Blank Tax Declaration Nat 3092 PDF Template

Embarking on new employment or engagement in various work arrangements necessitates a crucial step for individuals and businesses alike: dealing with the Tax Declaration NAT 3092 form. This document serves as a bridge, ensuring the correct amount of tax is withheld from payments made to individuals by their payers, under the Pay As You Go (PAYG) withholding system. It's important to understand that this form is not used for applying for a Tax File Number (TFN), but rather for declaring it to the payer. The information provided through this declaration has far-reaching implications, allowing payers to deduce the accurate amount of tax to withhold, thus impacting one's take-home pay and tax obligations. The necessity for accuracy when completing this form cannot be overstated, as providing incorrect information can result in either more tax being withheld than necessary or potentially owing tax at the end of the financial year. It is tailored for individuals embarking on various forms of payment arrangements, from traditional employment to more specific scenarios such as superannuation benefits and several types of allowances. Moreover, the form touches on significant considerations for non-residents, working holiday makers, and those claiming exemptions, making it a comprehensive tool for managing tax withholding in a myriad of situations. The NAT 3092 form is a critical piece of documentation that requires careful attention to ensure compliance with the Australian Taxation Office requirements and to facilitate a smooth financial relationship between payers and payees.

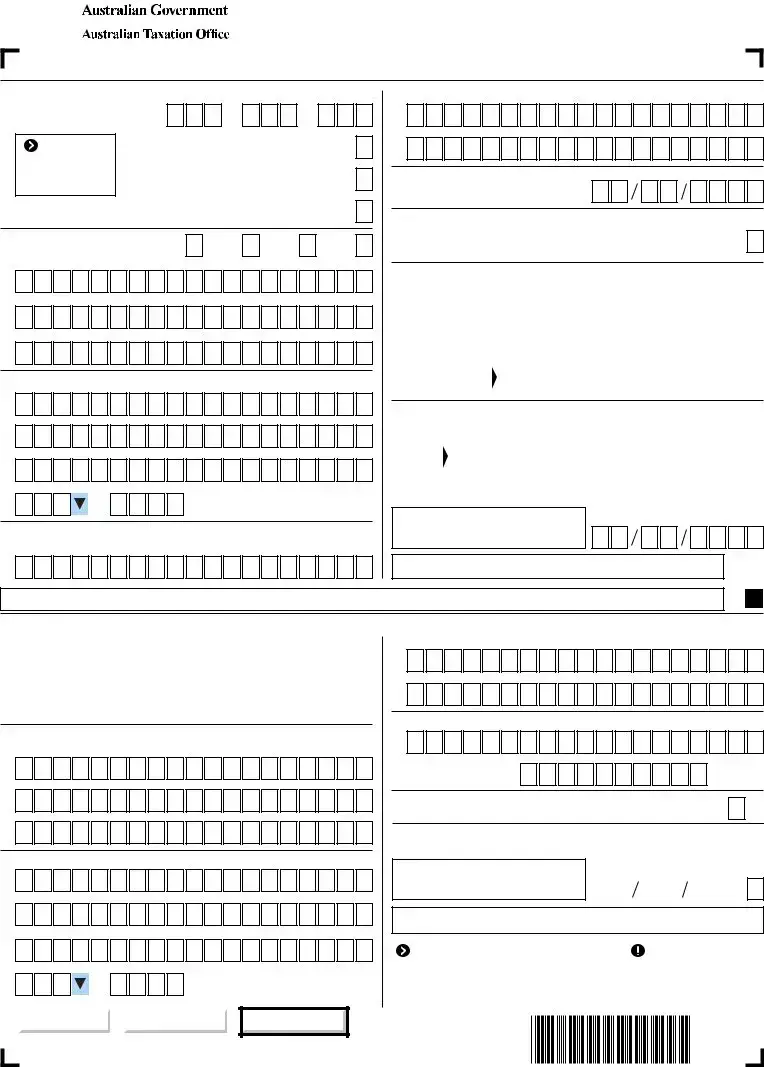

Preview - Tax Declaration Nat 3092 Form

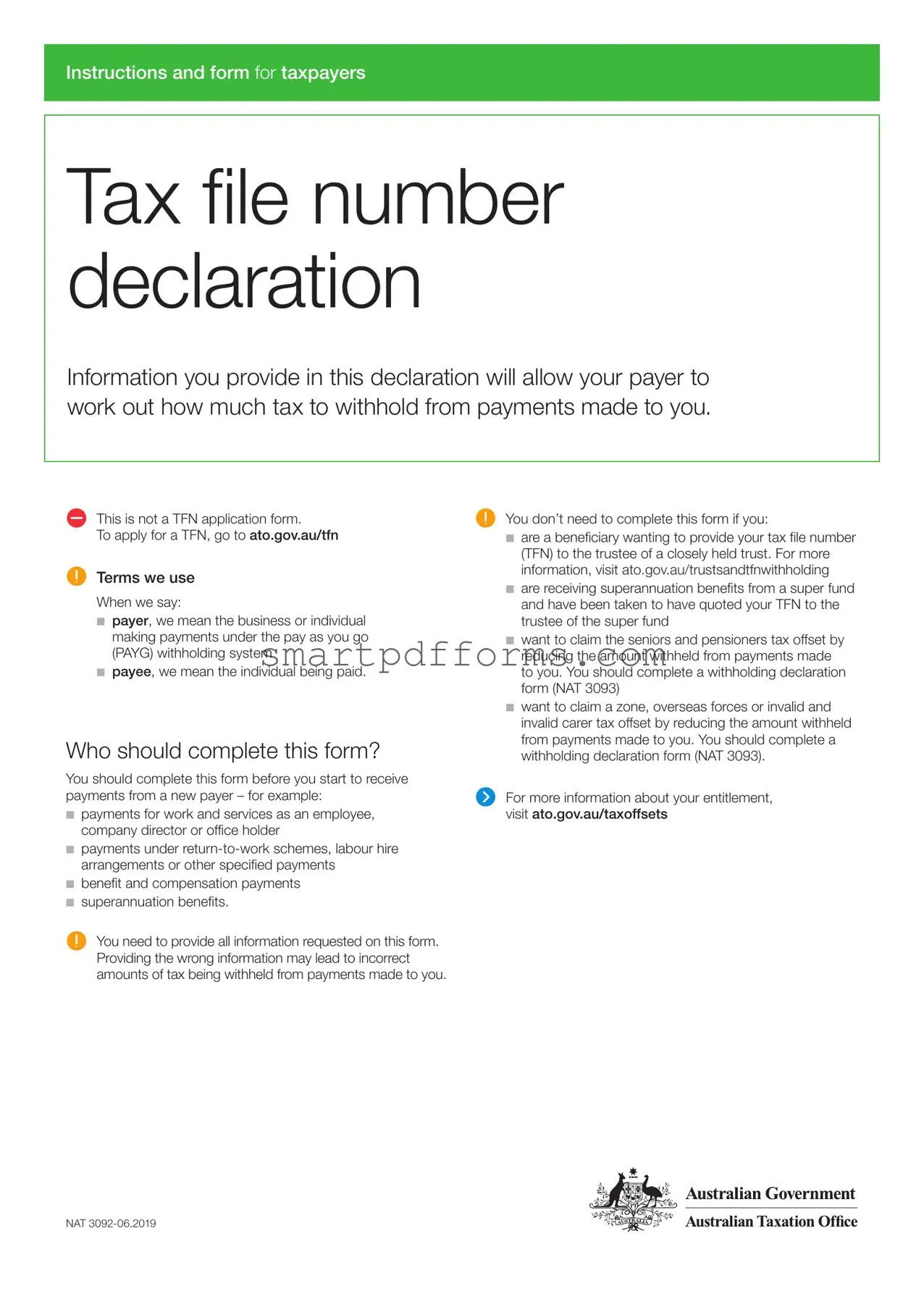

Instructions and form for taxpayers

Tax file number declaration

Information you provide in this declaration will allow your payer to work out how much tax to withhold from payments made to you.

This is not a TFN application form.

To apply for a TFN, go to ato.gov.au/tfn

Terms we use

When we say:

■■payer, we mean the business or individual making payments under the pay as you go (PAYG) withholding system

■■payee, we mean the individual being paid.

Who should complete this form?

You should complete this form before you start to receive payments from a new payer – for example:

■■payments for work and services as an employee, company director or office holder

■■payments under

■■benefit and compensation payments

■■superannuation benefits.

You need to provide all information requested on this form. Providing the wrong information may lead to incorrect amounts of tax being withheld from payments made to you.

You don’t need to complete this form if you:

■■are a beneficiary wanting to provide your tax file number (TFN) to the trustee of a closely held trust. For more information, visit ato.gov.au/trustsandtfnwithholding

■■are receiving superannuation benefits from a super fund and have been taken to have quoted your TFN to the trustee of the super fund

■■want to claim the seniors and pensioners tax offset by reducing the amount withheld from payments made to you. You should complete a withholding declaration form (NAT 3093)

■■want to claim a zone, overseas forces or invalid and invalid carer tax offset by reducing the amount withheld from payments made to you. You should complete a withholding declaration form (NAT 3093).

For more information about your entitlement, visit ato.gov.au/taxoffsets

NAT

Section A: To be completed by the payee

Question 1

What is your tax file number (TFN)?

You should give your TFN to your employer only after you start work for them. Never give your TFN in a job application or over the internet.

We and your payer are authorised by the Taxation Administration Act 1953 to request your TFN. It’s not an offence not to quote your TFN. However, quoting your TFN reduces the risk of administrative errors and having extra tax withheld. Your payer is required to withhold the top rate of tax from all payments made to you if you do not provide your TFN or claim an exemption from quoting your TFN.

How do you find your TFN?

You can find your TFN on any of the following:

■■your income tax notice of assessment

■■correspondence we send you

■■a payment summary your payer issues to you.

If you have a tax agent, they may also be able to tell you. If you still can’t find your TFN, you can:

■■phone us on 13 28 61 between 8.00am and 6.00pm, Monday to Friday.

If you phone or visit us, we need to know we are talking to the correct person before discussing your tax affairs. We will ask you for details only you, or your authorised representative, would know.

You don’t have a TFN

If you don’t have a TFN and want to provide a TFN to your payer, you will need to apply for one.

For more information about applying for a TFN, visit ato.gov.au/tfn

You may be able to claim an exemption from quoting your TFN.

Print X in the appropriate box if you:

■■have lodged a TFN application form or made an enquiry to obtain your TFN. You now have 28 days to provide your TFN to your payer, who must withhold at the standard rate during this time. After 28 days, if you haven’t given your TFN to your payer, they will withhold the top rate of tax from future payments

■■are claiming an exemption from quoting a TFN because you are under 18 years of age and do not earn enough to pay tax, or you are an applicant or recipient of certain pensions, benefits or allowances from the:

––Department of Human Services – however, you will need to quote your TFN if you receive a Newstart, Youth or sickness allowance, or an Austudy or parenting payment

––Department of Veterans’ Affairs – a service pension under the Veterans’ Entitlement Act 1986

––Military Rehabilitation and Compensation Commission.

Providing your TFN to your super fund

Your payer must give your TFN to the super fund they pay your contributions to. If your super fund doesn’t have your TFN, you can provide it to them separately. This ensures:

■■your super fund can accept all types of contributions to your accounts

■■additional tax will not be imposed on contributions as a result of failing to provide your TFN

■■you can trace different super accounts in your name.

For more information about providing your TFN to your super fund, visit ato.gov.au/supereligibility

Question

Complete with your personal information.

Question 7

On what basis are you paid?

Check with your payer if you’re not sure.

Question 8

Are you an Australian resident for tax purposes or a working holiday maker?

Generally, we consider you to be an Australian resident for tax purposes if you:

■■have always lived in Australia or you have come to Australia and now live here permanently

■■are an overseas student doing a course that takes more than six months to complete

■■migrate to Australia and intend to reside here permanently.

If you go overseas temporarily and don’t set up a permanent home in another country, you may continue to be treated as an Australian resident for tax purposes.

If you are in Australia on a working holiday visa (subclass 417) or a work and holiday visa (subclass 462) you must place an X in the working holiday maker box. Special rates of tax apply for working holiday makers.

For more information about working holiday makers, visit ato.gov.au/whm

If you’re not an Australian resident for tax purposes or a working holiday maker, place an X in the foreign resident box, unless you are in receipt of an Australian Government pension or allowance.

Temporary residents can claim super when leaving Australia, if all requirements are met. For more information, visit ato.gov.au/departaustralia

Foreign resident tax rates are different

A higher rate of tax applies to a foreign resident’s taxable income and foreign residents are not entitled to a tax‑free threshold nor can they claim tax offsets to reduce withholding, unless you are in receipt of an Australian Government pension or allowance.

To check your Australian residency status for tax purposes or for more information, visit ato.gov.au/residency

2 |

Tax file number declaration |

Question 9

Do you want to claim the tax‑free threshold from this payer?

The

Answer yes if you want to claim the tax‑free threshold, you are an Australian resident for tax purposes, and one of the following applies:

■■you are not currently claiming the tax‑free threshold from another payer

■■you are currently claiming the tax‑free threshold from another payer and your total income from all sources will be less than the tax‑free threshold.

Answer yes if you are a foreign resident in receipt of an Australian Government pension or allowance.

Answer no if none of the above applies or you are a working holiday maker.

If you receive any taxable government payments or allowances, such as Newstart, Youth Allowance or Austudy payment, you are likely to be already claiming the tax‑free threshold from that payment.

For more information about the current tax‑free threshold, which payer you should claim it from, or how to vary your withholding rate, visit ato.gov.au/taxfreethreshold

Question 10

Do you have a Higher Education Loan Program (HELP), VET Student Loan (VSL), Financial Supplement (FS), Student Start‑up Loan (SSL) or Trade Support Loan (TSL) debt?

Answer yes if you have a HELP, VSL, FS, SSL or TSL debt.

Answer no if you do not have a HELP, VSL, FS, SSL or TSL debt, or you have repaid your debt in full.

You have a HELP debt if either:

■■the Australian Government lent you money under HECS‑HELP, FEE‑HELP, OS‑HELP, VET FEE‑HELP, VET Student loans prior to 1 July 2019 or SA‑HELP.

■■you have a debt from the previous Higher Education Contribution Scheme (HECS).

You have a SSL debt if you have an ABSTUDY SSL debt.

You have a separate VSL debt that is not part of your HELP debt if you incurred it from 1 July 2019.

For information about repaying your HELP, VSL, FS, SSL or TSL debt, visit ato.gov.au/getloaninfo

Have you repaid your HELP, VSL, FS, SSL or TSL debt?

When you have repaid your HELP, VSL, FS, SSL or TSL debt, you need to complete a Withholding declaration (NAT 3093) notifying your payer of the change in your circumstances.

Sign and date the declaration

Make sure you have answered all the questions in section A, then sign and date the declaration. Give your completed declaration to your payer to complete section B.

Section B: To be completed by the payer

Important information for payers – see the reverse side of the form.

Lodge online

Payers can lodge TFN declaration reports online if you have software that complies with our specifications.

For more information about lodging the TFN declaration report online, visit ato.gov.au/lodgetfndeclaration

Tax file number declaration |

3 |

More information

Internet

■■For general information about TFNs, tax and super in Australia, including how to deal with us online, visit our website at ato.gov.au

■■For information about applying for a TFN on the web, visit our website at ato.gov.au/tfn

■■For information about your super, visit our website at ato.gov.au/checkyoursuper

Useful products

In addition to this TFN declaration, you may also need to complete and give your payer the following forms which you can download from our website at ato.gov.au:

■■Medicare levy variation declaration (NAT 0929), if you qualify for a reduced rate of Medicare levy or are liable for the Medicare levy surcharge. You can vary the amount your payer withholds from your payments.

■■Standard choice form (NAT 13080) to choose a super fund for your employer to pay super contributions to. You can find information about your current super accounts and transfer any unnecessary super accounts through myGov after you have linked to the ATO. Temporary residents should visit ato.gov.au/departaustralia for more information about super.

Other forms and publications are also available from our website at ato.gov.au/onlineordering or by phoning 1300 720 092.

Phone

■■Payee – for more information, phone 13 28 61 between 8.00am and 6.00pm, Monday to Friday. If you want to vary your rate of withholding, phone 1300 360 221 between 8.00am and 6.00pm, Monday to Friday.

■■Payer – for more information, phone 13 28 66 between 8.00am and 6.00pm, Monday to Friday.

If you phone, we need to know we’re talking to the right person before we can discuss your tax affairs. We’ll ask for details only you, or someone you’ve authorised, would know. An authorised contact is someone you’ve previously told us can act on

your behalf.

If you do not speak English well and need help from the ATO, phone the Translating and Interpreting Service on 13 14 50.

If you are deaf, or have a hearing or speech impairment, phone the ATO through the National Relay Service (NRS) on the numbers listed below:

■■TTY users – phone 13 36 77 and ask for the ATO number you need (if you are calling from overseas, phone +61 7 3815 7799)

■■Speak and Listen (speech‑to‑speech relay) users – phone 1300 555 727 and ask for the ATO number you need (if you are calling from overseas, phone +61 7 3815 8000)

■■Internet relay users – connect to the NRS on relayservice.gov.au and ask for the ATO number you need.

If you would like further information about the National Relay Service, phone 1800 555 660 or email helpdesk@relayservice.com.au

Privacy of information

Taxation law authorises the ATO to collect information and to disclose it to other government agencies. For information about your privacy, go to ato.gov.au/privacy

Our commitment to you

We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations.

If you follow our information in this publication and it turns out to be incorrect,

or it is misleading and you make a mistake as a result, we must still apply the law correctly. If that means you owe us money, we must ask you to pay it but we will not charge you a penalty. Also, if you acted reasonably and in good faith we will not charge you interest.

If you make an honest mistake in trying to follow our information in this publication and you owe us money as a result, we will not charge you a penalty. However, we will ask you to pay the money, and we may also charge you interest. If correcting the mistake means we owe you money, we will pay it to you. We will also pay you any interest you are entitled to.

If you feel that this publication does not fully cover your circumstances, or you are unsure how it applies to you, you can seek further assistance from us.

We regularly revise our publications to take account of any changes to the law, so make sure that you have the latest information. If you are unsure, you can check for more recent information on our website at ato.gov.au or contact us.

This publication was current at June 2019.

© Australian Taxation Office for the Commonwealth of Australia, 2019

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

Published by

Australian Taxation Office

Canberra

June 2019

4 |

Tax file number declaration |

|

|

Tax file number declaration |

|

|

This declaration is NOT an application for a tax file number. |

|

|

■ Use a black or blue pen and print clearly in BLOCK LETTERS. |

|

|

■ Print X in the appropriate boxes. |

ato.gov.au |

■ Read all the instructions including the privacy statement before you complete this declaration. |

|

Section A: To be completed by the PAYEE

5 What is your primary

1What is your tax file number (TFN)?

For more information, see question 1 on page 2 of the instructions.

OR I have made a separate application/enquiry to the ATO for a new or existing TFN.

OR I am claiming an exemption because I am under 18 years of age and do not earn enough to pay tax.

OR I am claiming an exemption because I am in receipt of a pension, benefit or allowance.

Day |

Month |

Year |

6 What is your date of birth?

7 On what basis are you paid? (select only one)

2 What is your name? |

Title: Mr |

Mrs |

Miss |

Ms |

Surname or family name |

|

|

|

|

First given name |

|

|

|

|

Other given names |

|

|

|

|

3 What is your home address in Australia?

Suburb/town/locality

State/territory Postcode

4If you have changed your name since you last dealt with the ATO, provide your previous family name.

Full‑time |

|

Part‑time |

|

Labour |

|

Superannuation |

|

Casual |

|

|

|

|

|||||

employment |

|

employment |

|

hire |

|

or annuity |

|

employment |

|

|

|

income stream |

|

||||

|

|

|

|

|

|

|

|

8Are you: (select only one)

An Australian resident |

|

A foreign resident |

|

OR |

A working |

|

|

|

|

||||

for tax purposes |

|

for tax purposes |

|

holiday maker |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

9 Do you want to claim the tax‑free threshold from this payer?

Only claim the tax‑free threshold from one payer at a time, unless your total income from all sources for the financial year will be less than the tax‑free threshold.

|

|

|

|

Answer no here if you are a foreign resident or working holiday |

Yes |

|

No |

|

maker, except if you are a foreign resident in receipt of an |

|

|

|

|

Australian Government pension or allowance. |

|

|

|

|

10Do you have a Higher Education Loan Program (HELP), VET Student Loan (VSL), Financial Supplement (FS), Student Start‑up Loan (SSL) or

Trade Support Loan (TSL) debt?

Yes |

|

Your payer will withhold additional amounts to cover any compulsory |

No |

|

|

|

|||

|

repayment that may be raised on your notice of assessment. |

|

||

|

|

|

|

|

|

|

|

|

|

DECLARATION by payee: I declare that the information I have given is true and correct.

Signature

Date

Day |

Month |

Year |

You MUST SIGN here

There are penalties for deliberately making a false or misleading statement.

There are penalties for deliberately making a false or misleading statement.

Once section A is completed and signed, give it to your payer to complete section B.

Once section A is completed and signed, give it to your payer to complete section B.

Section B: To be completed by the PAYER (if you are not lodging online)

1 |

|

What is your Australian business number (ABN) or |

|

|

|

Branch number |

|||||||||||||||||

|

withholding payer number? |

|

|

|

(if applicable) |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

If you don’t have an ABN or withholding |

|

Yes |

|

|

|

No |

|

|

|||||||||||||

|

|

|

|

|

|

||||||||||||||||||

|

|

payer number, have you applied for one? |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

3What is your legal name or registered business name (or your individual name if not in business)?

4What is your business address?

Suburb/town/locality

State/territory Postcode

5What is your primary

6Who is your contact person?

Business phone number

7 If you no longer make payments to this payee, print X in this box. DECLARATION by payer: I declare that the information I have given is true and correct.

Signature of payer

Date

Day |

|

Month |

|

|

Year |

|||

|

|

|

|

|

|

|

|

|

There are penalties for deliberately making a false or misleading statement.

There are penalties for deliberately making a false or misleading statement.

Return the completed original ATO copy to: |

|

IMPORTANT |

Australian Taxation Office |

|

See next page for: |

PO Box 9004 |

|

■ payer obligations |

PENRITH NSW 2740 |

|

■ lodging online. |

|

|

|

|

|

|

Print form |

|

Save form |

|

|

|

NAT

Reset form

Sensitive (when completed)

30920619

Payer information

The following information will help you comply with your pay as you go (PAYG) withholding obligations.

Is your employee entitled to work in Australia?

It is a criminal offence to knowingly or recklessly allow someone to work, or to refer someone for work, where that person is from overseas and is either in Australia illegally or is working in breach of their visa conditions.

People or companies convicted of these offences may face fines and/or imprisonment. To avoid penalties, ensure your prospective employee has a valid visa

to work in Australia before you employ them. For more information and to check a visa holder’s status online, visit the Department of Home Affairs website at homeaffairs.gov.au

Lodging the form

You need to lodge TFN declarations with us within 14 days after the form is either signed by the payee or completed by you (if not provided by the payee). You need to retain a copy of the form for your records. For information about storage and disposal, see below.

You may lodge the information:

■■online – lodge your TFN declaration reports using software that complies with our specifications. There is no need to complete section B of each form as the payer information is supplied by your software.

■■by paper – complete section B and send the original to us within 14 days.

For more information about lodging your

TFN declaration report online, visit our website at ato.gov.au/lodgetfndeclaration

Is your payee working under a working holiday visa (subclass 417) or a work and holiday visa (subclass 462)?

Employers of workers under these two types of visa need to register with the ATO, see ato.gov.au/whmreg

For the tax table “working holiday maker” visit our website at ato.gov.au/taxtables

Payer obligations

If you withhold amounts from payments, or are likely to withhold amounts, the payee may give you this form with section A completed. A TFN declaration applies to payments made after the declaration is provided to you. The information provided on this form is used to determine the amount of tax to be withheld from payments based on the PAYG withholding tax tables we publish. If the payee gives you another declaration, it overrides any previous declarations.

Has your payee advised you that they have applied for a TFN, or enquired about their existing TFN?

Where the payee indicates at question 1 on this form that they have applied for an individual TFN, or enquired about their existing TFN, they have 28 days to give you their TFN. You must withhold tax for 28 days at the standard rate according to the PAYG withholding tax tables. After 28 days, if the payee has not given you their TFN, you must then withhold the top rate of tax from future payments, unless we tell you not to.

If your payee has not given you a completed form you must:

■■notify us within 14 days of the start of the withholding obligation by completing as much of the payee section of the form as you can. Print ‘PAYER’ in the payee declaration and lodge the form – see ‘Lodging the form’.

■■withhold the top rate of tax from any payment to that payee.

For a full list of tax tables, visit our website at ato.gov.au/taxtables

Provision of payee’s TFN to the payee’s super fund

If you make a super contribution for your payee, you need to give your payee’s TFN to their super fund on the day of contribution, or if the payee has not yet quoted their TFN, within 14 days of receiving this form from your payee.

Storing and disposing of TFN declarations

The TFN Rule issued under the Privacy Act 1988 requires a TFN recipient to use secure methods when storing and disposing of TFN information. You may store a paper copy of the signed form or electronic files of scanned forms. Scanned forms must be clear and not altered in any way.

If a payee:

■■submits a new TFN declaration (NAT 3092), you must retain a copy of the earlier form for the current and following financial year.

■■has not received payments from you for 12 months, you must retain a copy of the last completed form for the current and following financial year.

Penalties

You may incur a penalty if you do not:

■■lodge TFN declarations with us

■■keep a copy of completed TFN declarations for your records

■■provide the payee’s TFN to their super fund where the payee quoted their TFN to you.

Form Data

| Fact Name | Description |

|---|---|

| Main Purpose | The Tax Declaration Form (NAT 3092) is used for new payees to inform payers how much tax to withhold from payments. This form is crucial for ensuring accurate tax withholding for various types of payments, including employment income and superannuation benefits. |

| Not a TFN Application | It's important to note that NAT 3092 is not an application for a Tax File Number (TFN). Individuals who need to apply for a TFN must visit the official Australian Taxation Office (ATO) website or contact them directly. |

| Who Should Complete It | Individuals starting to receive payments from a new payer, such as employees, company directors, or recipients of superannuation benefits, need to complete this form before payments begin. This ensures tax is withheld correctly from the start. |

| Consequences of Incorrect Information | Providing incorrect or incomplete information on the NAT 3092 can lead to the wrong amount of tax being withheld. This could either result in a tax debt at the end of the financial year or an overpayment of tax, affecting the individual's financial well-being. |

| Exemptions and Special Conditions | There are conditions under which an individual may claim exemptions from quoting a TFN or may not be required to complete the form at all, such as certain pensions, benefits, or allowances recipients, and individuals under 18 years of age earning below a specified income threshold. |

Instructions on Utilizing Tax Declaration Nat 3092

Filling out the Tax Declaration NAT 3092 form is a necessary step before starting to receive payments from a new payer, ensuring that the correct amount of tax is withheld from payments made to you. This process helps in managing your tax obligations efficiently. Remember, providing incorrect information can lead to the wrong amount of tax being withheld. Let's walk through the steps needed to accurately complete the form.

- Start by using a black or blue pen and ensure you print clearly in BLOCK LETTERS.

- For Question 1, provide your Tax File Number (TFN). If you do not have a TFN, check the appropriate box indicating you have applied or are claiming an exemption. Remember, do not provide your TFN before you start your employment.

- Complete Question 2 by writing your full name, including your title, surname or family name, first given name, and other given names.

- For Question 3, enter your home address in Australia, specifying your suburb, town or locality, state or territory, and postcode.

- If applicable, answer Question 4 by providing your previous family name if it has changed since your last interaction with the Australian Tax Office (ATO).

- Question 5 asks for your primary email address. Fill this in accordingly.

- Provide your date of birth in Question 6, including the day, month, and year.

- In Question 7, indicate the basis on which you are paid by selecting the appropriate employment type.

- Answer Question 8 by marking whether you are an Australian resident for tax purposes, a foreign resident, or a working holiday maker.

- For Question 9, decide if you want to claim the tax-free threshold from this payer and mark 'Yes' or 'No'. Consider this carefully if you are receiving payments from multiple sources.

- Finally, answer Question 10 regarding any Higher Education Loan Program (HELP), VET Student Loan (VSL), Financial Supplement (FS), Student Start-up Loan (SSL), or Trade Support Loan (TSL) debts.

- Make sure to sign and date the declaration section to confirm that the information you've provided is true and correct.

After completing Section A, hand the form over to your payer to fill out Section B. Remember, both sections must be completed fully and correctly to avoid any issues with tax withholding on your payments. Once the entire form is filled out, your employer or payer will handle the submission process to the Australian Taxation Office (ATO).

Obtain Answers on Tax Declaration Nat 3092

FAQs about the Tax Declaration NAT 3092 Form

What is the Tax Declaration NAT 3092 form?

The Tax Declaration NAT 3092 form is used by payees to provide their Tax File Number (TFN) and other related information to their payer. This helps the payer determine the correct amount of tax to withhold from payments made to the payee.

Who should complete this form?

This form should be completed by individuals before they start receiving payments from a new payer. This includes employees, company directors, individuals receiving benefits, compensation payments, or superannuation benefits.

Do I need to complete the form if I don't have a TFN?

No, if you don't have a TFN, you should first apply for one through the Australian Taxation Office (ATO). However, you can indicate on the form if you have applied for a TFN or are claiming an exemption from quoting a TFN.

What happens if I provide the wrong information?

Providing incorrect information could result in the wrong amount of tax being withheld from your payments. It is important to ensure all information provided on the form is accurate.

Can I claim the tax-free threshold?

Yes, if you are an Australian resident for tax purposes and not claiming the tax-free threshold from another payer, you can claim it from your current payer.

What if I have a student loan debt?

If you have a Higher Education Loan Program (HELP), VET Student Loan (VSL), or other specified student loan debts, you should indicate this on the form by answering 'Yes' to the relevant question. Your payer will withhold additional amounts to cover any compulsory repayment that might be required.

How do I find my TFN?

Your TFN can be found on your income tax notice of assessment, correspondence from the ATO, or a payment summary issued by your payer. If you're unable to find it, you can contact the ATO for assistance.

What if I am a foreign resident?

Foreign residents for tax purposes should indicate their status on the form and are subject to different tax rates. They cannot claim the tax-free threshold except in certain cases, such as receiving an Australian Government pension or allowance.

How do I submit the form?

After completing and signing Section A, you should provide the form to your payer, who will complete Section B. The payer is responsible for submitting the form to the ATO.

Where can I get more information?

For more detailed information or assistance with the Tax Declaration NAT 3092 form, you can visit the ATO website or contact them by phone. Specific contact details and further guidance can be found on the last page of the form instructions.

Common mistakes

Not checking the box to indicate an exemption when lacking a Tax File Number (TFN). When individuals do not have a TFN and are either applying for one or are exempt (for reasons such as age or receiving certain benefits), it's crucial to mark the appropriate box on the form. Failure to do so can lead to the highest rate of tax being withheld.

Incorrectly filling in personal details. Personal information such as names and addresses must match official documents. Mistakes here can lead to processing delays or errors in record keeping.

Forgetting to select the correct employment status. This declaration asks whether an individual is paid on a full-time, part-time, casual, or labor hire basis. Not accurately indicating employment status can affect how tax is calculated.

Misunderstanding residency status for tax purposes. The form differentiates between Australian residents, foreign residents, and working holiday makers, each of which is taxed differently. Incorrectly identifying residency status may result in incorrect tax withholding.

Failing to claim the tax-free threshold appropriately. Only one payer at a time should be claimed for the tax-free threshold unless expected annual income from all sources is below the threshold. Missteps here can lead to unnecessary tax withholdings.

Overlooking debts related to education or training loans. The form requires an indication of whether individuals have a HELP, VSL, FS, SSL, or TSL debt. Not acknowledging these debts can lead to insufficient withholding, which may result in a debt owed at the end of the financial year.

Not signing and dating the form. A signature and date verify that the information provided is true and correct. Without this, the form is not officially completed, potentially delaying tax withholding adjustments.

Awareness of these mistakes and careful attention to detail when completing the Tax Declaration Nat 3092 form can significantly streamline the process, ensuring taxes are withheld accurately and reducing the risk of future discrepancies.

Documents used along the form

Filing taxes can sometimes feel like navigating through a maze with all the forms and documents one may need to gather. Besides the Tax Declaration (NAT 3092) form, which is pivotal for setting up tax withholdings from payments made to you, there are several other forms and documents that play a crucial role at various stages of managing your taxes and financial affairs. Here's a look at some of these important forms:

- Medicare Levy Variation Declaration (NAT 0929): This form is used to apply for a reduction in the Medicare levy if you qualify based on specific criteria, like certain medical conditions or low income.

- Withholding Declaration (NAT 3093): This document allows you to notify your payer of changes affecting the amount of tax to be withheld from your payments, such as claiming the tax-free threshold from a second job.

- Standard Choice Form (NAT 13080): This is used to nominate a superannuation fund for your employer contributions. It’s crucial for making sure your super is going where you want it to.

- Superannuation (Super) Standard Choice Form: Similar to the NAT 13080, this form is used for superannuation purposes, providing employees the ability to select a super fund.

- Income Tax Notice of Assessment: Not a form you fill out, but a crucial document sent by the ATO after your tax return is processed. It outlines what you owe or are refunded.

- Payment Summaries: Issued by your employer, these summaries show your income and the amount of tax withheld for the year. Essential for completing your tax return.

- Higher Education Loan Program (HELP) and Trade Support Loan (TSL) Statement: If you have a HELP or TSL debt, this statement provides balance and repayment information.

- Temporary Residents’ Superannuation Claim Form: Used by temporary residents to claim superannuation upon leaving Australia.

- Departing Australia Superannuation Payment (DASP) Application Form: Another form for claiming super benefits when leaving Australia.

- ABN Application Form: If you're starting a business, you'll need to apply for an Australian Business Number with this form.

Each of these documents serves a unique purpose, from changing how much tax is taken out of your paycheck to ensuring your superannuation is managed according to your wishes. Understanding when and why you might need each of these forms can make managing your financial and tax affairs simpler and less daunting. Whether you're an employee, a student with a loan, a super fund member, or a business owner, keeping these forms in mind and understanding their function will help streamline your dealings with the Australian Taxation Office and other financial entities.

Similar forms

Withholding Declaration (NAT 3093): This form, like the Tax Declaration (NAT 3092), is utilized for detailing personal circumstances that influence the amount of tax withheld from income. While the NAT 3092 is filled out by new employees for their employers to determine the correct withholding rates, the NAT 3093 is commonly used by existing employees to update their employers about changes that affect their tax withholdings, such as changes in residency status or financial loads due to education loans.

Medicare Levy Variation Declaration (NAT 0929): Similar to the Tax Declaration, this form is also used to adjust the amount of tax withheld by providing information relevant to the Medicare levy. Employees fill it out to claim a reduction or exemption from the Medicare levy based on their circumstances, directly impacting the withholding rate similar to how the NAT 3092 influences withholding amounts.

Standard Choice Form (NAT 13080): This relates to the Tax Declaration in the way it pertains to superannuation aspects. While the NAT 3092 includes a section for superannuation details, ensuring the correct management of super contributions by the payer, the Standard Choice Form is specifically dedicated to selecting a super fund, demonstrating a focused approach on superannuation management similarly highlighted in sections of the NAT 3092.

Superannuation (Super) Standard Choice Form: Directly connected to providing information regarding superannuation on the Tax Declaration, this form allows employees to nominate a super fund or retirement savings account to their employer. Both forms facilitate the correct handling of super contributions, though the Standard Choice Form strictly deals with the selection of the super fund itself.

Employment Declaration Form: Similar functions are seen with the Tax Declaration NAT 3092 as both forms are intended to gather new employee details for tax purposes. This form is critical for the payer to understand the tax-related aspects of an individual's employment, closely mirroring the objective of the NAT 3092 in establishing the foundation for correct tax withholding and compliance from the onset of employment.

Payment Summary Form: While the Payment Summary Form serves as a year-end summary of the earnings and amounts withheld, akin to the Tax Declaration, it collects important financial information that impacts tax filings and obligations. The connection is in the flow of financial information management, with the Tax Declaration affecting the real-time withholding and the Payment Summary encapsulating the annual outcomes.

HELP, TSL, VSL, SSL Debt Declaration: This form specifically gathers details about an individual's educational loan debts, similar to sections within the NAT 3092 that ask about such debts affecting tax withholdings. Both forms address the need to account for these debts in financial management and tax withholding calculations, underlining the tax implications of personal financial commitments.

Request for Tax File Number (TFN) – Benefits, Allowances, and Payments (specific forms per benefit type): These forms, though more specific in application, share the purpose of the Tax Declaration regarding the provision of TFN and related information for correct tax treatment. They focus on particular payments or benefits and their tax implications, similar to how the NAT 3092 collects TFN details to ensure appropriate tax withholding and compliance.

Dos and Don'ts

When it comes to filling out the Tax Declaration NAT 3092 form, navigating the intricacies can be quite daunting. However, knowing what you should and shouldn't do can demystify the process and ensure you complete the form correctly and efficiently. Here's a handy list to guide you through the do's and don'ts:

Things You Should Do

- Provide accurate information: Ensure all personal details, including your Tax File Number (TFN) and income details, are current and accurate to prevent any processing delays or issues.

- Check your residency status: Verify whether you are an Australian resident for tax purposes, as this affects your entitlements and obligations. Incorrect residency status can lead to incorrect tax withholdings.

- Decide on the tax-free threshold: Determine if you will claim the tax-free threshold from this payer. Remember, you can only claim the tax-free threshold from one payer at a time unless your total income is below the threshold.

- Report all debts: Accurately report any Higher Education Loan Program (HELP), VET Student Loan (VSL), or similar debts. Incorrect reporting can affect the amount of tax withheld from your payments.

Things You Shouldn't Do

- Avoid guessing your TFN: If you're unsure of your TFN, it’s better to confirm it through the proper channels rather than guessing. Incorrect TFN can lead to higher tax withholdings.

- Don’t leave sections blank: Ensure you complete all sections relevant to your situation. Incomplete forms can result in processing delays or the need to resubmit the form.

- Don’t ignore the declaration section: Failing to sign the declaration can invalidate your form. Ensure you read, understand, and sign the declaration to affirm that all the information provided is true and correct.

- Don’t use incorrect declaration forms: Make sure you're using the NAT 3092 form for your tax withholding declaration. Using the wrong form can lead to confusion and incorrect tax withholdings.

By following these do's and don'ts, you can navigate the Tax Declaration NAT 3092 form with greater confidence and accuracy, ensuring your tax withholdings are correctly processed.

Misconceptions

Many taxpayers encounter misunderstandings about the Tax Declaration form, NAT 3092. Addressing these misconceptions is crucial for ensuring that individuals provide correct information and avoid potential issues with their tax obligations. Here are seven common misconceptions clarified:

- It's an application for a Tax File Number (TFN). This is incorrect. The NAT 3092 form is not an application for a TFN but a declaration for taxpayers to inform their payers about their tax situation, so the correct amount of tax can be withheld from their payments.

- You must complete this form after starting a job. Before receiving any payments from a new payer, this form should be completed. It's a proactive step to ensure tax is correctly withheld from the very beginning of employment or other payer-to-payee relationships.

- Everyone must complete this form. Not everyone is required to fill out this form. For example, beneficiaries providing their TFN to the trustee of a closely held trust, or individuals receiving certain types of superannuation benefits, may not need to complete this form.

- It's okay to provide incorrect information if unsure. Providing incorrect information, whether intentionally or by mistake, can lead to the wrong amount of tax being withheld. This could result in a debt or a smaller refund when lodging an annual tax return.

- TFN is required to complete this form. While providing your TFN is important for ensuring the correct tax is withheld, it's not mandatory to quote your TFN. However, not quoting a TFN can lead to higher tax withholding rates.

- Completing this form allows you to claim all available tax offsets and benefits. This form does not cover claims for all tax offsets and benefits. Specific circumstances, such as eligibility for the seniors and pensioners tax offset or other offsets, require additional documentation or forms.

- The information on this form doesn't impact superannuation. Incorrectly assuming this can lead to unexpected tax implications for your super contributions. Providing your TFN through this form ensures your super fund can accept contributions and attribute them correctly to you, avoiding additional taxes.

Understanding these aspects of the NAT 3092 form is essential for accurately reporting tax information to payers. It not only helps in avoiding over or under-withholding of tax but also ensures compliance with tax regulations. Individuals uncertain about how to complete the form accurately should seek guidance, either through the Australian Taxation Office website or by consulting a tax professional.

Key takeaways

Understanding the Tax Declaration Nat 3092 form is crucial for both payers and payees in Australia to ensure accurate tax withholdings and compliance with obligations. Here are four key takeaways to consider:

- Completion Before Payments: It's important for payees to complete the Nat 3092 form before they start receiving payments from a new payer. This includes a wide range of payments such as employee salaries, benefits, superannuation benefits, and payments under return-to-work schemes, among others. Completing the form accurately ensures that the correct amount of tax is withheld, avoiding potential issues down the line.

- Providing Accurate Information: The form requires various pieces of personal information, including the payee's Tax File Number (TFN). Providing accurate information is essential because incorrect details can lead to the wrong amount of tax being withheld. If a TFN is not provided, the payer must withhold the top rate of tax from all payments.

- Eligibility for Claiming the Tax-Free Threshold: Payees have the option to claim the tax-free threshold from their payer if they are an Australian resident for tax purposes and they are not already claiming the threshold from another payer, or their total income from all sources will be below the tax-free threshold for that financial year. This can significantly affect the amount of tax withheld from their payments.

- Debt Declarations: If payees have any debts related to the Higher Education Loan Program (HELP), VET Student Loan (VSL), Financial Supplement (FS), Student Start‑up Loan (SSL), or Trade Support Loan (TSL), they must declare it on the form. Failing to do so can result in not enough tax being withheld, which could lead to a debt owed to the Australian Tax Office (ATO) at the end of the financial year.

It’s important for both payers and payees to ensure that the Tax Declaration Nat 3092 form is filled out diligently and accurately, as it plays a pivotal role in the management of tax withholdings and compliance with Australian tax laws. For more detailed guidance, the ATO website provides comprehensive resources and updates.

Popular PDF Forms

Eoir33 - Timeliness in submitting the EOIR 33 IC form is crucial for maintaining communication with the Immigration Court about your case.

Marriott Friends and Family Form - Detailed guide to obtaining and using the Marriott Friends and Family rate.