Blank Ssp PDF Template

Understanding the complexities of Statutory Sick Pay (SSP) is essential for both employers and employees navigating through periods of illness that result in time off work. Crucial to this understanding is the SSP form, a document that serves as an employee's statement of sickness, outlining the necessary information for SSP eligibility and claims. This form collects detailed personal information, including national insurance number and dates related to the onset and conclusion of the sickness, and in some cases, necessitates a medical statement or 'fit note' for illnesses surpassing seven days. Furthermore, it addresses the potential connection of the sickness to workplace incidents, which could open the avenue for Industrial Injuries Disablement Benefit claims. Besides serving as a submission to employers to evaluate SSP eligibility, the form advises on steps for individuals whose SSP claim might be disputed, including contacting HM Revenue & Customs for a decisive entitlement judgment within a six-month timeframe. Additionally, it points to alternative support and informational resources for those incapacitated by illness, underlining the form's role not just in SSP claims but as a guide through the broader spectrum of available aid and legal rights during sickness absence.

Preview - Ssp Form

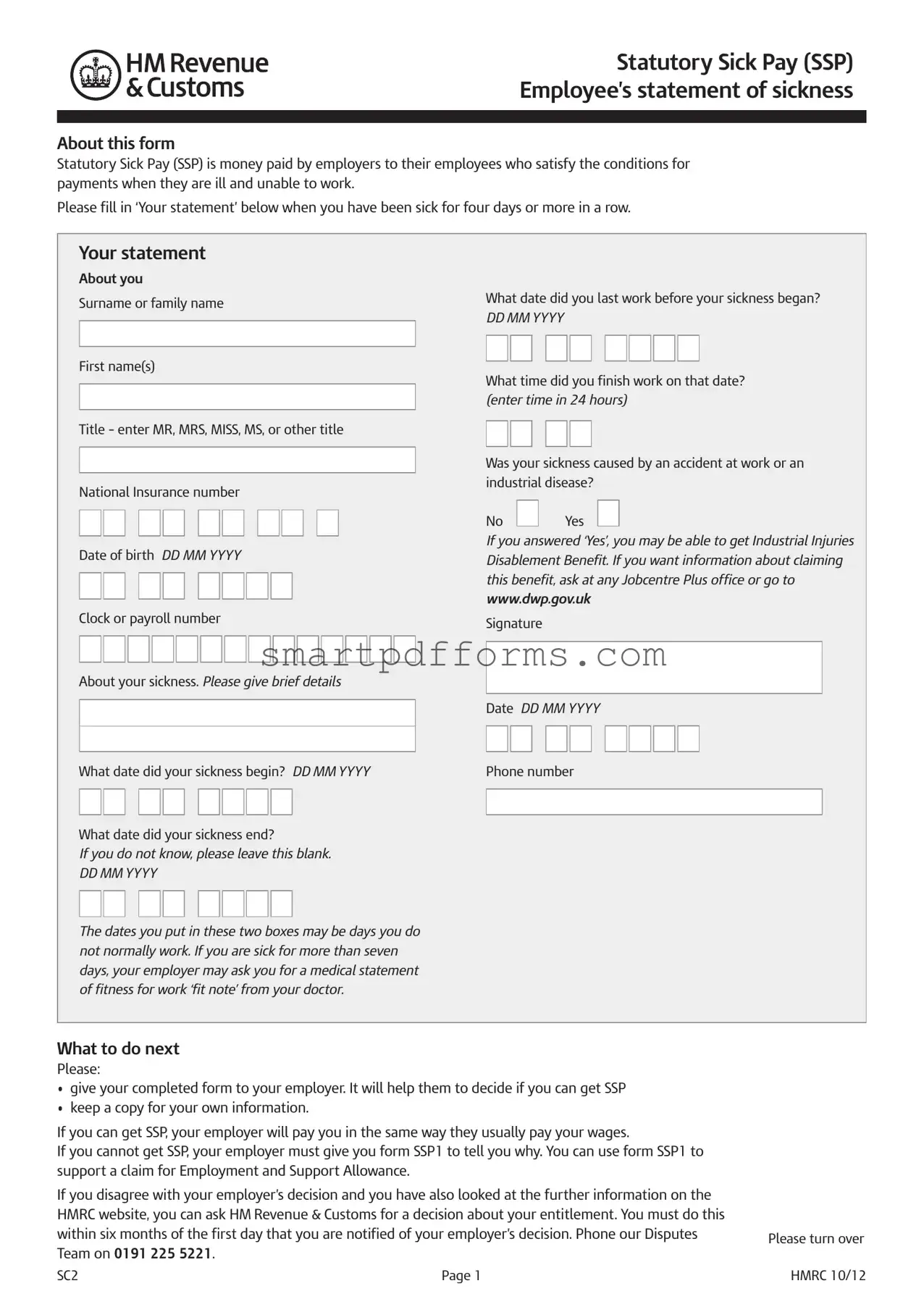

Statutory Sick Pay (SSP)

Employee’s statement of sickness

About this form

Statutory Sick Pay (SSP) is money paid by employers to their employees who satisfy the conditions for payments when they are ill and unable to work.

Please fill in ‘Your statement’ below when you have been sick for four days or more in a row.

Your statement

About you

Surname or family name

First name(s)

Title – enter MR, MRS, MISS, MS, or other title

National Insurance number

Date of birth DD MM YYYY

Clock or payroll number

About your sickness. Please give brief details

What date did your sickness begin? DD MM YYYY

What date did your sickness end?

If you do not know, please leave this blank.

DD MM YYYY

The dates you put in these two boxes may be days you do not normally work. If you are sick for more than seven days, your employer may ask you for a medical statement of fitness for work ‘fit note’ from your doctor.

What date did you last work before your sickness began?

DD MM YYYY

What time did you finish work on that date? (enter time in 24 hours)

Was your sickness caused by an accident at work or an industrial disease?

No |

|

Yes |

If you answered ‘Yes’, you may be able to get Industrial Injuries Disablement Benefit. If you want information about claiming this benefit, ask at any Jobcentre Plus office or go to www.dwp.gov.uk

Signature

Date DD MM YYYY

Phone number

What to do next

Please:

•give your completed form to your employer. It will help them to decide if you can get SSP

•keep a copy for your own information.

If you can get SSP, your employer will pay you in the same way they usually pay your wages.

If you cannot get SSP, your employer must give you form SSP1 to tell you why. You can use form SSP1 to support a claim for Employment and Support Allowance.

If you disagree with your employer’s decision and you have also looked at the further information on the HMRC website, you can ask HM Revenue & Customs for a decision about your entitlement. You must do this

within six months of the first day that you are notified of your employer’s decision. Phone our DisputesPlease turn over Team on 0191 225 5221.

SC2 |

Page 1 |

HMRC 10/12 |

Other help while you are sick

•You can get more information about other help while you are sick in leaflet DWP1026 Help if you’re ill or disabled.

You can get leaflet DWP1026 from:

–any Jobcentre Plus office

–most advice centres like the Citizens Advice Bureau, or

–any post office (except in Northern Ireland), or

–go to www.dwp.gov.uk

•If you do not have much money coming in while you are sick, you may be able to get a Social Security benefit. You should contact any Jobcentre Plus office or, go to www.dwp.gov.uk

You can also phone the Benefit Enquiry Line for people with disabilities. The phone call is free. The number is 0800 882 200 or in Northern Ireland 0800 220 674.

If you have any problems with hearing or speaking and use a textphone, phone 0800 243 355. The phone call is free.

If you do not have your own textphone system, they are available to use at the Citizens Advice Bureau and main libraries.

•If you want to know more about SSP go to www.gov.uk

Penalties

We may charge penalties where a person, either fraudulently or negligently, gives incorrect information or makes a false statement or declaration for the purpose of claiming entitlement to Statutory Sick Pay.

Page 2

Form Data

| Fact Name | Detail |

|---|---|

| Definition and Purpose | Statutory Sick Pay (SSP) is a financial benefit provided by employers to qualifying employees who are unable to work due to illness. |

| Eligibility Criteria | To be eligible for SSP, employees must have been ill for four or more consecutive days, including non-working days. |

| Application Requirement | Employees need to complete the SSP form when they've been sick for the required period, providing details about their sickness. |

| Medical Evidence | If the sickness lasts more than seven days, employers may request a 'fit note' from a doctor validating the employee's condition. |

| Additional Benefits Query | Employees whose illness is work-related may be eligible for Industrial Injuries Disablement Benefit and are advised to inquire at a Jobcentre Plus office or visit www.dwp.gov.uk. |

| Disputes and Further Action | If disagreements arise regarding SSP entitlement, employees can contact HM Revenue & Customs' Disputes Team within six months of the decision for a review. |

Instructions on Utilizing Ssp

Filling out the Statutory Sick Pay (SSP) Employee’s Statement of Sickness is a straightforward process that plays a crucial role when you're unwell and unable to work. This form helps your employer ascertain if you're eligible for SSP during your illness. Once completed, it's important to hand it over to your employer so they can proceed with the necessary steps to either grant you SSP or provide guidance on what to do if SSP isn't applicable. Keeping a copy for your records is recommended. Following are the steps to properly fill out the form:

- Begin with "About you" section:

- Enter your surname or family name.

- Fill in your first name(s).

- Select your title (MR, MRS, MISS, MS, or other) appropriately.

- Provide your National Insurance number.

- Write down your date of birth in the format DD MM YYYY.

- Include your clock or payroll number if known.

- For the "About your sickness" section:

- Input the date your sickness began, following DD MM YYYY format.

- State the date your sickness ended, if applicable. Leave blank if unknown.

- Fill in the date you last worked before your sickness started, again in DD MM YYYY format.

- Indicate the time you finished work on your last working day (use 24-hour format).

- Answer whether the sickness was caused by an accident at work or an industrial disease with a simple Yes or No. If "Yes," consider checking eligibility for Industrial Injuries Disablement Benefit.

- Sign the form and date it accordingly in the space provided. Do not forget to include your phone number.

Once finished, ensure your form reaches your employer promptly. Maintaining a copy for your records is also a wise move. If eligible for SSP, your employer will integrate this payment into your usual salary. Conversely, if SSP is not granted, you'll receive form SSP1 to understand why and explore alternatives like the Employment and Support Allowance. Should discrepancies arise regarding SSP eligibility, HM Revenue & Customs offers a resolution path through their Disputes Team within six months from the employer's decision. Remember, additional support and information regarding sickness benefits can be accessed through various provided resources.

Obtain Answers on Ssp

-

What is Statutory Sick Pay (SSP)?

Statutory Sick Pay (SSP) is a form of financial support that employers provide to employees who are unable to work due to sickness. If you're sick for four or more days in a row, you may be eligible for SSP. This includes days you might not normally work. SSP aims to help you financially during your time of illness until you're able to return to work.

-

How do I apply for SSP?

To apply for SSP, you need to fill out the "Your statement" section of the SSP form with details about your sickness. Include when your sickness started and ended, along with the last day you worked before getting sick. If your illness lasted more than seven days, your employer might ask for a 'fit note' from your doctor. Once completed, give the form to your employer who will determine if you can receive SSP.

-

What if I'm not eligible for SSP?

If you find out you're not eligible for SSP, your employer should give you a form called SSP1. This form explains why you can't get SSP and can also be used to apply for Employment and Support Allowance (ESA). If you disagree with your employer's decision on your SSP eligibility, you have six months from the day you're notified of their decision to ask HM Revenue & Customs to review your case.

-

Where can I find more information or help while I'm sick?

While you're sick, you might need additional support. For more information:

- Leaflet DWP1026 "Help if you’re ill or disabled" offers details on extra help you can get. This leaflet is available at Jobcentre Plus offices, most advice centres, and main post offices (except in Northern Ireland). You can also find it online.

- If you're facing financial difficulties while sick, you may qualify for Social Security benefits. Contact your local Jobcentre Plus office or check the government's website for guidance.

- For those with hearing or speech impairments, support is available through a free call to the Benefit Enquiry Line using a textphone.

Common mistakes

-

One common mistake involves the accuracy of personal information. Filling in details such as the national insurance number or date of birth incorrectly can lead to delays or even denial of SSP entitlement. Every character matters, and ensuring these details match official documents is crucial.

-

Failure to specify the exact dates of illness onset and end (where applicable) can create confusion. These dates are integral for determining eligibility and the duration for which SSP may be payable. Leaving these fields blank or entering approximate dates compromises the assessment process.

-

Another mistake relates to the reporting on the last work date before sickness. Providing accurate information, including the time work was finished using the 24-hour format, is essential. Misreporting this can affect the calculation of SSP.

-

Overlooking the question about whether the sickness was due to an accident at work or an industrial disease can be a pivotal error. Affirmative responses not only influence SSP claims but could also open avenues for additional benefits such as Industrial Injuries Disablement Benefit.

-

Omitting contact information, namely a phone number, hampers communication between the employee and the employer or HMRC. This can delay the resolution of any issues or queries that may arise during the processing of the SSP claim.

-

Neglecting to sign and date the form constitutes a formal error, potentially rendering the claim invalid. The signature authenticates the information provided, while the date helps track the submission within the required timelines.

-

Insufficient details about the sickness, including vague or overly brief descriptions, fail to provide a clear understanding of the illness or injury, which is necessary for the employer to process the claim appropriately.

-

Ignoring the instruction to keep a copy of the completed form for personal records is a mistake. This oversight can affect one’s ability to follow up on the claim or reference specific information in communications with the employer or HMRC.

-

Avoiding or delaying the process of contesting an employer’s decision when there is disagreement over SSP entitlement. Failing to contact HM Revenue & Customs within the six-month timeframe limits the possibility of rectifying any misunderstandings or errors and securing rightful benefits.

-

Remember to consult the DWP1026 leaflet for additional guidance if you're ill or disabled, as it contains valuable information that can supplement your SSP application effectively.

-

Seeking advice from a Jobcentre Plus office or the Citizens Advice Bureau can provide clarity and assistance in navigating the complexities of sickness benefits, including SSP.

-

Exploring other social security benefits during sickness, especially if financial hardships arise, is crucial. The Benefit Enquiry Line for people with disabilities offers a pathway to understanding and accessing available supports.

Documents used along the form

When dealing with Statutory Sick Pay (SSP), it's essential to understand the broader context and the additional forms or documents that might be necessary throughout the process. SSP is a form of financial support for employees who are unable to work due to illness, but its administration often requires more than just the submission of an SSP form. Here’s an outline of other forms and documents that frequently accompany the SSP form, each playing a vital role in the process.

- Fit Note (Medical Statement of Fitness for Work): This document is issued by a doctor after an employee has been sick for more than seven days. It provides evidence of the illness and whether the employee is unfit for work or might be able to do some work with specific adjustments.

- SSP1 Form: If an employee is not eligible for SSP, the employer must provide this form to explain why. It can also be used by the employee to support a claim for Employment and Support Allowance (ESA).

- ES40 Booklet/Form: For individuals looking to claim Jobseeker’s Allowance or Employment and Support Allowance alongside or after receiving SSP, this form is necessary to initiate the claim process.

- SC2 Form (Self-Certification Form): Employees use this form to self-certify illness for short-term absences of up to seven days, without needing a Fit Note.

- P45 Form: When an employee leaves a job, this form outlines their salary and the taxes that were paid. This is necessary for adjusting tax and benefit claims accordingly.

- PIP2 Form: For those whose illness might lead them to claim Personal Independence Payment (PIP) due to long-term health conditions or disabilities resulting from their sickness.

- UC1 Form (Universal Credit): If the employee needs to claim Universal Credit due to low income or unemployment following their sickness, this form will start their claim.

- DWP1026 Leaflet – Help if you’re ill or disabled: This leaflet provides comprehensive information on the additional support and benefits available to those who are ill or disabled.

Beyond the SSP form itself, these documents and forms interconnect to provide a safety net and support system for employees during their time of illness. Whether it's to certify sickness, claim other benefits, or understand entitlements, each plays a crucial role in ensuring employees are supported. Understanding how these documents relate to and complement each other can significantly smooth the process for both employees and employers alike.

Similar forms

Family and Medical Leave Act (FMLA) Certification: Similar to the SSP form, FMLA certification requires employees to provide details about their medical condition and the need for leave. Both documents are integral for employees seeking time off due to health-related issues.

Fit Note (Statement of Fitness for Work): Doctors issue fit notes to indicate an employee's fitness for work, resembling the SSP form's section where employees must indicate if a doctor's note has been obtained for sickness lasting over seven days. Both documents are used to communicate an employee’s health status to their employer.

Employment and Support Allowance (ESA) Claim Form: The ESA claim form and the SSP form both cater to individuals unable to work due to illness or disability, requiring personal and health-related information to process claims.

Personal Independence Payment (PIP) Claim Form: While serving different purposes, the PIP claim form and the SSP form share the need for detailed personal information and health conditions impacting the claimant's daily life and work ability.

Accident Report Forms: These forms are used in workplaces to report accidents that may result in injuries requiring time off, similar to the SSP form's section on sickness caused by workplace accidents.

Industrial Injuries Disablement Benefit Claim Form: Related to the SSP question about accidents at work, this form is for employees seeking compensation for injuries caused at work, requiring similar information about the injury and its impact on the employee’s ability to work.

Unemployment Benefit Application: While focusing on joblessness rather than sickness, this application shares similarities with the SSP form in that it requires personal details and circumstances surrounding the applicant's current situation.

Workers’ Compensation Claim Form: Like the SSP form, it’s used when an employee gets injured or sick because of their job. Both require information on the nature of the illness or injury and its impact on the employee’s work capacity.

Disability Insurance Claim Form: This form is used for claiming insurance benefits due to disability, requiring detailed medical information similar to what is required for the SSP, especially concerning the inability to work.

SSP1 Form: The SSP1 is directly related to the SSP form, given to employees when they're not eligible for SSP, detailing why and serving as a prerequisite for certain other benefits, thus closely linked through the process of claiming illness-related pay or support.

Dos and Don'ts

Filling out the Statutory Sick Pay (SSP) form is a crucial step for employees when they're unable to work due to sickness. Here's a guide to help you navigate the do's and don'ts during this process:

- Do thoroughly read through the entire form before you start filling it out. This ensures you understand what information is required.

- Do provide accurate personal details such as your surname, first name(s), title, National Insurance number, and date of birth. Accuracy in these details is crucial for processing your form.

- Do be specific about the dates of your sickness period, including the start and (if applicable) end dates. Remember, SSP is for those who've been sick for four days or more consecutively.

- Do give a clear but brief description of your sickness. While privacy is important, the information helps in assessing your SSP eligibility.

- Do indicate whether your sickness was related to an accident at work or an industrial disease, as this might make you eligible for other types of benefits.

- Do not guess your sickness dates or other details. If you're unsure of the exact dates, check your medical certificates or other relevant documents before filling this in.

- Do not leave sections blank unless the form specifically instructs you to do so if certain conditions don't apply to you, like the end date of your sickness if it's ongoing.

- Do not forget to sign and date the form. An unsigned form is considered incomplete and can delay the processing of your SSP.

- Do not submit the form without retaining a copy for your records. Having a copy can be incredibly helpful for future reference, especially if there are disputes or delays.

- Do not overlook the guidance about contacting HM Revenue & Customs or exploring additional help if your SSP is denied or if you're struggling financially due to sickness.

Remember, filling out the SSP form accurately and completely is key to ensuring a smooth process in claiming your statutory sick pay. Taking the time to double-check details and follow these guidelines will help avoid delays or issues in receiving your entitlements.

Misconceptions

Understanding the Statutory Sick Pay (SSP) process is crucial for both employees and employers. However, there are several misconceptions that can lead to confusion and incorrect handling of SSP claims. Here are eight common misconceptions explained:

SSP is optional for employers to offer. This is incorrect; if an employee meets the eligibility criteria, SSP is a statutory obligation for employers to provide.

You need to be off work for two weeks before you can claim SSP. Actually, employees need to be ill for at least four days in a row (including non-working days) to be eligible for SSP.

SSP can only be claimed once a year. This is not true; employees can claim SSP multiple times a year, as long as they meet the eligibility requirements each time.

Employees must present a doctor’s note from day one of sickness. In fact, employees are only required to provide a medical note if they are off work for more than seven days.

Part-time workers aren't eligible for SSP. Part-time workers can be eligible for SSP, assuming they meet the other eligibility criteria, just like full-time employees do.

SSP amount is the same for all employees. The amount of SSP paid is based on the employee's average weekly earnings, subject to a minimum threshold, not a one-size-fits-all payment.

If an illness is caused by work, SSP isn’t available. On the contrary, employees might still be eligible for SSP, regardless of where or how the illness or injury occurred. They may also qualify for Industrial Injuries Disablement Benefit depending on the situation.

An employee’s claim for SSP has no deadline. It is important to note that disputes regarding SSP entitlement must be raised with HM Revenue & Customs within six months from the first day the employer’s decision was notified.

Eliminating these misconceptions ensures that both employers and employees handle SSP claims correctly, leading to smoother processes and rightful entitlements being upheld.

Key takeaways

Understanding the Statutory Sick Pay (SSP) form is crucial for both employees and employers to ensure sick pay is handled correctly. Here are key takeaways to remember when dealing with the SSP form:

- Eligibility timeframe: Fill in the "Your statement" section if you've been sick for four days in a row or more. This includes days you wouldn't normally work.

- Info accuracy is key: Providing accurate information on your sickness, including the start and end dates, helps avoid delays or issues with SSP payments.

- Documentation for longer illnesses: If your sickness extends beyond seven days, your employer will likely ask for a 'fit note' from your doctor. This is a medical statement of fitness for work.

- Report workplace-related sickness: Indicate if your sickness is due to a workplace accident or industrial disease, as you may qualify for Industrial Injuries Disablement Benefit.

- What to do after filling out the form: Once completed, give the form to your employer and keep a copy for your records. Your employer will use this to determine your SSP eligibility.

- Understanding payment and disputes: If eligible, you'll receive SSP in the same way you get your salary. If denied, an SSP1 form will be provided, and you can dispute the decision with HM Revenue & Customs within six months.

- Seeking additional help: For more information on SSP or if you're facing financial difficulties during your sickness, various resources are provided, including the Benefit Enquiry Line for people with disabilities and advice from the Citizens Advice Bureau.

Remember, falsifying information on this form can lead to penalties, so it's important to fill it out with care and honesty. This ensures a smoother process for receiving the support you need during your time of illness.

Popular PDF Forms

How Do I Get My Money From Transamerica - Section B clarifies the reason for the distribution request, with multiple options to specify the cause of withdrawal.

Foreign Person's U.S. Source Income Subject to Withholding - The IRS 1042-S form is used to report income paid to a foreign person that is subject to income tax withholding in the United States.

How Is Child Support Calculated New Jersey - Suitable for those whose case docket number begins with "FD" and involves non-dissolution matters.