Blank Tc 569A PDF Template

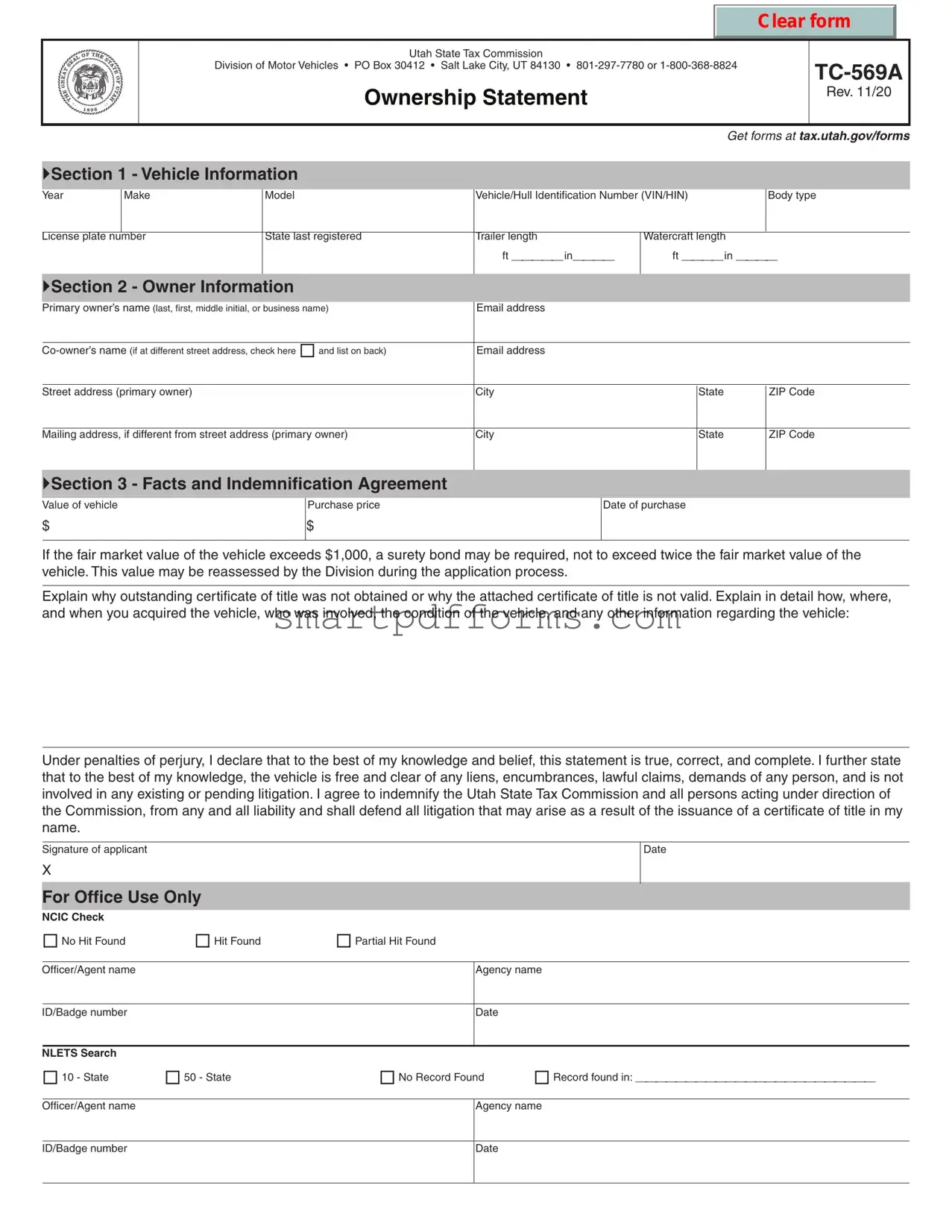

Navigating the complexities of vehicle ownership in Utah requires careful attention to legal documents, one of which is the TC-569A form issued by the Utah State Tax Commission's Division of Motor Vehicles. This crucial document plays a fundamental role in the ownership transfer process, providing a structured way for sellers to declare their vehicle's specifics, including year, make, model, and identification numbers, alongside personal owner information. It caters not just to standard automobiles but extends its reach to trailers and watercraft, emphasizing the form's versatility within the vehicular domain. The form also addresses the financial aspects tied to the ownership transfer, asking for details regarding the vehicle's value and purchase price to assess the need for a surety bond if the vehicle's worth surpasses a certain threshold. Additionally, it rigorously inquiries about the history of the vehicle’s title to ensure a thorough understanding and documentation of its legal standing and any potential encumbrances. By insisting on a detailed narrative of how the ownership was acquired and including an indemnification agreement to protect the Utah State Tax Commission as well as other parties involved in the title issuance process, the TC-569A form stands as a testament to the rigorous standards set forth to maintain transparency, legality, and security in the transfer of vehicle ownership within Utah.

Preview - Tc 569A Form

Clear form

Utah State Tax Commission

Division of Motor Vehicles • PO Box 30412 • Salt Lake City, UT 84130 •

Ownership Statement

Rev. 11/20

Get forms at tax.utah.gov/forms

Section 1 - Vehicle Information

|

Year |

Make |

Model |

Vehicle/Hull Identification Number (VIN/HIN) |

Body type |

||

|

|

|

|

|

|

|

|

|

License plate number |

State last registered |

Trailer length |

Watercraft length |

|

||

|

|

|

|

ft _____in____ |

ft ____in ____ |

||

|

|

|

|

|

|

|

|

|

Section 2 - Owner Information |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Primary owner’s name (last, first, middle initial, or business name) |

Email address |

|

|

|

||

|

|

|

|

|

|

|

|

|

Email address |

|

|

|

|||

|

|

|

|

|

|

|

|

|

Street address (primary owner) |

|

City |

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

Mailing address, if different from street address (primary owner) |

City |

|

State |

ZIP Code |

||

|

|

|

|

|

|

|

|

Section 3 - Facts and Indemnification Agreement

Value of vehicle |

Purchase price |

$ |

$ |

|

|

Date of purchase

If the fair market value of the vehicle exceeds $1,000, a surety bond may be required, not to exceed twice the fair market value of the vehicle. This value may be reassessed by the Division during the application process.

Explain why outstanding certificate of title was not obtained or why the attached certificate of title is not valid. Explain in detail how, where, and when you acquired the vehicle, who was involved, the condition of the vehicle, and any other information regarding the vehicle:

Under penalties of perjury, I declare that to the best of my knowledge and belief, this statement is true, correct, and complete. I further state that to the best of my knowledge, the vehicle is free and clear of any liens, encumbrances, lawful claims, demands of any person, and is not involved in any existing or pending litigation. I agree to indemnify the Utah State Tax Commission and all persons acting under direction of the Commission, from any and all liability and shall defend all litigation that may arise as a result of the issuance of a certificate of title in my name.

Signature of applicant

X

Date

For Office Use Only

NCIC Check |

|

|

No Hit Found |

Hit Found |

Partial Hit Found |

Officer/Agent name

Agency name

ID/Badge number

Date

NLETS Search |

|

|

|

10 - State |

50 - State |

No Record Found |

Record found in: ________________________ |

Officer/Agent name

Agency name

ID/Badge number

Date

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | Used for declaring the rightful ownership of a vehicle or watercraft in Utah. |

| Governing Body | Utah State Tax Commission Division of Motor Vehicles. |

| Revision Date | The form was last revised in November 2020. |

| Accessibility | Obtainable online at the Utah State Tax Commission's website. |

| Key Sections | Includes sections for vehicle information, owner information, and an indemnification agreement. |

| Surety Bond Requirement | If the vehicle's fair market value exceeds $1,000, a surety bond not exceeding twice the fair market value may be required. |

| Legal Protection | The form includes an indemnification agreement to protect the Utah State Tax Commission and all acting under its direction against liability arising from the issuance of a title. |

Instructions on Utilizing Tc 569A

Filling out the TC-569A form is a critical step for those needing to declare the ownership of a vehicle in the state of Utah. This process ensures that your vehicle's information is accurately recorded by the Utah State Tax Commission. Whether you're establishing ownership due to a lack of a valid title or clarifying the vehicle's status, completing this form meticulously is essential. The steps outlined below are designed to guide you seamlessly through the process.

- Begin by gathering all necessary information about the vehicle, including its year, make, model, Vehicle/Hull Identification Number (VIN/HIN), body type, license plate number, and, if applicable, trailer or watercraft length.

- In Section 1 - Vehicle Information, accurately fill in the gathered details about your vehicle. Ensure each piece of information is correct to avoid any future complications.

- Move to Section 2 - Owner Information. Here, enter the primary owner's name (last, first, middle initial, or if a business, the business name), email address, and street address. If there's a co-owner with a different address, check the specified box and include this information on the back of the form.

- If the mailing address differs from the street address, include this information in the designated area.

- In Section 3 - Facts and Indemnification Agreement, detail the value of the vehicle and the purchase price. If applicable, note that a surety bond may be required for vehicles valued over $1,000.

- Explain why a valid certificate of title was not obtained or why the current title may not be valid. Include a detailed account of how, where, and when you acquired the vehicle, who was involved, the condition of the vehicle, and any other relevant information.

- Read the indemnification agreement closely. By signing this document, you’re attesting under penalty of perjury that the information provided is accurate to the best of your knowledge. You are also acknowledging that the vehicle is free of liens, encumbrances, or any legal disputes.

- Sign and date the form in the space provided to validate your ownership claim and agree to indemnify the Utah State Tax Commission against any liability.

- If an officer or agent is involved in this process, there’s a section reserved for them to complete, which includes an NCIC Check and an NLETS Search. However, as the applicant, this area is not for your action.

Upon completing and signing the TC-569A form, review it once more to ensure all information provided is complete and accurate. The subsequent steps, which often involve submitting the form to the appropriate office and possibly other related documentation, varies depending on your specific circumstance. Always follow up with the Utah State Tax Commission or consult their website for any updates or additional requirements. Taking the time to accurately complete this form is a vital step in establishing or verifying vehicle ownership within Utah.

Obtain Answers on Tc 569A

-

What is the TC-569A form used for?

The TC-569A form, also known as the Ownership Statement, is a document required by the Utah State Tax Commission's Division of Motor Vehicles. It is used to establish or transfer ownership of a vehicle when the current certificate of title is not available. This form is necessary for documenting the vehicle information, owner information, and the circumstances under which the vehicle was acquired, especially if the declared value exceeds $1,000.

-

Who needs to fill out the TC-569A form?

Individuals or businesses acquiring a vehicle without a current certificate of title in the state of Utah need to fill out the TC-569A form. This includes situations where the previous owner cannot provide the title due to various reasons, or in cases of purchase, inheritance, or gift where the title was lost or never transferred properly.

-

What information do I need to provide in Section 1 - Vehicle Information?

In Section 1, you are required to provide detailed information about the vehicle, including its year, make, model, Vehicle/Hull Identification Number (VIN/HIN), body type, license plate number, state last registered, and, if applicable, trailer or watercraft length.

-

What details are required in Section 2 - Owner Information?

Section 2 asks for the primary owner's full name (or business name), email address, street address, city, state, and ZIP code. If there is a co-owner with a different address, you must also provide their name and email address. A separate area is designated for a mailing address if it differs from the street address.

-

What is the purpose of Section 3 - Facts and Indemnification Agreement?

Section 3 requires you to disclose the value and purchase price of the vehicle, the date of purchase, and a detailed explanation of why the current title is not available or valid. You must also describe how, where, and when you acquired the vehicle, including the condition of the vehicle and any relevant information about the previous owner. This section includes an indemnification agreement, where you declare the information provided is true and the vehicle is free of liens or litigation, agreeing to indemnify the Utah State Tax Commission against any liabilities or litigation resulting from the title issuance.

-

Is a surety bond always required when filling out the TC-569A form?

No, a surety bond is not always required. It is necessary only if the fair market value of the vehicle exceeds $1,000. The bond, which cannot exceed twice the fair market value of the vehicle, serves as a security against any claims of ownership or liens against the vehicle that might arise after the title is issued.

-

What happens after the TC-569A form is submitted?

After submitting the TC-569A form, the Utah State Tax Commission's Division of Motor Vehicles will conduct a check through the National Crime Information Center (NCIC) and possibly other law enforcement databases to ensure the vehicle is not stolen or involved in any pending litigation. The outcome of these checks will influence the decision to issue a new certificate of title in your name.

-

Where can I get more information or assistance with the TC-569A form?

For more information or assistance with the TC-569A form, you can visit the Utah State Tax Commission's official website at tax.utah.gov/forms, or contact the Division of Motor Vehicles directly by phone at 801-297-7780 or 1-800-368-8824.

Common mistakes

- Not accurately reporting the vehicle's year, make, model, and identification numbers in Section 1. These details are crucial for identifying the vehicle and any mistakes can lead to significant delays in the processing of the form.

- Failing to completely fill out the owner information in Section 2, including both the primary and co-owner's names, addresses, and email addresses. Incomplete information may result in the inability to contact the owner(s) for any necessary follow-up.

- Omitting the mailing address if it's different from the street address. This is important for ensuring that all correspondence reaches the owner in a timely manner.

- Incorrectly stating the value of the vehicle or the purchase price in Section 3. The accuracy of these figures is important for tax and title purposes, especially if the fair market value exceeds $1,000, as this may necessitate a surety bond.

- Not providing a detailed explanation for the absence of an outstanding certificate of title or the reasons for the attached certificate of title being invalid. This explanation is fundamental to understanding the vehicle's history and resolving any titling issues.

- Leaving out details of how, where, and when the vehicle was acquired, along with who was involved and the condition of the vehicle at that time. These details are essential for the Tax Commission to assess the legitimacy of the ownership claim.

- Forgetting to sign the form or incorrectly dating it at the bottom of Section 3. The signature and date validate the form, asserting that all the information provided is true to the best of the applicant's knowledge, making this a critical final step in the application process.

Each of these mistakes can significantly impact the processing of the TC-569A form, leading to delays, additional inquiries, or even the rejection of the application. It's vital for individuals to review their form thoroughly before submission to ensure all information is complete and accurate.

Documents used along the form

When dealing with the TC-569A form, an Ownership Statement from the Utah State Tax Commission, it's important to recognize that this form doesn't operate in isolation. Typically, there are several other forms and documents that you might need to gather or complete, either as prerequisites or to comply with related legal requirements. Understanding what each of these documents is and what they are used for can significantly streamline the process of vehicle ownership transfer, registration, or titling in Utah.

- Bill of Sale: This document acts as a record of the transaction between the seller and the buyer, detailing the agreement terms, purchase price, and the vehicle's description. It's crucial for establishing proof of purchase and transfer of ownership.

- Odometer Disclosure Statement: Federal law requires this document for all vehicles under ten years old. It certifies the mileage reported by the seller is accurate, helping to prevent odometer fraud.

- Application for Utah Title (Form TC-656): This form is necessary to officially apply for a vehicle title in Utah, detailing information about the vehicle and its ownership.

- Vehicle Inspection Form: In some cases, a safety inspection or emissions test result may be needed for registration. This form verifies that the vehicle meets the state's safety and environmental standards.

- Emission Certificate: Depending on the age of the vehicle and the county in which it's being registered, an emission certificate may be required to ensure the vehicle complies with Utah's air quality standards.

- Proof of Insurance: Utah law requires all vehicles to be insured. This document proves that the vehicle has at least the minimum coverage required by the state.

- Lien Release: If there was a previous lien on the vehicle, this document proves that the debt has been fully paid and the lienholder relinquishes any claim to the vehicle.

- Power of Attorney: If someone is signing documents on behalf of the vehicle owner, a Power of Attorney may be needed. This legal document grants the individual the authority to make decisions and act in transactions related to the vehicle.

Together, these documents support the process involved with the TC-569A form, ensuring everything from the vehicle's legal status to the environmental compliance is in order. Whether you're selling, buying, or inheriting a vehicle, preparing these documents alongside the TC-569A can make the process smoother and help you avoid potential legal complications. Understanding each document's role and requirement underscores the importance of thorough preparation when dealing with vehicle-related matters.

Similar forms

Application for Vehicle Registration: This document is similar to the TC-569A form in that it gathers detailed information about the vehicle, such as year, make, model, and Vehicle/Hull Identification Number (VIN/HIN), along with the owner's information. Both forms are crucial for documenting the legal ownership and registration status of a vehicle.

Vehicle Title Application: Similar to the TC-569A, this form requires comprehensive vehicle and owner information to process the request for a vehicle title. Both forms include sections for detailing the acquisition of the vehicle and for an indemnification agreement, emphasizing the legal responsibility of the owner to ensure the accuracy of the information provided.

Bill of Sale: A bill of sale closely resembles the section of the TC-569A form that outlines the vehicle’s purchase price and date of purchase. Both documents are used to document the transaction between seller and buyer, serving as proof of transfer of ownership.

Vehicle Transfer Notification: This form shares commonalities with the TC-569A regarding the change of ownership. Both documents require detailed information about the previous and new owner(s), including names and addresses, to ensure the accurate transfer of vehicle ownership records.

Statement of Error or Erasure: Similar to the part of the TC-569A where the applicant explains why an outstanding certificate of title was not obtained or why the attached certificate of title is not valid, a Statement of Error or Erasure is used to correct misinformation on official documentation related to vehicle ownership.

Release of Lien: The TC-569A form's assertion that the vehicle is free of any liens or encumbrances mirrors the purpose of a Release of Lien document. Both assure that the vehicle is not subjected to any claims that could affect its ownership or sale.

Surety Bond: The section of the TC-569A mentioning the requirement for a surety bond if the vehicle’s fair market value exceeds $1,000 closely aligns with the function of a Surety Bond. This document is used when clear ownership cannot be established through a regular title, ensuring financial coverage up to a specified amount based on the vehicle's value.

Indemnity Agreement: The indemnification agreement within the TC-569A is essentially a standalone agreement as well, obligating the vehicle owner to protect the Utah State Tax Commission from liability associated with the issuance of a certificate of title. These agreements are used across various contexts to manage risk and protect against potential legal claims.

Dos and Don'ts

When filling out the TC-569A form for the Utah State Tax Commission, it's important to pay close attention to the details to ensure the process goes smoothly. Here are some dos and don'ts to guide you:

Dos:

- Double-check the vehicle information in Section 1, including the year, make, model, and Vehicle/Hull Identification Number (VIN/HIN), for accuracy.

- Provide complete owner information in Section 2. This includes the primary owner’s full name, email address, street and mailing addresses, and if applicable, the co-owner’s name and address.

- Accurately report the value of the vehicle and the purchase price in Section 3 to avoid delays.

- Thoroughly explain in detail how, where, and when you acquired the vehicle. Include information on who was involved and the condition of the vehicle.

- Sign and date the form to affirm that your statement is true to the best of your knowledge and that the vehicle is free of any liens or legal disputes.

Don'ts:

- Don't leave any sections blank. If a section does not apply to you, write "N/A" (not applicable) to indicate that the question was read but does not pertain to your situation.

- Don't guess on vehicle details; ensure all information is correct by verifying against the vehicle's documents.

- Avoid underestimating the value of your vehicle to prevent potential legal or processing issues.

- Don't provide vague explanations regarding the acquisition of the vehicle. Lack of detail can result in processing delays or denials.

- Never sign the form without reviewing all the entered information for accuracy and completeness.

Misconceptions

Misconception 1: The TC-569A form is only used for motor vehicles. While it's common to associate vehicle forms with cars and trucks, the TC-569A form encompasses a broader range of vehicles. This includes watercraft and trailers, as indicated by sections detailing trailer and watercraft length. It's important to understand that this form is versatile and applicable to various types of vehicle transactions.

Misconception 2: Providing the fair market value of the vehicle is optional. Some individuals believe that filling out the value section is not mandatory if they already have a purchase price listed. However, the form requires both the value of the vehicle and the purchase price. This is particularly important if the fair market value exceeds $1,000, triggering the potential need for a surety bond. Thus, accurately reporting both figures is crucial for the application process.

Misconception 3: A surety bond is always required for the titling process. It's incorrectly assumed by some that securing a surety bond is a standard step for all vehicle titling. In truth, the need for a surety bond is conditional, based on the fair market value of the vehicle exceeding $1,000. Even then, the bond required will not exceed twice the vehicle's fair market value and may be adjusted during the application review.

Misconception 4: The indemnification agreement is a standard liability release. The indemnification agreement on the TC-569A form is sometimes misunderstood as a simple formality, similar to a generic liability waiver. Instead, it is a significant legal commitment where the applicant agrees to protect the Utah State Tax Commission against any liability, ensuring the vehicle is free of liens and not involved in litigation. This agreement demonstrates the seriousness of the information provided and the legal responsibilities assumed by the applicant.

Misconception 5: All sections of the form must be completed by the vehicle owner. While it's essential that the ownership statement be filled out comprehensively, certain parts, specifically the section for office use only, are reserved for official use by the Utah State Tax Commission and law enforcement. Attempting to fill out or alter these sections can lead to confusion or legal issues. It is vital for applicants to focus on accurately completing their portions of the form and leaving the designated sections for the appropriate authorities.

Key takeaways

Understanding the TC-569A form is crucial for individuals in Utah dealing with vehicle ownership issues, especially when the standard documentation, like a title, is unavailable. Here are seven key takeaways about filling out and utilizing this form effectively:

- The TC-569A form serves as an Ownership Statement, primarily used when a certificate of title for a vehicle cannot be obtained or when the existing title is considered invalid for some reason.

- Section 1 of the form requires detailed vehicle information, including the year, make, model, Vehicle/Hull Identification Number (VIN/HIN), body type, and if applicable, license plate number, and the lengths of trailers or watercraft.

- In Section 2, the form asks for comprehensive owner information, encompassing the primary owner’s name and email address, along with the co-owner's details if applicable. It also includes the requirement for the street and mailing addresses, ensuring the Tax Commission can contact the owner(s) efficiently.

- The Facts and Indemnification Agreement segment is at the heart of the TC-569A form. It asks the applicant to detail the vehicle's acquisition, including how, where, and from whom it was purchased, as well as any pertinent information about its condition and history.

- If the vehicle’s fair market value exceeds $1,000, applicants might need to secure a surety bond, up to twice the vehicle’s fair market value. This requirement underscores the importance of accurately assessing and reporting the vehicle's value.

- The TC-569A form includes a declaration that must be signed under penalty of perjury, affirming that the information provided is accurate, and the vehicle is free of liens and not involved in pending litigation. This signature legally binds the applicant to the form’s statements and their veracity.

- For verification, the form features sections for Office Use Only, where law enforcement officials can record the results of National Crime Information Center (NCIC) and National Law Enforcement Telecommunications System (NLETS) searches. These checks help to ensure the vehicle is not stolen or involved in criminal activity.

Completing the TC-569A form is a critical step for establishing legal ownership in cases where conventional documentation is lacking. Understanding these key aspects can simplify the process and help ensure compliance with Utah State requirements.

Popular PDF Forms

Bbs Forms - Mandates disclosure of whether the experience was gained in a private practice setting, aligning with California's legal requirements.

Sowp Document Checklist - A necessary bureaucratic step in formalizing employment with a foreign employer.

Cms 485 - Assesses functional limitations and activities permitted to understand the patient's capacity for self-care and movement.