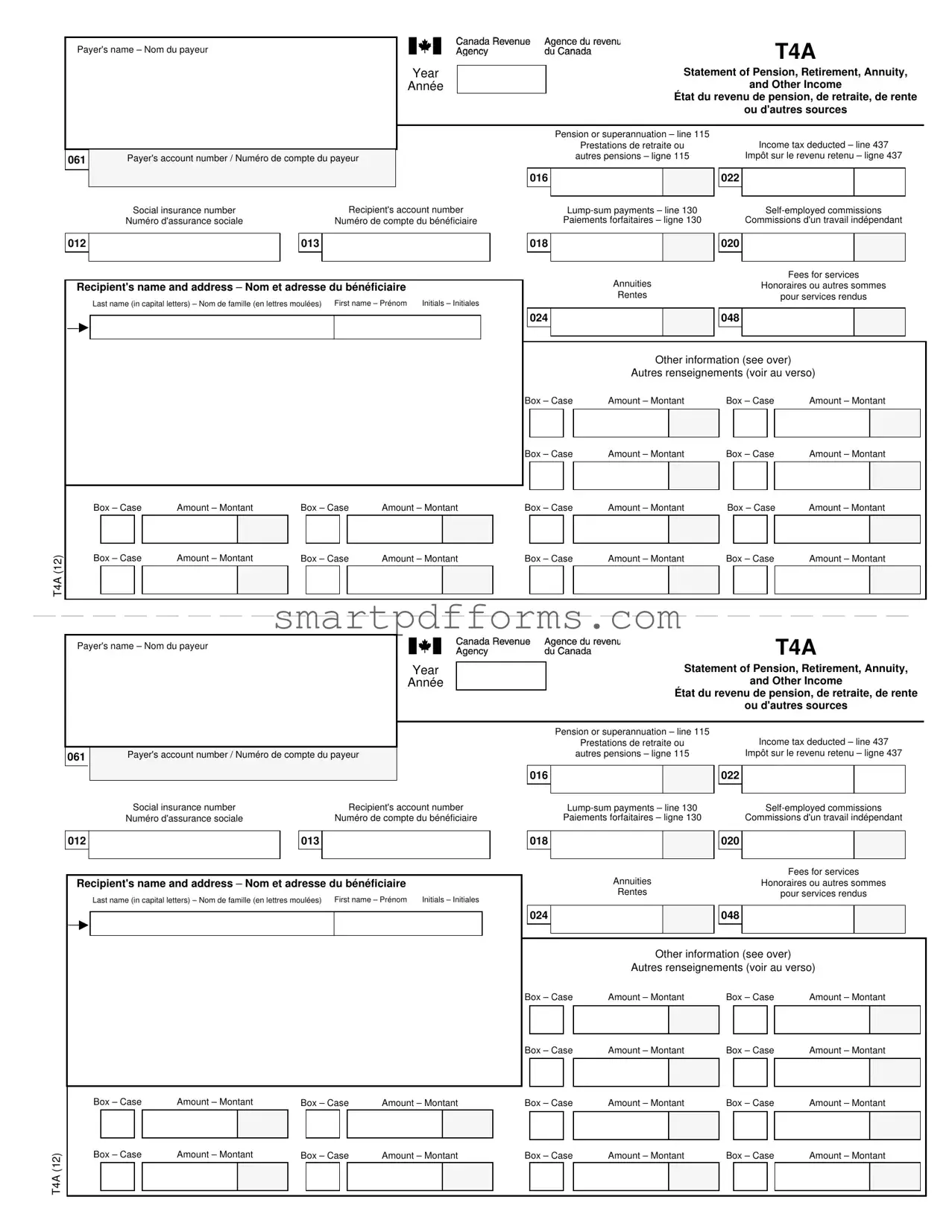

Blank T4A PDF Template

The T4A form is a critical document for Canadians, encapsulating various types of income that go beyond the regular employment income reported on a T4 slip. This form encompasses pension, retirement, annuity, and other miscellaneous income components, making it essential for accurately reporting and complying with tax obligations. With fields ranging from the payer's details to the recipient's social insurance number and comprehensive income breakdowns, the T4A serves as a cornerstone for financial transparency between individuals and the Canada Revenue Agency (CRA). It details sources of income such as pension or superannuation, lump-sum payments, self-employed commissions, annuities, and even scholarships or bursaries, ensuring that each is appropriately reported for tax purposes. Instructions within the form guide taxpayers on how to report each amount on their tax return, from income tax deducted to eligible retiring allowances and contributions to registered pension plans. This clear delineation helps prevent errors and ensures individuals can claim eligible deductions and credits, fostering a fair and efficient tax administration system. Moreover, the form addresses various cases, including payments from wage-loss replacement plans to research grants, underlining the diversity of income types the T4A represents. With specific guidance on how to report these amounts, the form is instrumental in navigating the complexities of tax reporting and compliance.

Preview - T4A Form

Payer's name – Nom du payeur

Year

Année

061Payer's account number / Numéro de compte du payeur

|

Social insurance number |

Recipient's account number |

|

||

|

Numéro d'assurance sociale |

Numéro de compte du bénéficiaire |

|

||

|

|

|

|

|

|

012 |

|

|

013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Recipient's name and address – Nom et adresse du bénéficiaire |

|

||||

|

Last name (in capital letters) – Nom de famille (en lettres moulées) |

First name – Prénom Initials – Initiales |

|

||

|

|

|

|

Box – Case |

|

Amount – Montant |

|

Box – Case |

|

Amount – Montant |

|

|

|

||||||||||||||||||||

T4A (12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Box – Case |

|

Amount – Montant |

|

Box – Case |

|

Amount – Montant |

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payer's name – Nom du payeur

Year

Année

061Payer's account number / Numéro de compte du payeur

|

Social insurance number |

Recipient's account number |

|||

|

Numéro d'assurance sociale |

Numéro de compte du bénéficiaire |

|||

|

|

|

|

|

|

012 |

|

|

013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recipient's name and address – Nom et adresse du bénéficiaire |

|||||

|

Last name (in capital letters) – Nom de famille (en lettres moulées) |

First name – Prénom Initials – Initiales |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box – Case |

Amount – Montant |

Box – Case |

Amount – Montant |

||||||||

T4A (12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Box – Case |

Amount – Montant |

Box – Case |

Amount – Montant |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T4A |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement of Pension, Retirement, Annuity, |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and Other Income |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

État du revenu de pension, de retraite, de rente |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ou d'autres sources |

||||||||||||||

|

|

|

|

Pension or superannuation – line 115 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

Prestations de retraite ou |

|

|

|

|

|

Income tax deducted – line 437 |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

autres pensions – ligne 115 |

|

|

|

|

Impôt sur le revenu retenu – ligne 437 |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

Paiements forfaitaires – ligne 130 |

|

|

|

|

Commissions d'un travail indépendant |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fees for services |

|||||||||

|

|

|

|

|

|

|

|

|

|

Annuities |

|

|

|

|

|

|

Honoraires ou autres sommes |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Rentes |

|

|

|

|

|

|

|

|

|

pour services rendus |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

048 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other information (see over) |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Autres renseignements (voir au verso) |

||||||||||||||||||||||||

Box – Case |

|

|

Amount – Montant |

|

Box – Case |

|

Amount – Montant |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box – Case |

|

|

Amount – Montant |

|

Box – Case |

|

Amount – Montant |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box – Case |

|

|

Amount – Montant |

|

Box – Case |

|

Amount – Montant |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box – Case |

|

|

Amount – Montant |

|

Box – Case |

|

Amount – Montant |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T4A |

|||

|

|

|

|

|

|

Statement of Pension, Retirement, Annuity, |

|||||||||

|

|

|

|

|

|

|

|

|

|

and Other Income |

|||||

|

|

|

|

|

|

État du revenu de pension, de retraite, de rente |

|||||||||

|

|

|

|

|

|

|

|

|

|

ou d'autres sources |

|||||

|

|

|

Pension or superannuation – line 115 |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

Prestations de retraite ou |

|

|

Income tax deducted – line 437 |

|||||||

|

|

|

|

|

autres pensions – ligne 115 |

|

|

Impôt sur le revenu retenu – ligne 437 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

016 |

|

|

|

|

|

022 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

Paiements forfaitaires – ligne 130 |

|

|

Commissions d'un travail indépendant |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

018 |

|

|

|

|

|

020 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fees for services |

|||

|

|

|

|

|

Annuities |

|

|

Honoraires ou autres sommes |

|||||||

|

|

|

|

|

Rentes |

|

|

|

|

pour services rendus |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

024 |

|

|

|

|

|

048 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other information (see over) |

||||||||||

|

|

|

|

|

Autres renseignements (voir au verso) |

||||||||||

Box – Case |

Amount – Montant |

Box – Case |

Amount – Montant |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box – Case |

Amount – Montant |

Box – Case |

Amount – Montant |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box – Case |

Amount – Montant |

Box – Case |

Amount – Montant |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box – Case |

Amount – Montant |

Box – Case |

Amount – Montant |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Report these amounts on your tax return.

Box 016, Pension or superannuation – Enter this amount on line 115. It may qualify for the pension income amount (see line 314 in your tax guide).

Box 018,

Box 102,

Box 158,

Box 180,

Box 020,

Box 022, Income tax deducted – Enter this amount on line 437. Box 024, Annuities – See line 115 in your tax guide.

The amounts in the following boxes are included in box 024: Box 111, Income averaging annuity contracts (IAAC)

Box 115, Deferred

Box 026, Eligible retiring allowances (for 2009 and prior years only) – Enter this amount on line 130. You may be able to transfer part or all of this amount into a registered retirement savings plan or registered pension plan. See line 130 in your tax guide.

Box 027,

Box 028, Other income – Amounts not reported anywhere else on the T4A slip. See line 130 and lines 135 to 143 in your tax guide.

Box 030, Patronage allocations – Enter this amount on line 130. Do not report the amount if it was for goods or services you consumed and for which you cannot deduct the cost when you calculate your income. This amount does not qualify for the federal dividend tax credit.

Box 032, Registered pension plan contributions (past service) – Enter the amount you can deduct on line 207 (see Guide T4040, RRSPs and Other Registered Plans for Retirement).

Box 126,

Box 034, Pension adjustment – Enter this amount on line 206. This amount is not an income or a deduction.

Box 040, RESP accumulated income payments – Enter this amount on line 130 and complete Form T1172, Additional Tax on Accumulated Income Payments from RESPs.

Box 122, RESP accumulated income payments paid to other (included in box 040)

Box 042, RESP educational assistance payments – Enter this amount on line 130. For details, see Information Sheet RC4092, Registered Education Savings Plans.

Box 046, Charitable donations – See line 349 in your tax guide.

Box 048, Fees for services – Report this amount as business income. Box 133, Variable pension benefits – See line 115 in your tax guide.

Box 135,

Enter on line 104:

Box 104, Research grants – See line 104 in your tax guide.

Box 107, Payments from a

Box 119, Premiums paid to a group term life insurance plan Box 127, Veterans' benefits

Box 132, Wage Earner Protection Program

Box 152, SUBP qualified under the Income Tax Act Box 156, Bankruptcy settlement

Enter on line 125:

Box 131, Registered disability savings plan

Enter on line 130:

Box 105, Scholarships, bursaries, fellowships, artists' project grants, and prizes – See line 130 in your tax guide.

Box 106, Death benefits – See line 130 in your tax guide. Box 109, Periodic payments from an unregistered plan Box 117, Loan benefits

Box 123, Payments from a revoked DPSP

Box 125, Disability benefits paid out of a superannuation or pension plan Box 129, Tax deferred cooperative share

Box 130, Apprenticeship incentive grant or Apprenticeship completion grant Box 134,

Box 150, Labour Adjustment Benefits Act and Appropriation Acts

Box 154, Cash award or prize from payer

Do not report on your tax return – Canada Revenue Agency use only |

Box 142, Indian (exempt income) – Eligible retiring allowances |

Box 014, Recipient number |

Box 143, Indian (exempt income) – |

Box 036, Plan registration number |

Box 144, Indian (exempt income) – Other income |

Box 116, Medical travel assistance |

Box 146, Indian (exempt income) – Pension or superannuation |

Box 124, Board and lodging at special work sites |

Box 148, Indian (exempt income) – |

Privacy Act, Personal Information Bank numbers CRA PPU 005 and 047, Loi sur la protection des renseignements personnels, Fichiers de renseignements personnels ARC PPU 005 et 047

Déclarez ces montants dans votre déclaration de revenus.

Case 016, Prestations de retraite ou autres pensions – Inscrivez ce montant à la ligne 115. Vous pourriez avoir droit au montant pour revenu de pension (lisez la ligne 314 de votre guide d'impôt).

Case 018, Paiements forfaitaires – Inscrivez ce montant à la ligne 130.

Les montants figurant dans les cases suivantes sont inclus dans la case 018 :

Case 102, Paiements forfaitaires – transfert de services de

Case 158, Paiements forfaitaires non admissible à un transfert, et qui ne sont pas déclarés ailleurs Case 180, Paiements forfaitaires versés à partir d'un RPDB non admissible à un transfert

Case 190, Paiements forfaitaires – Prestations d'un régime de pension non agréé

Case 020, Commissions d'un travail indépendant – Inscrivez le montant brut de vos revenus de commissions

àla ligne 166 et le montant net de vos revenus de commissions à la ligne 139. Case 022, Impôt sur le revenu retenu – Inscrivez ce montant à la ligne 437.

Case 024, Rentes – Lisez la ligne 115 de votre guide d'impôt.

Les montants figurant dans les cases suivantes sont inclus dans la case 024 : Case 111, Contrat de rentes à versement invariable (CRVI)

Case 115, Paiements d'une rente ou versements selon un régime de participation différée aux bénéfices (RPDB)

Case 026, Allocations de retraite admissibles (pour l’année 2009 et les années précédentes seulement) – Inscrivez ce montant à la ligne 130. Il se pourrait que ce montant soit transférable en partie ou en totalité dans un REER ou dans un régime de pension agréé. Lisez la ligne 130 de votre guide d'impôt.

Case 027, Allocations de retraite non admissibles (pour l’année 2009 et les années précédentes seulement) – Inscrivez ce montant à la ligne 130.

Case 028, Autres revenus – Montants non déclarés à d'autres endroits sur le feuillet T4A. Lisez la ligne 130 ainsi que les lignes 135 à 143 de votre guide d'impôt.

Case 030, Répartitions selon l'apport commercial – Inscrivez ce montant à la ligne 130. Ne déclarez pas ce montant s'il concerne des produits de consommation ou des services dont vous ne pouvez pas déduire le coût dans le calcul de votre revenu. Ce montant ne vous donne pas droit au crédit d'impôt fédéral pour dividendes.

Case 032, Cotisations à un régime de pension agréé (services passés) – Inscrivez le montant que vous pouvez déduire à la ligne 207 (consultez le guide T4040, REER et autres régimes enregistrés pour la retraite).

Case 126, Cotisations pour périodes de services avant 1990 (incluses dans la case 032)

Case 034, Facteur d'équivalence – Inscrivez ce montant à la ligne 206. Ce montant n'est ni un revenu ni une déduction.

Case 040, Paiements de revenu accumulé d'un REEE – Inscrivez ce montant à la ligne 130. Vous devez aussi remplir le formulaire T1172, Impôt supplémentaire sur les paiements de revenu accumulé de REEE.

Case 122, Paiements de revenu accumulé d'un REEE payé à un tiers (inclus dans la case 040)

Case 042, Paiements d'aide aux études d'un REEE – Inscrivez ce montant à la ligne 130. Pour en savoir plus, consultez la feuille de renseignements RC4092, Les régimes enregistrés

Case 046, Dons de bienfaisance – Lisez la ligne 349 de votre guide d'impôt.

Case 048, Honoraires ou autre sommes pour services rendus – Inscrivez ces montants comme revenu d'entreprise.

Case 133, Prestations de retraite variables – Lisez la ligne 115 de votre guide d'impôt. Case 135, Primes versées à un régime privé

Inscrivez à la ligne 104 :

Case 104, Subventions de recherche – Lisez la ligne 104 de votre guide d'impôt.

Case 107, Paiements reçus d'un régime

Case 118, Avantages pour primes de soins médicaux

Case 119, Primes payées pour une police

Case 132, Programme de protection des salariés

Case 152, PSC admissible à ce titre en vertu de la Loi de l'impôt sur le revenu Case 156, Règlements d'une société en faillite

Inscrivez à la ligne 125 :

Case 131, Régime enregistré

Inscrivez à la ligne 130 :

Case 105, Bourses d'études, de perfectionnement et d'entretien; subventions reçues par un artiste pour un projet et récompenses – Lisez la ligne 130 de votre guide d'impôt.

Case 106, Prestations consécutives au décès – Lisez la ligne 130 de votre guide d'impôt. Case 109, Paiements périodiques d'un plan non agréé

Case 117, Avantages liés à un prêt

Case 123, Paiements provenant d'un RPDB dont l'agrément a été retiré

Case 125, Prestations d'invalidité payées à même un régime de prestations de retraite ou d'autres pensions

Case 129, Part de votre coopérative à imposition différée

Case 130, Subvention incitative aux apprentis ou à l'achèvement de la formation d'apprenti Case 134, Compte d'épargne libre d'impôt (CELI) – montant imposable

Case 150, Loi sur les prestations d'adaptation pour les travailleurs et Lois de crédits Case 154, Prime en espèces ou prix payé d'un payeur

Ne déclarez pas les renseignements suivants dans votre déclaration de revenus – À l'usage de l'Agence du revenu du Canada seulement

Case 014, Numéro du bénéficiaire

Case 036, Numéro d'agrément du régime

Case 116, Aide financière pour voyages pour soins médicaux Case 124, Logement et repas sur les chantiers particuliers

Case 142, Indien (revenu exonéré) – Allocations de retraite admissibles

Case 143, Indien (revenu exonéré) – Allocations de retraite non admissibles Case 144, Indien (revenu exonéré) – Autres revenus

Case 146, Indien (revenu exonéré) – Prestations de retraite ou autres pensions Case 148, Indien (revenu exonéré) – Paiements forfaitaires

Privacy Act, Personal Information Bank numbers CRA PPU 005 and 047, Loi sur la protection des renseignements personnels, Fichiers de renseignements personnels ARC PPU 005 et 047

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The T4A form is used for reporting pension, retirement, annuity, and other income sources in Canada. |

| Key Components | It includes details such as the payer's name and account number, recipient's name, social insurance number, and the amounts pertaining to various income sources. |

| Income Reporting | Recipients must report amounts from the T4A form on their tax return, including pensions, lump-sum payments, self-employed commissions, and annuities among others. |

| Tax Implications | Apart from declaring income, certain boxes on the form guide recipients on where to report potential tax deductions and credits on their tax return. |

| Specific Inclusions | The form includes boxes for various income types, such as RESP accumulated income payments, educational assistance payments, and fees for services, which have designated lines on the tax return for reporting. |

| Governing Law | This form is governed by Canadian tax law, specifically by the Canada Revenue Agency (CRA), which mandates the reporting and taxation stipulations for T4A income. |

Instructions on Utilizing T4A

Once you've gathered all necessary information, including social insurance numbers, payer's account numbers, and total amounts for various incomes and deductions, you're ready to fill out the T4A form. This form is essential for accurately reporting pension, retirement, annuity, and other forms of income received during the year. It's crucial to complete each section with precise details to ensure compliance with tax obligations and to avoid any potential issues with the Canada Revenue Agency (CRA).

- Start with the payer's information by entering the Payer's name and the Year in the designated sections at the top of the form.

- Input the Payer's account number as indicated in the section labeled "Numéro de compte du payeur."

- Fill in your Social Insurance Number carefully to ensure it's accurate.

- If applicable, enter the Recipient's account number in the space provided.

- Under the section "Recipient's name and address," write the recipient's Last Name in capital letters, followed by the First Name and any Initials.

- Proceed to report each applicable Amount next to its corresponding Box or Case number, based on the types of income received, such as pensions, lump-sum payments, self-employed commissions, and annuities.

- For every entry, ensure that the Amount field is completed with the exact figure provided in your income documentation.

- Review each section for accuracy, transferring any totals from additional sheets if you've used more than one form to capture all necessary information.

- Refer to your tax guide for specific line numbers related to each box amount on the form. This includes line numbers for pension or superannuation, income tax deducted, and various types of payments like lump-sum or self-employed commissions. Enter these amounts on your tax return as directed by the instructions linked to each box.

- Once all sections are accurately filled out, double-check the form for any errors or omissions. Making sure all relevant boxes have been completed correctly is crucial for accurate tax reporting.

After finishing the form, the next steps involve including this information in your tax return. Every amount entered correlates with specific lines on the tax return, such as pensions (line 115), lump-sum payments (line 130), and income tax deducted (line 437). Carefully transferring these amounts to your tax return ensures that your income is reported accurately, which is essential for calculating the correct amount of tax owed or any potential refund. Keep a copy of the completed T4A form for your records and submit it along with your tax return as required by the CRA.

Obtain Answers on T4A

What is a T4A form?

A T4A form, known as the Statement of Pension, Retirement, Annuity, and Other Income, is a document issued by payers in Canada to report certain types of income they have paid to individuals. This can include pensions, annuities, self-employed commissions, and other various types of income. Individuals who receive a T4A form must report these amounts on their tax return to the Canada Revenue Agency (CRA).

Who needs to fill out a T4A form?

Individuals do not fill out the T4A form themselves; instead, it is the responsibility of the payer to complete and issue this form to the recipient of the payments covered under it. This includes administrators of pension plans, and entities or individuals who have made payments to self-employed contractors, for example. Any Canadian taxpayer who receives income from pensions, annuities, self-employed commissions, or other sources reported on a T4A will use the information on the form to complete their income tax return.

What types of income are reported on a T4A form?

The T4A form encompasses a wide range of income types beyond traditional employment income. These include, but are not limited to, pension or superannuation, lump-sum payments, self-employed commissions, fees for services, annuities, and other payments like research grants, scholarships, bursaries, and death benefits. Each type of income is reported in specific boxes on the form, designed to organize and categorize the various income sources for tax reporting purposes.

How do I report T4A income on my tax return?

T4A income is reported in various lines on your tax return, depending on the type of income. For instance, amounts from box 016 (pension or superannuation) are entered on line 115 of the tax return, whereas lump-sum payments reported in box 018 should be reported on line 130. The specific line number will depend on the type of income being reported, and individuals should refer to their tax guide for detailed instructions on where to report each amount from the T4A on their tax return.

Can I transfer amounts from my T4A to other tax-deferred plans?

Yes, under certain conditions, some amounts reported on the T4A form can be transferred to tax-deferred plans such as a Registered Retirement Savings Plan (RRSP) or a Registered Pension Plan (RPP). For example, eligible retiring allowances (box 026 for amounts applicable for 2009 and prior years) might be transferred in part or in full into an RRSP or RPP. The transferability of specific amounts depends on various factors, including the nature of the income and current tax laws. Individuals should consult the CRA's guidelines or a tax professional to understand the eligibility and process for such transfers.

What should I do if I believe there is an error on my T4A form?

If an individual believes there is an error on their T4A form, they should first contact the issuer of the form to request a correction. This may involve providing documentation or other evidence to support the need for a revision. If the form has been incorrectly reported and the issuer agrees, a corrected T4A (often marked as "amended") will be issued. If discrepancies cannot be resolved directly with the issuer, the individual may need to contact the CRA for further guidance on reporting the income accurately on their tax return.

Common mistakes

Filling out the T4A form, a crucial document for reporting pension, retirement, annuity, and other income received during the year in Canada, requires accuracy and attentiveness. Mistakes can easily occur but knowing what they are can help avoid potential issues with the Canada Revenue Agency (CRA). Here are seven common errors to be mindful of:

Incorrect personal information: Entering an incorrect Social Insurance Number (SIN) or misspelling the recipient's name can lead to processing delays or the misattribution of income for tax purposes.

Omitting income reported: Failing to report all amounts received as indicated in the various boxes on the T4A slip (e.g., pension or superannuation, lump-sum payments, self-employed commissions) can result in underreported income and potential penalties.

Reporting amounts in the wrong boxes: Misplacing figures, such as entering lump-sum payments in the box for pension amounts or vice versa, can lead to incorrect tax calculations.

Ignoring eligible deductions: Overlooking the opportunity to deduct eligible amounts, such as registered pension plan contributions or eligible retiring allowances, can result in a higher tax bill than necessary.

Failure to apply for eligible credits: Not recognizing or claiming eligible tax credits, for example, the pension income amount, means missing out on reducing one's taxable income.

Not understanding the tax implications: Each box on the T4A form represents income that may be tax-deductible or tax-exempt in certain conditions. Not understanding these implications fully can lead to inaccuracies on the tax return.

Incorrectly calculating totals: Simple mathematical errors when adding or transferring amounts can lead to discrepancies, requiring corrections and possibly delaying tax assessments.

Tips for Accurate Completion:

Double-check all personal and financial information before submission.

Ensure all income received is reported in the correct boxes according to the guidelines.

Consult the CRA's tax guide or a tax professional if unsure about where to report specific income or claim eligible deductions and credits.

Use a calculator to avoid any mathematical errors and review the form thoroughly before submitting.

By avoiding these common mistakes and following the provided tips, taxpayers can ensure their T4A forms are correctly completed, thereby facilitating a smoother tax filing process with the Canada Revenue Agency.

Documents used along the form

The T4A form, utilized for reporting pension, retirement, annuity, and other forms of income in Canada, often necessitates the completion and submission of additional forms and documents to fully comply with the Canada Revenue Agency (CRA) requirements. This list highlights supplementary documents frequently associated with the T4A to provide a clearer picture of the comprehensive tax reporting process.

- Form T1 General – Income Tax and Benefit Return: This is the primary form used by individuals to file their annual income tax returns in Canada. It includes income from all sources, including those reported on the T4A form.

- Form T2202 – Tuition and Enrolment Certificate: For students receiving scholarships, bursaries, or tuition reimbursements reported on a T4A, this form allows them to claim eligible tuition fees and education amounts.

- Form T1172 – Additional Tax on Accumulated Income Payments from RESPs: If a T4A reports payments from a Registered Education Savings Plan (RESP), this form calculates the additional tax owed on these amounts.

- Form T2125 – Statement of Business or Professional Activities: Individuals who receive business income (as reported on a T4A for services rendered) must fill out this form as part of their T1 tax return to provide details about their business income and expenses.

- Form T1032 – Joint Election to Split Pension Income: For pension income reported on a T4A, this form allows eligible spouses to split pension income for tax benefits.

- Form T1013 – Authorizing or Cancelling a Representative: This form is used to authorize another individual or entity, such as an accountant, to communicate with the CRA and access information related to the filer's tax records, including T4A information.

- RRSP Contribution Receipts: For those reporting eligible retiring allowances or other amounts transferred to an RRSP (Registered Retirement Savings Plan), contribution receipts serve as proof of the transfer and are necessary for tax filing.

- Form T2200 – Declaration of Conditions of Employment: Though not directly related to T4A income, this form may be required for individuals claiming employment expenses, some of which may be relevant for self-employed commissions reported on a T4A.

These documents collectively ensure accurate reporting and compliance with Canadian tax laws, providing the CRA with a complete financial picture for individuals receiving various types of income, as detailed on the T4A form and beyond. Understanding and utilizing these forms appropriately can aid in optimizing tax outcomes and ensuring legal compliance.

Similar forms

The T4 form, often used by employers to report the income earned by employees and the deductions taken, is quite like the T4A. While the T4A focuses on pension, retirement, annuity, and other special types of income, the T4 emphasizes employment income. Both provide essential data for accurately filing personal income taxes.

Form 1099-MISC in the United States serves a similar function to the T4A, reporting miscellaneous income. This can encompass freelance payments, rent, or prizes, paralleling the catch-all nature of the T4A for various non-employment income sources in Canada.

The 1099-R form, used in the U.S. for reporting distributions from pensions, annuities, retirement plans, or profit-sharing, mirrors the pension and annuity income aspects of the T4A. They both ensure that individuals report their retirement income accurately for tax purposes.

W-2G is an American form for reporting gambling winnings and parallels the section of the T4A that might cover lottery or gambling earnings in Canada. Gambling proceeds must be reported by taxpayers in both countries to fulfill their legal obligations.

RRSP Contribution Receipts in Canada share similarities with elements of the T4A, focusing specifically on retirement savings. They are essential for tax filings to claim deductions on contributions, whereas the T4A might report income drawn from such savings.

The T5013 Statement of Partnership Income is analogous to portions of the T4A that report business income, such as self-employed commissions or indirect income sources through partnerships. Both forms cater to reporting income that falls outside traditional employment relationships.

Schedule K-1 in the U.S., used for reporting income from trusts, estates, and partnerships, shares similarities with the business and investment income aspects of the T4A. Each document caters to sophisticated income sources, ensuring accurate tax reporting.

The T5 Statement of Investment Income in Canada is like the T4A in its role of reporting certain types of income, such as dividends or interest from investments, albeit the T4A’s scope is broader, covering a wider range of income types.

The 1042-S form in the U.S., focusing on income paid to foreign persons, including freelancers and independent contractors, parallels the non-employment income reporting function of the T4A for Canadian tax residents.

Dos and Don'ts

Understanding the T4A form—Statement of Pension, Retirement, Annuity, and Other Income—is crucial for accurately reporting various types of income on your tax return in Canada. Here are some essential do's and don’ts when it comes to filling out your T4A form:

- Do review all the boxes carefully to ensure you report each amount on the corresponding line of your tax return. Accurate reporting helps avoid processing delays.

- Do enter your Social Insurance Number correctly. This number is vital for the Canada Revenue Agency (CRA) to match the T4A form with your tax records.

- Do report the gross commissions income on line 166 and your net commissions income on line 139 if you are self-employed, as indicated in box 020 of the form.

- Do ensure that pension or superannuation amounts from box 016 are entered on line 115 of your return. This could qualify you for the pension income amount.

- Do include lump-sum payments, as indicated in box 018, on line 130 of your tax return. Remember, certain amounts listed in other boxes also consolidate into this entry.

- Don't overlook the requirement to complete additional forms for certain types of income, such as the Form T1172 for RESP accumulated income payments.

- Don't miss out on claiming eligible deductions like the pension adjustment in box 034 or the registered pension plan contributions in box 032. These can significantly impact your tax obligations.

- Don't report exempt income, such as amounts in boxes related to Indian (exempt income) directly on your tax return. These figures are not taxable and are for CRA's use only.

- Don't forget to double-check your entries for accuracy against your personal records before submitting the form. Mistakes or omissions can lead to unnecessary delays or inquiries from CRA.

Following these guidelines can smooth the process of handling your T4A form, ensuring you report your income correctly and take advantage of eligible deductions and credits to optimize your tax outcome.

Misconceptions

When it comes to taxation and understanding the various forms that must be filled out, it's easy to be overwhelmed or misinformed. The T4A Statement of Pension, Retirement, Annuity, and Other Income is one such document that can seem daunting at first glance. There are common misconceptions about this form, each of which deserves clarification:

T4A is only for retirees: A common misconception is that the T4A form is exclusive to retirees receiving pension or retirement benefits. However, this form also reports other types of income, such as scholarships, bursaries, annuities, and self-employed commissions, among others. It's a comprehensive document for various income reports outside of regular employment income.

Only large amounts are reported: Some believe that only significant amounts of income need to be reported through a T4A form. In reality, any amount paid in the categories required by the Canada Revenue Agency (CRA) must be reported, regardless of its size. Every dollar counts when it comes to taxation.

Employment income is included on a T4A: Another misconception is the belief that employment income is reported on a T4A statement. Employment income, however, is actually reported on a T4 slip. The T4A focuses on pension, retirement, annuity, and other specific types of income.

Income reported on a T4A is tax-free: Some recipients might think that income reported on a T4A form is not taxable. This isn't correct. Many types of income reported on the T4A are subject to taxation, depending on the total income, deductions, and credits of the individual.

No need to report if no tax was deducted: There's a belief that if no tax was deducted at the source for the income listed on a T4A form, then it doesn't need to be reported. This is false. All income reported on a T4A, with or without tax withheld, must be included in your tax return.

Scholarships and bursaries are always tax-exempt: While it's true that many scholarships, fellowships, and bursaries are not taxable, there are conditions that apply. For instance, post-secondary program scholarships are often exempt up to the amount required for school enrollment. However, this is not an automatic exemption for all scholarships and bursaries reported on a T4A.

Self-employed individuals don't receive T4A slips: Contrary to this belief, self-employed individuals may receive a T4A slip for certain types of income, such as self-employed commissions or fees for services. It’s important for independent contractors and freelancers to understand this aspect of income reporting.

T4A forms are optional for payers to issue: It's mandatory for payers to issue a T4A slip for many types of payments. This requirement ensures proper reporting and taxation of a wide range of income types, safeguarding both the payer and the recipient from potential tax discrepancies.

All retirement income is reported on a T4A: This is partially true, but other forms like the T4RSP, T4RIF, or T4A(P) are specifically designed for other retirement income sources, such as RRSP withdrawals, RRIF withdrawals, or Canada Pension Plan benefits, respectively. The T4A covers only certain types of retirement income.

Amendments to income reported on a T4A cannot be made: If mistakes are found on a T4A slip, corrections can and should be made. Either the issuer of the T4A can correct it and issue an amended slip, or individuals can contact the issuer or the CRA for guidance on how to correct the error on their tax return.

Understanding the intricacies of the T4A form can significantly impact tax reporting and compliance. It is essential to address these misconceptions to ensure accurate and efficient handling of your tax obligations.

Key takeaways

The T4A form, otherwise known as the Statement of Pension, Retirement, Annuity, and Other Income, plays a critical role in Canada's income reporting system, especially for individuals receiving non-employment income. Here are key takeaways regarding the completion and usage of the T4A form that individuals should bear in mind:

- Understanding the type of income reported: The T4A form encompasses a wide range of income types. This includes pensions, annuities, self-employed commissions, scholarships, bursaries, certain grants, and other payments like lump-sum payments from pensions or retirement plans. Recognizing the specific box numbers and the corresponding income they represent is essential for accurate reporting.

- Importance of accurate information: Every section of the T4A form—from the payer's and recipient's information to the detailed account numbers and amounts—must be accurately filled. Misreported information can lead to discrepancies that may require amendments later, causing delays in the processing of your tax return.

- Reporting income on your tax return: The amounts documented on the T4A form must be reported on your tax return. It is crucial to understand where on the tax return these amounts should be included. For example, pension or superannuation payments are entered on line 115, while self-employed commissions are reported on lines 166 and 139 for gross and net income, respectively. Incorrect reporting can affect your tax liabilities or entitlements like tax credits or deductions.

- Special considerations for certain amounts: Some amounts reported on the T4A form may have specific considerations. For instance, eligible retiring allowances can potentially be transferred into a Registered Retirement Savings Plan (RRSP) or Registered Pension Plan (RPP). Furthermore, other amounts, such as Educational Assistance Payments (EAPs) from a Registered Education Savings Plan (RESP), are included but have particular instructions on where they should be reported in the income tax return. Awareness and comprehension of these special conditions are pivotal.

Overall, the careful completion and proper understanding of the T4A form enable individuals to accurately report their income, which is fundamental in fulfilling their tax obligations and maximizing potential benefits.

Popular PDF Forms

How to Notify Medicaid of Income Change - Learn the critical importance of updating income details, including job earnings or benefits, to ensure your Medi-Cal coverage remains unchanged.

Itinerary Builder - A comprehensive layout for planning club sports travel, including transportation, accommodation, and match details.