Blank Tennessee Ss 4247 PDF Template

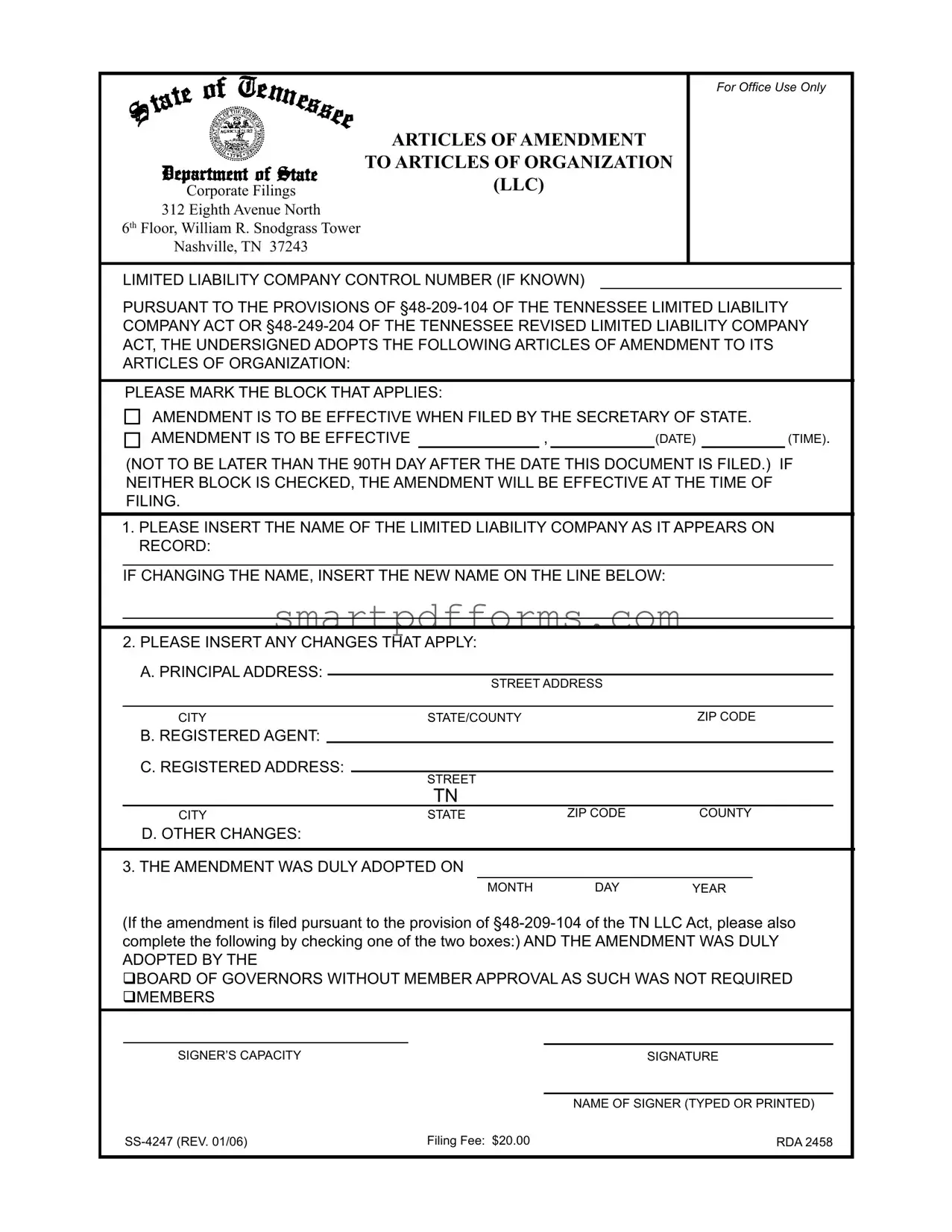

In the bustling state of Tennessee, businesses that operate as Limited Liability Companies (LLCs) might find themselves in situations where changes to their foundational structure are necessary. This could include alterations to the company's name, address, registered agent, or other significant details. When such changes are needed, the Tennessee SS-4247 form becomes a critical document. Designed to amend the Articles of Organization for LLCs, this form accommodates modifications under the guidance of Tennessee statutes §48-209-104 of the Tennessee Limited Liability Company Act or §48-249-204 of the Tennessee Revised Limited Liability Company Act. With options to make amendments effective either upon filing or at a specified later date, the form provides flexibility within a 90-day time frame after submission. The form clearly outlines areas for company identification, the specifics of the amendment(s), and verification of legiti mate adoption procedures—whether through the Board of Governors' decision or member approval, contingent upon the company's governance structure. Along with a nominal filing fee, and located conveniently in Nashville for submission, the process is streamlined for efficiency. Ensuring accurate and timely amendments is crucial, not only for legal compliance but also for the smooth operation and representation of the LLC.

Preview - Tennessee Ss 4247 Form

For Office Use Only

ARTICLES OF AMENDMENT

TO ARTICLES OF ORGANIZATION

Corporate Filings

(LLC)

312 Eighth Avenue North

6th Floor, William R. Snodgrass Tower

Nashville, TN 37243

LIMITED LIABILITY COMPANY CONTROL NUMBER (IF KNOWN)

PURSUANT TO THE PROVISIONS OF

PLEASE MARK THE BLOCK THAT APPLIES:

AMENDMENT IS TO BE EFFECTIVE WHEN FILED BY THE SECRETARY OF STATE.

AMENDMENT IS TO BE EFFECTIVE |

|

, |

|

(DATE) |

|

(TIME). |

|

|

|

|

(NOT TO BE LATER THAN THE 90TH DAY AFTER THE DATE THIS DOCUMENT IS FILED.) IF NEITHER BLOCK IS CHECKED, THE AMENDMENT WILL BE EFFECTIVE AT THE TIME OF FILING.

1.PLEASE INSERT THE NAME OF THE LIMITED LIABILITY COMPANY AS IT APPEARS ON RECORD:

IF CHANGING THE NAME, INSERT THE NEW NAME ON THE LINE BELOW:

2. PLEASE INSERT ANY CHANGES THAT APPLY:

|

A. PRINCIPAL ADDRESS: |

|

|

|

|

|

|

|

|

|

|

|

|

STREET ADDRESS |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||||

|

CITY |

STATE/COUNTY |

|

ZIP CODE |

||||||

|

B. REGISTERED AGENT: |

|

|

|

|

|

|

|

|

|

|

C. REGISTERED ADDRESS: |

|

|

|

|

|

|

|

||

|

STREET |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

TN |

|

|

|

|

|

|

|

CITY |

STATE |

ZIP CODE |

COUNTY |

|

|||||

|

D. OTHER CHANGES: |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

3. THE AMENDMENT WAS DULY ADOPTED ON |

|

|

|

|

|

|

|||

|

|

|

|

|

MONTH |

DAY |

YEAR |

|||

(If the amendment is filed pursuant to the provision of

BOARD OF GOVERNORS WITHOUT MEMBER APPROVAL AS SUCH WAS NOT REQUIRED MEMBERS

SIGNER’S CAPACITY |

|

SIGNATURE |

|

|

|

|

|

NAME OF SIGNER (TYPED OR PRINTED) |

Filing Fee: $20.00 |

RDA 2458 |

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The form is designated for the purpose of amending articles of organization for a Limited Liability Company (LLC) in Tennessee. |

| 2 | Governing laws for the form include §48-209-104 of the Tennessee Limited Liability Company Act and §48-249-204 of the Tennessee Revised Limited Liability Company Act. |

| 3 | The form allows for amendments to be effective immediately upon filing or at a specific later time, not exceeding the 90th day after filing. |

| 4 | Changes that can be made using this form include the LLC's name, principal address, registered agent, and registered address, among other changes. |

| 5 | The amendment can be adopted by either the board of governors without member approval, or by the members, depending on the circumstances as outlined in the provided options. |

| 6 | Form SS-4247 has a filing fee of $20.00. |

| 7 | The form is submitted to the Corporate Filings section of the TN Secretary of State, located at the 6th Floor, William R. Snodgrass Tower, Nashville, TN. |

| 8 | It is required to enter the control number of the LLC if known, which assists in the identification and processing of the amendment. |

| 9 | The document must be signed by an individual with the authority to make amendments to the LLC, and the signer’s capacity must be clearly stated. |

Instructions on Utilizing Tennessee Ss 4247

Once a Limited Liability Company (LLC) in Tennessee decides to make changes to its Articles of Organization, the SS-4247 form is the essential tool for making it official. From altering the company's name to updating the registered address or agent, this document is vital for ensuring the state has the most current information. The process may seem daunting at first, but by following a step-by-step guide, the filing can be completed accurately and efficiently.

- Begin by determining the effective date of the amendment. Decide if the change will take effect when filed by the Secretary of State or specify another date and time (not to exceed the 90th day after filing). Mark the corresponding box. If neither is selected, it defaults to the time of filing.

- If known, enter the Limited Liability Company Control Number at the top of the form.

- In the provided space, type the current official name of the LLC as it appears in state records.

- If the LLC is changing its name, enter the new name directly below the current name. Make sure it complies with Tennessee state requirements for LLC names.

- Fill in any changes to the LLC's principal address, including the street address, city, state/county, and zip code in the designated area.

- Update the information regarding the Registered Agent and Registered Address if applicable. Include the complete street address, city, state, and county details.

- For any other changes not specifically mentioned in the sections above, provide a clear description of these adjustments in the designated "D. OTHER CHANGES" area.

- Indicate the date the amendment was officially adopted by the LLC. Provide the month, day, and year.

- Next, specify the method of adoption for the amendment. Check the relevant box to indicate whether the amendment was adopted by the Board of Governors without member approval or by member approval, as required.

- Finally, the signer must print their name, sign, and indicate their capacity (e.g., Member, Manager) at the bottom of the form.

After thoroughly reviewing the document for accuracy and completeness, submit the form along with the required $20.00 filing fee to the Secretary of State's office. Delivery can be made in person or via mail to the address provided on the form. Ensuring all information is accurate and the form is fully completed are critical steps to avoid delays. Once filed, the amendments become part of the official record, heralding a new chapter for the LLC.

Obtain Answers on Tennessee Ss 4247

What is the Tennessee SS-4247 form used for?

The Tennessee SS-4247 form is utilized for making amendments to the Articles of Organization of a Limited Liability Company (LLC) registered in the state of Tennessee. This includes changes such as the company's name, principal address, registered agent, and any other details originally filed with the Articles of Organization. Essentially, it's a way to officially update the company's foundational information with the Secretary of State.

When does the amendment to the Articles of Organization take effect?

The amendments can take effect either at the time of filing with the Secretary of State or at a specified future date and time, which cannot be later than the 90th day after the form is filed. If no option is selected on the form, the default is that the amendment becomes effective upon filing. This flexibility allows for a company to strategically plan when the changes are to be officially recognized.

How can one choose the amendment effective date on the form?

To select the effective date of the amendment, one must mark the appropriate block on the form. There are two options: either the amendment will be effective when filed by the Secretary of State, or it will become effective on a specified date and time, provided it's within 90 days of filing. If no selection is made, the amendment automatically takes effect at the time it's filed.

What is the process for adopting the amendment?

The amendment to the Articles of Organization must be duly adopted either by the board of governors (if member approval is not required) or by the members of the LLC. This requires checking one of the two boxes on the form to indicate which group has adopted the amendment. This process ensures that the amendment is made with the appropriate consent within the organization, following the provisions set under either §48-209-104 of the TN LLC Act or §48-249-204 of the Tennessee Revised LLC Act.

Common mistakes

Not providing the full, legal name of the Limited Liability Company as it currently appears on record. This omission can lead to confusion and potential rejection of the form.

Checking both blocks regarding the effectiveness of the amendment or failing to check any block at all. This decision is crucial for the timeline of the amendment's implementation.

Omitting the new name of the Limited Liability Company when a name change is intended. This mistake can invalidate the whole purpose of filing the amendment.

Leaving out the complete change details in Section 2, specifically:

- The principal address,

- The registered agent, and

- The registered address.

Incorrectly marking the box in Section 3 regarding the adoption of the amendment. This error could misrepresent how the amendment was approved, potentially compromising its validity.

Failing to provide the exact date when the amendment was adopted. This oversight may lead to unnecessary delays or even rejection due to the lack of precise information.

Neglecting to include the signer's capacity, signature, and the name of the signer (typed or printed). This lapse can render the document incomplete, risking its acceptance.

Documents used along the form

When managing a Limited Liability Company (LLC) in Tennessee, certain forms and documents beyond the Tennessee SS-4247, which is used for amending the Articles of Organization, are important for compliance and operational purposes. This brief overview outlines such documents, highlighting their relevance and purpose in the context of maintaining or altering the business structure of an LLC.

- SS-4418 – Articles of Organization for a Domestic Limited Liability Company: This document officially forms an LLC in Tennessee, containing essential information about the company, including its name, address, and the names of its members.

- SS-4233 – Annual Report for a Domestic or Foreign Limited Liability Company: LLCs must file an annual report with the Tennessee Secretary of State, providing current information about the company, such as the principal address and the name and address of the registered agent.

- SS-4228 – Change of Registered Agent/Office: When an LLC needs to change its registered agent or office location within Tennessee, this form is required to update the official records with the Secretary of State.

- SS-4244 – Articles of Termination: If an LLC is winding down its operations and dissolving, this document formally terminates the company's existence under state law.

- SS-4524 – Foreign Limited Liability Company Application for Certificate of Authority: This is necessary for LLCs organized under the laws of another state but intending to conduct business in Tennessee, allowing them to legally operate within the state.

- SS-4488 – Certificate of Good Standing: While not a form, this certificate may be obtained from the Secretary of State and is often required by financial institutions and during business transactions to prove the LLC is compliant with Tennessee regulations and filings.

- Operating Agreement: Although not filed with the State, the operating agreement is crucial for outlining the governance structure, financial arrangements, and operational guidelines of an LLC. It's a key document for managing the internal affairs of the company.

- SS-4438 – Amendment to the Articles of Organization: This form is used for making changes to an LLC's Articles of Organization, beyond those amendments covered by the SS-4247, especially when major changes to the company structure or operations are made.

- SS-4239 – Application for Reservation of Limited Liability Company Name: Before forming an LLC, this form can reserve a unique name for a specified period to ensure its availability upon filing the Articles of Organization.

Each of these documents plays a critical role in the life cycle of an LLC in Tennessee, from its formation to any structural or operational changes and, ultimately, to its dissolution. Timely and accurate filing of these forms ensures legal compliance and facilitates smoother operation of the LLC within the regulatory framework of the state.

Similar forms

Documents similar to the Tennessee SS-4247 form, which is used for amending the Articles of Organization for a limited liability company (LLC), often share the goal of updating or altering official business records. These documents can vary across states and business structures but generally serve similar purposes in ensuring that a business's public records are current and reflect the accurate status and structure of the company. Here are ten documents and how they compare:

- Articles of Incorporation Amendment: Similar to the SS-4247 form for LLCs, this document is used by corporations to amend their Articles of Incorporation. It typically includes changes like the company name, address, and the nature of the business.

- Articles of Organization: Though not an amendment, the original Articles of Organization form is the document filed to officially form an LLC. It shares elements with the SS-4247, such as providing the company's name and address but is used for formation rather than amendment.

- Certificate of Amendment: Used by both LLCs and corporations, this document serves a similar purpose to the SS-4247 by officially recording any changes made to the company's foundational documents. Its content and structure can vary by state.

- Statement of Information: This form is filed periodically by LLCs and corporations with their respective state to update or confirm the recorded information, such as address and contact information, not unlike certain updates provided through the SS-4247.

- Registered Agent Change Form: Specifically focused on changing a company's registered agent or their address, this form covers a very specific amendment that might also be part of the broader changes included in an SS-4247 submission.

- DBA (Doing Business As) Filing: When a business operates under a name different from its legal name, a DBA filing is required. While not an amendment to the Articles of Organization directly, it signifies a change in how the business is presented to the public, akin to a name change amendment.

- Corporate Bylaws Amendment: For a corporation, altering its bylaws to reflect changes in governance or operations might be comparable to an LLC amending its Articles of Organization through the SS-4247, even though bylaws are internal documents.

- Operating Agreement Amendment: Similar to amending corporate bylaws, an LLC may need to amend its Operating Agreement to reflect changes in the company's operation or organization, although this document is not usually filed with the state.

- Foreign Qualification Application: When an LLC or corporation wants to do business in a state other than its origin, it must file a form similar to what's called a Foreign Qualification. This process can involve amending documents to meet another state's requirements.

- Dissolution Documents: At the end of its lifecycle, a company must file documents to dissolve officially. While the goal is different, the process of formally notifying the state about significant changes to the company's status is somewhat similar to filing an amendment.

Dos and Don'ts

When filling out the Tennessee SS-4247 form, which is for Articles of Amendment to Articles of Organization for a limited liability company, it's essential to follow some guidelines to ensure the process is done correctly and efficiently. Here are things you should and shouldn't do:

Things You Should Do:- Review the original Articles of Organization: Before making any amendments, carefully review your limited liability company's original Articles of Organization to understand the changes needed.

- Be clear and precise: When detailing changes in the SS-4247 form, ensure that your information is clear, accurate, and precise to avoid any confusion.

- Mark the effective date of amendment: Decide and correctly mark if the amendment should take effect upon filing or specify another effective date but not later than the 90th day after filing.

- Sign and print your name: Ensure the form is signed, and the name of the signer is printed clearly to validate the document.

- Include the filing fee: Remember to include the necessary filing fee, which is $20.00, to ensure your form is processed without delays.

- Double-check for completeness: Before submitting, verify that all required sections are completed and that no applicable sections are left blank.

- Leave sections incomplete: Do not overlook any section that applies to your amendments. An incomplete form may result in rejection or delays.

- Forget to specify the effective date: Avoid leaving the effective date sections unmarked. Failing to choose an effective date can lead to unintended timing for your amendments.

- Miss out on member or board approval: If the amendment requires approval (either by members or the board of governors), do not forget to check the appropriate box indicating such approval.

- Use unclear language: Avoid using language that is ambiguous or difficult to understand which might complicate the amendment process.

- Submit without reviewing: Do not submit the form without a final review to catch any errors or incomplete information that could invalidate the submission.

- Ignore the filing fee: Failing to include the $20.00 filing fee can result in the non-processing of your form, so ensure this is not overlooked.

Properly completing and submitting the Tennessee SS-4247 form is a critical step in ensuring your limited liability company's records are current and accurately reflect any amendments to the Articles of Organization.

Misconceptions

When it comes to filing legal forms for a business, such as the Tennessee SS-4247 form for Articles of Amendment to Articles of Organization for a Limited Liability Company (LLC), misconceptions can lead to errors that may impact the filing process. Here are eight common misconceptions about the form and its requirements:

- It's only for name changes: While many assume the SS-4247 form is solely for changing the name of an LLC, it actually covers a broader range of amendments. These can include changes to the principal address, registered agent, registered address, and other modifications to the organization's original articles.

- Immediate effectiveness is mandatory: Another common misconception is that amendments filed using this form take effect immediately upon filing. However, filers have the option to specify a later date, not exceeding 90 days from the date of filing, for the amendment to become effective.

- Member approval is always required: Some believe that any amendment must have the approval of all members. This is not always the case. Depending on the nature of the amendment and the company's operating agreement, the Board of Governors may be able to adopt the amendment without member approval.

- No fee is required: Filing the SS-4247 form does indeed require a fee. As noted in the form, there is a $20.00 filing fee that must accompany the form when submitted to the Tennessee Secretary of State.

- Electronic filing is not an option: In today's digital age, many assume that important legal documents must be submitted in person or via mail. However, Tennessee allows for electronic filing of many business documents, including amendments to Articles of Organization.

- Any change requires a new form: Some think that each different amendment requires a separate form. In reality, multiple changes can be included in a single SS-4247 filing as long as they are properly detailed in the form.

- Unlimited amendments can be filed at once: While you can include multiple changes in one form, there are practical and legal limitations to consider. Significant alterations might require separate filings or additional documentation to ensure clarity and compliance with state laws.

- Legal assistance is not necessary: Finally, some individuals mistakenly believe they can navigate the amendment process without any legal guidance. Given the potential implications of amendments on an LLC's legal and operational status, consulting with legal professionals to ensure accuracy and compliance is often advisable.

Understanding these misconceptions and addressing them properly is crucial for the smooth operation of an LLC in Tennessee. Filing the SS-4247 form accurately and in compliance with state regulations helps ensure that the desired amendments are reflected correctly in the company's legal record. It is equally important to stay updated with any changes to state law or filing procedures to avoid future complications.

Key takeaways

Understanding how to properly complete and use the Tennessee SS-4247 form is essential for making amendments to the Articles of Organization for a Limited Liability Company (LLC). Here are key takeaways to guide you through this process.

- Identifying the Act: Be aware that this form pertains to amendments under two specific acts - §48-209-104 of the Tennessee Limited Liability Company Act or §48-249-204 of the Tennessee Revised Limited Liability Company Act. Understanding which act your amendment falls under is essential for compliance.

- Choosing the Effective Date: The form allows you to choose when the amendment becomes effective. This can be immediately upon filing or at a specified date and time, not exceeding 90 days after filing. If no choice is made, the amendment takes effect at the time of filing.

- Amendment Details: Clearly state the amendments being made to the Articles of Organization, including changes to the company name, principal address, registered agent, and registered address among potentially other alterations. Specify exactly what is being changed to ensure clarity and accuracy.

- Approval Process: Indicate the method of approval for the amendment. It can be approved by the Board of Governors without member approval if not required, or it can require approval by the members. This distinction is crucial for validating the amendment process.

- Signature Requirements: The form must be signed by someone with the authority to do so, usually a current member or manager of the LLC. The signer's capacity must be indicated, along with a typed or printed name to validate the document.

- Filing Fee: There is a $20.00 filing fee associated with the submission of the SS-4247 form. This fee is payable to the Tennessee Secretary of State and is required for processing the amendment.

Ensuring that the SS-4247 form is filled out accurately and completely is crucial for the legal amendment of your LLC’s Articles of Organization. Careful attention to detail, understanding the requirements, and complying with the specified provisions will facilitate a smooth amendment process.

Popular PDF Forms

Ps3971 - It includes sections for the type of leave requested and the duration of the leave.

Aoausa Forms - Addresses issues related to mold prevention and responsibility, emphasizing the importance of maintenance and prompt reporting of problems.