Blank Statement Of Repossession PDF Template

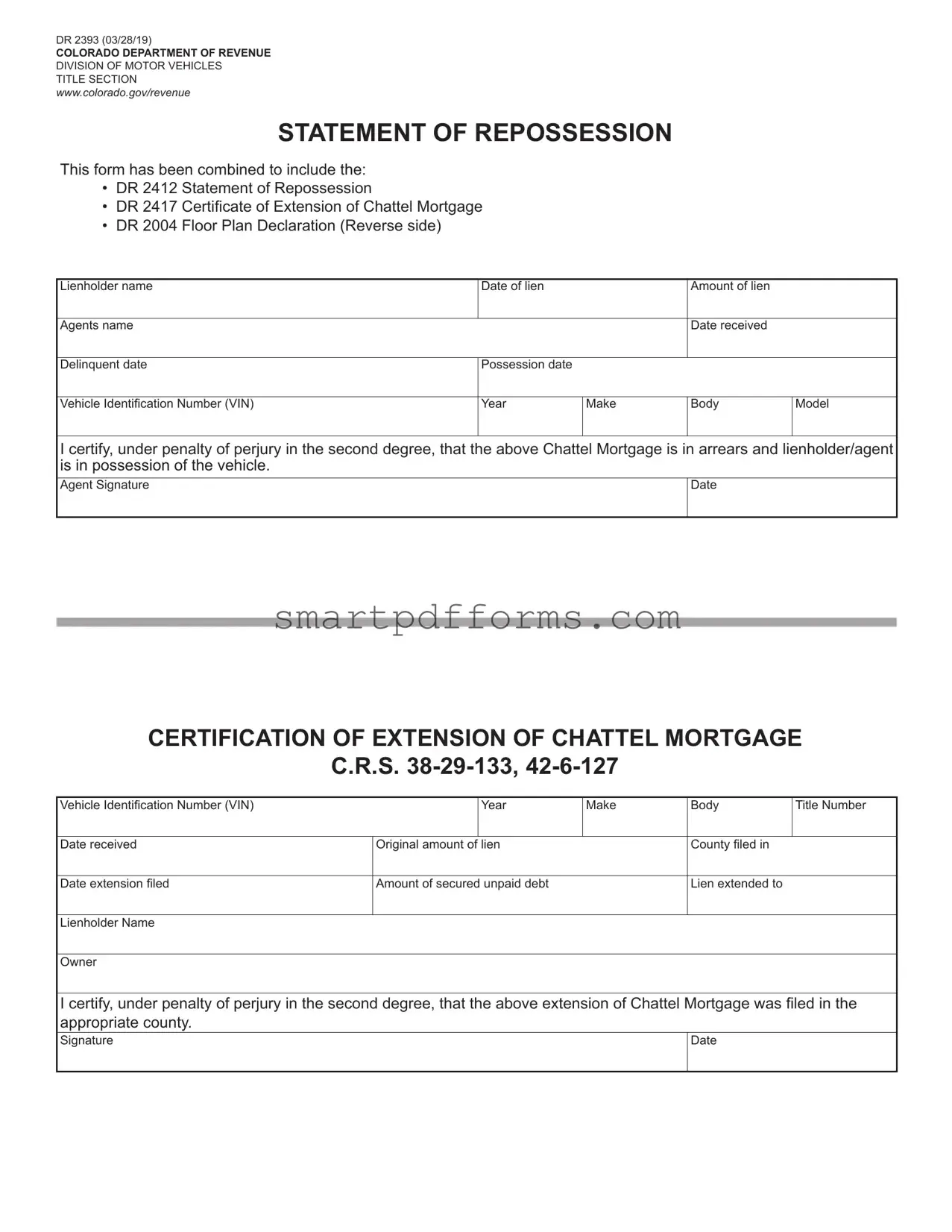

In the complex world of vehicle financing and repossession, the Colorado Department of Revenue, Division of Motor Vehicles, offers a vital tool for lienholders navigating the intricacies of reclaiming possession of a vehicle: the Statement of Repossession form (DR 2393, revised on 03/28/19). This multifaceted legal document serves several critical functions—it merges the DR 2412 Statement of Repossession, the DR 2417 Certificate of Extension of Chattel Mortgage, and on its reverse, the DR 2004 Floor Plan Declaration, streamlining the process and paperwork required for lienholders to legally assert their rights. For lienholders, this form is a declaration under penalty of perjury that a chattel mortgage is in default and that possession of the vehicle has been taken. Detailed within are necessities such as the lienholder's name, the date the lien was placed, the amount of the lien, as well as the agent’s information, making it comprehensive in nature. It also meticulously records the vehicle's identification number (VIN), year, make, body, and model, ensuring all parties have complete and transparent information about the repossession. Furthermore, it certifies, also under penalty of perjury, extension of chattel mortgage particulars, including the original amount of lien, the county in which it was filed, and any secured unpaid debt. For dealers, the Floor Plan Declaration aspect specifies that all documents of ownership must accompany the form, outlining protocols for transferring the vehicle whether the lienholder is a licensed Colorado dealer or not. Essential for the lienholder is the affirmation that the note and chattel mortgage executed against a dealer for the described vehicle remains a valid lien, now in default, granting them possession of the vehicle. In sum, the Statement of Repossession form is a critical document, laying down the procedure and legal framework necessary for the efficient and lawful repossession of vehicles, embodying the intersection of legal requirements and practical necessity in the realm of secured transactions.

Preview - Statement Of Repossession Form

DR 2393 (03/28/19)

COLORADO DEPARTMENT OF REVENUE

DIVISION OF MOTOR VEHICLES

TITLE SECTION

www.colorado.gov/revenue

STATEMENT OF REPOSSESSION

This form has been combined to include the:

•DR 2412 Statement of Repossession

•DR 2417 Certificate of Extension of Chattel Mortgage

•DR 2004 Floor Plan Declaration (Reverse side)

Lienholder name |

Date of lien |

|

Amount of lien |

|

Agents name |

|

|

Date received |

|

Delinquent date |

Possession date |

|

|

|

Vehicle Identification Number (VIN) |

Year |

Make |

Body |

Model |

I certify, under penalty of perjury in the second degree, that the above Chattel Mortgage is in arrears and lienholder/agent is in possession of the vehicle.

Agent Signature |

Date |

CERTIFICATION OF EXTENSION OF CHATTEL MORTGAGE

C.R.S.

Vehicle Identification Number (VIN) |

Year |

Make |

Body |

Title Number |

Date received |

Original amount of lien |

|

County filed in |

|

Date extension filed |

Amount of secured unpaid debt |

|

Lien extended to |

|

Lienholder Name |

|

|

|

|

Owner |

|

|

|

|

I certify, under penalty of perjury in the second degree, that the above extension of Chattel Mortgage was filed in the appropriate county.

Signature |

Date |

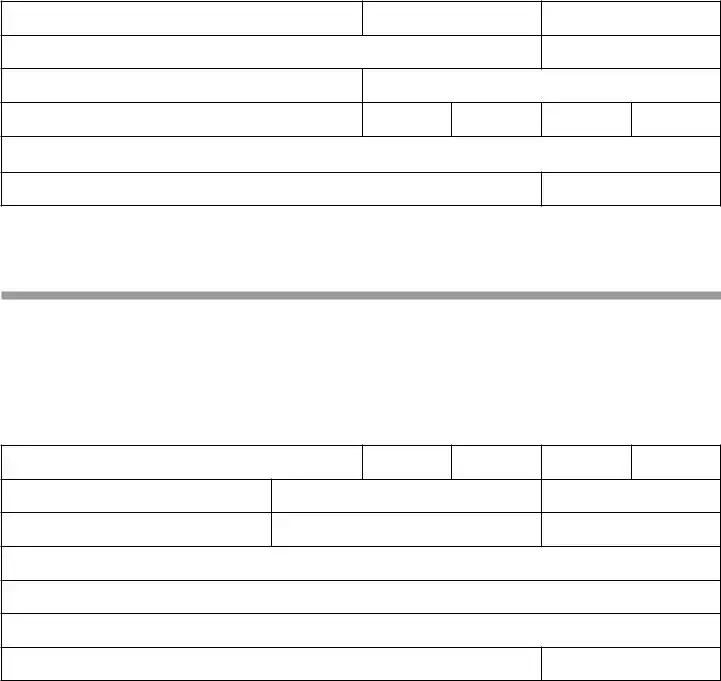

DR 2393 (03/28/19)

COLORADO DEPARTMENT OF REVENUE

DIVISION OF MOTOR VEHICLES

TITLE SECTION

www.colorado.gov/revenue

STATEMENT OF REPOSSESSION

FLOOR PLAN DECLARATION

This form has been combined to include the:

•DR 2004 Floor Plan Declaration

•DR 2412 Statement of Repossession (Reverse side)

•DR 2417 Certificate of Extension of Chattel Mortgage (Reverse side)

•This Floor Plan Declaration must be accompanied by all documents of ownership;

Manufacturer’s Statement of Origin or Title properly assigned to defaulting dealer.

•If the lienholder is a licensed Colorado dealer, they may transfer this vehicle using a Colorado

Dealer’s Bill of Sale (DR 2407).

•If the lienholder is not a licensed Colorado dealer, they must establish title in their name before transferring ownership.

this is to declare that

Lienholder

IS THE OWNER AND HOLDER OF A NOTE SECURED BY A CHATTEL MORTGAGE EXECUTED ON

Date

UCC Filing Number

against the following dealer:

Dealer’s Name

Dealer Number

the note and chattel mortgage is a valid and existing lien against the vehicles held under agreement;

the note and chattel mortgage is a valid and existing lien against the vehicles held under agreement;  the following described motor vehicle is included in that agreement:

the following described motor vehicle is included in that agreement:

Vehicle Identification Number (VIN)

Year

Make

the note and chattel mortgage described above is in default;

the note and chattel mortgage described above is in default;

in accordance with the provisions of the chattel mortgage, the undersigned has taken possession of the above described vehicle;

in accordance with the provisions of the chattel mortgage, the undersigned has taken possession of the above described vehicle;

and,

the vehicle is now in his/her possession.

the vehicle is now in his/her possession.

i certify, under penalty of perjury in the second degree, that the above statements are true and accurate to the best of my knowledge.

Lienholder

Agent Signature

Date

Form Data

| Fact Name | Detail |

|---|---|

| Form Number and Version | DR 2393 (03/28/19) |

| Issuing Department | COLORADO DEPARTMENT OF REVENUE DIVISION OF MOTOR VEHICLES TITLE SECTION |

| Website | www.colorado.gov/revenue |

| Combined Forms | This form includes the DR 2412 Statement of Repossession, DR 2417 Certificate of Extension of Chattel Mortgage, and DR 2004 Floor Plan Declaration. |

| Governing Laws for Certification of Extension of Chattel Mortgage | C.R.S. 38-29-133, 42-6-127 |

| Penalty for False Certification | Under penalty of perjury in the second degree. |

| Requirements for Transfer by a Licensed Dealer | Licensed Colorado dealers may use a Colorado Dealer’s Bill of Sale (DR 2407) for transfer. |

Instructions on Utilizing Statement Of Repossession

Filling out the Statement of Repossession form is an important process for lienholders to navigate after repossessing a vehicle. The form serves as a formal declaration of repossession and is crucial for the process of recovering debts or adjusting the status of the repossessed vehicle with the Colorado Department of Revenue, Division of Motor Vehicles. The detailed steps below guide you through completing the form accurately to ensure that all legal and procedural requirements are met.

- Start by visiting the Colorado Department of Revenue's website at www.colorado.gov/revenue to download the most recent version of the Statement of Repossession form, identified by the form number DR 2393 (03/28/19).

- Fill in the lienholder name, which is the name of the institution or individual who currently holds the lien on the vehicle.

- Enter the date of the lien, referring to when the lien was initially placed on the vehicle's title.

- Input the amount of lien, which is the total outstanding debt secured against the vehicle.

- Specify the agent's name, the individual authorized by the lienholder to act on their behalf.

- Record the date received, indicating when the lienholder or agent received notice of the delinquency or decided to act on the repossession.

- Input the delinquent date, the date when the account became delinquent.

- List the possession date, the actual date when the lienholder or agent took physical possession of the vehicle.

- Provide the Vehicle Identification Number (VIN), Year, Make, Body, and Model of the repossessed vehicle, ensuring each detail accurately matches the vehicle's registration documents.

- Under the certification section, the agent must certify the statements provided are true and sign the form. Include the agent's signature and date to validate the form.

- If applicable, complete the reverse side of the form regarding the Certificate of Extension of Chattel Mortgage and the Floor Plan Declaration, following the specified instructions for each section.

After completing the form, it should be submitted to the Colorado Department of Revenue, Division of Motor Vehicles along with any required accompanying documents. Ensuring the form is filled out accurately and completely is crucial for the lienholder to officially report the repossession and proceed with any necessary actions regarding the status of the vehicle's title or to recover the owed debts. Ensure copies of the completed form are kept for your records and any future correspondence with the state or the vehicle's owner.

Obtain Answers on Statement Of Repossession

What is a Statement of Repossession?

A Statement of Repossession is a formal document that is used when a lienholder takes back, or repossesses, a vehicle due to the borrower's failure to adhere to the agreed upon terms, typically due to non-payment. In the state of Colorado, the document combines the DR 2412 Statement of Repossession, the DR 2417 Certificate of Extension of Chattel Mortgage, and the DR 2004 Floor Plan Declaration. It provides details such as the vehicle identification number (VIN), year, make, model, lienholder's name, and important dates like the possession and delinquent dates. This document is crucial for lienholders as it helps to certify the repossession legally under the penalty of perjury in the second degree.

Who needs to fill out the Statement of Repossession form?

The Statement of Repossession form must be filled out by the lienholder or an authorized agent acting on behalf of the lienholder after a vehicle has been repossessed. It is essential for individuals or entities that have a financial interest in the vehicle as secured by a chattel mortgage or a floor plan lending agreement. Lienholders might include banks, financial institutions, or car dealerships that financed the vehicle's purchase or lent funds using the vehicle as collateral.

How do I submit the Statement of Repossession form?

Upon completion, the Statement of Repossession form must be submitted to the Colorado Department of Revenue, Division of Motor Vehicles (DMV), Title Section. Lienholders are encouraged to ensure that all information provided on the form is accurate and complete before submission. Furthermore, the form must be accompanied by all relevant documents of ownership, such as the Manufacturer’s Statement of Origin or the Title properly assigned to the defaulting dealer. In some cases, additional documentation or steps may be required, particularly if the lienholder seeks to transfer ownership of the repossessed vehicle. It's advised to consult directly with the Colorado DMV or an attorney for specific submission guidelines.

What are the implications of signing the Statement of Repossession?

By signing the Statement of Repossession, the lienholder or their agent certifies, under penalty of perjury in the second degree, that the information provided is accurate and that the vehicle has been legally repossessed. This act has legal implications, including the transfer of vehicle possession back to the lienholder and potentially affecting the original owner's credit history and rights. It is a critical step in the repossession process, as it helps to document the lienholder's right to take possession of the vehicle due to a breach in the agreement terms, such as defaulting on loan payments. The lienholder or agent must carefully review all details entered in the form to avoid potential legal issues.

Common mistakes

When completing the Statement of Repossession form, a number of common errors can occur. These mistakes can lead to delays or complications in the repossession process. Recognizing and avoiding these errors is essential for a smooth transaction.

Failing to accurately record the Vehicle Identification Number (VIN). The VIN is crucial for identifying the vehicle in question and must be entered precisely.

Incorrectly noting the lienholder's name or confusing it with the agent’s name. It is important to clearly differentiate between these parties.

Leaving the date of the lien, possession date, or delinquent date fields blank or inaccurately filled. Precision with dates ensures legal compliance and clarity in the timeline of repossession.

Misidentifying the amount of the lien. This amount should reflect the total owed under the lien at the time of repossession.

Omitting the agent’s signature or dating inaccurately. A signature confirms the statement's accuracy under penalty of perjury, making it a critical component of the form.

In the Floor Plan Declaration, not including all documents of ownership. Failing to provide these documents can complicate or invalidate the repossession process.

Incorrectly completing the section related to the Certificate of Extension of Chattel Mortgage, such as misstating the extension date or secured unpaid debt amount.

Using the form inaccurately for purposes other than stated, such as attempting to transfer ownership without establishing title in the lienholder's name when they are not a licensed Colorado dealer.

To ensure the repossession process proceeds without legal hitches, attention to detail is paramount. Here are specific areas that should be carefully reviewed:

Ensure all sections of the form are completed, leaving no relevant field blank.

Review the form for accuracy and completeness before submission, cross-referencing all information against legal documents.

Understand the requirements about the lienholder's ability to transfer ownership based on their licensing status in Colorado.

Seek clarification or legal advice if any part of the form or process is unclear, to avoid making erroneous declarations.

By avoiding these common errors and adhering to the form's requirements, the repossession and title transfer process can be executed effectively and within legal boundaries.

Documents used along the form

When managing the complexities of repossession, especially regarding vehicles, the Statement of Repossession form plays a pivotal role. Yet, this document often does not stand alone in the process. Several other forms and documents come into play, serving various functions from verifying the debt to legally transferring the vehicle's ownership. Understanding these forms ensures a smoother, legally sound process during what can be a stressful time for all parties involved.

- Notice of Default and Right to Cure: Prior to repossession, this document is sent to the borrower. It informs them of the default on the loan and provides a final opportunity to rectify the situation, typically by paying the outstanding amount within a given timeframe.

- Authorization to Repossess: This form is often used by the lienholder to formally authorize a repossession company or agent to retrieve the vehicle. It specifies the details of the vehicle and the authority granted to the agent.

- Inventory Checklist: Upon repossessing a vehicle, a detailed inventory of the items inside the vehicle is taken. This checklist documents personal property left in the vehicle at the time of repossession, providing a record for both the lienholder and the borrower.

- Condition Report: This report is prepared post-repossession to document the condition of the vehicle. It is vital for determining its value and for addressing any claims of damage that occurred during the repossession process.

- Redemption Letter: Following repossession, the borrower is usually given a chance to reclaim the vehicle by paying the full amount owed, plus any applicable fees. This letter outlines the terms and total cost required for redemption.

- Deficiency Notice: If the vehicle is sold and the sale amount does not cover the outstanding loan and associated costs, this notice is sent to the borrower. It details the amount still owed, known as the deficiency balance.

- Bill of Sale: After a repossession, if the vehicle is sold, a Bill of Sale is used to document the transaction and transfer ownership to the new buyer. This form includes details about the vehicle, the sale price, and the parties to the transaction.

Together, these documents form a comprehensive framework that guides the repossession process from initial notification of default to the final sale or return of the vehicle. Understanding and properly utilizing each document ensures that the process is conducted legally and fairly, protecting the rights of both the lienholder and the borrower.

Similar forms

Bill of Sale (DR 2407): The Bill of Sale document shares similarities with the Statement of Repossession form in that both are used to facilitate changes in ownership of a vehicle, but from different circumstances. The Bill of Sale is typically used in voluntary transactions between buyers and sellers, while the Statement of Repossession is used following the involuntary recovery of a vehicle by a lienholder due to non-payment.

Certificate of Title: This document, necessary for establishing legal ownership of a vehicle, is closely related to the Statement of Repossession. The Statement of Repossession often precedes a change in the title, indicating the transition of vehicle ownership back to the lienholder or to a new owner after repossession.

Manufacturer’s Statement of Origin: Similar to the Certificate of Title, the Manufacturer’s Statement of Origin is required when a vehicle is initially titled. It is akin to the Statement of Repossession in that both serve as foundational documents for establishing or transferring ownership, with the latter being specifically for repossession cases.

UCC Financing Statement: The Uniform Commercial Code (UCC) Financing Statement, which establishes a public record of a security interest in a vehicle, is similar to the Statement of Repossession because both involve the assertion of rights over a vehicle by a lienholder. However, the UCC Financing Statement is more about claiming these rights, while the Statement of Repossession enacts them.

Notice of Default: This document serves as a formal notification to a borrower that they have failed to meet their repayment obligations. It is similar to the Statement of Repossession in that both documents deal with the fallout of unpaid debts, but the Notice of Default typically precedes repossession as a warning.

Lien Release: The Lien Release document, which removes a lienholder’s legal right to repossess, is inversely related to the Statement of Repossession. While the Lien Release signifies the fulfillment of a debt obligation, the Statement of Repossession comes into play when obligations are not met.

Affidavit of Repossession: This legal document is used to assert that a repossession has taken place, making it very similar to the Statement of Repossession. Both documents serve as formal notifications that a lienholder has taken possession of a vehicle due to nonpayment.

Power of Attorney for a Motor Vehicle: While distinct in purpose, the Power of Attorney document, which authorizes another party to make decisions regarding a vehicle on behalf of its owner, shares the principle of acting on one’s behalf with the Statement of Repossession, where a lienholder takes action due to contract breaches.

Vehicle Registration Application: This document is required for legally operating a vehicle on public roads and shares a similarity with the Statement of Repossession in the context of vehicle ownership and legal status updates, albeit for different reasons and outcomes.

Dos and Don'ts

Filling out the Statement of Repossession form requires careful attention to detail and adherence to specific guidelines. Here are ten do’s and don’ts to consider:

- Do double-check the Vehicle Identification Number (VIN) to ensure accuracy. A single mistake can invalidate the entire document.

- Do verify the lienholder name and ensure it matches the name on the original lien or loan documents exactly.

- Do fill in the date the lien was placed on the vehicle, as this establishes the timeline of the agreement.

- Do provide the precise amount of the lien to clarify the financial aspect of the repossession.

- Do include the agent’s name who is handling the repossession, ensuring there is a point of contact for the process.

- Do not sign the document until all other information has been filled in correctly to avoid discrepancies.

- Do not leave the possession date blank, as this date is vital to establishing when the lienholder took control of the vehicle.

- Do not forget to acknowledge the certification section by signing it, which is a legal attestation to the truthfulness of the information provided.

- Do not ignore the requirement for accompanying documents. For the Floor Plan Declaration, for instance, ensure all ownership documents are included.

- Do not attempt to transfer ownership without establishing title in the lienholder’s name first, unless the lienholder is a licensed Colorado dealer.

Following these guidelines will help in the successful and accurate completion of the Statement of Repossession form, facilitating a smoother repossession and title transfer process.

Misconceptions

Understanding the Statement of Repossession form, especially in Colorado, involves navigating through numerous misconceptions. These misconceptions can often lead to confusion about what the form entails and its use. Unraveling these falsehoods is crucial for both lienholders and vehicle owners to handle repossession matters accurately and lawfully.

Only applies to vehicles: While the Statement of Repossession form primarily deals with vehicles, it's essential to understand that it can also apply to any property subject to a chattel mortgage. This misconception might arise because the form details information like the Vehicle Identification Number (VIN) and the make and model of the vehicle. However, a "chattel" refers to any movable personal property, indicating the form's broader applicability.

Does not require certification: A significant misconception is that the Statement of Repossession or its accompanying documents do not require certification. Contrary to this belief, the form mandates certification under penalty of perjury in the second degree, ensuring all declared information is accurate and truthful.

Completion by the lienholder only: Many believe that only the lienholder is involved in completing the Statement of Repossession. While it's true that the lienholder must fill out and sign the form, it's also necessary for this process to involve legal and regulatory oversight, meaning that completing the form properly involves understanding specific legal requirements and possibly consulting legal professionals.

Immediate owner transfer: Another common misconception is that completing the Statement of Repossession form immediately transfers ownership back to the lienholder. In reality, this form is part of the process, and further steps, including obtaining the title in the lienholder's name (if not a licensed Colorado dealer), are required before complete ownership transfer is legally recognized.

Limited to Colorado: The specific form referenced (DR 2393) is for the Colorado Department of Revenue, suggesting that repossession forms and procedures are identical across all states. This is not the case as each state has its unique forms and legal requirements regarding repossession. Thus, it's a misconception that this form's provisions are universally applicable.

Is a single form: Finally, the belief that the Statement of Repossession is a standalone document is incorrect. It has been combined to include the DR 2412 Statement of Repossession, DR 2417 Certificate of Extension of Chattel Mortgage, and DR 2004 Floor Plan Declaration, highlighting that several critical pieces of information are consolidated into this one form for convenience and clarity.

Dispelling these misconceptions is vital for correctly navigating the legal landscape surrounding repossession, ensuring that all parties involved are adequately informed and protected throughout the process.

Key takeaways

Understanding the process of vehicle repossession and related legal documentation in Colorado, including filling out and using the Statement Of Repossession form, is crucial for lienholders and agents. Below are key takeaways to guide you through the process:

- The Statement Of Repossession form (DR 2393) is a critical document that combines several key functions and forms, including the DR 2412 Statement of Repossession, DR 2417 Certificate of Extension of Chattel Mortgage, and the DR 2004 Floor Plan Declaration.

- It is important to accurately complete all sections of the form, including details such as the lienholder's name, date of the lien, amount of the lien, agent's name, dates received, delinquency date, possession date, and relevant vehicle information like the VIN.

- Lienholders must certify, under penalty of perjury in the second degree, that the chattel mortgage is in arrears and the lienholder or agent is in possession of the vehicle. This certification requires a signature and date.

- The Certificate of Extension of Chattel Mortgage section requires detailed information about the vehicle, original and extended lien amounts, and dates, all of which must be filed in the appropriate county.

- For vehicles held under a chattel mortgage that has been repossessed, the form serves as a declaration that the lienholder is now in possession of the vehicle and that the chattel mortgage is in default.

- If the lienholder is a licensed Colorado dealer, the vehicle can be transferred using a Colorado Dealer’s Bill of Sale (DR 2407). If not, the lienholder must first establish title in their name before transferring ownership.

- All documents of ownership, including either the Manufacturer’s Statement of Origin or Title, must be properly assigned to the defaulting dealer and accompany the Floor Plan Declaration.

- The form includes space for the inclusion of vehicles under a floor plan agreement, where specific vehicle information and certification of ownership due to default must be accurately provided.

- The precise completion and certification of the form are essential steps in the repossession process, ensuring that all legal requirements for repossession and subsequent ownership transfer are met.

- It is advisable for lienholders and agents to consult with a professional or legal advisor to ensure compliance with all applicable Colorado laws and regulations concerning vehicle repossession and the necessary documentation.

By following these guidelines and accurately completing the Statement Of Repossession form, lienholders and agents can navigate the complexities of vehicle repossession with greater ease and legality.

Popular PDF Forms

How to Respond to an Eviction Notice - Allows defendants to argue the eviction is based on unpermitted fees or charges during the COVID-19 pandemic.

Sf 600 Army - The SF 600 enables efficient medical record-keeping and quick reference to an individual's medical history.