Blank Texas Sos Payment 807 PDF Template

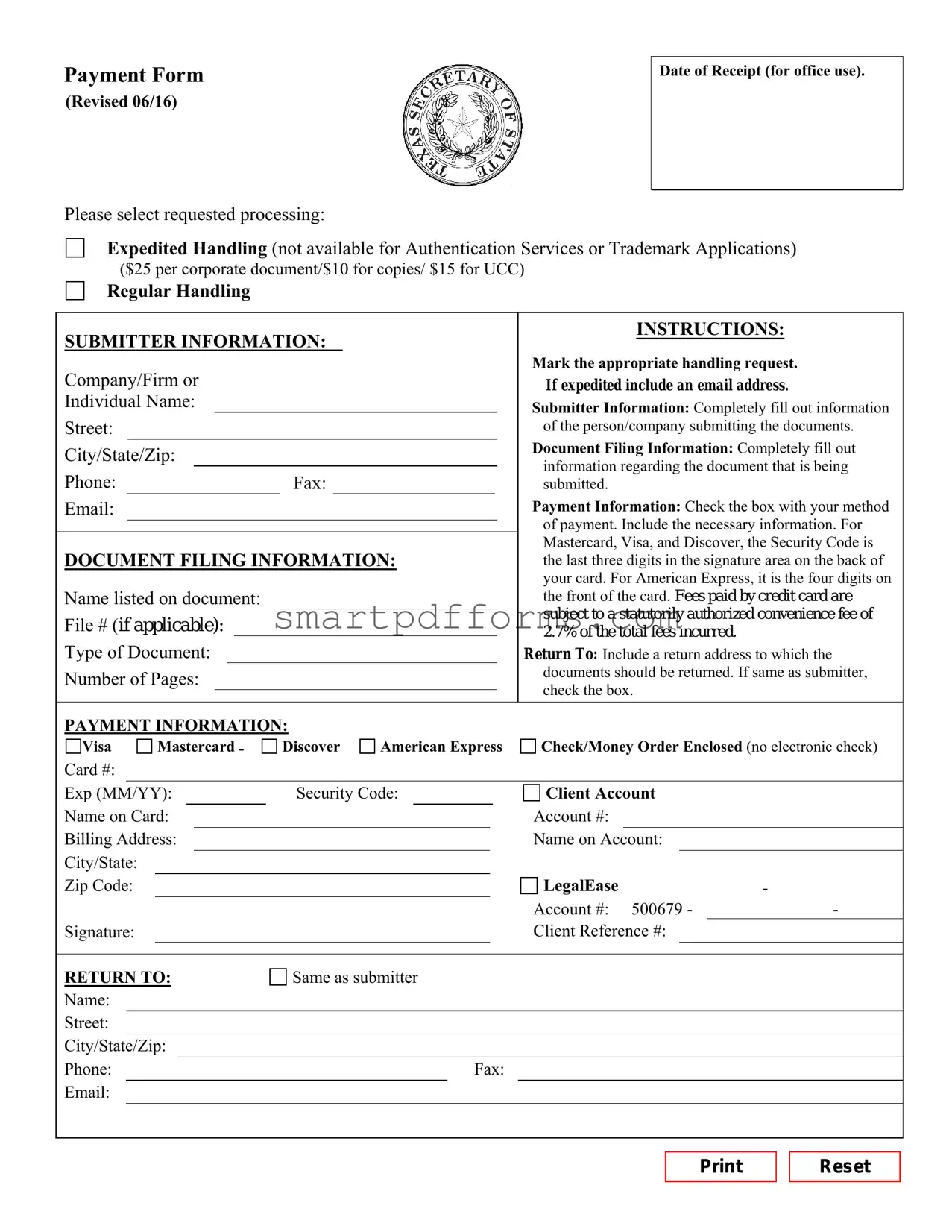

In the complex landscape of legal and corporate document handling, understanding the nuances of specific forms becomes crucial, especially within the Texas legal system. The Texas Secretary of State Payment Form 807, revised in June 2016, stands as a critical component for those looking to navigate through the submission process efficiently. This form caters to a broad spectrum of services, notably excluding Authentication Services or Trademark Applications, and offers options for expedited or regular handling, tailoring to the urgency of each request. The expedited service, coming with an additional cost, underscores the form's adaptability to meet varying deadlines and requirements. Highlighted within the form is a meticulous breakdown of submitter information—demanding comprehensive details about the company or individual initiating the document filing. Moreover, it lays out specific sections dedicated to document filing particulars and payment information, inclusive of a detailed payment method section, which underscores the form's aim to streamline the processing of documents. Notably, it embraces modern payment methods while attaching a convenience fee for credit card payments, reflecting an understanding of contemporary business transactions. Lastly, the form's design, with a clear section for the return address, ensures that the processed documents are directed appropriately, wrapping up the filing process with an eye towards efficiency and client convenience.

Preview - Texas Sos Payment 807 Form

Payment Form

(Revised 06/16)

Please select requested processing:

Date of Receipt (for office use).

Expedited Handling (not available for Authentication Services or Trademark Applications)

($25 per corporate document/$10 for copies/ $15 for UCC)

Regular Handling

|

SUBMITTER INFORMATION: |

|

|

|

|

|

|

|

|

INSTRUCTIONS: |

||||||||||||||

|

|

|

|

|

|

|

|

Mark the appropriate handling request. |

||||||||||||||||

|

Company/Firm or |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

If expedited include an email address. |

||||||||||||

|

Individual Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Submitter Information: Completely fill out information |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Street: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of the person/company submitting the documents. |

|||

|

City/State/Zip: |

|

|

|

|

|

|

|

|

|

|

|

Document Filing Information: Completely fill out |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

information regarding the document that is being |

||||||||||||

|

Phone: |

|

|

|

|

|

|

|

|

|

|

Fax: |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

submitted. |

|

||||||

|

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Information: Check the box with your method |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of payment. Include the necessary information. For |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

DOCUMENT FILING INFORMATION: |

Mastercard, Visa, and Discover, the Security Code is |

||||||||||||||||||||||

|

the last three digits in the signature area on the back of |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

your card. For American Express, it is the four digits on |

|||

|

Name listed on document: |

|

|

|

|

|

|

|

|

|

the front of the card. Fees paid by credit card are |

|||||||||||||

|

File # (if applicable): |

|

|

|

|

|

|

|

|

|

|

|

|

subject to a statutorily authorized convenience fee of |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

2.7% of the total fees incurred. |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Type of Document: |

|

|

|

|

|

|

|

|

|

|

|

|

Return To: Include a return address to which the |

||||||||||

|

Number of Pages: |

|

|

|

|

|

|

|

|

|

|

|

documents should be returned. If same as submitter, |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

check the box. |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

PAYMENT INFORMATION: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Visa |

Mastercard |

- |

|

Discover |

American Express |

Check/Money Order Enclosed (no electronic check) |

|||||||||||||||||

|

Card #: |

|

- |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Exp (MM/YY): |

|

|

|

Security Code: |

|

|

Client Account |

|

|||||||||||||||

|

Name on Card: |

|

|

|

|

|

|

|

|

|

|

|

|

Account #: |

|

|

||||||||

|

Billing Address: |

|

|

|

|

|

|

|

|

|

|

|

Name on Account: |

|

||||||||||

|

City/State: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zip Code: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LegalEase |

- |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account #: 500679 - |

|

- |

|

|

Signature: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Client Reference #: |

|

|||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

RETURN TO: |

|

|

Same as submitter |

|

|

|

|

||||||||||||||||

|

Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City/State/Zip: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Phone: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax: |

|

|

|

|

||||

|

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reset

Form Data

| Fact Name | Detail |

|---|---|

| Processing Options | There are two processing options: Expedited Handling and Regular Handling. Expedited Handling incurs additional fees of $25 per corporate document, $10 for copies, and $15 for UCC, but is not available for Authentication Services or Trademark Applications. |

| Submitter Information Requirement | The form requires detailed submitter information including the name of the company/firm or individual, street address, city/state/zip, phone, fax, and email. |

| Document Filing Information | Complete information about the document being submitted is needed. This includes the name listed on the document, file number (if applicable), type of document, and the number of pages. |

| Payment Methods | Payment can be made using Visa, MasterCard, Discover, American Express, or by check/money order. Credit card payments are subject to a 2.7% convenience fee. |

| Return Address Information | A return address must be provided for where the documents should be returned. If the return address is the same as the submitter's address, a specific box can be checked to indicate this. |

| Governing Law | The Texas SOS Payment 807 form is governed by the laws and regulations of the State of Texas, specifically relating to the processing fees and procedures for filing documents with the Texas Secretary of State's office. |

Instructions on Utilizing Texas Sos Payment 807

When submitting documents to the Texas Secretary of State, ensuring proper completion of the Texas Sos Payment 807 form is crucial. This form, integral for processing fees associated with your documents, requires careful attention to detail. Below are clear, stepwise instructions designed to guide users through each section of the form, ensuring a seamless submission process for your filings.

- Handling Request: At the top of the form, make a selection between "Expedited Handling" and "Regular Handling". Remember, expedited handling incurs an additional charge and is not available for Authentication Services or Trademark Applications.

- Submitter Information: In this section, input the name of the company, firm, or individual submitting the documents. Include a complete address (street, city, state, zip) and contact information (phone, fax). If expedited processing is requested, provide an email address.

- Document Filing Information: Here, detail the document being submitted. Include the name as it appears on the document, the file number if applicable, the type of document, and the total number of pages.

- Payment Information: Select your method of payment by checking the appropriate box: Visa, Mastercard, Discover, American Express, or Check/Money Order (note that electronic checks are not accepted). For credit card payments, provide the card number, expiration date (MM/YY), and the security code. Add the name on the card, account number (if using LegalEase), and billing address. Remember, credit card payments will include a 2.7% convenience fee on the total fees incurred.

- Return To Information: Specify the return address for the processed documents. If it is the same as the submitter's information, simply check the "Same as submitter" box. If different, provide the name, address, phone, fax, and email where the documents should be returned.

- Ensure all provided information is accurate before signing the form at the indicated section to verify the submission.

After the Texas Sos Payment 807 form is filled out, review the entire form to ensure all information is accurate and complete. Submitting this form correctly is essential for prompt and accurate processing of your document filings. Make sure to keep a copy for your records before sending the original to the Texas Secretary of State's office.

Obtain Answers on Texas Sos Payment 807

What is the Texas SoS Payment 807 form used for?

The Texas SoS Payment 807 form is designed for submitting payment for various services offered by the Texas Secretary of State. It is used when processing documents such as corporate filings, trademark applications, or requests for copies or certifications of documents. The form allows you to choose between regular and expedited handling, providing a way to pay for these services either by credit card or check/money order.

Can I use the Texas SoS Payment 807 form for all types of document filings?

No, the Texas SoS Payment 807 form cannot be used for all types of document filings. Specifically, the form points out that expedited handling is not available for Authentication Services or Trademark Applications. It is essential to assess the type of document you are filing to determine if this form applies to your needs.

What payment methods are accepted with the Texas SoS Payment 807 form?

Accepted payment methods include Visa, Mastercard, Discover, and American Express credit cards, as well as checks or money orders. Electronic checks are not accepted. Note that payments made by credit card are subject to a convenience fee of 2.7% of the total fees incurred.

How do I indicate if I want expedited handling for my document?

To request expedited handling for your document, you must select the expedited handling option on the form and include an email address for communications. Remember, expedited handling incurs additional fees ($25 per corporate document/$10 for copies/ $15 for UCC) and is not available for certain services.

What information is required in the Submitter Information section?

In the Submitter Information section, you must provide complete details regarding the individual or company submitting the documents. This includes the name, street address, city/state/zip, phone number, fax number, and email. Providing accurate and complete information ensures that any communications or returns can be efficiently directed to the submitter.

Is it necessary to include the Security Code for credit card payments?

Yes, when making a payment by credit card, it is necessary to include the Security Code. This code can be found on the back of your Mastercard, Visa, and Discover card (last three digits) and on the front of your American Express card (four digits). The Security Code helps verify the physical presence of the card during the transaction, providing an additional layer of security against fraud.

What information should be included under Document Filing Information?

Under Document Filing Information, you are required to provide details about the document being submitted. This includes the name listed on the document, the file number (if applicable), the type of document, the number of pages, and information on where the document should be returned. If the return address is the same as the submitter's, this should be indicated on the form.

Can I specify a different address for the return of documents?

Yes, you have the option to specify a different address for the return of documents. If the return address is different from the submitter’s address, you must provide the name, street, city/state/zip, phone, fax, and email for the return destination. Ensure to fill this section out completely if you require the documents to be sent to an alternate location.

Common mistakes

When filling out the Texas SOS Payment Form 807, attention to detail is crucial. Many people, unfortunately, miss the mark by making simple yet significant mistakes. Understanding these common errors can help ensure your form is processed smoothly and without delay.

- Not selecting the requested processing type: The form requires you to choose either expedited or regular handling. Missing this selection can cause delays.

- Omitting the email address when expedited processing is requested: Expedited processing requires an email address for communication. Failing to provide one can lead to processing issues.

- Incomplete submitter information: Submitting incomplete information about the person or company responsible for the submission can lead to unnecessary delays or complications.

- Leaving document filing information blank or incomplete: Properly detailing the document being submitted, including file number if applicable, ensures accurate processing.

- Incorrect payment information: Ensure the credit card details, including the security code, are accurate. Incorrect details will result in payment processing errors.

- Forgetting to include the convenience fee: Payments made by credit card are subject to a convenience fee. Not including this in your total payment can cause shortfalls and processing hiccups.

- Not specifying a return address: Failing to specify where the documents should be returned, or assuming it will automatically be sent to the submitter without indicating so, can lead to documents being misplaced.

- Signature omission: Skipping the signature at the bottom of the form is a common mistake that renders the submission invalid. Always remember to sign the form before submitting.

To avoid these common mistakes, it's essential to review the Texas SOS Payment Form 807 carefully before submission. A diligent and meticulous approach will ensure a smooth process for your document handling needs.

Documents used along the form

When filing the Texas SOS Payment Form 807, it's often not the only document you'll need to submit to the Texas Secretary of State. This form facilitates the payment process for a variety of services, such as business filings or requests for copies of documents. However, depending on the specific transaction or service you're engaging in, you might find yourself needing additional forms or documents to complete your submission effectively. Here is a brief overview of other forms and documents frequently used in conjunction with the Texas SOS Payment Form 807.

- Certificate of Formation: This is for businesses establishing themselves in Texas. It outlines basic information about the business, such as its name, purpose, organizational structure, and the initial registered agent and office.

- Name Reservation or Registration: Before forming your business, you might want to reserve or register your business name to ensure it's available and meets Texas naming requirements.

- Articles of Amendment: If there are any changes to the original information filed with the state, such as changes to the business name, address, or management, this document is necessary to update your records officially.

- Articles of Dissolution: When a business decides to terminate its existence, this document formally dissolves it under Texas law.

- Annual Reports: Most businesses are required to file periodic reports with the Secretary of State’s office, providing updated information about the business activities and financial status.

- DBA (Doing Business As) Forms: If your business operates under a trade name different from its legal name, you’ll need to file a DBA form to officially register that name.

- Registered Agent Change Form: This form is used to update the registered agent information. A registered agent is responsible for receiving legal documents on behalf of the company.

Each of these documents serves a different purpose, catering to various aspects of business operation and compliance. When submitting any form to the Texas Secretary of State, including the Payment Form 807, it's essential to ensure that all accompanying paperwork is correctly filled out and submitted together to avoid processing delays. This helps to streamline the process, making it smoother and more efficient for both the submitter and the state.

Similar forms

The Texas SOS Payment 807 form, a vital document for processing various transactions with the Texas Secretary of State's office, shares similarities with a range of other forms used in both business and legal settings. Here's a look at seven such documents:

- IRS Form 1040: The U.S. Individual Income Tax Return form, like the Payment 807, requires detailed personal information, including financial details, to process accurately. Both forms include sections for personal data, filing status, and payment information.

- Uniform Commercial Code (UCC) Financing Statement: This form, used to declare a security interest in a transaction, is similar to the 807 regarding its necessity for precise document filing information and the option for expedited handling, reflecting the importance of timely processing in financial transactions.

- Trademark Application Form: Though the Texas SOS Payment 807 explicitly states that expedited handling is not available for trademark applications, both this form and trademark applications require detailed submitter information, document specifics, and careful indication of handling choices.

- Business Entity Formation Forms: Forms used to establish business entities, such as LLCs or corporations, also require the submission of detailed information about the entity, similar to the document filing and submitter information sections found in the 807 form.

- Driver's License Renewal Forms: State-issued forms for renewing a driver's license share similarities with the Payment 807 form in their collection of personal data, payment information, and sometimes the option for expedited processing, demonstrating the wide applicability of such structured data collection in governmental documents.

- Bank Loan Application Forms: Like the 807 form, loan applications are comprehensive, demanding thorough personal and financial information, details about the purpose of the loan (similar to the "Type of Document" section on the 807 form), and often a choice between standard and expedited processing.

- Passport Application Form: Required for international travel, the passport application form collects detailed personal information, payment details, and contains sections that resemble the 807's instructions for expedited processing, with both emphasizing the importance of accurate and complete submissions for timely processing.

Each of these documents caters to specific administrative or legal processes. While their contexts vary greatly – from tax filings and securing a loan to establishing a business entity or traveling internationally – the structural and procedural similarities they share with the Texas SOS Payment 807 form highlight a universal approach to collecting and processing essential information across diverse fields.

Dos and Don'ts

When filling out the Texas SOS Payment 807 form, it's essential to follow specific guidelines to ensure the process goes smoothly. Here are some dos and don'ts:

Do:

- Make sure to select the correct processing request (Expedited Handling or Regular Handling) based on your needs.

- Completely fill out the Submitter Information section with accurate details of the person or company submitting the documents.

- Provide complete and accurate Document Filing Information, including the name listed on the document, file number if applicable, type of document, and number of pages.

- Check the appropriate payment method under the Payment Information section and include all the required details, such as card number, expiration date, security code, and the name on the card.

Don't:

- Leave any field blank. Incomplete forms may lead to processing delays or the rejection of your form.

- Forget to include your email address if you're requesting expedited handling. This detail is crucial for expedited processing times.

- Ignore the convenience fee associated with credit card payments. Remember, fees paid by credit card will incur a convenience fee of 2.7% of the total fees.

- Fail to check the return address. It's essential to ensure the return address is correct so that the processed documents reach the right place. If it's the same as the submitter's address, mark the appropriate box to avoid any confusion.

Misconceptions

When dealing with the Texas Secretary of State Payment Form 807, it's easy to fall prey to misunderstandings. Let's clear up some common misconceptions about this specific form:

- Expedited handling is available for all services. This is not true. The form clearly states that expedited handling is not available for Authentication Services or Trademark Applications. It's important to note which services can be expedited to set realistic expectations.

- Many believe that email addresses are optional for expedited services, but the form requires an email address if you select expedited handling. This is crucial for receiving timely updates about your submission.

- There's a misconception that you can pay with an electronic check. However, the form specifies that payments can be made via Visa, Mastercard, Discover, American Express, or by including a check/money order, clearly excluding electronic checks.

- Some think the security code for credit card payments isn't necessary. Yet, for the processing of payments, the form requires the card’s security code, emphasizing the importance of this detail for security purposes.

- A common misunderstanding is that there's no extra fee for credit card payments. In reality, fees paid by credit card are subject to a 2.7% convenience fee, which can affect the total cost of the services requested.

- Any document can be submitted with this form, but it is specifically designed for corporate documents, copies, and UCC filings, as indicated by the expedited handling section. Understanding the form’s intended use helps avoid submission errors.

- Lastly, there's the belief that you can leave the payment information section incomplete if you have LegalEase or an account. The form still requires comprehensive payment information, even when utilizing an account, to ensure proper processing of the fees.

Understanding these nuances will make the submission process smoother and more efficient, ensuring that your documents are processed correctly and in a timely manner.

Key takeaways

When dealing with the Texas Secretary of State Payment Form 807, understanding the key aspects can make the process smoother and more efficient. Here are some vital takeaways to remember:

- Choice of processing time: You have the option to select between regular handling or expedited handling for your document processing. Note that expedited handling incurs additional fees ($25 per corporate document/$10 for copies/$15 for UCC) and is not available for Authentication Services or Trademark Applications.

- Submitter information is crucial: It is important to provide complete and accurate information about the individual or company submitting the document. This includes name, address, phone number, fax, and email address. Providing an email address is essential, especially if expedited processing is requested.

- Document details need to be clear: Ensure all information related to the document being filed – such as the name on the document, file number (if applicable), type of document, and number of pages – is thoroughly filled out. This ensures your document can be processed without unnecessary delays.

- Payment information must be precise: When choosing to pay by credit card (Visa, Mastercard, Discover, American Express), make sure to include the card number, expiration date, and security code correctly. Remember, payments made by credit card are subject to a 2.7% convenience fee. Checks and money orders are also accepted but no electronic checks.

- Return instructions: Indicate clearly where the processed documents should be returned. If the return address is the same as the submitter’s, simply mark the provided box. Providing accurate return instructions is essential to ensure the timely receipt of your processed documents.

By keeping these points in mind, you can ensure a smooth and successful submission of documents to the Texas Secretary of State's Office using the Payment Form 807.

Popular PDF Forms

Advanced Care Planning - Personal wishes regarding the withdrawal or withholding of treatment can be documented.

How to Fill Out Ohio Employee Withholding Exemption Certificate - The form requires purchasers to include detailed business information, promoting transparency in tax-exempt transactions.