Blank Third Party Authorization PDF Template

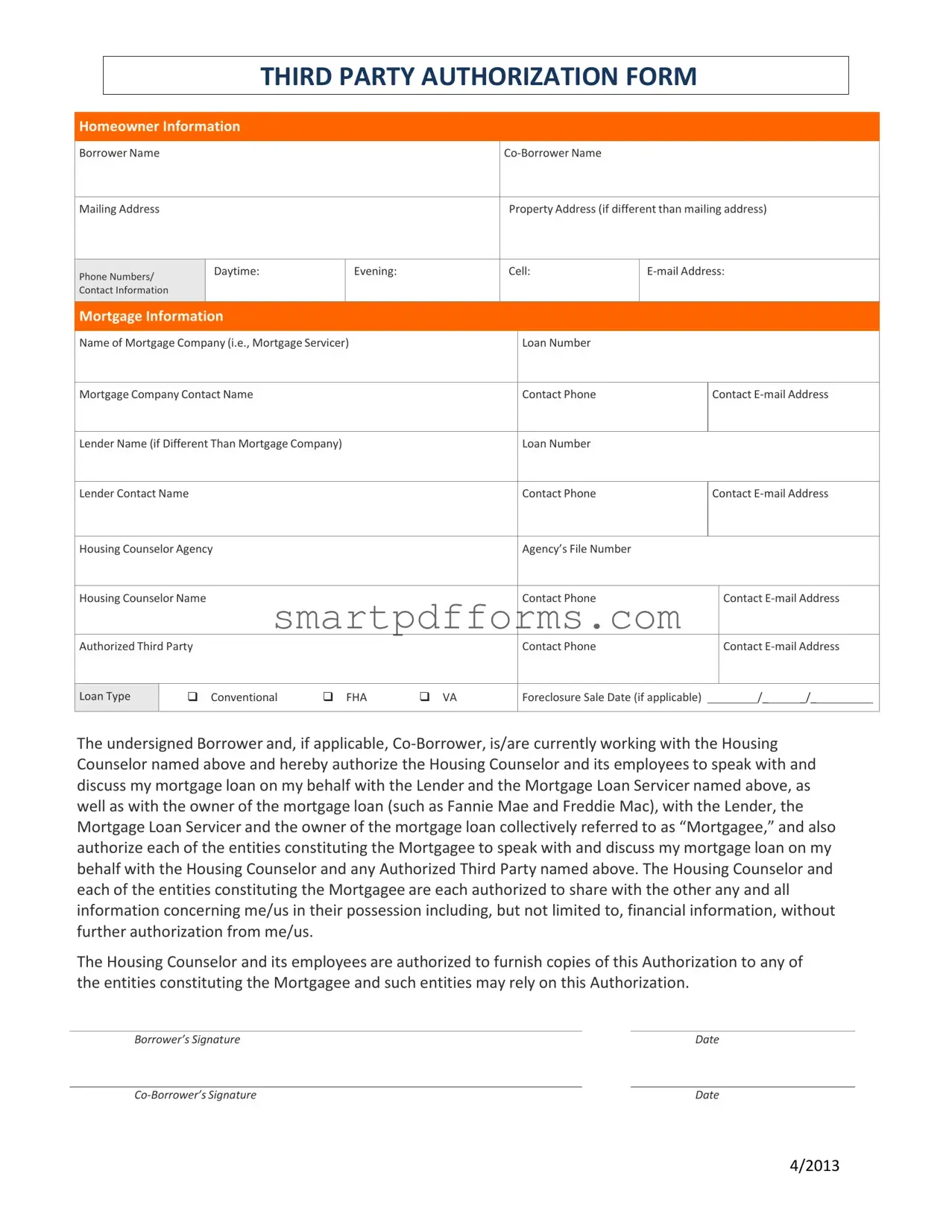

At the heart of navigating mortgage issues, especially when seeking guidance or facing difficulties, a Third Party Authorization form serves as a crucial tool. This document, designed to streamline communication, allows homeowners to officially authorize a housing counselor or another designated party to interact with their mortgage company, loan servicer, or lender on their behalf. The content of the form covers essential homeowner information, including both borrower and co-borrower names, contact details, and both the mailing and property addresses. The mortgage information section requires details about the mortgage company, loan number, and contact points, while also specifying the type of loan in question, such as conventional, FHA, or VA loans. Notably, the form permits the sharing of sensitive financial information between the homeowner's authorized third party and various entities involved in the mortgage process—be it the mortgage company, servicer, or the loan owner. This authorization, which must be formally agreed upon with the signatures of the borrower and, if applicable, co-borrower, is pivotal in facilitating a transparent and efficient exchange of information, aiding homeowners in managing their mortgage responsibilities more effectively.

Preview - Third Party Authorization Form

THIRD PARTY AUTHORIZATION FORM

Homeowner Information

Borrower Name |

|

|

|

|

|

Co‐Borrower Name |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address |

|

|

|

|

|

Property Address (if different than mailing address) |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daytime: |

|

Evening: |

|

Cell: |

E‐mail Address: |

|

|

|

|

||||

Phone Numbers/ |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Contact Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name of Mortgage Company (i.e., Mortgage Servicer) |

|

|

Loan Number |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Mortgage Company Contact Name |

|

|

|

|

Contact Phone |

|

Contact E‐mail Address |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Lender Name (if Different Than Mortgage Company) |

|

|

|

Loan Number |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Lender Contact Name |

|

|

|

|

Contact Phone |

|

Contact E‐mail Address |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Housing Counselor Agency |

|

|

|

|

Agency’s File Number |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Housing Counselor Name |

|

|

|

|

Contact Phone |

|

|

Contact E‐mail Address |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Authorized Third Party |

|

|

|

|

Contact Phone |

|

|

Contact E‐mail Address |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Loan Type |

|

Conventional |

|

FHA |

VA |

|

Foreclosure Sale Date (if applicable) |

/_ |

_/_ |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The undersigned Borrower and, if applicable, Co‐Borrower, is/are currently working with the Housing Counselor named above and hereby authorize the Housing Counselor and its employees to speak with and discuss my mortgage loan on my behalf with the Lender and the Mortgage Loan Servicer named above, as well as with the owner of the mortgage loan (such as Fannie Mae and Freddie Mac), with the Lender, the Mortgage Loan Servicer and the owner of the mortgage loan collectively referred to as “Mortgagee,” and also authorize each of the entities constituting the Mortgagee to speak with and discuss my mortgage loan on my behalf with the Housing Counselor and any Authorized Third Party named above. The Housing Counselor and each of the entities constituting the Mortgagee are each authorized to share with the other any and all information concerning me/us in their possession including, but not limited to, financial information, without further authorization from me/us.

The Housing Counselor and its employees are authorized to furnish copies of this Authorization to any of the entities constituting the Mortgagee and such entities may rely on this Authorization.

Borrower’s Signature |

|

Date |

|

|

|

Co‐Borrower’s Signature |

|

Date |

4/2013

Form Data

| Fact | Description |

|---|---|

| Purpose of Form | This form authorizes a housing counselor and any named third party to discuss the borrower's mortgage loan with the lender and mortgage servicer. |

| Parties Involved | The form involves multiple parties: the borrower, co-borrower (if applicable), housing counselor, mortgage servicer, lender, and any authorized third parties. |

| Information Required | Borrower and co-borrower names, contact information, mortgage company details, loan numbers, and housing counselor information are required. |

| Loan Types Covered | The form covers conventional, FHA, and VA loans. |

| Authorization Scope | It permits the discussion of the borrower's mortgage, including sharing financial information, between the mortgagee and the housing counselor or authorized third party. |

| Foreclosure Information | The form requests the foreclosure sale date if applicable. |

| Governing Laws | The authorization is subject to state law, which may dictate specific requirements or limitations for third-party authorizations in mortgage discussions. |

Instructions on Utilizing Third Party Authorization

Completing a Third Party Authorization form is a crucial step in enabling a trusted housing counselor or other designated third party to discuss your mortgage loan details with your lender or mortgage service provider on your behalf. This process ensures that your chosen advisor can negotiate, obtain information, and potentially make decisions that could impact your mortgage situation. It's important to fill out the form accurately to avoid any delays or misunderstandings.

- Begin by filling out the Homeowner Information section. Write the Borrower Name and if applicable, the Co‐Borrower Name.

- Enter the Mailing Address. If the property address where the mortgage is different from the mailing address, provide the Property Address as well.

- For Phone Numbers/ Contact Information, provide your daytime, evening, and cell phone numbers in the respective fields, along with your E‐mail Address.

- Under Mortgage Information, write the Name of Mortgage Company (or Mortgage Servicer), and include the Loan Number.

- Fill in the Mortgage Company Contact Name, their Contact Phone, and Contact E‐mail Address.

- If your Lender Name is different than the Mortgage Company, provide their details including the Loan Number, Lender Contact Name, Contact Phone, and Contact E‐mail Address.

- In the Housing Counselor Agency section, input the Agency’s File Number, the Housing Counselor Name, and their contact information.

- If there is an Authorized Third Party, include their Contact Phone and Contact E‐mail Address.

- Select the Loan Type by checking the appropriate box for Conventional, FHA, or VA.

- If applicable, fill in the Foreclosure Sale Date.

- Both the Borrower and, if applicable, the Co‐Borrower must sign and date the form at the bottom where it says Borrower’s Signature and Co‐Borrower’s Signature, respectively. Ensure the signatures are dated correctly.

Once the form is fully completed, it's ready to be delivered to the appropriate party, usually the housing counselor or the mortgage service provider. Ensure that every piece of information is accurate and clearly written to avoid any potential issues. This authorization will facilitate communication and information sharing between your mortgage service provider and your authorized advisor, which could be beneficial in managing or resolving your mortgage concerns.

Obtain Answers on Third Party Authorization

-

What is the purpose of the Third Party Authorization form?

The Third Party Authorization form allows borrowers to give permission for a named Housing Counselor and any other authorized third parties to communicate directly with their mortgage lender, loan servicer, and the owner of the mortgage loan. This form enables these authorized representatives to discuss the borrower's mortgage loan on their behalf and to receive and share financial and other relevant information with the involved parties.

-

Who should be listed as an Authorized Third Party on the form?

Any Housing Counselor you are working with should be listed as an Authorized Third Party. Additionally, you can list any other individual or organization you want to allow to discuss and manage your mortgage loan with your lender and loan servicer. This could include financial advisors, attorneys, or family members whom you trust to act on your behalf.

-

Do both the Borrower and Co-Borrower need to sign the form?

Yes, if there is a Co-Borrower listed on the mortgage, both the Borrower and the Co-Borrower must sign the Third Party Authorization form. This ensures that both parties agree to allow the named Housing Counselor and any Authorized Third Parties to have access to and discuss their loan information.

-

What types of loans does this authorization cover?

This authorization can apply to various types of loans, including Conventional, FHA (Federal Housing Administration), and VA (Veterans Affairs) loans. When completing the form, you'll need to check the box that corresponds to your loan type to ensure the correct processing of your authorization.

-

How long is the authorization valid?

The authorization remains valid until you revoke it in writing. This means that the Housing Counselor and any other Authorized Third Parties can continue to communicate with your mortgage company and other entities as specified in the authorization until you formally withdraw your permission.

-

Can I revoke the authorization?

Yes, you can revoke the authorization at any time. To do so, you need to send a written notice to your mortgage servicer and any other involved parties indicating that you are withdrawing the permission for the Housing Counselor and any other Authorized Third Parties to act on your behalf. It's recommended to also inform the Housing Counselor and the Authorized Third Parties directly of your decision.

-

What are the benefits of completing a Third Party Authorization form?

Completing a Third Party Authorization form has several benefits, including allowing experts like Housing Counselors to advocate on your behalf, facilitate communication between you and your mortgage servicer, and help manage or resolve any issues related to your mortgage loan. It also ensures that your privacy is protected, as information will only be shared with parties you have authorized.

Common mistakes

Filling out a Third Party Authorization form is a critical step in managing your mortgage, especially if you're working with a housing counselor or need someone else to discuss your mortgage details on your behalf. However, people often make mistakes that can delay or complicate this process. Here are seven common errors to avoid:

-

Not providing complete borrower information. It is crucial to include all required details such as both the borrower and, if applicable, co-borrower's names, along with accurate mailing and property addresses. Leaving sections incomplete can cause significant delays.

-

Including incorrect phone numbers or email addresses. Providing the wrong contact information for daytime, evening, or cell phone numbers, as well as email addresses, can hinder communication between parties.

-

Failing to properly identify the mortgage information. This includes not only the name of the mortgage company but also accurate loan numbers, which are essential for any third party trying to access or discuss the loan.

-

Not specifying the type of loan (Conventional, FHA, VA). This detail helps the authorized party understand the nature of the loan and any specific considerations or regulations that may apply.

-

Omitting the foreclosure sale date, if applicable. This is especially important if the property is at risk of foreclosure, as it informs all parties of the urgency and timeline they're working within.

-

Forgetting to sign and date the form. An unsigned or undated authorization form is invalid and will not be processed, which could jeopardize any timely intervention needed for the mortgage.

-

Incorrectly naming or failing to identify the authorized third party. If the form asks for a specific housing counselor or other third party to be authorized to speak about the mortgage, their information needs to be filled out accurately. Incorrect details can prevent the authorized party from being able to act on behalf of the borrower.

By taking the time to carefully review and accurately complete the Third Party Authorization form, borrowers can avoid these common mistakes. This ensures smoother communication between all parties involved and aids in the effective management and resolution of the mortgage process.

Documents used along the form

When a borrower authorizes a third party to discuss their mortgage loan with their lender and other stakeholders, as outlined in the Third Party Authorization Form, it is often not the only document required to facilitate this process fully. Several additional forms and documents may also be necessary to ensure a smooth and comprehensive authorization setup. Each of these documents plays a vital role in protecting the interests of all parties involved and enabling the authorized third party to perform their duties effectively.

- Privacy Release Form: This document is crucial as it grants permission for the release of personal information. It typically complements the Third Party Authorization by explicitly allowing financial institutions to share the borrower's private financial information with the designated third party. This can include details about the borrower's income, assets, and credit history.

- Loan Modification Application: Should the borrower be seeking to modify the terms of their mortgage, a Loan Modification Application will likely be necessary. This form requires detailed financial information from the borrower to assess their eligibility for a modification. The third party can assist in completing and submitting this application on the borrower's behalf.

- Hardship Letter: When a borrower is experiencing a financial hardship and is seeking a loan modification, forbearance, or any form of relief, a Hardship Letter is often required. This document provides a personal account of the circumstances leading to the borrower's financial difficulties and justifies the need for assistance.

- Financial Statement: A detailed Financial Statement is key for providing a snapshot of the borrower's current financial status. This document lists assets, liabilities, income, and expenses, giving the lender a comprehensive view of the borrower's ability to meet their mortgage obligations. It supports the efforts of the authorized third party by substantiating the financial information discussed with the lender.

Together with the Third Party Authorization Form, these documents create a more complete picture of the borrower's situation, enabling lenders and authorized third parties to work together more effectively towards a resolution. Whether for modifying a loan, discussing hardship options, or simply managing communication between parties, these documents ensure that the process is handled securely, respecting the borrower's privacy and legal rights.

Similar forms

Power of Attorney: This document authorizes someone else to make decisions on your behalf in various areas, like healthcare or finances, similar to how the Third Party Authorization form allows a housing counselor to speak to mortgage entities on the homeowner's behalf.

Medical Release Form: This permits healthcare professionals to share your personal medical information with specified individuals or entities. Much like the Third Party Authorization form, it involves sharing sensitive information with authorized parties.

Privacy Release Form: Often used in a congressional office to allow the office to inquire about a personal case with a federal agency. It parallels the Third Party Authorization form in that it allows a designated party to obtain information that would normally be private.

Consent to Act on Behalf Form: This is used to give someone permission to act on your behalf, whether in a legal, business, or personal matter, sharing its purpose with the Third Party Authorization form in providing someone else the authority to represent you.

Loan Authorization Form: Similar to the Third Party Authorization, this document allows a lender to release information about your loan to third parties, or lets a third party make decisions regarding your loan.

Debt Settlement Authorization Form: Authorizes a debt settlement company to negotiate with creditors on your behalf, akin to how the Third Party Authorization form permits a housing counselor to negotiate your mortgage terms.

Release of Information Form: Commonly used in educational and medical sectors to permit the sharing of personal information with specified individuals. It's similar to the Third Party Authorization form in its function of allowing the sharing of private information with authorized entities.

Financial Information Release Form: This form authorizes the sharing of your financial records with designated parties, paralleling how the Third Party Authorization form allows for the exchange of financial information between the mortgage servicer, lender, and housing counselor.

Dos and Don'ts

Completing a Third Party Authorization form can be a crucial step in managing your mortgage, particularly when working with housing counselors or needing representation in communications with your mortgage company, lenders, and other entities. It's important to understand what you should and shouldn't do when filling out this form to ensure the process is handled smoothly. Here are several guidelines:

Do's:- Review the entire form before starting: Ensure you understand each section to provide accurate information.

- Provide complete information for all parties: This includes full names, contact information, and any specific identifiers like loan numbers or file numbers.

- Specify the type of mortgage loan: Clearly mark whether it’s Conventional, FHA, VA, or other, as incorrect information can lead to processing delays.

- Include the foreclosure sale date if applicable: This helps all parties understand the urgency and timeframe they are working within.

- Use clear and legible handwriting: If the form is not being filled out electronically, ensure your handwriting is easy to read to prevent any misunderstandings.

- Retain a copy for your records: After signing the form, make a copy for your personal files in case you need to refer back to it or if a dispute arises.

- Ensure all parties sign the form: The form is not valid without the signatures of the borrower and, if applicable, the co-borrower.

- Don’t leave sections blank: If a section doesn’t apply, write “N/A” instead of leaving it empty to indicate that you did not overlook the section.

- Don’t provide outdated information: Ensure all contact information, loan details, and other pertinent information are current.

- Don’t guess information: If you are unsure about specific details, such as your loan type or the appropriate contact person, verify this information before submitting the form.

- Don’t use nicknames or initials: Always use full legal names of all individuals involved to prevent any confusion or processing delays.

- Don’t forget to date the signature: The date next to your signature is crucial for validating the form’s activation period.

- Don’t ignore the need for additional documentation: In some cases, you might be asked to provide further documentation. Ignoring these requests can invalidate your authorization.

- Don’t delay in submitting the completed form: Delaying submission can hinder timely communication and potentially impact the handling of your mortgage situation.

Misconceptions

Understanding the Third Party Authorization form is crucial for homeowners, particularly those working with housing counselors during processes like loan modifications or foreclosure prevention. However, misconceptions about this form can lead to confusion and misuse. Here is a list of common misconceptions and clarifications to help understand the Third-Party Authorization form more clearly.

It gives the third party complete control over the mortgage account. This is incorrect. The form merely authorizes the third party, such as a housing counselor, to discuss and receive information about the borrower's mortgage. It doesn't allow the third party to make decisions or changes to the mortgage without the borrower's express consent.

It is a lifelong agreement. Many believe once signed, the Third Party Authorization form grants indefinite access to the authorized party. However, these forms usually have expiration dates or can be revoked by the borrower at any time, thus terminating the authorization.

It eliminates the borrower's involvement in the decision-making process. This is a misconception. Though it allows the third party to communicate with the lender or mortgage servicer, the borrower remains integral to any decision regarding their loan. The form doesn't transfer the borrower's rights or responsibilities.

Any third party can be authorized. Actually, borrowers should be careful whom they authorize. It's advisable to choose someone who has a professional understanding of mortgage issues, like a HUD-certified housing counselor, rather than just any acquaintance.

Signing the form is a requirement for all loan negotiations. This is not always true. While helpful in many cases, especially for borrowers working with housing counselors, it is not universally required by all lenders for loan modifications or other negotiations.

The form only applies to mortgage discussions. This is partly true but overlooks that the authorization also allows the third party to obtain and discuss detailed financial information which can be related to but not limited to the mortgage itself, such as the borrower's overall financial situation.

It's only for borrowers in foreclosure or default. Though often used in such situations, any borrower seeking advice or assistance from a third party can benefit from this authorization. It's practical for exploring different mortgage options or getting assistance with paperwork and understanding complex mortgage terms.

The same form is used by all lenders and servicers. While many utilize a similar format, specific details and requirements may vary. It's essential to use the form provided by your lender or servicer or ensure that any generic form you use meets their requirements.

Dispelling these misconceptions encourages a more informed use of the Third Party Authorization form, fostering better communication and understanding between borrowers, their chosen representatives, and mortgage holders during often stressful financial negotiations.

Key takeaways

Filling out and using a Third Party Authorization form is crucial for homeowners who are working with housing counselors or need to authorize another party to communicate with their mortgage company on their behalf. Here are nine key takeaways to understand this process better:

- Understand the purpose: This form serves as a permission slip, allowing your housing counselor or another authorized third party to discuss your mortgage loan with your lender, mortgage servicer, and the owner of your mortgage.

- Complete homeowner information: It's essential to provide detailed information about both the borrower and, if applicable, co-borrower. This includes names, mailing and property addresses if different, and multiple contact numbers.

- Mortgage details are key: Clearly mentioning the name of the mortgage company, loan number, and contact details removes ambiguity and speeds up communication.

- Identify the loan type: Marking whether your loan is Conventional, FHA, or VA helps the servicer understand the specific rules and options that apply to your situation.

- Foreclosure sale date: If your property is facing foreclosure, indicating the sale date on the form is critical for the housing counselor to prioritize actions.

- Housing counselor agency: Including complete information about your housing counselor, such as the agency’s file number and contact details, facilitates direct communication between your counselor and the mortgage company.

- Third-party authorization: By designating an authorized third party, you are specifying whom you allow to speak and obtain information about your mortgage loan on your behalf.

- Consent for sharing information: Signing this form permits the housing counselor and mortgage entities to exchange your financial and loan information freely, aiding in finding solutions for your situation.

- Ensure correct signatures: The form must be signed by the borrower and, if applicable, the co-borrower. These signatures legally authorize the discussed arrangements and sharing of information.

Correctly filling out and submitting the Third Party Authorization form is a significant step towards managing your mortgage issues more effectively. It simplifies the process for housing counselors to act on your behalf, potentially preventing foreclosure and helping to secure loan modifications or other solutions suited to your financial situation.

Popular PDF Forms

Wv Nrw-4 - This form is integral for nonresidents wishing to manage their tax liabilities on income from West Virginia sources directly.

How to Apply for Social Security Benefits at Age 62 - Facilitates older adults’ transition to a government-sponsored healthcare insurance model.