Blank Tennessee Lb 0456 PDF Template

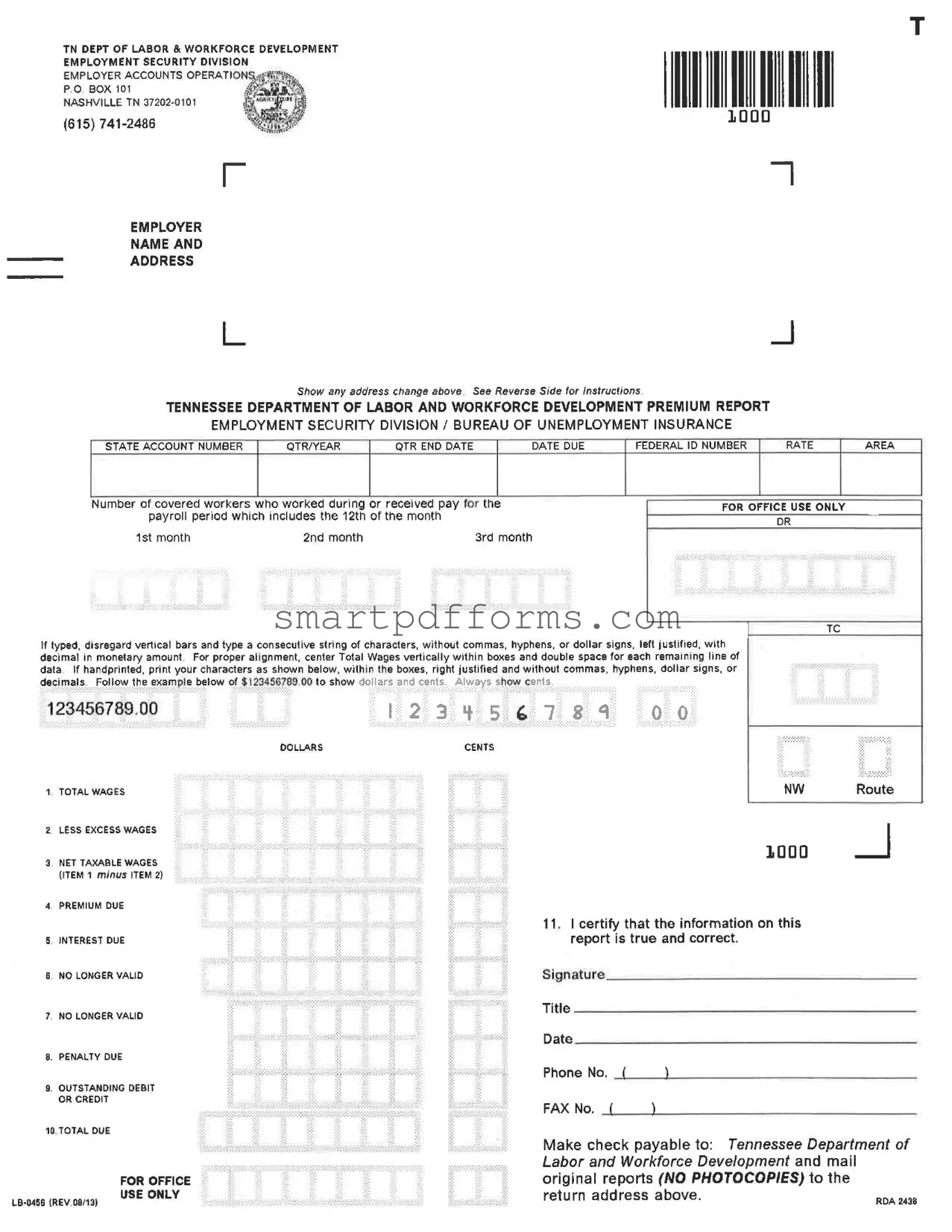

Navigating the intricacies of payroll and unemployment insurance reporting in Tennessee is made clear with the LB-0456 form. This essential document, provided by the Tennessee Department of Labor and Workforce Development's Employment Security Division, serves as a premium report for employers within the state. It details the process for reporting total wages paid, calculating taxes due, and ensuring compliance with state unemployment insurance regulations. The form is meticulously designed to gather employer information, including any changes in address, the state account number, the federal ID number, and relevant payroll data for the reported period. Employers are required to meticulously report total wages, deduct excess wages to arrive at net taxable wages, and calculate the premium due, along with any interest or penalties. The LB-0456 form emphasizes the importance of accuracy and timely submission, underscoring its role in the smooth operation of Tennessee's unemployment insurance system. Furthermore, the form's design aids in preventing errors by guiding the employer through each step of the reporting process, ensuring that all financial information is accurately captured and reported. Compliance with the reporting requirements set forth in the LB-0456 form is not just a legal obligation for Tennessee employers but also a critical component of the state’s efforts to maintain a fair and functioning labor market.

Preview - Tennessee Lb 0456 Form

Form Data

| Fact Name | Description |

|---|---|

| Form Number | LB-0456 |

| Issuing Body | Tennessee Department of Labor and Workforce Development, Employment Security Division |

| Purpose | Used for reporting employer payroll for unemployment insurance purposes |

| Contents | Includes employer name and address, state account number, quarter/year, due dates, federal ID number, rates, and payroll information |

| Submission Requirement | Original reports must be mailed; no photocopies allowed |

| Revision Date | Revised August 2013 |

| Key Sections | Total wages, excess wages, net taxable wages, premiums due, interest, penalty, and total due |

| Document Type | Premium Report |

| Address for Submission | P.O. Box 101, Nashville, TN |

| Governing Laws | Tennessee Unemployment Insurance Law |

Instructions on Utilizing Tennessee Lb 0456

The Tennessee LB 0456 form plays an essential role in reporting employment taxes and wages for businesses operating within the state. Its completion ensures compliance with state regulations, aiding in the proper management of unemployment insurance contributions. The form is divided into sections to capture employer details, wage reports, and the corresponding dues. Following the steps below will help ensure accurate and timely submission.

- Start by entering the Employer Name and Address in the designated area at the top of the form. If there has been a change in the address, ensure to indicate the new address clearly.

- Enter the Tennessee Department of Labor and Workforce Development State Account Number, along with the quarter/year and quarter end date relevant to the report being filed.

- Provide the Date Due, Federal ID Number, and the Rate at which the premiums are due, in the sections provided.

- Under the section marked "FOR OFFICE USE ONLY," record the payroll for each month of the quarter, specifically noting the payroll period that includes the 12th of the month.

- If the form is being typed, ensure all data strings are left-justified without commas, hyphens, or dollar signs, with the decimal point in monetary amounts clearly shown. If the form is handprinted, right-justify the characters in the boxes without using commas, hyphens, dollar signs, or decimals. Always include cents in your monetary amounts.

- Complete the financial sections:

- Total Wages - Enter the total wages paid during the quarter.

- Less Excess Wages - Subtract any wages that exceed the taxable amount to find the net taxable wages.

- Net Taxable Wages (Item 1 minus Item 2) - Calculate and enter this amount.

- Premium Due - Based on the net taxable wages and the rate provided, calculate the premium due.

- Complete the sections for Interest Due, Penalty Due, Outstanding Debit or Credit, and Total Due as applicable. Ensure that all financial calculations are accurate to prevent any discrepancies.

- Sign and date the form, providing the title of the person responsible for its completion. Also, fill in the contact phone number and fax number if available.

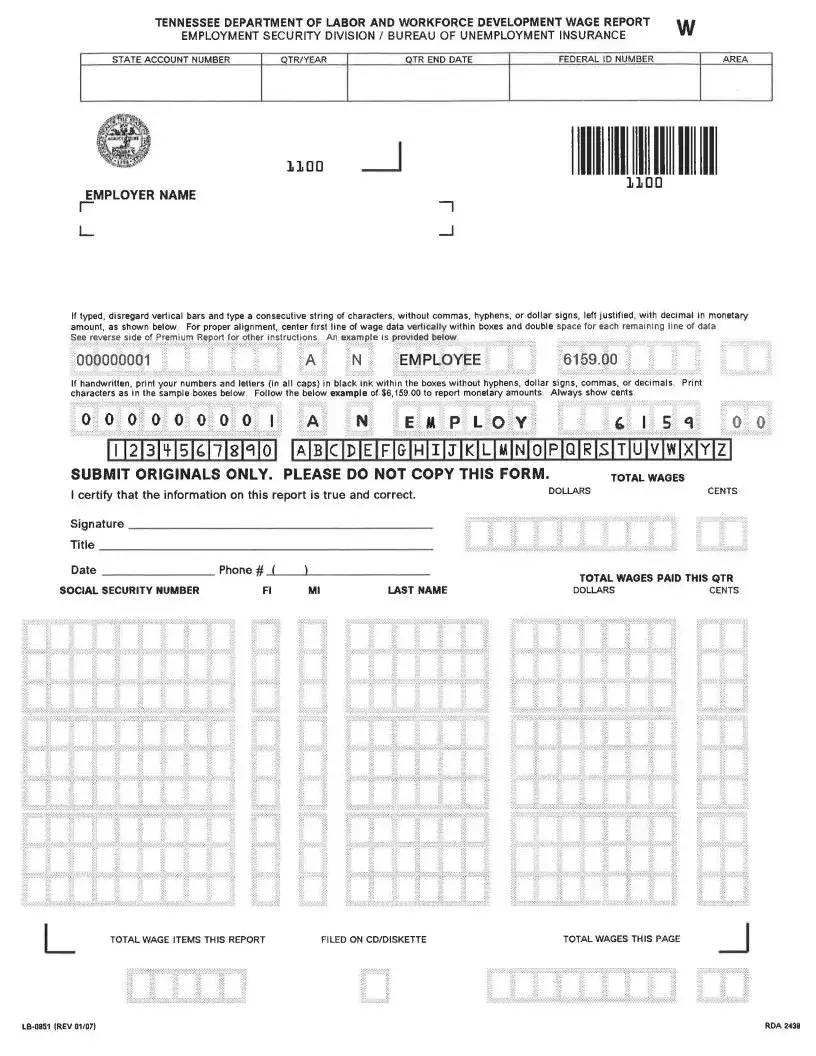

- Lastly, ensure a check payable to the Tennessee Department of Labor and Workforce Development is attached if there are amounts due, and mail the original report (no photocopies) to the return address mentioned at the top of the form. For the Wage Report section that should accompany this form, follow similar instructions regarding the type or print method and ensure total wages and social security numbers for employees are accurately reported.

This step-by-step guide should facilitate the accurate completion of the LB 0456 form, aiding employers in maintaining compliance with the Tennessee Department of Labor and Workforce Development's requirements. Timely and accurate submission of this form contributes to the efficient management of unemployment insurance and benefits within the state.

Obtain Answers on Tennessee Lb 0456

Welcome to the FAQ section where we provide detailed information about the Tennessee LB 0456 Form, a paramount document for employers in Tennessee. This form is related to employment and unemployment insurance, a field vital for both employers and employees in ensuring legal compliance and securing benefits entitlements. Here, we address common questions associated with the LB 0456 form.

- What is the purpose of the Tennessee LB 0456 Form?

The LB 0456 form serves as a Premium Report for employers in Tennessee, relating to the Employment Security Division of the Tennessee Department of Labor and Workforce Development. Its primary purpose is to declare total wages paid, calculate excess wages, and ascertain net taxable wages. Through this form, employers contribute to unemployment insurance, a critical component in providing a safety net for individuals who find themselves unemployed.

- Who is required to fill out the LB 0456 Form?

All Tennessee employers who are subject to the state's unemployment insurance system must complete the LB 0456 form. This requirement is part of the responsibilities of being an employer in Tennessee, aimed at ensuring that workers have access to unemployment benefits should they lose their jobs. Compliance is not only a legal obligation but also a demonstration of the employer's commitment to the welfare of their employees.

- When is the LB 0456 Form due?

The due date for submitting the LB 0456 form is specified within the document as the "Date Due." Typically, this deadline corresponds with quarterly reporting periods that align with the fiscal calendar. It is paramount for employers to heed this date to avoid potential penalties for late submissions, ensuring they remain in good standing within the regulatory framework governing employment and unemployment insurance.

- How should the LB 0456 Form be filled out and submitted?

The form requires careful attention to detail. Employers must report total wages paid during the payroll period including the 12th of each month within the quarter. Both typed and handwritten entries are acceptable, with specific guidelines on how to format monetary amounts. After ensuring the accuracy and completeness of the information, the original form (no photocopies) should be mailed to the address provided on the form. This process underscores the importance of precision and adherence to guidelines in official documentation.

- Are there penalties for late or incorrect submission of the LB 0456 Form?

Yes, employers may face penalties for the late submission of the LB 0456 form or for submitting inaccurate information. These penalties are in place to encourage timely and correct reporting, which is essential for the administration of unemployment benefits. Employers should endeavor to submit their forms on time and ensure the accuracy of the reported data to avoid these penalties.

- Where can employers get assistance or more information about the LB 0456 Form?

Employers seeking assistance or requiring further information about the LB 0456 form can directly contact the Tennessee Department of Labor and Workforce Development. The department provides resources and guidance to ensure employers can fulfill their reporting requirements confidently and accurately. This support underscores the commitment to maintaining a fair and functional unemployment insurance system.

Through understanding and proper management of the LB 0456 form, employers play a crucial role in sustaining the workforce's well-being in Tennessee. Compliance with these requirements not only adheres to legal obligations but also contributes to the broader social safety net designed to protect workers during times of unemployment. For both employers and employees, navigating these processes with careful consideration ensures stability and tranquility within the labor market.

Common mistakes

Completing the Tennessee LB 0456 form accurately is vital for employers to ensure compliance with state labor and workforce development requirements. However, mistakes can happen. Here’s an expanded list of nine common errors to watch for:

Not updating address changes. Employers often overlook the need to update their address at the top of the form, which can lead to missed communications.

Incorrect State Account Number. A crucial detail, the state account number must be accurately entered to ensure proper processing.

Entering incorrect quarter/year and quarter end date information. This detail is essential for the timely and accurate processing of forms.

Federal ID Number errors. Misentering this number can lead to significant processing delays and confusion.

Incorrect calculations in the wages section. Whether it’s not correctly adding total wages or misreporting excess wages, calculation errors can significantly impact the premium due.

Failure to properly format numeric entries, such as not right justifying numbers or including dollar signs, commas, or decimals when handprinting.

Not following the correct monetary amount formatting guidelines, especially for representing dollars and cents accurately.

Omitting signature, title, or date at the bottom of the form, which is essential for verification purposes.

Misunderstanding the submission instructions by sending photocopies instead of original documents, or failing to mail the check to the correct address as specified in the instructions.

Avoiding these common mistakes can streamline the process, ensuring accurate and efficient submissions.

Documents used along the form

When handling employment and workforce management in Tennessee, particularly with the submission of the LB-0456 form for unemployment insurance and premium reporting, several other forms and documents are commonly used. These additional forms ensure compliance with state laws and facilitate the smooth operation of employment-related administrative tasks. Understanding each document's purpose can support employers in maintaining accurate records and making timely submissions.

- LB-0851 (Wage Report): This form accompanies the LB-0456 and is used for reporting the total wages paid to employees during the quarter. It captures detailed employee wage information, which helps in calculating unemployment insurance premiums.

- LB-0489 (Employer's Quarterly Wage and Premium Report): An alternative comprehensive form that combines wage reporting and premium calculation. It's designed for employers to report their total quarterly wages and calculate the due premiums for unemployment insurance in one document.

- SS-4 (Application for Employer Identification Number): Before an employer can file an LB-0456, they must obtain a Federal Employer Identification Number (FEIN) from the IRS using the SS-4 form. This number is crucial for identifying the business on all employment-related tax filings.

- LB-0443 (Application for Employer Number): New employers in Tennessee use this form to register with the Tennessee Department of Labor and Workforce Development. It is a prerequisite for obtaining a state account number, which is necessary for filing the LB-0456.

- LB-0850 (Notice of Change): Employers must report any change in their address, business status, or ownership. This form ensures that all correspondence related to the LB-0456 and other employment-related filings reaches the correct address.

- New Hire Reporting Form: While not specific to unemployment insurance, Tennessee law requires employers to report new hires or rehires to the state. This process helps in monitoring and enforcing child support obligations. Although not a specific form, the information can usually be submitted online through the state's new hire reporting website.

Together, these forms create a comprehensive framework for managing employment relations from a legal and administrative perspective in Tennessee. Proper use and timely filing of these documents not only ensure compliance with state regulations but also support accurate and fair unemployment insurance funding. Employers are encouraged to familiarize themselves with these forms and their specific requirements to maintain good standing within the state's labor framework.

Similar forms

Form UC-1, "Unemployment Insurance Tax Report": Similar to the Tennessee LB 0456 form, the UC-1 form is used by employers to report wages paid and unemployment insurance taxes owed on a quarterly basis. Both require employer and employee wage details, including total wages paid and adjustments for excess wages to calculate net taxable wages.

Form 940, "Employer's Annual Federal Unemployment (FUTA) Tax Return": While the Tennessee LB 0456 form is filed quarterly, Form 940 shares the necessity of reporting total wage payments and identifying taxable wages. Both forms play a critical role in calculating unemployment insurance contributions, albeit on different timeframes and jurisdictional levels.

Form 941, "Employer's Quarterly Federal Tax Return": This form is akin to the LB 0456 in that it's used for quarterly wage reporting. Employers must detail wages paid, taxes collected, and the total due to the government. Both forms are essential for compliance with federal and state tax obligations.

State-Specific New Hire Reporting Forms: These documents, while not tax-related, are similar to LB 0456 as they require employers to report wage earners' information. The emphasis is on submitting details about newly hired or rehired employees to a state directory, showcasing the cross-functionality between employment and tax reporting obligations.

Form W-2, "Wage and Tax Statement": Similar to the segment of LB 0456 that reports individual employee wages, the W-2 summarizes an employee's annual wages and taxes withheld. Though the W-2 is annual and more comprehensive, both documents are crucial for tax recording and reporting.

Form W-3, "Transmittal of Wage and Tax Statements": Operating in tandem with Form W-2, Form W-3 is a summary report for all W-2 forms submitted by an employer. Like the LB 0456's role in consolidating quarterly wage data, the W-3 provides a cumulative view for annual wage reporting purposes.

Form WR-30, "Employer Report of Wages Paid": Predominantly used in New Jersey, this form parallels LB 0456's requirements for reporting employee wages and calculating contributions to unemployment insurance. Both serve as a state-level signature document to inform unemployment insurance and wage data collection.

Form UIA-1028, "Employer's Quarterly Wage/Tax Report": Utilized in Michigan, this document, like LB 0456, necessitates the reporting of quarterly wages, taxable wage base calculations, and determination of owed unemployment insurance taxes, underlining the uniformity in state-level unemployment tax reporting processes.

SUTA (State Unemployment Tax Act) Reports: These are state-specific quarterly reports similar to the LB 0456, requiring employers to report wages for the purpose of calculating state unemployment insurance taxes. The forms vary by state but maintain a core focus on wage reporting and tax calculation to fund state unemployment benefits.

Dos and Don'ts

When filling out the Tennessee LB 0456 form, it's important to adhere to specific dos and don'ts to ensure the submission is accurate and compliant with state requirements. These guidelines are designed to simplify the process and help avoid common mistakes.

Do:- Read the instructions carefully before starting the form. The reverse side of the form provides essential guidelines that can assist with correct filling.

- Use black ink if you're handprinting the form, ensuring that all characters are legible and within the boxes provided.

- Report monetary amounts with dollars and cents, showing the cents even if the amount is a whole number.

- Sign and date the form at the bottom, as this certifies that the information provided is true and correct.

- Make the check payable to the Tennessee Department of Labor and Workforce Development, following the specific payment instructions.

- Use commas, hyphens, dollar signs, or decimals when typing or handprinting amounts, except to show dollars and cents.

- Submit photocopies of the form. Original reports are required for processing.

- Disregard alignment instructions for entering data. Proper alignment ensures that your information is processed accurately.

- Forget to show any address change at the top of the form. Keeping your address updated is crucial for receiving future correspondence.

- Rush through the form without double-checking your entries for mistakes. A quick review can save you time in corrections later.

Following these guidelines can help streamline the process of filling out the Tennessee LB 0456 form, making it easier to comply with state employment security regulations.

Misconceptions

Understanding the Tennessee LB 0456 form requires clarity and attention to detail. This complex form, essential for employers within the state, is often misunderstood. Let's address five common misconceptions about it to ensure accuracy and compliance in its usage.

- Misconception 1: The LB 0456 is a universal form for all employment-related filings.

Contrary to this belief, the LB 0456 is specifically designed for the reporting of wages and premiums to the Tennessee Department of Labor and Workforce Development’s Employment Security Division. It is not intended for other employment-related reports or taxes. This form plays a crucial role in unemployment insurance premium calculations, making it exclusive to this particular process.

- Misconception 2: Digital submission of the LB 0456 form is optional.

While the form emphasizes the submission of original reports by mail (as stated, “Submit originals only. Please do not copy this form.”), the increasing push towards digitalization in government transactions fosters a misunderstanding. Employers should verify current submission methods and requirements, as digital filing options may exist or be introduced, aiming to streamline and secure the process.

- Misconception 3: All fields on the LB 0456 can be completed manually with any writing tool.

It’s specified that if the form is handprinted, certain guidelines must be followed. Numbers and letters must be printed in black ink, without commas, hyphens, dollar signs, or decimals, and always showing cents. This precision ensures clarity and accuracy, reducing the risk of errors in processing the document.

- Misconception 4: Any employer, regardless of size or payroll, must file the LB 0456.

Although it’s a critical document for many, not every employer in Tennessee is required to file it. The obligation to submit the LB 0456 form is dependent on an employer’s payroll size, the type of business, and other criteria as defined by the Tennessee Department of Labor and Workforce Development. Employers should confirm their filing responsibilities based on these factors.

- Misconception 5: The instructions for the LB 0456 form are solely on the front page.

This overlooks important details, as the form clearly directs recipients to “See Reverse Side for Instructions.” Essential information and guidance for accurately completing and submitting the form are provided on both sides. Thus, a thorough review of the entire form, including any reverse side instructions, is crucial for compliance and proper filing.

Dispelling these misconceptions ensures a stronger understanding and adherence to the procedures set forth by the Tennessee Department of Labor and Workforce Development. It promotes accuracy in reporting, which is beneficial for both the employer and the state.

Key takeaways

Filling out the Tennessee LB-0456 form is an essential process for employers within the state, guiding the reporting and payment of unemployment insurance premiums. Understanding the key aspects of this form is crucial for compliance and accurate financial reporting. Here are four key takeaways:

- Accuracy is paramount: It is imperative that all information provided on the LB-0456 form is accurate and truthful. Incorrect information can lead to penalties, including fines or legal action. Both the total wages paid and taxable wages must be reported with precision, ensuring that cents are always shown.

- Report formatting: Whether submitting the form typed or handwritten, specific instructions must be followed. If typed, characters should be a consecutive string without commas, hyphens, or dollar signs, and the decimal must be included in monetary amounts. When handprinted, figures should be right justified within the boxes, again without commas, hyphens, dollar signs, or decimals. This consistency aids in the clear interpretation and processing of the form.

- Original documents are required: Employers must submit original reports to the Tennessee Department of Labor and Workforce Development, as photocopies are not acceptable. This emphasizes the importance of the original document's integrity and encourages employers to keep a copy for their records before submitting.

- Timeliness: Adhering to the due dates for submission and payment is critical. Late submissions can incur penalties such as interest and fines, which are additional to the standard premium due. Employers should be mindful of the dates to ensure compliance and avoid unnecessary costs.

Overall, the LB-0456 form is a crucial component of an employer's obligations within Tennessee, ensuring that unemployment insurance premiums are correctly calculated and reported. Attention to detail, adherence to formatting instructions, submitting original documents, and meeting deadlines are all key to successfully navigating this process.

Popular PDF Forms

Delaware Prevailing Wage - How to properly list each employee's work schedule, earnings, and classification on the Delaware Payroll Report.

Written Documentation Should - The ambulance report acts as a crucial touchstone for quality improvement efforts within emergency medical services, providing data for review and analysis.