Blank St 13A PDF Template

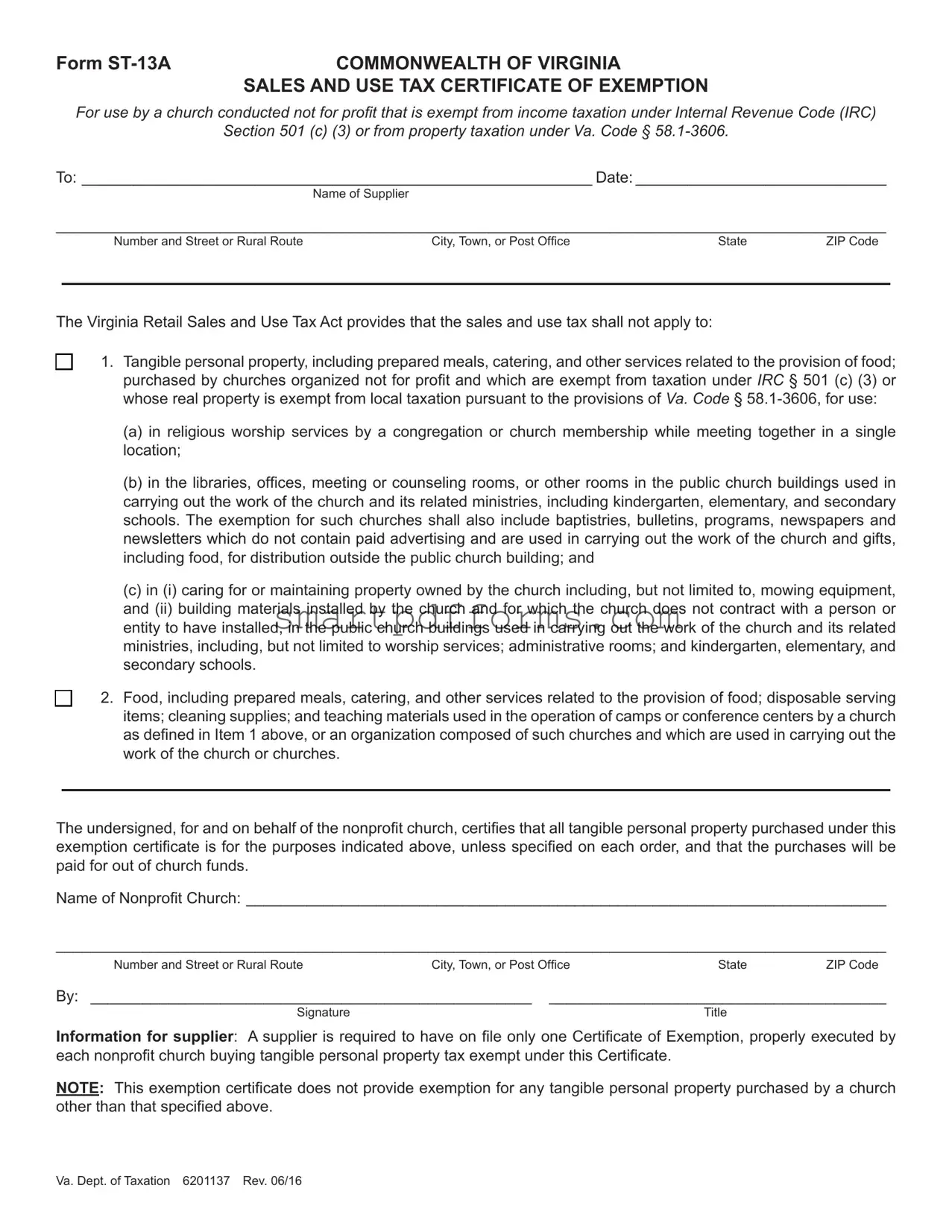

Navigating the complexities of tax exemptions can be a challenging endeavor, especially for nonprofit organizations striving to ensure compliance while maximizing their financial resources. Among the various forms and documents that nonprofit entities, particularly churches, must familiarize themselves with is the Form ST-13A. This pivotal document, issued by the Commonwealth of Virginia, serves as a Sales and Use Tax Certificate of Exemption specifically designed for churches conducted not for profit and recognized under the Internal Revenue Code (IRC) Section 501(c)(3) or those exempt from property taxation under Va. Code § 58.1-3606. It outlines provisions allowing qualifying churches to purchase tangible personal property, including prepared meals and building materials, without the burden of sales and use tax, provided these purchases are for sanctioned uses such as religious services, church-run schools, or maintenance of church property. Moreover, it highlights the conditions under which food, catering services, and other specified items used in camps or conference centers operated by these churches can also enjoy tax-exempt status. Importantly, the form requires detailed information about the purchasing church and necessitates a declaration that all purchases made under this exemption will be for the approved purposes and out of church funds, offering a clear pathway for churches to navigate the exemption process while underscoring the importance of compliance and accurate record-keeping.

Preview - St 13A Form

Form |

COMMONWEALTH OF VIRGINIA |

|

SALES AND USE TAX CERTIFICATE OF EXEMPTION |

For use by a church conducted not for profit that is exempt from income taxation under Internal Revenue Code (IRC)

Section 501 (c) (3) or from property taxation under Va. Code §

To:____________________________________________________________ Date:______________________________

Name of Supplier

________________________________________________________________________________________________

Number and Street or Rural Route |

City, Town, or Post Office |

State |

ZIP Code |

The Virginia Retail Sales and Use Tax Act provides that the sales and use tax shall not apply to:

c1. Tangible personal property, including prepared meals, catering, and other services related to the provision of food; purchased by churches organized not for profit and which are exempt from taxation under IRC § 501 (c) (3) or whose real property is exempt from local taxation pursuant to the provisions of Va. Code §

(a)in religious worship services by a congregation or church membership while meeting together in a single location;

(b)in the libraries, offices, meeting or counseling rooms, or other rooms in the public church buildings used in carrying out the work of the church and its related ministries, including kindergarten, elementary, and secondary schools. The exemption for such churches shall also include baptistries, bulletins, programs, newspapers and newsletters which do not contain paid advertising and are used in carrying out the work of the church and gifts, including food, for distribution outside the public church building; and

(c)in (i) caring for or maintaining property owned by the church including, but not limited to, mowing equipment, and (ii) building materials installed by the church and for which the church does not contract with a person or entity to have installed, in the public church buildings used in carrying out the work of the church and its related ministries, including, but not limited to worship services; administrative rooms; and kindergarten, elementary, and secondary schools.

c2. Food, including prepared meals, catering, and other services related to the provision of food; disposable serving items; cleaning supplies; and teaching materials used in the operation of camps or conference centers by a church as defined in Item 1 above, or an organization composed of such churches and which are used in carrying out the work of the church or churches.

The undersigned, for and on behalf of the nonprofit church, certifies that all tangible personal property purchased under this exemption certificate is for the purposes indicated above, unless specified on each order, and that the purchases will be paid for out of church funds.

Name of Nonprofit Church: __________________________________________________________________________

________________________________________________________________________________________________

Number and Street or Rural RouteCity, Town, or Post OfficeStateZIP Code

By: ____________________________________________________ |

_______________________________________ |

Signature |

Title |

Information for supplier: A supplier is required to have on file only one Certificate of Exemption, properly executed by each nonprofit church buying tangible personal property tax exempt under this Certificate.

NOTE: This exemption certificate does not provide exemption for any tangible personal property purchased by a church other than that specified above.

Va. Dept. of Taxation 6201137 Rev. 06/16

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The ST-13A form is used in the Commonwealth of Virginia. |

| 2 | It serves as a Sales and Use Tax Certificate of Exemption specifically for churches operating not for profit. |

| 3 | Churches must be exempt from income taxation under Internal Revenue Code (IRC) Section 501(c)(3) or from property taxation under Virginia Code § 58.1-3606 to use this certificate. |

| 4 | The form exempts qualified churches from sales and use tax on purchases of tangible personal property, including specific items and services mentioned in the document. |

| 5 | Exemptions include items for use in religious services, church operations, educational institutions operated by the church, and for property maintenance. |

| 6 | Additionally, exemptions extend to food, disposable items, cleaning supplies, and teaching materials for church-operated camps or conference centers. |

| 7 | Churches are required to certify that all purchases under this exemption are for the purposes indicated and are paid for with church funds. |

| 8 | Suppliers must have on file a properly executed Certificate of Exemption by each nonprofit church purchasing tax-exempt tangible personal property under this certificate. |

Instructions on Utilizing St 13A

Completing the ST-13A Form for a church seeking to claim a sales and use tax exemption in Virginia necessitates accuracy and an understanding of the church's purchases intended for exemption. This form is pivotal for churches conducting not for profit and holding tax-exempt status under the IRC Section 501(c)(3) or property taxation exemption under Va. Code § 58.1-3606. The exemption applies to tangible personal property, including certain food services and buildings materials, used within the church's religious, educational, and charitable functionalities. Proceed with the following steps to ensure the form is filled out accurately.

- To: Enter the name of the supplier from whom the church is purchasing exempt items.

- Date: Specify the date when the form is being filled out.

- Name of Supplier: Provide the complete name of the supplier. If already entered, proceed to the next section.

- Number and Street or Rural Route: Fill in the address of the supplier, including the street number and name or rural route.

- City, Town, or Post Office, State, ZIP Code: Enter the city, state, and ZIP code for the supplier’s address.

- Under the explanation section regarding the Virginia Retail Sales and Use Tax Act, no entry is needed, but ensure to read through it to understand the exemptions covered under this form.

- Name of Nonprofit Church: Input the full legal name of the church claiming the tax exemption.

- Address of Nonprofit Church: Provide the address of the church, including the number and street or rural route, city, town or post office, state, and ZIP code.

- By (Signature): The authorized representative of the church must sign, indicating that the purchase is for the church’s use under the specified exemptions.

- Title: Indicate the title or position of the individual signing on behalf of the church.

After completing the form, it serves as a declaration by the church that any purchases made from the named supplier aim for specific exempt purposes as outlined. It's important that the church keeps a copy for their records and provides the original to the supplier. The supplier is then responsible for retaining this certificate to justify tax-exempt sales to the church. Remember, the ST-13A form is specific to certain types of purchases detailed within, and it will not cover items outside the scope of the exemptions stated.

Obtain Answers on St 13A

What is the Form ST-13A and who is it for?

The Form ST-13A is a Certificate of Exemption issued by the Commonwealth of Virginia. It's specifically designed for use by churches conducted not for profit that are exempt from income taxation under the Internal Revenue Code (IRC) Section 501(c)(3) or from property taxation under Virginia Code § 58.1-3606. This form allows these organizations to purchase tangible personal property, including but not limited to prepared meals, catering, cleaning supplies, and teaching materials, exempt from sales and use tax when the items are used in accordance with the conditions outlined in the exemption.

What tangible personal property is exempt under the Form ST-13A?

The exemption applies to a wide range of tangible personal property used for religious and related activities. This includes items used in religious worship services, in the operations of the church's libraries, offices, meeting or counseling rooms, or other rooms in public church buildings. It also covers materials for caring for church property, building materials installed by the church without outside contracting, food and related services for camps or conference centers operated by the church, disposable serving items, cleaning supplies, and teaching materials. Gifts, including food distributed outside the church building, are also exempt, provided they are used in carrying out the work of the church and its ministries.

Are there any restrictions or conditions for using the ST-13A exemption?

Yes, the exemption comes with specific conditions. The key requirement is that all purchases made under this exemption must be for the purposes indicated in the Form ST-13A, and they must be paid for with church funds. Additionally, this certificate only applies to items explicitly mentioned in the form. It does not cover any tangible personal property not specified, and the exemptions are strictly related to the church's activities and operations as defined by the form's criteria.

How does a church qualify for the exemption provided by Form ST-13A?

A church must meet two primary criteria to qualify for the exemption: it must be conducted not for profit and either be exempt from income taxation under IRC § 501(c)(3) or from property taxation under Virginia Code § 58.1-3606. To use the exemption, the church must fill out and submit Form ST-13A to the supplier from whom they are purchasing the tangible personal property. The form must be properly executed, indicating that the church will use the purchased items as stipulated in the exemption criteria.

What information must be provided on the Form ST-13A?

The church must provide detailed information when completing the form, including the date of issuance, the name and address of the supplier, and the name and address of the nonprofit church itself. Additionally, a representative of the church must sign the form, indicating their authority (title) within the church. This signed declaration certifies that all purchases made under this certificate are for exempt purposes and that payment will be made from church funds.

What is required from suppliers regarding the ST-13A Certificate of Exemption?

Suppliers are required to keep on file a properly executed Certificate of Exemption for each nonprofit church that purchases tangible personal property from them tax exempt under the Certificate. This means that once a church has submitted a completed Form ST-13A, the supplier must retain this document to validate the tax-exempt status of any future purchases made by the church. It’s a safeguard that ensures compliance with the Virginia Retail Sales and Use Tax Act regarding exempt sales to qualified nonprofit churches.

Common mistakes

Filling out the ST-13A form, the Commonwealth of Virginia Sales and Use Tax Certificate of Exemption, is a critical step for churches that operate not for profit and qualify under specific tax-exemption statuses. However, certain common mistakes can compromise the accuracy and validity of these exemption claims. Recognizing and avoiding these errors ensures compliance and the rightful application of tax exemptions.

Not verifying eligibility: One of the first missteps is failing to confirm the church's eligibility under the Internal Revenue Code Section 501(c)(3) or the property taxation exemption per Va. Code § 58.1-3606. Each church must ensure it meets these criteria before proceeding with the form.

Incomplete supplier information: Churches must provide comprehensive details of the supplier, including name, address, and ZIP code. Omitting any part of this information may lead to processing delays or the rejection of the exemption certificate.

Misidentifying purchase types: The form distinctly outlines the types of tangible personal property and services eligible for exemption. Incorrectly identifying the nature of purchases or assuming all church-related purchases qualify can result in unauthorized claims.

Using church funds improperly: The certification statement at the bottom of the form asserts that all purchases made under this exemption will be paid for with church funds for the specified exempt purposes. Misapplication of this certification, such as using funds not properly allocated or for non-exempt purposes, invalidates the exemption claim.

Adherence to the form's instructions and a comprehensive review of the church's eligibility and the nature of its purchases play pivotal roles in the successful application of the ST-13A exemption. Churches are encouraged to consult with knowledgeable individuals or seek professional guidance to ensure the accurate completion of this form, leveraging their tax-exempt status effectively without risking compliance issues.

Documents used along the form

The Form ST-13A serves as a crucial document for churches in Virginia, ensuring they can purchase tangible personal property without paying sales and use tax, contingent upon their compliance with specific tax exemption qualifications. This form is just one of many documents and forms that organizations might need to handle their financial and operational activities compliantly. Below is a list of other forms and documents often utilized alongside the Form ST-13A, each with its respective brief description:

- IRS Form 1023: This form is used by nonprofit organizations, including churches, to apply for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. It's crucial for establishing a church's tax-exempt status.

- IRS Form 990: An annual reporting return that certain tax-exempt organizations must file with the IRS. It provides information on the organization's mission, programs, and finances.

- Form W-9: Request for Taxpayer Identification Number and Certification. This form is often required to be completed by the church and provided to entities that pay them, to avoid backup withholding.

- Employment Eligibility Verification Form I-9: This form is used by employers, including churches, to verify the identity and employment authorization of individuals hired for employment in the United States.

- Employee's Withholding Certificate Form W-4: This form is filled out by employees to inform employers of their tax situation so that the employer can withhold the correct federal income tax from the employee's paycheck.

- Virginia State Annual Report: Required by the Commonwealth of Virginia to be filed by churches and other organizations, providing updates on the organization's activities and confirming its continued operation.

- Volunteer Application form: Used by churches to collect information on individuals seeking to volunteer. This form helps ensure a good fit between the church's needs and the volunteer's skills and interests.

- Building Use Agreement: A document that outlines the terms and conditions under which outside parties may use church facilities, ensuring proper scheduling, liability coverage, and usage rules.

- Donation Receipt form: This form is given to donors to acknowledge receipt of charitable donations. It provides the documentation that donors need for tax deduction purposes.

- Conflict of Interest Policy: A statement or form that outlines procedures to be followed should a conflict of interest arise within the church's leadership or decision-making processes.

Together, these documents support the operational, financial, and legal integrity of churches in Virginia, enabling them to maintain their tax-exempt status, manage their resources effectively, and comply with various state and federal regulations. Understanding and utilizing these forms correctly is essential for the seamless operation of a non-profit church.

Similar forms

Form W-9: This form, requested by a third party from an individual or entity in the United States to confirm their taxpayer identification number, is similar to the ST-13A in that it is used to verify tax status for compliance with U.S. tax laws. Both forms play a crucial role in ensuring proper tax treatment and exemption where applicable.

Form 1023: Used by non-profit organizations to apply for recognition of exemption under IRC Section 501(c)(3), this document, like the ST-13A, involves an entity asserting its tax-exempt status for specific purposes, although the 1023 is for federal income tax exemption.

Form 990: Filed by non-profit organizations to provide the IRS with annual financial information, Form 990 is akin to the ST-13A in that both involve organizations exempt under IRC Section 501(c)(3), but while ST-13A is for sales and use tax exemption on purchases, Form 990 deals with income disclosure.

State Resale Certificate: Similar to the ST-13A, state resale certificates allow businesses to purchase goods without paying sales tax if the goods are intended for resale. Both certificates avoid the immediate payment of sales tax, albeit for different types of exempt entities and purposes.

Exemption Certificate for Government Purchase (Federal, State, Local): This certificate, which exempts government entities from sales tax on purchases, shares a similar utility with the ST-13A. Both certify that the purchaser is entitled to a tax exemption under specific conditions.

Form 8843: Filed by nonresident aliens to explain the details of their stay in the U.S., notably for tax purposes, Form 8843 and ST-13A both interact with the U.S. tax system, albeit from different angles—personal versus organizational exemptions.

Certificate of Capital Improvement: Issued when purchasing services or materials for capital improvements, this certificate exempts these purchases from sales tax, drawing a parallel to the ST-13A, which does the same for certain purchases made by churches.

Streamlined Sales Tax Exemption Certificate: A multi-state form that businesses can use to claim sales tax exemption across participating states. It is similar to the ST-13A in its purpose of certifying tax-exempt purchases, though it is more broadly applicable and not limited to non-profit religious entities.

Direct Pay Permit: Allows companies to purchase goods and services without paying sales tax at the point of sale, on the condition they will remit it directly. It shares functionality with the ST-13A by enabling an exemption mechanism, though the ST-13A focuses on non-profit religious exemptions.

Uniform Sales & Use Tax Exemption/Resale Certificate - Multijurisdiction: This certificate, similar to the ST-13A, allows entities to claim sales tax exemption in multiple states. While it serves a broader audience, it parallels the ST-13A’s function of providing tax exemption under certain conditions.

Dos and Don'ts

When filling out the ST-13A form for a church conducted not for profit, there are specific guidelines to follow to ensure accuracy and compliance:

Do:- Read the form thoroughly before beginning to understand all requirements and conditions.

- Use black ink or type the information to ensure legibility.

- Ensure that the church's name and address are accurately entered as registered.

- Include the church's tax-exempt number if applicable, under the Internal Revenue Code Section 501(c)(3) or Va. Code § 58.1-3606.

- Sign and date the form to validate the certificate.

- Keep a copy for church records before submitting the original to the supplier or the Virginia Department of Taxation.

- Leave any required fields incomplete; verify all information is provided.

- Use pencil or non-permanent ink, as this could lead to information being altered or becoming illegible over time.

- Assume all purchases by the church are exempt; only those specified on the form qualify for exemption.

- Forget to specify on each order that the purchase is for the exempt purposes indicated on the certificate.

- Overlook the necessity to have the supplier's name and address correctly filled out.

- Assume a single certificate covers all types of tax-exempt purchases; some items may not be exempt under this form.

Misconceptions

There are several common misconceptions about the Virginia Sales and Use Tax Certificate of Exemption, specifically the Form ST-13A, which are important to clarify for nonprofit churches and religious organizations seeking to understand their tax-exempt purchasing rights. These misunderstandings can lead to improper filing or usage of the form, potentially impacting the church's financial responsibilities and legal standing.

Only applicable to churches. A common misconception is that the Form ST-13A is exclusively for churches. While it is designed for churches conducted not for profit and that are exempt under specific tax codes, the form also applies to religious organizations that meet the same tax exemption criteria. It's the nature of the exemption, not the entity type, that defines eligibility.

Unlimited exemptions. Another misunderstanding is believing that once a church obtains a Form ST-13A, all its purchases are tax-exempt. In reality, the exemption strictly applies to tangible personal property intended for certain uses, such as in worship services, church-operated schools, or maintenance of church property. It does not cover personal property not used in these specific functions.

Use for all church-related meals and catering. The exemption includes prepared meals, catering, and related food services, but it's designed for those used within the church's exempt activities, such as feeding the homeless or church functions. Misapprehension sometimes occurs when churches assume all food-related activities are covered, including those not directly tied to exempt church work.

Automatic renewal or permanent status. Some believe that once a church files Form ST-13A, it grants a permanent tax-exempt status. In fact, while the form validates the exemption, the church's eligibility depends on maintaining its status under the IRS and Virginia tax codes. Changes in church activities or legal status may affect exemption eligibility.

Exemption applies to all church property. There's a notion that the exemption extends to all property owned or used by the church. However, the text specifies that the exemption is for tangible personal property and certain building materials used directly in exempt church activities. Real estate and other types of property not used as stipulated do not fall under this exemption.

No need to specify usage on purchases. Lastly, there is a misconception that churches do not need to declare the purpose of each exempt purchase. In truth, the form requires that the church certifies all tangible personal property purchased under this exemption is for the purposes indicated. This ensures accountability and compliance with the scope of the tax exemption.

Clarifying these misconceptions is vital for churches and related religious organizations to navigate tax exemptions correctly, ensuring compliance and proper utilization of Form ST-13A for the benefit of their mission and operations.

Key takeaways

Filling out and using the ST-13A form is an important process for churches in Virginia that are looking to purchase goods without paying sales tax. To ensure that your church can benefit from this exemption, here are four key takeaways to keep in mind:

- Eligibility is specific: This form is exclusively for churches that are not conducted for profit and have been exempted from income taxation under Internal Revenue Code Section 501 (c) (3) or from property taxation under Virginia Code § 58.1-3606.

- Covered items vary: Tangible personal property that can be purchased tax-free includes items used in religious worship services, administrative purposes, the operation of church-related schools, food services, maintenance, and building materials for self-installation. It also covers items used in camps or conference centers operated by the church or a related organization.

- Certification by the church is required: The form requires certification from an authorized representative of the church, stating that all purchased items under this exemption are for the specified purposes and that these purchases will be paid for with church funds.

- Supplier responsibility: Suppliers are only required to keep one properly executed Certificate of Exemption on file for each nonprofit church. This ensures that future purchases also fall under the exemption, provided they meet the stated conditions.

Understanding and correctly applying these points when filling out the ST-13A form will help your church make the most of tax-exempt purchases, ensuring compliance with Virginia law and supporting the church's financial health.

Popular PDF Forms

How to Pay a Nanny Legally - Contract establishing guidelines for childcare services, including hours of operation, payment, and provider certification.

18 Person Tournament Bracket - The concluding matches offer a chance for dramatic comebacks and unforgettable tournament moments.