Blank Standard 2 T PDF Template

The Standard 2 T form is a comprehensive document that lays out the terms and conditions under which the sale and purchase of real estate property are agreed upon by both buyer and seller. It specifies the detailed information regarding the real property, including its location and legal description, and outlines the fixtures and personal property to be included in the sale, ensuring clarity on what remains with the property upon sale. The form also elaborates on the financial aspects of the deal such as the purchase price, earnest money deposit, and the method of payment, including provisions for escrow arrangements. Special attention is given to conditional aspects of the contract that need to be met before finalizing the sale, such as obtaining financing, property inspections, and the satisfactory condition of the property at the time of sale. The document includes clauses about prorations, adjustments, and who bears the responsibility for specific expenses associated with the purchase. Further, it provides details regarding risk of loss, the survival of certain agreements post-closing, and the binding nature of the agreement on both parties and their successors. This form serves as a critical tool in real estate transactions, facilitating clear communication and understanding between all parties involved, and ensuring that legal requirements are thoroughly addressed. As such, it's advisable for individuals engaging in the sale or purchase of property to consult with a North Carolina real estate attorney to ensure that their interests are adequately protected and that they fully understand the legal implications of the agreement.

Preview - Standard 2 T Form

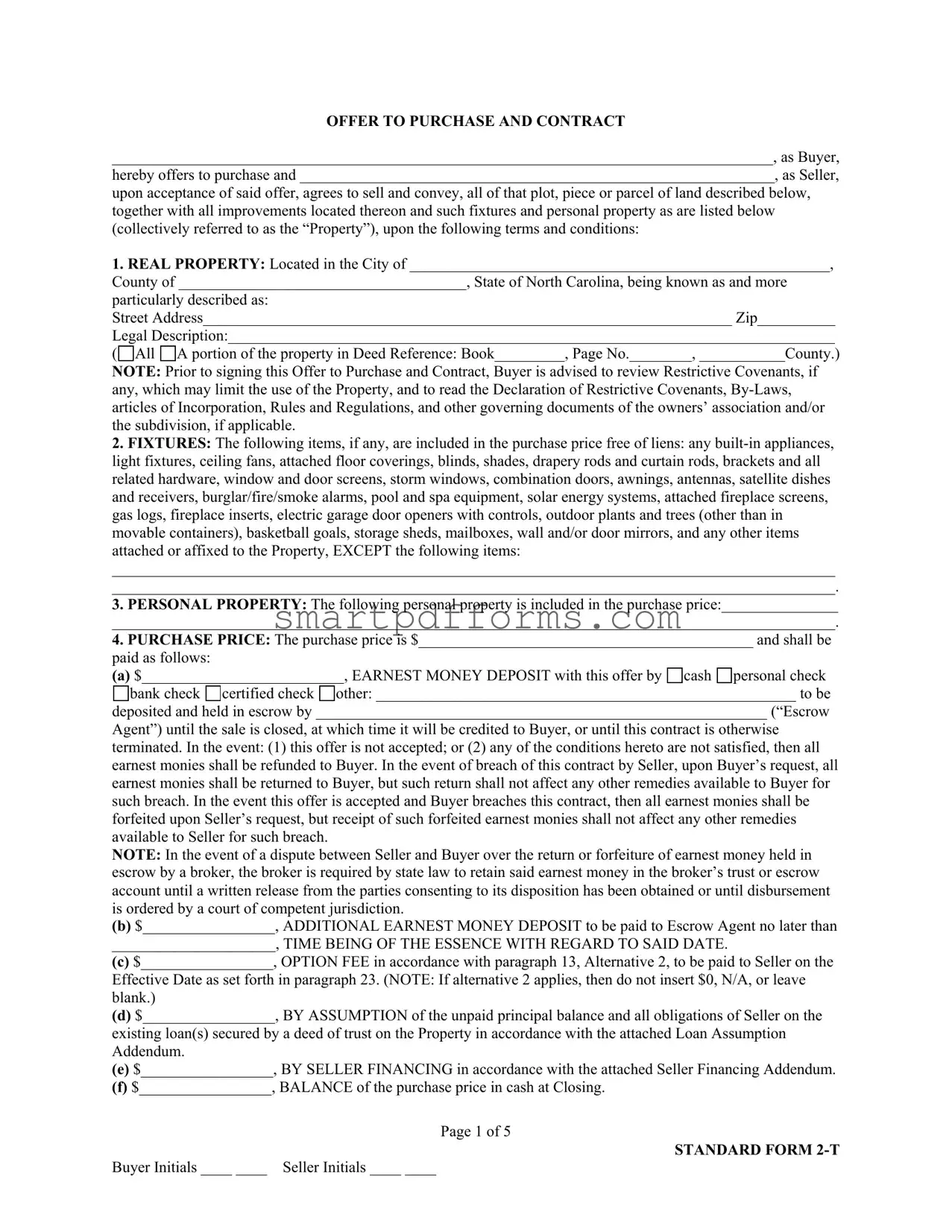

OFFER TO PURCHASE AND CONTRACT

_____________________________________________________________________________________, as Buyer,

hereby offers to purchase and _____________________________________________________________, as Seller,

upon acceptance of said offer, agrees to sell and convey, all of that plot, piece or parcel of land described below, together with all improvements located thereon and such fixtures and personal property as are listed below (collectively referred to as the “Property”), upon the following terms and conditions:

1.REAL PROPERTY: Located in the City of ______________________________________________________, County of _____________________________________, State of North Carolina, being known as and more particularly described as:

Street Address____________________________________________________________________ Zip__________

Legal Description:______________________________________________________________________________

(

All

All

A portion of the property in Deed Reference: Book_________, Page No.________, ___________County.)

A portion of the property in Deed Reference: Book_________, Page No.________, ___________County.)

NOTE: Prior to signing this Offer to Purchase and Contract, Buyer is advised to review Restrictive Covenants, if any, which may limit the use of the Property, and to read the Declaration of Restrictive Covenants,

2.FIXTURES: The following items, if any, are included in the purchase price free of liens: any

_____________________________________________________________________________________________

_____________________________________________________________________________________________.

3.PERSONAL PROPERTY: The following personal property is included in the purchase price:_______________

_____________________________________________________________________________________________.

4.PURCHASE PRICE: The purchase price is $___________________________________________ and shall be paid as follows:

(a) $__________________________, EARNEST MONEY DEPOSIT with this offer by

cash

cash

personal check

personal check

bank check

certified check

certified check

other: ______________________________________________________ to be

other: ______________________________________________________ to be

deposited and held in escrow by __________________________________________________________ (“Escrow

Agent”) until the sale is closed, at which time it will be credited to Buyer, or until this contract is otherwise terminated. In the event: (1) this offer is not accepted; or (2) any of the conditions hereto are not satisfied, then all earnest monies shall be refunded to Buyer. In the event of breach of this contract by Seller, upon Buyer’s request, all earnest monies shall be returned to Buyer, but such return shall not affect any other remedies available to Buyer for such breach. In the event this offer is accepted and Buyer breaches this contract, then all earnest monies shall be forfeited upon Seller’s request, but receipt of such forfeited earnest monies shall not affect any other remedies available to Seller for such breach.

NOTE: In the event of a dispute between Seller and Buyer over the return or forfeiture of earnest money held in escrow by a broker, the broker is required by state law to retain said earnest money in the broker’s trust or escrow account until a written release from the parties consenting to its disposition has been obtained or until disbursement is ordered by a court of competent jurisdiction.

(b)$_________________, ADDITIONAL EARNEST MONEY DEPOSIT to be paid to Escrow Agent no later than

_____________________, TIME BEING OF THE ESSENCE WITH REGARD TO SAID DATE.

(c)$_________________, OPTION FEE in accordance with paragraph 13, Alternative 2, to be paid to Seller on the Effective Date as set forth in paragraph 23. (NOTE: If alternative 2 applies, then do not insert $0, N/A, or leave blank.)

(d)$_________________, BY ASSUMPTION of the unpaid principal balance and all obligations of Seller on the existing loan(s) secured by a deed of trust on the Property in accordance with the attached Loan Assumption Addendum.

(e)$_________________, BY SELLER FINANCING in accordance with the attached Seller Financing Addendum.

(f)$_________________, BALANCE of the purchase price in cash at Closing.

Page 1 of 5

STANDARD FORM

Buyer Initials ____ ____ Seller Initials ____ ____

5.CONDITIONS: (State N/A in each blank that is not a condition to this contract.)

(a) Buyer must be able to obtain a

FHA

FHA

VA (attach FHA/VA Financing Addendum)

VA (attach FHA/VA Financing Addendum)

Conventional

Conventional

Other: _______________________ loan at a

Fixed Rate

Fixed Rate

Adjustable Rate in the principal amount of

Adjustable Rate in the principal amount of

_______________________________ (plus any financed VA Funding Fee or FHA MIP) for a term of

___________ year(s), at an initial interest rate not to exceed ____________ % per annum, with mortgage loan

discount points not to exceed ______ % of the loan amount. Buyer shall apply for said loan within ________ days of

the Effective Date of this contract. Buyer shall use Buyer’s best efforts to secure the lender’s customary loan commitment letter on or before __________________________________ and to satisfy all terms and conditions of

the loan commitment letter by Closing. After the above letter date, Seller may request in writing from Buyer a copy of the loan commitment letter. If Buyer fails to provide Seller a copy of the loan commitment letter or a written waiver of this loan condition within five days of receipt of Seller’s request, Seller may terminate this contract by written notice to Buyer at any time thereafter, provided Seller has not then received a copy of the letter or the waiver.

(b)There must be no restriction, easement, zoning or other governmental regulation that would prevent the reasonable use of the Property for _________________________________________________________ purposes.

(c)The Property must be in substantially the same or better condition at Closing as on the date of this offer reasonable wear and tear excepted.

(d)All deeds of trust, liens and other charges against the Property, not assumed by Buyer, must be paid and satisfied by Seller prior to or at Closing such that cancellation may be promptly obtained following Closing. Seller shall remain obligated to obtain any such cancellations following Closing.

(e)Title must be delivered at Closing by GENERAL WARRANTY DEED unless otherwise stated herein, and must be fee simple marketable and insurable title, free of all encumbrances except: ad valorem taxes for the current year (prorated through the date of Closing); utility easements and unviolated restrictive covenants that do not materially affect the value of the Property; and such other encumbrances as may be assumed or specifically approved by Buyer. The Property must have legal access to a public right of way.

6. SPECIAL ASSESSMENTS: Seller warrants that there are no pending or confirmed governmental special assessments for sidewalk, paving, water, sewer, or other improvements on or adjoining the Property, and no pending or confirmed owners’ association special assessments, except as follows: __________________________________

_____________________________________________________________________________________________. (Insert “None” or the identification of such assessments, if any.) Seller shall pay all owners’ association assessments and all governmental assessments confirmed through the time of Closing, if any, and Buyer shall take title subject to all pending assessments, if any, unless otherwise agreed as follows: ______________________________________

_____________________________________________________________________________________________. 7. PRORATIONS AND ADJUSTMENTS: Unless otherwise provided, the following items shall be prorated and either adjusted between the parties or paid at Closing: (a) Ad valorem taxes on real property shall be prorated on a calendar year basis through the date of Closing; (b) Ad valorem taxes on personal property for the entire year shall be paid by the Seller unless the personal property is conveyed to the Buyer, in which case, the personal property taxes shall be prorated on a calendar year basis through the date of Closing; (c) All late listing penalties, if any, shall be paid by Seller; (d) Rents, if any, for the Property shall be prorated through the date of Closing; (e) Owners’ association dues and other like charges shall be prorated through the date of Closing. Seller represents that the regular owners’ association dues, if any, are $_______________ per __________________.

8. EXPENSES: Buyer shall be responsible for all costs with respect to any loan obtained by Buyer. Buyer shall pay for recording the deed and for preparation and recording of all instruments required to secure the balance of the purchase price unpaid at Closing. Seller shall pay for preparation of a deed and all other documents necessary to perform Seller’s obligations under this agreement, and for excise tax (revenue stamps) required by law. Seller shall pay at closing $______________________ toward any of the Buyer’s expenses associated with the purchase of the Property, including any FHA/VA lender and inspection costs that Buyer is not permitted to pay, but excluding any portion disapproved by Buyer’s lender.

9. FUEL: Buyer agrees to purchase from Seller the fuel, if any, situated in any tank on the Property at the prevailing rate with the cost of measurement thereof, if any, being paid by Seller.

10. EVIDENCE OF TITLE: Seller agrees to use his best efforts to deliver to Buyer as soon as reasonably possible after the Effective Date of this contract, copies of all title information in possession of or available to Seller, including but not limited to: title insurance policies, attorney’s opinions on title, surveys, covenants, deeds, notes and deeds of trust and easements relating to the Property. Seller authorizes (1) any attorney presently or previously representing Seller to release and disclose any title insurance policy in such attorney's file to Buyer and both Buyer's and Seller's agents and attorneys; and (2) the Property’s title insurer or its agent to release and disclose all materials

Page 2 of 5

STANDARD FORM

Buyer Initials ____ ____ Seller Initials ____ ____

in the Property's title insurer's (or title insurer's agent's) file to Buyer and both Buyer's and Seller's agents and attorneys.

11.LABOR AND MATERIAL: Seller shall furnish at Closing an affidavit and indemnification agreement in form satisfactory to Buyer showing that all labor and materials, if any, furnished to the Property within 120 days prior to the date of Closing have been paid for and agreeing to indemnify Buyer against all loss from any cause or claim arising there from.

12.PROPERTY DISCLOSURE:

Buyer has received a signed copy of the N.C. Residential Property Disclosure Statement prior to the signing of this Offer to Purchase and Contract.

Buyer has received a signed copy of the N.C. Residential Property Disclosure Statement prior to the signing of this Offer to Purchase and Contract.

Buyer has NOT received a signed copy of the N.C. Residential Property Disclosure Statement prior to the signing of this Offer to Purchase and Contract and shall have the right to terminate or withdraw this contract without penalty prior to WHICHEVER OF THE FOLLOWING EVENTS OCCURS FIRST: (1) the end of the third calendar day following receipt of the Disclosure Statement; (2) the end of the third calendar day following the date the contract was made; or (3) Closing or occupancy by the Buyer in the case of a sale or exchange.

Buyer has NOT received a signed copy of the N.C. Residential Property Disclosure Statement prior to the signing of this Offer to Purchase and Contract and shall have the right to terminate or withdraw this contract without penalty prior to WHICHEVER OF THE FOLLOWING EVENTS OCCURS FIRST: (1) the end of the third calendar day following receipt of the Disclosure Statement; (2) the end of the third calendar day following the date the contract was made; or (3) Closing or occupancy by the Buyer in the case of a sale or exchange.

Exempt from N.C. Residential Property Disclosure Statement because (SEE GUIDELINES)

___________________________________________________________________________________________.

The Property is residential and was built prior to 1978 (Attach

The Property is residential and was built prior to 1978 (Attach

13.PROPERTY INSPECTION, APPRAISAL, INVESTIGATION (Choose ONLY ONE of the following

Alternatives):

ALTERNATIVE 1:

ALTERNATIVE 1:

(a) Property Inspection: Unless otherwise stated herein, Buyer shall have the option of inspecting, or obtaining at Buyer’s expense inspections, to determine the condition of the Property. Unless otherwise stated herein, it is a condition of this contract that: (i) the

(b)

(c) Repairs: Pursuant to any inspections in (a) and/or (b) above, if any repairs are necessary, Seller shall have the option of completing them or refusing to complete them. If Seller elects not to complete the repairs, then Buyer shall have the option of accepting the Property in its present condition or terminating this contract, in which case all earnest monies shall be refunded. Unless otherwise stated herein, any items not covered by (a)(i), (a)(ii), (a)(iii) and

(b) above are excluded from repair negotiations under this contract.

(d) Radon Inspection: Buyer shall have the option, at Buyer's expense, to have the Property tested for radon on or before the date for completion of inspections as set forth in paragraph 13 (a) above. The test result shall be deemed satisfactory to Buyer if it indicates a radon level of less than 4.0 pico curies per liter of air (as of January 1, 1997, EPA guidelines reflect an "acceptable" level as anything less than 4.0 pico curies per liter of air). If the test result exceeds the

Page 3 of 5

STANDARD FORM

Buyer Initials ____ ____ Seller Initials ____ ____

bring the radon level within the satisfactory range, Buyer shall have the option of: a) accepting the Property with its then current radon level; or

b) terminating the contract, in which case all earnest monies shall be refunded.

(e)Cost Of Repair Contingency: Notwithstanding the above and as an additional remedy of Buyer, if a reasonable estimate obtained by Buyer of the total cost of repairs required by (a) and (b) and/or remediation required by (d) above equals or exceeds $__________________, then Buyer shall have the option to terminate this contract pursuant to the Cost of Repair Contingency no later than seven days following the inspection date and all earnest monies shall be refunded to Buyer.

(f)Appraisal Contingency: The Property must appraise at a value equal to or exceeding the purchase price or, at the option of Buyer, this contract may be terminated and all earnest monies shall be refunded to Buyer. If this contract is not subject to a financing contingency requiring an appraisal, Buyer shall arrange to have the appraisal completed on or before _____________________________. The cost of the appraisal shall be borne by Buyer.

(g)CLOSING SHALL CONSTITUTE ACCEPTANCE OF THE PROPERTY IN ITS THEN EXISTING CONDITION UNLESS PROVISION IS OTHERWISE MADE IN WRITING.

ALTERNATIVE 2: (This Alternative applies ONLY if Alternative 2 is checked AND Buyer has paid the Option Fee.)

ALTERNATIVE 2: (This Alternative applies ONLY if Alternative 2 is checked AND Buyer has paid the Option Fee.)

(a)Property Investigation with Option to Terminate: In consideration of the sum of $___________________ (do not insert $0, N/A, or leave blank) paid by Buyer to Seller (not Escrow Agent) and other valuable consideration, the receipt and sufficiency of which is hereby acknowledged (the “Option Fee”), Buyer shall have the right to terminate this contract for any reason or no reason, whether related to the physical condition of the Property or otherwise, by delivering to Seller written notice of termination (the “Termination Notice”) by 5:00 p.m. on

_________________________________, 20____, time being of the essence (the “Option Termination Date”). At any time prior to Closing, Buyer shall have the right to inspect the Property at Buyer’s expense (Buyer is advised to have all inspections and appraisals of the Property, including but not limited to those matters set forth in Alternative 1, performed prior to the Option Termination Date).

(b)Exercise of Option: If Buyer delivers the Termination Notice prior to the Option Termination Date, time being of the essence, this contract shall become null and void and all earnest monies received in connection herewith shall be refunded to Buyer; however, the Option Fee will not be refunded and shall be retained by Seller. If Buyer fails to deliver the Termination Notice to Seller prior to the Option Termination Date, then Buyer will be deemed to have accepted the Property in its physical condition existing as of the Option Termination Date, excluding matters of survey. The Option Fee is not refundable, is not a part of any earnest monies, and will be credited to the purchase price at Closing.

(c)CLOSING SHALL CONSTITUTE ACCEPTANCE OF THE PROPERTY IN ITS THEN EXISTING CONDITION UNLESS PROVISION IS OTHERWISE MADE IN WRITING.

14.REASONABLE ACCESS: Seller will provide reasonable access to the Property (including working, existing utilities) through the earlier of Closing or possession by Buyer, to Buyer or Buyer’s representatives for the purposes of appraisal, inspection, and/or evaluation. Buyer may conduct a

15.CLOSING: Closing shall be defined as the date and time of recording of the deed. All parties agree to execute any and all documents and papers necessary in connection with Closing and transfer of title on or before

_______________________________, at a place designated by Buyer. The deed is to be made to

___________________________________________________________.

16.POSSESSION: Unless otherwise provided herein, possession shall be delivered at Closing. In the event

possession is NOT to be delivered at Closing:

a Buyer Possession Before Closing Agreement is attached. OR, a Seller Possession After Closing Agreement is attached.

a Buyer Possession Before Closing Agreement is attached. OR, a Seller Possession After Closing Agreement is attached.

17.OTHER PROVISIONS AND CONDITIONS: (ITEMIZE ALL ADDENDA TO THIS CONTRACT AND ATTACH HERETO.)

18.RISK OF LOSS: The risk of loss or damage by fire or other casualty prior to Closing shall be upon Seller. If the improvements on the Property are destroyed or materially damaged prior to Closing, Buyer may terminate this contract by written notice delivered to Seller or Seller’s agent and all deposits shall be returned to Buyer. In the

Page 4 of 5

STANDARD FORM

Buyer Initials ____ ____ Seller Initials ____ ____

event Buyer does NOT elect to terminate this contract, Buyer shall be entitled to receive, in addition to the Property, any of the Seller’s insurance proceeds payable on account of the damage or destruction applicable to the Property being purchased.

19.ASSIGNMENTS: This contract may not be assigned without the written consent of all parties, but if assigned by agreement, then this contract shall be binding on the assignee and his heirs and successors.

20.PARTIES: This contract shall be binding upon and shall inure to the benefit of the parties, i.e., Buyer and Seller and their heirs, successors and assigns. As used herein, words in the singular include the plural and the masculine includes the feminine and neuter genders, as appropriate.

21.SURVIVAL: If any provision herein contained which by its nature and effect is required to be observed, kept or performed after the Closing, it shall survive the Closing and remain binding upon and for the benefit of the parties hereto until fully observed, kept or performed.

22.ENTIRE AGREEMENT: This contract contains the entire agreement of the parties and there are no representations, inducements or other provisions other than those expressed herein. All changes, additions or deletions hereto must be in writing and signed by all parties. Nothing contained herein shall alter any agreement between a REALTOR® or broker and Seller or Buyer as contained in any listing agreement, buyer agency agreement, or any other agency agreement between them.

23.NOTICE AND EXECUTION: Any notice or communication to be given to a party herein may be given to the party or to such party’s agent. This offer shall become a binding contract (the “Effective Date”) when signed by both Buyer and Seller and such signing is communicated to the offering party. This contract is executed under seal in signed multiple originals, all of which together constitute one and the same instrument, with a signed original being retained by each party and each REALTOR® or broker hereto, and the parties adopt the word “SEAL” beside their signatures below.

Buyer acknowledges having made an

THE NORTH CAROLINA ASSOCIATION OF REALTORS®, INC. AND THE NORTH CAROLINA BAR ASSOCIATION MAKE NO REPRESENTATION AS TO THE LEGAL VALIDITY OR ADEQUACY OF ANY PROVISION OF THIS FORM IN ANY SPECIFIC TRANSACTION. IF YOU DO NOT UNDERSTAND THIS FORM OR FEEL THAT IT DOES NOT PROVIDE FOR YOUR LEGAL NEEDS, YOU SHOULD CONSULT A NORTH CAROLINA REAL ESTATE ATTORNEY BEFORE YOU SIGN IT.

Date: __________________________________ |

|

Date: ________________________________ |

|

Buyer _________________________________ (SEAL) |

Seller _______________________________ (SEAL) |

||

Date: __________________________________ |

|

Date: ________________________________ |

|

Buyer _________________________________ (SEAL) |

Seller _______________________________ (SEAL) |

||

|

|||

Escrow Agent acknowledges receipt of the earnest money and agrees to hold and disburse the same in |

|||

Accordance with the terms hereof. |

|

|

|

Date: ___________________________________ |

Firm: _____________________________________________ |

||

|

|

By: _______________________________________________ |

|

|

|

|

(Signature) |

Selling Agent/Firm/Phone________________________________________________________________________ |

|||

Acting as |

Buyer’s Agent |

Seller’s (sub)Agent Dual Agent |

|

Listing Agent/Firm/Phone________________________________________________________________________ |

|||

Acting as |

Seller’s (sub)Agent Dual Agent |

||

|

|

Page 5 of 5 |

|

|

|

|

STANDARD FORM |

Buyer Initials ____ ____ Seller Initials ____ ____

Form Data

| Fact Name | Description |

|---|---|

| Form Identification | Standard Form 2-T is an "Offer to Purchase and Contract" form. |

| Parties Involved | The agreement involves two primary parties: the Buyer and the Seller. |

| Property Description | Details the plot or parcel of land being sold, including improvements and fixtures. |

| Governing Law | This form is governed by the laws of the State of North Carolina. |

| Financing and Payment | Outlines the purchase price, earnest money deposit, additional deposits, and other financial arrangements. |

| Additional Provisions | Includes clauses on inspections, risk of loss, closing conditions, and legal access to the property. |

Instructions on Utilizing Standard 2 T

Filling out the Standard 2 T form, which is a pivotal document for purchasing real estate in North Carolina, requires careful attention to detail. It's designed to lay out the terms of the offer to purchase and contract, including the property details, purchase price, and conditions of the sale. It's important to review all sections thoroughly and provide accurate information to prevent any misunderstandings or legal issues down the line. Here are the steps to fill out the form:

- Enter the Buyer's full name and the Seller's full name at the top of the form where indicated.

- For the "REAL PROPERTY" section, input the street address, city, county, state, zip code, and legal description of the property being purchased. Include the deed reference book and page number if available.

- In the "FIXTURES" section, list all items included in the purchase price. If certain items are not included, mention them explicitly.

- For the "PERSONAL PROPERTY" section, detail any personal property items that are included with the purchase.

- Under "PURCHASE PRICE", specify the total purchase price and break down the payment as required in sections (a) through (f), including earnest money deposit, additional earnest money deposit, option fee (if applicable), assumption details, seller financing details, and the balance to be paid at closing.

- In the "CONDITIONS" section, state any conditions that apply to the contract. Specify terms related to financing, property use restrictions, property condition at closing, and other relevant conditions.

- Detail any governmental or owners' association special assessments in the "SPECIAL ASSESSMENTS" section.

- Address how taxes, rents, owners' association dues, and other proratable items will be adjusted in the "PRORATIONS AND ADJUSTMENTS" section.

- Complete the "EXPENSES" section by detailing which party will be responsible for various costs associated with the transaction.

- In the "FUEL" section, agree on terms for purchasing any fuel left on the property.

- The "EVIDENCE OF TITLE" section requires the seller to agree to provide the buyer with all relevant title information.

- Fill out the "LABOR AND MATERIAL", "PROPERTY DISCLOSURE", and "PROPERTY INSPECTION, APPRAISAL, INVESTIGATION" sections according to the specific circumstances of your transaction, selecting the appropriate alternative for inspections and specifying any contingencies.

- Ensure access to the property for appraisal, inspection, and investigation as indicated in the "REASONABLE ACCESS" section.

- Specify the closing and possession details, including dates and any agreements on possession before or after closing.

- List any additional provisions or conditions and addenda attached to the contract in the "OTHER PROVISIONS AND CONDITIONS" section.

- Complete sections on risk of loss, assignments, parties involved, survival of provisions, the entire agreement, notice and execution, and acknowledge the advice to consult a North Carolina real estate attorney if needed.

- Enter the dates and have both the buyer and seller sign and seal the form to make the offer official. Remember to include the escrow agent's acknowledgment if applicable.

After filling out the Standard 2 T form, carefully review all entries and double-check for accuracy. Ensuring the form is complete and accurate is crucial for a smooth real estate transaction. Once submitted, the form initiates the formal process of the real estate transaction, leading to further steps such as inspections, appraisals, and finally, closing. Always consult a real estate attorney or a professional if you have questions or need guidance throughout this process.

Obtain Answers on Standard 2 T

Frequently asked questions about the Standard 2-T form, commonly used in North Carolina real estate transactions, can provide clarity on its purpose and how it is utilized in buying or selling property.

- What is the Standard 2-T form?

The Standard 2-T form, officially known as the "Offer to Purchase and Contract," is a legally binding document used in North Carolina real estate transactions. It outlines the terms and conditions under which a buyer offers to purchase property and a seller agrees to sell it. This form includes details about the real property, fixtures and personal property included in the sale, the purchase price, and conditions of the sale. It is designed to ensure that both parties are clear on the agreement's terms, thus minimizing misunderstandings.

- What does the section on fixtures and personal property include?

In the Standard 2-T form, fixtures refer to items permanently attached to the property, like built-in appliances and light fixtures, and are included in the sale price unless specifically excluded. Personal property, on the other hand, includes movable items that the seller agrees to include in the sale, such as furniture or outdoor equipment. The form details which items are considered fixtures and personal property to prevent any disputes over what is included in the sale.

- What is earnest money, and how does it work?

Earnest money is a deposit made by the buyer when they offer to purchase a property, signifying their seriousness about the transaction. It is held in escrow by a third party until the sale closes or is terminated. Should the transaction proceed successfully, the earnest money is credited towards the purchase price. However, if the buyer breaches the contract, they may forfeit this deposit. Alternatively, if the seller breaches the contract or the agreement is legally terminated due to unmet conditions, the earnest money is typically refunded to the buyer.

- Can the buyer back out after an inspection?

Yes, the Standard 2-T form includes provisions for property inspections and appraisals, allowing the buyer to terminate the contract under certain conditions. If inspections reveal substantial issues not agreed to be corrected by the seller, or if the property does not appraise for at least the purchase price, the buyer may have the option to walk away from the deal with their earnest money returned, assuming this is done within the stipulated time frames and conditions outlined in the contract.

- What happens if the property is damaged before closing?

If the property suffers significant damage before the closing date, the buyer has options under the Standard 2-T form. They can choose to terminate the contract, with their deposit returned, or proceed with the sale and receive the seller’s insurance proceeds for the damage. This protects the buyer from being forced into purchasing a property that no longer meets the conditions agreed upon at the time of the offer.

Common mistakes

Not reviewing restrictive covenants and owners’ association documents: Before signing the Standard 2 T form, it is crucial for the buyer to review any restrictive covenants, by-laws, rules, and regulations that might limit the use of the property. Failing to do so can lead to unforeseen restrictions on the property's use.

Omitting fixtures and personal property from the list: The form includes sections to list fixtures and personal property that are part of the purchase. Leaving these sections incomplete or inaccurately filled out can lead to disputes about what is included in the sale.

Inaccurate purchase price and payment details: The purchase price must be clearly stated along with the specifics of the earnest money deposit, additional deposits, and the balance due at closing. Mistakes in this section can cause confusion or legal complications during the sale process.

Ignoring the conditions section: Buyers must be clear about the conditions to which the contract is subject, such as obtaining specific types of financing or the property passing certain inspections. Not addressing these conditions adequately can jeopardize the transaction.

Overlooking the requirement for a property disclosure or lead-based paint addendum: The form stipulates that the buyer should receive a residential property disclosure statement or, for properties built before 1978, a lead-based paint hazards disclosure. Neglecting these disclosures can lead to legal issues post-sale.

Documents used along the form

When parties engage in the process of buying or selling real estate, the Standard 2-T form, which outlines the offer to purchase and contract, is a crucial document. However, to complete a real estate transaction comprehensively and legally protect all parties involved, several other forms and supporting documents are often utilized in conjunction with the Standard 2-T form. Understanding these additional documents is essential for a smooth and effective real estate transaction.

- FHA/VA Financing Addendum: This document is used when the buyer is obtaining a Federal Housing Administration (FHA) or Veterans Affairs (VA) loan to purchase the property. It outlines the specific terms and conditions related to this type of financing, including any required inspections, the apportionment of closing costs, and the satisfactory appraisal of the property.

- Loan Assumption Addendum: If the buyer is assuming the seller's existing mortgage, this addendum details the terms under which the assumption will occur, including the assumption fee, the balance of the mortgage, and any alterations to the terms of the original mortgage.

- Seller Financing Addendum: In cases where the seller offers financing to the buyer, this document outlines the terms of the loan provided by the seller, including the interest rate, repayment schedule, and consequences of default. It is crucial for ensuring that both parties are clear on the financing arrangement.

- Residential Property Disclosure Statement: This is a mandatory disclosure in many jurisdictions, including North Carolina, whereby the seller must inform the buyer of the property's condition, including any known defects or problems. It is designed to give the buyer a comprehensive overview of the property's state before the sale is finalized.

Together with the Standard 2-T form, these documents play a vital role in ensuring that all aspects of the real estate transaction are clearly defined and legally binding. By carefully preparing and reviewing each of these forms, buyers, sellers, and their agents can help to mitigate risks and avoid potential disputes, making the process of buying or selling property more transparent and secure for everyone involved.

Similar forms

The Residential Lease Agreement is similar to the Standard 2-T form in that both delineate the terms of an agreement between two parties. Whereas the Standard 2-T form focuses on the sale and purchase of property, the Residential Lease Agreement outlines the conditions under which a tenant may occupy property owned by a landlord for a specified period.

A Deed of Trust shares similarities with the Standard 2-T form, particularly in the conveyance of interest in real property. However, while the Standard 2-T form is a bilateral agreement for the sale and purchase, a Deed of Trust involves a third party who holds the title for the benefit of the lender until the borrower fulfills the terms of the loan.

The Bill of Sale document resembles the Standard 2-T form in its function to transfer ownership of property from seller to buyer. Both documents outline the specific items being transferred and any conditions of the sale, although a Bill of Sale is typically used for personal property rather than real estate.

A Mortgage Agreement shares the aspect of real property transactions with the Standard 2-T form. Both legal documents involve conditions and terms related to real estate, but a Mortgage Agreement specifically secures a loan on the property until the debt is repaid.

Property Insurance Policies can be akin to parts of the Standard 2-T form, especially those sections dealing with the risk of loss or damage to the property before closing. Both ensure protections are in place for the value and integrity of the property, albeit from different aspects.

The Home Inspection Report aligns with the Standard 2-T form’s sections on property condition and inspections. Each document addresses the importance of identifying and addressing any issues with the property, although the Home Inspection Report does so from an evaluative standpoint rather than contractual terms.

A Title Insurance Commitment parallels the Standard 2-T form’s focus on ensuring clear and marketable title at closing. Both documents deal with the aspects of confirming the property is free of liens or other encumbrances that could affect the sale.

The Loan Assumption Addendum is similar to the financing sections of the Standard 2-T form, where the terms for assuming an existing loan are outlined. Both address the need for agreement on the transfer of financial obligations related to the property.

A Seller’s Disclosure is related to the Standard 2-T form’s sections on property disclosures and inspections. Each requires the seller to disclose known issues that could affect the property’s value or desirability, ensuring the buyer is fully informed before the purchase.

The Real Estate Commission Agreement overlaps with the Standard 2-T form in that both involve aspects of real estate transactions that may require the services of a professional agent. While the Commission Agreement focuses on the terms under which an agent is compensated, the Standard 2-T form encompasses the broader agreement between buyer and seller.

Dos and Don'ts

When filling out the Standard 2-T form, an Offer to Purchase and Contract, accuracy and diligence are key. This form is a critical part of the real estate transaction in North Carolina, outlining the terms and conditions under which a buyer offers to purchase property from a seller. Here are some essential dos and don'ts to keep in mind:

Do:- Read all instructions and notes thoroughly before starting to fill out the form. This ensures you understand the form's requirements and the implications of the information you provide.

- Review restrictive covenants and other governing documents if applicable. Being aware of these restrictions is crucial as they can affect your use and enjoyment of the property.

- Ensure accuracy in filling out the property description, including the legal description and address. Errors in this section can lead to significant legal complications.

- Use clear, legible handwriting or type the information if the form is available in an editable format. This prevents misunderstandings and errors in interpreting your entries.

- Leave blanks in critical sections such as purchase price, earnest money deposit, and personal property included in the sale. If a section does not apply, mark it as N/A (not applicable).

- Overlook the importance of dates, such as those for submitting earnest money deposits, obtaining loan commitment letters, and closing. Incorrect dates can delay the process or jeopardize the transaction.

- Forget to specify conditions of the sale, including any contingent upon obtaining financing, property inspections, and appraisals. Clear conditions prevent disputes later.

- Sign the form without a final review. Double-check all entries, terms, and conditions to ensure they accurately reflect the agreement between the buyer and seller.

Following these guidelines can make the process smoother and help avoid common pitfalls that could jeopardize the real estate transaction. Always consult with a real estate attorney if you have questions or require clarification on any aspect of the form.

Misconceptions

Misconceptions about the Standard 2-T form, a document used in real estate transactions in North Carolina, can complicate the buying and selling process. Clear understanding of this form is essential for both parties to navigate their obligations and rights effectively. Below are six common misconceptions explained:

- It is only a formality and does not require thorough review. Every clause and provision in the Standard 2-T form lays down significant legal obligations and rights between the buyer and the seller. It is crucial for both parties to review and understand every part of the document thoroughly before signing to avoid unforeseen complications.

- All fixtures and personal property are automatically included. The form specifies which fixtures and personal property items are included in the sale. If there is any personal property the buyer expects to keep, it needs to be listed explicitly in the contract. Otherwise, it may not legally be part of the deal.

- Buyers are always required to deposit earnest money. While the Standard 2-T form does have provisions for an earnest money deposit to demonstrate the buyer’s commitment, the terms surrounding the earnest money, including the amount and conditions for refund, are negotiable between the buyer and seller.

- Home inspections are optional. While the form offers an option clause for property inspection, it is generally in the best interest of the buyer to conduct a thorough inspection. This ensures they are fully aware of the condition of the property before the purchase is finalized.

- The seller is responsible for all repairs. The Standard 2-T form allows for negotiation regarding who is responsible for necessary repairs identified during the home inspection. Seller’s willingness to undertake repairs or adjust the price accordingly is subject to agreement between the parties.

- The closing date is fixed and not subject to change. The closing date identified in the Standard 2-T form is initially agreed upon by both parties but can be renegotiated if both the buyer and seller agree. Unforeseen circumstances might necessitate a change in the closing date, which must then be documented in writing.

Both buyers and sellers are advised to get legal advice to fully understand their rights and obligations under the Standard 2-T form. Misinterpretations can lead to legal and financial issues that could have been avoided with proper guidance.

Key takeaways

- Before signing the Standard 2T form, the buyer is encouraged to investigate any restrictive covenants affecting the property's use and to review all relevant documents if the property is part of an owners' association or subdivision.

- The purchase includes not just the land and buildings but also specified fixtures and personal property listed in the agreement, clearly identified to avoid any confusion.

- The agreed-upon purchase price is detailed in the contract, including how it is to be paid—such as earnest money, additional deposits, or financing arrangements—and the responsibilities concerning these payments.

- Conditions of the sale are thoroughly outlined, covering loan approval, property use restrictions, the property's condition at closing, clear title provision, and the handling of any special assessments or charges.

- The contract specifies which items will be prorated and adjusted at closing, like taxes and association dues, clearly delineating financial responsibilities.

- Buyer and seller expenses for the transaction are listed, including who pays for various reports, closing costs, and other specified expenses tied to the sale.

- Any labor and materials provided to the property within a specific time frame before closing must be paid for, with the seller providing an affidavit to this effect, ensuring the buyer is not unexpectedly liable post-purchase.

- The receipt of a N.C. Residential Property Disclosure Statement is a critical step, and its absence permits the buyer to withdraw from the contract under certain conditions without penalty.

- Options for property inspections are delineated, providing a clear path for the buyer to understand the property's condition and negotiate or terminate based on findings.

- The contract allows for an appraisal contingency, giving the buyer an out if the property does not appraise for the purchase price or higher, protecting the buyer's investment.

- Seller's and buyer's rights in cases of the property's loss or damage before closing are clearly stated, indicating who bears the risk and how insurance proceeds are handled.

Popular PDF Forms

Why Is the Signature Card Important When You Open a Checking Account? - Account holders acknowledge the bank's right to rely on the listed signatures for operational instructions until formally revoked, providing consistency in operations.

How to Claim Rent on Taxes Ontario - Management fees and mortgage interest are specified to highlight the ongoing costs associated with property management and financing.

Australia Visa Requirements - The structure of the form, with sections dedicated to each family member, aims to simplify the process of conveying complex family compositions.