Blank Ssa 21 PDF Template

Understanding the nuances of the SSA-21 form is crucial for U.S. citizens who find themselves or their dependents outside the United States and engaged with the Social Security system. This form, formally titled "Supplement to Claim of Person Outside the United States," serves as a comprehensive document to be completed by or on behalf of individuals living, or planning to live, outside the U.S. for more than 30 consecutive days. It addresses a range of important information, including the claimant's employment status outside the U.S., citizenship details, and the impact on Social Security benefits. Particularly notable is the form's role in clarifying the tax obligations of non-U.S. citizens and individuals claiming U.S. residency for tax purposes, which can significantly affect one's Social Security benefits and taxation levels. Moreover, the SSA-21 is essential for ensuring that Social Security payments are directed accurately and efficiently to beneficiaries residing abroad, facilitating a smoother management of their benefits. Engaging with this form also implies a commitment on the part of the claimant or their representative to keep the Social Security Administration informed about significant life changes that could affect benefit status or entitlement. In essence, the SSA-21 encapsulates critical procedures and responsibilities for Americans overseas in relation to their Social Security entitlements, making it a key piece of administration for expatriates and long-term travelers.

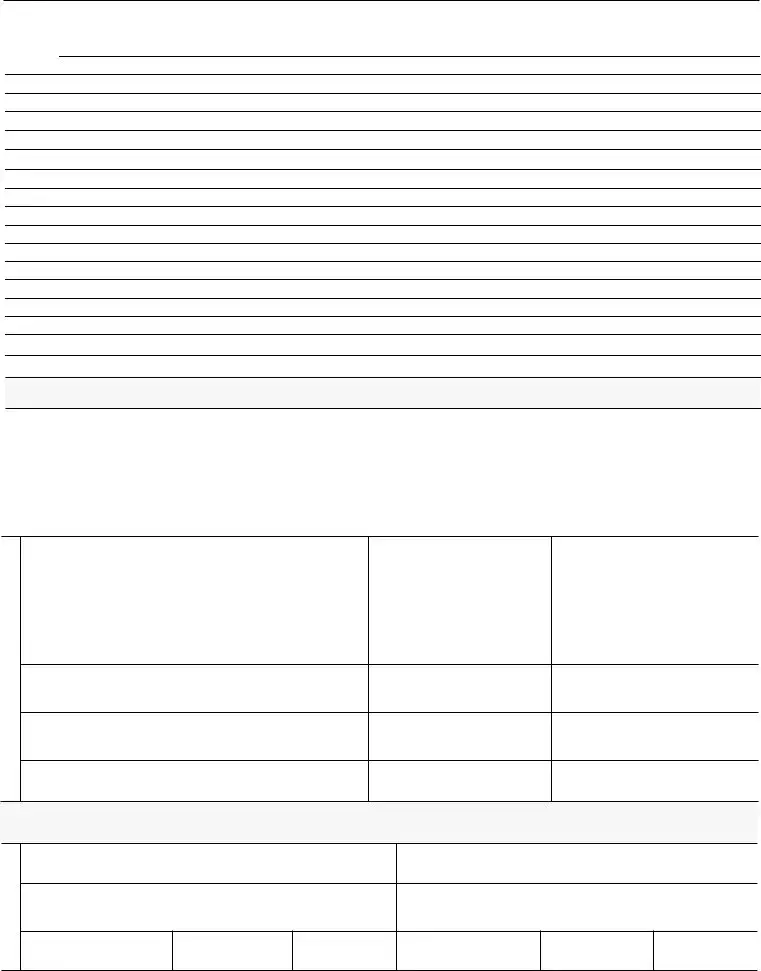

Preview - Ssa 21 Form

Form |

Page 1 of 5 |

Discontinue Prior Editions |

|

Social Security Administration |

OMB No. |

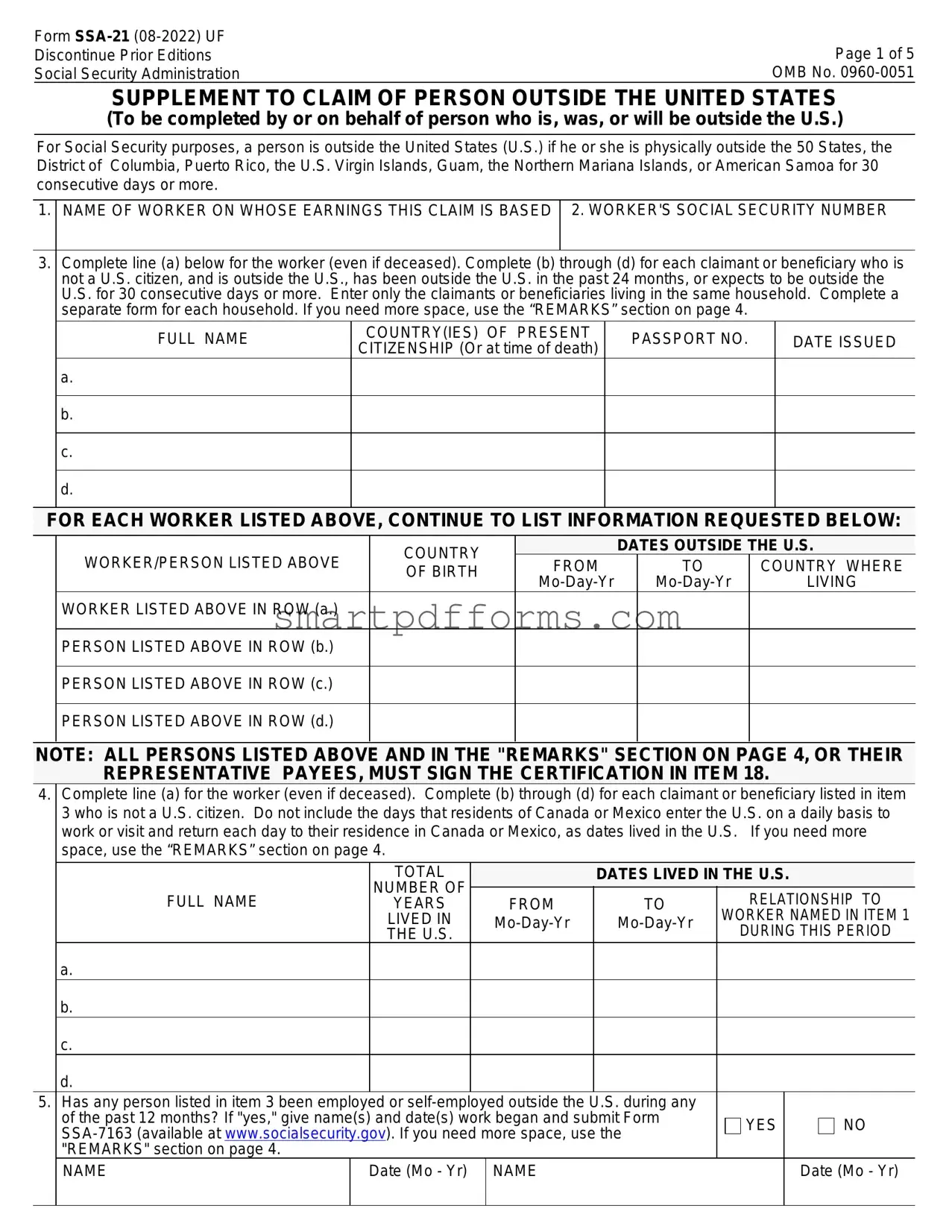

SUPPLEMENT TO CLAIM OF PERSON OUTSIDE THE UNITED STATES (To be completed by or on behalf of person who is, was, or will be outside the U.S.)

For Social Security purposes, a person is outside the United States (U.S.) if he or she is physically outside the 50 States, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands, or American Samoa for 30 consecutive days or more.

1.

NAME OF WORKER ON WHOSE EARNINGS THIS CLAIM IS BASED

2. WORKER'S SOCIAL SECURITY NUMBER

3.Complete line (a) below for the worker (even if deceased). Complete (b) through (d) for each claimant or beneficiary who is not a U.S. citizen, and is outside the U.S., has been outside the U.S. in the past 24 months, or expects to be outside the U.S. for 30 consecutive days or more. Enter only the claimants or beneficiaries living in the same household. Complete a separate form for each household. If you need more space, use the “REMARKS” section on page 4.

FULL NAME |

COUNTRY(IES) OF PRESENT |

PASSPORT NO. |

DATE ISSUED |

|

CITIZENSHIP (Or at time of death) |

||||

|

|

|

a.

b.

c.

d.

FOR EACH WORKER LISTED ABOVE, CONTINUE TO LIST INFORMATION REQUESTED BELOW:

|

|

|

|

|

|

|

|

WORKER/PERSON LISTED ABOVE |

COUNTRY |

|

DATES OUTSIDE THE U.S. |

||

|

FROM |

|

TO |

COUNTRY WHERE |

||

|

OF BIRTH |

|

||||

|

|

|

LIVING |

|||

|

|

|

|

|||

|

WORKER LISTED ABOVE IN ROW (a.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

PERSON LISTED ABOVE IN ROW (b.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

PERSON LISTED ABOVE IN ROW (c.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

PERSON LISTED ABOVE IN ROW (d.) |

|

|

|

|

|

|

|

|

|

|

|

|

NOTE: ALL PERSONS LISTED ABOVE AND IN THE "REMARKS" SECTION ON PAGE 4, OR THEIR REPRESENTATIVE PAYEES, MUST SIGN THE CERTIFICATION IN ITEM 18.

4.Complete line (a) for the worker (even if deceased). Complete (b) through (d) for each claimant or beneficiary listed in item 3 who is not a U.S. citizen. Do not include the days that residents of Canada or Mexico enter the U.S. on a daily basis to work or visit and return each day to their residence in Canada or Mexico, as dates lived in the U.S. If you need more space, use the “REMARKS” section on page 4.

|

|

|

TOTAL |

|

|

DATES LIVED IN THE U.S. |

|

||||

|

|

|

NUMBER OF |

|

|

|

|

|

|

|

|

|

FULL NAME |

|

|

FROM |

TO |

|

|

RELATIONSHIP TO |

|||

|

|

YEARS |

|

|

|

||||||

|

|

|

LIVED IN |

|

WORKER NAMED IN ITEM 1 |

||||||

|

|

|

THE U.S. |

|

|

|

|

DURING THIS PERIOD |

|||

|

a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. |

|

|

|

|

|

|

|

|

|

|

|

c. |

|

|

|

|

|

|

|

|

|

|

|

d. |

|

|

|

|

|

|

|

|

|

|

5. Has any person listed in item 3 been employed |

or |

|

|

|

|

|

|||||

|

of the past 12 months? If "yes," give name(s) and date(s) work began and submit Form |

|

|

YES |

|

NO |

|||||

|

|

|

|

||||||||

|

|

|

|

||||||||

|

|

|

|

|

|

||||||

|

"REMARKS" section on page 4. |

|

|

|

|

|

|

|

|

|

|

|

NAME |

Date (Mo - Yr) |

|

NAME |

|

|

|

|

|

Date (Mo - Yr) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

|

|

|

Page 2 of 5 |

|

|

|

|

|

|

|

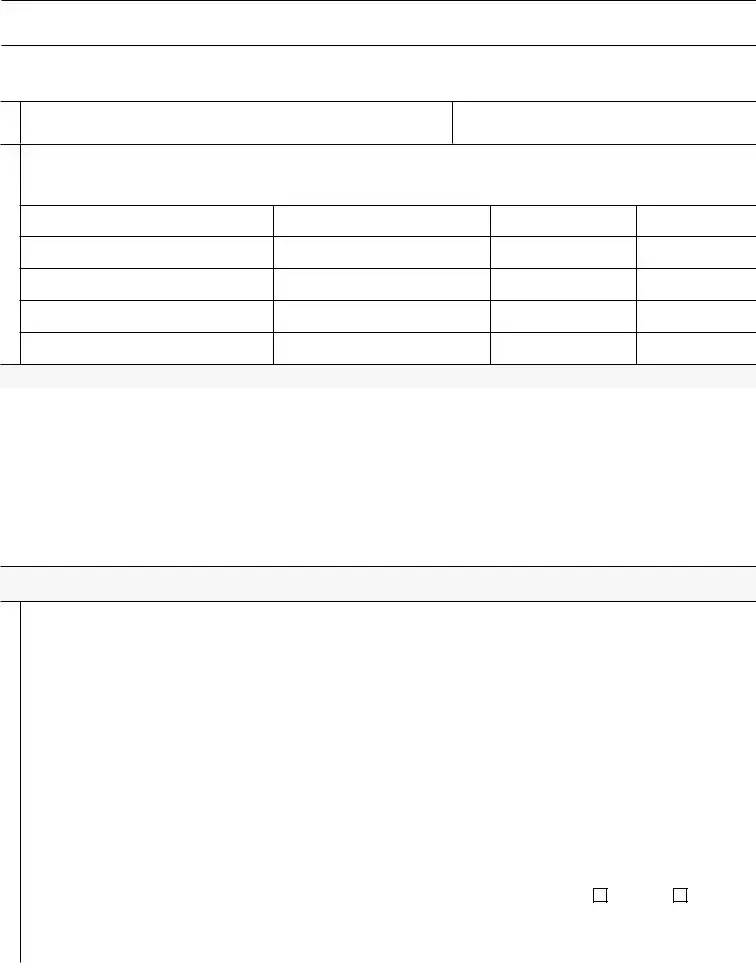

6. |

Does any person listed in item 3 expect to begin employment or |

YES |

NO |

||

|

U.S. in the future? If "yes," give name(s) and date(s) work is expected to begin. If you need |

||||

|

more space, use the “REMARKS” section on page 4. |

|

|

||

|

NAME |

Date (Mo - Yr) |

NAME |

|

Date (Mo - Yr) |

|

|

|

|

|

|

7. |

Answer item 7 only if the worker named in item 1 is deceased. Did the worker die while in the |

YES |

NO |

||

|

military service of the U.S. or as a result of disease or injury incurred or made worse while in |

||||

|

military service? |

|

|

|

|

8.Supplementary Medical Insurance generally is payable only for medical services provided inside the U.S. If anyone listed in item 3 is now enrolled in Supplementary Medical Insurance under Medicare and wishes to terminate that enrollment, enter his or her name here. If you need more space, use the ”REMARKS” section on page 4.

NAME(S)

The U.S. Internal Revenue Code (IRC) requires the Social Security Administration (SSA) to withhold a 30 percent Federal income tax from 85 percent of monthly retirement, survivors and disability benefits paid to beneficiaries who are neither citizens nor residents of the United States. This results in an effective tax of 25.5 percent of the monthly benefit. SSA must withhold this tax from the benefits of all nonresident aliens except those who are residents of countries that have tax treaties with the U.S. that provide an exemption from this tax, or a lower rate of withholding. Currently these countries are Canada, Egypt, Germany, India, Ireland, Israel, Italy, Japan, Romania, Switzerland, and the United Kingdom. For details and changes regarding income tax treaties, you may check with the Internal Revenue Service.

For Federal income tax purposes, a person can be considered a U.S. resident, even if that person lives outside the United States, if he or she:

•Has not claimed a tax treaty benefit as a resident of a country other than the United States in the same year; AND

•Has been lawfully admitted to the United States for permanent residence and that residence has not been revoked or determined to have been administratively or judicially abandoned; OR

•Meets a substantial presence test as defined by the IRC. To meet this test in a given year, the person must be present in the U.S. on at least 31 days in that year, and a minimum total of 183 days counting all the days of U.S. presence in that year,

If you are a U.S. resident alien for Federal income tax purposes, generally your worldwide income is subject to U.S. income tax, regardless of where you are living.

COMPLETE ITEMS 9 THROUGH 13 ABOUT ALL PERSONS LISTED IN ITEM 3 WHO ARE NOT U.S. CITIZENS AND WANT TO BE CONSIDERED U.S. RESIDENTS FOR INCOME TAX PURPOSES.

9.

Enter below the name of all persons listed in item 3 who believe they will have U.S resident status while living outside the U.S. Also show the number of each person's Permanent Resident Card (sometimes referred to as a Green Card) and the date that card was issued. If any person was not lawfully admitted for permanent residence, show "None" and explain why he or she is a U.S. resident in the "REMARKS" section on page 4.

NAME |

PERMANENT RESIDENT CARD |

DATE CARD WAS |

|

(GREEN CARD) NUMBER |

ISSUED |

||

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

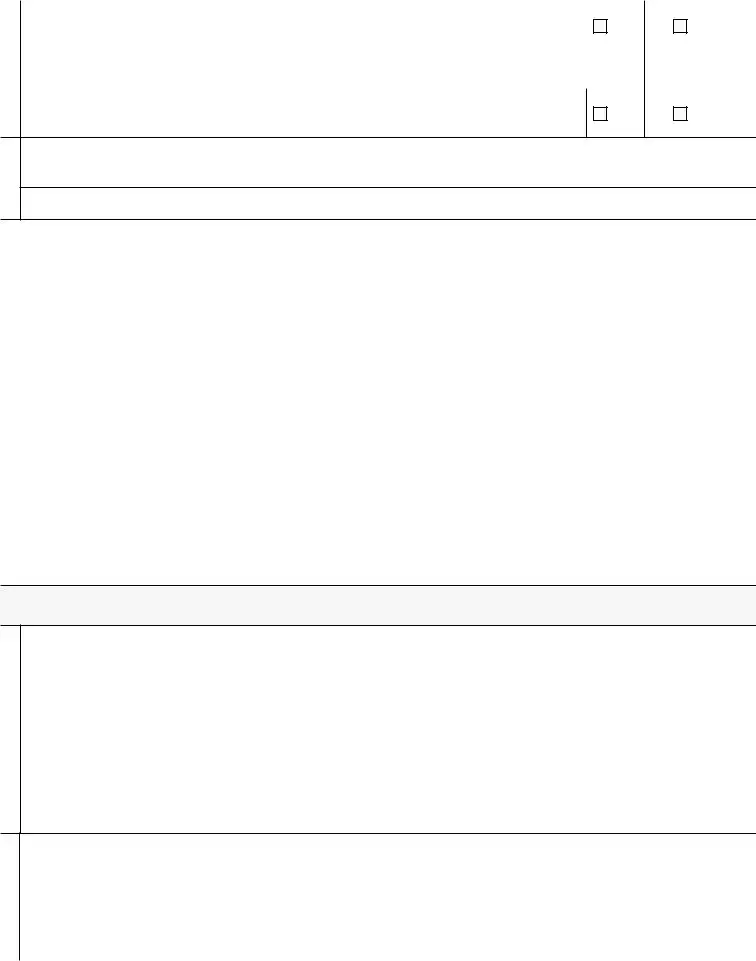

10.Enter the name(s) of any person(s) listed in item 9 who has ever notified the U.S. government, by letter or formal application, that he or she has abandoned, or wishes to abandon, his or her U.S. residence status, or has commenced to be treated as a resident of a foreign country under the provisions of a tax treaty between the U.S. and the foreign country.

|

NAME |

Date |

NAME |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

Page 3 of 5 |

11.

Enter the name(s) of any person(s) listed in item 9 whose Permanent Resident Card has been taken away, or who has been notified by the U.S government that his or her U.S. resident status has been taken away. Enter the date of the notice or the date the Permanent Resident Card was taken away.

NAME |

Date |

NAME |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Does each person listed in item 9 understand that, as a U.S. resident, his or her worldwide income will |

YES |

NO |

|

be subject to U.S. income tax regardless of where he or she is living? If no, enter the name |

||

|

of each individual who does not understand in the "REMARKS" section on page 4. |

|

|

|

|

|

|

13. |

Does each person listed in item 9 agree to notify SSA promptly if he or she abandons his or her U.S. |

|

|

|

residence status, or if he or she commences to be treated as a resident of a foreign country under the |

YES |

NO |

|

provisions of a tax treaty between the U.S. and the foreign country? If no, enter the name of each |

||

|

|

|

|

|

individual who does not agree in the "REMARKS" section on page 4. |

|

|

|

|

|

|

14.INCOME TAX TREATY BENEFITS Complete this item for any person(s) who intend(s) to claim a reduced rate of Federal income tax withholding under the provisions of an income tax treaty with the U.S. To enter additional person(s), use the "REMARKS” section on page 4.

|

NAME |

TAX TREATY COUNTRY |

DATES OF RESIDENCE |

|

|

OF RESIDENCE |

FROM |

TO |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15.PAYMENT ADDRESS (Where payments should be sent while you are abroad. If your payments are, or will be, sent directly to a bank or other financial institution, do not complete this item. Go to item 16.) If more than one address is required, use the "REMARKS" section below and show names for each address.

NUMBER AND STREET |

CITY |

POSTAL CODE |

COUNTRY |

16.MAILING ADDRESS (Where your mail should be sent while you are abroad. If it is the same as the address in item 15, enter "same as 15" and go to item 17.) If more than one address is required, use the "REMARKS" section on page 4 and show names for each address.

NUMBER AND STREET |

CITY |

POSTAL CODE |

COUNTRY |

17.RESIDENCE ADDRESS (You must complete this item if you live, or will live, at an address other than the address shown in item 15 or 16. If the address where you live, or will live, is the same as the address in item 15 or 16, enter "same as 15 (or 16 if appropriate)" and go to item 18.) If your payments are not, or will not be, sent directly to a bank or other financial institution and you receive, or will receive, them by mail at an address that is not your residence address, explain the reason in the "REMARKS" section on page 4.

NAME |

NUMBER AND STREET |

CITY |

POSTAL CODE |

COUNTRY |

|

|

|

|

|

a.

b.

c.

d.

Form |

Page 4 of 5 |

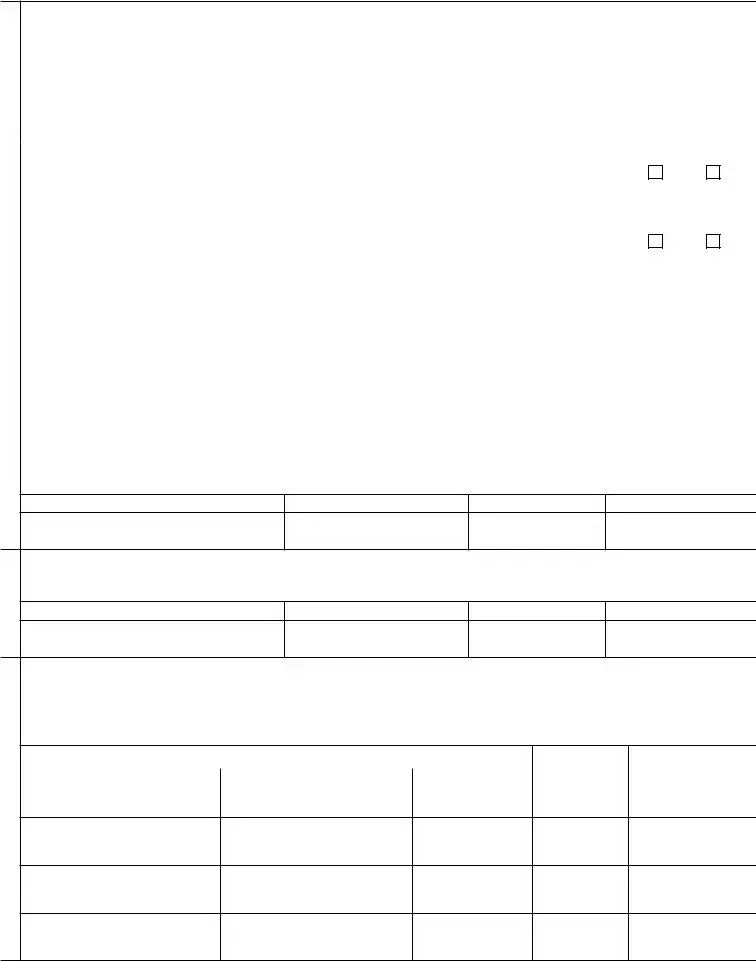

REMARKS (You may use this space for any additions and explanations. If you are giving information for a particular item on this form, enter the item number in your remark. If you need more space, attach a separate sheet.)

CERTIFICATION AND SIGNATURES

I agree to notify the Social Security Administration promptly if I (or any person for whom I receive benefits) become employed or

Under penalties of perjury, I declare that I have examined the information on this form and to the best of my knowledge and belief it is true, correct, and complete. I understand that anyone who knowingly gives a false or misleading statement about a material fact in this information, or causes someone else to do so, commits a crime and may be sent to prison, or may face other penalties, or both.

18.

SIGNATURE (FIRST NAME, MIDDLE INITIAL, AND |

|

|

LAST NAME) OF EACH PERSON LISTED IN ITEM 3. |

DATE |

TELEPHONE NUMBER WHERE |

REPRESENTATIVE PAYEES MUST SIGN FOR MINORS |

YOU MAY BE CONTACTED |

|

AND FOR INCAPABLE OR INCOMPETENT ADULTS. |

|

DURING THE DAY |

(Write in ink) |

|

|

a. |

|

|

b.

c.

d.

Witnesses are required only if this application has been signed by mark (X) in item 18.

If signed by mark (X), two witnesses who know the signer(s) must sign below, giving their full addresses.

19.(1) SIGNATURE OF WITNESS ADDRESS (NUMBER AND STREET)

(2)SIGNATURE OF WITNESS ADDRESS (NUMBER AND STREET)

CITY

POSTAL CODE

COUNTRY

CITY

POSTAL CODE COUNTRY

Form |

Page 5 of 5 |

Privacy Act Statement

Collection and Use of Personal Information

Sections 202(t), 203, 205, and 1836(b) of the Social Security Act and sections 871(a)(3) and 1441 of the Internal Revenue Code, as amended, allow us to collect this information. Furnishing us this information is voluntary. However, failing to provide all or part may prevent us from making an accurate and timely decision on any claim filed or could result in the loss of benefits.

We will use the information you provide to determine eligibility for benefits. We may also share your information for the following purposes, called routine uses:

•To the IRS, Department of the Treasury, for the purpose of auditing SSA’s compliance with the safeguard provisions of the IRC of 1986, as amended; and

•To the Centers for Medicare & Medicaid Services (CMS), for the purpose of administering Medicare Part D enrollment and premium collection and Medicare Advantage Part C premium collections, as well as Medicare Part B

•To contractors and other Federal agencies, as necessary, for the purpose of assisting the Social Security Administration (SSA) in the efficient administration of its programs. We will disclose information under the routine use only in situations in which SSA may enter into a contractual or similar agreement with a third party to assist in accomplishing an agency function relating to this system of records.

In addition, we may share this information in accordance with the Privacy Act and other Federal laws. For example, where authorized, we may use and disclose this information in computer matching programs, in which our records are compared with other records to establish or verify a person’s eligibility for Federal benefit programs and for repayment of incorrect or delinquent debts under these programs.

A list of additional routine uses is available in our Privacy Act System of Records Notices (SORN)

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C.

§3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget (OMB) control number. We estimate that it will take about 10 minutes to read the instructions, gather the facts, and answer the questions. Send only comments regarding this burden estimate or any other aspect of this collection, including suggestions for reducing this burden to: SSA, 6401 Security Blvd, Baltimore, MD

Form Data

| Fact Name | Description |

|---|---|

| Form Title | Supplement to Claim of Person Outside the United States |

| Form Number | SSA-21 |

| Revision Date | May 2018 (05-2018) |

| OMB Control Number | 0960-0051 |

| Purpose | To be completed by or on behalf of a person who is, was, or will be outside the U.S. for Social Security purposes. |

| Definition of Outside the U.S. | A person is outside the United States if they are physically outside the 50 States, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands, or American Samoa for 30 consecutive days or more. |

| Information Required | It gathers detailed information about the claimant or beneficiary's time spent outside the U.S., employment or self-employment outside the U.S., and tax withholding preferences for nonresidents. |

Instructions on Utilizing Ssa 21

When completing the SSA-21 form, awareness of each step is crucial for a smooth submission process. This form is essential for individuals claiming Social Security benefits while outside of the United States, ensuring they meet the necessary criteria and their information is accurately recorded. Here’s how to approach the form methodically.

- Start with the worker’s details: Enter the name and Social Security number of the worker on whose earnings the claim is based.

- For item 3, provide full names and other specifics such as country of citizenship and passport numbers for each claimant or beneficiary who is not a U.S. citizen and is, was, or will be outside the U.S.

- Detail the period each person listed in item 3 has spent outside the United States, including the countries visited and the dates of each stay. If needed, extend explanations in the “REMARKS” section.

- Under item 4, record the total time each non-U.S. citizen has lived in the U.S., highlighting their full name, relationship to the worker, number of years, and specific dates lived in the U.S.

- If any listed person has been employed or self-employed outside the U.S. in the past 12 months, note their names and work start dates under item 5. Use Form SSA-7163 if required.

- For those expecting to begin work outside the U.S., mention their names and anticipated start dates in item 6.

- Only if the worker is deceased, answer item 7 regarding their military service status.

- Specify any individual currently enrolled in Supplementary Medical Insurance who wishes to terminate their enrollment in item 8.

- For items 9 through 13, input details about each non-U.S. citizen wanting to be considered a U.S. resident for income tax purposes, including their beliefs on U.S. residency, any abandonment notices, understanding of tax responsibilities, and agreement to notify SSA about residency status changes.

- Item 14 involves indicating those intending to claim income tax treaty benefits, detailing residency periods and treaty countries.

- For payment, mailing, and residence addresses, fill in items 15, 16, and 17 accordingly. Utilize the remarks section for additional addresses or explanations as needed.

- If you’re utilizing the “REMARKS” section for further clarification, ensure each comment clearly relates to specific item numbers on the form.

- After completing the form, each person listed in item 3 or their representative payees must sign in item 18. Ensure ink is used for signatures. Include date and a daytime contact telephone number.

- If the application was signed by a mark (X), two witnesses familiar with the signer must provide their signatures, addresses, and other details in item 19.

Once the form is fully completed and signed, it should be sent or taken to the nearest Social Security office. This careful process ensures that all necessary information is accurately captured, helping to streamline the review and approval of claims for those living outside the United States.

Obtain Answers on Ssa 21

What is Form SSA-21 used for?

Form SSA-21, known as the Supplement to Claim of Person Outside the United States, is essentially used by individuals who are, were, or will be outside the U.S. for an extended period (30 consecutive days or more) to provide additional information needed to process their Social Security benefits claim. This form helps the Social Security Administration (SSA) determine eligibility for benefits under circumstances where residency and citizenship status may impact benefits.

Who needs to fill out Form SSA-21?

This form should be completed by or on behalf of a person not currently in the United States but is claiming benefits based on work in the U.S. This includes U.S. citizens living abroad, non-citizens who have worked in the U.S., and dependents or survivors of such individuals if they are outside the U.S. for 30 consecutive days or more.

What information is required on Form SSA-21?

Information required includes the Social Security Number (SSN) of the worker on whose earnings the claim is based, details of any employment outside the U.S. in the past 12 months, expectations of future employment abroad, and specifics about residency status and citizenship. It also requests information regarding the claimant’s presence outside the U.S., including dates and countries of residence.

Why is my and my family's travel history important for SSA?

Your travel history, especially the periods you and your family members have spent outside the U.S., are crucial for the SSA. This information helps the SSA ensure that benefit payments are accurate based on the rules that govern payments to people residing in different countries. Furthermore, it affects taxation of benefits and eligibility for Supplementary Medical Insurance under Medicare, amongst other factors.

How does my citizenship affect my Social Security benefits?

Citizenship can significantly impact Social Security benefits, especially regarding tax obligations and eligibility. Non-U.S. citizens may be subject to mandatory withholding taxes. However, residents of countries with tax treaties with the U.S. might qualify for exemptions or a reduced rate of withholding on their benefits.

Do I need to report employment outside the U.S.?

Yes, any employment or self-employment outside the United States must be reported on Form SSA-21. This includes starting dates of past and expected future employment. This information helps SSA determine how such employment affects your benefits.

Can residing outside the U.S. affect my Medicare benefits?

Yes, residing outside the U.S. can significantly affect Medicare benefits, primarily because Supplementary Medical Insurance under Medicare is typically only payable for services provided within the United States. If a beneficiary moves outside the U.S. and does not anticipate using Medicare services, they may elect to terminate their enrollment.

What happens if I don't complete and submit Form SSA-21?

Failing to submit Form SSA-21, when required, can delay the processing of your Social Security benefits claim. It may also result in receiving incorrect payment amounts or even the temporary suspension of benefits until the necessary information is provided to the SSA.

Where can I find Form SSA-21?

Form SSA-21 is available on the official website of the Social Security Administration (www.socialsecurity.gov). Alternatively, you can obtain a copy by contacting your local Social Security office or by calling SSA directly.

How do I submit Form SSA-21?

Once completed, Form SSA-21 should be sent or brought to your local Social Security office. You can use the SSA website to locate the nearest office or for instructions on how to send the form electronically, if available.

Common mistakes

Failing to complete the form for each household separately. The SSA-21 form requires that a separate form be filled out for each household if there are multiple claimants or beneficiaries living in different households. This is a commonly overlooked step, creating confusion and delays in processing.

Incorrectly listing countries of citizenship and dates of employment. It's crucial to accurately list all countries of citizenship for the claimants or beneficiaries as well as the correct dates of employment outside the U.S. in the past 12 months. Inaccurate information can lead to incorrect benefit determinations or unnecessary follow-ups.

Omitting signatures in item 18. All persons listed in item 3, along with their representative payees for minors and those incapable or incompetent, must sign the certification in item 18. Missing signatures can invalidate the form, preventing the processing of claims or benefits.

Not utilizing the "REMARKS" section for additional information or clarifications. The "REMARKS" section on page 4 is an essential part of the form, allowing for the addition of information that does not fit in the provided fields or needs further explanation. Failure to use this section when necessary can result in incomplete or unclear applications.

Documents used along the form

When navigating the terrain of Social Security benefits, especially concerning individuals outside the United States, the Form SSA-21 becomes a crucial piece of documentation. However, it's often just one component of a broader collection of forms and documents necessary to accurately process a claim or update beneficiary information. Understanding these additional forms can provide a clearer pathway through the procedural requirements set by the Social Security Administration (SSA).

- Form SSA-7162 (OMB No. 0960-0104): Titled "Report to United States Social Security Administration by Person Receiving Benefits for a Child or Adult Unable to Handle Funds," this form is essential for individuals acting as representative payees. It helps the SSA ensure that the benefits are being used in the best interest of the beneficiary.

- Form SSA-7161-OCR-SM (OMB No. 0960-0049): Known as "Report to the Social Security Administration by the Worker Outside the United States," it is used by workers receiving Social Security benefits who live outside the U.S. to update their earnings and employment status.

- Form SSA-1696 (OMB No. 0960-0527): This "Appointment of Representative" form is pivotal for beneficiaries or claimants appointing a third party to represent them in matters related to Social Security processes.

- Form SSA-623 (OMB No. 0960-0549): Titled "Representative Payee Report," this form is utilized by representative payees to report on the use of benefits received on behalf of a beneficiary, ensuring the funds are being managed properly.

- Form SSA-827 (OMB No. 0960-0623): Known as "Authorization to Disclose Information to the Social Security Administration," this document allows SSA to obtain medical and other information necessary to assess a claimant's eligibility for benefits.

- Form SSA-3368 (OMB No. 0960-0579): The "Disability Report - Adult" form is critical in disability claims, providing detailed information about the claimant's medical condition, treatment, and the impact on their ability to work.

- Form SSA-3369 (OMB No. 0960-0618): Titled "Work History Report," this document complements the disability claim process, detailing the claimant's employment history to help evaluate their ability to perform work-related activities.

- Form SSA-454-BK (OMB No. 0960-0072): Known as "Continuing Disability Review Report," it is a form used in the review process of a beneficiary's disability status to determine if they continue to be eligible for benefits.

Together, these forms and documents play a vital role in the administration of Social Security benefits, particularly for beneficiaries outside the United States. Whether it's for claims processing, updates to personal information, or representing the interests of another, the precise completion and submission of relevant forms ensure the smooth operation of benefit distribution and compliance with SSA guidelines.

Similar forms

The SSA-7163 form, also known as the "Questionnaire About Employment or Self-Employment Outside the United States," shares similarities with the SSA-21 form as both collect information regarding a person's employment status outside the U.S. This is crucial for determining eligibility and accurate benefit amounts for Social Security claimants living or working abroad.

The IRS Form 1040NR, "U.S. Nonresident Alien Income Tax Return," resembles the SSA-21 in its focus on non-U.S. residents for tax purposes. Both forms address the financial implications of living or earning income outside the United States, with specific attention to taxation and benefit eligibility.

Form I-407, "Record of Abandonment of Lawful Permanent Resident Status," parallels the SSA-21 form through its relevance to changes in U.S. residence status. While the I-407 form is used to formally abandon residence status, SSA-21 includes questions regarding changes in residence for tax and benefit considerations.

The DS-82 form, “U.S. Passport Renewal Application for Eligible Individuals,” shares a connection with the SSA-21 as both necessitate accurate personal identification and citizenship information for Americans residing abroad, impacting their social security benefits and legal identity documents.

Form SSA-7004, "Request for Social Security Statement," is akin to the SSA-21 as it entails the provision of personal information to the Social Security Administration to receive specific details about one's Social Security account and benefits, highlighting an individual's work history both within and potentially outside the U.S.

The USCIS Form N-400, "Application for Naturalization," is related to the SSA-21 in addressing the residency and citizenship status of individuals. Both forms gather detailed personal history to assess eligibility for U.S. citizenship in the case of N-400, or for Social Security benefits with SSA-21.

The IRS Form 8833, "Treaty-Based Return Position Disclosure," is similar to SSA-21 in dealing with tax implications for individuals claiming benefits under a tax treaty. Both forms require detailed information about international residence and income for correct tax treatment and benefit eligibility.

Form W-8BEN, "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)," mirrors the SSA-21 in its focus on non-U.S. residents’ tax situations. Both documents are essential for accurately determining tax obligations and benefits for individuals living outside the U.S.

Form DS-11, “Application for a U.S. Passport,” has similarities with the SSA-21 due to its necessity for U.S. citizens abroad to prove their identity and citizenship, a requirement that also influences their Social Security benefits and status reporting.

Dos and Don'ts

When filling out the SSA-21 form, being accurate and thorough is crucial for ensuring your Social Security benefits are processed correctly, especially when you are outside the United States. Here are some important do's and don'ts to keep in mind:

Do:- Read the instructions carefully before starting to ensure you understand what is required.

- Provide accurate information for every question, as inaccuracies can delay processing or affect your benefits.

- Use ink and write legibly to prevent any misunderstandings or processing delays.

- Include additional pages if you run out of space on the form but make sure to reference the item numbers your remarks pertain to.

- Double-check the form for completeness and accuracy before submitting it.

- Sign and date the form as indicated. If you're signing on behalf of someone else, ensure you have the authority to do so.

- Keep a copy of the completed form and any other documents you provide for your records.

- Skip any sections that apply to you. If a section doesn't apply, it's better to fill it with "N/A" than to leave it blank.

- Guesstimate dates or figures. Be as precise as possible; if you're unsure, look up the correct information.

- Use white-out or correction tape if you make a mistake. Instead, cross out errors neatly and write the correct information nearby.

- Forget to list all countries you have lived in or visited as required, especially if you have been outside the U.S. for extensive periods.

- Overlook the need to attach additional documentation that might be required for your claim or status.

- Delay submitting your form as this could affect the timely processing of benefits.

- Ignore follow-up requests from the Social Security Administration (SSA) for additional information or clarification.

Misconceptions

When handling the Supplement to Claim of Person Outside the United States (Form SSA-21), people often encounter misunderstandings. Here are nine common misconceptions about the form, clarified for better understanding.

- Misconception 1:

The form is only for U.S. citizens living abroad. This is incorrect; the SSA-21 form is also essential for non-U.S. citizens who reside outside the United States and are, were, or will be outside the U.S. for 30 consecutive days or more, affecting their Social Security benefits.

- Misconception 2:

Completing Form SSA-21 is optional. In reality, failing to provide all or part of the requested information may prevent accurate and timely decisions on claims or result in the loss of benefits.

- Misconception 3:

Individuals think they need to file a separate SSA-21 form for each family member. However, the form requires information only for individuals living in the same household. Separate forms are needed for each household, not each individual.

- Misconception 4:

Many believe the form is only related to work outside the U.S. Although the form does inquire about employment outside the United States, it also gathers crucial information about periods spent outside the U.S., tax status, and other factors influencing Social Security benefits.

- Misconception 5:

The SSA-21 form is solely for updating the Social Security Administration about address changes. The form's scope is broader, including tax withholding status, citizenship changes, and employment outside the U.S., not just changes in address.

- Misconception 6:

Residents and citizens of the U.S. do not need to complete this form. This misunderstanding overlooks those individuals who are U.S. residents for tax purposes but live abroad. They may still need to complete the form to comply with tax withholding requirements.

- Misconception 7:

Tax information on the form does not need to be current. This is false. The SSA uses the form to determine nonresident alien tax withholding status, so current tax information, including treaties and residency status, is crucial.

- Misconception 8:

The form only pertains to retirement benefits. In fact, it is relevant to retirement, survivors, and disability benefits, affecting a wider group of individuals.

- Misconception 9:

Submission of the form guarantees continuation of benefits. Completing and submitting SSA-21 is a requirement but does not automatically ensure the continuation of Social Security benefits. Eligibility and other factors will dictate the outcome.

Understanding the purpose and requirements of Form SSA-21 can greatly assist individuals living outside the United States in navigating their Social Security benefits more effectively and avoiding potential pitfalls due to common misconceptions.

Key takeaways

Understanding the SSA-21 form, also known as the Supplement to Claim of Person Outside the United States, is crucial for individuals residing or planning to reside outside the U.S. This form is part of the Social Security Administration's process to ensure accuracy in claim management for those living internationally. Below are key takeaways regarding completing and using the SSA-21 form effectively:

- The SSA-21 form is designed for individuals who are, were, or will be outside the United States for 30 consecutive days or more, affecting their Social Security benefits.

- It is necessary for claimants or beneficiaries who are not U.S. citizens and reside outside the U.S. to complete this form if they want to be considered for Social Security benefits.

- The form captures detailed information about periods spent outside the U.S., including the countries visited and the duration of each stay, to determine eligibility and correct benefit amounts.

- Claimants must provide information about any employment or self-employment outside the U.S. within the past 12 months or expected in the future, which can impact benefit calculations.

- Understanding the tax implications is essential; the form outlines the need for non-U.S. citizens to be aware of the Federal income tax withholding that applies to nonresident aliens receiving Social Security benefits.

- Individuals who are residents of countries with tax treaties with the U.S. that provide exemptions or reduced tax rates should pay special attention to the relevant section to claim these benefits correctly.

- The form also asks about enrolment in Supplementary Medical Insurance under Medicare, offering a chance to terminate this enrollment if necessary, a critical decision for those living abroad.

- Accuracy and honesty in filling out the form are paramount. Providing false information can result in penalties, including imprisonment or fines.

- It's a requirement to update the Social Security Administration (SSA) about changes in employment status, citizenship, or residency outside the U.S. after submitting the form.

- Privacy is a significant concern, and the SSA assures that the information provided will be used strictly for determining benefit eligibility and tax withholding status. Sharing of information is limited to necessary administrative functions and as allowed by law.

This form embodies the SSA's effort to manage benefits for U.S. citizens and residents living abroad accurately. Understanding these takeaways ensures that individuals provide the complete and accurate information necessary for the SSA to make informed decisions regarding their benefits and tax implications while they are outside the U.S.

Popular PDF Forms

Form Film - A perfect guide for aspiring film critics, this organizer helps refine your perspectives and present them coherently.

Shipper's Export Declaration - Assists shippers in meeting strict air transport regulations for dangerous goods, mitigating risks to aircraft and personnel.

Tricare for 100 Disabled Veterans - Use this document to update CHAMPVA about changes in your other insurance coverage.