Blank St 108 PDF Template

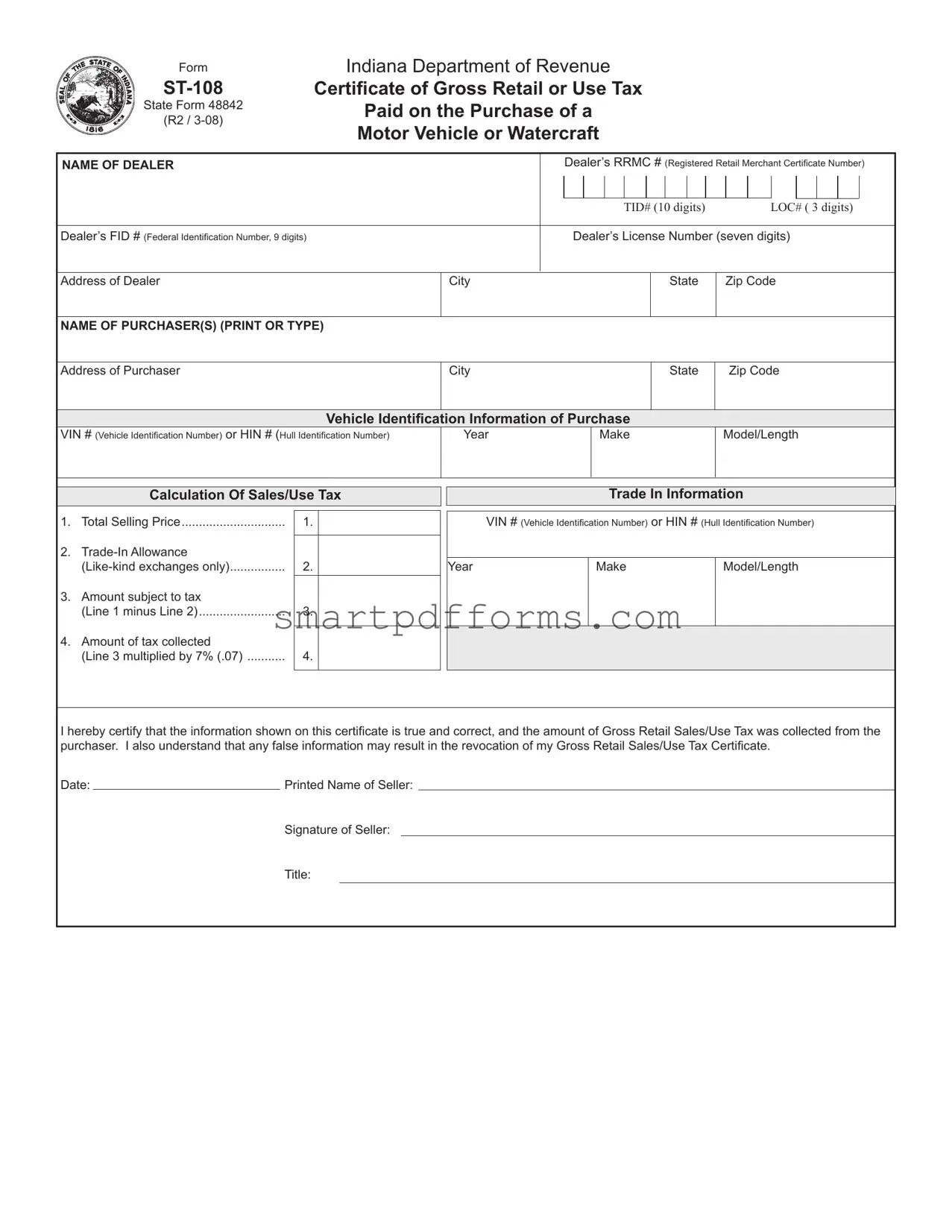

When purchasing a motor vehicle or watercraft in Indiana, the exchange is not merely about making a payment and receiving the keys. There's a critical step involving the Form ST-108, the Certificate of Gross Retail or Use Tax Paid on the Purchase of a Motor Vehicle or Watercraft, that ensures the transaction adheres to the state’s tax laws. This document, vital for both buyers and sellers, captures the essence of the transaction, including the vehicle or watercraft identification, the sale price, and details about trade-ins, if any. Sellers are mandated to fill out this form with accurate details such as the dealership’s name, Registered Retail Merchant Certificate Number, Federal Identification Number, and the total sales and use tax collected, based on the selling price minus any trade-in allowance. It's this form that substantiates the tax has been duly collected at the point of sale, a prerequisite for the purchaser to title and register their new acquisition without untimely hurdles at the Bureau of Motor Vehicles. For transactions exempt from sales tax, completing Form ST-108E is necessary to declare such exemptions. Therefore, a thorough understanding and accurate completion of Form ST-108 play a crucial role in the seamless transfer of ownership while complying with Indiana’s tax statutes.

Preview - St 108 Form

Form

State Form 48842

(R2 /

Indiana Department of Revenue

Certificate of Gross Retail or Use Tax

Paid on the Purchase of a

Motor Vehicle or Watercraft

NAME OF DEALER |

|

|

Dealer’s RRMC # (Registered Retail Merchant Certificate Number) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TID# (10 digits) |

|

|

LOC# ( 3 digits) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Dealer’s FID # (Federal Identification Number, 9 digits) |

|

|

Dealer’s License Number (seven digits) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of Dealer |

City |

|

|

|

|

|

|

|

State |

|

Zip Code |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Purchaser(s) (pRINT OR tYPE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of Purchaser |

City |

|

|

|

|

|

|

|

State |

|

Zip Code |

||||||||

Vehicle Identification Information of Purchase

VIN # (Vehicle Identification Number) or HIN # (Hull Identification Number) |

Year |

Make |

Model/Length |

|

|

|

|

Calculation Of Sales/Use Tax

1. |

Total Selling Price |

1. |

|

2. |

|

|

|

|

2. |

|

|

3. |

Amount subject to tax |

|

|

|

(Line 1 minus Line 2) |

3. |

|

4. |

Amount of tax collected |

|

|

|

|

||

|

(Line 3 multiplied by 7% (.07) |

4. |

|

|

|

|

|

Trade In Information

VIN # (Vehicle Identification Number) or HIN # (Hull Identification Number)

Year |

Make |

Model/Length |

|

|

|

|

|

|

I hereby certify that the information shown on this certificate is true and correct, and the amount of Gross Retail Sales/Use Tax was collected from the purchaser. I also understand that any false information may result in the revocation of my Gross Retail Sales/Use Tax Certificate.

Date: |

|

Printed Name of Seller: |

|

|

|

Signature of Seller: |

|

|

|

Title: |

|

Instructions for completing Form

or Use Tax on the Purchase of a Motor Vehicle or Watercraft.

INDIANA CODE

The

If an exemption from the tax is claimed, the purchaser and the dealer must complete Form

Seller Information

NAME OF DEALER: Indicate the name of the dealer as it appears on the Registered Retail Merchant Certificate (RRMC).

FID # (Federal Identification Number): Indicate the Federal Identification Number of the dealer, if applicable.

Dealer’s License #: Indicate the Dealer’s License Number(seven digits) as it appears on the Dealer’s License Certificate.

RRMC # (same as TID # - 10 Digits + LOC # - 3 Digits): Indicate the Indiana Taxpayer Identification Number and Location Number as it appears on the Registered Retail Merchant Certificate. This number must be in the following format:

Address of Dealer: Indicate the address of the dealer as it appears on the Registered Retail Merchant Certifi- cate.

Vehicle Identification Information

VIN or HIN ID #: Enter the Vehicle ID # (VIN) or the Hull ID # (HIN).

YEAR: Indicate the year the motor vehicle or watercraft was manufactured.

MODEL # OR WATERCRAFT LENGTH: If a motor vehicle is being sold indicate the model name for the vehicle. If a watercraft is being sold indicate the length of the craft.

Calculation of Sales/Use Tax

TOTAL SELLING PRICE: When determining the total selling price include all delivery, make ready, repair, or other costs incurred prior to transfer to the buyer. Federal excise tax is NOT included.

You must also indicate the make, model, year, and ID # of the

AMOUNT SUBJECT TO TAX: Line 1 minus Line 2 results in the amount on which the sales/use tax will be calcu- lated.

AMOUNT OF TAX COLLECTED: Line 3 multiplied by 7% or .07 equals the amount to be collected by the seller.

Signature Section: The Seller must sign the

Form Data

| Fact Name | Fact Detail |

|---|---|

| Form Number and Revision Date | ST-108, State Form 48842 (R2 / 3-08) |

| Issuing Body | Indiana Department of Revenue |

| Primary Purpose | Certificate of Gross Retail or Use Tax Paid on the Purchase of a Motor Vehicle or Watercraft |

| Governing Law | INDIANA CODE 6-2.5-9-6 |

| Seller Information Requirements | Name, RRMC #, TID#, LOC#, FID#, License Number, and Address of Dealer |

| Purchaser Information Requirements | Name and Address of Purchaser(s) |

| Vehicle/Watercraft Identification Information | VIN or HIN, Year, Make, and Model/Length |

| Calculation of Sales/Use Tax | Involves Total Selling Price, Trade-In Allowance, and Amount Subject to Tax to determine Tax Collected |

| Signature Requirement | Seller's certification and understanding that false information may revoke their Gross Retail Sales/Use Tax Certificate |

Instructions on Utilizing St 108

Filling out Form ST-108 is crucial for documenting that the appropriate sales or use tax was collected during the sale of a motor vehicle or watercraft in Indiana. This documentation is essential for the purchaser when titling the vehicle or watercraft at a Bureau of Motor Vehicles license branch. Below are the steps required to properly fill out the form, ensuring all needed information is accurately recorded and the process at the BMV goes smoothly.

- Dealer Information:

- Enter the dealer's name as it appears on their Registered Retail Merchant Certificate (RRMC).

- Fill in the dealer’s Federal Identification Number (FID #), which should have 9 digits.

- Write down the Dealer’s License Number. This number has seven digits.

- Record the RRMC #, which is the Indiana Taxpayer Identification Number. It should be formatted as 10 digits followed by a hyphen and then 3 location digits (e.g., 0001234567-001). If not in this format, the form will be rejected.

- Provide the full address of the dealer, including city, state, and zip code as listed on their Merchant Certificate.

- Purchaser Information:

- Write the name(s) of the purchaser(s). Ensure it's printed or typed clearly.

- Include the address of the purchaser, along with the city, state, and zip code.

- Vehicle or Watercraft Identification:

- Enter the Vehicle Identification Number (VIN) or Hull Identification Number (HIN).

- Specify the year of manufacture.

- For motor vehicles, include the make and model. For watercraft, include the make and length.

- Calculation of Sales/Use Tax:

- Input the total selling price, including any delivery, preparation, or repair costs before transferring to the buyer. Do not include federal excise tax.

- Specify the trade-in allowance, if applicable, only for like-kind exchanges. Also, provide the make, model, year, and ID# of the trade-in.

- Calculate the amount subject to tax (total selling price minus trade-in allowance).

- Compute the amount of tax collected (amount subject to tax multiplied by 7% or .07).

- Signature Section:

- Certify the form by having the seller sign, providing their printed name, and indicating their title.

- Note the date of the certification to complete the documentation process.

Once the ST-108 Form is completed with the necessary information and properly signed, it serves as proof the state sales or use tax has been collected. This form should be retained with the vehicle or watercraft's documentation and presented at the BMV during the titling process. If claiming an exemption from the tax, the purchaser and dealer must complete Form ST-108E, demonstrating the exemption eligibility, which must then be submitted to the license branch.

Obtain Answers on St 108

What is Form ST-108 used for?

Form ST-108, officially titled the Certificate of Gross Retail or Use Tax Paid on the Purchase of a Motor Vehicle or Watercraft, serves a critical function in the state of Indiana. This document is required when titling a vehicle or watercraft, as it certifies that the state gross sales and use tax has been paid on the purchase. The Indiana Department of Revenue mandates the presentation of this certification at a Bureau of Motor Vehicles license branch to avoid direct tax payment by the purchaser at the time of licensing. Moreover, the form enables dealers to document the tax collected from the purchaser, which they then report to the Department of Revenue through a sales and use tax report.

How is the sales/use tax on a vehicle or watercraft calculated and reported on Form ST-108?

To accurately calculate the sales/use tax on a motor vehicle or watercraft using Form ST-108, the process involves several steps. Initially, one must determine the total selling price, which includes all pre-transfer costs to the buyer such as delivery, preparation, repairs, and other related charges, excluding federal excise tax. If a trade-in of like-kind (another vehicle or watercraft) is part of the transaction, its value is subtracted from the total selling price. The resultant figure is the amount subject to tax. This subtotal is then multiplied by the state tax rate of 7% to find the total amount of tax collected. This calculated tax must be accurately reported in the designated section of the ST-108 form by the seller.

What should I do if an exemption from the sales/use tax is claimed?

When an exemption from sales/use tax is claimed on the purchase of a motor vehicle or watercraft, both the purchaser and the dealer are required to complete Form ST-108E. This specific form must then be submitted to the Bureau of Motor Vehicles license branch at the time of licensing. Form ST-108E acts as an affidavit of exemption by the purchaser, outlining the qualifications and descriptions of available exemptions. It's important for purchasers to understand the specific exemptions they qualify for and ensure all necessary documentation is accurately completed and submitted.

What happens if Form ST-108 includes incorrect information or is incomplete?

The Indiana Bureau of Motor Vehicles (BMV) stringently reviews Form ST-108 for accuracy and completeness. Should the form contain incorrect information or lack essential details — for example, an improperly formatted Registered Retail Merchant Certificate (RRMC) number or an absence of the dealer's signature — it will be rejected by the BMV. Consequently, the purchaser will be required to revisit the dealer to procure a correctly completed form. It is of paramount importance for both dealers and purchasers to ensure that all information provided on Form ST-108 is true, correct, and complete to avoid delays in vehicle or watercraft titling and potential legal complications.

Common mistakes

Filling out the ST-108 form, which is essential when purchasing a motor vehicle or watercraft in Indiana, requires attention to detail. Avoid common mistakes to ensure the process is smooth and accurate. Here are seven errors buyers and sellers frequently make on this form:

-

Incorrect Dealer Information: Not providing the dealer’s Registered Retail Merchant Certificate Number (RRMC #), which must include both the 10-digit Taxpayer Identification Number (TID#) and the 3-digit Location Number (LOC#) in the correct format. A mistake here can lead to the form’s rejection.

-

Leaving Vehicle Identification Info Blank: Failing to enter either the Vehicle Identification Number (VIN) for a motor vehicle or the Hull Identification Number (HIN) for a watercraft. This information is crucial for identifying the purchased vehicle or vessel.

-

Omitting Trade-In Details: Overlooking the inclusion of trade-in information, including the make, model, year, and ID number of the traded vehicle or watercraft. Remember, trade-in allowances can only reduce taxable selling price for like-kind exchanges.

-

Inaccurate Total Selling Price: Not accurately reporting the total selling price of the vehicle or watercraft, which should include all costs incurred prior to transfer to the buyer, excluding the federal excise tax.

-

Incorrect Tax Calculation: Errors in calculating the amount of sales/use tax collected. This figure should be precise, reflecting 7% of the amount subject to tax, as inaccuracies can affect the legality of the tax document.

-

Failure to Sign: The seller's failure to sign the form, certifying that the correct amount of Gross Retail Sales/Use Tax was collected. An unsigned form will be rejected, causing delays for the purchaser.

-

Misunderstanding Exemptions: Not correctly understanding or claiming exemptions. If the sale is exempt from tax, Form ST-108E must be completed and submitted. It's essential to fill this out accurately to avoid any issues with tax exemptions.

Understanding and avoiding these common errors can help ensure the ST-108 form is correctly filled out and processed without delay, facilitating a smoother vehicle or watercraft purchase process in Indiana.

Documents used along the form

When purchasing a motor vehicle or watercraft, the Form ST-108 is a crucial document for certifying the payment of Gross Retail or Use Tax to the Indiana Department of Revenue. However, several other forms and documents often accompany the ST-108 during vehicle transactions, ensuring compliance with Indiana's legal and tax requirements. Understanding these documents can streamline the buying process and ensure all legal obligations are met efficiently.

- Form ST-108E: This form serves as an affidavit of exemption for the purchaser, declaring specific tax exemptions on the purchase of a motor vehicle or watercraft under certain qualifications.

- Title Application: A formal application to obtain a legal title for the newly purchased vehicle or watercraft, signifying ownership.

- Bill of Sale: Provides detailed information about the transaction, including the sale price, vehicle description, and information about the buyer and seller.

- Odometer Disclosure Statement: Required by federal law for vehicles under ten years old, this form discloses the mileage at the time of sale and helps prevent odometer fraud.

- Loan Agreement: If the vehicle is financed, a loan agreement outlines the terms of the loan, including interest rate, payment schedule, and duration.

- Insurance Proof: Proof of valid insurance coverage is typically required at the time of sale, especially for registration and titling purposes.

- Registration Application: An application to register the vehicle or watercraft with the state, which is necessary for legal operation on public roads or waterways.

- Power of Attorney (POA): If someone is signing documents on behalf of the purchaser or seller, a POA may be required to authorize these actions legally.

- Inspection Documents: Certain vehicles may require an inspection for emissions or safety before registration, depending on state laws.

- Trade-In Documentation: If a vehicle or watercraft is traded in as part of the purchase agreement, detailed information about the trade-in must be documented for tax calculation purposes.

Each of these documents plays a vital role in the legal, tax, and regulatory aspects of purchasing a motor vehicle or watercraft. Buyers and sellers should ensure they thoroughly understand and correctly complete all applicable forms and documentation to avoid delays or legal complications. Compliance with these requirements not only facilitates a smoother transaction but also helps maintain accurate records for future reference and legal compliance.

Similar forms

The Form W-9 (Request for Taxpayer Identification Number and Certification) is similar to the ST-108 in that it requires the disclosure of taxpayer identification numbers (such as an individual's social security number or a business's employer identification number). Both forms are used to ensure compliance with tax laws, though the W-9 is primarily used to provide information to entities that will pay you money, helping them report payments to the IRS accurately.

The Form 1040 (U.S. Individual Income Tax Return) shares similarities with the ST-108 by requiring detailed financial information for tax purposes. Both forms involve the calculation and reporting of taxes owed to or refunds due from the government, with the 1040 focusing on individual income tax and the ST-108 focusing on sales/use tax on certain purchases.

The Form 8300 (Report of Cash Payments Over $10,000 Received in a Trade or Business) is similar to the ST-108 in its purpose of reporting specific financial transactions to the government. While the ST-108 reports sales/use tax collected from the purchaser for a vehicle or watercraft, Form 8300 reports cash payments over $10,000 to help prevent money laundering.

Form 1099-MISC (Miscellaneous Income) parallels the ST-108 because it's involved in the reporting of financial transactions, specifically miscellaneous income paid during the business or trade. Similar to ST-108's role in reporting and calculating sales/use tax, the 1099-MISC ensures the IRS is informed about various types of income beyond wages, such as rental income or prize money.

The Form 2290 (Heavy Highway Vehicle Use Tax Return) is similar to the ST-108 in that both involve the reporting and payment of taxes related to vehicles, albeit for different purposes. The ST-108 focuses on sales/use tax for motor vehicles or watercraft purchases, whereas the 2290 is concerned with the annual federal tax on heavy highway vehicles operating on public highways at registered gross weights equal to or exceeding 55,000 pounds.

Dos and Don'ts

When preparing to fill out the Form ST-108, it's crucial to understand the right steps to take and the missteps to avoid. This form is vital for recording the certificate of gross retail or use tax paid on the purchase of a motor vehicle or watercraft in Indiana. To assist with this obligation, below is a list of dos and don'ts:

Do:- Verify the dealer's information: Make sure to fill in the dealer’s name exactly as it appears on the Registered Retail Merchant Certificate (RRMC), including the Federal Identification Number (FID #), the dealer’s license number, RRMC #, and address.

- Accurately enter vehicle or watercraft identification info: The Vehicle Identification Number (VIN) or Hull Identification Number (HIN), year, make, and model or length must be accurately recorded to avoid any discrepancies.

- Include all applicable costs in the total selling price: The total selling price should encompass all delivery, make-ready, repair, or other costs incurred before the transfer to the buyer, excluding federal excise tax.

- Calculate the sales/use tax properly: Ensure the calculation of the amount subject to tax is correct by subtracting any trade-in allowance and applying the correct tax rate.

- Sign the form: The seller’s signature is mandatory to verify that the information on the form is true and correct and that the sales/use tax has been collected from the purchaser.

- Overlook the trade-in allowance: Don’t forget to deduct the trade-in allowance for like-kind exchanges. Remember to document the details of the traded vehicle or watercraft.

- Ignore tax exemptions: If the purchase qualifies for an exemption, do not fill out Form ST-108 without also completing Form ST-108E to claim the exemption.

- Submit incomplete or inaccurate forms: An incomplete or inaccurately filled form will be rejected by the license branch, requiring the purchaser to return to the seller for corrections. Ensure all information is complete and accurate before submission.

- Forget to submit the form: Failing to submit the ST-108 form to the Department of Revenue with the sales/use tax return can lead to complications. Always ensure timely submission following the collection of tax.

By following these guidelines, individuals and dealers can ensure they meet Indiana’s legal requirements, facilitating a smoother transaction process for both the seller and the purchaser.

Misconceptions

Understanding the Form ST-108 and clarifying common misconceptions can ensure smoother transactions when purchasing motor vehicles or watercraft in Indiana. Misunderstandings can lead to unexpected issues or delays. Let's address some of the most common misconceptions:

Only for Cars and Boats: Some people might think the Form ST-108 is used exclusively for cars and boats. However, it's crucial to note that it applies to both motor vehicle and watercraft purchases, including motorcycles, RVs, and other types of watercraft, not just traditional cars and boats.

Trade-In Allowance Applies to All Trade-Ins: A common misconception involves the trade-in allowance. People often assume any traded item will reduce the taxable selling price. In reality, only like-kind vehicles or watercraft qualify for this exemption. Therefore, trading a boat for a car is acceptable, but non-like-kind trade-ins won't affect the form's calculation.

Only the Dealer's Information Is Needed: While dealer information is crucial on the form, many overlook the importance of accurate purchaser information. The form requires detailed information from both the dealer and the purchaser, including names and addresses, to ensure proper processing and tax compliance.

No Need for Seller Signature If Taxes Are Paid: Regardless of whether the taxes are collected at the time of sale, the seller's signature is mandatory on the Form ST-108. This certifies that the correct amount of Gross Retail Sales/Use Tax has been collected and the information presented is accurate. Failure to sign the document can lead to its rejection by the license branch, necessitating further action from the purchaser.

The Form Exempts You From Future Taxes: Completing and submitting the Form ST-108 correctly means that the state gross sales and use tax was paid at the time of the vehicle or watercraft's purchase. However, some may mistakenly believe that this exempts them from any future taxes related to the vehicle or watercraft, such as property tax or registration fees, which is not the case.

Addressing these common misconceptions and ensuring all required information is correctly provided on the Form ST-108 can help streamline the process of purchasing and titling a vehicle or watercraft in Indiana. It exemplifies the significance of thorough understanding and attention to detail in legal and tax-related matters.

Key takeaways

Understanding the ST-108 form is crucial when purchasing a motor vehicle or watercraft in Indiana, as it serves as evidence that the state gross retail or use tax has been paid. This document is significant for both the seller and the buyer for several reasons. Here are key takeaways about filling out and using the ST-108 form:

- Accurate Dealer Information: It's imperative to ensure that all dealer-related information is correctly entered on the form. This includes the dealer's name, as it appears on the Registered Retail Merchant Certificate (RRMC), the Federal Identification Number (FID #), and the exact format of the Indiana Taxpayer Identification Number (TID #) along with the Location Number (LOC #). Incorrect or incomplete information can lead to the rejection of the form at the license branch, necessitating a resubmission and causing delays.

- Vehicle or Watercraft Identification: Complete accuracy is also required when filling out the vehicle or watercraft identification section. This part demands the Vehicle Identification Number (VIN) or Hull Identification Number (HIN), the year of manufacture, and the model or length of the watercraft. Accurate identification helps in preventing potential issues during the titling process.

- Calculation of Sales/Use Tax: The form meticulously guides sellers on how to calculate the sales/use tax, starting from the total selling price, accounting for any trade-in allowances (where applicable for like-kind exchanges only), and finally determining the amount subject to tax. This calculation is vital as it directly affects the amount of tax collected and subsequently forwarded to the Department of Revenue.

- Signature and Certification: The completion and signing of the ST-108 by the seller are not just procedural formalities; they are legal affirmations confirming the collection of the correct amount of sales/use tax from the purchaser. Failing to sign the ST-108 can invalidate the document, forcing the buyer to return for a valid signature. Hence, ensuring that this section is duly completed and signed off is critical for the smooth transfer of vehicles or watercrafts to the new owner.

Lastly, for those claiming an exemption from the tax, completing the ST-108E form and submitting it at the time of licensing is necessary. This action serves as an affidavit of exemption, outlining the exemptions for which the purchaser qualifies. Whether you are a dealer or a purchaser, understanding and correctly completing the ST-108 form is a fundamental step in the transaction process for motor vehicles or watercrafts in Indiana.

Popular PDF Forms

How Do I Get Tsa Precheck Status - Forms 2811 and 2812 represent an important step in the rigorous selection process for roles that ensure transportation security.

Certificate of Membership Template - A foundational document for LLCs, showing the link between member investments and their share of ownership.