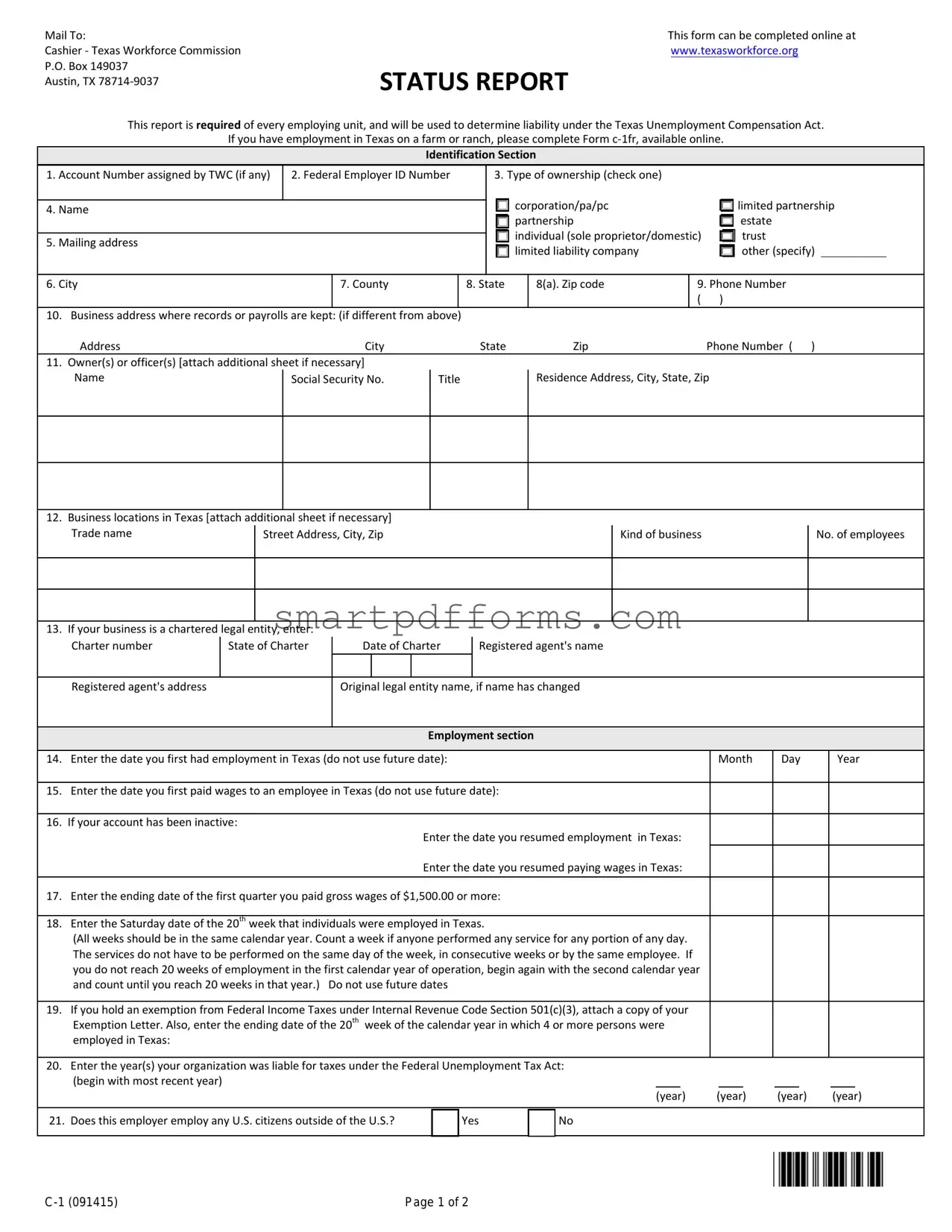

Blank Texas Workforce Commission Report PDF Template

In the state of Texas, every employing unit that has employees is required to complete the Texas Workforce Commission Report Form, a crucial document for establishing liability under the Texas Unemployment Compensation Act. This comprehensive form, which can be filled out online at the official website, covers a broad range of information designed to provide the Texas Workforce Commission (TWC) with a detailed overview of an employer's operations. It includes sections for identification where employers must provide their account number, if they have one, the type of ownership, and detailed contact information. Moreover, it requires information on the business’s charter if applicable, employment details including the dates employment began, wages were first paid, and if the business has ever been inactive, employment dates upon resumption. Notably, for employers of domestic or household employees, specific sections apply to them as well. The form also delves into the nature of the business activity in Texas, key for understanding the business's contributions to the local economy, and information on any business acquisition that might have occurred. Moreover, employers have the option to elect to pay state unemployment taxes voluntarily, with conditions detailed within the form. Finally, a signature section confirms the authenticity of the information provided, making it a pivotal document for both new and existing businesses in Texas to ensure compliance and proper contribution to state unemployment insurance funds. This ensures a structured process for employers to follow, facilitating a smoother engagement with state employment regulations.

Preview - Texas Workforce Commission Report Form

Mail To:

Cashier - Texas Workforce Commission

P.O. Box 149037

Austin, TX

This form can be completed online at

www.texasworkforce.org

STATUS REPORT

This report is required of every employing unit, and will be used to determine liability under the Texas Unemployment Compensation Act.

If you have employment in Texas on a farm or ranch, please complete Form

Identification Section

1. Account Number assigned by TWC (if any) |

2. Federal Employer ID Number |

|

|

3. Type of ownership (check one) |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

corporation/pa/pc |

|

limited partnership |

|||||

4. Name |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

partnership |

|

estate |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

individual (sole proprietor/domestic) |

trust |

||||||

5. Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

limited liability company |

|

other (specify) |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

6. City |

|

|

|

7. County |

|

|

8. State |

|

8(a). Zip code |

9. Phone Number |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

10. |

Business address where records or payrolls are kept: |

(if different from above) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Address |

|

|

|

City |

|

|

|

State |

|

Zip |

|

Phone Number ( ) |

|||||||

11. |

Owner(s) or officer(s) [attach additional sheet if necessary] |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Name |

|

|

Social Security No. |

Title |

|

|

|

|

Residence Address, City, State, Zip |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Business locations in Texas [attach additional |

sheet if necessary] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Trade name |

|

Street Address, City, Zip |

|

|

|

|

|

|

|

Kind of business |

|

No. of employees |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

If your business is a chartered legal |

entity, enter: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Charter number |

State of Charter |

Date of Charter |

|

Registered agent's name |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Registered agent's address |

|

|

|

Original legal entity name, if name has changed |

|

|

|

|

|

||||||||||

Employment section

14. |

Enter the date you first had employment in Texas (do not use future date): |

|

|

|

|

Month |

Day |

Year |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

Enter the date you first paid wages to an employee in Texas (do not use future date): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

If your account has been inactive: |

Enter the date you resumed employment in Texas: |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||

|

|

Enter the date you resumed paying wages in Texas: |

|

|

|

|

|

|

|

|||

17. |

Enter the ending date of the first quarter you paid gross wages of $1,500.00 or more: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

Enter the Saturday date of the 20th week that individuals were employed in Texas. |

|

|

|

|

|

|

|

|

|

|

|

|

(All weeks should be in the same calendar year. Count a week if anyone performed any service for any portion of any day. |

|

|

|

|

|

|

|

||||

|

The services do not have to be performed on the same day of the week, in consecutive weeks or by the same employee. If |

|

|

|

|

|

|

|

||||

|

you do not reach 20 weeks of employment in the first calendar year of operation, begin again with the second calendar year |

|

|

|

|

|

|

|

||||

|

and count until you reach 20 weeks in that year.) Do not use future dates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

19. |

If you hold an exemption from Federal Income Taxes under Internal Revenue Code Section 501(c)(3), attach a copy of your |

|

|

|

|

|

|

|

||||

|

Exemption Letter. Also, enter the ending date of the 20th week of the calendar year in which 4 or more persons were |

|

|

|

|

|

|

|

||||

|

employed in Texas: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

20. |

Enter the year(s) your organization was liable for taxes under the Federal Unemployment Tax Act: |

|

|

|

|

|

|

|

||||

|

(begin with most recent year) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(year) |

(year) |

(year) |

(year) |

|||||

|

|

|

|

|

|

|

|

|

|

|||

21. Does this employer employ any U.S. citizens outside of the U.S.? |

Yes |

No |

|

|

|

|

|

|

|

|||

Page 1 of 2 |

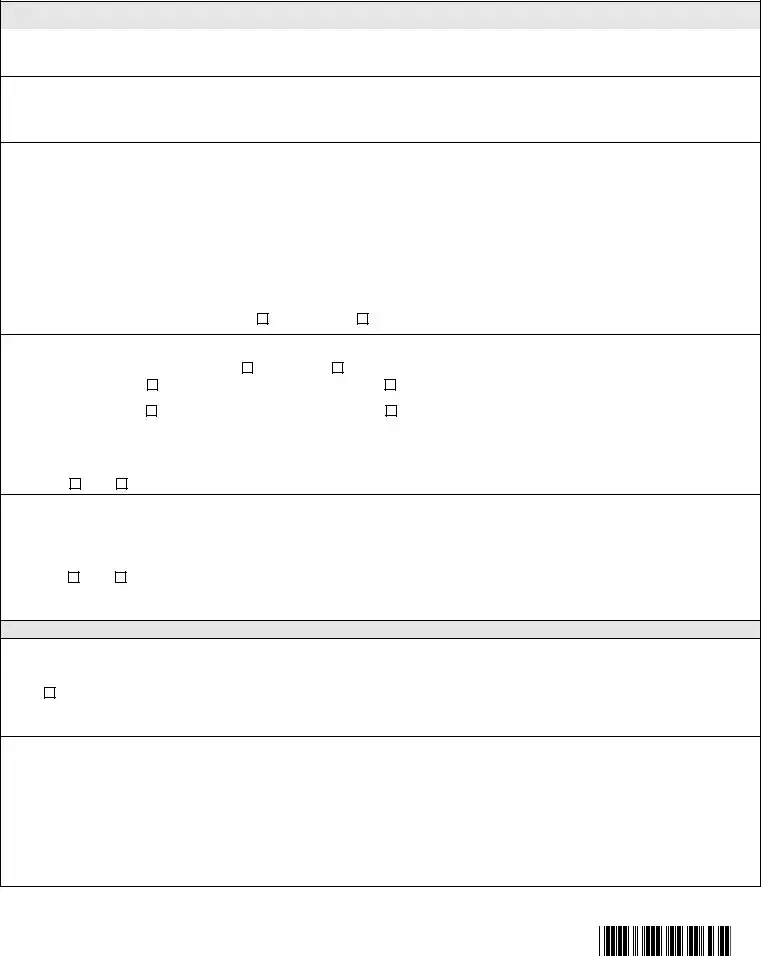

Domestic - Household Employment Section

Complete 22 only if you have domestic or household employees (includes maids, cooks, chauffeurs, gardeners, etc.)

22. Enter the ending date of the first calendar quarter in which you paid gross wages of $1,000 or more to employees |

Month |

Day |

Year |

performing domestic service: |

|

|

|

Nature of Activity Section |

|

|

|

|

|

|

|

23.Describe fully the nature of activity in Texas, and list the principal products or services in order of importance:

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

24.If the business in Texas was acquired from another legal entity, you must complete items

a) |

Previous owner’s TWC Account Number (if known) |

______________________________________________________________________________ |

|||

b) |

Date of acquisition |

_________________________________________________________________________________________________________ |

|||

c) |

Name of previous owner(s) |

_________________________________________________________________________________________________ |

|||

d) |

Address |

________________________________________________________________________________________________________________ |

|||

e) City |

_______________________ |

What portion of business was acquired? (check one)

State |

__________________________ |

Zip |

_________________________________ |

||

all |

part (specify) |

|

|

|

|

25.On the date of the acquisition, was the previous owner(s), or any partner(s), officer(s), shareholder(s), other owner(s) or a person related by blood or marriage to any of these individuals, holding a legal or equitable interest in the predecessor business, also an owner, partner, officer, shareholder, or other owner of a legal or

equitable interest in the successor business? |

Yes |

No |

If “Yes”, check all that apply:

same owner, officer, partner, or shareholder

sole proprietor incorporating

same parent company

other (describe below)

_________________________________________________

If “No,” on the date of the acquisition, did the previous owner(s), partner(s), officer(s), shareholder(s), other owner(s) or a person related by blood or marriage to any of these individuals, holding a legal or equitable interest in the predecessor business, hold an option to purchase such an interest in the successor business?

yes

no

26.After the acquisition, did the predecessor continue to:

•Own or manage the organization that conducts the organization, trade or business?

•Own or manage the assets necessary to conduct the organization, trade or business?

•Control through security or lease arrangement the assets necessary to conduct the organization, trade or business?

•Direct the internal affairs or conduct of the organization, trade or business?

Yes

No

If “Yes” to any of above, describe: |

_____________________________________________________________________________________________ |

Voluntary Election Section

27.A

Yes, effective Jan. 1, |

|

|

I wish to cover all employees (except those performing service(s) which are specifically exempt in the Texas Unemployment |

Compensation Act). |

|

||

|

|

|

|

|

|

|

Signature Section |

|

|

|

|

I hereby certify that the preceding information is true and correct, and that I am authorized to execute this Status Report on behalf of the employing unit named herein. (this report must be signed by the owner, officer, partner or individual with a valid Written Authorization on file with the Texas Workforce Commission)

Date of signature:

Month ___ Day |

___ Year ___ |

Sign here ________________________________________ |

Title |

_______________ |

|||||

|

|

||||||||

|

|

|

|

|

|

|

|

||

Driver's license number |

__________________ State |

__________ |

______________________________________________ |

||||||

|

|

|

|

|

|

|

|

|

|

Individuals may receive, review and correct information that TWC collects about the individual by emailing to open.records@twc.state.tx.us or writing to: TWC Open

Records, 101 E. 15th St., Rm. 266, Austin, TX

Page 2 of 2 |

Form Data

| Fact Name | Detail |

|---|---|

| Form Purpose | This report is required from every employing unit to determine liability under the Texas Unemployment Compensation Act. |

| Online Submission | The form can be completed online at the Texas Workforce Commission's website. |

| Special Form for Agricultural Employers | If employment is on a farm or ranch in Texas, Form C-1FR must be completed instead. |

| Employer Information Required | Employers must provide detailed information, including identification, type of ownership, business locations in Texas, and the nature of business activities. |

| Employment Section Details | Employers must enter specific dates related to employment and wage payments in Texas, including the first time wages were paid and the date marking $1,500.00 or more in gross wages for a quarter. |

| Exemption for Nonprofits | Nonprofit organizations exempt under IRS Section 501(c)(3) must attach their Exemption Letter. |

| Business Acquisition Information | If the business was acquired from another entity, detailed information about the acquisition and the previous owner is required. |

| Governing Law | The form is governed by the Texas Unemployment Compensation Act. |

Instructions on Utilizing Texas Workforce Commission Report

Filling out the Texas Workforce Commission Report form is an important step for every employing unit operating within Texas. This document helps determine the liability under the Texas Unemployment Compensation Act. Whether you’re starting a new venture or maintaining an existing business, accuracy and thoroughness are key. Follow these steps to ensure you complete the form correctly and comply with state requirements.

- Visit the website www.texasworkforce.org if you prefer to submit the form online.

- Account Number assigned by TWC: Enter the number if you have one.

- Federal Employer ID Number: Fill in your federal employer identification number.

- Type of ownership: Check the appropriate box that describes your business structure.

- Name: Provide the legal name of your business.

- For mailing address, include:

- Street or P.O. Box

- City

- County

- State

- Zip code

- Phone Number: Enter the phone number, including area code.

- If applicable, provide the business address where records or payrolls are kept, if different from the mailing address.

- For owner(s) or officer(s): Attach additional sheet if necessary. Include name, Social Security No., title, and residence address.

- Detail your business locations in Texas, including trade name, address, kind of business, and number of employees. Attach an additional sheet if necessary.

- If applicable, enter your chartered legal entity information, including charter number, state of charter, date of charter, registered agent's name and address, and original legal entity name if it has changed.

- For the Employment section, enter relevant dates pertaining to employment and wage payment in Texas. Do not use future dates.

- If you are exempt under Internal Revenue Code Section 501(c)(3), attach your Exemption Letter and provide the specified employment dates.

- Answer whether this employer employs any U.S. citizens outside of the U.S. with a simple Yes or No.

- If you have domestic or household employees, complete the appropriate section with the ending date of the first calendar quarter you paid gross wages of $1,000 or more.

- In the Nature of Activity Section, describe your business activities and list principal products or services.

- For businesses acquired from another legal entity, fill out the details regarding the previous owner and the nature of the acquisition in items 24-26.

- If electing to pay state unemployment tax voluntarily, complete the section with the effective date of January 1, indicating you wish to cover all employees.

- In the Signature Section, certify the information provided is true and correct. This must be signed by an authorized individual.

- Include date of signature, the signee's title, driver's license number, and state.

- Provide an email address for contact purposes.

After completing these steps, review the information to ensure accuracy before submitting the form to the Texas Workforce Commission. This careful preparation helps ensure compliance with state regulations, supporting the smooth operation of your business in Texas.

Obtain Answers on Texas Workforce Commission Report

What is the purpose of the Texas Workforce Commission (TWC) Status Report?

The Texas Workforce Commission Status Report is mandatory for every employer to determine liability under the Texas Unemployment Compensation Act. It collects detailed information about the business, including its type, ownership, number of employees, and payroll information, to assess if and how much the business should contribute to the state's unemployment compensation fund.

Can the TWC Status Report be completed online?

Yes, the TWC Status Report can be filled out and submitted online via the official TWC website at www.texasworkforce.org. This online submission method provides a convenient and efficient way for employers to comply with reporting requirements.

What specific information is required in the Identification Section of the report?

In the Identification Section, businesses must provide their TWC Account Number (if applicable), Federal Employer ID Number, type of ownership, business name, mailing and business addresses, contact information, and details about the owner(s) or officer(s) including names and social security numbers.

How does a business report employment and payroll details in the report?

The report requires details such as the date the employer first had employees in Texas, the date of first payroll, and specific payroll thresholds that were met, including the date the business paid over $1,500 in wages in a quarter and the date it employed individuals for a total of 20 weeks. These details help TWC determine the employer's liability for unemployment taxes.

What should an employer do if they acquire a business in Texas?

If a business is acquired, the new owner must complete specific sections of the report detailing the previous owner's TWC Account Number, acquisition date, and information about the previous owner. Additionally, it addresses whether the new business has any legal or equitable interest connections with the predecessor business.

Is there an option for voluntary election to pay state unemployment tax?

Yes, a non-liable employer, one not yet required to pay state unemployment taxes based on their current employment and payroll levels, may choose to pay these taxes voluntarily. This election requires the employer to commit to paying taxes for a minimum of two years, beginning January 1 of the first election year. Employers can withdraw this election by written request after the two-year period if they have not become liable under the act during that time.

How can individuals correct information on the TWC Status Report?

Individuals looking to review or correct information submitted in the TWC Status Report can do so by emailing open.records@twc.state.tx.us or writing to TWC Open Records, located at 101 E. 15th St., Rm. 266, Austin, TX 78778-0001. This ensures that the information TWC holds is accurate and up to date.

Common mistakes

Not including the account number assigned by the Texas Workforce Commission (TWC) if it has already been assigned. It's crucial for businesses that have one to include this information as it helps in identifying their account quickly.

Failing to check the appropriate type of ownership. The form allows for various ownership structures such as individual, corporation, partnership, and others. Selecting the correct type ensures that the TWC can accurately assess the business structure and its liabilities.

Incorrectly entering the Federal Employer ID Number (FEIN). This number is essential for the TWC to correctly identify the business with the federal government. Mistakes here can lead to processing delays or errors in the business's tax records.

Overlooking the completion of fields regarding business activity in Texas, such as the nature of activity and principal products or services. Detailed and accurate descriptions here help the TWC understand the scope and scale of the business, which is important for determining tax liabilities and benefits.

Omitting owner or officer information. The form requires details about owners or officers, including names and social security numbers. This information is vital for the TWC for identification and verification purposes.

When businesses accurately complete the Texas Workforce Commission Report form, it ensures their information is processed efficiently and correctly. Common mistakes range from omitting crucial information to inaccuracies in identifying numbers, all of which can delay processing and affect the business's compliance status.

Documents used along the form

When businesses in Texas engage with the Texas Workforce Commission (TWC) by completing the Status Report, they commonly find themselves dealing with various other forms and documents. These additional materials are pivotal for ensuring compliance and accurately conveying the business's operations and workforce details. Below are seven forms and documents frequently associated with the TWC Status Report, each serving its unique purpose in the realm of business administration and employment regulation.

- Form C-1FR: Specifically designed for farm and ranch employers in Texas, this form is required to ascertain liability for unemployment contributions under the Texas Unemployment Compensation Act. It addresses the unique nature of agricultural employment.

- Quarterly Wage Report (Employer's Quarterly Report): This document details the wages paid to employees each quarter. Employers must submit it to report wages and calculate unemployment insurance taxes due.

- Power of Attorney (POA) Form: Businesses may need to submit a POA form when authorizing an individual to represent their interests before the TWC, especially in matters of tax or legal representation.

- Change of Status Report: If there are significant changes to a business's operation, such as changes in ownership or address, this form must be completed to update the TWC records accordingly.

- UI Tax Registration: New employers or businesses establishing operations in Texas are required to register for Unemployment Insurance Tax, ensuring they are in compliance with state law regarding worker unemployment benefits.

- Request for Duplicate Tax Forms: Companies may occasionally need to request duplicates of tax documents from previous years for their records or compliance verification purposes.

- Appeal Form: In situations where an employer disagrees with a decision made by the TWC, particularly concerning tax liabilities or benefit claims, this form allows for the initiation of an appeal process.

Together, these forms and documents encompass the essential administrative tasks associated with employment in Texas. They facilitate clear communication between the Texas Workforce Commission and businesses, ensuring that employers accurately report and manage their workforce according to state laws and regulations. Staying informed and diligent in completing these tasks is paramount for businesses to remain in good standing and to foster a healthy economic environment in Texas.

Similar forms

The Internal Revenue Service (IRS) Form 941, also known as the Employer's Quarterly Federal Tax Return, is very similar in that it requires businesses to report wages paid, taxes withheld from employees' wages, and the employer's portion of Social Security or Medicare tax. Just like the Texas Workforce Commission Report, the IRS Form 941 plays a critical role in determining a business's tax liabilities and compliance status.

The U.S. Department of Labor's Form WH-347, used for reporting wages on federally funded construction projects under the Davis-Bacon and related Acts, mirrors the TWC report in terms of requiring detailed employee information, including wage rates. Both forms are used to ensure compliance with employment and labor standards.

The Employee's Withholding Allowance Certificate (W-4 Form) shares similarities with the TWC report, as it collects essential employee information for tax purposes. However, the W-4 is specifically focused on determining the amount of federal income tax to withhold from an employee's paycheck.

State Unemployment Insurance (SUI) Reports, which vary by state, have a similar function to the TWC report in that they require employers to report wages for the purpose of determining unemployment insurance tax rates. These forms ensure that the state has the necessary funding to provide unemployment benefits to eligible workers.

The Employment Eligibility Verification Form (I-9) also collects information on employees, such as their identity and eligibility to work in the United States. While serving a different regulatory requirement related to immigration and work authorization, it similarly requires employers to maintain records on individuals they hire.

The New Hire Reporting Form, required by state agencies to track employment for purposes such as enforcing child support orders, is comparable in its mandate for employers to report basic employee information shortly after the date of hire, much like the TWC report requires for tax and unemployment insurance purposes.

Dos and Don'ts

Filling out the Texas Workforce Commission (TWC) Report form accurately is crucial for ensuring your business complies with state regulations regarding employment. The information provided helps determine your liability under the Texas Unemployment Compensation Act. To aid in this process, here are four essential dos and don'ts to keep in mind:

Do:

- Review the form thoroughly before starting: Ensure you understand every section to provide accurate information. Mistakes or omissions could delay processing or result in incorrect liability determinations.

- Use the correct form for your employment type: For instance, if your employment in Texas includes working on a farm or ranch, complete Form c-1fr. Using the correct form ensures that the TWC can accurately assess your employment situation.

- Attach additional sheets if necessary: The form allows for attachment of additional sheets for sections where space may be insufficient, such as listing business locations in Texas or owners and officers. This ensures you can provide comprehensive information without compromise.

- Attach a copy of your Exemption Letter if applicable: If your organization holds an exemption from Federal Income Taxes under Internal Revenue Code Section 501(c)(3), attaching your Exemption Letter is crucial for accurate tax liability assessment.

Don't:

- Use future dates for employment history: When entering dates you first had employment or paid wages in Texas, make sure to use actual past dates. Speculating or using future dates can lead to inaccuracies in your liability assessment.

- Overlook the signature section: The form must be signed by an individual authorized to execute this report on behalf of the employing unit. Failing to sign or providing an unauthorized signature could invalidate the submission.

- Forget to indicate if you employ U.S. citizens outside of the U.S.: This information is crucial for the TWC to understand the full scope of your employment practices and must be answered accurately.

- Ignore instructions for specific sections based on your business transactions: If your business in Texas was acquired from another legal entity or if you have domestic or household employees, special instructions apply. Paying close attention to these details ensures the TWC receives all necessary information for your situation.

Misconceptions

The Texas Workforce Commission (TWC) report form is a critical document for employers in Texas, instrumental in determining liability under the Texas Unemployment Compensation Act. Despite its importance, there are several misconceptions surrounding this form. Understanding these misconceptions can help employers accurately complete the form and comply with state regulations.

- Misconception 1: The form is only for large businesses. This form is required for every employing unit that operates in Texas, regardless of size. Whether you are a sole proprietor or part of a large corporation, this report is mandatory if you have employees in Texas.

- Misconception 2: It's optional to report farm or ranch employment. Specific forms exist for agricultural operations, such as Form C-1FR. Employers in these sectors must report their employment, using the appropriate form designed to meet their unique reporting needs.

- Misconception 3: Only businesses with a physical presence in Texas need to complete it. If your business employs individuals in Texas, you are required to fill out the form, regardless of where your business is physically located.

- Misconception 4: Completing the form manually is mandatory. While the option to mail a completed form exists, employers can complete this form online at www.texasworkforce.org, making the process more convenient and efficient.

- Misconception 5: Information on former business owners is irrelevant. If your business in Texas was acquired from another entity, detailed information about the acquisition, including details about the previous owner(s), must be provided. This data plays a crucial role in assessing your tax liability.

- Misconception 6: Voluntary election to pay state unemployment tax is irreversible. Non-liable employers can choose to pay state unemployment tax voluntarily, but this decision is not permanent. Employers can withdraw their election after a minimum of two calendar years, provided they meet the necessary conditions.

- Misconception 7: The form is strictly for tax purposes. Beyond determining tax liability, the information provided helps the Texas Workforce Commission manage unemployment claims and ensure employees are eligible for benefits if they lose their job through no fault of their own.

Accurately understanding and completing the TWC report form is essential for employers in Texas. It not only ensures compliance with state laws but also protects the rights of employees within the state. Employers are encouraged to review the form's requirements carefully and seek clarification when needed to avoid any potential complications.

Key takeaways

Filling out the Texas Workforce Commission (TWC) Report form accurately is vital for employers in Texas to comply with the state's Unemployment Compensation Act. Here are some key takeaways for correctly completing and using the form:

- The form is mandatory for every employing unit operating within Texas to determine their liability under the Texas Unemployment Compensation Act.

- Employers can complete the form online at the TWC's official website, which streamlines the submission process.

- For agricultural operations, such as farms or ranches, a specific form, Form c-1fr, must be completed, indicating the specialized nature of such employment.

- The Identification Section requires precise information, including the business's TWC Account Number (if available), Federal Employer ID Number, and details about the type of business ownership, such as corporation, partnership, or individual proprietorship.

- Accurate contact information is crucial, including both the mailing and business addresses, as these are used by TWC for correspondence and potentially sending important notifications.

- Details about the business's owner(s) or officer(s) are necessary to establish the responsible parties for the business's operations and compliance with state regulations.

- The Employment Section requires information about the first date of employment in Texas and the first date wages were paid, which are used to determine the start of the employer's liability.

- A thorough description of the business's activities in Texas, including the principal products or services, gives TWC a clear understanding of the business's operations.

- For businesses that have acquired another business, detailed information about the acquisition, including the previous owner’s details and the nature of the transfer, must be provided.

- If applicable, there is an option for non-liable employers to voluntarily elect to pay state unemployment tax, with specific conditions outlined in the form.

- The signature section is legally binding. It must be signed by an authorized individual, certifying the accuracy of the information provided.

Furthermore, it’s important for employers to be aware that they might need to assess and correct the information collected by TWC. Employers can request access to this information by contacting TWC as specified in the form. This ensures not only compliance but also that the data reflecting their operations and responsibilities under the Texas Unemployment Compensation Act are accurate and current.

Popular PDF Forms

Non Profit Form 990 - Facilitates the sharing of information about awards, recognitions, or achievements not detailed on the main form.

Florida Corporate Tax - If a corporation amends its federal tax return, it must also amend its Florida F-1120 to reflect those changes.

Privacy Act Statement for Email - Mandates that all documents with private data are accompanied by this cover sheet, reinforcing the importance of adhering to privacy laws and regulations.