Blank Tp 584 PDF Template

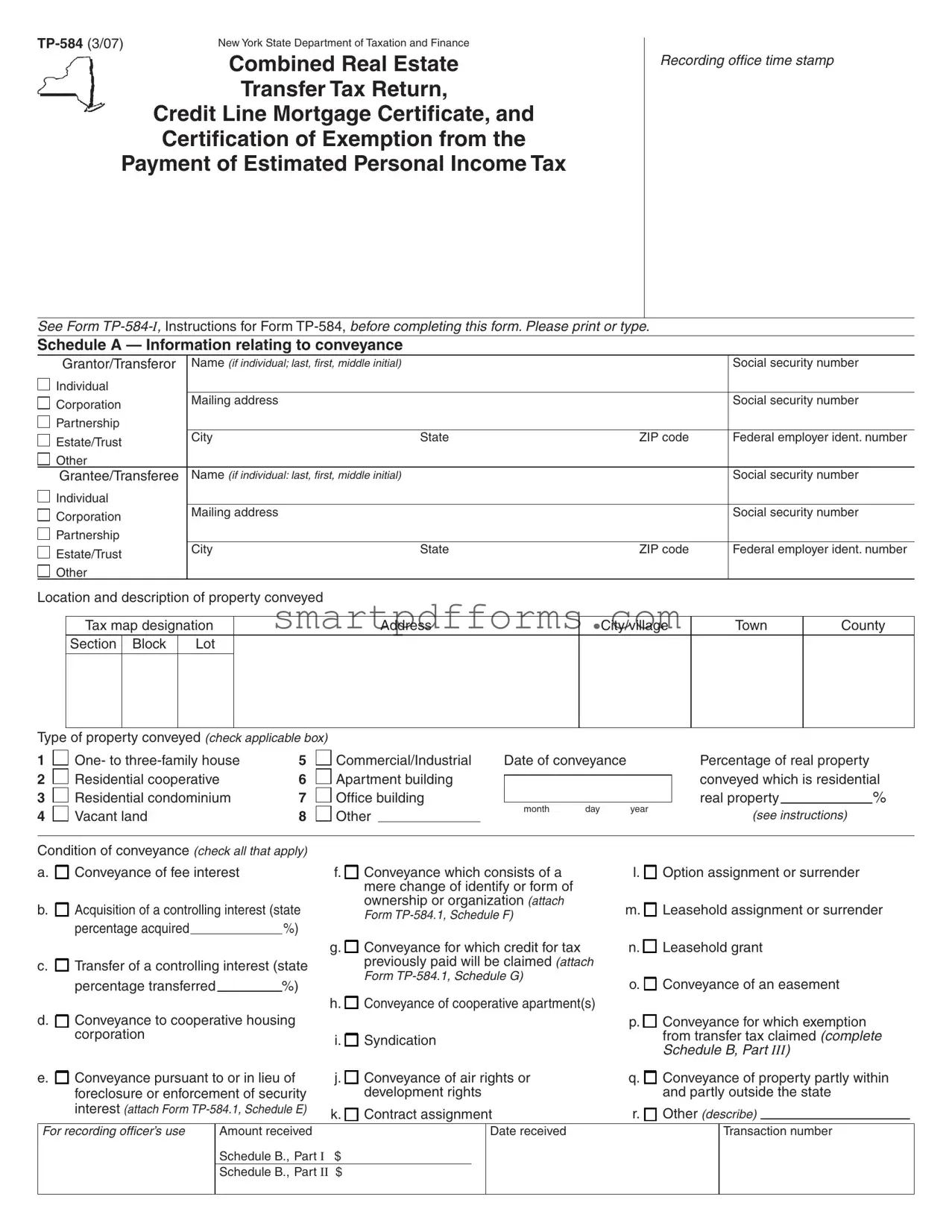

The TP-584 form plays a crucial role in the realm of real estate transactions within New York State, functioning as a Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the Payment of Estimated Personal Income Tax. This comprehensive document not only facilitates the calculation and payment of real estate transfer taxes but also addresses the specifics of credit line mortgages and outlines situations that may exempt the involved parties from estimated personal income tax. It demands detailed information about the conveyance including the identities and roles of the grantor and grantee, the specifics of the property being transferred, and the nature of the property's conveyance. The form delves into the breakdown of tax due based on the value of the conveyance and includes provisions for claiming exemptions under various circumstances, reflecting its significance in ensuring proper tax treatment and legal compliance in real estate transactions. Importantly, it also encompasses certifications regarding the exemption from estimated personal income tax for both residents and non-residents of New York State, showcasing its vital role in the broader financial and regulatory landscape surrounding property transfers.

Preview - Tp 584 Form

Combined Real Estate

Transfer Tax Return,

Credit Line Mortgage Certificate, and

Certification of Exemption from the

Payment of Estimated Personal Income Tax

Recording office time stamp

See Form

Schedule A — Information relating to conveyance

Grantor/Transferor |

Name (if individual; last, first, middle initial) |

|

|

Social security number |

||||||

Individual |

|

|

|

|

|

|

|

|||

Corporation |

Mailing address |

|

|

|

Social security number |

|||||

|

|

|

|

|

|

|

||||

Partnership |

|

|

|

|

|

|

|

|||

Estate/Trust |

City |

State |

ZIP code |

|

Federal employer ident. number |

|||||

|

|

|

|

|

|

|

||||

Other |

|

|

|

|

|

|

|

|||

Grantee/Transferee |

Name (if individual: last, first, middle initial) |

|

|

Social security number |

||||||

Individual |

|

|

|

|

|

|

|

|||

Corporation |

Mailing address |

|

|

|

Social security number |

|||||

|

|

|

|

|

|

|

||||

Partnership |

|

|

|

|

|

|

|

|||

Estate/Trust |

City |

State |

ZIP code |

|

Federal employer ident. number |

|||||

|

|

|

|

|

|

|

||||

Other |

|

|

|

|

|

|

|

|||

Location and description of property conveyed |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||

|

Tax map designation |

|

Address |

City/village |

|

Town |

County |

|||

|

Section |

Block |

|

Lot |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of property conveyed (check applicable box)

1 |

One- to |

5 |

2 |

Residential cooperative |

6 |

3 |

Residential condominium |

7 |

4 |

Vacant land |

8 |

Commercial/Industrial |

Date of conveyance |

|

|||

Apartment building |

|

|

|

||

|

|

|

|||

Office building |

|

|

|

||

Other |

|

|

month |

day |

year |

|

|

|

|||

Percentage of real property conveyed which is residential

real property |

|

% |

(see instructions)

Condition of conveyance (check all that apply)

a.  Conveyance of fee interest

Conveyance of fee interest

b. |

|

Acquisition of a controlling interest (state |

|||

|

|

percentage acquired |

|

|

%) |

c. |

|

Transfer of a controlling interest (state |

|||

|

|||||

|

|

percentage transferred |

%) |

||

|

|

|

|

|

|

d. Conveyance to cooperative housing corporation

Conveyance to cooperative housing corporation

e. Conveyance pursuant to or in lieu of foreclosure or enforcement of security interest (attach Form

Conveyance pursuant to or in lieu of foreclosure or enforcement of security interest (attach Form

f.  Conveyance which consists of a mere change of identify or form of ownership or organization (attach

Conveyance which consists of a mere change of identify or form of ownership or organization (attach

Form

g.

Conveyance for which credit for tax previously paid will be claimed (attach

Conveyance for which credit for tax previously paid will be claimed (attach

Form

h.

Conveyance of cooperative apartment(s)

Conveyance of cooperative apartment(s)

i.

Syndication

Syndication

j.

Conveyance of air rights or development rights

Conveyance of air rights or development rights

k.

Contract assignment

Contract assignment

l.

Option assignment or surrender

Option assignment or surrender

m.

Leasehold assignment or surrender

Leasehold assignment or surrender

n.

Leasehold grant

Leasehold grant

o.

Conveyance of an easement

Conveyance of an easement

p.

Conveyance for which exemption from transfer tax claimed (complete Schedule B, Part III)

Conveyance for which exemption from transfer tax claimed (complete Schedule B, Part III)

q.  Conveyance of property partly within and partly outside the state

Conveyance of property partly within and partly outside the state

r.

Other (describe)

Other (describe)

For recording officer’s use |

Amount received |

|

|

Date received |

Transaction number |

|

Schedule B., Part I |

$ |

|

|

|

|

Schedule B., Part II |

$ |

|

|

|

|

|

|

|

|

|

Page 2 of 4

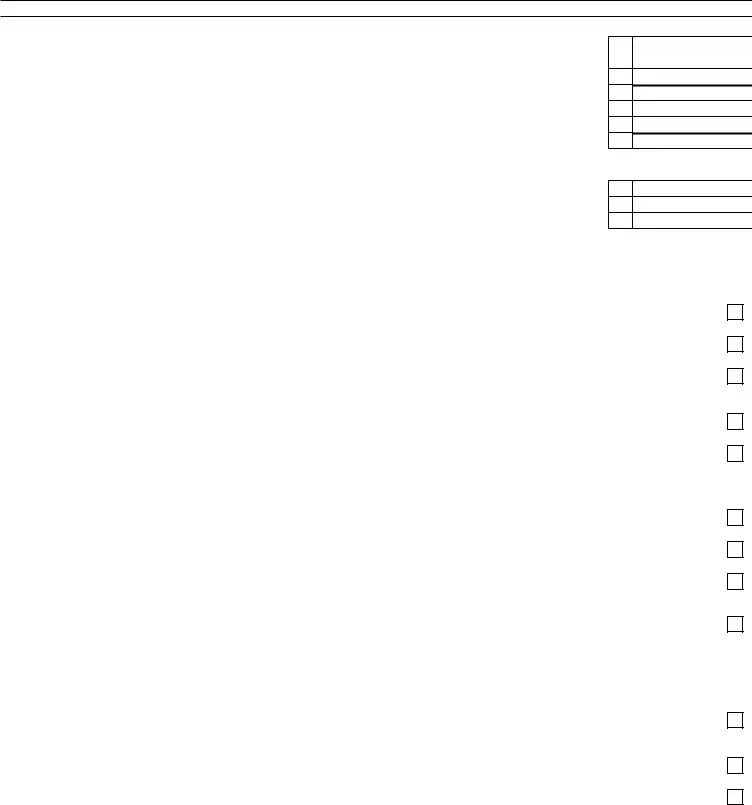

Schedule B — Real estate transfer tax return (Tax Law, Article 31)

Part I – Computation of tax due

1Enter amount of consideration for the conveyance (if you are claiming a total exemption from tax, check the

|

exemption claimed box, enter consideration and proceed to Part III) |

|

Exemption claimed |

2 |

Continuing lien deduction (see instructions if property is taken subject to mortgage or lien) |

......................................... |

|

3 |

Taxable consideration (subtract line 2 from line 1) |

|

|

4 |

Tax: $2 for each $500, or fractional part thereof, of consideration on line 3 |

|

|

5 |

Amount of credit claimed (see instructions and attach Form |

|

|

6 |

Total tax due* (subtract line 5 from line 4) |

|

|

Part II – Computation of additional tax due on the conveyance of residential real property for $1 million or more

1 Enter amount of consideration for conveyance (from Part I, line 1) ........................................................................

2 Taxable consideration (multiply line 1 by the percentage of the premises which is residential real property, as shown in Schedule A) ...

3 Total additional transfer tax due* (multiply line 2 by 1% (.01)) ..................................................................................

Part III – Explanation of exemption claimed on Part I, line 1 (check any boxes that apply)

The conveyance of real property is exempt from the real estate transfer tax for the following reason:

1.

2.

3.

4.

5.

6.

1.

2.

3.

a.Conveyance is to the United Nations, the United States of America, the state of New York, or any of their instrumentalities, agencies, or political subdivisions (or any public corporation, including a public corporation created pursuant to agreement or

compact with another state or Canada) |

a |

b. Conveyance is to secure a debt or other obligation |

b |

c. Conveyance is without additional consideration to confirm, correct, modify, or supplement a prior conveyance |

c |

d. Conveyance of real property is without consideration and not in connection with a sale, including conveyances conveying |

|

realty as bona fide gifts |

d |

e. Conveyance is given in connection with a tax sale |

e |

f.Conveyance is a mere change of identity or form of ownership or organization where there is no change in beneficial ownership. (This exemption cannot be claimed for a conveyance to a cooperative housing corporation of real property

comprising the cooperative dwelling or dwellings.) Attach Form |

f |

g. Conveyance consists of deed of partition |

g |

h. Conveyance is given pursuant to the federal Bankruptcy Act |

h |

i. Conveyance consists of the execution of a contract to sell real property, without the use or occupancy of such property, or |

|

the granting of an option to purchase real property, without the use or occupancy of such property |

i |

j.Conveyance of an option or contract to purchase real property with the use or occupancy of such property where the consideration is less than $200,000 and such property was used solely by the grantor as the grantor’s personal residence and consists of a

in a cooperative housing corporation in connection with the grant or transfer of a proprietary leasehold covering an

individual residential cooperative apartment |

j |

k. Conveyance is not a conveyance within the meaning of Tax Law, Article 31, section 1401(e) (attach documents |

|

supporting such claim) |

k |

l. Other (attach explanation) |

l |

*Please make check(s) payable to the county clerk where the recording is to take place. If the recording is to take place in New York City, make check(s) payable to the NYC Department of Finance. If a recording is not required, send this return and your check(s) made payable to the NYS Department of Taxation and Finance, directly to the NYS Tax Department, RETT Return Processing, PO Box 5045, Albany NY

Page 3 of 4

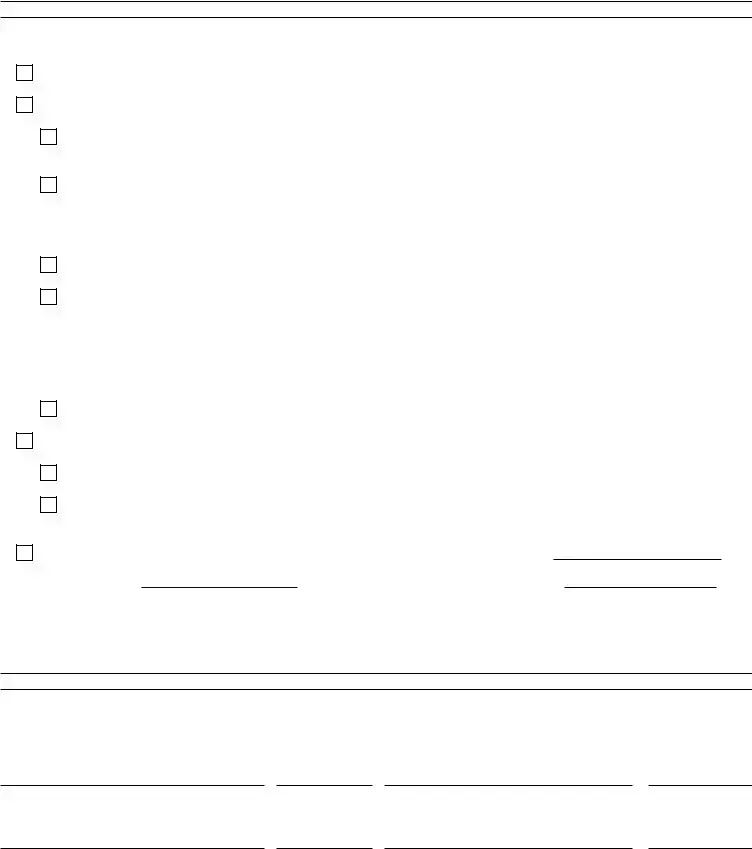

Schedule C — Credit Line Mortgage Certificate (Tax Law, Article 11)

Complete the following only if the interest being transferred is a fee simple interest.

I (we) certify that: (check the appropriate box)

1.

2.

3.

4.

The real property being sold or transferred is not subject to an outstanding credit line mortgage.

The real property being sold or transferred is subject to an outstanding credit line mortgage. However, an exemption from the tax is claimed for the following reason:

The transfer of real property is a transfer of a fee simple interest to a person or persons who held a fee simple interest in the real property (whether as a joint tenant, a tenant in common or otherwise) immediately before the transfer.

The transfer of real property is (A) to a person or persons related by blood, marriage or adoption to the original obligor or to one or more of the original obligors or (B) to a person or entity where 50% or more of the beneficial interest in such real property after the transfer is held by the transferor or such related person or persons (as in the case of a transfer to a trustee for the benefit of a minor or the transfer to a trust for the benefit of the transferor).

The transfer of real property is a transfer to a trustee in bankruptcy, a receiver, assignee, or other officer of a court.

The maximum principal amount secured by the credit line mortgage is $3,000,000 or more, and the real property being sold or transferred is not principally improved nor will it be improved by a one- to

Please note: for purposes of determining whether the maximum principal amount secured is $3,000,000 or more as described above, the amounts secured by two or more credit line mortgages may be aggregated under certain circumstances. See

Other (attach detailed explanation).

The real property being transferred is presently subject to an outstanding credit line mortgage. However, no tax is due for the following reason:

A certificate of discharge of the credit line mortgage is being offered at the time of recording the deed.

A check has been drawn payable for transmission to the credit line mortgagee or his agent for the balance due, and a satisfaction of such mortgage will be recorded as soon as it is available.

The real property being transferred is subject to an outstanding credit line mortgage recorded in

(insert liber and page or reel or other identification of the mortgage). The maximum principal amount of debt or obligation secured

by the mortgage is. No exemption from tax is claimed and the tax of

is being paid herewith. (Make check payable to county clerk where deed will be recorded or, if the recording is to take place in New York City, make check payable to the NYC Department of Finance.)

Signature (both the grantor(s) and grantee(s) must sign)

The undersigned certify that the above information contained in schedules A, B, and C, including any return, certification, schedule, or attachment, is to the best of his/her knowledge, true and complete, and authorize the person(s) submitting such form on their behalf to receive a copy for purposes of recording the deed or other instrument effecting the conveyance.

Grantor signature |

Title |

Grantee signature |

Title |

Grantor signature |

Title |

Grantee signature |

Title |

Reminder: Did you complete all of the required information in Schedules A, B, and C? Are you required to complete Schedule D? If you checked e, f, or g in Schedule A, did you complete Form

Page 4 of 4

Schedule D - Certification of exemption from the payment of estimated personal income tax (Tax Law, Article 22, section 663)

Complete the following only if a fee simple interest or a cooperative unit is being transferred by an individual or estate or trust.

Part I - New York State residents

If you are a New York State resident transferor(s)/seller(s) listed in Schedule A of Form

Certification of resident transferor(s)/seller(s)

This is to certify that at the time of the sale or transfer of the real property or cooperative unit, the transferor(s)/seller(s) as signed below was a resident of New York State, and therefore is not required to pay estimated personal income tax under Tax Law, section 663(a) upon the sale or transfer of this real property or cooperative unit.

Signature |

Print full name |

Date |

|

|

|

Signature |

Print full name |

Date |

|

|

|

Signature |

Print full name |

Date |

|

|

|

Signature |

Print full name |

Date |

|

|

|

Note: A resident of New York State may still be required to pay estimated tax under Tax Law, section 685(c), but not as a condition of recording a deed.

Part II - Nonresidents of New York State

If you are a nonresident of New York State listed as a transferor/seller in Schedule A of Form

If none of these exemption statements apply, you must complete Form

Exemption for nonresident transferor(s)/seller(s)

This is to certify that at the time of the sale or transfer of the real property or cooperative unit, the transferor(s)/seller(s) (grantor) of this real property or cooperative unit was a nonresident of New York State, but is not required to pay estimated personal income tax under Tax Law, section 663 due to one of the following exemptions:

The real property or cooperative unit being sold or transferred qualifies in total as the transferor’s/seller’s principal residence

(within the meaning of Internal Revenue Code, section 121) from |

|

to |

|

(see instructions). |

|

|

|||

|

Date |

|

Date |

|

The transferor/seller is a mortgagor conveying the mortgaged property to a mortgagee in foreclosure, or in lieu of foreclosure with no additional consideration.

The transferor/seller is a mortgagor conveying the mortgaged property to a mortgagee in foreclosure, or in lieu of foreclosure with no additional consideration.

The transferor or transferee is an agency or authority of the United States of America, an agency or authority of the state of New York, the Federal National Mortgage Association, the Federal Home Loan Mortgage Corporation, the Government National Mortgage Association, or a private mortgage insurance company.

The transferor or transferee is an agency or authority of the United States of America, an agency or authority of the state of New York, the Federal National Mortgage Association, the Federal Home Loan Mortgage Corporation, the Government National Mortgage Association, or a private mortgage insurance company.

Signature |

Print full name |

Date |

|

|

|

Signature |

Print full name |

Date |

|

|

|

Signature |

Print full name |

Date |

|

|

|

Signature |

Print full name |

Date |

|

|

|

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The TP-584 form is used for the Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the Payment of Estimated Personal Income Tax in the state of New York. |

| Document Revision Date | The form revision currently in use is from March 2007 (3/07). |

| State-specific | This form is specific to the state of New York and is governed by the New York State Department of Taxation and Finance. |

| Form Components | It includes schedules for conveying information related to the conveyance, real estate transfer tax, credit line mortgage certificate, and exemptions pertaining to estimated personal income tax. |

| Key Information Required | Information such as grantor/transferor and grantee/transferee details, property description, type of conveyance, and conditions of conveyance are required. |

| Tax Calculation | The form facilitates the computation of real estate transfer tax as well as any additional tax for conveyances of residential real property valued at $1 million or more. |

| Exemptions | There are detailed sections for claiming exemptions based on specific conditions concerning the conveyance and transfer situations specified in Schedule B, Part III. |

| Signatory Requirement | Both the grantor(s) and grantee(s) must sign the form, certifying that the information provided is complete and accurate to the best of their knowledge. |

| Governing Laws | The form is governed by Article 31 of the Tax Law for real estate transfer tax and Article 22, section 663 for exemptions from estimated personal income tax payments. |

Instructions on Utilizing Tp 584

Filling out the TP-584 form is a straightforward task with the right guidance. This form is used for reporting real estate transactions in New York State. Paying attention to each section ensures that your transfer tax obligations are met accurately. Let's walk through the steps needed to complete this form correctly.

- Begin with Schedule A, which asks for information relating to the conveyance. Enter the Grantor/Transferor and Grantee/Transferee information, including names, addresses, and identifying numbers (social security number or federal employer identification number).

- Identify the Location and Description of Property Conveyed, including tax map designation, address, city/village, town, county, section, block, and lot.

- Select the Type of Property Conveyed by checking the applicable box.

- Enter the Date of Conveyance and specify the percentage of real property conveyed which is residential.

- Check any conditions that apply to the conveyance in the provided list, such as conveyance of fee interest, acquisition or transfer of a controlling interest, or any exemptions you're claiming.

- In Schedule B, compute the real estate transfer tax due. Enter the amount of consideration for the conveyance and subtract any continuing lien deduction. Calculate the taxable consideration and the tax due.

- If applicable, complete Part II of Schedule B to calculate any additional tax due on the conveyance of residential real property for $1 million or more.

- Check any exemptions claimed on Part III of Schedule B that apply to your transfer.

- For transfers involving a credit line mortgage, complete Schedule C by checking the appropriate box regarding the status of the property with respect to an outstanding credit line mortgage and providing the necessary certifications.

- Grantors and grantees must sign at the end of Schedule C to certify the accuracy of the information provided.

- If a fee simple interest or a cooperative unit is being transferred, complete Schedule D to certify exemption from the payment of estimated personal income tax. Indicate whether you are a New York State resident or nonresident and check the appropriate exemption.

- Sign and date the bottom of Schedule D, along with printing full names.

- Before submitting, double-check all sections for completeness and accuracy, ensuring you are ready to attach any required checks payable to the proper authority.

Upon completing these steps, your TP-584 form will be ready for submission. Make sure all schedules are fully completed and remember to attach any necessary payment. Submitting a complete and accurate form is crucial for the proper recording of your real estate transaction and to comply with New York State's taxation requirements.

Obtain Answers on Tp 584

What is the purpose of the TP-584 form?

The TP-584 form is a document required by the New York State Department of Taxation and Finance for almost all real estate transactions. Its primary purpose is to report the transfer of real estate property, allowing for the calculation and payment of real estate transfer taxes. Additionally, it includes a credit line mortgage certificate and a certification of exemption from the payment of estimated personal income tax for certain transactions. This form is necessary for the recording of deeds and other similar legal documents to ensure compliance with tax obligations related to property transfers.

When must the TP-584 form be filed?

This form must be completed and submitted at the time of recording the deed or other conveyance document with the county clerk's office or, if in New York City, with the NYC Department of Finance. For transactions where a recording is not required, the completed form and any applicable checks made payable to the NYS Department of Taxation and Finance must be sent directly to the department. To avoid penalties, it is critical to ensure this form is accurately filled out and submitted by the deadline associated with the conveyance of real property.

Are there any exemptions available that could impact the amount of tax due?

- a. A conveyance to the United Nations, the United States of America, the State of New York, or their instrumentalities qualifies for an exemption.

- b. Transfers without additional consideration to confirm or correct a prior conveyance are exempt.

- c. Gifts of real property, conveyances pursuant to a tax sale, and mere changes of identity or form of ownership without a change in beneficial ownership may also be exempt.

- d. Conveyances not defined as taxable under the Tax Law, Article 31, section 1401(e), are exempt, provided supporting documents are attached.

These exemptions, among others, can significantly impact the amount of real estate transfer tax due. Detailed information about each exemption and the required documentation can be found in the instructions for the TP-584 form.

What are the penalties for failing to file the TP-584 form or for filing it incorrectly?

Failing to file the TP-584 form on time, or filing an incorrect or incomplete form, can result in penalties, interest charges, and delays in the recording of the property transfer. The penalties may vary based on the amount of tax due, the length of the filing delay, and the nature of the inaccuracies in the filing. It is important to review the form and its instructions carefully, or consult a professional, to ensure that all information is accurately reported, all necessary schedules are completed, and the form is filed by the appropriate deadline to avoid these penalties.

Common mistakes

Filling out the TP-584 form can be complex, and errors can delay transactions or have other serious consequences. Here are nine common mistakes to avoid:

- Not providing complete information on the grantor/transferor and grantee/transferee, including names, social security numbers or federal employer identification numbers, and mailing addresses.

- Failing to accurately describe the location and details of the property being conveyed. This includes the correct tax map designation, address, city, village, town, county, and the type of property.

- Omitting the date of conveyance or inaccurately reporting it, which is crucial for the legal effectiveness of the document.

- Incorrectly calculating the percentage of real property conveyed that is residential, which is necessary for determining certain taxes and fees.

- Not checking the correct conditions of conveyance that apply to the transaction, leading to inaccurate representation of the property transfer.

- Improper completion of the real estate transfer tax section, including inaccuracies in the amount of consideration for the conveyance, any deductions claimed, and the resulting tax due.

- Incorrectly claiming an exemption from the real estate transfer tax without proper justification or supporting documentation.

- Not completing the credit line mortgage certificate section accurately, particularly regarding the status of existing mortgages that can affect tax responsibilities.

- Failure to sign and date the form by both the grantor(s) and grantee(s), which is necessary to confirm the accuracy of the information provided and for the document to be legally binding.

It's important for individuals involved in property transfers to thoroughly review the form TP-584 instructions and ensure that all sections are completed accurately and comprehensively to avoid these common pitfalls.

Documents used along the form

The TP-584 form, known as the Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the Payment of Estimated Personal Income Tax, is a document primarily used in New York State during the process of real estate transactions. When undergoing real estate transactions, particularly in New York, various additional forms and documents are also typically required to ensure the smooth progression of the deal. Among these, four key forms often accompany the TP-584 form to address specific details of the transaction or to adhere to legal requirements.

- RP-5217 Form: This real property transfer report is mandatory for documenting the sale of either residential or commercial property. It provides detailed information about the property and the terms of the transaction to the local assessor's office for accurate record-keeping and assessment purposes.

- IT-2663 Form: This form is crucial for nonresidents of New York State. It is used to report and pay estimated personal income tax on income generated from the sale or transfer of real property located within the state. This ensures compliance with state tax regulations for individuals who do not reside in New York.

- Form TP-584.1: Used in conjunction with the TP-584 form, this document is necessary when specific conditions of the conveyance, such as transfers pursuant to foreclosure or a change in organizational structure, are met. It provides additional details to support the claim for exemption or credit as outlined in the main TP-584 form.

- Affidavit of Exemption: This document is utilized to declare certain exemptions from the real estate transfer tax. Different scenarios can warrant an exemption, and this affidavit allows the transferor to clearly state the exemption being claimed, such as transfers to governmental bodies or diplomatic entities.

While the TP-584 form is an integral part of real estate transactions in New York, these accompanying forms ensure that all aspects of the transaction are fully documented and in compliance with state laws and regulations. They provide a comprehensive framework for the recording of the transaction, ensuring that both legal and tax-related aspects are suitably addressed.

Similar forms

The TP-584 form, also known as the New York State Department of Taxation and Finance Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the Payment of Estimated Personal Income Tax, is a multifaceted document used in specific real estate transactions. It bears similarities to a range of other documents that are also integral to real estate or financial transactions. Below are ten such documents and how they compare to the TP-584 form:

- IRS Form 1099-S: This form is issued by the Internal Revenue Service to report proceeds from real estate transactions. Like the TP-584, it is necessary for tax reporting purposes related to real estate sales, ensuring compliance with tax laws.

- HUD-1 Settlement Statement: Used in real estate transactions to itemize all charges imposed on borrowers and sellers, the HUD-1 shares similarities with TP-584 in detailing the financial aspects of real estate transactions.

- Grant Deed: A legal document used to transfer ownership of real property. The TP-584 also deals with the transfer of real property but includes additional tax and financial reporting requirements.

- Mortgage Loan Disclosure Statement: A critical document in mortgage transactions, detailing the terms and conditions, similar to how TP-584 outlines the financial and tax aspects of real property transfers.

- Warranty Deed: It guarantees a clear title to the buyer of real property, akin to the TP-584's role in documenting the conveyance and the tax obligations tied to that conveyance.

- Quitclaim Deed: This document transfers any ownership the grantor may have in a property without warranties, related to TP-584 through its involvement in real property transactions, albeit with a focus on tax implications.

- Form 1098: The Mortgage Interest Statement provided by lenders to report interest payments, paralleling the TP-584's tax reporting function, albeit with a focus on mortgage interest rather than transfer taxes.

- Statement of Information (Title Companies): Required for real estate transactions to clear title, it shares the purpose of ensuring accurate documentation similar to the TP-584's role in real estate conveyances.

- Estoppel Certificate: Used in real estate to outline the current status of lease agreements and any existing claims, like the TP-584, it ensures clear and accurate reporting for transaction parties.

- Form IT-2663: New York State Nonresident Real Property Estimated Income Tax Payment Form, directly related to the TP-584, is used by nonresidents to report income from the sale of real property, emphasizing the tax aspect of real estate transactions.

Each of these documents, while unique in their specific purposes and requirements, shares the common thread of facilitating crucial aspects of real estate and financial transactions, ensuring compliance with legal standards, and assisting in the accurate reporting and documenting of these transactions.

Dos and Don'ts

When it comes to filling out the TP-584 form for real estate transactions in New York, it's essential to follow certain do's and don'ts to ensure the process goes smoothly. This form, used for reporting real estate transfers and associated taxes, requires careful attention to detail. Below are eight key points—four things you should do and four things you should avoid—to keep in mind:

- Do thoroughly review the instructions (Form TP-584-I) before you start. Understanding the form's requirements upfront can save you time and prevent common mistakes.

- Do print or type your responses clearly. This ensures that all information is legible and can be processed efficiently by the Department of Taxation and Finance.

- Do double-check all social security numbers and federal employer identification numbers for accuracy. Incorrect numbers can lead to processing delays or misfiled information.

- Do carefully determine the type of property being conveyed and the condition of the conveyance, as errors could impact tax calculations and exemptions.

- Don't leave any applicable sections blank. If a section doesn't apply to your transaction, make sure to indicate this as instructed, rather than skipping it.

- Don't forget to attach any required schedules or documents, such as Schedule E for conveyances pursuant to or in lieu of foreclosure, or Schedule F for mere changes in identity or form of ownership.

- Don't overlook the certification sections at the end of Schedules A, B, and C. These need to be signed by both the grantor(s) and grantee(s) to verify the accuracy of the information provided.

- Don't ignore the instructions regarding check payment. Ensure your check(s) are made out correctly and accompany the form if required.

By following these do's and don'ts, you can help ensure that your TP-584 form is completed accurately and efficiently, paving the way for a smooth real estate transaction.

Misconceptions

Understanding the TP-584 form, a crucial document for real estate transactions in New York, is essential for both buyers and sellers. However, there are several misconceptions about this form that can cause confusion. Here are seven common misunderstandings and their explanations:

- Misconception 1: The TP-584 form is only necessary for the sale of residential properties.

This is incorrect. The TP-584 form must be filed for the conveyance of both residential and commercial properties, including one- to three-family houses, residential cooperatives, condominiums, vacant land, and commercial/industrial spaces.

- Misconception 2: The TP-584 form is only for the transferor's information.

Both the transferor (seller) and the transferee (buyer) must provide information on the form. It includes details such as name, social security number or EIN, and mailing address for both parties involved.

- Misconception 3: Filing the TP-584 form exempts the transaction from all taxes.

The form is used to compute real estate transfer taxes and to claim possible exemptions. However, filing it does not automatically exempt a transaction from all taxes; exemptions depend on specific conditions detailed within the form.

- Misconception 4: The form is complicated and requires a legal background to complete.

While the TP-584 form is comprehensive, following the instructions provided in Form TP-584-I can help simplify the process. Assistance from a legal professional or tax advisor can also be sought if needed.

- Misconception 5: The TP-584 form does not need to be updated once filed.

If there are changes to the information or if errors are discovered after filing, the form should be updated or amended as necessary. Accurate and current information is crucial for the proper processing of your real estate transaction.

- Misconception 6: Only the transfer or sale of property requires the TP-584 form.

This form is needed for a variety of real estate transactions beyond sales, including transfers of controlling interest, changes in organization form, and even certain leaseholds and easements, among others.

- Misconception 7: Any real estate transaction across the state uses the same TP-584 form.

While the TP-584 form is standard, certain transactions might require additional schedules or attachments, particularly for exemptions or specific types of conveyances, like cooperative apartments or when related to credit line mortgages.

Correctly understanding and completing the TP-584 form is essential for a smooth real estate transaction process in New York. Being aware of these misconceptions can help avoid potential issues and ensure compliance with state tax laws.

Key takeaways

When dealing with New York State real estate transactions, the TP-584 form plays a pivotal role. Here are eight key takeaways regarding filling out and using this form:

- The TP-584 form is a multifaceted document required for the recording of a real estate transfer, acting as both a tax return and a certification form.

- It is necessary to thoroughly review the Form TP-584-I instructions before attempting to complete this form to ensure all parts are filled out accurately.

- Included within the form are details about the grantor/transferor and grantee/transferee, including their names, Social Security numbers or Federal Employer Identification Numbers, and contact information.

- The form requires comprehensive information about the property being conveyed, including location, tax map designation, type, and the percentage that is residential real property.

- Various conditions of conveyance are addressed within the form, enabling those involved in diverse types of transactions to report specifics accurately, such as conveyances to cooperative housing, foreclosure scenarios, and changes in ownership identity or form.

- Schedule B of the form calculates the real estate transfer tax due, and under certain circumstances, an additional tax on conveyances of residential real property valued at $1 million or more.

- The form also includes a section for claiming any applicable exemptions from the real estate transfer tax, a necessary step for qualifying transfers to reduce or eliminate tax liability.

- Signatures are required from both the grantor(s) and grantee(s) at the end of the form, certifying the accuracy of the information provided. This is a crucial step for the form's validity and the legality of the real estate transaction.

Understanding the TP-584 form is essential for any party involved in a real estate transaction in New York State. It not only facilitates the proper recording of the transfer but also ensures compliance with tax laws, potentially saving time and money by avoiding common mistakes.

Popular PDF Forms

Delaware Prevailing Wage - An overview on how to properly fill out the Delaware Payroll Report, including prevailing wage determinations.

Osip - This form acts as a testament to the strength of an employer’s efforts to comply with federal identification number collection requirements.