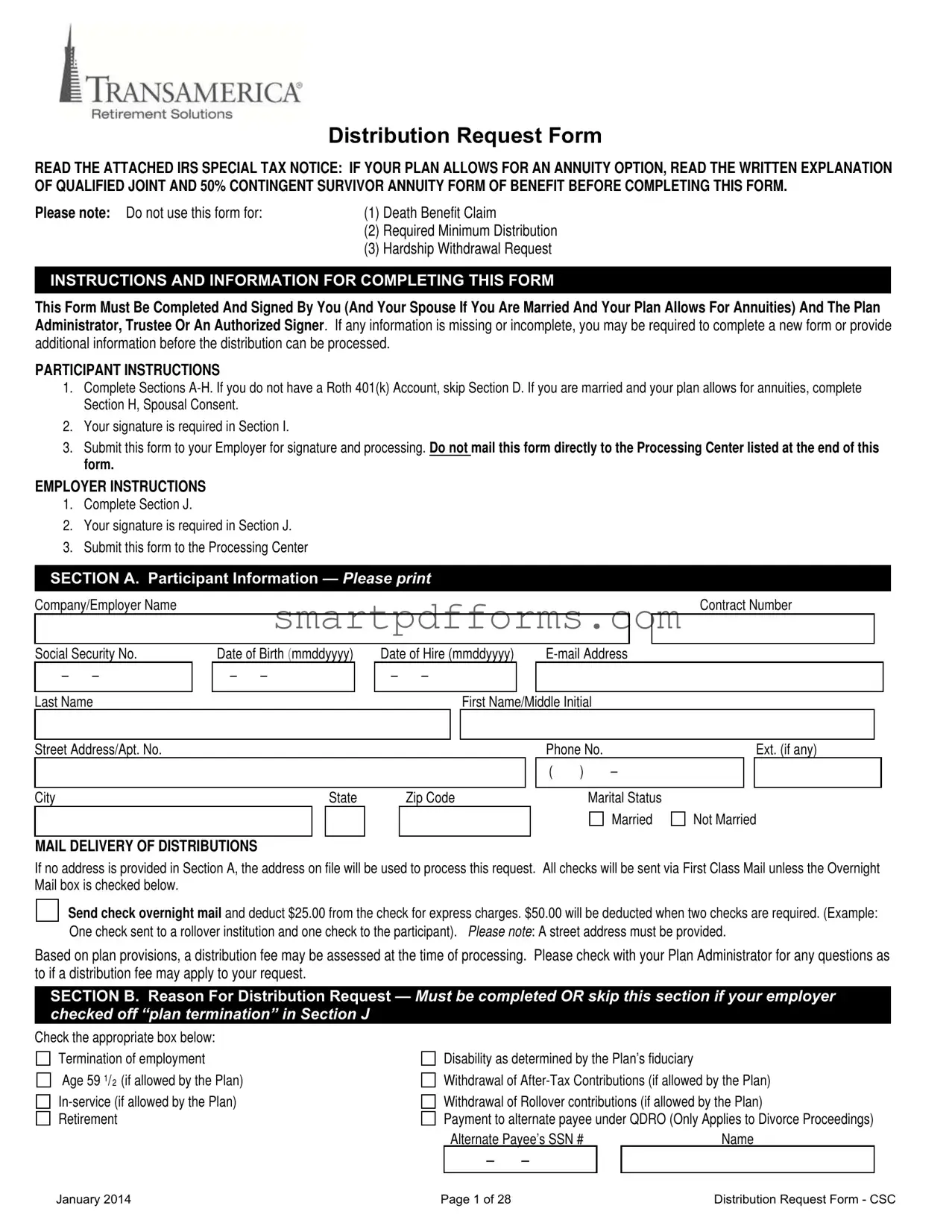

Blank Transamerica 401K Withdrawal PDF Template

Navigating the process of withdrawing funds from your 401K can feel daunting, but the Transamerica 401K Withdrawal Form aims to streamline this procedure, offering clarity and direction for both participants and employers. This comprehensive form covers various withdrawal scenarios, excluding death benefits, required minimum distributions, and hardship withdrawals, ensuring regulatory compliance and safeguarding participants' interests. It requires meticulous completion and signatures from the account holder, potentially their spouse, and the plan administrator, emphasizing the importance of accuracy to avoid delays in processing. With options catering to different distribution reasons like retirement, employment termination, and age-based withdrawals, the form allows for both partial and total account distributions. It details the processes for traditional and Roth 401K accounts, including direct rollovers to IRAs or other eligible plans, combinations of rollovers and cash payments, and cash distributions, each with specific tax implications. Additionally, the form accommodates unique situations like loans against the 401K and necessitates spousal consent in certain conditions, highlighting the importance of understanding one's plan specifics. This form is a crucial tool in managing one's retirement savings responsibly, offering pathways for account holders to access their funds while considering their future financial security.

Preview - Transamerica 401K Withdrawal Form

Distribution Request Form

READ THE ATTACHED IRS SPECIAL TAX NOTICE: IF YOUR PLAN ALLOWS FOR AN ANNUITY OPTION, READ THE WRITTEN EXPLANATION OF QUALIFIED JOINT AND 50% CONTINGENT SURVIVOR ANNUITY FORM OF BENEFIT BEFORE COMPLETING THIS FORM.

Please note: Do not use this form for: |

(1) |

Death Benefit Claim |

|

(2) |

Required Minimum Distribution |

|

(3) |

Hardship Withdrawal Request |

INSTRUCTIONS AND INFORMATION FOR COMPLETING THIS FORM

This Form Must Be Completed And Signed By You (And Your Spouse If You Are Married And Your Plan Allows For Annuities) And The Plan Administrator, Trustee Or An Authorized Signer. If any information is missing or incomplete, you may be required to complete a new form or provide additional information before the distribution can be processed.

PARTICIPANT INSTRUCTIONS

1.Complete Sections

2.Your signature is required in Section I.

3.Submit this form to your Employer for signature and processing. DoUnot mailUthis form directly to the Processing Center listed at the end of this form.

EMPLOYER INSTRUCTIONS

1.Complete Section J.

2.Your signature is required in Section J.

3.Submit this form to the Processing Center

SECTION A. Participant Information — Please print

Company/Employer Name |

|

Contract Number |

|

|

|

Social Security No.

– –

Last Name

Date of Birth (mmddyyyy)

– –

Date of Hire (mmddyyyy) |

|

||

– |

– |

|

|

|

|

|

|

First Name/Middle Initial

Street Address/Apt. No. |

|

|

|

|

|

|

Phone No. |

|

|

Ext. (if any) |

||

|

|

|

|

|

|

|

( |

) |

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

Zip Code |

|

Marital Status |

|

|

|

|||

|

|

|

|

|

|

|

|

|

Married |

Not Married |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

MAIL DELIVERY OF DISTRIBUTIONS

If no address is provided in Section A, the address on file will be used to process this request. All checks will be sent via First Class Mail unless the Overnight Mail box is checked below.

Send check overnight mail and deduct $25.00 from the check for express charges. $50.00 will be deducted when two checks are required. (Example: One check sent to a rollover institution and one check to the participant). Please note: A street address must be provided.

Based on plan provisions, a distribution fee may be assessed at the time of processing. Please check with your Plan Administrator for any questions as to if a distribution fee may apply to your request.

SECTION B. Reason For Distribution Request — Must be completed OR skip this section if your employer checked off “plan termination” in Section J

Check the appropriate box below:

Termination of employment

Age 59 1P /P R2R (if allowed by the Plan)

Disability as determined by the Plan’s fiduciary

Withdrawal of

Withdrawal of Rollover contributions (if allowed by the Plan)

Payment to alternate payee under QDRO (Only Applies to Divorce Proceedings)

Alternate Payee’s SSN # |

Name |

– –

January 2014 |

Page 1 of 28 |

Distribution Request Form - CSC |

SECTION C. Form of Payment For Traditional 401(k) Account - Only choose one of the three options

SECTION C. Form of Payment For Traditional 401(k) Account - Only choose one of the three options

²Option 1 (Rollover) - I am requesting a Direct Rollover of

all or a

partial amount of my Traditional 401(k) account.

¹Partial amount to be rolled over: $___________________

Direct Rollover to: (Select Only One)

_____ AN IRA OFFERED THROUGH Transamerica (Minimum rollover amount is $5,000). If you are interested in the Rollover IRA option

through Transamerica, call (866)

_____ AN ELIGIBLE RETIREMENT PLAN (401(a), 401(k), 403(b), and Governmental 457)

_____ AN IRA

|

NEW ACCOUNT INFORMATION: |

MAILING ADDRESS: |

|

|

|

|

|

|

|

|

|

|

IRA Account Number (Required) / Plan Name |

Name of Trustee or Custodian for the New Plan or IRA |

|

|

|

|

|

|

|

|

|

|

Make Check Payable To: |

Address – Number & Street |

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

²Option 2 (Combination) - I am requesting a distribution of my Traditional 401(k) account to be paid partially to me and partially as a Direct Rollover.

I understand that the portion payable to me may be subject to 20% federal income tax withholding.

Distribute __________% of my Traditional 401(k) account:

____________% of the above paid directly to me, and

____________% of the above applied to the Direct Rollover Account indicated below.

The above two percentages must equal 100%

Direct Rollover to: (Select Only One)

_____ AN IRA OFFERED THROUGH Transamerica (Minimum rollover amount is $5,000). If you are interested in the Rollover IRA option

through Transamerica, call (866)

_____ AN ELIGIBLE RETIREMENT PLAN (401(a), 401(k), 403(b), and Governmental 457)

_____ AN IRA

NEW ACCOUNT INFORMATION: |

MAILING ADDRESS: |

IRA Account Number (Required) / Plan Name |

Name of Trustee or Custodian for the New Plan or IRA |

Make Check Payable To:

Address – Number & Street

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option 3 (Cash) - I am requesting a distribution of |

all or a |

partial amount of my Traditional 401(k) account. I am not electing a Direct |

||

Rollover of any portion of the distribution. I understand the check will be made payable to me and that the portion payable to me may be subject to 20% federal income tax withholding.

¹Partial amount to be paid directly to me: $_____________

¹Actual Value of the distribution may vary based on the final market closing price at the time the distribution is processed, and any applicable processing fees.

PARTIAL DISTRIBUTION AMOUNTS

²DIRECT ROLLOVER

In a Direct Rollover, an eligible rollover distribution is paid from your retirement plan directly to an IRA or your new Employer's 401(a), 401(k), 403(b) or governmental 457 Plan. An IRS Form

January 2014 |

Page 2 of 28 |

Distribution Request Form - CSC |

SECTION D. Form of Payment For A Roth 401(k) Account – Complete only if your plan allows for Roth Contributions. Only choose one of the three options

²Option 1 (Rollover) - I am requesting a Direct Rollover of

all or a

partial amount of my Roth 401(k) account.

¹Partial amount to be rolled over: $___________________

Direct Rollover to: (Select Only One)

_____A ROTH IRA OFFERED THROUGH Transamerica. (Minimum rollover amount is $5,000.) If you are interested in the Rollover IRA

option through Transamerica, call (866)

______A DESIGNATED ROTH ACCOUNT (401(k) or 403(b)) OR ROTH IRA

NEW ACCOUNT INFORMATION: |

MAILING ADDRESS: |

|

|

Roth IRA Account Number (Required) / Plan Name |

Name of Trustee or Custodian for the New Roth 401(k) or Roth IRA |

Make Check Payable To:

Address – Number & Street

City |

State |

Zip Code |

²Option 2 (Combination) - I am requesting a distribution of my Roth 401(k) account to be paid partially to me and partially as a Direct Rollover.

I understand that the portion payable to me may be subject to 20% federal income tax withholding.

Distribute __________% of my Roth 401(k) account:

____________% of the above paid directly to me, and

____________% of the above applied to the Direct Rollover Account indicated below.

The above two percentages must equal 100%

Direct Rollover to: (Select Only One)

_____ A ROTH IRA OFFERED THROUGH Transamerica. (Minimum rollover amount is $5,000.) If you are interested in the Rollover IRA

option through Transamerica, call (866)

_____ A DESIGNATED ROTH ACCOUNT (401(k) or 403(b)) OR ROTH IRA

NEW ACCOUNT INFORMATION: |

MAILING ADDRESS: |

IRA Account Number (Required) / Plan Name |

Name of Trustee or Custodian for the New Plan or IRA |

Make Check Payable To:

Address – Number & Street

|

|

City |

State |

Zip Code |

||

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Option 3 (Cash) - I am requesting a distribution of |

all or a |

partial amount of my Roth 401(k) account. I am not electing a Direct Rollover of |

|||

any portion of the distribution. I understand the check will be made payable to me and that the portion payable to me may be subject to 20% federal income tax withholding.

¹Partial amount to be paid directly to me: $___________

¹Actual Value of the distribution may vary based on the final market closing price at the time the distribution is processed, and any applicable processing fees.

DISTRIBUTION AMOUNTS

²DIRECT ROLLOVER

In a Direct Rollover, an eligible rollover distribution is paid from your retirement plan directly to an IRA or your new Employer's 401(a), 401(k), 403(b) or governmental 457 Plan. An IRS Form

For participants required to take a minimum distribution during the current year that was not satisfied, please note the following: Your required minimum distribution (RMD) for the current year will need to be completed and made payable to you prior to the processing of your direct rollover request.

January 2014 |

Page 3 of 28 |

Distribution Request Form - CSC |

SECTION E. Annuity Request (Not applicable to vested account under $5000 or if your plan does not offer annuities)

Skip this section if you made an election in Section C or D.

By selecting this option your entire account balance will be distributed in order to purchase the annuity

Annuity: If the plan offers annuities as a form of benefit payment, I elect payment as a monthly annuity with payments to commence ___________________.

Upon my death, my spouse’s payments should be _____% (from 50% to 100%) of my payments. My spouse’s date of birth is _________________. Such

annuity will be a Joint and Contingent Survivor Annuity if I am married and a Single Life Annuity if I am not married. I also understand that if I am married, my spouse need not consent to this election if I choose a Qualified Joint and Contingent Survivor Annuity (“QJSA”).

SECTION F. Outstanding Loan Payoff Instructions — Skip this section if you do not have an outstanding loan or are requesting an

One of the following will occur if you have an outstanding loan amount and your reason for a distribution request in Section B is for Termination of Employment, Disability or a Retirement Benefit.

♦Your Loan will be considered paid in full if you have submitted your payment for the outstanding loan amount to your employer or have attached a money order or cashier’s check to this form.

♦Your outstanding loan balance will default and become taxable to you if Transamerica receives this form and your payment has not been received and processed.

SECTION G. Income Tax Withholding

The income tax withholding requirements vary depending on whether or not the distribution requested is an eligible rollover distribution. Please see the attached Special Tax Notice for the definition of eligible rollover distribution and a detailed explanation of the federal income tax withholding rules. If you request a Direct Rollover, no federal income tax will be withheld from the amount directly rolled over.

FEDERAL INCOME TAX

Eligible Rollover Distributions:

•If you request a Direct Rollover, no federal income tax will be withheld from the amount directly rolled over.

•If you request any portion that is an Eligible Rollover Distribution and payable to you: 20% mandatory federal income tax withholding will apply if the taxable amount of the distribution is more than $200 unless paid over 10 or more years.

STATE INCOME TAX

If your address of record is within a mandatory withholding state, state taxes will be withheld from your distribution in accordance with the respective state rules. Other states allow an independent election and in these states, state tax will be withheld unless you elect otherwise. If your state does not allow withholding, no state tax can be withheld. Please consult a tax advisor or Transamerica if you have questions regarding state tax withholding.

Do not withhold state income tax (ONLY IF INDEPENDENT ELECTION IS PERMITTED).

Withhold state income tax:__________% (If your state requires a greater withholding percentage than what you have indicated, the mandatory state

tax will apply).

SECTION H. Spousal Consent

Check with your Employer/Plan Administrator or Summary Plan Description to determine whether your plan is subject to spousal consent requirements. If spousal consent is required, complete this section. If your plan is not subject to spousal consent requirements, skip to Section I. Please note: You must have your spouse’s signature notarized or have a plan representative witness your spouse’s signature if your vested account balance is greater than $5,000 and your plan provides for joint and survivor annuities. However, if your vested account balance is less than $5,000 spousal consent is not required.

Spousal Consent

I, the undersigned spouse of the participant, have read the “Special Tax Notice Regarding Payments From Qualified Plans” provided to me and understand the effects of the waiver. I understand that federal law requires that the retirement benefit of my spouse must be paid under a Qualified Joint and Survivor Annuity Form as described in the attached “Special Tax Notice Regarding Payments From Qualified Plans,” unless I consent otherwise in writing to another benefit form. I hereby consent to the waiver of the annuity and consent to the form of benefit elected by my spouse.

Signature of Participant’s Spouse: |

|

Date: |

||

|

|

|

Statement of Plan Representative or Notary Public |

|

The spouse whose signature I have witnessed is known to me and signed this form in my presence. |

||||

Plan Representative: |

|

|

Date: |

|

Notary Public Signature: |

|

|

Date: |

|

PLACE SEAL HERE (if applicable)

January 2014 |

Page 4 of 28 |

Distribution Request Form - CSC |

SECTION I. Participant Signature

SECTION I. Participant Signature

My signature acknowledges that I have read, understand and agree to all the terms of this Distribution Request form, and affirm that all information that I have provided is true and correct. Further, I acknowledge that I have received the “Special Tax Notice Regarding Payments From Qualified Plans” and other required notices. The above information is true and correct to the best of my knowledge. I further understand that I may revoke this election at any time prior to the distribution taking place.

Signature of Participant |

Date |

PARTICIPANT: RETURN COMPLETED FORM TO YOUR PLAN ADMINISTRATOR FOR PROCESSING

Section J. For Completion by Plan Administrator, Trustee Or Authorized Signer Only

Section J. For Completion by Plan Administrator, Trustee Or Authorized Signer Only

Plan Name

Contract Number |

Sub ID/Division # (if applicable) |

Participant’s SSN # |

– –

Participant’s Termination Date (if applicable):

– –

The Participant is entitled to a vested benefit of% of company matching contributions.

The Participant is entitled to a vested benefit of _______________________% of profit sharing contributions.

The Number of hours worked in the Plan Year of Termination: __________________

Please refer to your Plan Document for the vesting schedule. If this information is not provided, the distribution will be processed with the data in Transamerica’s recordkeeping system.

Is payment of this benefit subject to Plan Termination?

No

Yes

By signing below, I hereby authorize Transamerica to process the distribution described in this form. This request is in compliance with plan provisions.

If spousal consent is not provided, then in accordance with the terms and provisions of the plan and under the current law, spousal consent is not required for payment of the requested benefit.

If this request is for a disability distribution, I certify that the participant meets the requirements of Section 72(m)(7).

Only submit this form after final contributions and loan repayments have been processed for termination distributions

Once this form has been completed with all of the necessary information and required signatures, please forward to the Processing Center. This form cannot be processed without the Plan Administrator, Trustee or Authorized Signer’s signature.

Be sure to keep a copy for your records.

By: Signature of Plan Administrator, Trustee or Authorized Signer |

|

Date |

|

|

|

|

|

Print Name of Plan Administrator, Trustee or Authorized Signer |

|

Date |

|

FOR PLAN ADMINISTRATOR USE ONLY - MAIL TO: 8488 Shepherd Farm Drive, West Chester, OH 45069,Fax #: (877)

January 2014 |

Page 5 of 28 |

Distribution Request Form - CSC |

SPECIAL TAX NOTICE

REGARDING PAYMENTS FROM QUALIFIED PLANS

YOUR ROLLOVER OPTIONS

You are receiving this notice because all or a portion of a payment you are receiving from your Employer’s plan (the "Plan") is eligible to be rolled over to an IRA, a Roth IRA, an employer plan, or a designated Roth account in an employer plan. This notice is intended to help you decide whether to do a rollover.

This notice describes the rollover rules that apply to two types of payments that you may be eligible to receive from the Plan: payments that are from a designated Roth account and payments that are not from a designated Roth account. A designated Roth account is a type of account with special tax rules that is available in some employer plans. If you are eligible to receive payments from the Plan that are from a designated Roth account and payments that are not from such an account, the Plan administrator or the payor will tell you the amount that is being paid from each account.

Rules that apply to most payments from a plan are described in the "General Information About Rollovers" section. In addition, additional rules that apply to most payments from a designated Roth account are described in the "General Information About Rollovers From A Designated Roth Account" section. Special rules that only apply in certain circumstances are described in the "Special Rules and Options" section.

Your Right to Waive the

Generally, neither a Direct Rollover nor a payment can be made from the plan until at least 30 days after your receipt of this notice. Thus, after receiving this notice, you have at least 30 days to consider whether or not to have your withdrawal directly rolled over. If you do not wish to wait until this

GENERAL INFORMATION ABOUT ROLLOVERS

How can a rollover affect my taxes?

You will be taxed on a payment from the Plan if you do not roll it over. If you are under age 59 1/2 and do not do a rollover, you will also have to pay a 10% additional income tax on early distributions (unless an exception applies). However, if you do a rollover, you will not have to pay tax until you receive payments later and the 10% additional income tax will not apply if those payments are made after you are age 59 1/2 (or if an exception applies).

Where may I roll over the payment?

You may roll over the payment to either an IRA (an individual retirement account or individual retirement annuity) or an employer plan (a

January 2014 |

Page 6 of 28 |

Distribution Request Form - CSC |

How do I do a rollover?

There are two ways to do a rollover. You can do either a direct rollover or a

If you do a direct rollover, the Plan will make the payment directly to your IRA or an employer plan. You should contact the IRA sponsor or the administrator of the employer plan for information on how to do a direct rollover.

If you do not do a direct rollover, you may still do a rollover by making a deposit into an IRA or eligible employer plan that will accept it. You will have 60 days after you receive the payment to make the deposit. If you do not do a direct rollover, the Plan is required to withhold 20% of the payment for federal income taxes (up to the amount of cash and property received other than employer stock). This means that, in order to roll over the entire payment in a

How much may I roll over?

If you wish to do a rollover, you may roll over all or part of the amount eligible for rollover. Any payment from the Plan is eligible for rollover, except:

●Certain payments spread over a period of at least 10 years or over your life or life expectancy (or the lives or joint life expectancy of you and your beneficiary)

●Required minimum distributions after age 70 1/2 (or after death)

●Hardship distributions

●ESOP dividends

●Corrective distributions of contributions that exceed tax law limitations

●Loans treated as deemed distributions (for example, loans in default due to missed payments before your employment ends)

●Cost of life insurance paid by the Plan

●Contributions made under special automatic enrollment rules that are withdrawn pursuant to your request within 90 days of enrollment

●Amounts treated as distributed because of a prohibited allocation of S corporation stock under an ESOP (also, there will generally be adverse tax consequences if you roll over a distribution of S corporation stock to an IRA).

The Plan administrator or the payor can tell you what portion of a payment is eligible for rollover.

If I don't do a rollover, will I have to pay the 10% additional income tax on early distributions?

If you are under age 59 1/2, you will have to pay the 10% additional income tax on early distributions for any payment from the Plan (including amounts withheld for income tax) that you do not roll over, unless one of the exceptions listed below applies. This tax is in addition to the regular income tax on the payment not rolled over.

The 10% additional income tax does not apply to the following payments from the Plan:

●Payments made after you separate from service if you will be at least age 55 in the year of the separation

●Payments that start after you separate from service if paid at least annually in equal or close to equal amounts over your life or life expectancy (or the lives or joint life expectancy of you and your beneficiary)

●Payments from a governmental defined benefit pension plan made after you separate from service if you are a public safety employee and you are at least age 50 in the year of the separation

●Payments made due to disability

●Payments after your death

●Payments of ESOP dividends

●Corrective distributions of contributions that exceed tax law limitations

●Cost of life insurance paid by the Plan

●Payments made directly to the government to satisfy a federal tax levy

●Payments made under a qualified domestic relations order (QDRO)

●Payments up to the amount of your deductible medical expenses

●Certain payments made while you are on active duty if you were a member of a reserve component called to duty after September 11, 2001 for more than 179 days

●Payments of certain automatic enrollment contributions requested to be withdrawn within 90 days of the first contribution.

January 2014 |

Page 7 of 28 |

Distribution Request Form - CSC |

If I do a rollover to an IRA, will the 10% additional income tax apply to early distributions from the IRA?

If you receive a payment from an IRA when you are under age 59 1/2, you will have to pay the 10% additional income tax on early distributions from the IRA, unless an exception applies. In general, the exceptions to the 10% additional income tax for early distributions from an IRA are the same as the exceptions listed above for early distributions from a plan. However, there are a few differences for payments from an IRA, including:

●There is no exception for payments after separation from service that are made after age 55.

●The exception for qualified domestic relations orders (QDROs) does not apply (although a special rule applies under which, as part of a divorce or separation agreement, a

●The exception for payments made at least annually in equal or close to equal amounts over a specified period applies without regard to whether you have had a separation from service.

●There are additional exceptions for (1) payments for qualified higher education expenses, (2) payments up to $10,000 used in a qualified

Will I owe State income taxes?

This notice does not describe any State or local income tax rules (including withholding rules).

January 2014 |

Page 8 of 28 |

Distribution Request Form - CSC |

GENERAL INFORMATION ABOUT ROLLOVERS

FROM A DESIGNATED ROTH ACCOUNT

How can a rollover affect my taxes?

If the payment from the Plan is not a qualified distribution and you do not do a rollover to a Roth IRA or a designated Roth account in an employer plan, you will be taxed on the earnings in the payment. If you are under age 59 1/2, a 10% additional income tax on early distributions will also apply to the earnings (unless an exception applies). However, if you do a rollover, you will not have to pay taxes currently on the earnings and you will not have to pay taxes later on payments that are qualified distributions.

If the payment from the Plan is a qualified distribution, you will not be taxed on any part of the payment even if you do not do a rollover. If you do a rollover, you will not be taxed on the amount you roll over and any earnings on the amount you roll over will not be taxed if paid later in a qualified distribution.

A qualified distribution from a designated Roth account in the Plan is a payment made after you are age 59 1/2 (or after your death or disability) and after you have had a designated Roth account in the Plan for at least 5 years. In applying the

Where may I roll over the payment?

You may roll over the payment to either a Roth IRA (a Roth individual retirement account or Roth individual retirement annuity) or a designated Roth account in an employer plan (a

●If you do a rollover to a Roth IRA, all of your Roth IRAs will be considered for purposes of determining whether you have satisfied the

●If you do a rollover to a Roth IRA, you will not be required to take a distribution from the Roth IRA during your lifetime and you must keep track of the aggregate amount of the

●Eligible rollover distributions from a Roth IRA can only be rolled over to another Roth IRA.

January 2014 |

Page 9 of 28 |

Distribution Request Form - CSC |

How do I do a rollover?

There are two ways to do a rollover. You can either do a direct rollover or a

If you do a direct rollover, the Plan will make the payment directly to your Roth IRA or designated Roth account in an employer plan. You should contact the Roth IRA sponsor or the administrator of the employer plan for information on how to do a direct rollover.

If you do not do a direct rollover, you may still do a rollover by making a deposit within 60 days into a Roth IRA, whether the payment is a qualified or nonqualified distribution. In addition, you can do a rollover by making a deposit within 60 days into a designated Roth account in an employer plan if the payment is a nonqualified distribution and the rollover does not exceed the amount of the earnings in the payment. You cannot do a

If you do a direct rollover of only a portion of the amount paid from the Plan and a portion is paid to you, each of the payments will include an allocable portion of the earnings in your designated Roth account.

If you do not do a direct rollover and the payment is not a qualified distribution, the Plan is required to withhold 20% of the earnings for federal income taxes (up to the amount of cash and property received other than employer stock). This means that, in order to roll over the entire payment in a

How much may I roll over?

If you wish to do a rollover, you may roll over all or part of the amount eligible for rollover. Any payment from the Plan is eligible for rollover, except:

●Certain payments spread over a period of at least 10 years or over your life or life expectancy (or the lives or joint life expectancy of you and your beneficiary)

●Required minimum distributions after age 70 1/2 (or after death)

●Hardship distributions

●ESOP dividends

●Corrective distributions of contributions that exceed tax law limitations

●Loans treated as deemed distributions (for example, loans in default due to missed payments before your employment ends)

●Cost of life insurance paid by the Plan

●Contributions made under special automatic enrollment rules that are withdrawn pursuant to your request within 90 days of enrollment

●Amounts treated as distributed because of a prohibited allocation of S corporation stock under an ESOP (also, there will generally be adverse tax consequences if S corporation stock is held by an IRA).

The Plan administrator or the payor can tell you what portion of a payment is eligible for rollover.

January 2014 |

Page 10 of 28 |

Distribution Request Form - CSC |

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The attached IRS Special Tax Notice must be read before completing the Transamerica 401K Withdrawal form. |

| 2 | This form is not to be used for Death Benefit Claim, Required Minimum Distribution, or Hardship Withdrawal Request. |

| 3 | The form requires completion and signatures from the participant and, if applicable, their spouse, as well as from the plan administrator, trustee, or an authorized signer. |

| 4 | Participants must complete Sections A to H, sign at Section I, and then submit to their employer for processing. |

| 5 | The employer must complete and sign Section J and submit the form to the Processing Center. |

| 6 | Mail delivery of distributions requires a street address and may incur express charges if expedited delivery is selected. |

| 7 | Reasons for distribution must be specified in Section B or skipped if the employer checked "plan termination" in Section J. |

| 8 | There are different forms of payment options for Traditional 401(k) and Roth 401(k) accounts, which include direct rollovers, combination of direct rollover and cash, or all cash. |

| 9 | The income tax withholding requirements vary for direct rollovers and eligible rollover distributions, with specific details provided in Section G. |

| 10 | Spousal consent might be required in Section H depending on the plan's provisions and the account balance. |

Instructions on Utilizing Transamerica 401K Withdrawal

Filling out the Transamerica 401K Withdrawal Form is a critical step towards accessing your retirement funds under certain conditions. This process involves several specific instructions that must be followed to ensure your request is processed smoothly and efficiently. Here are the steps you should take to complete the form correctly.

- Section A: Participant Information

- Print your company or employer name, contract number, and social security number.

- Fill in your last name, first name, middle initial, date of birth, and date of hire.

- Provide your email address, street address, apartment number, phone number with extension (if applicable), city, state, and zip code. Indicate your marital status by checking the appropriate box.

- If you prefer to have the check sent via overnight mail, check the respective box and note that a $25.00 charge for express charges will apply, or $50.00 if two checks are required. A street address is necessary for this option.

- Section B: Reason For Distribution Request

- Check the appropriate box for your reason for the distribution request such as termination of employment, retirement, disability, etc. Skip this section if your employer checked off “plan termination” in Section J.

- Sections C & D: Form of Payment For Traditional and Roth 401(k) Account

- Select your preferred form of payment by choosing either a direct rollover, a combination of direct payment and rollover, or cash for both your Traditional and Roth 401(k) accounts. Specify amounts and provide new account information if you selected a rollover.

- Section E: Annuity Request (Skip if not applicable)

- If your plan allows for annuities and your account balance qualifies, select your preferred payment commencement date and, if applicable, specify details for survivor benefits.

- Section F: Outstanding Loan Payoff Instructions (Skip if not applicable)

- Indicate whether you have submitted payment for any outstanding loan amount or attach a money order or cashier’s check if applicable.

- Section G: Income Tax Withholding

- Review the tax withholding requirements and make selections as appropriate for your situation. This includes decisions concerning federal and, if applicable, state income tax.

- Section H: Spousal Consent (Complete only if required by your plan)

- If your plan requires spousal consent for distributions, have your spouse read the Special Tax Notice, understand the waiver implications, and sign in the presence of a notary or plan representative. This section also requires notarization or a plan representative’s witness.

- Section I: Participant Signature

- Sign and date the form to certify that you have read, understood, and agreed to all terms, and that the information provided is accurate. Acknowledge receipt of the Special Tax Notice.

- Section J: For Completion by Plan Administrator

- Submit the completed form to your Plan Administrator for review and signature. Do not mail this form directly to the Processing Center as mentioned.

Once all necessary sections are completed, and the form is signed by both you and your Plan Administrator, the form should be forwarded to the Processing Center as directed by your employer. Always ensure that you keep a copy of the completed form for your records. Following these steps will facilitate a smooth transaction for your 401K withdrawal request.

Obtain Answers on Transamerica 401K Withdrawal

Who needs to complete the Transamerica 401K Withdrawal form?

Individuals who are planning to withdraw funds from their 401K must complete this form. It's important for the plan participant to fill out sections A-H, including spousal consent if married and the plan offers annuities. The form must then be signed by both the participant and the plan administrator, trustee, or an authorized signer before submission.

What reasons qualify for a distribution request on this form?

A distribution request can be made for several reasons, including termination of employment, reaching the age of 59 1/2, retirement, disability as determined by the plan's fiduciary, withdrawal of after-tax contributions, or withdrawal of rollover contributions. Additionally, payments to an alternate payee under a QDRO due to divorce proceedings are also a valid reason for distribution.

What are the options for receiving a distribution?

Distributions can be received in three forms: as a direct rollover to another retirement account, as a combination of a rollover and a cash distribution, or entirely in cash. The choice affects tax implications, with direct rollovers not subjected to federal income tax withholding. Participants must decide based on their financial situation and future plans.

Is spousal consent necessary for this withdrawal?

Spousal consent may be required if the plan participant is married, the vested account balance is greater than $5,000, and the plan offers joint and survivor annuities. The spouse must sign the form in the presence of a notary public or plan representative, waiving their right to have benefits paid under a Qualified Joint and Survivor Annuity format.

What happens if there is an outstanding loan?

If there's an outstanding loan, participants must either submit payment for the outstanding amount to their employer or attach a money order or cashier's check with their withdrawal form. Failure to do this will result in the outstanding loan balance being defaulted and taxed.

How are taxes handled on these withdrawals?

Tax withholding on distributions depends on whether the withdrawal is an eligible rollover distribution. Direct rollovers are not subject to federal income tax withholding. For cash distributions or combinations, 20% federal income tax withholding applies. State income tax withholding varies based on the participant's residency and state laws.

How should the form be submitted?

After completing the relevant sections and obtaining the necessary signatures, the form must be submitted to the employer for processing. It's crucial not to mail this form directly to the Processing Center. The employer will then forward the completed form to the Processing Center for the distribution to be processed.

Common mistakes

-

Failing to review the attached IRS Special Tax Notice and annuity explanations, if applicable. Before completing the Transamerica 401K Withdrawal form, participants should carefully review the IRS Special Tax Notice and, if their plan allows for an annuity option, the written explanation of the Qualified Joint and 50% Contingent Survivor Annuity form of benefit. This information is vital for making informed decisions regarding distribution options and understanding the tax implications.

-

Omitting necessary signatures and not submitting to the correct entity. The form must be completed and signed by the participant, their spouse (if married and plan allows for annuities), and the plan administrator, trustee, or an authorized signer. Also, it's crucial not to mail this form directly to the Processing Center; instead, it should be submitted to the employer for signature and processing.

-

Incorrectly completing or skipping the reason for distribution request in Section B. Participants should mark the specific reason for their distribution request. Overlooking this section or failing to provide a clear reason can delay processing.

-

Choosing the wrong form of payment or not providing necessary new account information for a rollover. In Sections C and D, participants need to select only one payment option and, if opting for a Direct Rollover, provide all requested details for the new account, including the IRA account number and the name of the trustee or custodian for the new plan or IRA.

-

Not adhering to spousal consent requirements in Section H, when applicable. If a participant's plan is subject to spousal consent requirements and their vested account balance is greater than $5,000, failure to have the spouse's signature notarized or witnessed by a plan representative can invalidate the request.

-

Incomplete or inaccurate participant information in Section A. Providing incorrect or incomplete participant information, such as the wrong social security number, date of birth, or contact details, can lead to significant delays in the processing of the withdrawal request.

-

Neglecting to address outstanding loans in Section F, if applicable. Participants with outstanding loan amounts must provide clear instructions on how these should be handled as part of their distribution. Overlooking this step can result in unintended tax consequences or impact the amount received.

Documents used along the form

When handling a Transamerica 401K withdrawal form, there are several other documents and forms that you might need to complete the withdrawal process properly. These documents ensure the withdrawal process aligns with legal, tax, and personal requirements. Understanding the purpose and detail of each is beneficial for smooth processing.

- IRS Special Tax Notice: This document provides detailed information about the tax implications of your distribution. It helps understand the taxes you might owe and any exceptions that could apply to your situation.

- Plan Administrator Approval Form: Usually, the withdrawal process requires an approval or signature from your plan administrator. This form is their way of documenting and confirming the withdrawal request.

- Beneficiary Designation Form: In case of a death benefit claim, this form outlines who the beneficiaries of the account are and what portion of the account they are entitled to.

- Qualified Domestic Relations Order (QDRO): For those going through a divorce, this legal document determines how retirement benefits should be divided between spouses. It’s necessary if you're using the withdrawal for alimony or marital property rights.

- Loan Application or Agreement Form: If you have an outstanding loan from your 401(k), this form outlines the terms of the loan and repayment. It’s needed if you plan to pay off the loan with part of your withdrawal.

- Spousal Consent Form: Depending on your plan and state laws, if you are married, you might need your spouse to sign off on your withdrawal, especially if you're choosing a payment option other than a joint survivor annuity.

- Direct Rollover Request Form: If you plan to move your distribution directly to another retirement account, this form helps facilitate the transfer without incurring immediate taxes.

Each of these documents plays a crucial role in ensuring that your withdrawal request is handled accurately and efficiently. Depending on your specific situation and the rules of your 401K plan, not all of these documents may be necessary. However, being familiar with them and prepared with the correct information can streamline the process and prevent any unnecessary delays.

Similar forms

IRA Contribution Form: Similar to the Transamerica 401K Withdrawal form, an IRA Contribution Form involves retirement savings and requires the individual's personal information, contribution details, and potentially spousal consent depending on the type of IRA and marital status. Both forms play crucial roles in managing retirement funds.

Beneficiary Designation Form: These forms capture critical participant information, such as name, social security number, and marital status, much like the Transamerica form does in Section A. Additionally, both documents may necessitate spousal consent if the retirement plan or policy stipulates this requirement for certain decisions.

Loan Application Form for 401(k) or 403(b) plans: Similarities include the need for detailed participant information and consideration of spousal consent. Both forms may deal with the impact of loans on retirement balances, although the Transamerica 401K Withdrawal form specifically excludes this scenario in its introduction.

Qualified Domestic Relations Order (QDRO) Distribution Form: This form, like the Transamerica Withdrawal Form, requires detailed participant information, can involve direct rollovers to retirement accounts, and may entail interactions with spousal consent in the context of divorce proceedings.

Hardship Withdrawal Request Form: Although specifically excluded from use in place of the Transamerica form, it shares several components, such as requiring participant information, detailing the reason for the distribution, and understanding tax implications. Both forms scrutinize the legitimacy of the withdrawal request based on qualifying criteria.

Required Minimum Distribution (RMD) Form: It also gathers comprehensive participant information and discusses the tax withholding requirements for distributions, similar to the warnings and instructions provided in the Transamerica document regarding tax implications of distributions.

Annuity Election Form: The annuity section of the Transamerica form is akin to a standalone annuity election form that an individual might use to select annuity payment options upon retirement. Both require detailed information about the participant and their chosen form of benefit payment.

Change of Address Form for Retirement Accounts: While focused on a different aspect of account management, this form requires similar personal identification details as found in Section A of the Transamerica form. Both forms are integral to ensuring the accurate administration of retirement benefits.

Dos and Don'ts

Filling out the Transamerica 401K Withdrawal form is an important process that requires attention to detail. To ensure you complete the form correctly and efficiently, here are 10 dos and don’ts to keep in mind:

- Do read the attached IRS Special Tax Notice and any information about annuity options provided before completing the form.

- Do complete all relevant sections (A-H) fully and accurately. If you do not have a Roth 401(k) Account, remember to skip Section D.

- Do ensure your signature, and if applicable, your spouse's signature, is on Section I. Spousal consent is required in Section H if your plan offers annuities and you are married.

- Do submit the completed form to your employer for their signature and processing rather than mailing it directly to the Processing Center.

- Do check the correct box in Section B that matches your reason for the distribution request.

- Do clearly indicate your choice of payment form in Sections C and D for Traditional and Roth 401(k) accounts, respectively.

- Do provide detailed information for a Direct Rollover if that option is chosen, including the new account's mailing address and IRA account number.

- Do carefully consider the implications of choosing between a direct rollover, a partial distribution, or a cash option, as these choices can have significant tax implications.

- Do Not leave any required fields incomplete or provide inaccurate information as this can delay the processing of your distribution.

- Do Not use this form for situations that are not applicable, such as Death Benefit Claim, Required Minimum Distribution, or Hardship Withdrawal Request, as stated at the beginning of the form.

By following these guidelines, you can help ensure that your distribution request is processed smoothly and efficiently.

Misconceptions

Many individuals have misconceptions about the Transamerica 401K Withdrawal form, which may lead to confusion or misunderstandings. Below are eight common misconceptions and explanations to clarify them:

- Only for Hardship Withdrawals: People often believe the Transamerica 401K Withdrawal form is solely for hardship withdrawals. However, this form is not used for hardship withdrawals, death benefit claims, or required minimum distributions, indicating it has broader applications.

- Spousal Consent Always Required: It is a misconception that spousal consent is always necessary. The requirement for spousal consent depends on the plan’s stipulations and the vested account balance. If the vested account is less than $5,000, or the plan does not provide for joint and survivor annuities, spousal consent may not be mandated.

- Can Submit Directly to Processing Center: A common misunderstanding is that participants can submit the form directly to the processing center. In reality, the form must be submitted to the participant’s employer for processing, highlighting the importance of following the correct submission route.

- All Distributions Subject to 20% Federal Tax Withholding: People often think all distributions are automatically subject to a 20% federal income tax withholding. However, tax withholding varies based on the type of distribution and if the distribution is an eligible rollover distribution, no federal income tax will be withheld if directly rolled over.

- No Options for Direct Rollover: Some are under the impression that there are no options for a direct rollover. Yet, the form clearly provides options for direct rollovers to IRAs or other eligible retirement plans, allowing for tax-efficient management of retirement funds.

- Immediate Processing of Requests: The assumption that distribution requests are processed immediately upon submission is incorrect. Missing or incomplete information can delay processing, necessitating a new form submission or the provision of additional information.

- Annuities Not Offered: There’s a false belief that the plan does not offer annuities. The form specifies that if the plan allows for an annuity option and your account balance is sufficient, you can elect to receive your distribution as an annuity.

- Withdrawals Limited to Financial Hardship: It's mistakenly thought that withdrawals are limited to cases of financial hardship. While the form excludes hardship withdrawals, it mentions various other reasons for distribution, such as termination of employment, retirement, and reaching age 59 1/2, offering broader access to funds.

It is crucial for individuals to read and understand the specific instructions and options provided in the Transamerica 401K Withdrawal form to ensure accurate and compliant requests for distributions. Accurate knowledge can help in making informed decisions regarding retirement funds.

Key takeaways

Understanding how to properly fill out the Transamerica 401K Withdrawal Form is crucial for anyone looking to access their retirement funds. Below are four key takeaways from the guidelines provided with the form:

- Before completing the form, it is essential that participants read the attached IRS Special Tax Notice and, if applicable, the explanation of the Qualified Joint and 50% Contingent Survivor Annuity form of benefit. This will ensure that individuals are fully informed about the potential tax implications and rules surrounding annuity options.

- The withdrawal form requires detailed information, including sections that must be filled out by both the participant and the employer or plan administrator. The form must be completed and signed by the participant, their spouse (if married and if the plan allows for annuities), and an authorized individual from the employer or plan administrator's office. Incomplete information or missing signatures could lead to delays or the need to submit a new form.

- Participants looking to withdraw funds have multiple distribution options, including direct rollovers to another retirement plan, combination distributions, and cash outs. Each option has specific tax implications and requirements outlined in the form. For instance, direct rollovers can help avoid immediate income taxes, while cash distributions are subject to 20% federal withholding.

- Spousal consent may be necessary if the account holder is married and the plan provides for joint and survivor annuities. This section of the form requires notarization or a witness by a plan representative to verify the spouse’s consent, underscoring the importance of understanding how the withdrawal will affect spousal benefits.

These takeaways highlight the importance of thoroughly reviewing and accurately completing the Transamerica 401K Withdrawal Form. Each section of the form, from participant information to spousal consent, plays a critical role in ensuring that the withdrawal process is executed in accordance with IRS regulations and plan rules. Additionally, understanding the various payment options and their respective tax implications can help participants make informed decisions about their retirement funds.

Popular PDF Forms

Costco Cake Order Form - Addresses common queries within a FAQ section, streamlining the ordering process for both new and returning clients.

Va Form 21p-509 - Key for veterans to officially declare financial support given to their parents.