Blank Subrogation Sample PDF Template

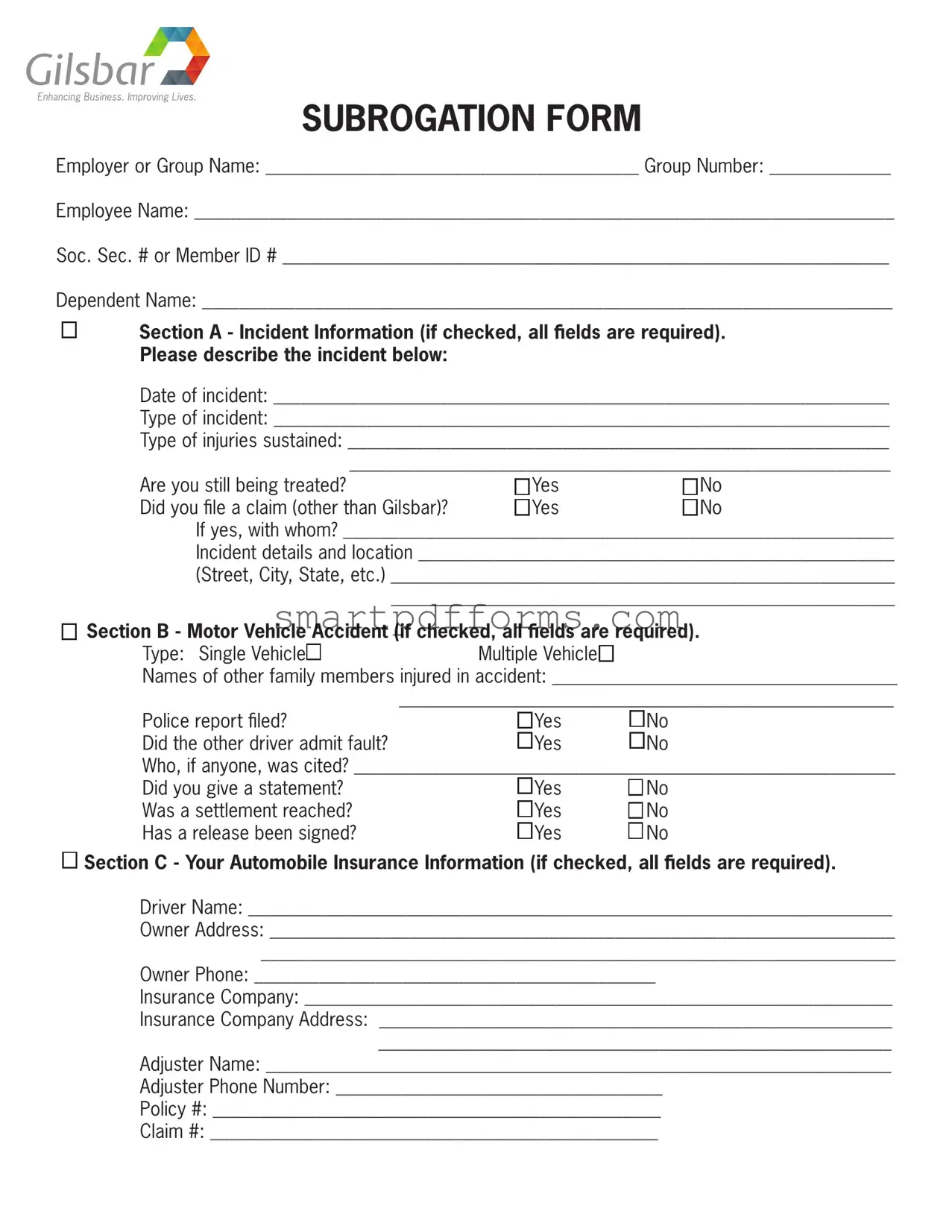

In the realm of insurance and personal injury claims, the Subrogation Sample form provided by Gilsbar stands as a critical document designed to streamline the process of identifying and recovering funds from third parties responsible for injuries or damages. This comprehensive form serves multiple purposes, catering to incidents ranging from workplace accidents to motor vehicle collisions. Its structured sections demand detailed information about the event, including the date, type of incident, injuries sustained, and ongoing treatment status. Furthermore, it extends into specifics about any motor vehicle accidents involved, detailing the necessity of police reports, fault admissions, and settlement information. Crucially, the document delves into insurance particulars, requiring data on the claimant's auto insurance as well as the responsible party's coverage. Additionally, the form facilitates the identification of legal representation and explicitly acknowledges the claimant's understanding of the subrogation process. This process empowers Gilsbar, alongside The Phia Group, to pursue reimbursements for medical benefits paid out due to the incident. With this form, individuals provide critical consent for the release of pertinent medical and legal information, ensuring a seamless subrogation process while upholding the accuracy and integrity of submitted details.

Preview - Subrogation Sample Form

Gilsbar

Enhancing Business. Improving Lives.

SUBROGATION FORM

Employer or Group Name: ________________________________________ Group Number: _____________

Employee Name: ___________________________________________________________________________

Soc. Sec. # or Member ID # _________________________________________________________________

Dependent Name: __________________________________________________________________________

□ |

Section A - Incident Information (if checked, all felds are required). |

||

|

Please describe the incident below: |

|

|

|

Date of incident: __________________________________________________________________ |

||

|

Type of incident: __________________________________________________________________ |

||

|

Type of injuries sustained: __________________________________________________________ |

||

|

__________________________________________________________ |

||

|

Are you still being treated? |

□Yes |

□No |

|

Did you fle a claim (other than Gilsbar)? |

□Yes |

□No |

|

If yes, with whom? ___________________________________________________________ |

||

|

Incident details and location ___________________________________________________ |

||

|

(Street, City, State, etc.) ______________________________________________________ |

||

|

______________________________________________________ |

||

□ |

Section B - Motor Vehicle Accident (if checked, all felds are required). |

||

|

Type: Single Vehicle□ |

Multiple Vehicle□ |

|

|

Names of other family members injured in accident: _____________________________________ |

||

|

_____________________________________________________ |

||

|

Police report fled? |

□Yes |

□No |

|

Did the other driver admit fault? |

□Yes |

□No |

|

Who, if anyone, was cited? __________________________________________________________ |

||

|

Did you give a statement? |

□Yes |

□No |

|

Was a settlement reached? |

□Yes |

□No |

|

Has a release been signed? |

□Yes |

□No |

□

Section C - Your Automobile Insurance Information (if checked, all felds are required).

Section C - Your Automobile Insurance Information (if checked, all felds are required).

Driver Name: _____________________________________________________________________

Owner Address: ___________________________________________________________________

____________________________________________________________________

Owner Phone: ___________________________________________

Insurance Company: _______________________________________________________________

Insurance Company Address: _______________________________________________________

_______________________________________________________

Adjuster Name: ___________________________________________________________________

Adjuster Phone Number: ___________________________________

Policy #: ________________________________________________

Claim #: ________________________________________________

□

Section D - Other Insurance Information (if checked, all felds are required).

Section D - Other Insurance Information (if checked, all felds are required).

The responsible party’s automobile insurance, the worker’s compensation insurance, or homeowner’s/liability insurance:

Name: __________________________________________________________________________

Address: _________________________________________________________________________

____________________________________________________________________

Phone: _______________________________________________

Insurance Company: _______________________________________________________________

Insurance Company Address: _______________________________________________________

_______________________________________________________

Adjuster Name: ___________________________________________________________________

Adjuster Phone Number: ___________________________________

Policy #: ________________________________________________

Claim #: ________________________________________________

□

Section E - Attorney Information (if checked, all felds are required).

Section E - Attorney Information (if checked, all felds are required).

Attorney Name: ___________________________________________________________________

Firm Name: ______________________________________________________________________

Firm Address: ____________________________________________________________________

____________________________________________________________________

Attorney Phone Number: _______________________________________________

Attorney Fax Number: _________________________________________________

I hereby acknowledge that my medical plan has a subrogation/reimbursement agreement provision which provides that medical benefts paid under the plan on behalf of me or any person covered under my plan. I agree to reimburse (up to the amount of such benefts paid) from any payments, awards, or settlements which may be paid by a third party because of the injury described above. I authorize Gilsbar, LLC and the Phia Group to release information regarding any claims in order to directly seek and receive such reimbursement from any third party payments that may in the future, become payable because of this injury. Furthermore, I hereby authorize any medical provider, my lawyer or agent, or any other person or corporation to release any and all medical information relating to the incident to The Phia Group.

The Phia Group is the administrator who pursues subrogation and reimbursement claims on behalf of Gilsbar. Thank you for your cooperation.

I represent that, to the best of my knowledge, the information provided on this form is complete and accurate.

Signature: ____________________________________________________________________

Date: ______________________________________

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used for subrogation, allowing Gilsbar to pursue reimbursement from third-party payments for medical benefits paid. |

| Incident Reporting | Section A requires detailed information about the incident leading to the claim, including date, type, injuries, and current treatment status. |

| Motor Vehicle Accident Specifics | Section B caters to motor vehicle accidents, requiring details about the accident, other parties involved, and police report status. |

| Insured Party's Information | Section C collects the claimant's automobile insurance information, including policy and claim numbers. |

| Other Insurance Details | Section D requests information on other relevant insurance coverages, such as responsible party’s or worker’s compensation insurance. |

| Legal Representation | Section E seeks information about the claimant's attorney, if involved, including contact details and the law firm's name. |

| Authorization and Acknowledgement | The claimant authorizes Gilsbar and the Phia Group to seek reimbursement and release medical information related to the incident. |

| Governing Law(s) | The form doesn't specify governing laws, but subrogation laws may vary by state, impacting how Gilsbar proceeds with claims. |

Instructions on Utilizing Subrogation Sample

Filling out a Subrogation Sample form involves providing detailed information about an incident that may trigger the subrogation process. The form requires specifics about the incident, involved parties, insurance details, and legal representation, if applicable. The accuracy and completeness of this information are crucial for the subrogation process to proceed efficiently. Following the steps outlined below will help ensure that the form is filled correctly, facilitating the involved parties' ability to reach an appropriate resolution.

- Start by entering the Employer or Group Name and Group Number at the top of the form.

- Provide the Employee Name, alongside the Social Security Number or Member ID Number.

- If applicable, fill in the Dependent Name.

- Check Section A - Incident Information if relevant, and accurately describe the incident, including the date, type, injuries sustained, and whether treatment is ongoing. Also, note if a claim has been filed with any party other than Gilsbar.

- In the event of a motor vehicle accident, complete Section B by indicating the accident type, family members injured, if a police report was filed, fault admission, citations, statements, settlements, and if a release has been signed.

- For Section C - Your Automobile Insurance Information, provide details about the driver, owner, insurance company, adjuster, policy, and claim numbers.

- Section D - Other Insurance Information requires information about any other relevant insurance policies, including the insurance and adjuster details, policy, and claim numbers.

- If an attorney is involved, fill in Section E - Attorney Information with the attorney and firm names, addresses, and contact numbers.

- Finally, read the acknowledgement at the bottom of the form regarding the subrogation/reimbursement agreement. Sign and date the form to validate the information provided.

Once the form is fully completed and signed, it should be submitted to the designated contact at Gilsbar or The Phia Group. This step is essential for initiating the subrogation process, allowing for the appropriate actions to be taken based on the details provided in the form.

Obtain Answers on Subrogation Sample

Frequently Asked Questions about the Subrogation Sample Form

- What is Subrogation?

Subrogation is a legal process used by insurance companies to recover funds from the party responsible for an incident, after the insurer has already paid out benefits under the policy. This occurs, for example, when an individual's health plan covers medical expenses arising from an accident, and then seeks reimbursement from the party at fault or their insurer.

- Why do I need to fill out a Subrogation Form?

Filling out a Subrogation Form is necessary to provide your insurer or their agent with essential details about the incident and any other insurance claims you may have filed. This information assists them in pursuing a reimbursement from the responsible party's insurer, helping to mitigate costs for all parties involved.

- What information do I need to provide on the form?

- The basic details about the incident including date, type, and location.

- Information on the injuries sustained and ongoing treatments.

- Details about any other claims filed with different insurers.

- Information regarding your automobile and any other insurance coverage applicable to the incident.

- Attorney information, if legal representation is involved.

- What happens if I don't fill out the form?

Failure to complete and submit the Subrogation Form may result in delays or refusal of your claim by the insurance company. It could also impact your insurer's ability to recover costs, potentially affecting future premiums and coverage terms.

- Is providing attorney information mandatory?

If you have engaged an attorney related to the incident, providing their information is crucial to facilitate direct communication between your insurer and your legal representative, ensuring the subrogation process is handled efficiently.

- Who is The Phia Group?

The Phia Group is an administrator that specializes in handling subrogation and reimbursement claims. They work on behalf of insurance providers, like Gilsbar, to manage the often complex process of recovering funds from third parties responsible for injuries or damages.

- What does signing the form imply?

By signing the Subrogation Form, you acknowledge and agree to reimburse your insurance plan from any settlements, awards, or payments received from a third party due to an injury for which your insurer paid benefits. It also grants permission for the release of necessary information to pursue these claims.

- What if I have multiple insurance policies?

If you are covered by multiple insurance policies, it is essential to disclose this on the form under "Other Insurance Information." This helps in identifying all potential sources for reimbursement and ensures the proper coordination of benefits.

- How can I ensure the accuracy of the information provided?

Before submitting the form, double-check all entries for completeness and accuracy. Providing incorrect information can delay the subrogation process and affect the outcome of your claim and potential reimbursements.

- Where do I submit the completed form?

The submission instructions should be provided by your insurer or administrative agent. Typically, you might return it to the insurance company or a specific administrator like The Phia Group. Ensure to keep a copy for your records.

Common mistakes

Filling out a Subrogation Sample form, such as the one provided by Gilsbar, requires careful attention to detail. Unfortunately, people often make mistakes that can complicate the process. Here are nine common errors:

Not checking the appropriate sections to indicate the information that follows pertains to them (e.g., Section A - Incident Information, Section B - Motor Vehicle Accident). This oversight can lead to incomplete or incorrectly processed forms.

Leaving fields blank, especially in sections that are marked as required if checked. Every field in these sections needs to be filled out to provide a complete account of the incident and existing claims.

Failing to accurately describe the incident in sufficient detail, including both the circumstances and specific injuries sustained. Vague descriptions can hinder the subrogation process.

Forgetting to update the form with ongoing treatments if the initially checked "No" to still being treated but the situation changed. Continuous updates are crucial for accurate claim processing.

Omitting the details of any claims filed with entities other than Gilsbar, including the name of the organization and any claim numbers, which are essential for a thorough investigation.

Incorrectly listing or failing to list all family members injured in an accident, especially in multi-vehicle or complex incidents, which can result in insufficient subrogation or benefits recovery.

Neglecting to provide complete automobile and other insurance information including policy and claim numbers, which are necessary for Gilsbar to pursue reimbursement effectively.

Not furnishing detailed attorney information when represented. Accurate legal representation details ensure proper communication and coordination for reimbursement processes.

Signing the acknowledgment without fully understanding the implications of the subrogation/reimbursement agreement, or inaccurately representing the status of information provided on the form. Misunderstanding or misrepresentation can lead to legal complications.

Being meticulous and thorough while completing the Subrogation Sample form not only expedites the subrogation process but also maximizes the chances for accurate and timely reimbursement. It’s imperative to review every section carefully, provide all requested details, and update the form as needed. This attention to detail can significantly impact the recovery process in your favor.

Documents used along the form

When processing a Subrogation Sample form like the one provided by Gilsbar, which is aimed at reimbursing expenses from third parties responsible for injuries, a series of additional documents and forms are often required to support the process efficiently. These documents help to verify the incident details, establish the legitimacy of the claim, and ensure that all the necessary information is gathered for a successful subrogation claim. Understanding these documents enhances the claim's overall effectiveness and efficiency.

- Police Report: An official report filed by the police providing details of the incident, including the parties involved, witnesses, and circumstances of the event. It's crucial for motor vehicle accidents.

- Medical Records: Documentation from healthcare providers detailing the injuries sustained, treatments provided, and prognosis. These records are vital for establishing the extent of the injuries and the medical expenses incurred.

- Insurance Policy Documents: The insurance policies of both the claimant and the responsible party, which include terms, coverage limits, and exclusions. These documents are necessary to determine coverage applicability.

- Claim Form: A form submitted to an insurance company detailing the incident, injuries, and request for coverage. This form initiates the claim process with the insurer.

- Settlement Agreement: A document outlining the terms of a settlement between the injured party and the responsible party or their insurance company. It often stipulates the compensation amount and any conditions attached.

- Attorney Correspondence: Communication between legal representatives of the parties involved in the incident. These documents can include demand letters, settlement offers, and other legal negotiations.

- Witness Statements: Written or recorded statements from individuals who observed the incident. These statements can provide additional details and corroborate the claimant's account of the event.

- Receipts and Bills: Detailed invoices and receipts for expenses related to the incident, such as medical treatment, vehicle repairs, and other damages. These are necessary to substantiate the financial impact of the incident.

Together, these documents form a comprehensive dossier that supports the subrogation process. By thoroughly collecting and organizing this information, parties involved in a subrogation claim can streamline the recovery of funds, ensure a fair settlement, and expedite the resolution of the claim. The effectiveness of the subrogation claim relies not only on the accuracy of the Subrogation Sample form but also on the clarity and completeness of the supporting documents provided throughout the process.

Similar forms

The Health Insurance Claim Form shares similarities with the Subrogation Sample form as both require detailed information about the policyholder, including personal identification and incident specifics. The Health Insurance Claim Form is used to apply for reimbursement or direct payments for medical services rendered. Like the Subrogation Sample form, it asks for a description of the incident, types of injuries sustained, and details about any other claims filed in relation to the incident. Both forms play a crucial role in the financial transactions between insured individuals, healthcare providers, and insurance companies.

The Automobile Insurance Claim Form mirrors aspects of the Subrogation Sample form, particularly in Section B and Section C, where detailed information about motor vehicle accidents and automobile insurance details are required. Both forms collect data on the incident, including the date, nature of the incident, parties involved, and insurance information. This information is used to assess liability and determine financial responsibility for damages or injuries resulting from the accident.

The Workers' Compensation Claim Form is another document with objectives similar to those of the Subrogation Sample form, especially evident in the parts where information about an incident that occurred in the workplace is needed. Workers' Compensation forms focus on gathering detailed information about work-related injuries or illnesses, including the incident date, type of injury sustained, and ongoing treatment details, paralleling the requirements of the Subrogation Sample form for capturing incident-related information.

Property Damage Claim Form aligns closely with the Subrogation Sample form through its emphasis on documenting incidents leading to property loss or damage. This form requires details such as the incident's date, location, description, and any third-party involvement, similar to the comprehensive incident data captured by the Subrogation Sample form. The intent behind both forms is to establish the circumstances surrounding an event to facilitate financial recovery from any liable parties.

Dos and Don'ts

When filling out the Subrogation Sample form, it's important to pay attention to detail and follow specific guidelines. Here is a list of things you should and shouldn't do to ensure the process goes smoothly:

- Do ensure that every section applicable to your situation is filled out completely. Leaving out information can delay the process.

- Do provide accurate and detailed descriptions of the incident, including exact dates and locations. This helps in assessing the situation thoroughly.

- Do check the appropriate boxes that apply to your situation, especially in sections dealing with the type of incident and ongoing treatments.

- Do include all relevant insurance information, such as policy numbers and contact details for adjusters, ensuring that both your insurance and the third party’s information are complete if available.

- Don't forget to check if a section requires a specific format for the information, like dates (MM/DD/YYYY), and follow it accordingly.

- Don't leave sections blank if they are marked as required for your specific case. If a question does not apply, consider noting it as N/A (not applicable) rather than leaving it empty.

- Don't sign the form without reviewing all the information for accuracy and completeness. Your signature certifies that the information provided is true to the best of your knowledge.

- Don't hesitate to contact a representative if you are unsure about any section of the form. It's better to ask for clarification than to submit incorrect information.

By following these guidelines, you can help ensure that your subrogation form is filled out correctly, which aids in the processing of your case without unnecessary delays.

Misconceptions

When it comes to understanding the Subrogation Sample form provided by Gilsbar, several misconceptions may arise due to its complex nature. It's important to dispel these misconceptions to ensure clarity and proper procedure in handling insurance claims and understandings.

- Subrogation only applies to auto accidents: While Section B of the form specifically deals with motor vehicle accidents, the form encompasses other incidents as well, such as workplace injuries or incidents involving homeowners' liability, as indicated in Sections A and D.

- No need for detailed incident information if there’s police or incident report: Even if there is an official report by the police or any other authority, the form requires a detailed description of the incident in the applicant's own words in Section A. This aids in the assessment and processing of the subrogation claim.

- Legal representation is mandatory: Section E requests attorney information if applicable, implying that having an attorney is not a prerequisite for subrogation. Individuals can pursue subrogation without legal representation, although seeking professional advice might be beneficial.

- Subrogation claims are only for the immediate aftermath of an incident: The form acknowledges ongoing treatments and future settlements via tick boxes and fields for details, indicating that subrogation can extend beyond initial claims until the full extent of damages and recoveries are realized.

- Submitting this form means immediate reimbursement: By submitting the form, individuals agree to the subrogation/reimbursement agreement provision. However, this does not guarantee immediate reimbursement. The process involves negotiations and settlements which can be lengthy.

- Signing the form waives all rights to future claims: While signing the form does involve agreeing to reimburse benefits from future settlements, it doesn't entirely waive rights to all future claims related to the incident. It specifically relates to reimbursements from third-party payments.

- Only the policyholder needs to fill out the form: The form requires information about the employee/policyholder and dependents if they are involved in the incident. This means not just the primary insured individual but also any dependents affected need to be accounted for in the submission.

- Personal insurance information is irrelevant if the other party is at fault: Section C requests the applicant's automobile insurance information regardless of fault. This is crucial as it helps in determining the extent of coverage and the process of subrogation.

- Incident details are required only if seeking reimbursement: The form demands a comprehensive incident description even if the individuals have not decided to seek reimbursement yet. This anticipates potential subrogation and assists in creating a complete record.

- All sections of the form must be completed: The form highlights specific sections that must be filled out only if applicable through checkboxes. This means not all sections are mandatory for all incidents, which allows for flexibility based on the specifics of the incident.

Understanding these misconceptions clarifies the subrogation process, ensures the proper documentation is completed, and assists both the insurer and insured in the efficient handling of claims.

Key takeaways

Handling the Subrogation Sample form can seem daunting at first, but it’s an essential step in ensuring that your medical benefits are appropriately managed in the event of an incident that involves another party. To make this process smoother, here are four key takeaways to guide you through filling out and using the form:

- Complete all required sections thoroughly: The form is divided into sections that cover different scenarios, such as incidents and motor vehicle accidents. It’s crucial to check the applicable sections and provide detailed information for each field. Accurate and comprehensive details will streamline the subrogation process.

- Understand the purpose of each section: Each part of the form serves a unique purpose. For instance, Section A focuses on incident information, Section B is for motor vehicle accidents, Section C and D request insurance information of both your automobile and the responsible party, and Section E concerns your attorney’s information. Recognizing what each section aims to capture will help in filling out the form accurately.

- Sign and date the form to acknowledge the agreement: By signing the form, you agree to reimburse your medical plan for any benefits paid on your behalf or any covered person under your plan, from any third-party payments because of the injury described. It’s a legal agreement that also authorizes the release of necessary information between medical providers, your lawyer, or any other relevant parties to ensure the reimbursement process can proceed.

- Cooperation is key for a smooth process: The form ends with a note thanking you for your cooperation, highlighting the importance of collaboration in the subrogation process. Not only does your cooperation facilitate the reimbursement process, but it also helps in ensuring that all parties involved are adequately informed and can perform their roles effectively.

Handling a Subrogation Sample form with care and attention to these key points will assist in the efficient processing of your case. This not only aids in the correct management of your medical benefits following an incident but also ensures that all involved parties have the information they need to support you through this process.

Popular PDF Forms

New Driver's License Tn - Guidelines for listing the insurance representative’s contact details ensure effective follow-up and support in resolving insurance claims.

How Do Fish Hatcheries Work - Specify any special care instructions for your poultry directly on the Welp Hatchery form to ensure they receive the best care upon arrival.