Blank Tax Exempt Ohio PDF Template

In Ohio, navigating the complexities of sales and use tax can be a daunting task for both businesses and individuals alike. Central to understanding these complexities is the Sales and Use Tax Blanket Exemption Certificate, known formally as STEC B, which underwent its latest revision in March 2015. This certificate serves as a pivotal tool for purchasers claiming exemptions on all acquisitions of tangible personal property and selected services. It operates under the assertion that the exemption is valid based on the intended use of the purchased items or services, the nature of the purchasing activity, or a combination of both. The form requires purchasers to articulate a legitimate reason for the exemption, alongside providing detailed information including the purchaser's name, type of business, and contact details. Additionally, it stipulates conditions for vendors, particularly those dealing with motor vehicles, watercraft, and outboard motors, guiding them on how to properly utilize this certificate under a "resale" exception. Interestingly, the document draws a clear line on its applicability: it expressly forbids construction contractors from leveraging this certificate for buying materials intended for integration into real property under an exempt construction contract, thereby necessitating compliance with specific rules within the Ohio Administrative Code.

Preview - Tax Exempt Ohio Form

OHIO STATE UNIVERSITY EXTENSION

STATE OF OHIO

DEPARTMENT OF TAXATION

SALES AND USE TAX

BLANKET EXEMPTION CERTIFICATE

Ohio

This exemption only applies to the

Complete the form as follows:

•Vendor’s name - the business you are purchasing from

•Valid Reason – Revised Code of Ohio, Section 5739.02 (B)(9) To conduct Ohio

•Purchaser’s name – The authorized Ohio

•Address – Of club/affiliate

•Signature – Advisor or authorized individual

•Vendor License – leave blank. The club/affiliate is not a vendor.

Revised 3/12/2015

ohio4h.org

CFAES provides research and related educational programs to clientele on a nondiscriminatory basis. For more information: go.osu.edu/cfaesdiversity.

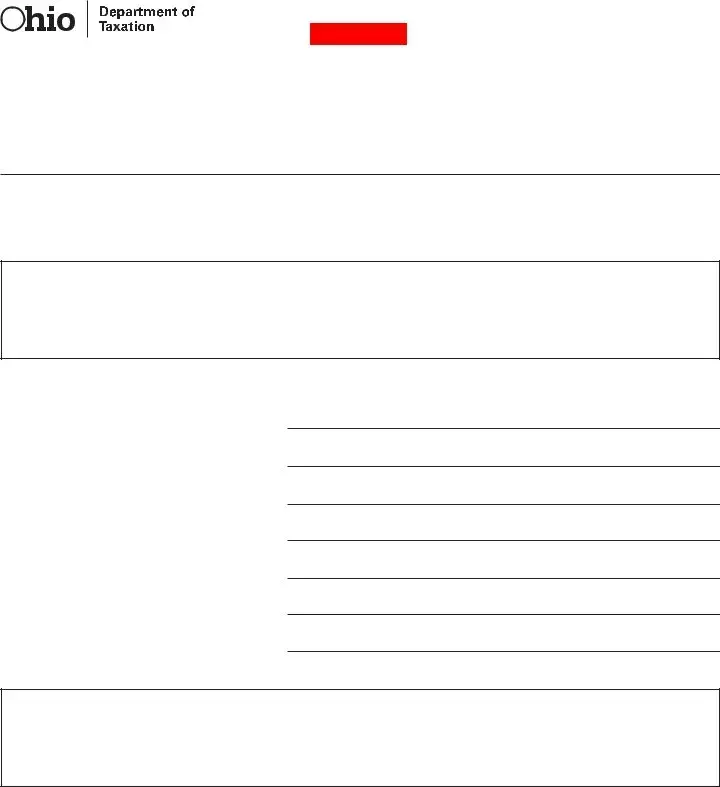

STEC B

Rev. 3/15

Reset Form

tax.ohio.gov

Sales and Use Tax

Blanket Exemption Certificate

The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from:

(Vendor’s name)

and certifies that the claim is based upon the purchaser’s proposed use of the items or services, the activity of the purchase, or both, as shown hereon:

ASD

Purchaser must state a valid reason for claiming exception or exemption.

D

Purchaser’s name

ASD

Purchaser’s type of business

ASDSAD

Street address

City, state, ZIP code

Signature |

Title |

Date signed

ASD

Vendor’s license number, if any

Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certificate to purchase these items under the “resale” exception. Otherwise, purchaser must comply with either rule

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The STEC B Rev. 3/15 is used to claim exemption from sales and use tax for purchases of tangible personal property and selected services in Ohio. |

| Claim Basis | The exemption claim is based on the purchaser's proposed use of the items or services, the activity of the purchase, or both. |

| Restrictions for Construction Contractors | Construction contractors cannot use this certificate to purchase material for incorporation into real property under an exempt construction contract, as mandated by rule 5703-9-14 of the Ohio Administrative Code. |

| Governing Laws | The certificate is regulated under Ohio's Administrative Code, specifically rules 5703-9-10, 5703-9-25, and 5703-9-14, guiding its proper use and restrictions. |

Instructions on Utilizing Tax Exempt Ohio

Filling out the Tax Exempt Ohio form is a straightforward process that ensures your purchases of tangible personal property and selected services are exempt from sales and use tax. Whether you are acquiring goods for resale, or your operations qualify for a tax exemption, completing this form accurately is crucial. Follow these steps to ensure you properly complete the form. Remember, providing accurate information is key to avoiding any issues with tax exemptions.

- At the top of the form, where it says "Vendor’s name," fill in the name of the company from which you are making the purchases. This establishes the seller that acknowledges your tax exempt status.

- Under the section for claiming exception or exemption, state your valid reason for exemption clearly. This could be based on the use of the items, your business's qualifying activities, or both.

- Enter your business’s name in the "Purchaser’s name" field to identify your entity as the one claiming the exemption.

- Specify your "Purchaser’s type of business" to provide context regarding why your purchases are exempt. This helps in verifying that your business qualifies for the exemption.

- Fill in your business’s "Street address" along with the "City, state, ZIP code" to provide accurate contact information.

- If applicable, enter the "Vendor’s license number" in the provided space. This is especially relevant for vendors of motor vehicles, titled watercraft, and titled outboard motors using the resale exception.

- Finally, the form must be signed and dated. Place your signature in the "Signature" field, then print your title next to it in the "Title" field and indicate the date the form was signed in the "Date signed" field.

It's essential to note that this certificate is not applicable to construction contractors purchasing materials for incorporation into real property under an exempt construction contract. Such contractors must adhere to rule 5703-9-14 of the Administrative Code. By carefully following these steps, you can ensure your Tax Exempt Ohio form is filled out correctly, helping streamline your purchase processes by accurately claiming your tax exemption.

Obtain Answers on Tax Exempt Ohio

Frequently Asked Questions about the Tax Exempt Ohio Form (STEC B Rev. 3/15)

What is the purpose of the Tax Exempt Ohio form?

The form, officially known as the Sales and Use Tax Blanket Exemption Certificate, allows businesses and individuals to claim exemptions from sales tax on purchases of tangible personal property and selected services. It's based on the purchaser's intended use of the items or services or the nature of their activity.

Who can use this form?

Buyers seeking to purchase items or services without paying the associated sales tax for qualifying reasons can use this form. However, it specifically cannot be used by construction contractors for materials meant to be incorporated into real property under an exempt construction contract.

Can motor vehicle, watercraft, and outboard motor vendors use this certificate?

Yes, vendors of motor vehicles, titled watercraft, and titled outboard motors are permitted to use this certificate for purchases under the "resale" exemption. Otherwise, the purchaser must adhere to administrative code rules 5703-9-10 or 5703-9-25.

Is there a valid reason required for claiming an exemption?

Yes, the purchaser must provide a valid reason for the exemption, which relates to the proposed use of the purchased items or services, or the activity of the purchaser that justifies exemption under Ohio law.

What information is needed to complete this form?

The form requires the purchaser's name, type of business, and contact information, including the street address, city, state, and ZIP code. Also, the signing party must include their title and the date the form was signed, along with the vendor’s license number, if applicable.

How does one obtain a vendor’s license number?

The vendor’s license number can be obtained directly from the vendor. It's often available on invoices or other official documents provided by the vendor.

Can this certificate be used for purchases made online?

Yes, this certificate can be used for qualifying online purchases in the same way it would be used for physical store purchases, as long as the seller is subject to Ohio's sales tax laws and accepts the form.

Are there expiration dates for this exemption certificate?

The Ohio Sales and Use Tax Blanket Exemption Certificate does not explicitly state an expiration date. However, it is advisable for purchasers to periodically review and renew their certificates if necessary, to ensure compliance with any updates in tax laws.

How can a purchaser prove the validity of their exemption claim?

To validate an exemption claim, the purchaser may need to provide proof or detailed information regarding the intended use of the goods or services, or the nature of the business activity that qualifies for the exemption.

Where can one get assistance in filling out this form?

Assistance for completing the form can be found through the Ohio Department of Taxation’s website, tax.ohio.gov. Additionally, tax professionals or legal advisors knowledgeable about Ohio tax laws can offer guidance.

Common mistakes

Filling out the Tax Exempt Ohio form requires attention to detail and a clear understanding of the rules. Below are eight common mistakes that people often make when completing this form:

Not providing a valid reason for claiming exemption or exception. The form explicitly requires a justification based on the purchaser's intended use of the goods or services, their activities, or both.

Failure to include the purchaser's name and type of business. This information is crucial for establishing the identity and eligibility of the entity claiming the exemption.

Omitting the street address, city, state, and ZIP code. This complete address is necessary for legal and administrative purposes.

Forgetting to sign the form or include the title and date when it was signed. An unsigned form is considered incomplete and invalid.

Leaving the vendor's license number blank, if applicable. This number helps to verify the legitimacy of the transaction and the vendor's ability to sell tax-exempt items or services.

Assuming the certificate can be used for all transactions. The form is not valid for certain purchases like motor vehicles, titled watercraft, and titled outboard motors, except under specific conditions for resale.

Attempting to use the certificate for construction materials intended for real property incorporation under an exempt construction contract. This specific use is prohibited and requires compliance with different administrative rules.

Not realizing that the certificate cannot be used indefinitely. Regulations surrounding tax exemptions may change, and it's important for purchasers to stay informed about the current laws and administrative code provisions.

Avoiding these mistakes can streamline the process of claiming tax exemptions in Ohio and ensure compliance with state tax laws. Paying close attention to the details on the form and understanding the underlying rules are key steps toward successful submission.

Documents used along the form

When applying for or utilizing the Tax Exempt Ohio form, specifically the Sales and Use Tax Blanket Exemption Certificate, individuals and organizations often encounter several other forms and documents. These additional documents play vital roles in ensuring compliance, accuracy, and efficiency in tax-related matters. Below is a list of such documents, each briefly described to provide an understanding of their importance and application in conjunction with the Tax Exempt Ohio form.

- IRS Form 1023: Used by organizations to apply for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. This form is critical for non-profits seeking tax-exempt status.

- IRS Form 990: An annual reporting return that certain tax-exempt organizations must file with the IRS. It provides information on the filing organization's mission, programs, and finances.

- Ohio Business Gateway License Application: Used by businesses to apply for or renew licenses and permits, including those needed for tax exemptions in Ohio.

- Vendor’s License: Required for Ohio businesses selling goods or services. It allows businesses to collect sales tax and could be needed to buy items tax-exempt for resale.

- Annual Report Form: Filed with the state, this document provides updates on an organization's operations and financial condition, which can affect its tax-exempt status.

- Exemption Certificate Renewal Notice: An alert or form indicating that an organization’s tax-exempt certificate is due for renewal. Timely renewal is essential to maintain tax-exempt privileges.

- Change of Address Form: Used to update the organization or business address on file with the state tax authority, ensuring that all correspondence and documentation reach the right location.

- Financial Statement: A document detailing an organization's financial status, often required along with exemption applications or renewals to demonstrate fiscal responsibility.

- Use Tax Return: Filed by entities to report purchases made tax-exempt but used, consumed, or stored in Ohio, on which tax was not paid at the time of purchase.

- Articles of Incorporation: Legal documents filed with the state to legally establish an entity. These are often required for tax-exempt status applications to prove the entity’s existence and purpose.

The compilation and proper use of these documents are pivotal steps for ensuring that organizations accurately apply for, receive, and maintain their tax-exempt status. Careful attention to detail and adherence to deadlines are crucial in managing these forms, thereby helping organizations stay compliant with both state and federal tax regulations. Understanding and navigating these requirements can be a complex process, but it is essential for the lawful and efficient operation of tax-exempt entities in Ohio.

Similar forms

Form 1023: Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code

Just like the Tax Exempt Ohio form, Form 1023 is used by organizations seeking tax-exempt status, but on a federal level. Both documents require detailed information about the organization's activities, purpose, and how it plans to use the exempt purchases or its income. The focus is on ensuring that the activities align with tax-exempt purposes, although Form 1023 is specifically for 501(c)(3) organizations.

Uniform Sales & Use Tax Exemption/Resale Certificate – Multijurisdiction

This certificate, much like the Ohio tax exemption form, is used to claim sales tax exemption across multiple states by vendors and resellers. It collects information similar to the Ohio form, such as the purchaser’s type of business and the nature of the exempt purchases. The primary similarity is their purpose to avoid sales tax on qualifying transactions.

Form ST-5 Sales Tax Exempt Purchaser Certificate (Massachusetts)

Similar to the Ohio ST-5 form, the Massachusetts version also serves to grant tax exemption on purchases made by qualifying organizations or transactions. Both forms require purchasers to certify their eligibility for the exemption and describe the exempt nature of their purchases. Each form is tailored to its respective state's tax laws but serves the same fundamental purpose.

Form 3372, Michigan Sales and Use Tax Certificate of Exemption

The Michigan form, like Ohio's, is utilized by entities to claim tax exemption on eligible purchases. Both forms require information about the purchaser, such as their business type and a certification that the items purchased will be used in a manner that qualifies for exemption. Both are also specific to the tax regulations of their respective states but function similarly in practice.

California Resale Certificate

This certificate allows purchasers to buy goods without paying sales tax if the items will be resold in the regular course of business, akin to the resale exception mentioned in the Ohio form. It gathers information on the purchaser and the nature of the business, drawing parallels to the Tax Exempt Ohio form's requirements for claiming exemptions based on the intended resale of items.

Dos and Don'ts

When filling out the Tax Exempt Ohio form, it's important to follow best practices to ensure your claim is processed smoothly and without delay. Below are lists of things you should do and shouldn't do to assist you in completing the form correctly.

Do:

- Ensure the vendor's name is clearly written to avoid any confusion.

- Provide a valid reason for claiming an exception or exemption, making sure it is concise and falls within the guidelines provided by the Ohio Department of Taxation.

- Fill in all requested details such as the purchaser's name, type of business, street address, city, state, and ZIP code to validate your claim.

- Sign and date the form, as this certifies the information provided is accurate and truthful.

Don't:

- Leave any field blank. Incomplete forms may result in delays or denial of the exemption claim.

- Use the certificate for the purchase of motor vehicles, titled watercraft, and titled outboard motors for purposes other than resale, unless you comply with the specific administrative codes mentioned.

- Attempt to use this certificate for construction materials intended for incorporation into real property under an exempt construction contract. Specific rules apply to such situations.

- Submit the form without ensuring all the information is correct and matches the legal requirements for tax exemption in Ohio.

Misconceptions

When it comes to tax exemptions in Ohio, particularly with the use of the STEC B, also known as the Sales and Use Tax Blanket Exemption Certificate, there are several common misconceptions. Here's a breakdown of eight of these misunderstandings and the truths behind them:

- Any business can use the form for all purchases: This is incorrect. The exemption only applies to purchases of tangible personal property and selected services that are intended for the buyer's exempt use, as outlined on the certificate. The business's activity or the use of the purchased item must qualify under specific exemption criteria.

- The form grants a permanent exemption: Another misconception is that once you've filed this certificate with a vendor, you're exempt from sales and use tax indefinitely. The truth is, circumstances change, including tax laws and the nature of the buyer's exempt status. It's a good practice to periodically review and renew your certificates if necessary.

- Any purchase type is covered: Some believe that the exemption applies to any and all purchases a business might make, including items not directly related to the business's exempt purposes. However, the exemption strictly applies to items or services used in a manner that qualifies under the exemption criteria.

- Construction contractors can use it for all materials: A specific point of confusion is the assumption that construction contractors can use this certificate to exempt all material purchases from taxes. In reality, construction contractors cannot use this certificate to purchase material for incorporation into real property under an exempt construction contract. They must comply with rule 5703-9-14 of the Administrative Code.

- The certificate applies to vehicle purchases: While it's true that the certificate can be used by vendors of motor vehicles, titled watercraft, and titled outboard motors for resale purposes, other purchasers must adhere to specific rules laid out in the Administrative Code (rules 5703-9-10 and 5703-9-25).

- No documentation is needed after filing: Some believe that after providing this certificate to a vendor, no further documentation is required. In practice, it's wise to maintain detailed records of all exempt transactions, including the nature of the exemption claim and proof of the exempt use of purchased items or services, in case of an audit.

- The form automatically grants exemption on services: There's a common belief that this exemption certificate applies broadly to services. The reality is only selected services that directly relate to the exempt purpose of the purchase qualify. Each service must be evaluated against the exemption criteria.

- Purchasers need not specify their reason for exemption: Finally, a significant misunderstanding is the idea that a purchaser does not need to provide a specific reason for claiming exemption on the certificate. It's imperative that the purchaser clearly states the valid reason for claiming an exemption, based on the proposed use of the items, the activity of the purchase, or both.

Understanding these nuances can help Ohio businesses navigate the complexities of tax-exempt purchases more effectively and ensure compliance with state tax laws.

Key takeaways

Understanding the Tax Exempt Ohio form requires attention to detail and an appreciation for the nuances of tax law within the state. Whether you're a new business owner or managing an established entity, grasping these key takeaways will ensure compliance and optimize your tax benefits.

- Uniform application: The Tax Exempt Ohio form, known as the STEC B Rev. 3/15, is a comprehensive document that caters to a wide range of purchases and services, asserting a claim for tax exemption across multiple categories of tangible personal property and selected services.

- Validity of claims: To legitimately claim an exemption, the purchaser must explicitly state a valid reason. This requirement underscores the importance of understanding the specifics of your purchase or service and its eligibility under the law.

- Purchaser information is critical: Completing the form necessitates detailed information about the purchaser, including the business type and address. This information is essential for validating the exemption claim.

- Documentation matters: The purchaser’s signature, along with the date the form was signed and the title of the person signing, are mandatory fields. These elements serve as a declaration of the accuracy and truthfulness of the claim.

- Special provisions for certain vendors: Vendors dealing in motor vehicles, titled watercraft, and titled outboard motors are allowed to use this certificate for purchases under the "resale" exception, which highlights the form's flexibility in accommodating different business models.

- Limited use for construction contractors: The form explicitly states its non-applicability to construction contractors aiming to purchase materials for incorporation into real property under an exempt construction contract. Such exclusion emphasizes the need for specificity in claims for exemption.

- Regulatory compliance: The form references specific rules of the Administrative Code, namely rules 5703-9-10, 5703-9-25, and 5703-9-14, guiding its proper use and the conditions under which exemptions can be claimed. Awareness and understanding of these rules are vital for compliance.

- Vendor responsibilities: While the primary focus is on the purchaser, vendors must be aware of their obligations, especially regarding the verification of the purchaser’s claims and the maintenance of the exemption certificate for audit purposes.

In conclusion, the Tax Exempt Ohio form is a vital document for businesses seeking tax exemptions on purchases and services. Proper understanding and adherence to the specified guidelines are crucial for making the most out of tax exemption opportunities while ensuring compliance with Ohio’s tax laws.

Popular PDF Forms

Phone Message Slips - Promotes a systematic approach to managing daily communications, crucial for maintaining high service standards.

Use of Force Incident - Officers encountered a suspect under the influence of drugs displaying unpredictable behavior, requiring careful use of a TASER to prevent self-harm.