Blank St 119 1 Exempt PDF Template

Navigating the complexities of tax exemption can often seem daunting for educational institutions seeking relief from sales and use taxes on necessary purchases. The New York Exempt Purchase Certificate, more formally known as Form ST-119.1, plays a critical role in this process for entities like Indiana University, which is organized exclusively for educational purposes. According to New York's Section 1116(a)(4), organizations like Indiana University are entitled to exemption from sales and use tax for purchases directly related to the institution's educational mission. This exemption encompasses tangible personal property or taxable services that are directly invoiced and paid for by the University, ensuring that benefits are strictly confined to institutional advantage and not for personal gain of officers, members, or employees. Notably, there are restrictions, such as the non-applicability of the exemption to motor fuel or diesel motor fuel purchases. Moreover, the exemption claim process is streamlined through the option of using a blanket certificate, which covers all exempt transactions with a vendor for a three-year period, thereby obviating the need for repeated documentation for each transaction. The form itself requires careful completion, including the provision of the seller's and institution's details, with the signature of a designated officer of the University, emphasizing the importance of adherance to procedural accuracy to utilize the tax benefits effectively.

Preview - St 119 1 Exempt Form

NEW YORK EXEMPT PURCHASE CERTIFICATE (FORM ST 119.1)

***For internal Indiana University use only***

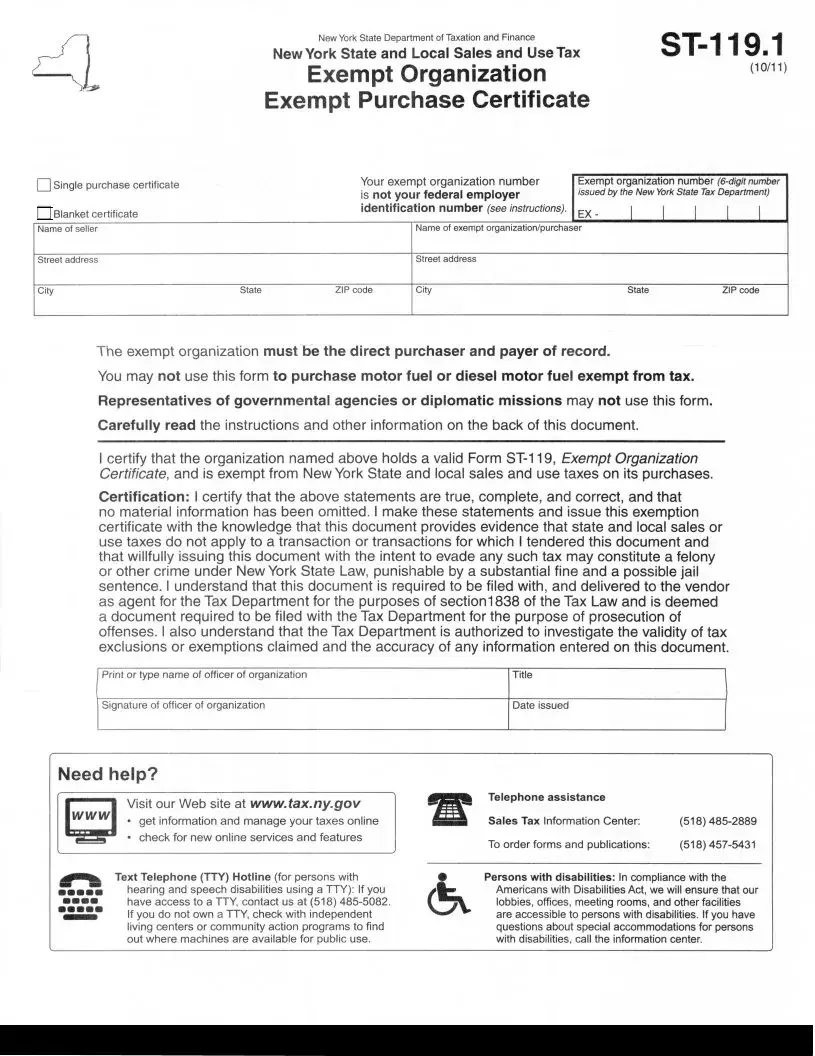

NOTE: According to New York, Section 1116(a)(4), Indiana University is exempt from sales and use tax because it is organized exclusively for educational purposes. The University must issue the attached certificate to vendors when purchasing tangible personal property or taxable services to qualify for the exemption. A vendor may accept Form ST 119.1 from Indiana University at the time of sale, or within 90 days of accepting delivery of the property or the rendering of services.

•Indiana University must be the direct purchaser and payer of record. Purchases must be made in the following manner:

O Are directly invoiced and charged to Indiana University, and O Are directly paid by Indiana University via

check,

credit card

•All purchases made using Form ST 119.1 must benefit the University only. The form may not be used for the benefit of any officer, member, or employee of Indiana University.

•The exemption does not apply to purchases of motor fuel or diesel motor fuel.

•It is not necessary to give the seller a new certificate every time a purchase is made. A blanket exemption claim covers all exempt transfers between the University and the vendor for a three year period from the date of purchase.

INSTRUCTIONS: Fill out all sections highlighted in blue including:

•Seller’s Name and Address

•The exemption certificate must have the original signature of a responsible officer. Indiana University has designated Associate Vice President & Director of Procurement Services, Jill Schunk, as the signatory. Please

New York State Department of Taxation and Finance |

|

New York State and Local Sales and Use Tax |

Exempt Organization |

(10/11) |

|

|

Exempt Purchase Certificate |

|

0 Single purchase certificate

0

Blanket certificate Name of seller

Blanket certificate Name of seller

Street address

Your exempt organization number |

Exempt organization number |

|||||

is not your federal employer |

issued by the New York State Tax Department) |

|||||

|

|

|

|

|

|

|

identification number (see instructions). |

EX- |

I |

I |

I |

I |

I |

|

||||||

Name of exempt organization/purchaser

Street address

City |

State |

ZIP code |

City |

State |

ZIP code |

T he exempt organization must be the direct purchaser and payer of record.

You may not use this form to purchase motor fuel or diesel motor fuel exempt from tax.

Representatives of governmental agencies or diplomatic missions may not use this form.

Carefully read the instructions and other information on the back of this document.

I certify that the organization named above holds a valid Form

Certification: I certify that the above statements are true, complete, and correct, and that no material information has been omitted . I make these statements and issue this exemption certificate with the knowledge that this document provides evidence that state and local sales or use taxes do not apply to a transaction or transactions for which I tendered this document and that willfully issuing this document with the intent to evade any such tax may constitute a felony or other crime under New York State Law, punishable by a substantial fine and a possible jail sentence. I understand that this document is required to be filed with , and delivered to the vendor as agent for the Tax Department for the purposes of section1838 of the Tax Law and is deemed a document required to be filed with the Tax Department for the purpose of prosecution of offenses. I also understand that the Tax Department is authorized to investigate the validity of tax exclusions or exemptions claimed and the accuracy of any information entered on this document.

Print or type name of officer of organization |

Title |

Signature of officer of organization |

Date issued |

Need help?

1;1 Visit our Web site at www.tax.ny.gov

• get information and manage your taxes online

• check for new online services and features

|

Text Telephone (TTY) Hotline (for persons with |

セ@ |

|

••••• |

hearing and speech disabilities using a TTY): If you |

•••• |

have access to a TTY, contact us at (518) |

••••• |

If you do not own a TTY, check with independent |

- |

living centers or community action programs to find |

out where machines are available for public use . |

|

• |

Telephone assistance |

|

|

|

Sales Tax Information |

Center: |

(518) |

||

To order forms and |

publications: |

(518) |

•Persons with disabilities: In compliance with the セ@Americans with Disabilities Act, we will ensure that our

lobbies, offices, meeting rooms, and other facilities are accessible to persons with disabilities. If you have questions about special accommodations for persons with disabilities, call the information center.

Form Data

| Fact Name | Description |

|---|---|

| Governing Law | New York, Section 1116(a)(4) |

| Eligibility | Organized exclusively for educational purposes, Indiana University is exempt from sales and use tax. |

| Purchase Conditions | Purchases must be directly invoiced to and paid by Indiana University using check or credit card to qualify for the exemption. |

| Restrictions | The form cannot be used for the benefit of any officer, member, or employee of Indiana University or for purchases of motor fuel or diesel motor fuel. |

Instructions on Utilizing St 119 1 Exempt

Filling out the ST-119.1 Exempt Purchase Certificate requires careful attention to detail to ensure the form is correctly completed. This certificate will support Indiana University's claim for exemption from sales and use tax in New York, based on its status as an educational organization. Following the steps listed will help ensure all necessary information is accurately provided to the seller and the New York State Department of Taxation and Finance. Once this form is properly filled out and submitted, the University can enjoy the benefits of tax-exempt purchases that directly serve its educational mission.

- Locate the section labeled Name of seller and enter the full name and address of the seller from whom Indiana University is purchasing goods or services.

- In the Street address section, enter the complete address of Indiana University, including the street name and number, city, state, and ZIP code, ensuring it matches official university records.

- Find the part labeled Your exempt organization number. Here, enter the six-digit exempt organization number issued to Indiana University by the New York State Tax Department.

- Under Name of exempt organization/purchaser, write "Indiana University" to specify the name of the organization making the purchase.

- Fill in the Street address, City, State, and ZIP code for Indiana University in the corresponding fields to provide the university's address once again.

- Check the box next to either Single purchase certificate or Blanket certificate, depending on whether the form is being used for a one-time purchase or if it will apply to multiple purchases over time.

- In the Certification section at the bottom, read the statement carefully to understand the legal implications. It verifies that the information provided is truthful and that the certificate is used in compliance with New York State laws.

- Print or type the name and title of Jill Schunk, Associate Vice President & Director of Procurement Services, in the designated spots under the certification statement, as she is the authorized signatory for Indiana University.

- Date the form on the line provided, marking when the certificate is issued.

- Finally, Jill Schunk must sign the form in the Signature of officer of organization space to validate the certificate.

With these steps completed, the ST-119.1 Exempt Purchase Certificate is ready to be presented to vendors for tax-exempt purchases. Keep in mind, communication with Jill Schunk to obtain her signature is crucial. This document will serve as a testament to Indiana University's eligibility for tax exemptions on qualifying purchases, streamlining the procurement process and ensuring compliance with New York State tax laws.

Obtain Answers on St 119 1 Exempt

What is Form ST 119.1?

Form ST 119.1, known as the New York Exempt Purchase Certificate, is a document that certain organizations, like Indiana University, can use to make tax-exempt purchases in New York. This is specifically beneficial for organizations that are exempt from sales and use tax due to their educational purposes.

Who can use Form ST 119.1?

Form ST 119.1 is exclusively for organizations that are organized for educational purposes and have been granted tax-exempt status according to New York, Section 1116(a)(4). Organizations must hold a valid Form ST-119, Exempt Organization Certificate, to use Form ST 119.1.

How do organizations qualify for this exemption?

To qualify for the exemption, an organization must issue Form ST 119.1 to vendors at the time of sale or within 90 days of accepting delivery of property or the rendering of services. The organization must be the direct purchaser and payer of record, and purchases must be made through direct invoicing to, and payment by, the organization.

Are there any restrictions on the use of Form ST 119.1?

Yes, the form cannot be used for personal benefits of any officer, member, or employee of the organization. Additionally, it does not apply to the purchases of motor fuel or diesel motor fuel.

Is it necessary to give the seller a new exemption certificate for every purchase?

No, a blanket exemption claim on Form ST 119.1 covers all exempt transactions between the university and the vendor for a three-year period from the date of purchase.

What information must be filled out on Form ST 119.1?

The form requires specific information, including the seller’s name and address, and the exempt organization’s number issued by the New York State Tax Department. It must also be signed by a responsible officer of the organization.

Who is authorized to sign Form ST 119.1 for an organization?

For Indiana University, the Associate Vice President & Director of Procurement Services, Jill Schunk, is designated to sign. Organizations should designate an officer responsible for this task.

What are the consequences of misuse of Form ST 119.1?

Misuse or willfully issuing Form ST 119.1 with the intent to evade tax may constitute a felony or other crime under New York State Law. Such acts are punishable by a substantial fine and possibly a jail sentence.

Where can organizations find more help or information?

For more assistance, organizations can visit the New York State Department of Taxation and Finance website or contact their Sales Tax Information Center for guidance on how to properly utilize Form ST 119.1.

Are accommodations available for persons with disabilities in accessing assistance?

Yes, in compliance with the Americans with Disabilities Act, facilities are accessible for persons with disabilities. Those in need of special accommodations are encouraged to contact the information center for further assistance.

Common mistakes

When filling out the ST-119.1 Exempt Purchase Certificate, individuals often make mistakes that can lead to delays or the denial of their exemption status. Understanding these common errors can help ensure that your submission is accurate and compliant.

- Not including the original signature of a responsible officer. It is compulsory to have the exemption certificate signed by a designated officer. Copies or digital signatures are not acceptable.

- Failing to fill out all sections highlighted in blue. Every section marked as such is critical for the review of your certificate. Leaving these sections incomplete can result in an invalid submission.

- Using the form for personal benefit. The certificate strictly prohibits use for the personal gain of officers, members, or employees of the exempt organization. It must exclusively benefit the organization itself.

- Incorrect exempt organization number. Some mistakenly input their federal employer identification number in place of the exempt organization number issued by the New York State Tax Department.

- Attempting to purchase ineligible items. The certificate does not cover purchases of motor fuel or diesel motor fuel. Using it for such purchases violates the terms of exemption.

Adhering to the guidelines and carefully reviewing the form before submission can significantly ease the process of claiming exemption status. If you need assistance or have questions, visiting the official website or contacting customer service can provide further clarification and support.

Documents used along the form

When engaging in transactions exempt from sales and use tax, organizations like Indiana University use the New York Exempt Purchase Certificate (Form ST 119.1) as a vital document to ensure compliance with tax laws. Alongside this certificate, a series of additional documents may be necessary to facilitate or further validate such tax-exempt purchases thoroughly. These documents support the exemption process, ensuring it adheres to the guidelines while providing clear records for both the organization and tax authorities.

- Form ST-119, Exempt Organization Certificate: This form is a prerequisite for obtaining the ST-119.1. It certifies that an organization is officially recognized by the New York State Department of Taxation and Finance as exempt from state and local sales and use taxes. It is proof of the organization’s eligibility for making tax-exempt purchases.

- Invoice or Receipt from Vendor: A detailed invoice or receipt from the vendor is crucial for documenting the specifics of each tax-exempt purchase. This document should outline the items or services bought, the amounts charged, and explicitly note the application of the tax exemption, tying the purchase back to the ST-119.1 form.

- Purchase Order: Often preceding the actual purchase, a purchase order is issued by the exempt organization to the vendor. It authorizes the purchase of goods or services under the terms agreed, including the tax exemption status. This document serves as a commitment to buy, specifying quantities, descriptions, and the agreed prices for products or services.

- Proof of Payment: Documentation that confirms the organization has paid for the goods or services directly is necessary to uphold the tax exemption. This proof can include transaction receipts, canceled checks, or credit card statements showing the payment from the exempt organization to the vendor. Ensuring the organization is the direct payer is essential for maintaining the integrity of the tax-exempt process.

Understanding and utilizing these documents effectively helps organizations like Indiana University navigate the complexities of tax-exempt purchases. Proper documentation not only supports an organization’s eligibility for tax exemptions but also aids in maintaining transparent and auditable records, crucial for compliance and financial management. Hence, it is beneficial for organizations to be well-acquainted with these forms and their proper usage.

Similar forms

Form W-9, Request for Taxpayer Identification Number and Certification: This form, like the ST-119.1, is used to confirm tax-exempt status, but for independent contractors or freelancers, not educational organizations. It ensures that the correct taxpayer identification number is provided to entities that are paying them, helping in the avoidance of backup withholding.

Form 990, Return of Organization Exempt from Income Tax: Non-profit organizations, similar to educational institutions claiming exemption using Form ST-119.1, use Form 990 to provide the IRS with the information required by section 6033. This document shares the feature of declaring tax-exempt status, although it's more focused on annual reporting.

Form 1023, Application for Recognition of Exemption under Section 501(c)(3) of the Internal Revenue Code: This application is akin to ST-119.1 in that it is a step toward obtaining a declaration of tax exemption. However, Form 1023 is specifically for organizations seeking 501(c)(3) status at the federal level, indicating a broader and more permanent exemption than the transactional nature of ST-119.1.

Form 8283, Noncash Charitable Contributions: Property donations made by organizations, which can be analogous to purchases made by educational institutions like Indiana University with Form ST-119.1, use Form 8283 to report information about noncash charitable contributions. It ensures compliance with federal tax deductions, similar to how ST-119.1 ensures compliance with state tax exemptions.

Sales Tax Exemption Certificate (Various States): Many states have their own versions of the sales tax exemption certificate that resemble the ST-119.1 form in purpose. These certificates allow eligible institutions to purchase goods or services without paying state sales tax, tailored to each state's tax code specifics.

Form 941, Employer's Quarterly Federal Tax Return: While primarily used for reporting payroll taxes, Form 941 shares a commonality with ST-119.1 in terms of being a routine, periodic filing required to maintain compliance with government tax regulations. Both forms play crucial roles in their respective areas of tax-related accountability for organizations.

Form 4506-T, Request for Transcript of Tax Return: This form, used for requesting tax return information, connects with ST-119.1 through the theme of tax documentation and compliance. Organizations might need to request past return transcripts as part of due diligence or compliance checks, similar to how organizations use ST-119.1 to document tax-exempt purchases.

Form 8843, Statement for Exempt Individuals and Individuals with a Medical Condition: Although serving a different purpose, this form, like ST-119.1, involves statements of exemption related to specific conditions or statuses under U.S. tax law. Form 8843 is used by certain nonresident aliens to claim exemptions from the substantial presence test.

Form 8868, Application for Extension of Time To File an Exempt Organization Return: Similar to Form ST-119.1's role in handling tax exemptions for purchases made by educational institutions, Form 8868 offers these organizations the ability to extend their deadline for submitting annual tax exemption information to the IRS.

Dos and Don'ts

When filling out the New York Exempt Purchase Certificate (Form ST 119.1), there are specific steps you should take to ensure the process is completed accurately and effectively. Below are guidelines to help you navigate this process smoothly.

Do's

- Ensure that Indiana University is the direct purchaser and the payer of record for all transactions. This maintains the integrity of the exemption.

- Complete all sections highlighted in blue, including the seller’s name and address, to ensure the form is filled out comprehensively.

- Obtain the original signature of Jill Schunk, Associate Vice President & Director of Procurement Services at Indiana University, as she is the designated signatory.

- Use the form for purchases that directly benefit Indiana University only. This ensures compliance with the stipulations of the exemption.

Don'ts

- Do not use the form for personal benefit or for the benefit of any officer, member, or employee of Indiana University outside the scope of its educational purpose.

- Avoid utilizing the exempt purchase certificate for transactions involving motor fuel or diesel motor fuel, as these are not covered by the exemption.

- Do not attempt to use the form after the designated three-year period from the date of purchase without renewing the blanket exemption claim.

- Refrain from leaving sections of the form incomplete, especially those highlighted in blue, as this could lead to processing delays or rejection of the exemption claim.

Adhering to these guidelines will help ensure that your use of Form ST 119.1 is in compliance with New York State Law, and supports the educational purposes of Indiana University effectively.

Misconceptions

When it comes to understanding the ST-119.1 Exempt Purchase Certificate in New York, there are several misconceptions that can lead to confusion. Here's a list to help clarify some of the common misunderstandings:

- It's not just for educational institutions. While the form mentions Indiana University specifically, other types of organizations, including certain non-profits and religious entities, may also qualify for this exemption, depending on their activities and the nature of their purchases.

- The form is not universally applicable for all purchases. The exemption covers tangible personal property or taxable services purchased for the organization's use. However, it explicitly excludes motor fuel or diesel motor fuel.

- Vendors automatically accept the form. It's important to note that vendors have the right to request additional documentation or clarification to ensure the purchase qualifies for the exemption. Acceptance of the form is at the vendor's discretion, within compliance of New York tax laws.

- The exemption is immediate and permanent. The form facilitates tax-exempt purchases, but it's valid for three years from the date of the transaction. Organizations need to renew or reissue the certificate for ongoing or new vendor relationships.

- Any university employee can sign the form. The certificate must bear the original signature of a responsible official designated by the organization. In the example of Indiana University, this is the Associate Vice President & Director of Procurement Services.

- The exemption applies to online purchases without submission. For online transactions, there may still be a need to present or submit Form ST-119.1 to claim the exemption, depending on the seller's process for handling tax-exempt transactions.

- A single certificate covers all types of exempt organizations. The ST-119.1 is specific to the type of organization and its qualification under New York tax law. Different organizations may need to submit different documentation to prove their tax-exempt status.

- There's no need to keep records once the form is submitted. Organizations should maintain accurate records of all transactions made under this exemption, including copies of the form and related purchase invoices, in case of audits or tax inquiries.

- Federal Tax Exemption equates to State Exemption. Holding a federal tax-exempt status does not automatically qualify an organization for state sales and use tax exemptions in New York. The ST-119.1 form is specific to New York State's requirements.

Correctly understanding and applying for tax-exempt status using the ST-119.1 Exempt Purchase Certificate can save eligible organizations significant amounts on their purchases. However, it's crucial to navigate the specific stipulations and maintain proper documentation to ensure compliance with New York State tax laws.

Key takeaways

When utilizing the New York Exempt Purchase Certificate (Form ST 119.1), there are several key takeaways that organizations such as Indiana University should be aware of to ensure their purchases are exempt from sales and use tax. Below is a summary of these crucial points:

- Form ST 119.1 should be issued to vendors when purchasing tangible personal property or taxable services to qualify for the tax exemption as provided under New York, Section 1116(a)(4), due to the organization’s exclusive organization for educational purposes.

- For the exemption to apply, Indiana University must be the direct purchaser and payer of record. This means that purchases are invoiced and charged directly to Indiana University and paid directly by Indiana University using accepted methods such as checks or credit cards.

- The exemption is explicitly for the benefit of Indiana University and cannot be used for personal benefit by any officer, member, or employee of the University.

- Certain purchases, including motor fuel or diesel motor fuel, are not covered by this exemption.

- A new certificate does not need to be issued for every purchase. A blanket exemption claim can cover all exempt transactions between the University and the vendor for a period of three years from the date of initial purchase.

- The form requires that all sections highlighted in blue are filled out, including the seller’s name and address.

- An original signature from a responsible officer of the organization is necessary. For Indiana University, Associate Vice President & Director of Procurement Services, Jill Schunk, is designated for this role, and appointments must be made via email for signature.

- Falsely issuing this document with the intent to evade tax may constitute a felony or other crime under New York State Law, including possible fines and jail sentences.

- The form acts as evidence that state and local sales or use taxes do not apply to transactions for which it is tendered. It must be filed and delivered to the vendor as the agent for the Tax Department.

- The Tax Department is authorized to investigate the validity of tax exclusions or exemptions claimed and the accuracy of the information provided in the document.

It's important for organizations like Indiana University to adhere to these guidelines when making exempt purchases in New York State to ensure compliance with tax laws and avoid potential legal consequences.

Popular PDF Forms

Court Affidavit - The information provided on the form allows the court to allocate resources effectively to those who need them most.

Form 433-a Instructions - Understanding and accurately completing this form can significantly impact the outcome of a taxpayer's Offer in Compromise application.

Massage Intake Form Pdf - It ensures that clients are informed about the nature of massage therapy and their responsibility to communicate for a comfortable experience.