Blank St 3 New Jersey PDF Template

In navigating the intricacies of conducting business in New Jersey, understanding and correctly applying for tax exemptions can significantly impact operational success and compliance. The New Jersey ST-3 Resale Certificate form plays a crucial role in this realm, designed for use by purchasers and sellers engaged in transactions involving taxable property or services. This form allows a seller to sell goods or provide services without collecting sales tax, under the condition that the purchaser provides a fully completed exemption certificate. Intent for the resale of goods in their original form, as a component part of a new product, or for use in taxable services on personal property, is a critical qualifier for this exemption. Moreover, the ST-3 form details specific responsibilities of both parties involved. Sellers are advised on how to accept and retain these certificates, laying out a safeguarding protocol for exempt transactions, ensuring compliance with the New Jersey Division of Taxation guidelines. Importantly, the document elaborates on situations where the certificate's improper use could lead to liabilities, underscoring the importance of understanding and adhering to the stipulated guidelines. Assistance through this dense terrain is provided by the state’s comprehensive instructions, aiming to aid both purchasers and sellers in navigating exemptions correctly, thus fostering a compliant business environment.

Preview - St 3 New Jersey Form

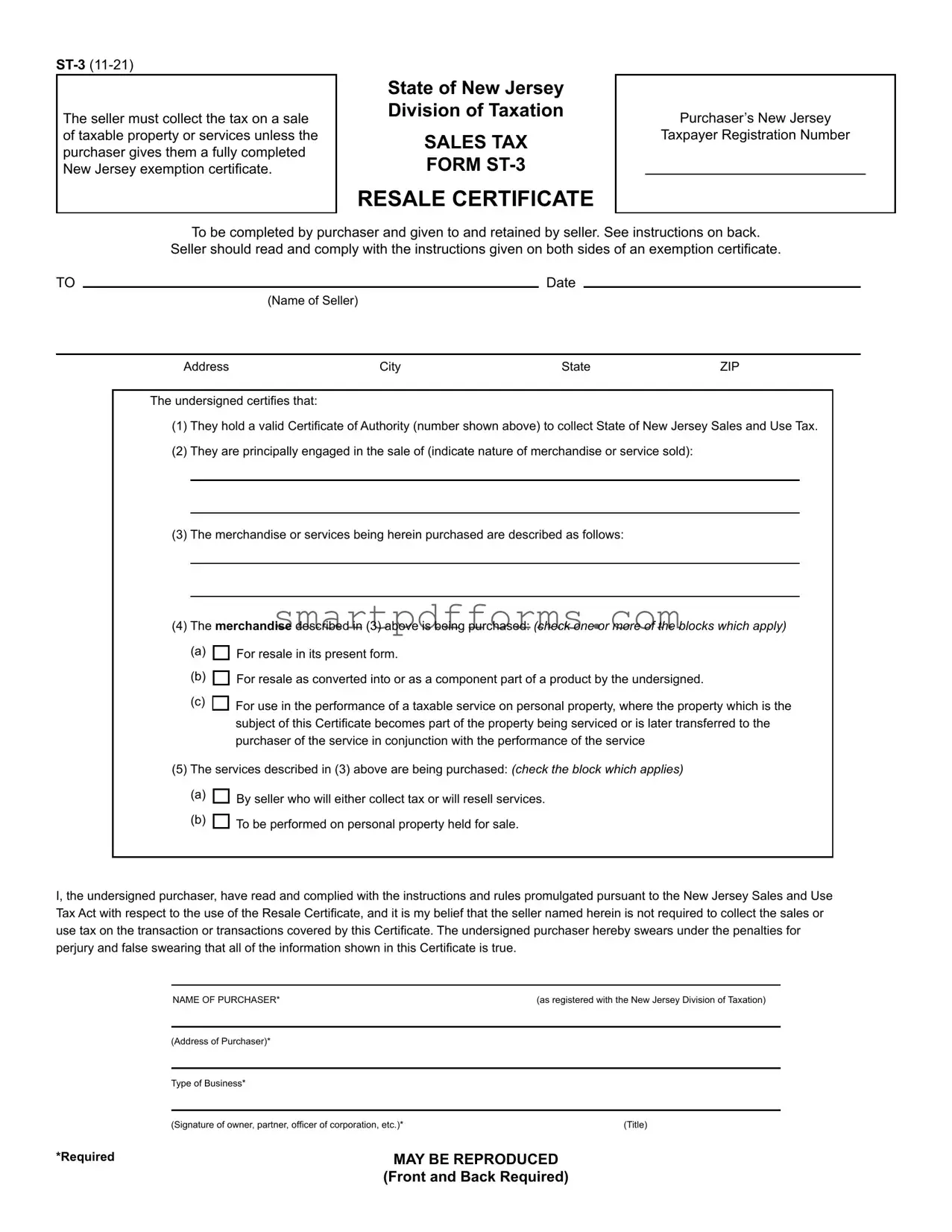

The seller must collect the tax on a sale of taxable property or services unless the purchaser gives them a fully completed New Jersey exemption certificate.

State of New Jersey

Division of Taxation

SALES TAX

FORM

RESALE CERTIFICATE

Purchaser’s New Jersey

Taxpayer Registration Number

To be completed by purchaser and given to and retained by seller. See instructions on back.

Seller should read and comply with the instructions given on both sides of an exemption certificate.

TO |

|

|

Date |

|

|

|

|

(Name of Seller) |

|

|

|

|

|

|

|

|

|

|

Address |

City |

State |

ZIP |

|

The undersigned certifies that:

(1)They hold a valid Certificate of Authority (number shown above) to collect State of New Jersey Sales and Use Tax.

(2)They are principally engaged in the sale of (indicate nature of merchandise or service sold):

(3)The merchandise or services being herein purchased are described as follows:

(4)The merchandise described in (3) above is being purchased: (check one or more of the blocks which apply)

(a)

(b)

(c)

For resale in its present form.

For resale as converted into or as a component part of a product by the undersigned.

For use in the performance of a taxable service on personal property, where the property which is the subject of this Certificate becomes part of the property being serviced or is later transferred to the purchaser of the service in conjunction with the performance of the service

(5) The services described in (3) above are being purchased: (check the block which applies)

(a)

(b)

By seller who will either collect tax or will resell services.

To be performed on personal property held for sale.

I, the undersigned purchaser, have read and complied with the instructions and rules promulgated pursuant to the New Jersey Sales and Use Tax Act with respect to the use of the Resale Certificate, and it is my belief that the seller named herein is not required to collect the sales or use tax on the transaction or transactions covered by this Certificate. The undersigned purchaser hereby swears under the penalties for perjury and false swearing that all of the information shown in this Certificate is true.

NAME OF PURCHASER* |

(as registered with the New Jersey Division of Taxation) |

(Address of Purchaser)*

Type of Business*

(Signature of owner, partner, officer of corporation, etc.)* |

(Title) |

*Required |

MAY BE REPRODUCED |

|

(Front and Back Required) |

INSTRUCTIONS FOR USE OF RESALE CERTIFICATES –

1.Registered sellers who accept fully completed exemption certificates within 90 days subsequent to the date of sale are relieved of liability for the collection and payment of sales tax on the transactions covered by the exemption certificate. The following information must be obtained from a purchaser in order for the exemption certificate to be fully completed:

•Purchaser’s name and address;

•Type of business;

•Reason(s) for exemption;

•Purchaser’s New Jersey tax identification number or, for a purchaser that is not registered in New Jersey, the

Federal employer identification number or

•If a paper exemption certificate is used (including fax), the signature of the purchaser.

The seller’s name and address are not required and are not considered when determining if an exemption certificate is fully completed. A seller that enters data elements from paper into an electronic format is not required to retain the paper exemption certificate.

The seller may, therefore, accept this certificate as a basis for exempting sales to the signatory purchaser and is relieved of liability even if it is determined that the purchaser improperly claimed the exemption. If it is determined that the purchaser improperly claimed an exemption, the purchaser will be held liable for the nonpayment of the tax.

2.Retention of Certificates - Certificates must be retained by the seller for a period of not less than four years from the date of the last sale covered by the certificate. Certificates must be in the physical possession of the seller and available for inspection.

3.Acceptance of an exemption certificate in an audit situation - On and after October 31, 2011, if the seller either has not obtained an exemption certificate or the seller has obtained an incomplete exemption certificate, the seller has at least 120 days after the Division’s request for substantiation of the claimed exemption to either:

1.Obtain a fully completed exemption certificate from the purchaser, taken in good faith, which, in an audit situation, means that the seller obtain a certificate claiming an exemption that:

(a)was statutorily available on the date of the transactions, and

(b)could be applicable to the item being purchased, and

(c)is reasonable for the purchaser’s type of business; OR

2.Obtain other information establishing that the transaction was not subject to the tax.

If the seller obtains this information, the seller is relieved of any liability for the tax on the transaction unless it is discovered through the audit process that the seller had knowledge or had reason to know at the time such information was provided that the information relating to the exemption claimed was materially false or the seller otherwise knowingly participated in activity intended to purposefully evade the tax that is properly due on the transaction. The burden is on the Division to establish that the seller had knowledge or had reason to know at the time the information was provided that the information was materially false.

4.Additional Purchases by Same Purchaser - This certificate will serve to cover additional purchases by the same purchaser of the same general type of property. However, each subsequent sales slip or purchase invoice based on this Certificate must show the purchaser’s name, address and New Jersey, Federal, or out of state registration number for your purpose of verification.

5.Retention of Certificates - Certificates must be retained by the seller for a period of not less than four years from the date of the last sale covered by the certificate. Certificates must be in the physical possession of the seller and available for inspection on or before the 90th day following the date of the transaction to which the certificate relates.

EXAMPLES OF PROPER USE OF RESALE CERTIFICATE

a. A retail household appliance store owner issues a Resale Certificate when purchasing household appliances from a supplier for resale. b. A furniture manufacturer issues a Resale Certificate to cover the purchase of lumber to be used in manufacturing furniture for sale.

c. An automobile service station operator issues a Resale Certificate to cover the purchase of auto parts to be used in repairing customers cars.

EXAMPLES OF IMPROPER USE OF RESALE CERTIFICATE

In the examples below, the seller should not accept Resale Certificates, but should insist upon payment of the sales tax. a. A lumber dealer can not accept a Resale Certificate from a tire dealer who is purchasing lumber for use in altering their premises.

b. A distributor may not issue a Resale Certificate on purchases of cleaning supplies and other materials for their own office maintenance, even though they are in the business of distributing such supplies.

c. A retailer may not issue a Resale certificate on purchases of office equipment for their own use, even though they are in the business of selling office equipment.

d. A supplier can not accept a Resale Certificate from a service station owner who purchases tools and testing equipment for use in their business.

REPRODUCTION OF RESALE CERTIFICATE FORMS: Private reproduction of both sides of Resale Certificates may be made without the prior permission of the Division of Taxation.

FOR MORE INFORMATION: Read publication

https://www.state.nj.us/treasury/pdf/pubs/sales/su6.pdf

DO NOT MAIL THIS FORM TO THE DIVISION OF TAXATION

This form is to be completed by purchaser and given to and retained by seller.

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The ST-3 form is used in New Jersey for a purchaser to claim exemption from sales tax on purchases meant for resale, or when the purchased goods or services are used in production or as part of a taxable service. |

| Governing Law | This form is governed by the New Jersey Sales and Use Tax Act, which outlines the requirements for tax exemption on certain sales and purchases within the state. |

| Requirements for Completion | To be fully completed, the form requires the purchaser's name and address, type of business, reason for exemption, and the New Jersey tax identification number, among other specifics. A signature is required if a paper exemption certificate is used. |

| Retainment and Acceptance | Sellers must retain the certificates for at least four years from the date of the last sale covered by the certificate and have them readily available for inspection. Accepting a fully completed exemption certificate relieves sellers from the liability for the collection and payment of sales tax on the transactions covered. |

Instructions on Utilizing St 3 New Jersey

When businesses engage in transactions where goods or services are bought for the purpose of resale, it's crucial to handle the paperwork correctly to ensure compliance with tax laws. The New Jersey ST-3 form is an essential document in these scenarios, used to claim sales and use tax exemptions for items or services purchased for resale. The process of accurately completing this form is straightforward but requires attention to detail. The following steps are designed to guide through this process efficiently.

Steps for Filling Out the ST-3 New Jersey Form- Begin by entering the Date of the sale at the top of the form.

- Write the Name of the Seller, along with the seller's Address, City, State, and ZIP code in the designated areas.

- Under the section titled "The undersigned certifies that:", fill in the purchaser’s New Jersey Taxpayer Registration Number in the provided space.

- Indicate the general nature of the merchandise or service sold by writing a brief description.

- Describe the merchandise or services being purchased in the space provided. Be specific to ensure clarity.

- Check the appropriate box(es) that describe how the merchandise will be used:

- (a) For resale in its present form.

- (b) For resale as converted into or as a component part of a product by the undersigned.

- (c) For use in the performance of a taxable service on personal property.

- For services, tick the box that accurately represents the purpose of the service purchase:

- (a) By seller who will either collect tax or will resell services.

- (b) To be performed on personal property held for sale.

- Enter the NAME OF PURCHASER, as registered with the New Jersey Division of Taxation, and the purchaser’s address.

- Specify the Type of Business of the purchaser.

- Sign the form in the designated area and print the Title of the signee next to the signature.

- Ensure all required fields marked with an asterisk (*) are completed to validate the form.

After the ST-3 New Jersey form is fully completed and signed, it should not be mailed to the Division of Taxation but instead given to and retained by the seller. Sellers are responsible for keeping this document on file for a period of not less than four years from the date of the last sale covered by the certificate. This form plays a crucial role in documenting tax-exempt transactions, making it pivotal for both parties to manage it accurately and maintain it for future reference or in case of audits.

Obtain Answers on St 3 New Jersey

What is the purpose of the ST-3 Resale Certificate in New Jersey?

The ST-3 Resale Certificate is used in New Jersey to certify that a purchase is being made for resale and not for personal use. This allows the seller to not collect sales tax on transactions where the goods or services purchased will be resold by the purchaser. It is a declaration by the purchaser that the items or services bought will either be sold as is, used in the production of goods to be sold, or used in taxable services where the item becomes part of the property being serviced. The certificate must be fully completed and given to the seller, who is then exempt from collecting sales tax on these transactions.

How does a seller use the ST-3 Resale Certificate?

Sellers who receive a fully completed ST-3 Resale Certificate from a purchaser within 90 days of the sale date can exclude the sale from being taxed. To ensure the exemption certificate is fully completed, it must include the purchaser's name and address, type of business, reason for exemption, and the purchaser's New Jersey tax identification number or federal or out-of-state registration number. If using a paper exemption certificate, it must also include the signature of the purchaser. Once accepted by the seller, the seller is relieved from the liability of collecting sales tax on those transactions, assuming the certificate was accepted in good faith.

What are the rules for retaining the ST-3 Resale Certificate?

Sellers must retain the ST-3 Resale Certificates for at least four years from the date of the last sale covered by the certificate. The certificates need to be readily accessible for inspection and should be in the physical possession of the seller. This retention is critical for audit purposes, helping verify that sales tax liability was appropriately managed.

What happens if a seller has an incomplete ST-3 Resale Certificate during an audit?

If, during an audit, it is discovered that a seller did not obtain an exemption certificate or obtained an incomplete one, the seller has at least 120 days after the auditor's request to obtain a fully completed exemption certificate from the purchaser. Alternatively, the seller can provide other substantive evidence proving the transaction was not subject to sales tax. If the seller can provide this evidence, they are relieved from liability unless it's proven that they knew the information provided was false or aimed to evade tax payments.

Are there guidelines for what constitutes an improper use of the ST-3 Resale Certificate?

Yes, the ST-3 Resale Certificate must only be used for purchases intended for resale. It should not be used for personal purchases or for goods and services that will not be resold. For example, a retailer cannot use the certificate to buy office equipment for their use even if they sell such equipment. Accepting a resale certificate for non-qualifying purchases can lead to the collection and payment of sales tax by the seller, and misuse by the purchaser could result in being held liable for the unpaid tax.

Common mistakes

Filling out the ST-3 New Jersey Resale Certificate form might seem straightforward, but mistakes can easily happen. These errors can lead to complications, such as tax liabilities or penalties for both the buyer and the seller. Below are nine common mistakes people make when completing the form:

- Not providing complete purchaser information: Failing to fill in all required fields regarding the purchaser's information, including the name, New Jersey Taxpayer Registration Number, address, and the type of business, can render the certificate invalid.

- Omitting the type of business: The form specifically requests the type of business of the purchaser. Overlooking this detail can lead to the disqualification of the exemption.

- Incorrect reasons for exemption: Carefully checking the applicable reasons for tax exemption and only selecting those that accurately represent the transaction is crucial. Misunderstanding the exemptions can result in improper filing.

- Leaving the seller’s information blank: Even though the seller’s name and address are not required for the exemption certificate to be considered complete, providing this information can help prevent any confusion or disputes down the line.

- Unsigned certificates: An unsigned certificate is like an unsigned check – it’s not valid. The purchaser’s signature is mandatory to certify the accuracy of the information provided.

- Using the certificate for non-qualifying purchases: Utilizing the resale certificate for personal use items or for products not intended for resale is a misuse of the certificate and can result in penalties.

- Failure to renew or update the certificate: Since business information can change, using an outdated certificate with old business details or expired registration numbers can invalidate the document.

- Not keeping a copy for records: Both buyers and sellers are required to retain a copy of the completed certificate for at least four years. Not doing so can prove problematic in case of an audit.

- Lack of verification: On the seller’s part, failing to verify the validity of the purchaser’s New Jersey Taxpayer Registration Number and other provided details can lead to the acceptance of a fraudulent exemption certificate.

Avoiding these mistakes can contribute to a smoother transaction for both parties involved. Being meticulous and ensuring all details are correctly filled out and truthful can prevent any future complications with tax exemption claims.

Documents used along the form

When dealing with transactions exempt from sales and use tax in New Jersey, particularly using the ST-3 form, it's often part of a larger process that requires attention to detail and adherence to specific regulatory requirements. The following documents frequently accompany the ST-3 form to ensure that all bases are covered in transactions where sales tax is not collected due to a valid exemption status.

- Certificate of Authority: This document is proof that a business is registered to collect state sales tax in New Jersey. It's a prerequisite for completing the ST-3 form, as it substantiates a seller's or purchaser's eligibility to partake in tax-exempt transactions.

- New Jersey Business Registration Certificate: Before engaging in commerce, companies operating in New Jersey must register with the state. This certificate is evidence of such registration and is necessary for obtaining a Certificate of Authority.

- Federal Employer Identification Number (FEIN) Documentation: For businesses not based in New Jersey or newly-established businesses, presenting FEIN documentation is crucial when they don't yet have state-specific identification but need to engage in exempt transactions.

- Resellers Permit: Similar to the ST-3 form, a reseller's permit confirms that purchases are for resale and not subject to sales tax at the time of purchase. This permit reinforces the purpose behind the exemption claimed on the ST-3 form.

- Exempt Use Certificate (ST-4): For purchases that are exempt from sales tax because they're used in a manner qualifying as exempt (like manufacturing or producing goods for sale), the ST-4 form supplements the ST-3 by detailing the nature of the exempt use.

- Capital Improvement Certificate (ST-8): When materials or services are purchased for capital improvements rather than for resale, this certificate is used to distinguish the transactions as exempt from sales tax, complementing the information on an ST-3 form.

Understanding and properly utilizing these forms and documents can greatly smooth the process of conducting sales tax-exempt transactions in New Jersey. Each document serves its unique role in substantiating the eligibility for a tax exemption, making them integral pieces of the tax compliance puzzle for businesses operating within the state.

Similar forms

Uniform Sales & Use Tax Exemption/Resale Certificate (Multijurisdiction): Like the ST-3 Form in New Jersey, this certificate allows a business to purchase goods or services tax-free, provided they intend to resell them. Both forms require the purchaser's tax identification number and a declaration of the intended resale or exemption purpose, ensuring that sales tax is not paid at the point of purchase but collected when the items are later sold to the end consumer.

California Resale Certificate (CDTFA-230): Similar to the New Jersey ST-3, the California Resale Certificate allows retailers to purchase goods without paying state sales tax if those goods are intended for resale. Both documents necessitate the disclosure of business and resale information. The principal difference is jurisdiction - one applies within New Jersey, while the other is specific to California - yet their functional purpose aligns closely.

New York Resale Certificate (ST-120): This document functions similarly to the ST-3 by enabling registered sellers in New York to buy goods tax-free for resale. Both certificates require pertinent details about the buyer's business and the nature of the transaction to confirm eligibility for sales tax exemption. Each emphasizes compliance with state-specific tax laws, ensuring that retailers properly manage tax liabilities.

Florida Annual Resale Certificate for Sales Tax (DR-13): Issued by the Florida Department of Revenue, this certificate parallels the ST-3 in its purpose: permitting businesses to make tax-exempt purchases that will be resold. Both demand that businesses provide their tax registration numbers and specify the goods or services intended for resale. An essential similarity is their role in facilitating tax compliance among businesses, ensuring that sales tax is correctly applied and collected downstream from the final consumer.

Dos and Don'ts

When filling out the ST-3 New Jersey form, it's crucial to ensure accuracy and compliance with the state's guidelines. Below are recommendations to help guide you through the process.

Do:- Ensure all required fields are completed: This includes the purchaser’s name and address, type of business, reason(s) for exemption, New Jersey tax identification number, and the signature of the purchaser if a paper exemption certificate is used.

- Check the appropriate boxes for the reasons for exemption: Clearly indicate whether the merchandise or services are purchased for resale, as a component part of a product, for use in the performance of a taxable service, or for any other eligible exemption reason provided on the form.

- Retain the certificate for the required duration: Sellers must keep the fully completed exemption certificate for not less than four years from the date of the last sale covered by the certificate.

- Review the certificate for completeness and accuracy before submission: Before the certificate is given to the seller, double-check that all information is accurately provided and that the certificate is fully completed to ensure compliance.

- Leave any required information blank: An incomplete form can invalidate the exemption, making the transaction subject to sales tax and potentially resulting in penalties or interest for non-compliance.

- Use the certificate for ineligible purchases: Misuse of the exemption certificate for personal purchases or for items not intended for resale or exempt use as described can result in liability for the sales tax, penalties, and interest.

- Overlook the signature requirement: If using a paper exemption certificate, the purchaser's signature is mandatory. An unsigned form may be considered incomplete and not valid for sales tax exemption.

- Fail to verify the purchaser’s eligibility: Sellers should ensure that the purchaser’s claimed exemption aligns with their type of business and the nature of the merchandise or services purchased. Inappropriate use of the exemption certificate can lead to an audit and potential penalties.

Misconceptions

Understanding the New Jersey ST-3 Resale Certificate can sometimes be confusing, and a few misconceptions often arise regarding its use and requirements. Here are six common misconceptions and clarifications to help demystify the process.

- Only New Jersey based businesses can use the ST-3 form. This is a misconception. While the ST-3 form is primarily for New Jersey transactions, out-of-state businesses can also use this form if they have a New Jersey Taxpayer Registration Number, or they can provide their Federal employer identification number or out-of-state registration number if they are not registered in New Jersey.

- The seller’s information is crucial for the form’s validity. Actually, the seller’s name and address are not necessary for determining the validity of the exemption certificate. The focus is on the purchaser’s ability to provide a fully completed certificate that complies with the guidelines set forth by the New Jersey Division of Taxation.

- Physical copies of the ST-3 form must always be retained. While retaining records is essential, sellers who input data from paper forms into an electronic format are not required to keep the physical copies. As long as the data is accurate and can be verified, electronic records fulfill the requirement for record-keeping.

- Any type of purchase can be exempted using the ST-3 form. This is incorrect. The ST-3 form is specifically designed for purchases intended for resale, as a component part of a product, or for use in a taxable service where the service is rendered on personal property. It cannot be used for personal purchases or for items not intended for resale or use in a taxable service.

- Submitting an ST-3 exempts the purchaser from all sales tax responsibilities. This is a misunderstanding. While presenting a fully completed ST-3 form exempts the seller from the requirement to collect sales tax on that transaction, the purchaser may still be responsible for ensuring that the exemption is correctly applied. If it is later found that the exemption was improperly claimed, the purchaser could be held liable for the tax.

- An ST-3 form is a one-time submission for a specific purchase. Actually, the ST-3 form can cover additional purchases of the same general type of property by the same purchaser. This means that once a valid ST-3 certificate is on file with the seller, it can be referenced for future transactions of a similar nature, streamlining the process for both the buyer and seller.

It's essential for both purchasers and sellers to understand these aspects of the New Jersey ST-3 Resale Certificate to ensure its correct use and compliance with state taxation laws.

Key takeaways

Filling out the ST-3 New Jersey Sales Tax Resale Certificate accurately is crucial for both buyers and sellers in keeping tax compliance and operations smooth. Here are some key takeaways about using and handling the ST-3 form effectively:

- Timely Submission: Sellers must receive a fully completed exemption certificate from the purchaser within 90 days subsequent to the sale to be relieved of the liability for the collection and payment of sales tax on the transaction. Ensuring the certificate is fully completed and submitted on time is essential for compliance.

- Mandatory Information: The ST-3 form requires specific information from the purchaser, including the New Jersey Taxpayer Registration Number or, for out-of-state businesses, a similar identification number. The form must also detail the type of business, the reason for exemption, and a description of merchandise or services purchased for resale. This detailed information is mandatory for the form to be considered fully completed.

- Retention of Certificates: Retention of fully completed exemption certificates is critical. Sellers are required to retain the certificates for not less than four years from the date of the last sale covered by the certificate. These documents must be readily available for inspection, ensuring that sellers can provide proof of exemption if audited.

- Audit Situations: In the event of an audit, if a seller has not obtained or has only obtained an incomplete exemption certificate, they have at least 120 days upon the auditor's request to either obtain a fully completed exemption certificate from the purchaser or to provide other information establishing that the transaction was not subject to tax. This grace period allows sellers to rectify documentation issues post-sale but underscores the importance of obtaining full and accurate documentation upfront.

Understanding and adhering to these guidelines will help ensure that transactions are processed accurately and that both buyers and sellers are protected under New Jersey's tax laws. The aim is not only to simplify the sales process but also to provide clarity and compliance in transactions that qualify for sales tax exemptions.

Popular PDF Forms

Costco Cake Order Form - Clarifies pricing for various customization options, providing transparency and helping customers stay within budget.

Mt 199 Swift Nedir - It specifies the amount both in numbers and words to avoid any discrepancies or misinterpretations regarding the financial commitment.