Blank Ssa 787 PDF Template

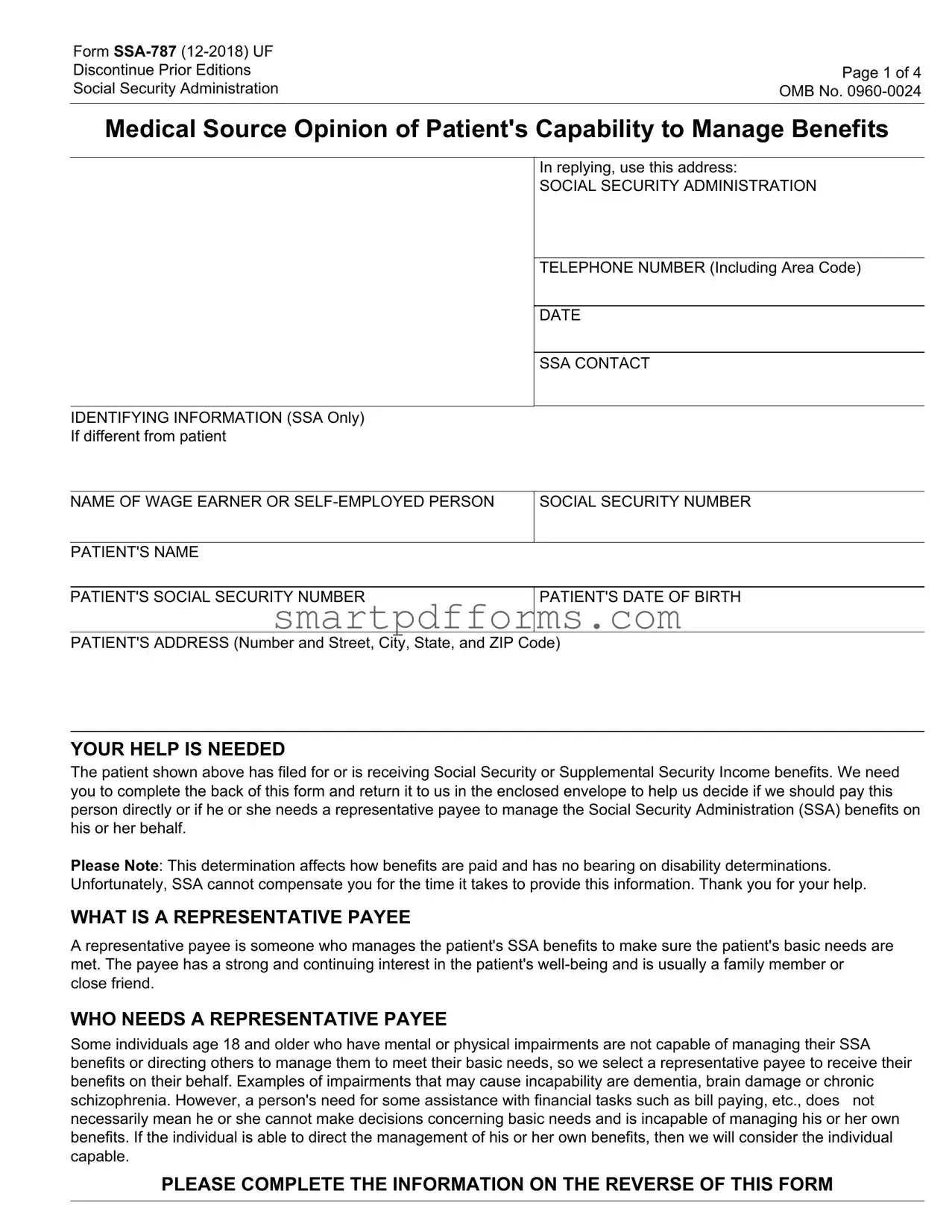

The Social Security Administration (SSA) Form SSA-787, officially named the Medical Source Opinion of Patient's Capability to Manage Benefits, plays a crucial role in ensuring the financial well-being of individuals receiving Social Security or Supplemental Security Income benefits. This form is integral in the process of determining whether an individual possesses the capability to directly manage their benefits or if they require the appointment of a representative payee. The representative payee, often a close family member or friend, is tasked with managing the SSA benefits to satisfy the beneficiary's basic needs, such as food, clothing, and shelter. The form seeks information from a medical professional about the patient’s ability to understand and manage finances, make timely bill payments, and handle a checking or savings account. Importantly, the determination made via Form SSA-787 is strictly about the management of SSA benefits and does not impact disability determinations. Medical professionals are asked to provide their observations, diagnostic test results, or information from family reports to support their assessment. If a beneficiary is unable to manage or direct the management of their funds, a representative payee is selected to ensure the beneficiary's needs are met. The form embodies the Social Security Administration's commitment to protecting the interests of individuals with impairments or disabilities, ensuring they have the support needed to live with dignity.

Preview - Ssa 787 Form

Form |

|

Discontinue Prior Editions |

Page 1 of 4 |

Social Security Administration |

OMB No. |

|

|

Medical Source Opinion of Patient's Capability to Manage Benefits

IDENTIFYING INFORMATION (SSA Only) If different from patient

In replying, use this address:

SOCIAL SECURITY ADMINISTRATION

TELEPHONE NUMBER (Including Area Code)

DATE

SSA CONTACT

NAME OF WAGE EARNER OR

SOCIAL SECURITY NUMBER

PATIENT'S NAME

PATIENT'S SOCIAL SECURITY NUMBER

PATIENT'S DATE OF BIRTH

PATIENT'S ADDRESS (Number and Street, City, State, and ZIP Code)

YOUR HELP IS NEEDED

The patient shown above has filed for or is receiving Social Security or Supplemental Security Income benefits. We need you to complete the back of this form and return it to us in the enclosed envelope to help us decide if we should pay this person directly or if he or she needs a representative payee to manage the Social Security Administration (SSA) benefits on his or her behalf.

Please Note: This determination affects how benefits are paid and has no bearing on disability determinations. Unfortunately, SSA cannot compensate you for the time it takes to provide this information. Thank you for your help.

WHAT IS A REPRESENTATIVE PAYEE

A representative payee is someone who manages the patient's SSA benefits to make sure the patient's basic needs are met. The payee has a strong and continuing interest in the patient's

WHO NEEDS A REPRESENTATIVE PAYEE

Some individuals age 18 and older who have mental or physical impairments are not capable of managing their SSA benefits or directing others to manage them to meet their basic needs, so we select a representative payee to receive their benefits on their behalf. Examples of impairments that may cause incapability are dementia, brain damage or chronic schizophrenia. However, a person's need for some assistance with financial tasks such as bill paying, etc., does not necessarily mean he or she cannot make decisions concerning basic needs and is incapable of managing his or her own benefits. If the individual is able to direct the management of his or her own benefits, then we will consider the individual capable.

PLEASE COMPLETE THE INFORMATION ON THE REVERSE OF THIS FORM

Form |

Page 2 of 4 |

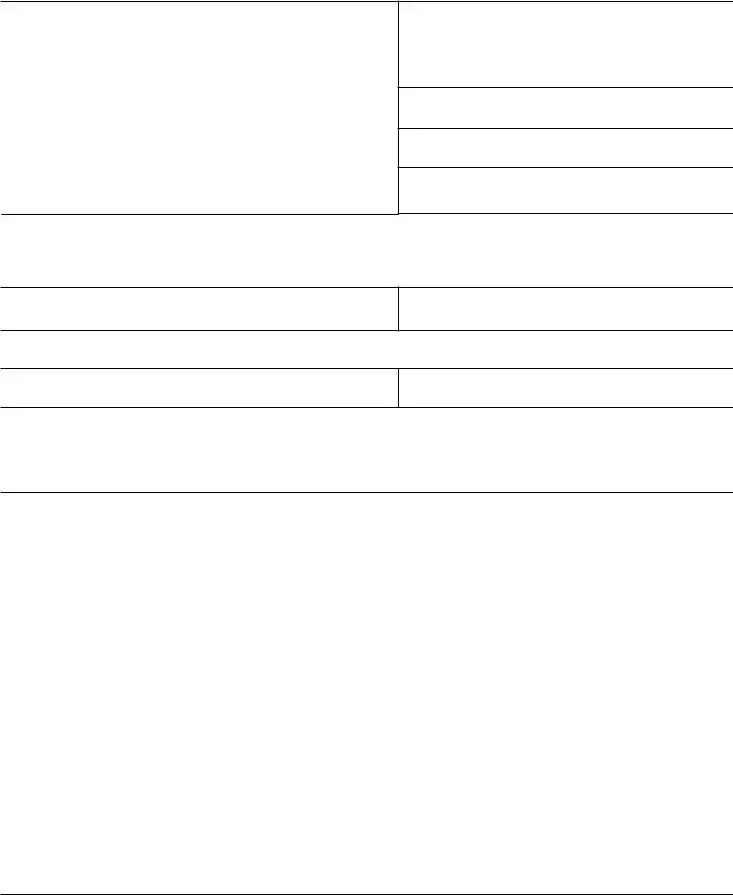

PATIENT'S NAME

PATIENT'S SOCIAL SECURITY NUMBER

PATIENT'S DATE OF BIRTH

PATIENT'S ADDRESS (Number and Street, City, State, and ZIP Code)

1.Date you first saw the patient

2.Date you last saw the patient

3.How many times have you seen this patient?

4.Are you able to assess the patient's ability to manage or direct the management of funds? If no, please skip the remaining questions and sign and date the form.

Yes

No

5.What is the basis for your assessment (e.g. observation, medical records, diagnostic tests, patient's

Note: Please keep in mind in responding to the following questions that the actual performance of the patient, when known, is usually the best indicator of the patient's abilities.

6.Does the patient:

•Have a general understanding of his or her finances (i.e., income, assets, expenses)?

•Have sufficient ability to handle a checking/savings account?

•Have sufficient ability to pay bills in a timely manner?

Yes

Yes

Yes

No

No

No

Unknown

Unknown

Unknown

7. Can the patient successfully manage or direct the management of funds to meet basic needs (e.g. food, clothing,

shelter)?

Yes

If "Yes," please provide a brief summary of the findings that led to this conclusion, and complete question 8. Please also sign and date the form.

No

If "No," please provide a brief summary of the findings that led to this conclusion, and complete question 8. Please also sign and date the form.

Unsure

"Unsure," please explain and sign and date the form.

Form |

Page 3 of 4 |

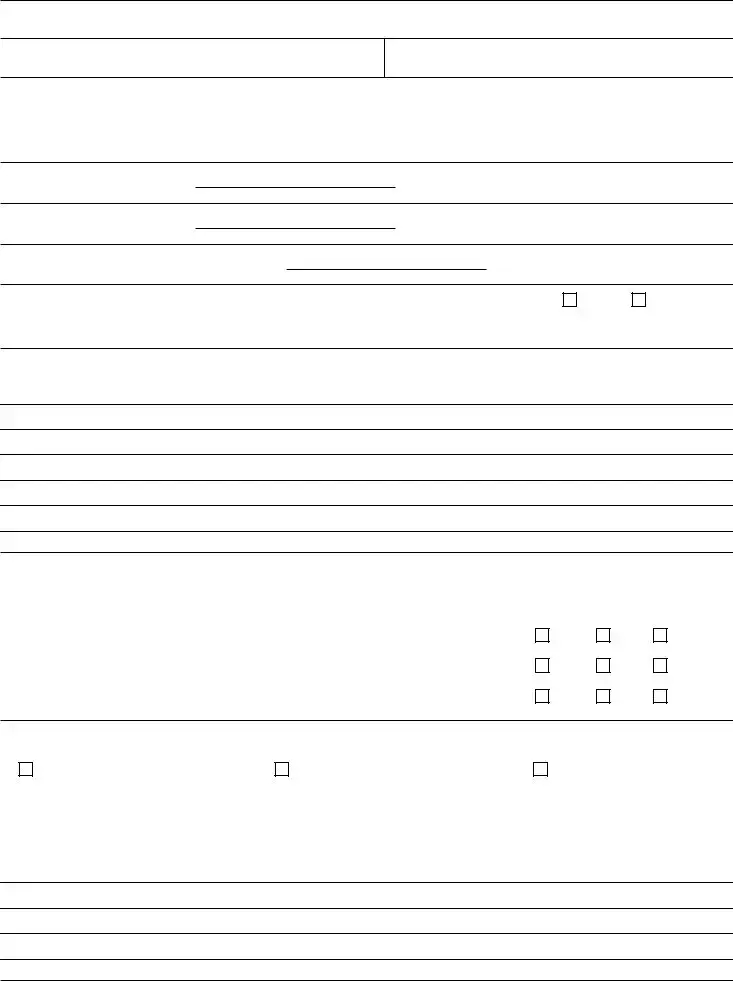

8.Do you expect the patient to be able to manage or direct the management of his or her benefits in the future (e.g. the patient is temporarily unconscious)?

Yes

No

Please explain your answer.

NAME OF MEDICAL SOURCE (Please print.)

TITLE

ADDRESS (Number and Street, City, State, and ZIP Code)

TELEPHONE NUMBER (Include Area Code)

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge. I understand that anyone who knowingly gives a false statement about a material fact in this information, or causes someone else to do so, commits a crime and may be subject to a fine or imprisonment.

SIGNATURE OF MEDICAL SOURCE

DATE

Form |

Page 4 of 4 |

Privacy Act Statement

Collection and Use of Personal Information

Sections 205, 807, and 1631(a) of the Social Security Act, as amended, allow us to collect this information. Furnishing us this information is voluntary. However, failing to provide all or part of the information may prevent us from making a determination regarding the beneficiary’s capability or inability to handle his or her own benefits.

We will use the information to determine the beneficiary’s need for a representative payee. We may also share your information for the following purposes, called routine uses:

•To Federal, State, or local agencies for administering cash or

•To contractors and other Federal agencies, as necessary, for the purpose of assisting the Social Security Administration in the efficient administration of its programs.

In addition, we may share this information in accordance with the Privacy Act and other Federal laws. For example, where authorized, we may use and disclose this information in computer matching programs, in which our records are compared with other records to establish or verify a person’s eligibility for Federal benefit programs and for repayment of incorrect or delinquent debts under these programs.

A list of additional routine uses is available in our Privacy Act System of Records Notices (SORN)

Paperwork Reduction Act Statement - This information collection meets the requirements of

44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget control number. We estimate that it will take about 20 minutes to read the instructions, gather the facts, and answer the questions. SEND OR BRING THE COMPLETED FORM TO YOUR LOCAL SOCIAL

SECURITY OFFICE. You can find your local Social Security office through SSA’s website at www.socialsecurity.gov. Offices are also listed under U.S. Government agencies in your telephone directory or you may call Social Security at

Form Data

| Fact Name | Detail |

|---|---|

| Form Version | SSA-787 (12-2018) UF |

| Form Purpose | Medical Source Opinion of Patient's Capability to Manage Benefits |

| OMB Number | 0960-0024 |

| Primary Use | Determining if an individual requires a representative payee to manage SSA benefits |

| Compensation for Completion | Not provided by SSA |

| Target Respondent | Medical professionals who have assessed the patient |

| Requirement for Representative Payee | Individuals with mental or physical impairments who cannot manage or direct the management of their finances |

| Privacy Act Statement | Information collected is for determining need for a representative payee and may be shared for administering programs or as authorized by law |

| Paperwork Reduction Act Statement | Form collection meets requirements of 44 U.S.C. § 3507 as amended by section 2 of the Paperwork Reduction Act of 1995 |

Instructions on Utilizing Ssa 787

Filling out the SSA-787 form is an essential task for medical professionals who are asked by the Social Security Administration to evaluate a patient's ability to manage their Social Security or Supplemental Security Income (SSI) benefits. This evaluation plays a pivotal role in determining whether the patient should receive their benefits directly or if a representative payee should be appointed. The accurate completion of this form is crucial as it directly impacts the financial welfare of the patient. Here's how to fill it out step by step:

- Start with the patient's identifying information at the top of the form. If it differs from the patient, ensure this section is filled out, including the patient’s name, Social Security Number, date of birth, and contact details.

- Under the section Date you first saw the patient, enter the first date you had a medical appointment or evaluation with the patient.

- Fill in the Date you last saw the patient field with the most recent visit date.

- Answer the question about how many times you have seen this patient by entering the total number of visits.

- Assess whether you can evaluate the patient's ability to manage funds by selecting Yes or No. If 'No', you should sign and date the form without answering the subsequent questions.

- For the question on the basis of your assessment, describe the method you used to evaluate the patient's financial management capabilities, citing observation, medical records, diagnostic tests, patient or family reports as applicable.

- Respond to the queries about the patient's understanding of their finances, ability to handle a bank account, and capability to pay bills on time with a simple Yes, No, or Unknown.

- Answer whether the patient can manage or direct the management of funds to meet basic needs. Provide a detailed explanation for your answer, whether 'Yes', 'No', or 'Unsure', and move to the next question based on your selection.

- Discuss the potential for the patient's future capability to manage or direct the management of his or her benefits in the provided space.

- Complete the section with your Name, Title, Address, and Telephone Number.

- Finally, sign and date the form, thereby certifying that all the provided information is accurate and complete to the best of your knowledge.

Upon completion, return the form to the Social Security office using the provided envelope or the address and contact information given by the requester. Ensure you carefully review all information for accuracy before submission, as this form significantly influences the patient's eligibility and capability to manage their financial benefits. Providing precise and thorough information will help ensure the patient receives the appropriate level of assistance with their Social Security or SSI benefits.

Obtain Answers on Ssa 787

What is Form SSA-787 used for?

Form SSA-787, officially titled "Medical Source Opinion of Patient's Capability to Manage Benefits", is utilized by the Social Security Administration (SSA) to gather medical opinions regarding an individual's ability to manage or direct the management of their Social Security or Supplemental Security Income (SSI) benefits. This form helps in deciding whether benefits should be paid directly to the beneficiary or if a representative payee is needed.

Who needs a representative payee, and why?

Individuals aged 18 and older who are unable to manage their SSA benefits due to mental or physical impairments, such as dementia, brain damage, or chronic schizophrenia, may require a representative payee. A representative payee manages the benefits to ensure the individual's basic needs, including food, clothing, and shelter, are met. The role of the payee involves a deep commitment to the well-being of the beneficiary and is often a family member or close friend.

How is the decision made about someone’s ability to manage benefits?

The ability of a person to manage their benefits is assessed through observations, medical records, diagnostic tests, and reports from the person or family members. The form requires a health professional to answer questions regarding the individual's understanding of their finances, ability to handle a checking or savings account, and capacity to pay bills timely. The actual performance of the individual, when known, is a critical indicator.

What happens if a professional cannot assess a patient's ability to manage funds?

If the medical professional is unable to assess the patient's ability to manage or direct the management of their funds, they are instructed to skip the remaining questions, sign, and date the form, indicating that an assessment could not be made.

Can an individual's ability to manage benefits change over time?

Yes. There are circumstances under which an individual's ability to manage their benefits may change. The form asks if the medical source expects the patient to be able to manage or direct the management of his or her benefits in the future, allowing for a reassessment of needs over time, especially in cases where the incapacity may be temporary.

Is there compensation for completing this form?

Unfortunately, the SSA does not compensate individuals or medical professionals for the time spent completing Form SSA-787. The contribution, however, is invaluable in ensuring the well-being and proper management of benefits for individuals who may not be capable of doing so on their own.

Where should the completed SSA-787 form be sent?

The completed SSA-787 form should be sent or brought to the submitter's local Social Security office. Local offices can be found through the SSA’s website or listed under U.S. Government agencies in telephone directories. Additionally, one may call Social Security at 1-800-772-1213 (or TTY 1-800-325-0778 for individuals who are deaf or hard of hearing) for assistance in locating the nearest office or for more information on where to send the form.

Common mistakes

Filling out the SSA-787 form accurately is crucial for ensuring individuals receive the appropriate support in managing their Social Security benefits. However, certain errors frequently occur during the completion process:

- Incorrect patient identification details. Omitting or inaccurately providing essential information such as the patient's Social Security Number, date of birth, or address can lead to processing delays.

- Failing to answer all relevant questions. Sometimes, crucial questions regarding the patient's ability to manage funds are left unanswered, which can hinder a proper assessment.

- Inadequate explanation of the patient's condition. Brief or unclear summaries regarding the patient's capability or inability to manage benefits can lead to misjudgments in the necessity for a representative payee.

- Not signing the form. The form requires a signature under penalty of perjury to confirm the accuracy and truthfulness of the provided information. Missing signatures invalidate the form.

To avoid these mistakes, individuals are advised to review the form thoroughly before submission, ensuring all sections are completed accurately and that the form is duly signed. This careful attention helps in making an informed decision regarding the patient's need for a representative payee and ensures a smoother process for all involved.

Documents used along the form

When dealing with the Social Security Administration (SSA), several forms and documents often accompany Form SSA-787, which is used for assessing a patient's capability to manage their SSA benefits. These documents are vital for ensuring that the needs of the person are adequately met and that the benefits are directed in the most beneficial manner.

- SSA-561-U2 (Request for Reconsideration): This form is used if a person disagrees with a decision made by the SSA regarding their benefits. It's the first step in the appeals process.

- SSA-3368 (Disability Report - Adult): This comprehensive form provides the SSA with detailed information about an individual's physical or mental condition that limits their ability to work. It's crucial for disability benefit applications.

- SSA-827 (Authorization to Disclose Information to the SSA): This document allows the SSA to obtain medical records, educational records, and other necessary information to make a decision on a person's claim.

- SSA-1696 (Appointment of Representative): This form is used to officially appoint someone to act on an individual's behalf in matters related to Social Security. It is essential for those who need assistance managing their affairs.

- HA-501-U5 (Request for Hearing by Administrative Law Judge): If a reconsideration is denied, this form can be used to request a hearing for further review of the decision by an administrative law judge.

- SSA-3441 (Disability Report - Appeal): This form is needed when an individual appeals a decision regarding their disability benefits. It updates the SSA on any changes in the individual’s condition or circumstances.

- SSA-454-BK (Continuing Disability Review Report): This document is used for periodic reviews of a person's medical condition to determine if they remain eligible for disability benefits.

- SSA-820-F4 (Work Activity Report - Self Employed): This form helps determine if the earnings of a self-employed person with disabilities reach a level that may affect their Social Security Disability Insurance benefits.

Together with Form SSA-787, these documents facilitate a comprehensive evaluation of a person's situation, ensuring that decisions regarding their benefits are made with the best available information. Filling out these forms accurately and completely is essential for a smooth process in managing or appealing Social Security benefits.

Similar forms

Form SSA-787 plays a crucial role in ensuring individuals who are unable to manage their Social Security or Supplemental Security Income benefits receive necessary assistance. The essence of this form revolves around assessing a beneficiary's mental or physical capability to manage their finances and determining the necessity for a representative payee. There are several documents that share similarities with the SSA-787, in terms of either their objectives, the information they gather, or the decisions they support.

- Form SSA-1696: This form is for appointing a representative for dealing with the Social Security Administration. Similar to the SSA-787, it involves appointing another individual to assist, although in a broader legal capacity beyond just financial management.

- VA Form 21-2680: Filed with the Department of Veterans Affairs, this form assesses the need for an increased pension due to being housebound or in need of Aid and Attendance (A&A). Like the SSA-787, it requires a health professional's certification regarding the individual's conditions and capabilities.

- HUD-9887/A: This form is used for verifying incomes of applicants and participants of certain HUD programs. It resembles the SSA-787 by necessitating the collection and verification of personal information to make eligibility or benefit determinations.

- Form SSA-11: Used to apply for a representative payee for Social Security benefits, this form directly correlates with the SSA-787, as the determination from SSA-787 can necessitate completing an SSA-11 to appoint a payee.

- Bank Trustee Application Forms: These are used when a bank account needs to be managed by a trustee for someone incapable of doing so themselves. They align with the SSA-787's purpose of assessing and endorsing financial management capabilities.

- Form SSA-561: The Request for Reconsideration form allows for the appeal of decisions made by the SSA regarding benefits, similar to how assessments made through SSA-787 can be contested.

- Form SSA-3369: This Work History Report form is filled out as part of disability benefits applications. It complements the SSA-787 by providing detailed employment history to assist in evaluating benefit eligibility and needs.

- Form SSA-454-BK: The Continuing Disability Review Report is used to review the status of individuals receiving disability benefits. Like the SSA-787, it involves an assessment of the individual's current condition and capability.

- Form HCFA-40B: This form is used for enrolling in Medicare Part B (medical insurance). Its connection to SSA-787 lies in the requirement for individuals (especially those aging into eligibility) to manage or direct their benefit selections effectively.

- Advance Directive Forms: These forms allow individuals to specify their preferences for healthcare and appoint healthcare agents, showing a connection to the SSA-787's theme of making arrangements for personal welfare through representation.

Each of these documents serves a specific function within its respective system, yet collectively, they highlight a broader societal effort to protect and support individuals who may be vulnerable or in need of assistance in managing their affairs, reflecting the intent and purpose behind Form SSA-787.

Dos and Don'ts

When completing the SSA-787 form, it's important to follow best practices to ensure the form is filled out accurately and efficiently. Here are six things you should do:

- Read the instructions carefully before starting to fill out the form. Understanding each request fully can help you provide accurate and complete information.

- Ensure that all provided information is accurate and truthful, especially regarding the patient's ability to manage funds. Inaccurate information can lead to improper decisions regarding the need for a representative payee.

- Include detailed observations or findings that support your assessment of the patient's ability to manage their benefits. Specific examples can be very helpful.

- Use clear and concise language when explaining your assessment and conclusions. This makes the form easier to review and the decision-making process more straightforward.

- Double-check the patient's identifying information (e.g., Social Security Number, address) for any errors. Correct identification is crucial for processing the form.

- Sign and date the form to validate the information provided. An unsigned form may be considered incomplete and could delay the process.

There are also things you should avoid when filling out the SSA-787 form:

- Do not overlook the importance of question 7, which asks about the patient’s capacity to manage or direct the management of funds. An incomplete answer here can impact the assessment.

- Avoid using technical jargon or medical terminology that may not be easily understood by non-medical reviewers at the SSA.

- Do not assume that the patient needs a representative payee without thoroughly evaluating their abilities and providing concrete examples.

- Refrain from providing unnecessary personal information about the patient that does not relate to their ability to manage SSA benefits.

- Do not forget to check the box indicating whether you are able to assess the patient’s ability to manage funds before proceeding to the rest of the questions.

- Finally, do not delay sending the completed form to the Social Security Administration. Prompt submission helps ensure that the patient's needs are addressed in a timely manner.

Misconceptions

Understanding the SSA-787 form is crucial for individuals navigating the Social Security system. Here are five common misconceptions corrected to provide clarity:

- Only doctors can complete the SSA-787 form. While the SSA-787 form is intended for medical sources to provide an opinion on a patient's ability to manage benefits, it is not strictly limited to physicians. Qualified health professionals who have a thorough understanding of the patient's condition are also eligible to complete this form.

- The form is only for determining disability benefits. The primary purpose of the SSA-787 form is to help the Social Security Administration (SSA) decide whether an individual needs a representative payee to manage their benefits. It is not used to determine eligibility for disability benefits.

- Completing the SSA-787 form automatically results in getting a representative payee. Filling out this form is just one step in the process. The SSA uses the information provided to make an informed decision. Simply completing the form does not guarantee that the SSA will assign a representative payee.

- The information on the form will affect the patient’s disability status. The SSA uses the form exclusively to assess a person's ability to manage or direct the management of Social Security or Supplemental Security Income benefits. It does not impact the assessment of a person's disability status or eligibility for benefits.

- The patient’s financial skills are the only factor considered. While the form asks about the patient’s understanding of finances and ability to manage funds, it's part of a broader assessment. The SSA also considers other factors, such as medical diagnoses and the patient's overall well-being, before deciding on the need for a representative payee.

It's essential for both patients and medical professionals to approach the SSA-787 form with accurate information and clear expectations. This ensures that the Social Security Administration can make the best decision for the individual's benefit management.

Key takeaways

The SSA-787 form is essential for determining a patient's capability to manage or direct the management of their Social Security or Supplemental Security Income benefits. Here are seven key takeaways to guide you through filling out and using this form:

- The form requires a medical professional to assess the patient's ability to manage finances. This is crucial for ensuring the patient's basic needs are met through effective handling of their Social Security benefits.

- Information such as the patient's name, Social Security Number, date of birth, and address must be clearly and accurately filled out to avoid any processing delays.

- It’s important for the medical professional to indicate their relationship with the patient and the frequency and dates of medical consultations to provide context for their assessment.

- Key questions focus on the patient's understanding of their finances, their ability to handle a checking or savings account, and their capacity to pay bills promptly. These are critical in determining the need for a representative payee.

- If a medical professional deems the patient incapable of managing their benefits, the form requires a summary of the findings leading to this conclusion. This helps the Social Security Administration (SSA) make an informed decision regarding the assignment of a representative payee.

- The form also inquires about the possibility of the patient gaining the ability to manage their benefits in the future. This can include temporary conditions that might impair the patient's current financial management capabilities.

- Privacy and accuracy are paramount, with an emphasis on the protection of the patient's personal information and the legal repercussions of providing false information. Medical sources are reminded of the gravity of their declarations under penalty of perjury.

Upon completion, the form should be sent or delivered to the local Social Security office, with additional guidance available online or via phone for locating the nearest office or for any inquiries regarding the form. This process is an integral part of ensuring that individuals who require assistance are provided with the support they need to manage their benefits effectively.

Popular PDF Forms

How to Quash a Bench Warrant - An indispensable tool for disputing an arrest warrant and securing a court review, crucial for defendants in Alaska.

What Is a Physical for a Job - By collecting comprehensive health information, the form enables employers to effectively manage risks associated with chronic conditions or disabilities.