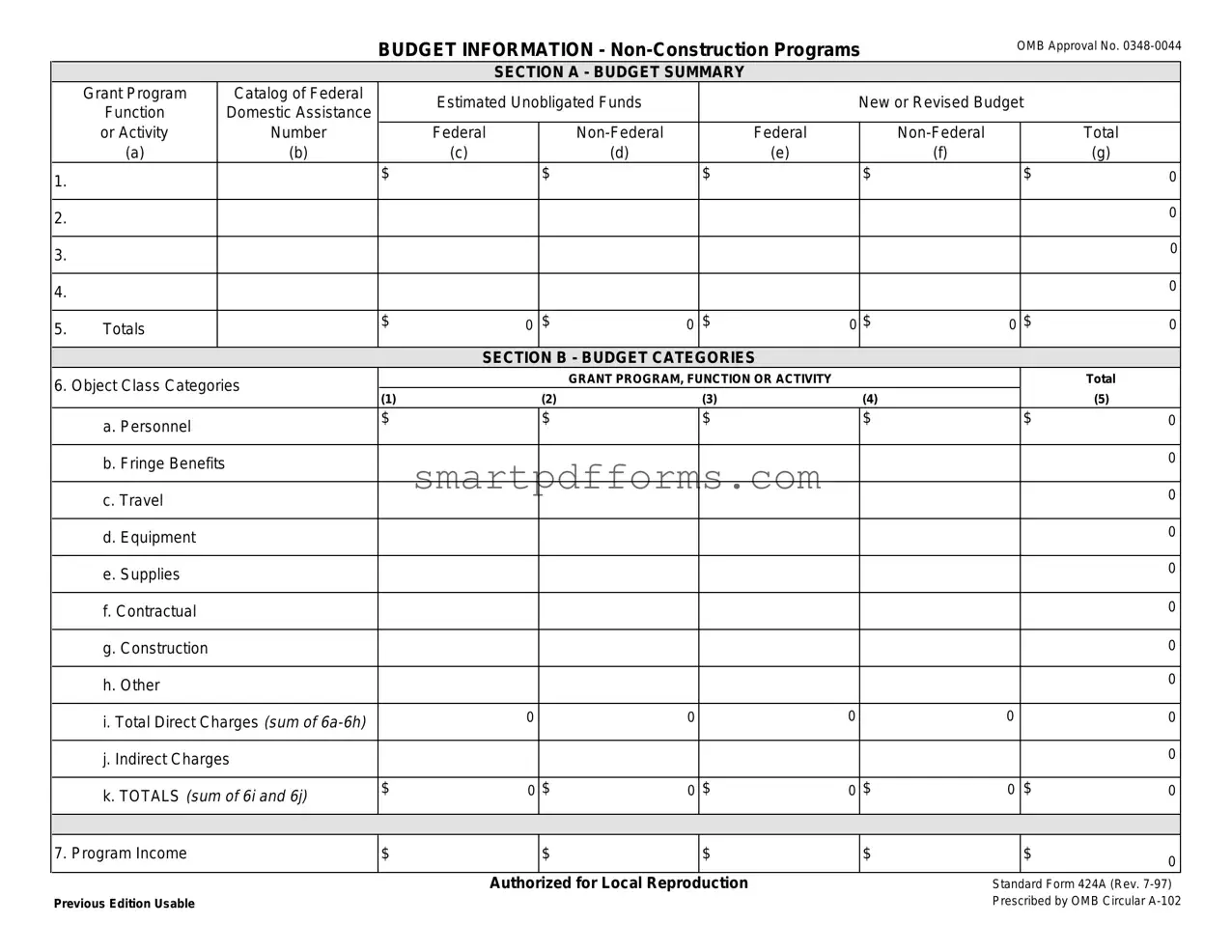

Blank Sf 424A PDF Template

The SF 424A form, officially titled "Budget Information for Non-Construction Programs," is a pivotal document utilized by entities seeking federal funding to outline proposed project budgets. Crafted under the oversight of the Office of Management and Budget, with an OMB Approval No. 0348-0044, this form facilitates a structured approach to presenting financial information, ensuring both clarity and uniformity across federal grant applications. At its core, the form is segmented into various sections, including a detailed budget summary (Section A), budget categories by object class (Section B), non-federal resources (Section C), forecasted cash needs (Section D), future federal funds requirements (Section E), and other budget-related information (Section F). Each of these sections is meticulously designed to extract precise financial data pertaining to grant program functions, anticipated unobligated funds, direct and indirect charges, non-federal contributions, and projected income, among other fiscal details. By submitting this form, applicants essentially provide a comprehensive financial snapshot of their proposed project, showcasing the allocation of funds across different categories such as personnel, supplies, and equipment, while also highlighting contributions from non-federal sources. The significance of accurate and thorough completion of the SF 424A form cannot be overstated, as it plays a crucial role in the grant evaluation process, aiding grantor agencies in making informed decisions regarding fund allocation.

Preview - Sf 424A Form

BUDGET INFORMATION -

OMB Approval No.

SECTION A - BUDGET SUMMARY

|

Grant Program |

|

Catalog of Federal |

|

Estimated Unobligated Funds |

|

|

New or Revised Budget |

|

|

|||||

|

Function |

|

Domestic Assistance |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

or Activity |

|

Number |

|

Federal |

|

Federal |

|

|

|

|

|

Total |

||

|

(a) |

|

(b) |

|

(c) |

|

(d) |

(e) |

|

|

|

(f) |

|

|

(g) |

1. |

|

|

|

$ |

|

$ |

|

$ |

|

|

$ |

|

|

$ |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Totals |

|

|

$ |

0 |

$ |

0 |

$ |

0 |

|

$ |

0 |

|

$ |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION B - BUDGET CATEGORIES |

|

|

|

|

|

|

|

|||

6. Object Class Categories |

|

|

|

GRANT PROGRAM, FUNCTION OR ACTIVITY |

|

|

|

|

|

|

Total |

||||

(1) |

|

(2) |

|

(3) |

|

(4) |

|

|

|

(5) |

|||||

|

|

|

|

|

|

|

|

|

|

||||||

|

a. Personnel |

|

$ |

|

$ |

|

$ |

|

|

$ |

|

|

$ |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Fringe Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. Travel |

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d. Equipment |

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e. Supplies |

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f. Contractual |

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

g. Construction |

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

h. Other |

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i. Total Direct Charges (sum of |

|

0 |

|

0 |

|

0 |

|

|

0 |

|

|

0 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

j. Indirect Charges |

|

|

|

|

|

|

|

|

|

|

|

0 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

k. TOTALS (sum of 6i and 6j) |

$ |

0 |

$ |

0 |

$ |

0 |

|

$ |

0 |

|

$ |

0 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. Program Income |

|

$ |

|

$ |

|

$ |

|

|

$ |

|

|

$ |

0 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized for Local Reproduction

Previous Edition Usable

Standard Form 424A (Rev.

SECTION C -

|

(a) Grant Program |

|

|

(b) Applicant |

|

(c) State |

|

(d) Other Sources |

|

|

(e) TOTALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

|

$ |

|

|

$ |

|

$ |

|

$ |

0 |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

12. TOTAL (sum of lines |

|

|

$ |

|

0 |

$ |

0 |

$ |

0 |

$ |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

SECTION D - FORECASTED CASH NEEDS |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total for 1st Year |

|

1st Quarter |

|

2nd Quarter |

|

3rd Quarter |

|

|

4th Quarter |

|

13. |

Federal |

|

|

|

|

|

|

|

|

|

|

|

$ |

0 |

$ |

|

|

$ |

|

$ |

|

$ |

|

||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

15. TOTAL (sum of lines 13 and 14) |

$ |

0 |

$ |

|

0 |

$ |

0 |

$ |

0 |

$ |

0 |

|

|

|

|

|

|

|

|

|

|

|

|||

|

SECTION E - BUDGET ESTIMATES OF FEDERAL FUNDS NEEDED FOR BALANCE OF THE PROJECT |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Grant Program |

|

|

|

|

|

FUTURE FUNDING PERIODS (Years) |

|

|

|

||

|

|

|

|

(b) First |

|

(c) Second |

|

(d) Third |

|

|

(e) Fourth |

|

16. |

|

|

|

$ |

|

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. TOTAL (sum of lines |

|

|

$ |

|

0 |

$ |

0 |

$ |

0 |

$ |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

SECTION F - OTHER BUDGET INFORMATION |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

Direct Charges: |

|

|

|

22. Indirect Charges: |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

23. |

Remarks: |

|

|

|

|

|

|

|

|

|

|

|

Authorized for Local Reproduction

Standard Form 424A (Rev.

INSTRUCTIONS FOR THE

Public reporting burden for this collection of information is estimated to average 180 minutes per response, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding the burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to the Office of Management and Budget, Paperwork Reduction Project

PLEASE DO NOT RETURN YOUR COMPLETED FORM TO THE OFFICE OF MANAGEMENT AND BUDGET. SEND IT TO THE ADDRESS PROVIDED BY THE SPONSORING AGENCY.

General Instructions

This form is designed so that application can be made for funds from one or more grant programs. In preparing the budget, adhere to any existing Federal grantor agency guidelines which prescribe how and whether budgeted amounts should be separately shown for different functions or activities within the program. For some programs, grantor agencies may require budgets to be separately shown by function or activity. For other programs, grantor agencies may require a breakdown by function or activity. Sections A, B, C, and D should include budget estimates for the whole project except when applying for assistance which requires Federal authorization in annual or other funding period increments. In the latter case, Sections A, B, C, and D should provide the budget for the first budget period (usually a year) and Section E should present the need for Federal assistance in the subsequent budget periods. All applications should contain a breakdown by the object class categories shown in Lines

Section A. Budget Summary Lines

For applications pertaining to a single Federal grant program (Federal Domestic Assistance Catalog number) and not requiring a functional or activity breakdown, enter on Line 1 under Column

(a)the Catalog program title and the Catalog number in Column

For applications pertaining to a single program requiring budget amounts by multiple functions or activities, enter the name of each activity or function on each line in Column (a), and enter the Catalog number in Column (b). For applications pertaining to multiple programs where none of the programs require a breakdown by function or activity, enter the Catalog program title on each line in Column (a) and the respective Catalog number on each line in Column (b).

For applications pertaining to multiple programs where one or more programs require a breakdown by function or activity, prepare a separate sheet for each program requiring the breakdown. Additional sheets should be used when one form does not provide adequate space for all breakdown of data required. However, when more than one sheet is used, the first page should provide the summary totals by programs.

Lines

For new applications, leave Column (c) and (d) blank. For each line entry in Columns (a) and (b), enter in Columns (e), (f), and

(g)the appropriate amounts of funds needed to support the project for the first funding period (usually a year).

For continuing grant program applications, submit these forms before the end of each funding period as required by the grantor agency. Enter in Columns (c) and (d) the estimated amounts of funds which will remain unobligated at the end of the grant funding period only if the Federal grantor agency instructions provide for this. Otherwise, leave these columns blank. Enter in columns (e) and (f) the amounts of funds needed for the upcoming period. The amount(s) in Column (g) should be the sum of amounts in Columns (e) and (f).

For supplemental grants and changes to existing grants, do not use Columns (c) and (d). Enter in Column (e) the amount of the increase or decrease of Federal funds and enter in Column (f) the amount of the increase or decrease of

Line 5 - Show the totals for all columns used.

Section B Budget Categories

In the column headings (1) through (4), enter the titles of the same programs, functions, and activities shown on Lines

Line

Line 6j - Show the amount of indirect cost.

Line 6k - Enter the total of amounts on Lines 6i and 6j. For all applications for new grants and continuation grants the total amount in column (5), Line 6k, should be the same as the total amount shown in Section A, Column (g), Line 5. For supplemental grants and changes to grants, the total amount of the increase or decrease as shown in Columns

Line 7 - Enter the estimated amount of income, if any, expected to be generated from this project. Do not add or subtract this amount from the total project amount, Show under the program

INSTRUCTIONS FOR THE

narrative statement the nature and source of income. The estimated amount of program income may be considered by the Federal grantor agency in determining the total amount of the grant.

Section C.

Lines

Column (a) - Enter the program titles identical to Column (a), Section A. A breakdown by function or activity is not necessary.

Column (b) - Enter the contribution to be made by the

Line 15 - Enter the totals of amounts on Lines 13 and 14.

Section E. Budget Estimates of Federal Funds Needed for Balance of the Project

Lines

If more than four lines are needed to list the program titles, submit additional schedules as necessary.

applicant.

Column (c) - Enter the amount of the State’s cash and

Column (d) - Enter the amount of cash and

Column (e) - Enter totals of Columns (b), (c), and (d).

Line 12 - Enter the total for each of Columns

Section D. Forecasted Cash Needs

Line 20 - Enter the total for each of the Columns

Section F. Other Budget Information

Line 21 - Use this space to explain amounts for individual direct object class cost categories that may appear to be out of the ordinary or to explain the details as required by the Federal grantor agency.

Line 22 - Enter the type of indirect rate (provisional, predetermined, final or fixed) that will be in effect during the funding period, the estimated amount of the base to which the rate is applied, and the total indirect expense.

Line 23 - Provide any other explanations or comments deemed necessary.

Line 13 - Enter the amount of cash needed by quarter from the grantor agency during the first year.

Line 14 - Enter the amount of cash from all other sources needed by quarter during the first year.

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The SF-424A is designed for non-construction programs to assist applicants in applying for Federal assistance. It breaks down funding requirements and matches them with the correct grant opportunities. |

| OMB Approval Number | This form carries the Office of Management and Budget (OMB) approval number 0348-0044, a necessary endorsement for all forms used in federal reporting and application processes. |

| Sections Breakdown | The form consists of multiple sections including Budget Summary, Budget Categories, Non-Federal Resources, Forecasted Cash Needs, Budget Estimates of Federal Funds Needed for Balance of the Project, and Other Budget Information, guiding applicants through a detailed financial breakdown. |

| Usage Instructions | Detailed instructions accompany the SF-424A, guiding applicants on how to accurately complete the form depending on their specific funding needs and the complexities of their projects, emphasizing adherence to Federal guidelines. |

Instructions on Utilizing Sf 424A

Filling out the SF 424A form is an essential step for organizations and agencies applying for federal financial assistance for non-construction programs. This form is designed to summarize budget information concerning grants and to lay out a comprehensive financial plan. The following step-by-step guide aims to streamline the process, making it less daunting for applicants. By ensuring accuracy and completeness when filling out this form, you can effectively communicate your project's financial needs and resources.

- Begin with Section A - Budget Summary. List each grant program, function, or activity for which you are seeking funds. For single program applications, this involves entering the program title and Catalog of Federal Domestic Assistance (CFDA) number in lines 1 and 2. For multiple programs or activities, additional sheets may be necessary.

- In Section A, lines 1-4, skip columns (c) and (d) if this is a new application. Enter the appropriate amounts of funds needed for the project in columns (e), (f), and (g), indicating Federal and non-Federal funds and totals respectively. The totals should be summarized in line 5.

- Move to Section B - Budget Categories. Align the column headings (1) through (4) with the program titles listed in Section A. Fill in the required funds for each object class category, such as personnel, supplies, and contractual costs, then calculate total direct charges, indirect charges, and the grand total.

- In Section C - Non-Federal Resources, document the non-Federal resources that will be used in the project. Include contributions from the applicant, state, and other sources, making sure to explain any in-kind contributions separately. The grand total of non-Federal resources should match the total indicated in Section A, line 5, column (f).

- For Section D - Forecasted Cash Needs, estimate the quarterly cash requirements from Federal and non-Federal sources for the first year of the project. Sum these amounts to provide a total cash need forecast.

- In Section E, project the future Federal funds needed for the lifespan of the project across the designated timeframes. This is crucial for new applications or continuation grant applications that span multiple funding periods.

- Finally, Section F - Other Budget Information is where you can detail direct and indirect charges further, and provide any additional remarks or explanations necessary to clarify your budget proposal.

- Review the completed form for accuracy and completeness. Ensure that the total amounts in each section are consistent and that all necessary information is clearly and accurately presented.

Once you have carefully filled out the SF 424A form according to these steps, check the form against the sponsoring agency's submission guidelines. Remember, do not send the completed form to the Office of Management and Budget (OMB); it should be submitted to the address provided by the sponsoring federal agency. Accurately completing this form is a critical step in the application process for federal assistance, as it lays the foundation for your project's financial structure and demonstrates your organization's ability to manage federal funds effectively.

Obtain Answers on Sf 424A

FAQs about the SF-424A Form

What is the purpose of the SF-424A form?

The SF-424A form is designed for non-construction programs and serves as a budget information form for applicants seeking federal grants. It assists in the application process for funds from one or more grant programs, helping applicants detail their budget requirements across various categories and periods.

How do I fill out Section A: Budget Summary?

In Section A, you will summarize your budget needs. This includes breaking down the funding requirements by federal and non-federal sources across different functions or activities if necessary. New applications should leave columns (c) and (d) blank and focus on columns (e), (f), and (g) to represent funds needed for the project for the first funding period, typically one year. For continuing programs, these sections should reflect estimates for continuing funding periods.

What are Indirect Charges in Section B, and how do I calculate them?

Indirect charges refer to expenses not directly tied to a specific project activity but necessary for the general operation of an organization, such as administration, facilities, or utilities. To calculate them, use your organization's federally negotiated indirect cost rate (if available) applied to the appropriate base, which could be the total direct costs, modified total direct costs, or another base as specified in your negotiated rate agreement. Enter this calculation in line 6j of Section B.

Can In-Kind Contributions be included in Section C: Non-Federal Resources?

Yes, in-kind contributions can and should be included in Section C. These contributions represent non-cash support provided by non-federal sources, such as volunteer services, donations of property, or other resources. When listing in-kind contributions, briefly explain their nature on a separate sheet if necessary and include their estimated value in your budget under the appropriate column in Section C.

Common mistakes

Filling out the SF-424A form, titled "Budget Information - Non-Construction Programs," is a crucial step for organizations seeking federal funding. However, several common mistakes can occur during this process, impacting the success of an application. Here are the top five mistakes to avoid:

- Incorrect or Incomplete Budget Summary: Applicants often overlook the importance of Section A, the Budget Summary, which requires a clear presentation of the funding needed for the project. Failing to provide detailed and exact amounts for each category, including the unobligated funds and the new or revised budget, can lead to unnecessary delays or rejections.

- Not Adhering to Specific Program Requirements: The form is designed to cater to multiple grant programs, each with its unique guidelines. A common mistake is not customizing the budget categories in Section B to align with the specific requirements of the target grant program, potentially resulting in an application that fails to communicate the budget effectively to the grantor agency.

- Failing to Accurately Estimate Non-Federal Resources: Section C asks for an outline of non-Federal resources that will be allocated toward the project. Underestimating or not providing a detailed account of these resources, including in-kind contributions, can significantly impact the perceived sustainability and commitment to the project, diminishing the application's credibility.

- Miscalculating Forecasted Cash Needs: Section D requires applicants to predict future cash needs, including both Federal and non-Federal contributions. Misjudging these amounts not only misrepresents the project's financial health but also may indicate poor planning, affecting the reviewers' confidence in the project's successful execution.

- Inadequate Explanation of Budget Line Items: In Section F, applicants have the opportunity to explain direct and indirect charges, along with any other remarks related to budgeting. Providing minimal or no context for why certain expenses are necessary or how they were calculated can lead to skepticism or a misunderstanding of the project's financial structure.

To avoid these errors, meticulous attention to detail, a thorough understanding of the grant's requirements, and clear, concise explanations of all budget items are essential. Properly completing the SF-424A form is not just about listing numbers but about telling the financial story of your project in a way that aligns with the grantor's expectations and guidelines.

Documents used along the form

When organizations or individuals apply for federal funding, they often need to complete and submit a variety of forms in addition to the Standard Form 424A, known as Budget Information for Non-Construction Programs. This document serves as a detailed presentation of the budget necessary for the requested funding. Understanding other commonly required documents can streamline the application process, ensuring that all necessary information is presented effectively.

- SF-424: Known as the "Application for Federal Assistance," this form is the standard cover sheet for submissions of pre-applications and applications under grant programs. It collects basic organizational and contact information, alongside details about the federal assistance being requested.

- SF-LLL: The "Disclosure of Lobbying Activities" form is used to disclose the use of federal funds for lobbying activities, ensuring compliance with restrictions on such expenditures.

- SF-425: The Federal Financial Report (FFR), is required for ongoing reporting of the financial status of grants, detailing expenditures and any obligations of federal funds.

- Project Narrative Attachment Form: An attachment that provides a detailed description of the project's goals, plans, and objectives. This document outlines how the project will be carried out, who will be involved, and the expected outcomes.

- Project Performance Site Location(s) Form: Identifies where the work described in the application will be performed, giving the funding agency a clear understanding of the geographical context of the project.

- Assurances - Non-Construction Programs (SF-424B): This form is needed for applicants seeking non-construction grants. It contains various legal assurances, certifications, and compliance requirements that the applicant must agree to.

- Certifications Regarding Lobbying; Debarment, Suspension and Other Responsibility Matters; and Drug-Free Workplace Requirements: Applicants must complete this form to certify compliance with several statutory and regulatory requirements.

- Disclosure of Duplication in Cost Sharing: This form is necessary when there is overlap in funding or cost-sharing commitments for the project. It ensures that there are no duplications in budget allocations or financial reporting.

Understanding and preparing these documents in conjunction with the SF-424A form is crucial for a successful application for federal assistance. Organizations should carefully review each form's requirements to ensure compliance with federal guidelines and to foster a thorough and accurate presentation of their funding request.

Similar forms

The SF-424 (R&R) - Application for Federal Assistance: Similar to the SF-424A in its purpose for securing federal grants, the SF-424 (R&R) is often the initial form applicants complete when seeking federal funding. It gathers basic information about the applicant and the proposed work but does not dive as deeply into the budget details as the SF-424A.

The SF-424B - Assurances for Non-Construction Programs: This form is used alongside the SF-424A when applying for non-construction federal grants. Whereas the SF-424A focuses on financial aspects, the SF-424B provides a set of assurances that the applicant must agree to, outlining legal obligations and compliance with federal regulations.

The SF-424C - Budget Information for Construction Programs: Serving a similar function to the SF-424A, the SF-424C is tailored for construction-related grants. It collects detailed budget information, but specifically for expenditures related to construction projects, highlighting the distinct financial considerations in construction versus non-construction programs.

The SF-424D - Assurances for Construction Programs: Complementary to the SF-424C, this form ensures applicants for construction grants understand and commit to specific legal and regulatory requirements. The difference stems from the nature of construction work and its unique legal landscape compared to non-construction objectives covered by the SF-424A and SF-424B.

The SF-LLL - Disclosure of Lobbying Activities: While focused on a different aspect of grant application, the SF-LLL intersects with the SF-424A through its role in ensuring transparency in the use of federal funds. Any applicant filling out the SF-424A might also need to disclose lobbying activities if federal funds are being used to influence government decision-making.

The SF-270 - Request for Advance or Reimbursement: This form is used for managing cash flow during the execution of federally funded projects. It is connected to the budget planning aspect of the SF-424A, as it involves reporting and requesting funds based on the budgeted project costs.

The SF-425 - Federal Financial Report: The SF-425 is essential for reporting the financial status and project expenditures of federally funded projects. It complements the SF-424A by providing post-award financial accountability, ensuring that the budget projected in the SF-424A aligns with actual spending.

The SF-428 - Tangible Personal Property Report Forms: These forms are a series of reports concerning federal assets used or acquired during federally funded projects. They relate to the SF-424A as both deal with the allocation and reporting of federal funds, particularly concerning how assets are managed within funded projects.

The OMB No. 4040-0004 - Assurances for Non-Construction Programs (Standard Form 424B): Notably aligned with the SF-424A through its collective aim of ascertaining applicant eligibility and project compliance with federal requirements for non-construction initiatives.

Dos and Don'ts

Things You Should Do When Filling Out the SF 424A Form

- Review all instructions provided by the Federal grantor agency carefully to ensure compliance with their specific guidelines.

- Ensure accuracy in the breakdown of budget estimates by object class categories (Personnel, Fringe Benefits, Travel, etc.) in Section B to match the total amounts requested in Section A.

- Include detailed explanations in Section F for any direct charges or indirect charges that are not self-explanatory or might seem unconventional.

- Accurately forecast your cash needs by quarter in Section D and ensure they align with the total budgeted amounts in earlier sections.

Things You Shouldn't Do When Filling Out the SF 424A Form

- Don't leave any required fields blank. If a section does not apply, clearly indicate with "N/A" or "Not Applicable" to demonstrate that the question was not overlooked.

- Avoid approximations. Ensure all budget figures are precise and based on the most current and accurate estimates available.

- Do not ignore the need to provide detailed explanations for in-kind contributions in Section C. If applicable, attach a separate sheet elaborating on these contributions.

- Refrain from submitting the completed form to the Office of Management and Budget (OMB); it should only be submitted to the address provided by the sponsoring Federal agency.

Misconceptions

When dealing with the SF-424A form, several misunderstandings commonly arise. Clarifying these misconceptions can help applicants provide accurate and complete budget information for non-construction programs.

- Misconception 1: The form is only for federal funding requests. While the SF-424A form is used to apply for federal funds, it also requires information about non-federal resources. Applicants must detail any non-federal contributions, including in-kind support, showing the total project funding sources.

- Misconception 2: Indirect costs do not need to be detailed. In fact, the form requires specific details about indirect costs, including the rate, base, and total amount. It’s crucial for applicants to understand their indirect cost rate agreement and accurately calculate and report these expenses.

- Misconception 3: The form is the same for new and continuing applications. Although the form layout does not change, the information provided differs depending on whether the application is for a new project or a continuation of existing funding. For example, unobligated funds from previous periods must be reported on continuing applications.

- Misconception 4: All sections of the form must be completed. Certain sections of the SF-424A form may not be applicable depending on the type of funding or project. It's important to carefully review which sections are required for your specific application to avoid providing unnecessary information.

- Misconception 5: Program income is deducted from the total project budget. Program income should be reported in Section B, Line 7, but it is not subtracted from the total project budget. Instead, it’s reviewed by federal agencies to understand the full scope of funding and resources supporting the project.

- Misconception 6: The form does not allow for future funding needs to be addressed. Section E of the form is specifically designed for applicants to outline federal funds needed for future periods beyond the initial funding cycle. This foresight is crucial for long-term projects that will require multiple funding periods.

Understanding these six misconceptions can significantly improve the accuracy and completeness of SF-424A submissions, facilitating smoother processing and evaluation of grant applications.

Key takeaways

Filling out the SF 424A form, known as Budget Information for Non-Construction Programs, requires detailed attention to correctly outlining your project's financial needs from Federal and non-Federal sources. Here are key takeaways to guide you through the process:

- Understand the sections: The form is divided into six main sections: A through F. Each section collects different types of budget information, from the summary totals in Section A to specific budget categories in Section B, non-Federal resources in Section C, forecasted cash needs in Section D, estimates of Federal funds needed for the balance of the project in Section E, and other budget information in Section F.

- Detailing the budget: When preparing your budget, ensure that you break down the costs into the object class categories shown in Section B, lines a-k. This includes everything from personnel costs, supplies, equipment, contractual, and other expenses, to indirect charges.

- Multiple programs and activities: If your project involves multiple Federal programs or activities, you may need to prepare additional sheets to adequately break down the data required for each. Make sure the first page provides summary totals by program to tie everything together.

- Supplemental and revised budgets: For supplemental grants and changes to existing grants, do not use the columns designed for unobligated funds. Instead, directly enter the increase or decrease of Federal and non-Federal funds in the provided columns, ensuring the new total budgeted amount reflects these adjustments.

- Non-Federal resources and in-kind contributions: Section C demands specifying the non-Federal resources that will support the grant. If your project includes in-kind contributions, a brief explanation on a separate sheet may be needed, clearly detailing the nature and source of these contributions.

Completing the SF 424A form accurately is crucial for receiving the right amount of funding for your project. Pay close attention to the instructions for each section, provide clear explanations where necessary, and carefully calculate your budget requests to reflect your project's financial needs effectively.

Popular PDF Forms

Uscg Career Intentions Worksheet - For those eligible and intending to reenlist or extend, the form outlines the minimum and maximum years of commitment required.

Purpose of Purchase Requisition Form - Empowers departments by allowing them to formally request the tools and supplies they need to perform effectively.