Blank Straight Note PDF Template

When individuals or businesses in California embark on the complex path of lending and borrowing, a Straight Note often becomes a pivotal document in outlining the terms of the transaction. This type of financial instrument clearly stipulates the borrower's promise to repay a specified sum of money, concrete in dollars, to the lender or their designate. Integral to such agreements are the terms concerning the interest rate from the time of the loan until its full repayment, denoted annually. Moreover, this form doesn't shy away from delving into the repercussions should the borrower fail to meet the interest payments on schedule, specifying that the entire principal along with accrued interest may become due immediately at the lender's discretion. The provision for legal fees, should the lender need to pursue court action for enforcement, aligns with the document's comprehensive coverage of potential eventualities. A particularly noteworthy aspect is its linkage to a Deed of Trust, suggesting that the note is secured by real property, which offers another layer of protection for the loan provider. It's also imperative that the original documents are preserved until the loan is fully repaid and then duly cancelled, underlining the formalities that govern the borrowing-lending relationship encapsulated by a Straight Note in California.

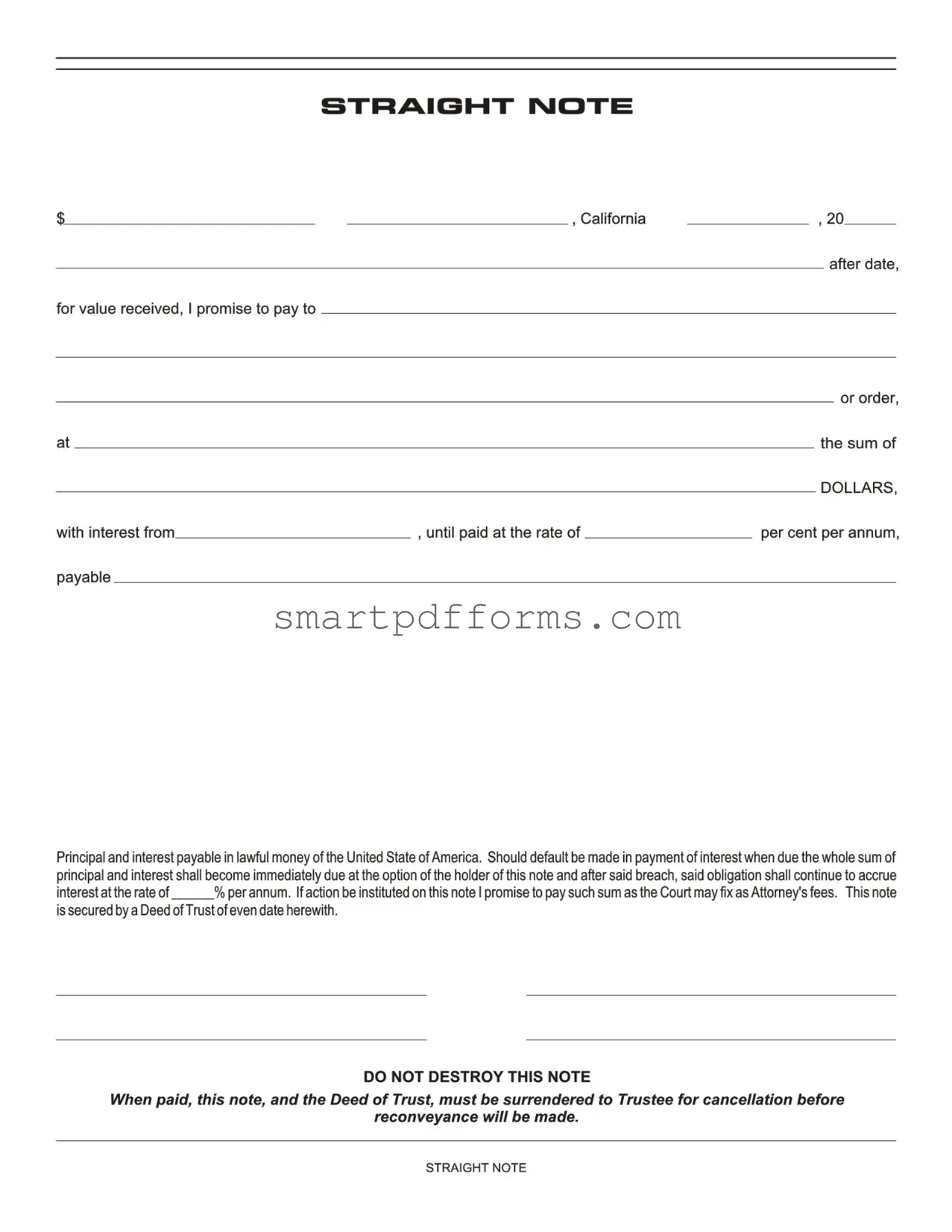

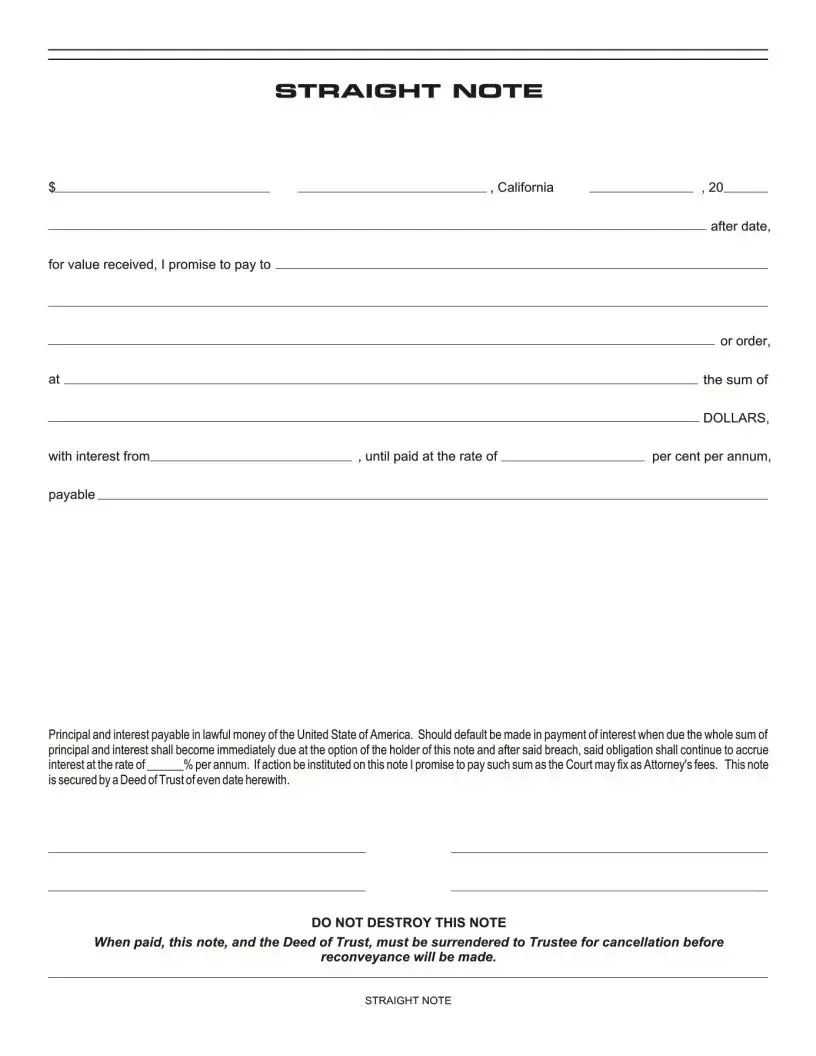

Preview - Straight Note Form

Form Data

| Fact Name | Fact Detail |

|---|---|

| Type of Note | Straight Note |

| State Specific Form | California |

| Value Promise | The borrower promises to pay a specified sum of money in dollars. |

| Interest Rate | Agreed upon per cent per annum from the date payable until paid. |

| Payment in Lawful Money | Principal and interest payable in lawful money of the United States of America. |

| Default Penalties | If default is made in payment of interest when due, the whole sum of principal and interest becomes due immediately at the holder’s option. |

| Continued Interest after Breach | After a breach, interest continues to accrue at the agreed rate per annum. |

| Attorney's Fees | If legal action is taken on the note, the borrower promises to pay court-determined attorney fees. |

| Collateral | This note is secured by a Deed of Trust of even date herewith. |

| Note Cancellation Requirement | The note and the Deed of Trust must be surrendered to the Trustee for cancellation when paid. |

Instructions on Utilizing Straight Note

Filling out a Straight Note form is a critical step in documenting a loan agreement, especially for individuals and entities in California looking to formalize the terms of a financial transaction. This document outlines the borrower's promise to repay a certain amount of money, under specified conditions, to the lender. Ensuring accuracy while completing this form is paramount to avoid potential disputes or legal complications down the line. The process involves providing detailed information about the loan amount, interest rate, repayment schedule, and the parties involved. Below is a simplified guide to help make filling out the Straight Note form a straightforward task.

- Start with the date: Insert the current date at the top where it says, "California 20-------." Make sure the year is fully written out to avoid any confusion.

- Enter the borrower's commitment: After the phrase "after date, for value received, I," clearly write the borrower's full name to indicate who promises to pay.

- Specify the payee: In the section "promise to pay to or order, at," write the name of the individual or entity the borrower is promising payment to.

- Fill in the loan amount: In the space provided, write the total amount of money being borrowed, in dollars. Ensure that this amount is written both in words and figures for clarity.

- Detail the interest rate and payment details: Indicate the interest rate agreed upon, starting from when it is payable and the conditions under which the principal and interest are to be paid. This should be in accordance with the terms agreed by both parties.

- Understand the default conditions: Be aware of the conditions under which the full sum becomes due immediately. This includes any default in the payment of interest or principal.

- Include attorney’s fees clause: Note the clause where it mentions the borrower's promise to pay legal fees if legal action is necessary. This is an acknowledgment of the potential additional cost in case of default.

- Acknowledge the security of the note: Confirm that this note is secured by a Deed of Trust, indicating that there's a physical asset providing security for the loan.

- Do not destroy the note warning: Recognize the instruction not to destroy the note after payment. It, along with the Deed of Trust, must be surrendered for cancellation.

After accurately completing the Straight Note form, both parties should review the document to ensure all information is correct and reflects their agreement. It is wise to have copies of the completed form for each party's records. Remember, this form is a legally binding document, and both the borrower and the lender should understand the commitments they are making. Always consider seeking legal advice if there are any uncertainties about the terms or how to fill out the form properly.

Obtain Answers on Straight Note

What is a Straight Note?

A Straight Note, often utilized in financial transactions within different states, including California, is a legal document in which the borrower promises to repay a certain amount of money to the lender or their designated party. This repayment includes both the principal amount and any accrued interest, as outlined in the terms of the note. It is payable in the lawful currency of the United States of America.

How does interest work on a Straight Note?

The interest on a Straight Note is calculated from the date the note is issued until the full payment is made. It is based on a specified annual percentage rate. Should there be a delay or default in the interest payment, the document often stipulates that the total sum of the note, combining principal and accrued interest, becomes immediately due. Additionally, following a default, interest may continue to accrue at a specified rate until full payment is achieved.

What happens if there is a default in payment?

In the event of a default on a payment, whether principal or interest, the entire balance owed may become immediately due and payable at the lender’s discretion. After such a default, the interest may continue to accumulate at the agreed-upon annual rate until the full outstanding balance is repaid.

What are the borrower's obligations in case of legal action?

If legal action is initiated to enforce the note, the borrower is also responsible for paying attorney's fees, the amount of which is to be determined by the court. This ensures that the lender can seek legal remedy without bearing the entire cost of litigation.

Is the Straight Note secured?

Yes, the Straight Note is secured by a Deed of Trust that is dated the same as the note. This means that the borrower is pledging real property as security for the loan, which provides the lender with a means of recourse should the borrower default on their repayments.

What should be done with the Straight Note upon full repayment?

Upon full repayment of the amount owed under a Straight Note, the document itself, along with the accompanying Deed of Trust, must be surrendered to the Trustee for cancellation. This step is crucial for ensuring that the borrower's obligation is formally cleared and the lien on the secured property is released.

Can the Straight Note terms be modified?

Any modification to the terms of a Straight Note requires the agreement of both the lender and borrower. Changes may potentially affect the repayment schedule, interest rates, or other conditions initially set forth. It's vital for any modifications to be documented in writing to protect both parties’ interests.

Where is the Straight Note applied?

While this example is specific to California, Straight Notes are used across various jurisdictions in the United States. Their format and enforcement can vary slightly depending on state laws, but generally, their purpose and function remain consistent in providing a structured means of documenting and enforcing a loan repayment agreement.

Common mistakes

-

Not specifying the exact amount in words and figures: It is essential to clearly state the amount of money being borrowed in both words and figures to avoid any ambiguity regarding the loan amount.

-

Failing to indicate the date correctly: Omitting or incorrectly stating the date from which the note is effective can lead to disputes regarding the commencement of interest accrual and the exact due date of the principal amount.

-

Leaving the interest rate blank or ambiguous: The interest rate must be written clearly to prevent disagreements on the cost of borrowing. An unclear rate can complicate the calculation of the total amount owed.

-

Omitting details about the payment schedule: It's important to outline whether the loan will be repaid in installments or a lump sum at a later date. Details about the frequency and amount of payments should be specified.

-

Ignoring attorney fees clause: Not discussing or agreeing upon the potential attorney fees in case of legal disputes can lead to unexpected financial burdens. This section should not be overlooked.

-

Neglecting to address what constitutes a default: Without a clear definition of what actions or inactions will be considered a default, the enforceability of the note's provisions can be weakened.

-

Improperly handling the execution of the document: The note must be signed by all parties involved. Failing to have the borrower's signature or not following the proper notarization procedures can void the document.

To further elaborate, let's consider additional factors that can contribute to a well-prepared Straight Note form:

-

Ensuring the legal description of any collateral: If the note is secured by collateral, including a detailed legal description of the asset is crucial.

-

Double-checking all inserted information for accuracy: Errors in names, addresses, or numerical information can lead to disputes or issues in enforcement.

-

Retaining copies of the note: Both the lender and the borrower should keep signed copies of the note for their records to prevent any discrepancies or misunderstandings in the future.

In conclusion, when filling out a Straight Note form, attention to detail is paramount. Each section of the form plays a vital role in defining the terms of the loan, the obligations of the parties involved, and the consequences of non-compliance. By avoiding these common mistakes and taking a meticulous approach to completing the form, parties can ensure that their financial dealings are based on a solid and enforceable agreement.

Documents used along the form

When dealing with the intricacies of financial agreements, particularly in real estate, a Straight Note is a common and critical document. It functions as a clear declaration from one party to another, promising the repayment of a loan under the agreed-upon terms. However, this note seldom operates in isolation. To fully protect the interests of all parties involved and to ensure the legal enforceability of the financial agreement, several other forms and documents are commonly used in conjunction. Understanding these documents can provide peace of mind and clarity throughout the process.

- Mortgage or Deed of Trust: This document complements a Straight Note by securing the loan with the borrower's property. It grants the lender a lien on the property as security for the repayment of the loan. If the borrower fails to meet the terms of the note, the lender may proceed with foreclosure to recover the loaned amount.

- Promissory Note: While a Straight Note is a type of promissory note, there are other variants too, tailored to different financing arrangements. A promissory note details the loan's repayment conditions, including the interest rate, payment schedule, and maturity date.

- Loan Agreement: This contract outlines the broader terms and conditions of the loan between the borrower and lender. It encompasses the obligations of each party, representations, warranties, and specifics regarding the use of loaned funds. The Loan Agreement ensures that both parties are clear about their commitments.

- Amortization Schedule: Often accompanying a Straight Note, an amortization schedule is a table detailing each payment throughout the life of the loan. It breaks down the portion of each payment that applies to the principal versus interest and shows the remaining balance after each payment.

- Title Report: Before securing a loan with a property, a Title Report is essential. It verifies the legal ownership of the property, ensuring there are no disputes, liens, or encumbrances that could jeopardize the lender's security interest.

Together, these documents form a comprehensive framework that supports the financial transaction detailed in a Straight Note, offering both the lender and borrower a structured and secure approach to lending. By understanding each component's purpose and how they interlink, individuals can navigate their financial transactions with greater confidence and insight.

Similar forms

Promissory Note: Similar to a Straight Note, a Promissory Note outlines an agreement to pay a specific sum of money to a person or entity under defined conditions. Both documents specify the interest rate, principal amount, and the obligation to pay attorney fees in case of legal action.

Mortgage Note: This document is closely related to the Straight Note as it also secures a promise to pay a specified sum of money, typically for real estate purchases. Both involve interest payments and are often secured by a deed of trust or similar security agreement.

IOU: An IOU (I Owe You) acknowledges that a debt exists, which is a concept central to the Straight Note. However, IOUs are typically less formal and may not detail repayment terms as comprehensively, lacking specifics on payment schedules and interest rates.

Deed of Trust: Mentioned in the Straight Note, a Deed of Trust is a document that secures a loan on real property. It involves three parties – the borrower, lender, and trustee, and complements the Straight Note by providing a means to enforce the debt through property collateral.

Loan Agreement: This document outlines the terms of a loan between two parties. Like the Straight Note, it details the loan amount, interest rate, repayment schedule, and the consequences of non-payment, making it a foundational document in lending transactions.

Security Agreement: A Security Agreement is related to the Straight Note in that it provides a lender a security interest in an asset as collateral for a loan. While the Straight Note serves as a promise to pay, the Security Agreement outlines the rights to the collateral if the borrower defaults.

Installment Note: An Installment Note specifies that the loaned amount will be repaid in periodic installments, often including interest. It shares similarities with the Straight Note regarding its function as a repayment promise and typically specifies payment terms and schedules.

Commercial Paper: This short-term debt instrument, used by corporations to finance operations, parallels the Straight Note's commitment to repay a specified sum with interest. Both are negotiable instruments, though commercial paper usually doesn't involve collateral.

Letter of Credit: Although used primarily in international trade, a Letter of Credit guarantees a buyer's payment to a seller, similar to how a Straight Note guarantees payment to a lender. Both provide a third-party assurance that helps facilitate transactions.

Bond: A bond is a fixed income instrument representing a loan made by an investor to a borrower. It's like a Straight Note in that it details payment obligations and interest. However, bonds are more commonly associated with corporations and governments as borrowers.

Dos and Don'ts

When filling out a Straight Note form, particularly within the context of California, it's crucial to navigate the process with accuracy and precision to ensure the document's validity and enforceability. Below are key directives to adhere to and pitfalls to avoid for seamless completion.

Do:Ensure all information is precise and accurate. Double-check the date, the sum of money (in both numbers and words), the interest rate, and all names and addresses involved.

Write clearly and legibly. The information on the form should be easily readable by all parties and any legal authorities that may need to review the document.

Verify the interest rate. Confirm that the rate is in compliance with state laws to avoid any issues of usury.

Keep a copy for personal records. Once the Straight Note is filled out and signed, make sure to retain a copy for your records to track payments or to resolve any future disputes.

Have the note reviewed by a legal professional before finalizing. This can prevent any legal oversights and ensure the note's enforceability.

Leave blanks on the form. Every required field must be filled out to avoid the note being contested for ambiguity or being considered incomplete.

Alter the form after it’s been signed without agreement from all parties. Any changes made post-signature must be agreed upon by everyone involved, and ideally, noted in an addendum to the note.

Ignore the clause about attorney's fees. Understand that if legal action is required, the note stipulates the borrower's responsibility for such fees.

Forget to specify the payment terms in regard to the principal and interest. The note should clearly state when these payments are due to ensure there are no misunderstandings.

Discard the Straight Note and accompanying documents after payment. These documents must be surrendered to the Trustee for cancellation and proper record-keeping.

Misconceptions

Regarding the Straight Note form, commonly used in financial transactions, especially in real estate in states like California, there exist several misconceptions that can lead to confusion among parties involved. Misunderstandings can impact the execution and enforcement of these financial instruments. Here are six notable misconceptions:

- Misconception 1: The belief that a Straight Note is only applicable in California. While this type of note is widely used in California, it is also applicable and enforceable in other states across the United States, provided it complies with local state laws.

- Misconception 2: Many assume that Straight Notes do not include interest rates or terms for interest payments. However, the form explicitly requires the inclusion of an interest rate and the terms of interest payments, making it clear when and how interest should be paid.

- Misconception 3: Another common misconception is that the holder of a Straight Note cannot demand immediate payment of the full sum before the due date. In reality, the note allows the holder to demand immediate full payment if there is a default in interest payment.

- Misconception 4: Some believe that Straight Notes are informal agreements and hence, not legally binding. This is incorrect; when properly executed, these notes are legally enforceable instruments binding the borrower to the agreed-upon repayment terms.

- Misconception 5: A frequent misunderstanding is that attorney's fees incurred in enforcing the note are not recoverable. However, the form stipulates that the borrower will pay reasonable attorney's fees fixed by the court if action is instituted on the note.

- Misconception 6: There's a notion that upon repayment, the Straight Note and associated Deed of Trust do not require any formal process for cancellation. Contrary to this belief, the note and Deed of Trust must be surrendered to the Trustee for cancellation, indicating a formal process is necessary for reconveyance.

Addressing these misconceptions is essential for all parties entering into agreements involving a Straight Note, ensuring clarity and preventing legal complications. Understanding the specific terms, the obligations, and the enforcement rights can aid in the smoother execution of real estate transactions or any other dealings that utilize such a note.

Key takeaways

Understanding how to properly fill out and use the Straight Note form is crucial for anyone engaged in financial or real estate transactions in California. Here are the key takeaways to ensure accuracy and compliance:

- Identification of Parties: Clearly specify the borrower and the lender. It's essential to include the full legal names to avoid any confusion about the parties involved.

- The principal sum must be precisely filled out in the space provided. This represents the amount of money being borrowed and should be written both in words and figures to prevent any discrepancies.

- Indicate the interest rate clearly. This percentage determines the additional amount the borrower needs to pay over the principal sum. Ensure that this rate is agreed upon by both parties and is within the legal limits.

- The note should specify how and when the interest is payable, such as monthly or yearly. This includes both the start date and the conditions under which interest payments are considered late.

- It's critical to outline the conditions under which the full sum (principal plus interest) becomes due. Normally, this occurs if the borrower fails to make interest payments as scheduled.

- If legal action becomes necessary, the note also mentions that the borrower agrees to pay attorney's fees, with the amount to be determined by the court.

- The statement that "This note is secured by a Deed of Trust" links the note to a tangible asset, offering the lender security against the borrower's failure to meet the payment terms. This requires including details of the Deed of Trust, such as date and parties involved.

- The note includes a non-destruction clause, advising against destroying the document even after the loan is fully repaid. Instead, it should be returned to the trustee for cancellation.

- Finally, it's important to address the procedure for cancelling the note and Deed of Trust upon full payment. This formal step is crucial for clearing the title of the property and absolving the borrower from further obligations under the note.

Properly completing and understanding each segment of the Straight Note form can prevent future legal complications, ensuring a smooth financial transaction for both parties involved.

Popular PDF Forms

How to Notify Medicaid of Income Change - Understand the implications of having or transferring assets, such as savings accounts or property, on your Medi-Cal eligibility.

How to Write a Progress Note - Patient seen for exacerbation of chronic heart failure; detailed review of symptoms and medication regimen; physical exam focuses on cardiac and pulmonary status.

How to Respond to an Eviction Notice - Tenants can use this form to dispute the landlord's claim for possession and other demands.