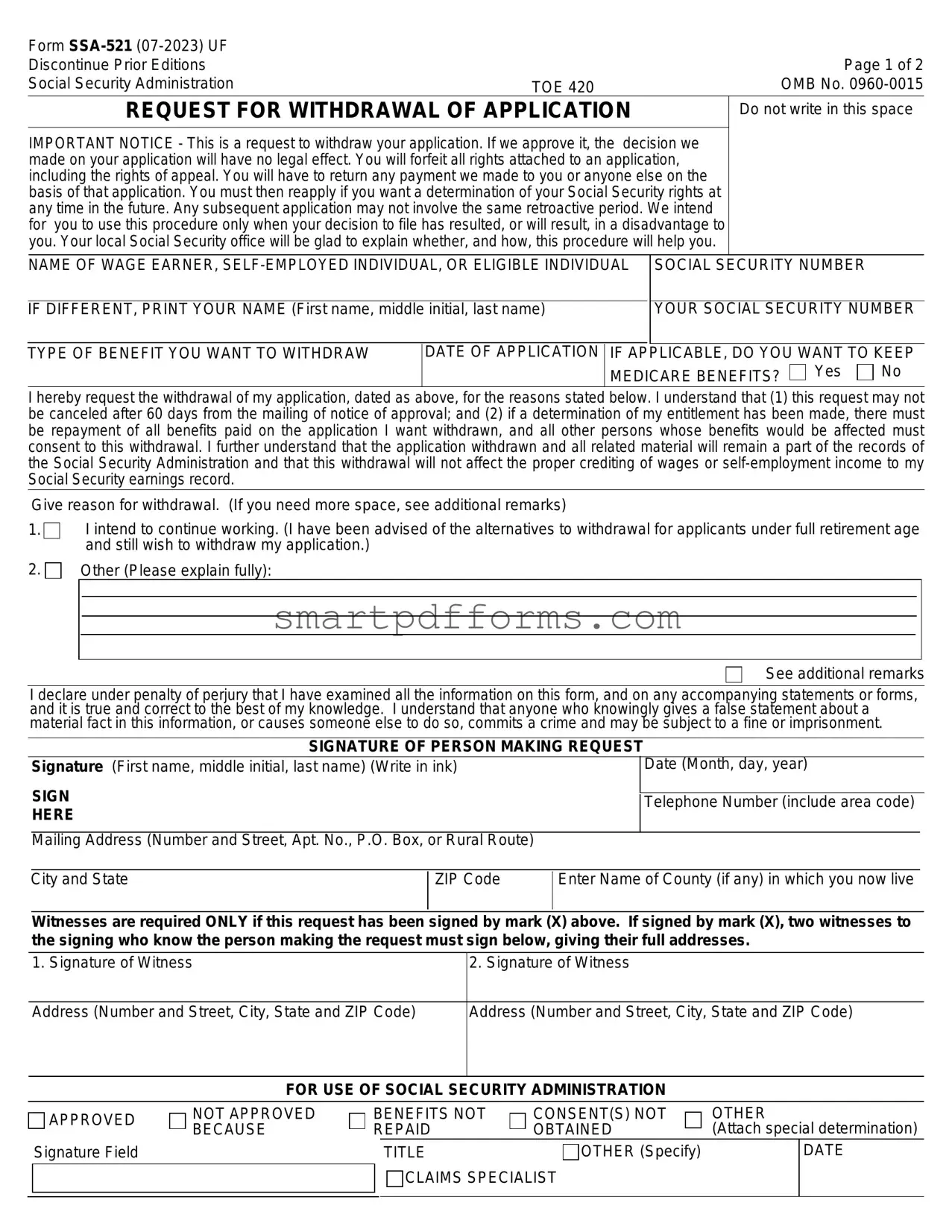

Blank Social Security Ssa 521 PDF Template

Navigating the complex landscape of Social Security benefits can sometimes lead to reconsidering decisions, and that's where the Social Security SSA 521 form comes into play. Designed for those who wish to withdraw their application for benefits, this form acknowledges a pivotal change of heart or circumstance, permitting applicants to cancel their initial request. However, it comes with the critical condition of forfeiting all rights previously attached to the application, including the right to appeal and the necessity to repay any benefits received. This form serves as a crucial tool for managing one’s Social Security benefits more strategically, especially in cases where continuing work or other factors make withdrawal a more beneficial option. The SSA 521 form stands as a testament to the fundamental principle that decisions concerning Social Security benefits are not always set in stone. Applicants are advised to proceed with caution, understanding that a withdrawal not only erases the legal effect of the original application but also mandates any other affected individuals to consent to this change. Beyond its primary function, the form is steeped in considerations of privacy, information sharing, and the administration's keen interest in ensuring the integrity and correctness of the withdrawal process. With spaces for detailed explanations and personal attestations, it underlines the seriousness and finality of choosing to withdraw an application for Social Security benefits.

Preview - Social Security Ssa 521 Form

Form |

|

|

Discontinue Prior Editions |

|

Page 1 of 2 |

Social Security Administration |

TOE 420 |

OMB No. |

REQUEST FOR WITHDRAWAL OF APPLICATION |

Do not write in this space |

|

IMPORTANT NOTICE - This is a request to withdraw your application. If we approve it, the decision we made on your application will have no legal effect. You will forfeit all rights attached to an application, including the rights of appeal. You will have to return any payment we made to you or anyone else on the basis of that application. You must then reapply if you want a determination of your Social Security rights at any time in the future. Any subsequent application may not involve the same retroactive period. We intend for you to use this procedure only when your decision to file has resulted, or will result, in a disadvantage to you. Your local Social Security office will be glad to explain whether, and how, this procedure will help you.

|

NAME OF WAGE EARNER, |

|

|

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

|

||

IF DIFFERENT, PRINT YOUR NAME (First name, middle initial, last name) |

YOUR SOCIAL SECURITY NUMBER |

|||||

|

|

|

|

|||

TYPE OF BENEFIT YOU WANT TO WITHDRAW |

DATE OF APPLICATION IF |

APPLICABLE, DO YOU WANT TO KEEP |

||||

|

|

MEDICARE BENEFITS? Yes |

No |

|||

I hereby request the withdrawal of my application, dated as above, for the reasons stated below. I understand that (1) this request may not be canceled after 60 days from the mailing of notice of approval; and (2) if a determination of my entitlement has been made, there must be repayment of all benefits paid on the application I want withdrawn, and all other persons whose benefits would be affected must consent to this withdrawal. I further understand that the application withdrawn and all related material will remain a part of the records of the Social Security Administration and that this withdrawal will not affect the proper crediting of wages or

Give reason for withdrawal. (If you need more space, see additional remarks)

1.I intend to continue working. (I have been advised of the alternatives to withdrawal for applicants under full retirement age and still wish to withdraw my application.)

2. |

Other (Please explain fully): |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See additional remarks

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge. I understand that anyone who knowingly gives a false statement about a material fact in this information, or causes someone else to do so, commits a crime and may be subject to a fine or imprisonment.

|

|

|

|

|

|

|

|

|

SIGNATURE OF PERSON MAKING REQUEST |

||||

Signature (First name, middle initial, last name) (Write in ink) |

|

Date (Month, day, year) |

||||

|

SIGN |

|

|

|

|

|

|

|

|

Telephone Number (include area code) |

|||

|

HERE |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address (Number and Street, Apt. No., P.O. Box, or Rural Route) |

|

|

|

||

|

|

|

|

|

|

|

|

City and State |

|

ZIP Code |

Enter Name of County (if any) in which you now live |

|

|

|

|

|

|

|

|

|

Witnesses are required ONLY if this request has been signed by mark (X) above. If signed by mark (X), two witnesses to the signing who know the person making the request must sign below, giving their full addresses.

1. Signature of Witness

2. Signature of Witness

Address (Number and Street, City, State and ZIP Code)

Address (Number and Street, City, State and ZIP Code)

FOR USE OF SOCIAL SECURITY ADMINISTRATION

APPROVED Signature Field

APPROVED Signature Field

NOT APPROVED BECAUSE

BENEFITS NOT |

CONSENT(S) NOT |

OTHER |

||

REPAID |

OBTAINED |

(Attach special determination) |

||

|

TITLE |

OTHER (Specify) |

|

DATE |

|

CLAIMS SPECIALIST |

|

|

|

|

|

|

|

|

Form |

Page 2 of 2 |

||

|

|

|

|

Additional Remarks: |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Privacy Act Statement

Collection and Use of Personal Information

Sections 202, 205, 223 and 1872 of the Social Security Act, as amended, allow us to collect this information. Furnishing us this information is voluntary. However, failing to provide all or part of the information may prevent withdrawal of the application for benefits.

We will use the information you provide to cancel your application for benefits. We may also share the information for the following purposes, called routine uses:

•To contractors and other Federal Agencies, as necessary, for the purpose of assisting us in the efficient administration of our programs. We will disclose information under this routine use only in situations in which we may enter into a contractual or similar agreement to obtain assistance in accomplishing an SSA function relating to this system of records; and,

•To student volunteers, individuals working under a personal services contract, and other workers who technically do not have the status of Federal employees, when they are performing work for us, as authorized by law, and they need access to personally identifiable information (PII) in our records in order to perform their assigned agency functions.

In addition, we may share this information in accordance with the Privacy Act and other Federal laws. For example, where authorized, we may use and disclose this information in computer matching programs, in which our records are compared with other records to establish or verify a person's eligibility for Federal benefit programs and for repayment of incorrect or delinquent debts under these programs.

A list of additional routine uses is available in our Privacy Act System of Records Notice (SORN)

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget control number. We estimate that it will take about 5 minutes to read the instructions, gather the facts, and answer the questions. SEND OR BRING THE COMPLETED FORM TO YOUR LOCAL SOCIAL SECURITY OFFICE. You can find your local Social Security office through SSA's website at www.socialsecurity.gov. Offices are also listed under U. S. Government agencies in your telephone directory or you may call Social Security at

You may send comments regarding this burden estimate or any other aspect of this collection, including suggestions for reducing this burden to: SSA, 6401 Security Blvd, Baltimore, MD

Form Data

| Fact | Description |

|---|---|

| Form Title | Request for Withdrawal of Application |

| Form Number | SSA-521 |

| Revision Date | 07-2023 |

| Page Number | Page 1 of 2 |

| Use of Form | This form is used to request the withdrawal of a Social Security application. |

| Consequences of Withdrawal | Withdrawal nullifies the application decision, requiring the return of any payments received and forfeiting appeal rights. |

| Repayment Requirement | Withdrawal requires repayment of all benefits received based on the application. |

| Withdrawal Consent | All individuals whose benefits would be affected must consent to the withdrawal. |

| Record Retention | Withdrawn applications remain part of Social Security Administration's records. |

| Privacy and Information Sharing | Information provided can be used for administrative purposes and shared according to routine uses. |

Instructions on Utilizing Social Security Ssa 521

When the need arises to withdraw a previously submitted application for Social Security benefits, the SSA-521 form is utilized to make this request official. This form signals your intent to cancel the application you previously submitted and understand the implications of such a decision, notably the necessity to return any benefits received. Following the completion and submission of this form, the Social Security Administration will review your request. If approved, you may reapply for benefits in the future, but note that the consideration of retroactive benefits may differ.

- Start by entering the full name of the wage earner, self-employed individual, or eligible individual associated with the application in the designated field.

- Next to the name, provide the Social Security Number (SSN) of the individual.

- If the applicant's current name differs from the one under which the application was filed, print the current name in the relevant section including first name, middle initial, and last name along with the current SSN in the respective field.

- Specify the type of benefit you initially applied for (e.g., retirement, disability, etc.) in the indicated area.

- Enter the date of the original application in the space provided.

- Indicate whether you wish to keep your Medicare benefits by selecting "Yes" or "No" in the appropriate section.

- In the space given, list your reason(s) for withdrawing the application. If you selected "I intend to continue working" as your reason, no additional details are required here. For any other reasons, provide a clear and full explanation. Use the "Additional Remarks" section on Page 2 if more space is needed.

- Under the penalty of perjury, declare that the information you have provided is accurate and complete by signing your name in ink, entering the current date (month, day, year), and including your telephone number (with area code).

- Fill in your mailing address including number and street, apartment number if applicable, P.O. Box or Rural Route, city and state, and ZIP Code. Also, indicate the name of your current county of residence.

- If the form is being signed with an "X" (mark), two witnesses familiar with the individual making the request must sign at the bottom of the form, providing their full addresses and affirming the authenticity of the signature.

Upon completion, the form should be sent or personally delivered to the local Social Security office. Finding the nearest office can be done through the Social Security Administration's website or by consulting the local telephone directory under U.S. Government agencies. Additionally, assistance is available through the Social Security Administration's helpline. It is important to ensure that all information is accurate and complete to avoid any delays in the processing of your request.

Obtain Answers on Social Security Ssa 521

What is Form SSA-521?

Form SSA-521, titled "Request for Withdrawal of Application," is a document issued by the Social Security Administration (SSA). This form allows individuals to withdraw their application for Social Security benefits. Upon approval, the original application is considered void, eliminating any legal effects it may have had. Importantly, withdrawing an application means forfeiting all associated rights, including any payments received, which must be repaid. This step is typically considered when the initial decision to apply proves disadvantageous to the individual.

Why would someone want to withdraw their Social Security application?

There are several reasons someone might choose to withdraw their Social Security application. One common reason is the intention to continue working, which could increase the future benefits received. The individual may have also found that their initial application timing was not optimal for maximizing benefits. Remember, withdrawal is intended as a remedy when the original application results in a disadvantage to the applicant.

How does one withdraw their Social Security application using Form SSA-521?

To withdraw a Social Security application, Form SSA-521 must be completed and submitted to the SSA. The form requests basic identification details, the type of benefit being withdrawn, and the reasoning for the request. It is crucial to note that all benefits paid out based on the application must be repaid, and any affected parties must consent to the withdrawal. After submission, a decision will be made by the SSA on whether to approve the withdrawal request.

Can the decision to withdraw an application be reversed?

Once the SSA approves the withdrawal request, the decision cannot be canceled after 60 days from the notification of approval. Therefore, it's essential to be certain about the decision to withdraw, as reversing this action is restricted.

What happens after a Social Security application has been successfully withdrawn?

After successfully withdrawing a Social Security application, the individual forfeits all rights previously attached to the application, including appeal rights and any payments received, which must be returned. The individual’s earnings record will not be affected by the withdrawal, preserving the accurate crediting of wages or self-employment income. If the individual wishes to pursue Social Security benefits in the future, a new application must be filed, potentially under different conditions or eligibility criteria.

Is it possible to keep Medicare benefits after withdrawing a Social Security application?

Yes, when withdrawing a Social Security application using Form SSA-521, individuals have the option to indicate whether they wish to retain their Medicare benefits. This choice must be clearly stated on the form at the time of submission.

Where can Form SSA-521 be submitted?

Form SSA-521 can be submitted to the individual’s local Social Security office. Offices can be located through the SSA’s website or the telephone directory. Alternatively, assistance can be sought by calling Social Security directly at their provided contact numbers. It's advisable to retain a copy of the form for personal records after submission.

Common mistakes

Completing the Social Security SSA-521 form, officially titled "Request for Withdrawal of Application," requires careful attention to detail and an understanding of the implications of withdrawing a Social Security application. Individuals often commit errors during this process, potentially affecting their benefits or future applications. Here are nine common mistakes to avoid:

- Failing to fully grasp the consequences of withdrawing an application, including the loss of any benefits already received and the requirement to repay those funds.

- Not providing a comprehensive explanation for the reason behind the withdrawal request, which is necessary for the Social Security Administration (SSA) to process and approve the withdrawal.

- Omitting or incorrectly entering personal identification details such as the Social Security number or name, leading to delays or the rejection of the form.

- Skipping the question regarding the desire to keep Medicare benefits, if applicable, which can have unintended effects on healthcare coverage.

- Not securing the required consent from all individuals whose benefits might be affected by the withdrawal, a step necessary for the form's approval.

- Overlooking the need for witnesses when the request is signed by mark (X), without which the form cannot be processed.

- Assuming the request can be easily canceled after submission. The form clearly states that the request may not be canceled after 60 days from the mailing of notice of approval.

- Misunderstanding the declaration section and not recognizing the legal commitment being made when attesting to the truthfulness of the information provided on the form.

- Forgetting to check or incorrectly filling out the contact information section, resulting in the SSA's inability to communicate effectively regarding the request.

To avoid these pitfalls, applicants are advised to carefully review the form's instructions, double-check all filled-out information for accuracy and completeness, and consider consulting with a Social Security expert or legal advisor if they have any uncertainties or concerns about the withdrawal process.

Documents used along the form

When a person decides to withdraw their application for Social Security benefits using Form SSA-521, several other forms and documents may also be involved in the process. These additional documents are often required to provide further details, clarify the applicant's intentions, or support the withdrawal request. They play a crucial role in ensuring that the application for withdrawal is comprehensive and meets all necessary requirements.

- SSA-1: Application for Retirement Insurance Benefits - This document initiates a claim for retirement benefits. It might be relevant if the withdrawer intends to delay benefits for a higher amount in the future.

- SSA-16: Application for Disability Insurance Benefits - Applicants seeking to withdraw an application for disability benefits must have initially submitted this form to claim such benefits.

- SSA-4: Application for Child's Insurance Benefits - If the withdrawal affects a child's benefits, this form might be part of the initial application process that needs reconsideration.

- SSA-2: Application for Wife's or Husband's Insurance Benefits - This document could be relevant in situations where spousal benefits were part of the initial application being withdrawn.

- SSA-7004: Request for Social Security Statement - Used to obtain a Social Security Statement, this document can provide valuable information in making the decision to withdraw an application by showing the applicant's earnings record and estimated benefits.

- SSA-5: Application for Mother's or Father's Insurance Benefits - If parents' benefits were initially claimed, withdrawing the application might require revisiting this form.

- SSA-561: Request for Reconsideration - Though primarily used for appealing decisions, this form may be required if the initial request to withdraw is not approved and further appeal is necessary.

Each of these documents contributes to the broader context in which Form SSA-521 is used. They enable applicants to provide comprehensive information about their Social Security benefits claims, facilitating informed decisions by the Social Security Administration. Whether used for initial claims, appeals, or providing necessary information, these forms ensure that the process remains tailored to the individual's specific circumstances and intentions.

Similar forms

Form SSA-1-BK: Application for Retirement Insurance Benefits is similar to Form SSA-521 because they both are integral to the Social Security benefits application process. Form SSA-1-BK is used to apply for retirement benefits, while Form SSA-521 is used to withdraw an application for benefits. Both forms require detailed personal information and an understanding of the applicant's Social Security benefits.

Form SSA-16-BK: Application for Disability Insurance Benefits shares similarities with Form SSA-521 in that it involves the Social Security benefits claim process. Form SSA-16-BK is used by individuals applying for disability benefits, whereas Form SSA-521 is utilized to withdraw any application for Social Security benefits. Both forms involve careful consideration of the applicant's current situation and potential future benefits.

Form SSA-44: Medicare Income-Related Monthly Adjustment Amount - Life-Changing Event is akin to Form SSA-521 as they both can involve adjustments to benefits based on changes in the applicant's life or financial situation. Form SSA-44 is specifically used for reporting changes that might affect Medicare premiums, while Form SSA-521 could be used to withdraw an application if the applicant’s circumstances change.

Form HA-501: Request for Hearing by Administrative Law Judge is similar to Form SSA-521 in its function of navigating through the Social Security Administration's processes based on the applicant's needs or circumstances. While Form HA-501 is used to request a hearing on a previously made decision regarding benefits, Form SSA-521 allows for the withdrawal of an application, potentially before such a hearing is needed.

Form SSA-561-U2: Request for Reconsideration is another form that shares similarities with Form SSA-521, as both are used within the processes for appealing or altering decisions related to Social Security benefits. Form SSA-561-U2 is specifically used to request a reconsideration of a decision made regarding benefit eligibility or payment amounts, while Form SSA-521 is used for withdrawing an application entirely.

Dos and Don'ts

When filling out the SSA-521 form for withdrawing a Social Security application, it is important to both understand and follow certain guidelines to ensure the process is completed correctly. Below are four things you should do, as well as four things you should avoid.

Things You Should Do:

- Read the instructions thoroughly before beginning to fill out the form to avoid any mistakes.

- Provide a clear and concise reason for your withdrawal in the space provided, ensuring it accurately reflects your situation.

- Verify all the personal information, including your Social Security number and the type of benefit you want to withdraw, to prevent processing delays.

- Sign and date the form to validate your request officially; use ink for durability and legibility.

Things You Shouldn't Do:

- Avoid leaving any required fields blank, as incomplete forms may result in the denial of your request.

- Do not provide false information or omit details about your situation, as this can lead to a crime charge.

- Do not delay in submitting the form after completion to ensure your request is processed in a timely manner.

- Refrain from neglecting the repayment clause; understand that if you've received any benefits, you must repay them upon approval of your withdrawal.

Misconceptions

There are several misconceptions about the Social Security Administration's SSA-521 form, also known as the Request for Withdrawal of Application. Understanding these misconceptions is important for anyone considering withdrawing their social security benefits application.

Misconception 1: The SSA-521 form can be used to withdraw any Social Security application at any time. In reality, there are specific guidelines and deadlines for withdrawing an application, and not all applications may be eligible for withdrawal once processed.

Misconception 2: Withdrawing an application has no consequences. In fact, withdrawing an application means forfeiting all rights attached to that application, including rights of appeal, and requires the repayment of any benefits received based on that application.

Misconception 3: Once the SSA approves a withdrawal request, it can easily be canceled. The truth is, a withdrawal request cannot be canceled after 60 days from the mailing of the notice of approval.

Misconception 4: Withdrawing an application will affect the Social Security earnings record. However, the withdrawal of an application and all related materials will still remain part of the Social Security Administration's records without affecting the proper crediting of wages or self-employment income.

Misconception 5: You can keep Medicare benefits automatically if you withdraw your Social Security benefits application. The SSA-521 form actually asks whether you want to keep Medicare benefits, indicating that keeping them is not automatic and requires affirmative action to maintain Medicare coverage.

Misconception 6: Submitting an SSA-521 form guarantees the withdrawal will be approved. Approval is actually contingent on meeting specific criteria, including consent from all other persons whose benefits would be affected by the withdrawal.

Misconception 7: You can file an SSA-521 form online. Currently, the completed form must be sent or brought to a local Social Security office, with no option to submit electronically.

Misconception 8: Withdrawing a Social Security application means you can reapply with the same retroactive period as the original application. When reapplying after a withdrawal, a subsequent application may not include the same retroactive period as the initial application.

Misconception 9: The SSA-521 form is lengthy and requires extensive time to complete. The form itself estimates that it will take about 5 minutes to read the instructions, gather the facts, and answer the questions, suggesting the process is relatively straightforward.

Clearing up these misconceptions helps in making an informed decision about whether to withdraw a Social Security benefits application and understanding the implications of such a decision.

Key takeaways

Filling out and using the Social Security SSA-521 form involves several key considerations:

- Submitting a Form SSA-521, or Request for Withdrawal of Application, means asking the Social Security Administration (SSA) to cancel a previously submitted application for benefits. This action, if approved, negates the original application as if it never existed.

- Upon approval of the withdrawal request, any benefits received as a result of the original application must be repaid. This includes any payments made to the applicant or to others based on the applicant's claim.

- The right to appeal attached to the original application is forfeited once the SSA-521 form is submitted and approved. Reapplication is possible, but the coverage for the same retroactive period may not be available.

- The decision to withdraw should be carefully considered, especially for individuals under full retirement age. Alternative options to withdrawal are available and can be discussed with a Social Security office.

- Execution of Form SSA-521 requires the applicant to provide a reason for withdrawal. This explanation is crucial, as it helps the SSA understand the context and justification for the request.

- After submitting the form, the withdrawal request cannot be canceled after 60 days from the mailing of the notice of approval. It’s important to be certain about the decision to withdraw because this time frame limits the opportunity to reconsider.

- Witness signatures are required if the request is signed by a mark (X) instead of a full signature. This ensures the authenticity of the request, especially in situations where the applicant cannot provide a traditional signature.

Understanding the implications and the process of submitting a Form SSA-521 is crucial for individuals considering the withdrawal of their Social Security application. Consulting with Social Security representatives can provide clarity and assistance in making an informed decision.

Popular PDF Forms

Teach Program - The TEACH Grant Certification Form is a key tool in ensuring recipients fulfill their teaching obligations and retain their grant benefits.

Rental Application Form Wisconsin - Evidence of identification stands as a necessary provision for applying, underlining the form's emphasis on verifying the identity of all applicants, crucial for background and credit checks.

Fmla Paperwork - Serves as a formal declaration from a healthcare provider regarding an employee’s medical fitness for work.