Blank Ssa 6232 PDF Template

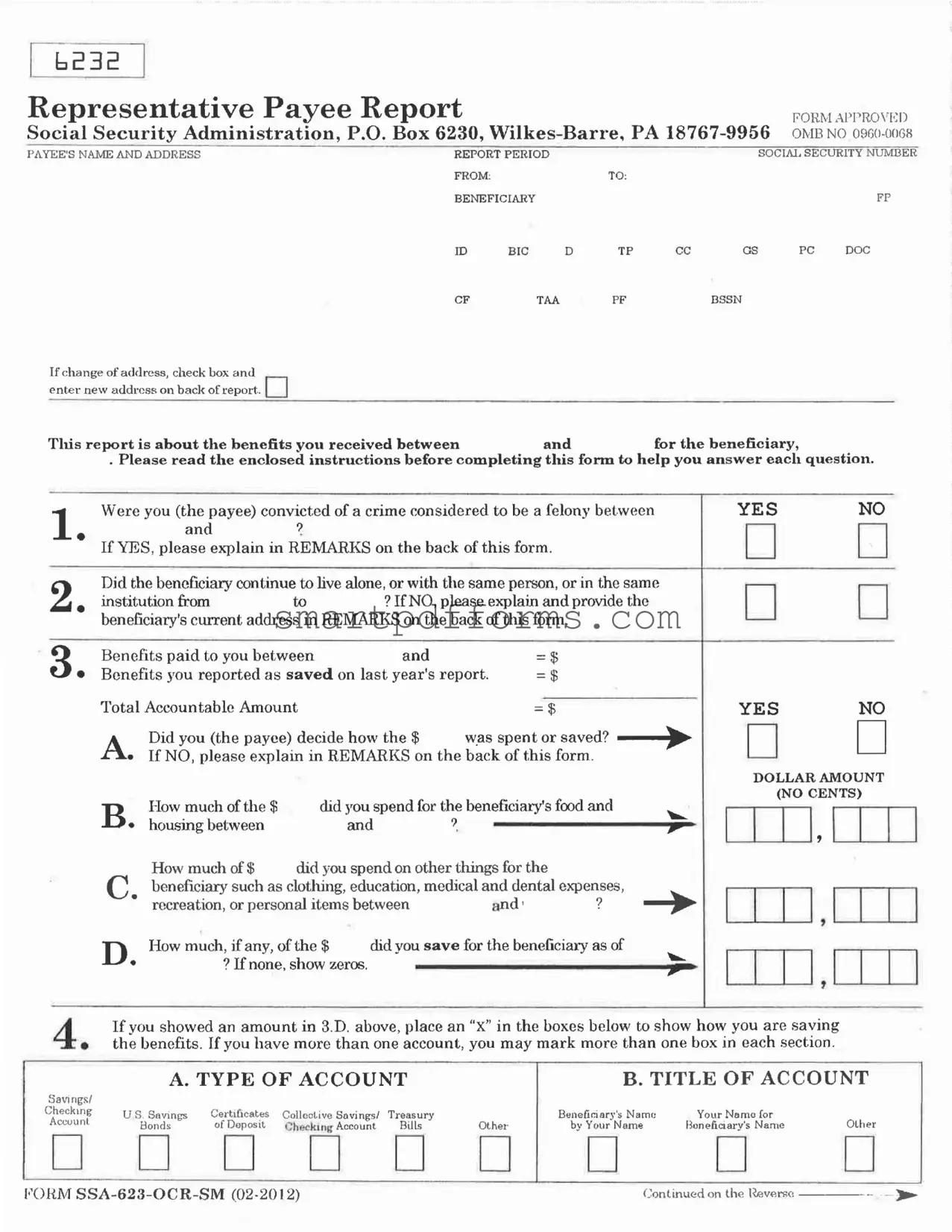

Managing the responsibilities that come with being a representative payee for Social Security beneficiaries is no small task, especially when it involves accurate reporting and utilization of beneficiary funds. At the heart of this responsibility lies the SSA-6232 form, officially known as the Representative Payee Report, a critical document issued by the Social Security Administration. This form serves as a detailed ledger in which payees must account for the benefits received and expended on behalf of the beneficiaries they serve. From delineating expenses such as food, housing, medical care, education, and personal items to reporting any savings set aside for the beneficiary, the form covers a comprehensive range of financial stewardship areas. It also addresses changes in the living arrangements of the beneficiary and poses questions regarding the payee's decision-making process on fund allocation. Furthermore, the form requires disclosure of any felonious convictions of the payee within the report period and outlines specific account types and titles under which the beneficiary's funds are saved, ensuring a transparent and accountable management of the beneficiary’s Social Security benefits.

Preview - Ssa 6232 Form

Representative Payee Reportformapproved

Social Security Administration, P.O. Box 6230,

PAYEE'S NAME AND ADDRESS |

REPORT PERIOD |

|

|

|

SOCIAL SECURITY NUMBER |

|||

|

FROM: |

|

|

TO; |

|

|

|

|

|

BENEFICIARY |

|

|

|

|

|

FP |

|

|

ID |

BIC |

D |

TP |

CC |

GS |

PC |

DOC |

|

CF |

|

TAA |

PF |

|

BSSN |

|

|

If change of address, check box and enter new address on back of report.

This report is about the benefits you received between |

and |

for the beneficiary, |

. Please read the enclosed instructions before completing this form to help you answer each question.

Were you (the payee) convicted of a crime considered to be a felony between 1. and ?

If YES, please explain in REMARKS on the back of this form.

2. |

Did the beneficiary continue to live alone, or with the same person, or in the same |

||

institution from |

to |

? If NO, please explain and provide the |

|

beneficiary's current address in REMARKS on the back of this form.

3 |

Benefits paid to you between |

|

and |

|

|

= $ |

||

• Benefits you reported as saved on last year's report. |

= $ |

|||||||

|

Total Accountable Amount |

|

|

|

|

|

||

|

A. |

Did you (the payee) decide how the $ |

|

was spent or saved? |

||||

|

If NO, please explain in REMARKS on the back of this form. |

|||||||

|

B. |

How much of the $ |

|

did you spend for the beneficiary's food and |

||||

|

housing between |

|

|

and |

? |

■ |

||

|

|

How much of $ |

did you spend on other things for the |

|||||

|

|

beneficiary such as clothing, education, medical and dental expenses, |

||||||

|

|

recreation, or personal items between |

|

and1 |

? |

|||

|

D. |

How much, if any, of the $ |

did you save for the beneficiary as of |

|||||

|

? If none, show zeros. |

|

|

. |

||||

YES

YES

DOLLAR AMOUNT

(NO CENTS)

If you showed an amount in 3.D. above, place an “X” in the boxes below to show how you are saving 4• the benefits. If you have more than one account, you may mark more than one box in each section.

Savings/ |

A. TYPE OF ACCOUNT |

|

B. TITLE OF ACCOUNT |

||||

|

|

|

|

|

|

|

|

Checking |

U S. Savings |

Certificates |

Collective Savings/ Treasury |

Other |

Beneficiary's Name |

Your Name for |

Other |

Account |

Bonds |

of Deposit |

Checking Account Bills |

bv Your Name |

Boneficiarv's Name |

||

FORM |

Continued on the |

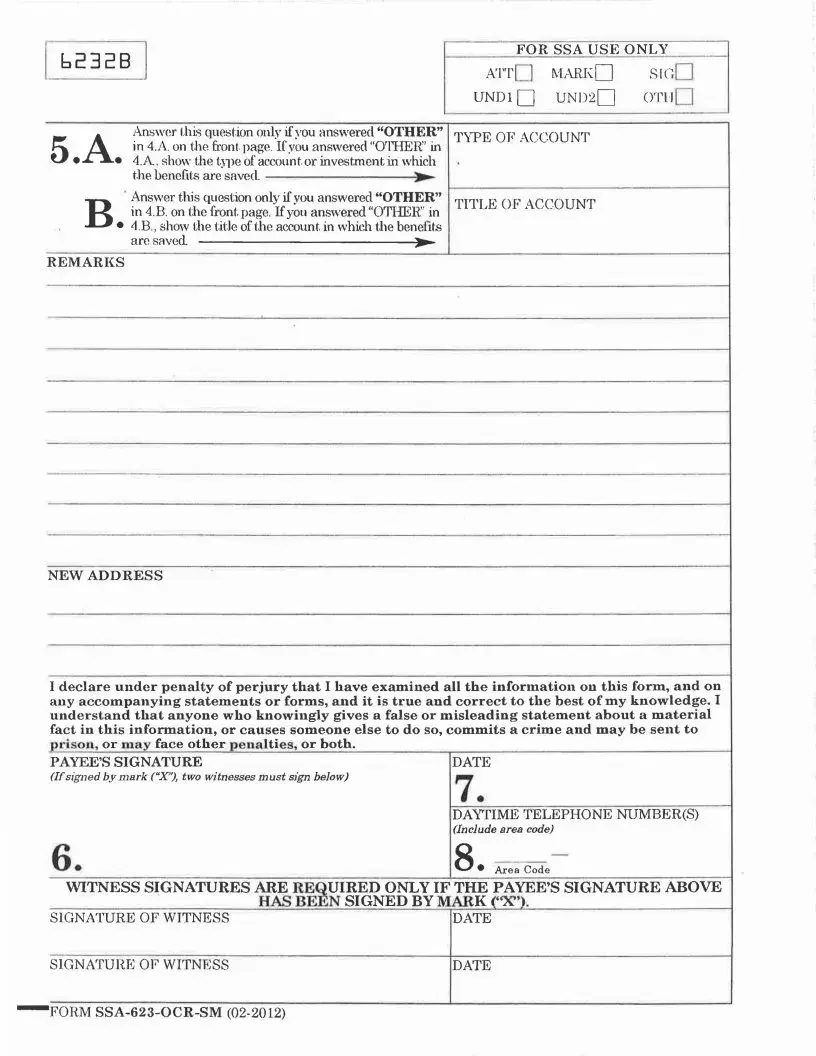

ьгзгв |

|

FOR SSA USE ONLY____ |

|

|

attO markQ |

sigD |

|

|

|

UNDlQ UND2Q |

ОТ1ІІ I |

5.A. |

Answer this question only if you answered “OTHER” |

TYPE OF ACCOUNT |

|

in 4.A. on the front page. Ifyou answered "OTHER” in |

|

|

|

4.A, show the type of account or investment in which |

|

|

|

the benefits are

ВAnswer this question only if you answered “OTHER” TITLE OF ACCOUNT in 4.B. on the front page. If you answered "OTHER” in

•4 .B., show the title of the account in which the benefits are saved

REMARKS

NEW ADDRESS

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge. I understand that anyone who knowingly gives a false or misleading statement about a material fact in this information, or causes someone else to do so, commits a crime and may be sent to prison, or may face other penalties, or both.

PAYEE’S SIGNATURE |

DATE |

(Ifsigned by mark (“X"), two witnesses must sign below) |

7. |

|

|

|

DAYTIME TELEPHONE NUMBER(S) |

6. |

(Include area code) |

g• Area Code |

WITNESS SIGNATURES ARE REQUIRED ONLY IF THE PAYEE’S SIGNATURE ABOVE

HAS BEEN SIGNED BY MARK (“X”).

SIGNATURE OF WITNESS |

DATE |

SIGNATURE OF WITNESS |

DATE |

'FORM

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form SSA-6232 | This form serves as a Representative Payee Report, utilized by payees to report on the use and management of benefits received on behalf of a Social Security beneficiary. |

| Report Period | The form requires payees to report the management and expenditure of benefits within a specified period, detailing both the start and end date of the reporting period. |

| Report Recipient | The completed report is directed to the Social Security Administration, specifically addressed to P.O. Box 6230, Wilkes-Barre, PA 18767-9956. |

| Information Required | Payees must provide detailed information regarding expenses, including allocations for the beneficiary’s food, housing, clothing, education, medical and dental care, recreation, and savings. |

| Accountability for Savings | If any amount of benefits has been saved as of the last question on the form, the type and title of the savings account or investment must be disclosed. |

| Verification and Penalties | Payees must declare under penalty of perjury that the information provided is accurate. False statements can result in criminal charges, penalties, or both. |

Instructions on Utilizing Ssa 6232

Filling out the SSA-6232 form is an essential task for individuals acting as a representative payee for Social Security beneficiaries. The form helps ensure that the benefits received are used in the best interest of the beneficiary. To complete this form correctly, it's important to pay close attention to the details and follow each step carefully to avoid any mistakes that could lead to delays or issues with the Social Security Administration.

- Start by entering the payee's name and address in the designated area at the top of the form.

- Fill out the report period section, indicating the start and end date of the period this report covers.

- Input the social security number and all requested beneficiary identification codes (such as FP ID, BIC, etc.) as listed on the form.

- If there has been a change of address, check the box next to the address update request and enter the new address on the back of the report.

- Answer the question regarding any felony convictions for the payee within the report period by checking 'YES' or 'NO', and if yes, provide an explanation in the REMARKS section on the back of the form.

- Indicate whether the beneficiary's living situation has remained the same, and if not, provide current details and addresses in the REMARKS section.

- Under the financial details section, report the total benefits paid, the amount reported as saved last year, and the total accountable amount. Ensure accuracy to avoid discrepancies.

- Explain how the benefits were used regarding the beneficiary's food, housing, and other expenses like clothing, education, and medical costs. Include the amount spent in each category.

- Report any savings for the beneficiary by specifying the amount in the designated space. If no savings were done, ensure to mark it accordingly.

- Detail the type and title of the account(s) where the benefits are saved by marking the appropriate boxes. If 'OTHER' is marked, specify the account type and title on the reverse side of the form.

- Sign the form, declaring that all information provided is true and correct under penalty of perjury. Include the date and a daytime telephone number for any potential follow-up.

- If the signature is marked with an "X", two witness signatures are required, providing their names and the date signed to validate the payee's mark.

Upon completing the SSA-6232 form, review all entered information for accuracy. This form plays a crucial role in managing the beneficiary's funds and ensuring their needs are met. Once satisfied with the details provided, mail the form to the address listed at the top. Remember, this report holds significant responsibility and aids in the welfare of the beneficiary; thus, it should be filled out with the utmost care and attention to detail.

Obtain Answers on Ssa 6232

FAQ: Understanding the SSA-6232 Form (Representative Payee Report)

- What is the SSA-6232 form?

- Why do I need to complete the SSA-6232 form?

- How do I report changes in the beneficiary's living arrangements?

- What should I do if I saved some of the beneficiary's money?

The SSA-6232 form, also known as the Representative Payee Report, is a document used by the Social Security Administration (SSA). It is completed by individuals or organizations appointed as representative payees. These payees manage Social Security benefits on behalf of beneficiaries who cannot manage their funds themselves due to age, illness, or disability. The form documents how the received benefits were used or saved, ensuring they are spent in the best interest of the beneficiary.

Completing the SSA-6232 form is a crucial responsibility for representative payees. It ensures accountability and transparency in the management of the beneficiary's funds. The SSA reviews the information to verify that the benefits are being used appropriately for the beneficiary's needs such as housing, food, medical care, and personal needs. Failure to submit this report can lead to the revocation of your status as a representative payee and the SSA may appoint a new payee.

If there has been a change in the beneficiary's living arrangements during the report period, you must indicate this by answering 'NO' to the question regarding their living situation and explain the change in detail in the REMARKS section on the back of the form. Include the new address and any changes in the living situation, such as moving to a new house, living with a different person, or moving into an institution.

If you saved any part of the benefits for the beneficiary, indicate the amount saved in question 3.D. on the form. Also, specify how these savings are held by marking the appropriate boxes in section 4. This includes identifying the type of account and whose name it is under. If the savings don't fit into the provided categories, select 'OTHER' and specify the type and title of the account on the reverse side of the form in the spaces provided. Properly documenting savings is essential for maintaining accurate financial records for the beneficiary.

Common mistakes

When filling out the SSA-6232 form, otherwise known as the Representative Payee Report, individuals can sometimes run into errors that might delay processing or affect the outcomes. Being mindful of common mistakes can help ensure the information is accurately communicated to the Social Security Administration. Here are five frequent mistakes made:

- Not updating the address: If there has been a change in address, it's crucial to check the box and enter the new address on the back of the report. Neglecting to update this information can lead to miscommunication or important documents being sent to the wrong location.

- Failing to report a felony conviction: If the payee was convicted of a felony during the report period, this must be disclosed by marking 'YES' and providing an explanation in the REMARKS section on the back of the form. Overlooking or omitting this information can have serious implications.

- Omitting changes in the beneficiary's living arrangements: It's imperative to accurately report if the beneficiary continued to live alone, with the same person, or in the same institution during the report period. If there were any changes, these need to be detailed in the REMARKS section, along with the beneficiary's current address. Improper reporting of living arrangements can affect benefits.

- Inaccurately reporting expenses and savings: Misreporting how the benefits were spent or saved for the beneficiary can lead to issues in how benefits are calculated or monitored in future. It's important to carefully consider and accurately report all amounts related to food, housing, personal items, and savings for the beneficiary.

- Misunderstanding account types and titles for savings: When indicating how savings are held, marking the correct type of account (e.g., US Savings Bonds, Checking Account) and ensuring the title of the account accurately reflects the beneficiary's name are both essential. Using incorrect account types or titles can lead to confusion or mismanagement of funds.

By avoiding these common mistakes, individuals act in the best interest of the beneficiary and maintain compliance with the requirements of the Social Security Administration.

Documents used along the form

When managing Social Security matters, especially for those acting as representative payees, it's essential to be familiar with various forms and documents that complement the SSA-6232 form, also known as the Representative Payee Report. These documents play a crucial role in ensuring that the benefits are used in the beneficiary's best interests and comply with the Social Security Administration's requirements. Here's a guide to some of the other forms and documents often utilized alongside the SSA-6232 form.

- SSA-11: Request to be Selected as Payee – This form is used by individuals applying to become a representative payee for someone receiving Social Security benefits. It collects information about the applicant to help the SSA decide their suitability for the role.

- SSA-454-BK: Continuing Disability Review Report – Required periodically to assess if the beneficiary continues to be eligible for disability benefits. This ensures that the payments are still necessary and appropriate.

- SSA-3368-BK: Disability Report - Adult – This document is filled out when an adult applies for disability benefits. It provides detailed information about their medical condition and how it affects their ability to work.

- SSA-3373-BK: Function Report - Adult – Often used in conjunction with the Disability Report, this form asks for more detailed information about how the beneficiary's daily activities are affected by their condition.

- SSA-795: Statement of Claimant or Other Person – This form is a general-purpose document that allows individuals to provide any additional information that may be relevant to a claim or to update existing information.

- SSA-1696: Appointment of Representative – Used by claimants to appoint a representative, such as an attorney or other advocate, to help with their Social Security claim or appeal. This form outlines the representative's authority and the claimant's agreement concerning representation fees.

Together, these forms ensure a comprehensive approach to managing Social Security benefits, providing a framework for documenting eligibility, use of benefits, and other critical information. They are indispensable tools for representative payees committed to fulfilling their duties with diligence and integrity, ensuring that beneficiaries' needs are met while adhering to regulations and requirements set forth by the Social Security Administration.

Similar forms

Form SSA-11: Similar to the SSA-6232, Form SSA-11 requests information for appointing a representative payee for someone receiving Social Security benefits. Both forms are used to ensure benefits are managed properly for someone who may not be able to manage their own funds.

Form SSA-454-BK: The Continuing Disability Review Report, this form, like the SSA-6232, requires beneficiaries or their representatives to provide updates on the beneficiary's condition and any income or resources. They both aim to ensure that the benefits provided are still appropriate given the current circumstances.

Form SSA-3288: Consent for Release of Information. This form and the SSA-6232 share a focus on managing and protecting the beneficiary's information, although SSA-3288 is specifically about consenting to release information, while SSA-6232 deals with reporting on the handling of benefits.

Form SSA-561-U2: Request for Reconsideration. It shares with the SSA-6232 form the context of Social Security Administration procedures, specifically in addressing decisions beneficiaries or their representatives wish to challenge. Both forms play a crucial role in maintaining the rights and welfare of beneficiaries.

Form SSA-1696: Appointing a Representative. This form, like the SSA-6232, is integral for appointing someone to act on behalf of a beneficiary, though the SSA-1696 is broader in scope, covering various types of representation before the SSA.

Form SSA-820-BK: Work Activity Report - Employee. The SSA-6232 and this form gather specific information about the beneficiary's ability to manage benefits or perform work, contributing to the assessment of benefit eligibility and the proper use of received benefits.

Form SSA-795: Statement of Claimant or Other Person. Both this form and the SSA-6232 are used to collect detailed information directly from beneficiaries or their representatives, ensuring that benefits are correctly administered and allocated.

Form HA-501-U5: Request for Hearing by Administrative Law Judge. Like the SSA-6232, this form is part of the broader Social Security Administration's appeals process, with both playing a role in protecting beneficiaries' rights and ensuring their needs are met according to the law.

Form SSA-3368-BK: Disability Report - Adult. It collects detailed personal, medical, and work information to determine eligibility for disability benefits, relating to the SSA-6232's role in ongoing assessment of benefit management by a representative.

Form SSA-1724: Claim for Amounts Due in the Case of a Deceased Beneficiary. This form is used to claim undistributed Social Security benefits after a beneficiary's death, which intersects with the SSA-6232's purpose of managing and reporting the use of benefits for beneficiaries, sometimes after changes including death.

Dos and Don'ts

When it comes to managing government forms, accuracy and attention to detail are paramount. One such important form is the SSA-623. Filling it out correctly helps ensure that beneficiaries have the support and resources they need. Below are key dos and don'ts to remember when completing the SSA-623 form.

Things You Should Do

Read the enclosed instructions carefully before you start filling out the form. This will help ensure you understand each question and how to answer it accurately.

Check the box for a change of address if the beneficiary's address has changed, and make sure to enter the new address on the back of the report. Keeping the address information up to date is crucial.

Answer all questions truthfully and provide detailed explanations in the REMARKS section on the back of the form when necessary. Transparency is key to processing.

Be precise with financial information. When reporting amounts, ensure accuracy down to the dollar, but do not include cents. Accurate financial reporting is essential for accountability.

Sign and date the form at the end, confirming that all the information provided is true and correct to the best of your knowledge. If the payee's signature is a mark (X), remember that two witnesses must sign the form.

Things You Shouldn't Do

Do not skip sections or leave questions unanswered. Each question is designed to gather specific information necessary for the correct administration of benefits.

Avoid guessing when unsure about an answer. If you're uncertain, it's better to verify the information first to ensure accuracy.

Do not include cents in any financial figures. The form requires dollar amounts only, rounding to the nearest dollar if needed.

Resist the temptation to fill in the form in a hurry. Take your time to ensure that every piece of information is correct and that nothing is overlooked.

Never falsify information or guess on important details. Incorrect information can result in penalties or, worse, legal trouble.

Misconceptions

Many people hold misconceptions about the SSA-6232 form, a representative payee report. Understanding these misconceptions can help ensure that both payees and beneficiaries manage Social Security benefits correctly and comply with the Social Security Administration's requirements. Here are four common misunderstands clarified:

- Only Financial Information Is Required: It's a common belief that the SSA-6232 form solely focuses on financial transactions. While it does require detailed financial reporting, the form also asks for non-financial information, such as changes in the beneficiary's living arrangements and any felonies the payee may have been convicted of during the report period.

- Beneficiary's Living Situation Doesn't Matter: Another misunderstanding is that changes in the beneficiary’s living situation do not need to be reported. However, question 2 explicitly asks if the beneficiary has continued to live alone, with the same person, or in the same institution. This information is crucial because it can impact the beneficiary's needs and how their benefits should be allocated.

- Savings Must Only Be in Checking or Savings Accounts: Some think that funds for the beneficiary can only be saved in a checking or savings account. However, the form allows for other types of accounts under section 4, including U.S. Savings Certificates, Treasury Bonds, or other collective savings plans. This gives payees the flexibility to choose savings options that best suit the beneficiary's future needs.

- Completion of the Form Is Discretionary: A significant misconception is believing that the completion and submission of the SSA-6232 form are optional. This could not be further from the truth. Representative payees are required to complete and return this form to report how they used or saved the Social Security benefits received on behalf of the beneficiary. Failure to properly complete and submit this form can result in the payee being replaced and possibly facing legal action.

It's essential for representative payees to accurately complete and understand every aspect of the SSA-6232 form. Doing so not only complies with the Social Security Administration's regulations but also ensures that beneficiaries' needs are appropriately met. Misunderstandings can lead to unintentional misuse of funds or non-compliance with federal regulations, underscoring the importance of carefully reviewing the form's instructions and requirements.

Key takeaways

Filling out and understanding the SSA 6232 form, also known as the Representative Payee Report, involves several critical steps to ensure its accuracy and completeness. Here are five key takeaways for navigating this process effectively:

- The SSA 6232 form is designed to account for the benefits received and managed by a representative payee on behalf of a Social Security beneficiary. It ensures that the funds are being used in the best interest of the beneficiary.

- Accuracy is paramount when completing the form. The representative payee must provide detailed information about how the beneficiary's funds were spent during the report period, including expenditures on food and housing, medical expenses, education, and any savings set aside for the beneficiary.

- If there has been any change in the beneficiary's living arrangements or if the payee has been convicted of a felony during the report period, these details must be disclosed in the form. Honest communication about such changes is crucial for the continued well-being of the beneficiary.

- It's necessary to specify the types of accounts where the beneficiary's funds are being saved. Whether it's in U.S. Savings Certificates, Treasury Bills, Checking Accounts, or another form of savings, clear identification helps maintain the integrity and traceability of the funds.

- In the event that the representative payee selects "OTHER" for either the type of account or the title of the account in which benefits are saved, further elaboration is required on the reverse side of the form. This additional detail is essential for a thorough understanding of the savings strategy.

Completing the SSA 6232 form with diligence and care not only complies with legal requirements but also plays a critical role in safeguarding the financial interests of Social Security beneficiaries who rely on their representative payees. It's a task that underscores the importance of trust, responsibility, and accountability.

Popular PDF Forms

22-6553d-1 - Specifies that information submitted through the form is subject to verification through computer-matching programs with other agencies.

Puppy Application Template - Prospective owners are asked about their plans for the puppy’s housing, training, and exercise.