Blank Ssa 8 PDF Template

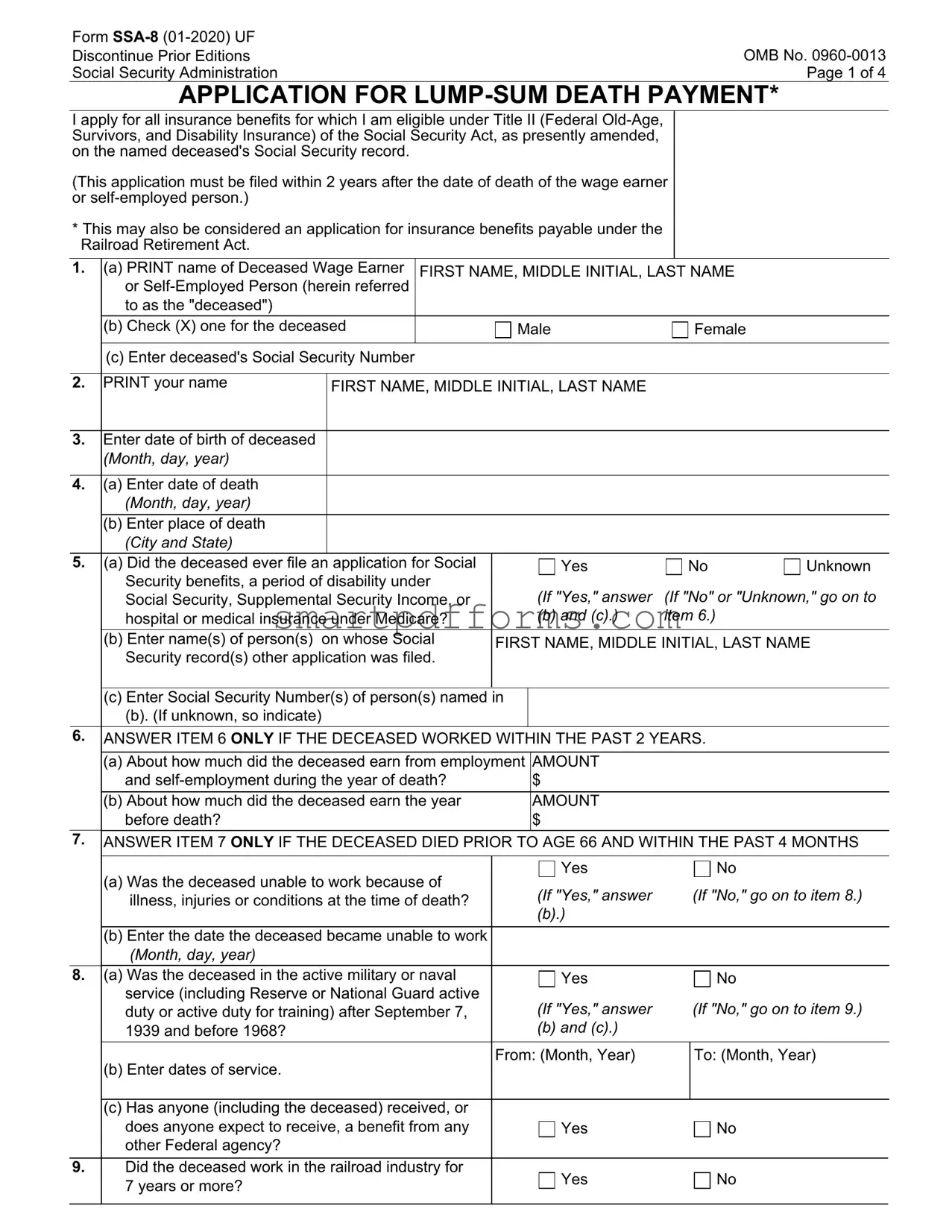

Navigating the aftermath of a loved one's passing involves not only coping with loss but also managing necessary paperwork, including the Social Security Administration’s Form SSA-8. Designed to facilitate applications for lump-sum death payments under Title II of the Social Security Act, this form represents a crucial step for survivors seeking to claim benefits potentially owed on the deceased's earnings record. Applicants must file within a strict two-year window post-death, highlighting the time-sensitive nature of this benefit. The form details are comprehensive, requiring the deceased’s Social Security Number, details of prior applications for Social Security benefits, employment history, and information regarding the deceased's marital status and surviving children or dependents. Furthermore, the SSA-8 form alerts to the intertwining eligibility with the Railroad Retirement Act, signalling a broadened scope for applicants. Additionally, the form solicits information regarding military service, work in the railroad industry, and any work covered under a foreign social security system, which may impact the benefit determination process. In essence, the SSA-8 encapsulates a vital process for surviving family members to secure financial assistance in a challenging time, underlining the importance of accurate and timely submission.

Preview - Ssa 8 Form

Form |

OMB No. |

Discontinue Prior Editions |

|

Social Security Administration |

Page 1 of 4 |

APPLICATION FOR

I apply for all insurance benefits for which I am eligible under Title II (Federal

(This application must be filed within 2 years after the date of death of the wage earner or

*This may also be considered an application for insurance benefits payable under the Railroad Retirement Act.

1. |

(a) PRINT name of Deceased Wage Earner |

FIRST NAME, MIDDLE INITIAL, LAST NAME |

|||

|

|

or |

|

|

|

|

|

to as the "deceased") |

|

|

|

|

|

(b) Check (X) one for the deceased |

Male |

Female |

|

|

|

|

|

|

|

|

|

(c) Enter deceased's Social Security Number |

|

|

|

|

|

|

|

|

|

2. |

PRINT your name |

FIRST NAME, MIDDLE INITIAL, LAST NAME |

|

||

3. |

Enter date of birth of deceased |

|

|

|

|

(Month, day, year) |

|

|

|

|

|

|

|

|

4. |

(a) Enter date of death |

|

|

|

|

(Month, day, year) |

|

|

|

|

(b) Enter place of death |

|

|

|

|

(City and State) |

|

|

|

5. |

(a) Did the deceased ever file an application for Social |

Yes |

No |

Unknown |

|

Security benefits, a period of disability under |

(If "Yes," answer |

(If "No" or "Unknown," go on to |

|

|

Social Security, Supplemental Security Income, or |

|||

|

hospital or medical insurance under Medicare? |

(b) and (c).) |

item 6.) |

|

|

(b) Enter name(s) of person(s) on whose Social |

FIRST NAME, MIDDLE INITIAL, LAST NAME |

||

|

Security record(s) other application was filed. |

|

|

|

(c)Enter Social Security Number(s) of person(s) named in

(b). (If unknown, so indicate)

6.ANSWER ITEM 6 ONLY IF THE DECEASED WORKED WITHIN THE PAST 2 YEARS.

(a)About how much did the deceased earn from employment AMOUNT

and |

$ |

(b) About how much did the deceased earn the year |

AMOUNT |

before death? |

$ |

7.ANSWER ITEM 7 ONLY IF THE DECEASED DIED PRIOR TO AGE 66 AND WITHIN THE PAST 4 MONTHS

(a) Was the deceased unable to work because of |

Yes |

No |

|

(If "Yes," answer |

(If "No," go on to item 8.) |

||

illness, injuries or conditions at the time of death? |

|||

|

(b).) |

|

(b)Enter the date the deceased became unable to work (Month, day, year)

8. |

(a) Was the deceased in the active military or naval |

Yes |

No |

|

service (including Reserve or National Guard active |

(If "Yes," answer |

(If "No," go on to item 9.) |

|

duty or active duty for training) after September 7, |

||

|

1939 and before 1968? |

(b) and (c).) |

|

|

(b) Enter dates of service. |

From: (Month, Year) |

To: (Month, Year) |

|

|

|

|

|

|

|

|

|

(c) Has anyone (including the deceased) received, or |

|

|

|

does anyone expect to receive, a benefit from any |

Yes |

No |

|

other Federal agency? |

|

|

9. |

Did the deceased work in the railroad industry for |

Yes |

No |

|

7 years or more? |

||

|

|

|

|

Form |

|

|

|

|

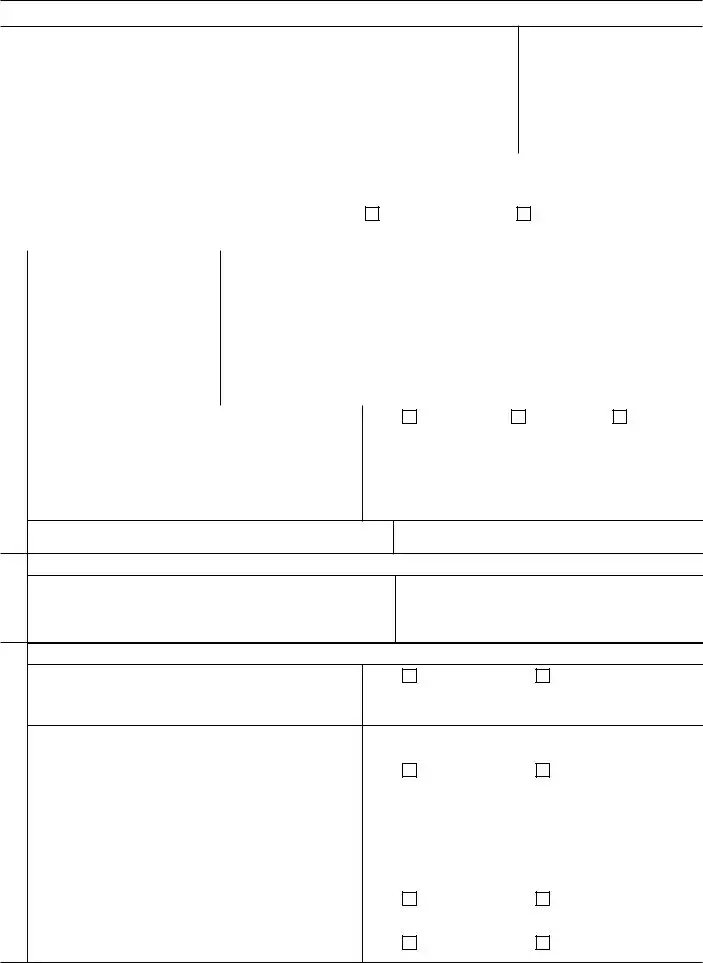

Page 2 of 4 |

|||

|

10. (a) Did the deceased ever engage in work that was covered under the social |

|

Yes |

(If "Yes," answer (b).) |

|||||

|

|

security system of a country other than the United States? |

|

No (If "No," go on to item 11.) |

|||||

|

|

|

|

|

|

||||

|

|

(b) If "Yes," list the country(ies). |

|

|

|

|

|

|

|

|

11. |

(a) Is the deceased survived by a |

spouse? |

|

|

|

|

Yes |

No |

|

|

If "Yes," enter information about the marriage at the time of death below. If "No," go on to |

|

||||||

|

|

item 11(b) if the deceased had prior marriages or item 12 if the deceased never married. |

|

|

|

||||

|

|

Spouse's Name (including Maiden Name) |

When (Month, day, year) |

Where (Name of City and State) |

|

||||

|

|

|

|

|

|

||||

|

|

How marriage ended |

When (Month, day, year) |

Where (Name of City and State) |

|

||||

|

|

|

|

|

|||||

|

|

Marriage performed by: |

Spouse's date of birth (or age) |

Spouse's Social Security Number (If |

|||||

|

|

Clergyman or public official |

none or unknown, so indicate) |

|

|||||

|

|

|

|

||||||

|

|

Other (Explain in "Remarks") |

|

|

|

|

|

|

|

(b)If the deceased had a prior marriage(s) that lasted at least 10 years, enter the information below. If the deceased married the same individual multiple times and the remarriage took place within the year immediately following the year of the divorce, and the combined period of marriage totaled 10 years or more, include the marriage. If no prior marriages or if information is unavailable, please indicate below.

Spouse's Name (including Maiden Name) |

When (Month, day, year) |

Where (Name of City and State) |

|

|

|

|

|

How marriage ended |

When (Month, day, year) |

Where (Name of City and State) |

|

|

|

|

|

Marriage performed by: |

Spouse's date of birth (or age) |

If spouse deceased, give date |

|

Clergyman or public official |

of death |

||

|

|||

Other (Explain in "Remarks") |

|

|

|

Spouse's Social Security Number (If none or unknown, so indicate) |

|

||

(c)If the deceased has a surviving child(ren) as defined in item 12 and the deceased was married to the child's mother or father but the marriage ended in divorce, enter information on the marriage if not already listed in 11(b). If no prior marriages or if information is unavailable, please indicate below.

|

Spouse's Name (including Maiden Name) |

When (Month, day, year) |

Where (Name of City and State) |

|

|

|

|

|

How marriage ended |

When (Month, day, year) |

Where (Name of City and State) |

|

|

|

|

|

Marriage performed by: |

Spouse's date of birth (or age) |

If spouse deceased, give date |

|

Clergyman or public official |

of death |

|

|

|

||

|

Other (Explain in "Remarks") |

|

|

|

Spouse's Social Security Number (If none or unknown, so indicate) |

|

|

|

|

|

|

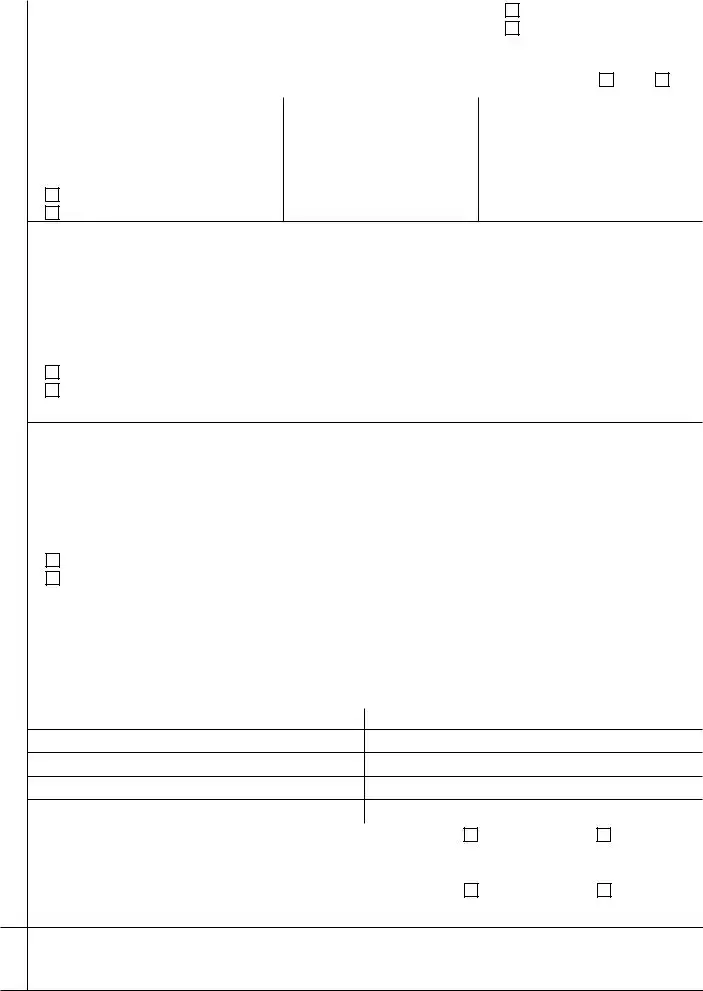

12. |

The deceased's surviving children (including natural children, adopted children, and stepchildren) or dependent |

||

|

grandchildren (including stepgrandchildren) may be eligible for benefits based on the earnings record of the deceased. |

||

|

List below ALL such children who are now or were in the past 12 months UNMARRIED and: |

||

|

• UNDER AGE 18 • AGE 18 TO 19 AND ATTENDING SECONDARY SCHOOL |

||

|

• AGE 18 OR OLDER WITH A DISABILITY THAT BEGAN BEFORE AGE 22 |

||

|

(If none, write ''None.'') |

|

|

|

|

|

|

|

Full Name of Child |

|

Full Name of Child |

13. |

Is there a surviving parent (or parents) of the deceased who |

Yes |

No |

|

was receiving support from the deceased either at the time |

(If "Yes," enter the name and |

|

|

the deceased became disabled under the Social Security law |

|

|

|

or at the time of death? |

address of the parent(s) in "Remarks".) |

|

14. |

Have you filed for any Social Security benefits on the |

Yes |

No |

|

deceased's earnings record before? |

||

|

|

|

|

NOTE: If there is a surviving spouse, continue with item 15. If not, skip items 15 through 18.

15.If you are not the surviving spouse, enter the surviving spouse's name and address here

Form |

|

Page 3 of 4 |

|

16. |

(a) Were the deceased and the surviving spouse living |

Yes |

No |

|

together at the same address when the deceased died? |

(If "Yes," go on to item 17.) |

(If "No," answer (b).) |

(b)If either the deceased or surviving spouse was away from home (whether or not temporarily) when the deceased died, give the following:

|

Who was away? |

|

Deceased |

|

Surviving spouse |

|

|

|

|

|

|

Date last home |

Reason absence began |

|

Reason they were apart at time of death |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

If separated because of illness, enter |

|

|

|

|

|

|

|

||

|

nature of illness or disabling condition. |

|

|

|

|

|

|

|

||

If you are the surviving spouse, and if you are under age 66, answer 17. |

|

|

|

|

||||||

17. |

(a) Are you so disabled that you cannot work or was there some period during the last 14 |

|

Yes |

No |

||||||

|

months when you were so disabled that you could not work? |

|

|

|||||||

|

|

|

|

|

||||||

|

(b) If ''Yes,'' enter the date you became disabled. |

|

|

|

(Month, day, year) |

|||||

|

|

|

|

|

|

|

|

|

||

Answer 18 ONLY if you are the surviving spouse. |

|

|

|

|

|

|

||||

18. Were you married before your marriage to the deceased? If yes, enter information about your |

|

Yes |

No |

|||||||

|

prior marriage(s) that lasted at least 10 years or ended due to death of the spouse. If you |

|

||||||||

|

divorced then remarried the same individual within the year immediately following the year of |

|

|

|

||||||

|

the divorce and the combined period of marriage totaled at least 10 years, include the marriage. |

|

|

|||||||

|

If you need more space, use "Remarks" section on back page or attach a separate sheet. |

|

|

|

||||||

|

Spouse's Name (including Maiden Name) |

When (Month, day, year) |

Where (Name of City and State) |

|

||||||

|

|

|

|

|

|

|||||

|

How marriage ended |

|

When (Month, day, year) |

Where (Name of City and State) |

|

|||||

|

|

|

|

|

|

|

|

|||

|

Marriage performed by: |

|

Spouse's date of birth (or age) |

If spouse deceased, give date |

|

|||||

|

Clergyman or public official |

of death |

|

|

|

|||||

|

|

|

|

|

|

|

||||

|

Other (Explain in "Remarks") |

|

|

|

|

|

|

|

||

Spouse's Social Security Number (If none or unknown, so indicate)

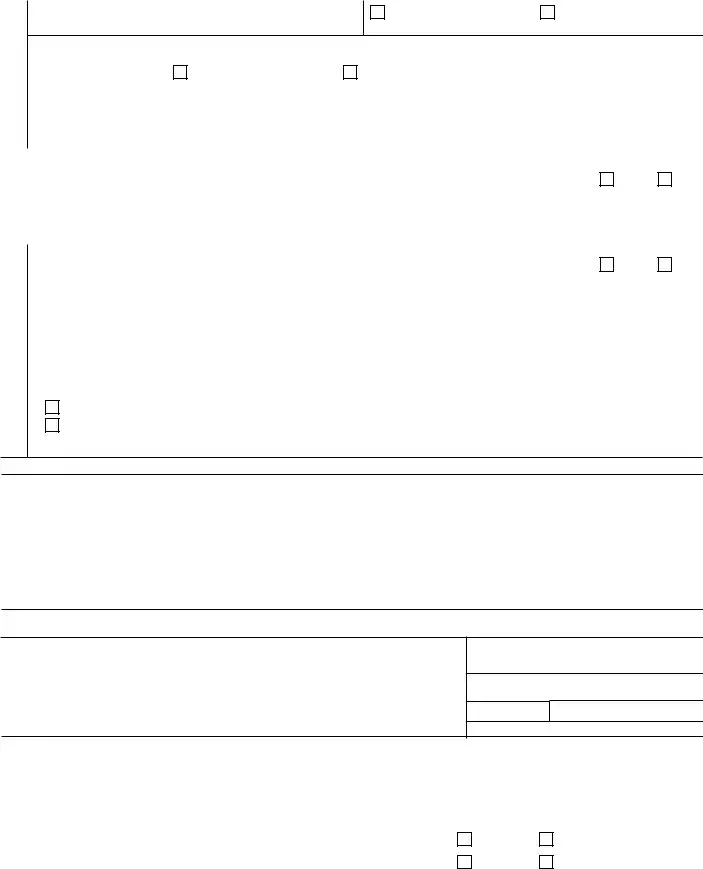

For additional information about survivor benefits see our publication at www.socialsecurity.gov.

Remarks: (You may use this space for any explanation. If you need more space, attach a separate sheet.)

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge.

SIGNATURE OF APPLICANTDate (Month, day, year)

Signature (First name, middle initial, last name) (Write in ink)

Telephone Number(s) at Which You

May Be Contacted During the Day

(Area Code)

Mailing Address (Number and street, Apt. No., P.O. Box, or Rural Route)

City and State |

|

ZIP Code |

Enter Name of County (if any) in which you now live |

||||

|

|

|

|

|

|

|

|

Direct Deposit Payment Information (Financial Institution) |

|

|

|

|

|||

Routing Transit Number |

Account Number |

|

Checking |

|

Enroll in Direct Express |

||

|

|

|

|

|

Savings |

|

Direct Deposit Refused |

|

|

|

|

|

|||

Witnesses are required ONLY if this application has been signed by mark (X) above. If signed by mark (X), two |

|||||||

witnesses to the signing who know the applicant must sign below, giving their full addresses. |

|

||||||

1. Signature of Witness |

|

|

|

2. Signature of Witness |

|

||

|

|

||||||

Address (Number and street, City, State, and ZIP Code) |

Address (Number and street, City, State, and ZIP Code) |

||||||

|

|

|

|

|

|

|

|

Form |

Page 4 of 4 |

RECEIPT FOR YOUR CLAIM FOR THE SOCIAL SECURITY |

|

TELEPHONE NUMBER TO CALL IF YOU HAVE A QUESTION OR SOMETHING TO REPORT

TELEPHONE NUMBER

SSA OFFICE

DATE CLAIM RECEIVED

RECEIPT FOR YOUR CLAIM

Your application for the

You should hear from us within days after you have given us all the information we requested. Some claims may take longer if additional information is needed.

In the meantime, if you change your mailing address, you should report the change.

Always give us your claim number when writing or telephoning about your claim.

If you have any questions about your claim, we will be glad to help you.

CLAIMANT

SOCIAL SECURITY CLAIM NUMBER

DECEASED'S NAME (If surname differs from claimant's name)

Privacy Act Statement - Application for

Collection and Use of Personal Information

Section 202 of the Social Security Act, as amended, allows us to collect this information. Furnishing us this information is voluntary. However, failing to provide all or part of the information may prevent us from making an accurate and timely determination on any claim filed and could result in a loss of a Social Security Administration (SSA) provided benefit.

We will use the information to authorize our

•Information may be disclosed to contractors and other Federal agencies, as necessary, for the purpose of assisting the SSA in the efficient administration of its programs. We contemplate disclosing information under this routine use only in situations in which SSA may enter a contractual or similar agreement with a third party to assist in accomplishing an agency function relating to this system of records; and

•To a congressional office in response to an inquiry from that office made at the request of the subject of a record.

In addition, we may share this information in accordance with the Privacy Act and other Federal laws. For example, where authorized, we may use and disclose this information in computer matching programs, in which our records are compared with other records to establish or verify a person’s eligibility for Federal benefit programs and for repayment of incorrect or delinquent debts under these programs.

A list of additional routine uses is available in our Privacy Act System of Records Notice (SORN)

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget (OMB) control number. We estimate that it will take about 10 minutes to read the instructions, gather the facts, and answer the questions. Send only comments relating to our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD

Form Data

| Fact Name | Description |

|---|---|

| Form Identification | The form is identified as SSA-8 (01-2020) UF. |

| Purpose | Application for the lump-sum death payment under Title II of the Social Security Act and potentially under the Railroad Retirement Act. |

| Filing Deadline | The application must be filed within 2 years after the date of death of the wage earner or self-employed person. |

| Governing Law | Governed by Title II (Federal Old-Age, Survivors, and Disability Insurance) of the Social Security Act, as presently amended. |

| OMB Control Number | OMB No. 0960-0013. |

Instructions on Utilizing Ssa 8

Filling out the SSA-8 form accurately and thoroughly ensures a smooth process in applying for the lump-sum death payment. It's important to approach this task with care, ensuring all the required information is at hand. By following these steps closely, applicants can ensure their forms are complete, which is key to a timely evaluation and determination by the Social Security Administration.

- Print the name of the Deceased Wage Earner or Self-Employed Person: Enter their first name, middle initial, and last name in the spaces provided.

- Select the Gender of the Deceased: Check the appropriate box indicating the deceased's gender.

- Enter the Social Security Number of the Deceased: Provide the deceased’s social security number in the space provided.

- Print Your Name: Enter your first name, middle initial, and last name.

- Enter the Date of Birth and Date of Death of the Deceased: Provide these dates in the format of month, day, and year.

- Enter the Place of Death: Specify the city and state where the death occurred.

- Answer Questions about the Deceased’s Previous Social Security Applications: Indicate whether the deceased ever filed for Social Security benefits, disability, Supplemental Security Income, or Medicare. If yes, provide the names and social security numbers of the person(s) on whose record application was filed.

- If the deceased worked within the last 2 years, provide the earnings amount during the year of death and the year before death.

- If applicable, provide information regarding the deceased’s inability to work due to illness, injuries, or conditions at the time of death.

- Answer questions concerning the deceased’s military service, employment in the railroad industry, and engagement in work covered under the social security system of another country.

- Provide details about the deceased's surviving spouse, prior marriages (if applicable), and children who may be eligible for benefits. Include all requested details such as names, dates of birth, social security numbers, and marriage information.

- Signature and Contact Information: Sign the application, providing the date (month, day, year), your telephone number(s), mailing address, and, if applicable, direct deposit information.

- Have witnesses sign the form if you signed it by mark (X).

Once the form is fully completed, review it to ensure all information provided is accurate and true. Submit the SSA-8 form to the Social Security Administration through the provided means. After submission, applicants should expect communication from the SSA, which will include details on the status of the claim and any further steps required. It's important to notify the SSA of any changes in contact information promptly to avoid delays in processing.

Obtain Answers on Ssa 8

What is the SSA-8 form?

The SSA-8 form is an official document provided by the Social Security Administration (SSA). It's used to apply for a lump-sum death payment under Title II of the Social Security Act. This payment is a one-time benefit provided to the eligible surviving spouse or children of a deceased person who paid into Social Security.

Who is eligible to apply for the lump-sum death payment using the SSA-8 form?

Eligibility for the lump-sum death payment primarily extends to the surviving spouse living in the same household at the time of death. If there is no surviving spouse, the payment can be made to the deceased's children if they meet certain eligibility criteria as defined by the SSA.

What is the deadline for filing the SSA-8 form?

The SSA-8 form must be filed within 2 years after the date of the deceased's death. Filing beyond this period may result in the loss of eligibility for the lump-sum death payment.

Can the SSA-8 form be considered for any benefits under the Railroad Retirement Act?

Yes, filing the SSA-8 form can also be considered an application for insurance benefits payable under the Railroad Retirement Act, if the deceased had earnings from the railroad industry that could qualify.

What information do I need to provide when filling out the SSA-8 form?

- Deceased's Social Security Number and personal details.

- Applicant's name, relationship to the deceased, and personal details.

- Information about the deceased's employment and earnings.

- Details about any surviving spouse, children, or dependent parents.

Where can I obtain and submit the SSA-8 form?

The SSA-8 form can be downloaded from the SSA's official website or picked up from a local Social Security office. It can be submitted either in person at a Social Security office or mailed directly to the SSA for processing.

What happens after I submit the SSA-8 form?

Upon submission, the SSA will review your application for the lump-sum death payment. You will receive a receipt for your claim and should hear back from the SSA within a specified period. The processing time can vary, and additional information may be requested to make a determination on your claim.

Common mistakes

Not providing complete information regarding the deceased's work history, particularly if the deceased worked within the last 2 years or had engagement in work covered under the social security system of a country other than the United States (items 6 and 10). This oversight can lead to delays or inaccuracies in processing the application.

Misunderstanding the eligibility for filing the application based on the marital status and history with the deceased. Some applicants fail to accurately report previous marriages of the deceased or the surviving spouse, including the duration of these marriages (items 11, 18). Essential benefits can be missed or delayed if this information is inaccurately reported.

Incorrectly reporting or failing to disclose other benefits received or expected to be received from Federal agencies or the railroad industry (items 8 and 9). This can not only affect the lump-sum death payment eligibility but also lead to possible overpayments that need to be repaid.

Omitting or incorrectly providing information about the deceased's children who might be eligible for benefits (item 12). This mistake can lead to incomplete processing of benefits that the children could be entitled to, impacting their financial support.

Documents used along the form

When dealing with the loss of a loved one and handling Social Security matters such as the Application for Lump-Sum Death Payment (Form SSA-8), several other forms and documents often come into play. These forms help in establishing eligibility, proving identity, and providing necessary information related to the deceased and the applicant. Each of these documents has a specific role in the process, ensuring that all the required information is accurately and thoroughly provided to the Social Security Administration (SSA).

- SSA-5 Application for a Social Security Card: This form is essential for individuals who need to apply for a new or replacement Social Security card. It's particularly relevant if there are discrepancies in records that need correction following a relative's death.

- SSA-561 Request for Reconsideration: If an application for the lump-sum death payment or any other Social Security benefit is denied, this form is used to request a review of the decision. It's a critical step in the appeals process if the applicant believes the decision was incorrect.

- SSA-795 Statement of Claimant or Other Person: This form is used to provide additional statements or claims that couldn't be included in the main application or other documents. It allows for the submission of extra information or clarification regarding the deceased's work history, income, or other relevant facts that could affect benefits.

- Death Certificate: An official death certificate is a crucial document required alongside Form SSA-8 to prove the death of the wage earner or self-employed person. It provides the SSA with verification of death, date, and place of death, which are necessary for processing any claims.

- Marriage Certificate: If the applicant is claiming benefits based on their status as a surviving spouse, a marriage certificate must be submitted to prove the legal marriage to the deceased. This document is vital in determining eligibility for spousal benefits.

Understanding and gathering the correct forms and documents is a vital step in applying for Social Security benefits after the loss of a loved one. These documents ensure that all required information is presented clearly, helping the Social Security Administration make accurate and timely decisions regarding benefits. Accurate documentation and careful attention to detail can greatly streamline the application process during a difficult time.

Similar forms

The Form SSA-5 Application for a Social Security Card is similar because it also collects personal information for benefits under the Social Security Act. Both forms require detailed personal identifiers and are integral to accessing benefits or services.

Form SSA-10 Application for Widow's or Widower's Insurance Benefits mirrors the SSA-8 in that it is used to claim benefits following the death of a spouse, focusing specifically on monthly survival benefits instead of a lump sum.

Form SSA-4 Application for Child's Insurance Benefits is similar to the SSA-8 form as it is used to apply for benefits on behalf of a child based on the earnings record of a deceased, disabled, or retired parent, illustrating the SSA’s role in providing support for dependents.

The Railroad Retirement Board's Application for Survivor Benefits has similarities in purpose as it involves applying for survivor benefits, akin to the SSA-8's role in the context of the Railroad Retirement Act for lump-sum death payments.

Form SSA-44 Medicare Income-Related Monthly Adjustment Amount - Life-Changing Event, although focused on Medicare, is similar because it involves reporting life changes that affect benefits, paralleling the life event reporting nature of the SSA-8 as it pertains to death.

The VA Form 21P-534EZ Application for DIC, Death Pension, and/or Accrued Benefits by a Surviving Spouse or Child mirrors SSA-8 by seeking benefits post the death of an individual, highlighting government assistance to survivors across different agencies.

Form SSA-1724 Claim for Amounts Due in the Case of a Deceased Beneficiary aligns with SSA-8 since both deal with posthumous claims involving Social Security benefits, focusing on recouping unpaid amounts to which the deceased was entitled at the time of death.

The Internal Revenue Service (IRS) Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer, is related by its focus on the financial affairs of deceased individuals, aiming to secure a refund owed, reflecting the financial settlement interests akin to SSA-8’s goal.

Form SSA-11 Request to be Selected as Payee is somewhat related through its focus on benefit payments, particularly in assigning an individual to receive Social Security benefits on behalf of another, illustrating the SSA’s broader mandate on benefit distribution.

The Department of Labor's OWCP-5c Work Capacity Evaluation Psychiatric/Psychological Conditions, while focused on work capacity and not death benefits, shares the SSA-8 form's aspect of evaluating circumstances that affect benefits, representing the broader governmental approach to managing individual welfare.

Dos and Don'ts

When dealing with the SSA-8 form, which is the Application for Lump-Sum Death Payment, it's important to approach it with care and attentiveness. This document serves as a request for insurance benefits under the Social Security Act, based on the earnings record of a deceased individual. Navigating this process can be complex, but focusing on what to do and what not to do can help streamline your application.

Things you should do:

Carefully read the entire form before starting to fill it out, ensuring understanding of each section. This preliminary step can save time and reduce the risk of errors.

Provide accurate information for every question, especially the deceased's Social Security Number, names, dates of birth, and dates of death. Accuracy is paramount to avoid delays or denial of benefits.

Attach supporting documents as required, such as a death certificate or proof of the deceased's earnings. These documents are crucial for verifying the information provided in the application.

Keep a copy of the completed form and all correspondence with the Social Security Administration (SSA). This record-keeping is essential for future reference or in case of any disputes.

Things you shouldn't do:

Do not leave any sections blank that are applicable to your situation. If a particular question does not apply, clearly mark it as "N/A" (Not Applicable) instead of leaving it empty.

Do not guess on dates or financial amounts. If uncertain, seek out the correct information before submitting the form. Estimates can lead to inaccuracies and potentially delay the processing of the application.

Avoid writing outside the provided spaces or attaching unsolicited documents. The SSA processes a vast number of forms; extraneous information can complicate and slow down this procedure.

Do not delay in submitting the application. The form must be filed within 2 years after the date of death of the wage earner or self-employed person. Failing to comply with this timeframe can result in the forfeiture of benefits.

Navigating the SSA-8 form process with diligence and attention to detail can significantly aid in the smooth processing of your application. Remember, the objective is to provide clear, concise, and correct information to expedite the decision on your eligibility for the lump-sum death payment.

Misconceptions

Understanding the Social Security Administration (SSA) Form SSA-8, the application for a lump-sum death payment, is crucial for many individuals navigating the aftermath of a loved one's passing. However, misconceptions about this application process are widespread. Addressing these misunderstandings can help applicants accurately complete their forms and set realistic expectations about their eligibility and the benefits process.

Misconception 1: The lump-sum death benefit is automatically paid to the deceased's estate. In reality, the SSA's lump-sum death payment is not automatically paid out. Eligible family members must apply for this benefit. The payment is designed to go to a surviving spouse living in the same household or, if none, to eligible children.

Misconception 2: Anyone related to the deceased can receive the lump-sum death payment. The lump-sum death payment is specifically intended for a surviving spouse or minor children who meet SSA's eligibility criteria, not for any relative of the deceased.

Misconception 3: The lump-sum is intended to cover all funeral expenses. The SSA's lump-sum death benefit is a one-time payment of $255, which may only contribute a small fraction towards funeral expenses, contrary to the belief that it's intended to cover all such costs.

Misconception 4: The application process is long and complicated. While dealing with government paperwork can be daunting, the SSA-8 form is straightforward, and the SSA offers guidance for completing it. Applicants are encouraged to seek assistance if they have questions.

Misconception 5: This payment can be claimed at any time after the person's death. There is a two-year window following the death of the individual for eligible family members to apply for the lump-sum death benefit, dispelling the notion that this claim can be made at any time.

Misconception 6: The lump-sum death benefit is only for those who were employed at the time of death. Eligibility for the lump-sum death benefit is not dependent on the deceased's employment status at the time of death but rather on their contribution to the Social Security system throughout their lifetime.

Misconception 7: Filing an SSA-8 form is sufficient for claiming all survivor benefits. While the SSA-8 form applies specifically to the lump-sum death payment, surviving family members may be eligible for other types of Social Security survivor benefits and must file separate applications for those.

Understanding the facts about the SSA-8 application can significantly influence the expectations and actions of those dealing with the loss of a loved one. It’s important for individuals to familiarize themselves with Social Security's rules and to engage with the SSA directly or seek authoritative guidance if there are uncertainties or complex situations. Armed with correct information, claimants can navigate the process more smoothly and ensure they receive any benefits for which they are eligible.

Key takeaways

Filling out and using the SSA-8 form, which applies for the lump-sum death payment, involves several critical steps and key points that applicants should be aware of to ensure that their application is correctly completed and submitted. Here are five key takeaways:

- Filing Deadline: It's crucial to remember that this application must be submitted within two years following the deceased's date of death. Failure to adhere to this deadline could result in forfeiting eligibility for the benefit.

- Eligibility Information: Applicants are applying for all insurance benefits for which they are eligible under Title II of the Social Security Act based on the deceased’s Social Security record. This might also be viewed as an application for benefits payable under the Railroad Retirement Act, making it imperative to understand all potential eligibility avenues.

- Required Information: Detailed information about the deceased, including their Social Security Number, date of birth, date and place of death, and employment history, is necessary. Information regarding the deceased's possible application for other Social Security benefits, military service, or railroad industry employment is also required.

- Information about Family Members: The form asks for information regarding the deceased's surviving spouse, previous marriages (if applicable), and surviving children or dependent grandchildren. Knowing the dynamics of the deceased’s family structure is vital when completing this form, as it could influence the distribution of benefits.

- Privacy and Accuracy: Applicants should be aware that the information they provide will be used to process the lump-sum death payment and could be shared for administrative purposes or in accordance with Federal laws. Additionally, signing the form declares that all provided information is accurate under penalty of perjury, highlighting the importance of submitting true and correct information.

Understanding these key points ensures a smoother application process for the lump-sum death payment and helps applicants navigate the steps required to apply for the benefits they or their family members may be entitled to receive.

Popular PDF Forms

Trailer Inspection Sheet Pdf - Ensures the safety and readiness of trailers for the road by checking vital components and systems.

Cn22 Form - Highlighting whether postal charges or fees have been prepaid or are due assists in financial processing and delivery expectations.