays all Federal benefit payments electronically. Most Federal payments are paid by Direct Deposit into a savings or checking account at a financial institution. If you do not have a bank account, or prefer not to have your annuity payments deposited directly to your bank account, you can choose a Direct Express debit card. If you choose this option, your annuity payment will be automatically deposited to the Direct Express card on the payment date. To obtain a debit card, go to www.godirect.org or call

You cannot receive your annuity payments by direct deposit or the Direct Express debit card program if your permanent payment address is outside the United States in a country where these programs are not available.

Section I - Applicant's Certification

Be sure to sign (do not print) and date your application after reviewing the warning.

Privacy Act Statement

Solicitation of this information is authorized by the Federal Employees Retirement law, (Chapter 84, title 5, U.S. Code), the Federal Employees Group Life Insurance law (Chapter 87, title 5, U.S. Code) and the Federal Employees Health Benefits law (Chapter 89, title 5, U.S. Code). The information you furnish will be used to identify records properly associated with your application for Federal benefits, to obtain additional information if necessary, to determine and allow present or future benefits, and to maintain a unique identifiable claim file. The information may be shared and is subject to verification via paper, electronic media, or through the use of computer matching programs with national, state, local or other charitable or social security administrative agencies in order to determine benefits under their programs, to obtain information necessary for determination or continuation of benefits under this program, or to report income for tax purposes. It may also be shared and verified, as noted above, with law enforcement agencies when they are investigating a violation or potential violation of civil or criminal law. Executive Order 9397 (November 22, 1943) authorizes use of the Social Security Number. The Government may use your number in collecting and reporting amounts that you owe the Government. Failure to furnish the requested information may delay or prevent action on your application. Information you provide about your unmarried dependent children may be used to expedite their claims after you die; however, your failure to supply such information will not affect any future rights they may have to benefits.

4 |

Standard Form 3107 |

Revised May 2014 |

Federal Employees Retirement System

Application for Immediate Retirement

Federal Employees Retirement System

See Privacy Act

Information on

Instruction Sheet

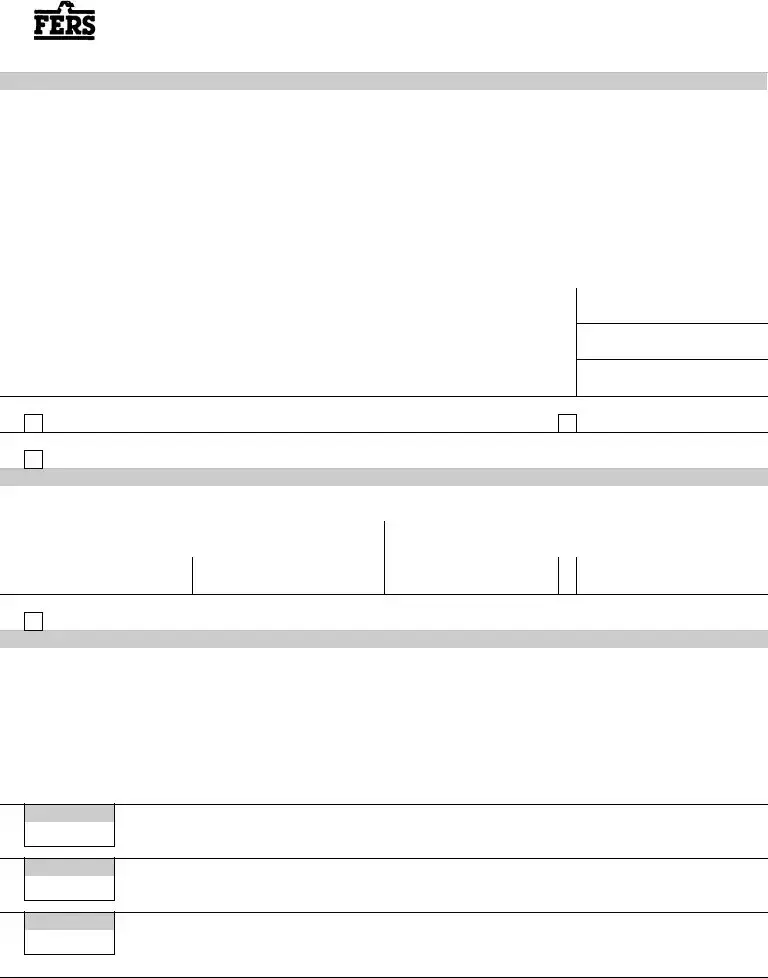

Section A - Identifying Information

1. |

Name (last, first, middle) |

|

|

|

|

2. List all other names you have used |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Address (number, street, city, state, ZIP code) |

4a. |

Daytime telephone # after retirement (including area |

4b. |

Best time to reach you |

|

|

||||

|

|

|

|

|

|

code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4c. |

Home email address |

4d. |

FAX Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Date of birth (mm/dd/yyyy) |

6. |

Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Are you a citizen of the United States of America? |

8. |

Is this an application for disability retirement? |

|

|

|

|

||||

|

|

Yes |

|

No |

|

Yes (Ask your employing office about other documents you must submit) |

|

No |

|||

|

|

|

|

|

|||||||

Section B - Federal Service |

|

|

|

|

|

|

|

||||

1. |

Department or agency from which you are retiring (include bureau or division, address and ZIP code) |

2. |

Date of final separation (mm/dd/yyyy) |

||||||||

|

|

|

|

|

|

|

|

3. |

Title of position from which you are |

||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

retiring |

|

|

|

|

|

|

|

|

|

|

3a. |

Your pay plan and occupational series |

||

|

|

|

|

|

|

|

|

||||

4.Have you performed active honorable service in the Armed Forces or other uniformed services of the United States (see instructions for definitions)?

Yes (Complete Schedule A and attach it to this form) |

No |

5.Are you receiving or have you applied for military retired pay? (Note: If you later become entitled to military retired pay you must notify OPM.)

Yes (Complete Schedule B and attach it to this form) |

|

No |

Section C - Marital Information (All applicants must complete questions 1 and 2 below.)

1.Are you married now? (A marriage exists until ended by death, divorce, or annulment.)

|

|

Yes (Complete items 1a - 1f and attach a copy of your marriage certificate) |

|

No (Go to item 2) |

|||

1a. |

Spouse's name (last, first, middle) |

|

1b. |

Spouse's date of birth (mm/dd/yyyy) |

1c. Spouse's Social Security Number |

||

|

|

|

|

|

|

||

1d. |

Place of marriage (city, state) |

1e. Date of marriage (mm/dd/yyyy) |

1f. |

Marriage performed by: |

Clergyman or Justice of Peace |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (explain): |

2.Do you have a living former spouse(s) to whom a court order gives a survivor annuity or a portion of your retirement benefits based on your Federal employment?

Yes (Attach a certified copy of the court order[s] and any amendments.) |

|

No |

Section D - Annuity Election

Make your election by initialing the box beside the type of annuity you want to receive and give any other information requested. Read the pamphlet SF 3113, Applying for Immediate Retirement under FERS and the explanations below and consider your election carefully. No change will be permitted after your annuity is granted except as explained in the pamphlet. If you are married at retirement, the law provides an annuity with full survivor benefits for your spouse unless your spouse consents to your election not to provide maximum survivor benefits.

Your election to provide a survivor annuity for a current spouse terminates upon the death of that spouse or if the marriage ends due to divorce or annulment. You are required to make a new election (reelect) within 2 years of the terminating event if you wish to reelect a survivor annuity for a former spouse or within 2 years of a

If you want to elect a partial survivor annuity for your current spouse and a survivor benefit for a former spouse, you should complete options 2 and 5 below. The total of the survivor annuities elected cannot exceed 50 percent. An election of an insurable interest survivor in option 4 is not included when determining the 50 percent maximum.

1.

Initials

I choose a reduced annuity with maximum survivor annuity for my spouse named in Section C. If you are married at retirement, you will receive this type of annuity unless your spouse consents to your election not to provide maximum survivor benefits. If you receive this annuity, your annuity will be reduced by 10%. Your spouse's annuity upon your death will be 50% of your unreduced earned annuity.

2.

Initials

I choose a reduced annuity with a partial survivor annuity for my spouse named in Section C. If you choose this option, your annuity will be reduced by 5%. Upon your death, your spouse's annuity will be 25% of your unreduced earned annuity. You must have your spouse's consent to choose this option. Complete form SF

3.

Initials

I choose an annuity payable only during my lifetime. If you are married at retirement, you cannot choose this type of annuity without your spouse's consent. No survivor annuity will be paid to your spouse after your death if he or she consents to this election and any health benefits will cease. In addition, your spouse will not be eligible to enroll in the Federal Long Term Care Insurance Program, if he/she is not enrolled at the time of your death. If you are married and elect this, complete form SF

|

Standard Form 3107 |

|

CSRS/FERS Handbook for Personnel and Payroll Offices |

Previous editions are not usable. |

Revised May 2014 |

4.

Initials

I choose a reduced annuity with survivor annuity for the person named below who has an insurable interest in me. You must be healthy and willing to provide medical evidence if you choose this type of annuity. (Disability annuitants are not eligible to choose this type of annuity.) If you are married and elect this option for your spouse, complete SF

Name of person with insurable interest |

|

Relationship to you |

Date of birth (mm/dd/yyyy) |

Social Security Number |

||

|

|

|

|

|

|

|

5. |

Initials |

I choose a reduced annuity with survivor annuity for my former spouse(s) as follows: You must attach: (1) Copies of divorce |

||||

|

|

decrees for all former spouses for whom you elect to provide a survivor annuity. (2) If you are married, attach a completed |

||||

|

|

|||||

|

|

SF |

Spouse's Consent to Survivor Election. You cannot choose this option and provide a maximum survivor annuity for |

|||

your spouse (Box 1). Your election to provide a survivor annuity for a former spouse terminates upon the death of that spouse or the remarriage of your former spouse before age 55.

Name and address of former spouse |

|

Date of marriage |

Date of divorce |

|

|

|

|

|

|

(mm/dd/yyyy) |

(mm/dd/yyyy) |

|

Survivor annuity equal |

|

|

|

|

|

|

to _______________% |

|

||

|

|

Date of birth |

Social Security Number |

|

|||

|

|

(mm/dd/yyyy) |

|

|

|

of my annuity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and address of former spouse |

|

Date of marriage |

Date of divorce |

|

|

|

|

|

|

(mm/dd/yyyy) |

(mm/dd/yyyy) |

|

Survivor annuity equal |

|

|

|

|

|

|

to _______________% |

|

||

|

|

Date of birth |

Social Security Number |

|

|||

|

|

(mm/dd/yyyy) |

|

|

|

of my annuity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (either 25% or 50% of your unreduced annuity) |

|

_______________% |

|

|||

|

|

|

|||||

1a.

2.

See the pamphlet SF 3113, Applying for Immediate Retirement Under the Federal Employees Retirement System, for information.

Are you eligible to continue Federal Employees Health Benefits coverage as a |

1b. Is there a court order or administrative order currently in effect that requires |

|

||||||

retiree? |

|

|

|

you to provide health benefits coverage for your child(ren)? |

|

|||

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

|

Yes (Attach a copy of the court/administrative order) |

No |

||

Are you eligible to continue Federal Employee's Group Life Insurance coverage as a retiree?

3.

Yes

Are you enrolled in the Federal Dental and Vision Insurance Program (FEDVIP)?

No

4.

Yes Your coverage will automatically continue into retirement as long as you continue to pay applicable premiums. Until work on your annuity is completed, you may receive bills from BENEFEDS. You must pay these bills in order to keep your FEDVIP coverage. After work on your annuity is completed, BENEFEDS will automatically begin deducting from your annuity to pay future premiums. If you have questions, please contact BENEFEDS at

No If you retire on an immediate annuity, you can enroll in FEDVIP during any Federal Benefits Open Season.

Are you currently enrolled in the Federal Long Term Care Insurance Program (FLTCIP)?

Yes You will automatically continue your coverage into retirement, as long as you continue to pay applicable premiums. If you are currently paying FLTCIP premiums by agency payroll deduction, you must arrange to pay premiums another way, either by deductions from your annuity, through automatic bank debit or direct bill. Please call LTC Partners at

No

Section F - Other Claim Information

1.Have you applied for, are you receiving, or have you ever received workers' compensation from the Department of Labor because of a

|

|

Yes (Complete Schedule C and attach it to this form) |

|

No |

|

|

||||

2. |

Have you previously filed any application under the Civil Service Retirement System or Federal Employees Retirement System (for retirement, refund, deposit or redeposit, |

|||||||||

|

or voluntary contributions)? |

|

|

Yes (Complete items 2a and 2b below.) |

|

No |

||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

||||

2a. |

Type of application |

|

Refund |

|

Deposit or redeposit |

2b. |

Claim number(s) |

|||

|

|

Retirement |

|

Return of excess deductions |

|

Voluntary contributions |

|

|

||

Section G (Optional) - Information About Your Unmarried Dependent Children

1.Dependent child's name

(first, middle, last)

2.Date of birth (mm/dd/yyyy)

3.Disabled 1. |

Dependent child's name |

() |

(first, middle, last) |

2.Date of birth (mm/dd/yyyy)

3.Disabled

()

|

|

CSRS/FERS Handbook for Personnel and Payroll Offices |

Previous editions are not usable. |

Standard Form 3107 Revised May 2014

Section H - Payment Instructions

1.Federal benefits payments will be made electronically by Direct Deposit into a savings or checking account or by a Direct Express debit card provided by the Department of the Treasury. See the instructions for Section H of this application and SF 3113 (Applying for Immediate Retirement Under the Federal Employees Retirement System) for additional information. This does not apply to you if your permanent payment address is outside the United States in a country not accessible via direct deposit.

Please select one of the following:

Please send my annuity payments directly to my checking or savings account. (Go to item 2) Please send my annuity payments to my Direct Express debit card. (Go to item 3a)

My permanent payment address is outside the United States in a country not accessible via Direct Deposit/Direct Express. (Go to item 3a)

2a. |

Financial Institution Routing Number |

|

|

You may obtain this number by calling your bank, credit union, or savings institution. |

||||||||

|

|

|

|

|

|

This number is very important. We cannot pay by direct deposit without it. |

||||||

2b. |

Checking or Savings Account Number |

2c. What kind of account is this? |

2d. Telephone number of your Financial Institution (including area code) |

|||||||||

|

|

|

|

|

|

Checking |

|

|

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2e. |

Name and address of Financial Institution |

|

|

|

|

|

|

|

Special Note: If you prefer, you may attach a cancelled personal check that |

|||

|

|

|

|

|

|

|

|

|

|

|

shows the information requested above, instead of filling in the requested |

|

|

|

|

|

|

|

|

|

|

|

|

financial institution information. If you attach your personal check, it is |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

especially important that you contact your bank, credit union, or savings |

|

|

|

|

|

|

|

|

|

|

|

|

institution to confirm that the information on the check is the correct |

|

|

|

|

|

|

|

|

|

|

|

|

information for direct deposit. (Some institutions, especially credit unions, |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

use different routing numbers on checks.) We can then use this information |

|

|

|

|

|

|

|

|

|

|

|

|

to start paying you by direct deposit. |

|

3a. |

Do you want Federal income tax withheld from your annuity payments? |

|

3b. Do you want to have Federal Income Tax withheld at the rate currently being |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

withheld from your salary? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes (Attach copy of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes (Go to item 3b) |

|

No (Go to Section I) |

|

|

|

No (Attach new |

||||

|

|

|

|

|

|

|

|

|

|

|

|

married with 3 exemptions.) |

|

|

|

|

|

|

|

|

|

|

|

||

Section I - Applicant's Certification |

|

|

|

|

||||||||

Warning

Any intentionally false statement in this application or willful misrepresentation relative thereto is a violation of the law punishable by a fine of not more than $10,000 or imprisonment of not more than 5 years, or both. (18 U.S.C. 1001)

I hereby certify that all statements made in this application are true to the best of my knowledge and belief.

Signature (Do not print) |

Date (mm/dd/yyyy) |

|

|

Applicant's Checklist

This checklist is provided to help you be certain you have attached all necessary documentation and to help your employing office be certain it forwards all of your retirement documentation to the Office of Personnel Management.

1.Military Service - If you answered "yes" to Section B, Item 4, did you attach Schedule A?

2.Military Service - If you completed Schedule A, did you attach a copy of your discharge certificate or other certificate of active military service?

3.Military Retired Pay - If you answered "yes" to Section B, Item 5, did you attach Schedule B?

4.Military Retired Pay - If you completed Schedule B and answered "yes" to Item b or c, did you attach a copy of the notice of award or other documentation of the type of military retired pay you are receiving?

5.Military Retired Pay - If you completed Schedule B and answered "yes" to item d, did you attach a copy of your request for waiver and a copy of the military finance office's acknowledgment or approval of your request for waiver (if applicable)?

6.Survivor Election - If you are married and did not initial box 1 of Section D, did you attach SF

7.Life Insurance - If you answered "yes" to Section E, item 2, did you attach SF 2818, Continuation of Life Insurance Coverage As an Annuitant or Compensationer?

8.OWCP - If you answered "yes" to Section F, item 1, did you attach Schedule C?

9.Tax - If you want to elect a Federal Income Tax withholding rate, did you attach a

10.Court or Administrative Order(s) - If you answered "yes" to Section C, item 2 and/or "yes" to Section E, Item 1b, did you attach a copy of the order(s)?

Yes

No

Not

Applicable

|

Standard Form 3107 |

|

CSRS/FERS Handbook for Personnel and Payroll Offices |

Previous editions are not usable. |

Revised May 2014 |

Schedules A, B and C

1.Name (last, first, middle)

2.Date of birth (mm/dd/yyyy)

3.Social Security Number

Schedule A - Military Service Information

1.If you have performed active honorable service in the United States Armed Services or other uniformed services, complete 1a - d below and attach a copy of your discharge certificate or other certificate of active military service (if available).

See instructions for definitions of Armed Services and Uniformed Services.

a.

Branch of service

b.

Serial number

c.Dates of active duty

From (mm/dd/yyyy) |

|

|

To (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d.Last grade or rank

2. If any of your military service occurred on or after January 1, 1957, have you paid a deposit to your agency for this service? (You must pay this deposit to your agency. |

|

You cannot pay OPM after you retire.) |

No |

Yes |

|

Schedule B - Military Retired Pay

1.If you are receiving or have applied for military retired or retainer pay (including disability or retired pay), complete Parts 1a - 1d below.

a. Are you receiving or have you ever applied for military retired or retainer pay? |

b. Was your military retired or retainer pay awarded for reserve service under |

(Answer "yes" if you are receiving payments from the Department of Veterans |

Chapter 1223, title 10, U.S. Code (formerly Chapter 67, title 10)? |

Affairs instead of military retired pay.) |

|

|

|

Yes |

|

No |

|

|

Yes (Attach a copy of notice of award) |

|

No |

c. |

Was |

your military retired pay or retainer pay awarded for a disability incurred |

d. Are you waiving your military retired or retainer pay in order to receive credit |

||||||

|

in combat or caused by an instrumentality of war and incurred in the line of |

|

for military service for FERS retirement benefits? |

|

|

||||

|

duty during a period of war? |

|

|

|

|

Yes (Attach a copy of your request for |

|

No |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||

|

|

Yes (Attach a copy of notice of |

|

No |

|

|

waiver and a copy of military finance |

|

|

|

|

|

|

|

|

|

|||

|

|

award) |

|

|

|

|

officer's acknowledgment or approval of |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

your request for waiver) |

|

|

Schedule C - Federal Employees Compensation Information

1.Are you receiving or have you ever received workers' compensation from the Office of Workers' Compensation Programs (OWCP), Department of Labor, because of a

|

|

Yes (complete parts 1a - c below) |

|

|

|

No (go to question 2) |

|

|

|

|

|

a. |

|

|

b. |

Benefit received |

|

c. |

|

|

|||

|

|

Compensation claim number |

|

|

|

|

|

|

Type of benefit |

||

|

|

From (mm/dd/yyyy) |

|

|

To (mm/dd/yyyy) |

|

|

||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Scheduled award |

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total or partial disability compensation |

||

|

|

|

|

|

|

|

|

|

Scheduled award |

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total or partial disability compensation |

||

2.If you have applied for workers' compensation (other than as listed in item 1a above) but are not receiving benefits, check reason below and give the information requested.

a.Awaiting OWCP decision

b. Claim denied

Compensation claim number |

|

Compensation claim number |

Date claim denied (mm/dd/yyyy) |

3.Except for scheduled compensation awards, workers' compensation and FERS retirement benefits cannot be paid for the same period of time. Please complete the information below regarding your claim. You must complete this section.

a.Do you agree to notify us promptly if the status of your workers' compensation claim changes?

Yes |

No |

b.Do you authorize the Office of Personnel Management and/or the Office of Workers' Compensation Programs (OWCP) to collect any overpayment if we later find you are not eligible for both compensation and annuity payments covering the same period of time?

Applicant's Certification

I certify that all statements made on these schedules are true to the best of my knowledge and belief.

Yes

Signature (do not print)

No

Date (mm/dd/yyyy)

|

Standard Form 3107 |

|

CSRS/FERS Handbook for Personnel and Payroll Offices |

Previous editions are not usable. |

Revised May 2014 |

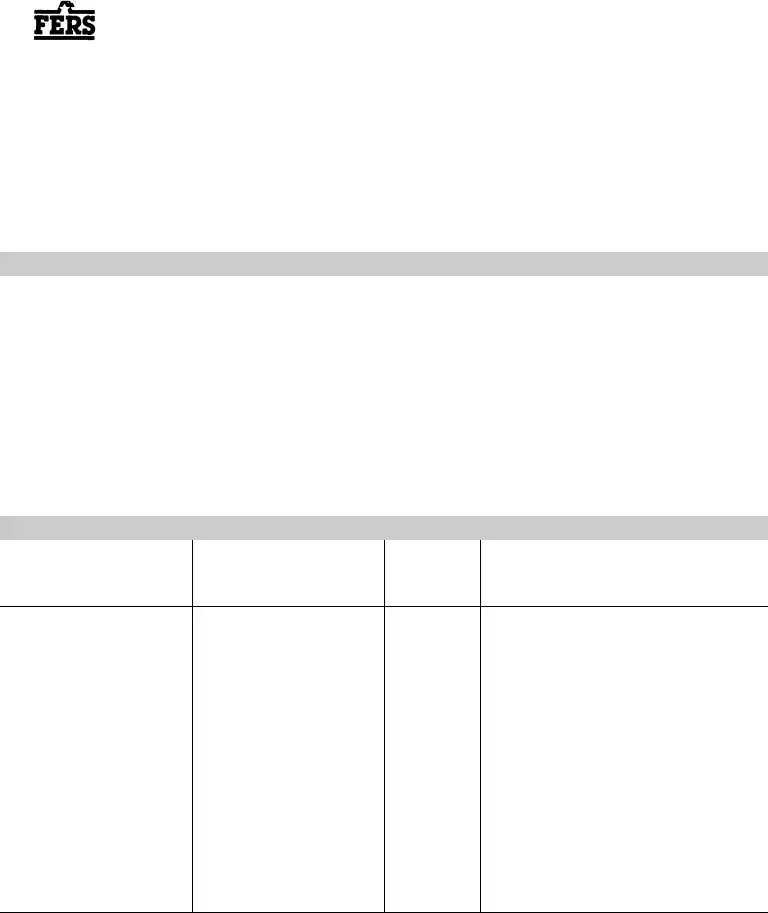

Federal Employees Retirement System

|

Office of Personnel |

Certified Summary of Federal Service |

Management |

5 CFR Part 841 |

|

Federal Employees Retirement System |

|

Information for the Agency

1.A certified copy of this form must accompany the employee's Application for Immediate Retirement (SF 3107).

2.This form may also be used:

•for retirement counseling purposes

•to respond to an employee's request for a record of creditable service

Instructions for the Employee

1.Your employing office will complete and certify this form for you.

2.Review this form carefully. Be sure it contains all of your service.

3.Complete Section E, Employee's Certification, and return the form to your employing office.

3.See the CSRS and FERS Handbook for Personnel and Payroll Offices for detailed instructions for completion and disposition of this form.

Section A - Identification

1. |

Name of employee (last, first, middle) |

2. |

Date of birth (mm/dd/yyyy) |

3. |

Social Security Number |

||||

|

|

|

|

|

|

|

|

|

|

4. |

List all other names used (maiden name, AKA, spelling variants) |

5. |

Other birth dates used |

6. |

Military serial number |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Service computation date for retirement |

purposes |

||

|

|

|

|

|

|

|

|

|

|

8a. |

Did this employee elect to transfer to FERS? |

8b. |

If the employee elected to transfer to FERS, is the employee entitled, according to |

||||||

|

|

|

|

|

|

your records, to have part of the FERS annuity computed under CSRS rules? |

|||

|

|

No |

|

Yes, give effective date of election: |

|

|

Yes |

|

No |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

9a. |

Does |

the applicant |

receive military retired pay? |

9b. |

If yes, has the applicant waived military retired pay to credit military service for |

||||

|

|

|

|

|

|

FERS retirement? |

|

|

|

|

|

Yes (Attach a copy of the applicant's military retired pay order, |

|

|

Yes (Attach a copy of the military finance center's letter to the |

||||

|

|

|

|

||||||

|

|

if available, and complete 9b.) |

|

|

employee accepting waiver, if available.) |

||||

|

|

|

|

||||||

|

|

No |

|

|

|

|

No (Include cases where a waiver is not necessary.) |

||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Section B - Verified Service History Documented in Official Personnel Records

Federal agency or

military service branch

Appointment, separation, or conversion dates for civilian and active honorable military service

From |

To |

(mm/dd/yyyy) |

(mm/dd/yyyy) |

|

|

Name of retirement

system*

Remarks and

* Give details of creditable civilian service not subject to retirement deductions in Section C.

**In Remarks, show if CSRS service on or after January 1, 1984, is "regular" CSRS or CSRS Offset.

Indicate if service is

CSRS/FERS Handbook for Personnel and Payroll Offices |

Standard Form |

|

Previous editions are not usable. |

Revised May 2014 |

Section C - Detail of Civilian Service Not Subject to Contributory Retirement System for Civilian Federal Employees

Detail below (1) any period of Federal civilian service subject only to "FICA" deductions, and (2) any other Federal civilian service not subject to a Federal employee (or D.C. Government) retirement system. If total basic salary earned for any such period of service is known, you may make a summary entry on the right hand side below. Otherwise, show each change affecting basic salary during the period of service. Show

Nature of action |

Effective date |

Basic |

Salary basis |

(Appt., pro., |

(mm/dd/yyyy) |

salary rate |

(per annum, |

res., etc.) |

|

|

per hour, |

|

|

|

WAE, etc.) |

|

|

|

|

|

|

|

|

Leave

without pay

If basic salary actually earned is available

make summary entry below

From |

To |

Total earned |

(mm/dd/yyyy) |

(mm/dd/yyyy) |

|

|

|

|

Section D - Agency Certification

I certify that the information on this form accurately reflects verified information contained in official records and that the applicant has sufficient service to be entitled to an annuity. I further certify that all required documentation in support of this application is attached, accurate and complete.

Signature of authorized agency personnel official

Agency name and address, including ZIP Code, telephone number (including area code), FAX number, and EMAIL address

Official Title

Date (mm/dd/yyyy)

Section E - Employee's Certification

The service listed is complete.

I have additional service. (If you claim additional service, attach signed statement(s) giving dates, positions, titles and locations of employment, including agency, bureau, and division. Claimed service cannot be credited for retirement until it has been verified. This includes unverified service listed on an SF 144, Statement of Prior Federal Civilian and Military Service, or similar affidavit.)

Note: If you have performed Federal civilian service subject to social security deductions (FICA) or not subject to retirement deductions, be sure that your agency has correctly completed Section C above.

Signature (do not print)

Date (mm/dd/yyyy)

CSRS/FERS Handbook for Personnel and Payroll Offices |

Reverse of Standard Form |

|

Previous editions are not usable. |

Revised May 2014 |

Form Data

| Fact Name | Detail |

|---|---|

| Form Revision | The SF 3107 form was revised in January 1997, replacing earlier versions from March 1988 and November 1995. |

| Governing Law | Public Law 104-134 mandates direct deposit for Federal retirees and survivors, effective July 26, 1996. |

| Direct Deposit Requirement | The revised SF 3107 includes an option for annuity payments through Electronic Funds Transfer or certification of lack of bank accounts. |

| Accompanying Pamphlet | A revised pamphlet, "Applying for Immediate Retirement Under the Federal Employees Retirement System" (SF 3113), assists applicants. |

| Obsolete Material | Prior editions and the old pamphlet "Applying for Immediate Retirement Under the Federal Employees Retirement System" (RI 92-28) are now outdated. |

| Ordering Procedure | Forms can be ordered using FEDSTRIP/MILSTRIP procedures via the General Services Administration's (GSA) Federal Supply Service. |

| Title of Form SF 3107 | Application for Immediate Retirement- Federal Employees Retirement System. |

| National Stock Number for SF 3107 | 7540-01-255-3670. |

| Estimated Cost for SF 3107 | $15.10 per 100 copies. |

| Online Availability | The SF 3113 pamphlet can be downloaded from OPM ONLINE or accessed on www.opm.gov. |

Instructions on Utilizing Sf 3107

Filling out the SF 3107 form is a critical step for federal employees navigating the journey towards immediate retirement under the Federal Employees Retirement System (FERS). This form has undergone revisions to accommodate modern requirements like direct deposit through Electronic Funds Transfer (EFT). It's designed to streamline the process of applying for retirement benefits, ensuring that applicants meet all necessary criteria and make informed decisions about their financial future. By following these steps carefully, applicants can complete the form accurately and avoid potential delays in the processing of their retirement benefits.

- Begin by gathering all necessary personal information, including your full name, Social Security Number, and contact information. This ensures that you can accurately complete the form without having to stop and look up information.

- Locate the most current version of the SF 3107 form, dated January 1997. Ensure that you're not using outdated versions of the form, as they are no longer acceptable.

- Read the accompanying information pamphlet titled "Applying for Immediate Retirement Under the Federal Employees Retirement System" (SF 3113), which provides valuable guidelines and information to assist you in the application process.

- Complete Section A of the form with your personal information, such as name, date of birth, Social Security Number, and other identifying details.

- In Section B, provide your employment information, including your agency and retirement coverage dates. It’s important to be precise to ensure your retirement benefits are calculated accurately.

- Section C requires you to decide on your annuity payment method. Here, you'll elect to receive payments via direct deposit or certify that you do not have a checking or savings account, complying with the requirements set forth in Public Law 104-134.

- Carefully review your entries and verify that all information is correct and complete. Inaccuracies can delay the processing of your retirement application.

- Sign and date the application in the designated area at the end of the form. Your signature is necessary to validate the information you have provided.

- Finally, submit the completed form to your agency's personnel office. They will process your application and forward it to the Office of Personnel Management (OPM) for final processing.

After submitting your SF 3107 form, your agency's personnel office will guide you through any further steps required in the retirement process. They serve as a valuable resource for any questions or concerns you may have. Remember, correctly filling out the SF 3107 is a significant step towards securing your retirement benefits under the FERS, ensuring a smoother transition into this new chapter of your life.

Obtain Answers on Sf 3107

- What is the SF 3107 form? The SF 3107, or Standard Form 3107, is an application used for immediate retirement under the Federal Employees Retirement System (FERS). It is designed for federal employees who are seeking to initiate their retirement benefits.

- Has the SF 3107 form been revised? Yes, the SF 3107 form underwent a revision with the new version dated January 1997. This version replaced previous editions dated March 1988 and November 1995. The revision was necessary to comply with new legal requirements and to update the application process.

- What significant changes were made in the latest version of the SF 3107 form? One notable change in the latest version of the SF 3107 form is the inclusion of a section that allows applicants to choose between receiving annuity payments via direct deposit (Electronic Funds Transfer) or certifying that they do not possess a checking or savings account. This adjustment was made to align with Public Law 104-134, which mandates that all Federal retirees and survivors' benefits be paid through Electronic Funds Transfer, unless an exception is made.

- Why is a revised pamphlet available with the SF 3107 form? A revised pamphlet accompanies the latest edition of the SF 3107 form to provide applicants comprehensive information on how to apply for immediate retirement benefits under the FERS. This pamphlet includes details on eligibility requirements, maintaining health benefits and life insurance into retirement, application procedures, payment information, and survivor benefits. The intention is to offer clear and updated guidance to applicants.

- Can previous editions of the SF 3107 and its accompanying pamphlet still be used? No, previous editions of the SF 3107 form (dated March 1988 and November 1995) and the older pamphlet edition are no longer usable. Applicants must use the January 1997 edition of the SF 3107 form and the current pamphlet to ensure compliance with the latest federal retirement application requirements.

- How can one obtain the SF 3107 form and the accompanying pamphlet? These documents can be ordered from the General Services Administration's (GSA) Federal Supply Service through the FEDSTRIP/MILSTRIP ordering procedures used by agencies. Additionally, the pamphlet "Applying for Immediate Retirement Under the Federal Employees Retirement System", SF 3113, can be downloaded from OPM ONLINE or accessed via the official website (www.opm.gov).

- What is the cost of ordering these documents? For agencies ordering the SF 3107 form, the estimated cost is $15.10 per 100 copies. For the accompanying pamphlet, SF 3113, the estimated cost is $9.92 per 100 copies.

- Are there specific eligibility requirements for applying for immediate retirement benefits under FERS using SF 3107? Yes, the accompanying pamphlet provides detailed information on eligibility requirements for applicants. It is crucial for potential applicants to review this information to ensure they meet the criteria for immediate retirement under the FERS before submitting their application.

- What are the options for receiving annuity payments according to the SF 3107 form? Applicants can choose to receive their annuity payments through direct deposit to a checking or savings account. Alternatively, if an applicant does not have a bank account, they can certify this fact and opt for a different payment method in compliance with federal requirements.

- Where can applicants find more information or assistance with the SF 3107 form? Applicants seeking more information or assistance can visit the Office of Personnel Management's official website at www.opm.gov. Resources, contact information, and further guidance on the retirement application process are available there.

Common mistakes

Not updating personal details such as address and phone number on the SF 3107 form can lead to important correspondence from the Office of Personnel Management (OPM) being missed. It's crucial for applicants to ensure all their contact information is current.

Failing to select a payment option for annuity payments, whether it be through Electronic Funds Transfer (EFT) or certifying that the applicant does not have a checking or savings account, as required by Public Law 104-134.

Omitting previous editions of the form that are outdated and thus no longer valid can be a common oversight. The current and valid version is dated January 1997, and previous versions from March 1988 and November 1995 should not be used.

Not including the pamphlet "Applying for Immediate Retirement Under the Federal Employees Retirement System" (SF 3113) with the application can lead to missing out on valuable information that aids in the application process, including eligibility and benefits details.

Incorrectly filling out sections of the form due to not reading the accompanying instructions carefully can lead to delays or issues in the processing of retirement benefits. It's essential to refer to the provided pamphlet for guidance.

Overlooking the requirement to order the SF 3107 and SF 3113 forms through the FEDSTRIP/MILSTRIP procedures if one is applying through a federal agency, which could delay the application process.

Ignoring the availability of downloading the necessary pamphlet from OPM ONLINE or accessing it via the OPM's website for those who prefer or need digital access to application guidance.

Documents used along the form

When preparing for retirement, federal employees navigating the complex process will find the Standard Form (SF) 3107, Application for Immediate Retirement, Federal Employees Retirement System, as a critical starting point. However, to ensure a smooth and informed transition to retirement, several other forms and documents are often required in conjunction with the SF 3107. These supplementary materials play vital roles in guaranteeing that all aspects of the retirement process, from financial to health benefits, are thoroughly addressed.

- SF 2801: Application for Immediate Retirement - Civil Service Retirement System (CSRS). This form is for employees covered under the Civil Service Retirement System, similar to SF 3107 but for a different retirement system.

- SF 2818: Continuation of Life Insurance Coverage. This form is used by retiring employees to continue their Federal Employees' Group Life Insurance coverage into retirement.

- SF 2821: Agency Certification of Insurance Status. Completed by the employing agency, this document verifies a retiring employee's Federal Employees' Group Life Insurance coverage.

- SF 2809: Employee Health Benefits Registration Form. This form is used to enroll in or change Federal Employees Health Benefits (FEHB) coverage for retirement.

- SF 3104: Application for Death Benefits. While not a retirement application, this form is crucial for designating beneficiaries for Federal Employees Retirement System (FERS) death benefits.

- RI 76-21: Information about Reemployed Annuitants. This pamphlet provides essential information for retirees considering returning to federal employment after retirement.

- DD Form 214: Certificate of Release or Discharge from Active Duty. This document is crucial for veterans who are applying for retirement and need to provide proof of military service, which can affect their retirement benefits.

Understanding each form's role and the information it requires can significantly ease the retirement application process. These documents collectively ensure that all necessary steps are taken for a seamless transition from active employment to retirement, providing peace of mind for future retirees. Applicants should work closely with their personnel office and review each form thoroughly to avoid any delays or issues with their retirement applications.

Similar forms

SF 2801: Application for Immediate Retirement - Civil Service Retirement System (CSRS). Similar to the SF 3107, SF 2801 is also an application for immediate retirement but is specifically designed for employees and members of the Civil Service Retirement System, as opposed to the Federal Employees Retirement System (FERS) which the 3107 form addresses. Both forms facilitate the retirement process for government employees, yet cater to different retirement systems under U.S. Federal employment.

SF 2818: Continuation of Life Insurance Coverage. This form parallels SF 3107 in its use of providing future financial security and benefits, but concentrates on life insurance continuation for federal employees. Whereas SF 3107 encompasses a broader retirement application, SF 2818 specifically allows retiring or separating employees to elect how they wish to continue their Federal Employees' Group Life Insurance (FEGLI) coverage into retirement.

SF 2821: Agency Certification of Insurance Status. It complements the process initiated by SF 3107 as it must be completed by the employing agency to certify a retiring employee's Federal Employees' Group Life Insurance coverage information. This form ensures the retiring employee's life insurance benefits are accurately transitioned post-retirement, aligning with the retirement process started by SF 3107.

SF 2809: Employee Health Benefits Registration Form. Like the SF 3107, which deals with retirement, the SF 2809 form is crucial for managing another aspect of federal employment benefits – health insurance. Upon retirement, employees must make decisions regarding their Federal Employees Health Benefits (FEHB) program, and changes might be necessary through the SF 2809 form, demonstrating its similarity in function concerning benefits management in federal employment.

RI 76-10: Assignment of Federal Employees' Group Life Insurance. While differing in specificity, this form is related to the SF 3107 in its concern with benefit management for federal employees, particularly with life insurance. The RI 76-10 form allows employees to assign their life insurance coverage to a beneficiary or beneficiaries, complementing the SF 3107’s role in securing employees' retirement and associated benefits.

Dos and Don'ts

Filling out the Standard Form (SF) 3107, Application for Immediate Retirement under the Federal Employees Retirement System (FERS), requires careful attention to detail and adherence to specific do's and don'ts. To ensure accuracy and completeness of your application, consider the following guidelines:

Do's:

- Read the accompanying information pamphlet first. Before filling out the form, thoroughly review the "Applying for Immediate Retirement Under the Federal Employees Retirement System" (SF 3113) pamphlet. It provides essential information that will guide you through the application process.

- Use the latest version of the form. Ensure you're working with the current version dated January 1997, as older editions are no longer accepted.

- Complete all required sections. Leaving out information can delay the processing of your application. If a section is not applicable, indicate with "N/A" (not applicable) where possible.

- Choose your annuity payment method carefully. Public Law 104-134 mandates that Federal retirees and survivors must receive payments through Electronic Funds Transfer (EFT), unless you certify not having a checking or savings account. Make your selection based on your actual financial setup.

- Provide accurate personal information. Double-check details like your Social Security Number and contact information for errors to prevent mistakes in your retirement records.

- Keep a copy for your records. After completing the application, make a copy for your personal records before submitting it. This can be helpful for future reference or in case any disputes arise.

Don'ts:

- Don't rush through the form. Take your time to understand each section and what information you need to provide. This will reduce the chances of errors and omissions.

- Don't use outdated editions of the form or pamphlet. As mentioned, older versions are obsolete and will not be processed. Always verify that you have the most current materials.

- Don't forget to indicate your payment preference. Failing to choose your annuity payment method can delay the processing of your benefits.

- Don't leave mandatory fields blank. If uncertain about what to fill in, seek clarification rather than skipping sections. Incomplete forms can lead to unnecessary delays.

- Don't provide inaccurate information. Mistakes, especially in personal identification areas, can lead to significant processing delays and issues with your retirement benefits.

- Don't hesitate to ask for help. If you're unsure about any aspect of the form or the process, contact the Office of Personnel Management (OPM) or your agency's human resources department for assistance.

Misconceptions

The SF 3107 form, entitled "Application for Immediate Retirement" for the Federal Employees Retirement System (FERS), is vital for those looking to retire from federal service. However, there are several misconceptions about this form that need clarification.

- Misconception 1: The SF 3107 form applies to all government employees. In reality, it is specifically designed for employees under the Federal Employees Retirement System. Those under different retirement systems need to use the appropriate forms that apply to their specific retirement plan.

- Misconception 2: Any edition of the SF 3107 form can be used. The truth is, only the most current version should be used. The version dated January 1997 is the one currently in effect, superseding all prior versions.

- Misconception 3: Direct deposit is only one of many payment options. Due to Public Law 104-134, effective from July 26, 1996, all federal retirees and survivors must be paid via direct deposit through Electronic Funds Transfer (EFT), unless they certify that they do not have a checking or saving account.

- Misconception 4: The form is all you need for retirement application. The form must be accompanied by the "Applying for Immediate Retirement Under the Federal Employees Retirement System" pamphlet (SF 3113), which provides essential information for applying.

- Misconception 5: The SF 3107 form also covers the continuation of health benefits and life insurance. While it is part of the process, specific sections and additional documentation are required to elect to continue these benefits into retirement.

- Misconception 6: The SF 3107 form is only available through physical locations or mail. In addition to printed copies, the form and its accompanying pamphlet can be downloaded from the Office of Personnel Management’s website or ordered online.

- Misconception 7: Completing the form guarantees retirement benefits. Completing and submitting the form is just the first step. Approval is subject to meeting all eligibility requirements outlined by the Federal Employees Retirement System.

Understanding these key points can significantly smooth the transition into retirement for federal employees. It’s crucial to stay informed about the most current requirements and processes to ensure a successful application.

Key takeaways

When it comes to planning for retirement from the Federal Employees Retirement System (FERS), understanding how to properly complete and use the SF 3107 form, Application for Immediate Retirement, is crucial. Here are six key takeaways to guide you through this important process:

- Use the Correct Version: It's essential to use the latest version of the SF 3107 form. As of January 1997, previous editions from March 1988 and November 1995 are outdated and cannot be used. This ensures your application aligns with current regulations and requirements.