Blank Texas Resale Certificate 01 339 PDF Template

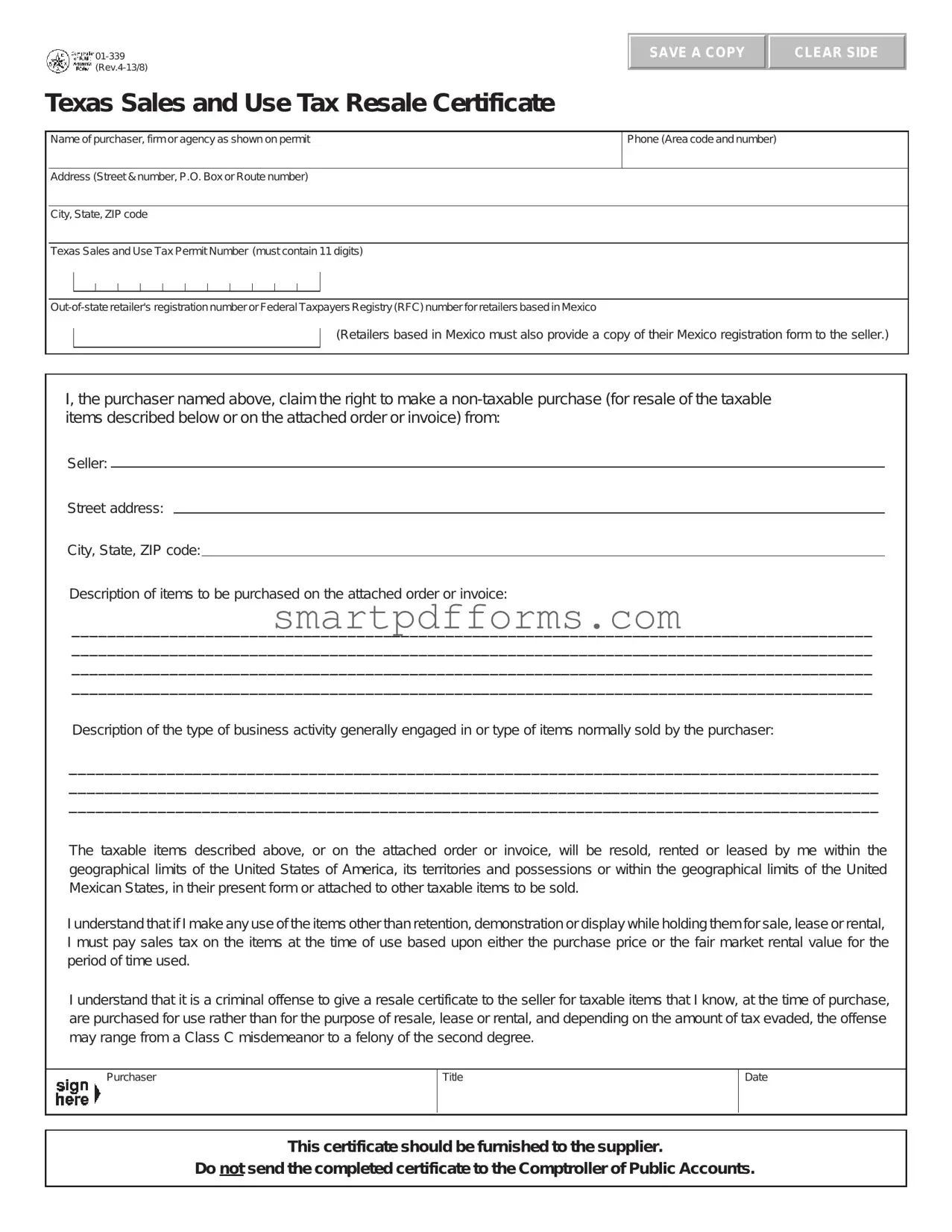

In today's fast-paced business environment, understanding the intricacies of tax-related documentation is paramount for companies wishing to ensure compliance and optimize their operational efficiencies. The Texas Resale Certificate, form 01 339, stands out as a critical tool for businesses engaged in the purchasing of goods for resale, lease, or rental. This form, which comes in two pivotal sections, allows businesses to procure taxable items without paying sales tax at the time of purchase, with the condition that these items will be sold, rented, or leased within the United States of America or the United Mexican States. The form not only delineates the buyer's details, such as the name, address, and contact information but also requires a valid Texas Sales and Use Tax Permit Number or, for retailers based in Mexico, a Federal Taxpayers Registry number along with a copy of their Mexico registration form. It emphasizes the legality and the serious undertone of the transaction by clearly stating the ramifications of misuse or fraudulent claims, which could range from a misdemeanor to a felony, depending on the tax amount evaded. Furthermore, the inclusion of an Exemption Certification segment within the document highlights its dual functionality, addressing situations where purchases are exempt from sales and use taxes. This underscores the importance of accurately understanding and utilizing the form not just as a means to defer tax payments but also as a measure to uphold the integrity and legality of business transactions in the realms of resale and tax exemption.

Preview - Texas Resale Certificate 01 339 Form

SAVE A COPY

CLEAR SIDE

Texas Sales and Use Tax Resale Certificate

Name of purchaser, firm or agency as shown on permit

Phone (Area code and number)

Address (Street & number, P.O. Box or Route number)

City, State, ZIP code

Texas Sales and Use Tax Permit Number (must contain 11 digits)

(Retailers based in Mexico must also provide a copy of their Mexico registration form to the seller.)

I, the purchaser named above, claim the right to make a

Seller:

Street address:

City, State, ZIP code:

Description of items to be purchased on the attached order or invoice:

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

Description of the type of business activity generally engaged in or type of items normally sold by the purchaser:

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

The taxable items described above, or on the attached order or invoice, will be resold, rented or leased by me within the geographical limits of the United States of America, its territories and possessions or within the geographical limits of the United Mexican States, in their present form or attached to other taxable items to be sold.

I understand that if I make any use of the items other than retention, demonstration or display while holding them for sale, lease or rental, I must pay sales tax on the items at the time of use based upon either the purchase price or the fair market rental value for the period of time used.

I understand that it is a criminal offense to give a resale certificate to the seller for taxable items that I know, at the time of purchase, are purchased for use rather than for the purpose of resale, lease or rental, and depending on the amount of tax evaded, the offense may range from a Class C misdemeanor to a felony of the second degree.

Purchaser

Title

Date

This certificate should be furnished to the supplier.

Do not send the completed certificate to the Comptroller of Public Accounts.

Texas Sales and Use Tax Exemption Certification

This certificate does not require a number to be valid.

Name of purchaser, firm or agency

SAVE A COPY

CLEAR SIDE

Address (Street & number, P.O. Box or Route number)

Phone (Area code and number)

City, State, ZIP code

I, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice) from:

Seller:

Street address: |

|

City, State, ZIP code: |

|

Description of items to be purchased or on the attached order or invoice:

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

Purchaser claims this exemption for the following reason:

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

I understand that I will be liable for payment of all state and local sales or use taxes which may become due for failure to comply with the provisions of the Tax Code and/or all applicable law.

I understand that it is a criminal offense to give an exemption certificate to the seller for taxable items that I know, at the time of purchase, will be used in a manner other than that expressed in this certificate, and depending on the amount of tax evaded, the offense may range from a Class C misdemeanor to a felony of the second degree.

Purchaser

Title

Date

NOTE: This certificate cannot be issued for the purchase, lease, or rental of a motor vehicle.

THIS CERTIFICATE DOES NOT REQUIRE A NUMBER TO BE VALID.

Sales and Use Tax "Exemption Numbers" or "Tax Exempt" Numbers do not exist.

This certificate should be furnished to the supplier.

Do not send the completed certificate to the Comptroller of Public Accounts.

Form Data

| Fact Number | Fact Information |

|---|---|

| 1 | The Texas Resale Certificate (Form 01-339) is utilized to make non-taxable purchases for resale, lease, or rental within the United States or Mexico. |

| 2 | Purchasers must provide their Texas Sales and Use Tax Permit Number, which is 11 digits, or, for out-of-state and Mexico-based retailers, the relevant registration or Federal Taxpayers Registry (RFC) number. |

| 3 | Retailers based in Mexico must also submit a copy of their Mexico registration form in addition to the certificate. |

| 4 | Items purchased under this certificate must be either resold, rented, or leased as specified, and misuse of items for purposes other than resale can result in owing sales tax. |

| 5 | It is a criminal offense to use the resale certificate for items known at the time of purchase to be used in a way other than for resale, lease, or rental, with penalties ranging from a Class C misdemeanor to a felony of the second degree. |

| 6 | This certificate should be furnished to the supplier, and it is not required to be sent to the Comptroller of Public Accounts. |

| 7 | The Texas Sales and Use Tax Exemption Certification part of the form clarifies that "Exemption Numbers" or "Tax Exempt" numbers do not exist and outlines the liability for taxes due to non-compliance with tax code provisions. |

Instructions on Utilizing Texas Resale Certificate 01 339

Filling out the Texas Resale Certificate (form 01-339) is a straightforward process, but it requires attention to detail. This certificate allows businesses to purchase goods without paying sales tax if the items are intended to be resold, leased, or rented. The process ensures that tax is only applied to the final retail transaction. Following these instructions step by step will help ensure your certificate is completed accurately, allowing for smooth transactions between sellers and purchasers.

- Start by entering the Name of purchaser, firm or agency exactly as it is shown on your sales and use tax permit.

- Fill in your Phone number, including the area code.

- Provide the complete Address, including street & number, P.O. Box or Route number, City, State, and ZIP code.

- Enter your Texas Sales and Use Tax Permit Number. Ensure this number contains 11 digits. If you do not have a Texas Permit but are an out-of-state retailer, provide your registration number or Federal Taxpayers Registry (RFC) number for retailers based in Mexico. Note: Retailers based in Mexico must also attach a copy of their Mexico registration form.

- Identify the Seller from whom you are purchasing items, including their Name, Street address, City, State, and ZIP code.

- Describe the items to be purchased in detail, including a description of what they are generally and their use. This can also include items listed on an attached order or invoice.

- State the type of business activity you are generally engaged in, or the type of items you normally sell. This helps clarify the context of the resale.

- Assert that the items described will be resold, rented, or leased within the indicated geographical limits and affirm your understanding of the tax obligations if the items are used differently.

- Clear acknowledgment of the certification's legal importance is critical. Acknowledge understanding that misuse of this certificate constitutes a criminal offense, with penalties that can range significantly based on the tax amount evaded.

- Finally, sign the form with the Purchaser’s Title and Date to validate the certificate. Remember, this form should be furnished to the supplier and not sent to the Comptroller of Public Accounts.

Once you've completed these steps, your Texas Resale Certificate is ready to be used for your business transactions. This document serves as a formal declaration to sellers that you are buying products with the intent to resell, lease, or rent, thus exempting you from paying sales tax at the point of purchase. Make sure to keep records of all your transactions using this certificate, as they may need to be produced during audits or compliance checks.

Obtain Answers on Texas Resale Certificate 01 339

What is the Texas Resale Certificate 01 339 form?

Who needs to fill out the Texas Resale Certificate 01 339?

What information is required on the Texas Resale Certificate 01 339?

How is the Texas Resale Certificate 01 339 form used?

What happens if I misuse the Texas Resale Certificate 01 339 form?

Can the Texas Resale Certificate 01 339 form be used for purchasing motor vehicles?

The Texas Resale Certificate 01 339 form is a document that allows businesses to purchase items tax-free, provided those items are intended for resale, lease, or rental. This certificate is presented to the seller to claim a non-taxable purchase on items that will be resold in their original form or as part of other items. It is crucial for both parties, the purchaser and the seller, to keep a copy of this certificate for record-keeping purposes and to remain compliant with Texas state tax laws.

Any business or individual who intends to purchase goods for resale, lease, or rental within Texas or to customers in other eligible regions without paying sales tax at the time of purchase needs to fill out this form. It's important that the purchaser holds a valid Texas Sales and Use Tax Permit or, for retailers based outside of the United States but in Mexico, a valid Federal Taxpayers Registry (RFC) number along with a copy of their Mexico registration form.

The required information on the certificate includes the name, phone number, and address of the purchaser, along with their Texas Sales and Use Tax Permit number or applicable out-of-state retailer's registration number. Additionally, the seller’s information, a detailed description of the items being purchased for resale, and an explanation of the purchaser's type of business or the items they normally sell are needed. The purchaser must also affirm that the purchased items will be resold, rented, or leased as stipulated in the certificate.

This form is used to document the reason for making a tax-free purchase of items intended for resale. After filling out the form, the purchaser should give it to the seller at the time of purchase to ensure the sales tax is not charged. This form helps prevent tax evasion and ensures compliance with tax laws by providing a record of tax-free transactions. The seller keeps the certificate on file for a period as required by the Texas Comptroller’s office and does not send it to the Comptroller.

Misusing the Texas Resale Certificate 01 339 form, such as purchasing items tax-free that are not intended for resale, is considered a criminal offense. The severity of the offense can range from a Class C misdemeanor to a felony of the second degree, depending on the amount of tax evaded. Such actions can lead to financial penalties, prosecution, and damage to the business’s reputation. It is important to only use the resale certificate for its intended purpose and to ensure all information provided on the form is accurate and truthful.

No, the Texas Resale Certificate 01 339 form cannot be used for the purchase, lease, or rental of a motor vehicle. Texas law requires payment of sales tax on motor vehicles at the time of purchase, and this form does not apply to such transactions. For tax exemptions related to motor vehicles, other provisions and forms within Texas tax law are applicable. Always ensure you are using the correct form and follow the appropriate processes for your specific situation.

Common mistakes

Completing the Texas Resale Certificate 01 339 form accurately is crucial for businesses aiming to purchase goods for resale without paying sales tax at the time of purchase. Mistakes on this form can lead to unwanted tax liabilities and penalties. Below are six common errors people tend to make when filling out this form.

Failing to include the full business name: Many people forget to write the full legal name of their business as it appears on their sales tax permit. This discrepancy can cause confusion and delay the processing of the certificate.

Omitting the Texas Sales and Use Tax Permit Number: It's essential to provide an 11-digit permit number. If this is left blank or incorrectly filled, it may invalidate the certificate, as this number verifies the business's eligibility for tax exemption on purchases for resale.

Incorrectly identifying the items to be purchased for resale: A detailed description of the items being purchased is required. Vague or incomplete descriptions can raise questions about the validity of the exemption claim.

Not specifying the type of business activity: The form asks for a description of the business activity or the type of items normally sold by the purchaser. This information helps clarify the connection between the goods purchased and the business's resale activities.

Using the resale certificate for non-qualifying purchases: Some people mistakenly use this certificate for items that will not be resold, which is against the tax law. The certificate is strictly for items that will be resold in the same form or as part of other taxable items.

Forgetting to sign and date the form: The certificate must be signed and dated by the purchaser. An unsigned or undated certificate is considered incomplete and invalid, potentially leading to the denial of the tax exemption at the time of purchase.

By avoiding these common errors, businesses can ensure they correctly utilize the Texas Resale Certificate 01 339 form, thus maintaining compliance with state tax regulations and making their purchase process smoother.

Documents used along the form

When engaging in business transactions that necessitate the use of the Texas Resale Certificate (Form 01-339), it's crucial to understand the additional documentation that may be required to ensure compliance with state tax laws. These documents play a vital role in providing clarity and legal proof for various aspects of business operations, from proving tax exemption status to validating the nature of business activities. Below is a list of forms and documents often used alongside the Texas Resale Certificate, each serving a specific purpose in the broader context of business transactions and compliance.

- Form 01-908, Texas Sales and Use Tax Exemption Certification: This form allows businesses to purchase items tax-free that are intended for resale, lease, or rental. It's similar to the resale certificate but focuses on exemptions from sales tax for other reasons besides resale.

- Form 01-117, Texas Sales and Use Tax Return: Required for reporting and paying collected sales tax from customers, this form is filed periodically and is essential to reconcile the sales tax liability with the state.

- Form AP-201, Texas Application for Sales and Use Tax Permit: Businesses must complete this form to obtain a sales tax permit, allowing them to collect and remit sales and use taxes. This permit is a prerequisite for issuing valid resale certificates.

- Form 01-114, Sales and Use Tax Return - Long Form: Used by businesses with more complex sales and use tax reporting requirements, this form offers a more detailed approach to filing taxes, beneficial for businesses with multiple locations or diverse product lines.

- Form 01-922, Instructions for Collecting Vehicle Sales Tax from Buyers Who Will Register and Title Their Vehicle Outside Texas: This document provides guidance on collecting sales tax for vehicles destined for registration outside of Texas, ensuring compliance with tax laws for vehicle dealerships and private sellers.

- Form 01-339, Texas Sales and Use Tax Exemption Certification (Back): Though part of the same document, the exemption certification section on the reverse side serves a distinct purpose, allowing purchasers to claim exemption from sales tax for items used in a way that qualifies for tax exemption, differentiating from resale purposes.

To navigate the complexities of tax compliance and documentation in Texas, businesses must familiarize themselves with these forms and understand their specific purposes. Proper use of these documents ensures that businesses can operate smoothly, maintaining compliance with state laws and regulations while efficiently managing their tax liabilities and benefits. It is a fundamental aspect of running a successful business to stay informed and diligent in handling these essential forms.

Similar forms

Uniform Sales & Use Tax Certificate – Multijurisdiction: This form, like the Texas Resale Certificate (Form 01-339), is used by businesses to certify that a purchase is for resale and thus exempt from sales tax. Both documents serve as a declaration to avoid the double taxation of goods by indicating that the purchase will be resold in the buyer's normal course of business.

Streamlined Sales Tax Exemption Certificate: Similar to the Texas Resale Certificate, this certificate is used across multiple states that are members of the Streamlined Sales and Use Tax Agreement. It helps businesses purchase goods tax-free for the purpose of resale, lease, or rental, aligning with the Texas document's purpose of certifying tax-exempt purchases.

California Resale Certificate: Like the Texas Resale Certificate, the California Resale Certificate allows businesses to purchase items without paying state sales tax if those items are to be resold. Both forms require detailed information about the purchaser and seller, as well as a declaration of intent to resell the goods.

New York Resale Certificate (Form ST-120): This document functions similarly to the Texas Resale Certificate by enabling businesses to make tax-exempt purchases for resale. Both certificates require the purchaser’s identifying information and the acknowledgment that the items purchased will be resold in the normal course of business.

Florida Annual Resale Certificate for Sales Tax: Florida’s resale certificate allows businesses to buy or rent property tax-free if it's intended for resale. Similar to Texas' form, it validates a business’s right to make tax-exempt purchases but differs in its annual renewal requirement.

Illinois Certificate of Resale: This certificate functions like the Texas Resale Certificate by allowing businesses to not pay tax on items they plan to sell. Both forms facilitate the resale process by ensuring that sales tax is paid only once, ultimately by the end consumer.

Colorado Sales Tax Exemption Certificate (Form DR-0563): Similar in purpose to the Texas Resale Certificate, it allows Colorado businesses to purchase goods without paying sales tax if the goods are for resale. Both certificates ensure compliance with tax laws while preventing double taxation.

Missouri Sales and Use Tax Exemption Certificate: This certificate is comparable to the Texas Resale Certificate as it is used by retailers to buy items without paying sales tax when those items are intended for resale. Each form plays a critical role in the supply chain, confirming the buyer's intent and business nature.

Washington State Reseller Permit: Issued by the state's Department of Revenue, this permit serves the same purpose as the Texas Resale Certificate, providing tax-exempt status for purchases meant for resale. Both are crucial for businesses to operate efficiently without unnecessary tax burdens.

Arizona 5000A Resale Certificate: This document allows Arizona businesses to buy goods tax-free if they are intended for resale, leasing, or rental. It parallels the Texas Resale Certificate in its aim to certify tax-exempt purchases for business purposes, ensuring the collection of sales tax at the final sale to the consumer.

Dos and Don'ts

When filling out the Texas Resale Certificate 01 339 form, adherence to specific guidelines ensures the process is completed correctly. Below are essential do's and don'ts to follow:

Do:- Provide accurate information regarding the purchaser's name, address, phone number, and (if applicable) the Texas Sales and Use Tax Permit Number or out-of-state retailer's registration number.

- Clearly describe the items to be purchased for resale in the designated section to avoid any ambiguity.

- Include a detailed description of the type of business activity you're engaged in or the type of items you normally sell.

- Ensure that the certificate is signed, dated, and includes the title of the individual completing the form.

- Keep a copy of the completed certificate for your records.

- Send the completed certificate to the Comptroller of Public Accounts; it should only be furnished to the supplier.

- Use this certificate for the purchase of items that you know will be used rather than sold, leased, or rented, as this is against the law.

- Leave essential fields, such as the sales tax permit number or description of items to be purchased, incomplete.

- Forget that misuse of this certificate, such as purchasing items for personal use under the guise of resale, can result in criminal charges ranging from a misdemeanor to a felony, depending on the amount of tax evaded.

Misconceptions

When dealing with the Texas Resale Certificate, Form 01-339, there are several common misconceptions that can lead to confusion for both sellers and purchasers. Here’s a list of these misconceptions cleared up for better understanding:

- All businesses can use the resale certificate. Only businesses with a valid Texas Sales and Use Tax Permit or similar legal documentation for non-Texas-based businesses can legally use this certificate.

- It can be used for personal purchases. The certificate strictly applies to items purchased for resale, lease, or rental within the United States or Mexico. Any personal use disqualifies the transaction from being tax-exempt under this certificate.

- Any item can be purchased tax-free with this certificate. Only items that the purchaser intends to resell, lease, or rent in their normal business operations qualify. Items meant for use by the business do not qualify.

- Out-of-state purchases are not eligible. Out-of-state retailers can use this certificate if they have a registration number or Federal Taxpayers Registry number for retailers based in Mexico, along with the required Mexico registration form.

- Only tangible personal property is covered. While primarily used for tangible personal property, certain taxable services purchased for resale also qualify under this certificate.

- The form is a one-time requirement. Sellers should ensure they have a current form on file for each buyer claiming resale exemption. Periodic updates or verifications may be necessary.

- Submitting the form to the Texas Comptroller's office is mandatory. This certificate should be furnished to the supplier, not sent to the Comptroller of Public Accounts.

- There’s no penalty for misuse. Misuse of this certificate, such as purchasing items for personal use, can result in criminal charges ranging from a Class C misdemeanor to a felony of the second degree, depending on the amount of tax evaded.

- Digital signatures are not allowed. While the form does not specify, digital signatures are commonly accepted for business transactions, including this certificate, in keeping with the trend towards digital documentation.

- It allows for indefinite use of items without tax. If the purchaser uses the items in any way other than for retention, demonstration, or display while holding them for sale, lease, or rental, they are obliged to pay sales tax on the items at the time of use.

Understanding these facts about the Texas Resale Certificate, Form 01-339, is crucial for businesses engaging in resale activities to ensure compliance and to effectively manage tax liabilities.

Key takeaways

Completing and using the Texas Resale Certificate Form 01-339 is essential for businesses engaging in tax-exempt transactions for resale purposes. The following points provide a concise overview of the key takeaways associated with this document:

- Identification and Claim: The form requires the purchaser to provide clear identification, including name, address, and the Texas Sales and Use Tax Permit Number or the applicable identification number for out-of-state and Mexican retailers. By completing this form, the purchaser is claiming the right to purchase items tax-free for the purpose of resale.

- Specificity of Items: It is mandatory to describe in detail the items to be purchased tax-free. The description can include a wide range of goods, as long as the intent is to resell these items within the permissible geographical limits.

- Type of Business Activity: The purchaser must outline the nature of their business activity or the types of items they normally sell. This information helps in validating the legitimacy of the tax-exempt purchase for resale.

- Geographical Limits: The resale certificate covers items that will be resold within the United States of America, its territories, and possessions, or within the United Mexican States. Items must be sold in their present form or as a part of other taxable items.

- Proper Use and Tax Liability: The form clearly states the purchaser's responsibility to use the items solely for resale, lease, or rental purposes. Any personal use of the items, outside of retention, demonstration, or display while holding them for sale, subjects the purchaser to the payment of sales tax based on the purchase price or fair market rental value.

- Legal Ramifications: Giving a resale certificate for items known at the time of purchase to be for personal use rather than for resale constitutes a criminal offense. This can range from a Class C misdemeanor to a felony of the second degree, depending on the amount of tax evaded. Thus, honesty and integrity in using this certificate are paramount.

It is crucial for purchasers to adhere to the guidelines outlined in the Texas Resale Certificate Form 01-339 to ensure compliance with tax laws and to avoid legal penalties. This certificate serves as a vital tool for businesses in managing tax-exempt purchases aimed at resale, and its proper use supports the integrity of tax collection efforts in Texas.

Popular PDF Forms

Split Sheet - Facilitates a smoother song registration process with performance rights organizations by clearly stating ownership percentages.

Pssq Navy - Designed to assess your qualifications for positions requiring security clearance through detailed personal and professional questions.