Blank Trip Sheet PDF Template

In the world of commercial transportation, efficient tracking and reporting of vehicle mileage and fuel consumption are fundamental. Here, the Trip Sheet form plays a vital role, serving as a comprehensive document that captures all necessary data associated with each journey a vehicle makes. By meticulously recording aspects such as the beginning and ending odometer readings, jurisdiction miles, fuel purchases, trip origins, and destinations, along with the routes traveled, this form provides a detailed account of the vehicle's operations. The inclusion of monthly and quarterly totals offers a structured overview, facilitating not only internal record-keeping but also compliance with regulatory requirements. This form is essential for companies looking to maintain accurate records for operational analysis, financial planning, and auditing purposes. Beyond its practical utility, the Trip Sheet form symbolizes the intersection of diligent fleet management and regulatory adherence, highlighting the importance of meticulous record-keeping in the transportation industry.

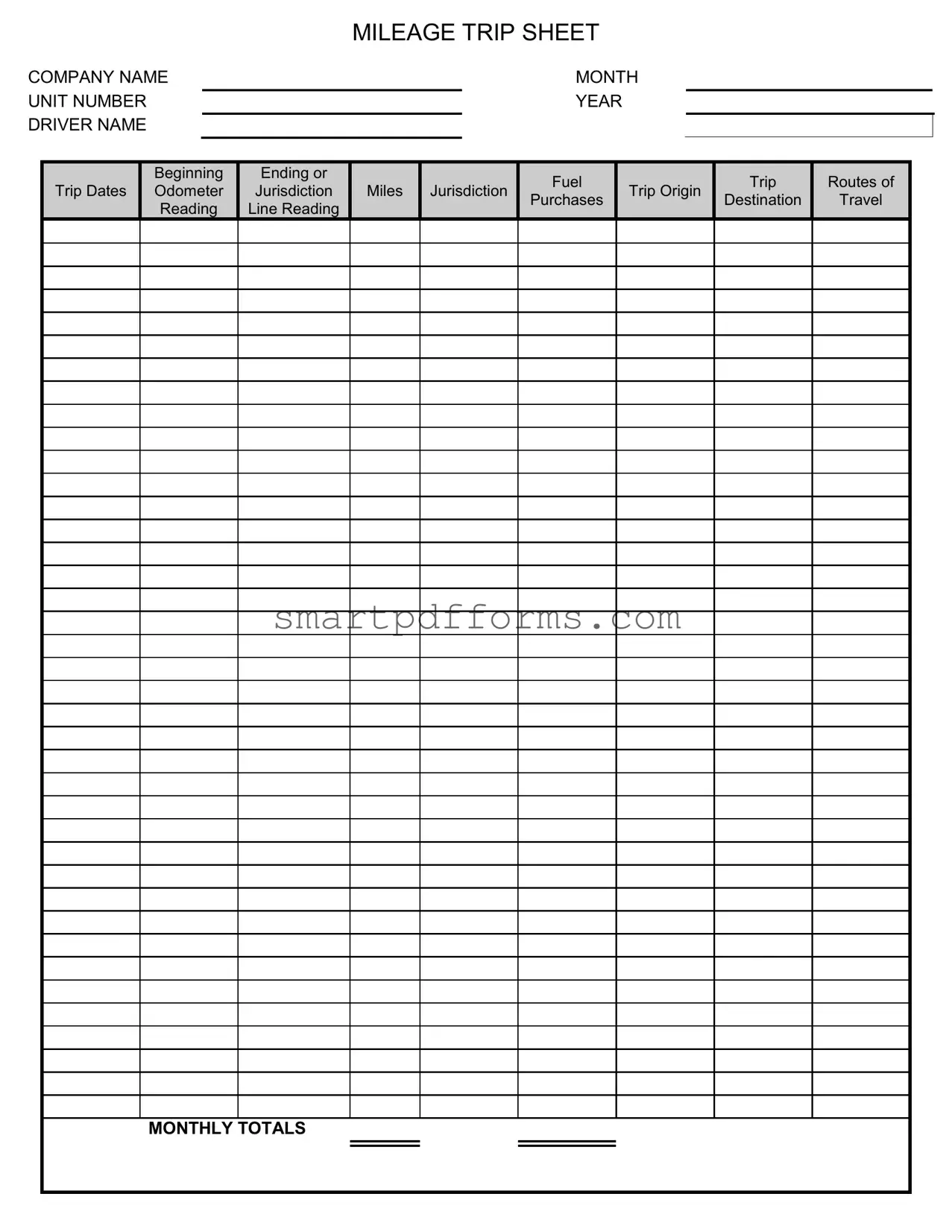

Preview - Trip Sheet Form

MILEAGE TRIP SHEET

COMPANY NAME

UNIT NUMBER

DRIVER NAME

|

|

Beginning |

|

Ending or |

|

|

|

|

|

|

Trip Dates |

Odometer |

|

Jurisdiction |

|

|

Miles |

|

Jurisdiction |

|

|

Reading |

|

Line Reading |

|

|

|

|

|

MONTH

YEAR

Fuel

Trip Origin

Purchases

Trip

Destination

Routes of

Travel

MONTHLY TOTALS

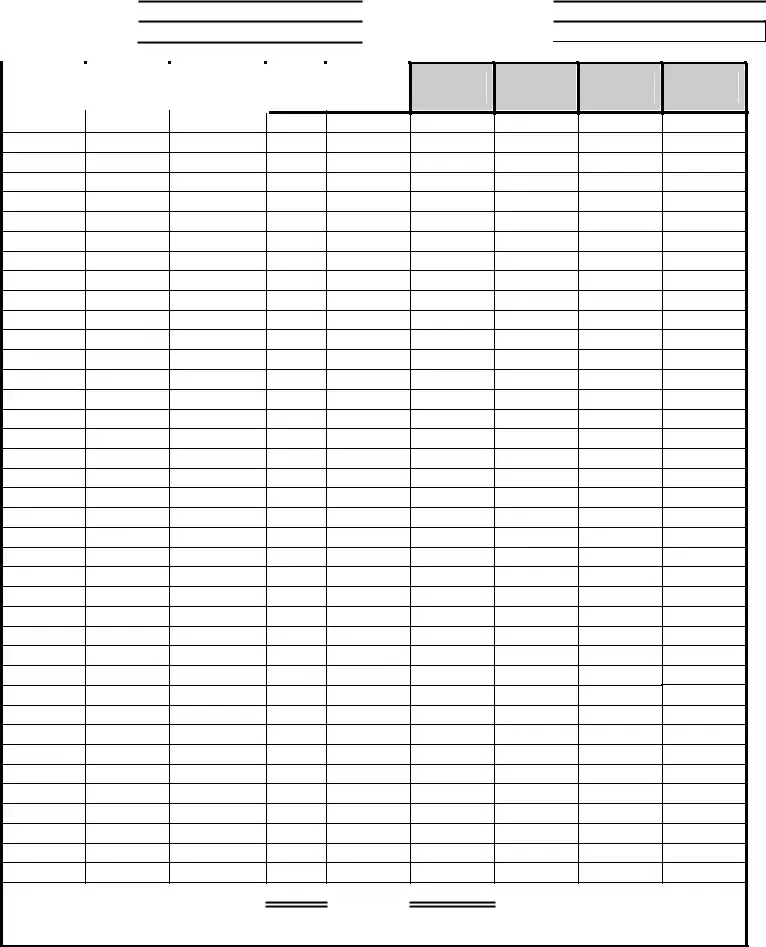

MILEAGE SUMMARY

COMPANY NAME

UNIT NUMBER

Month |

Unit # |

Beginning |

Ending |

Total |

AR |

_____ |

_____ |

_____ |

_____ |

|

Reading |

Reading |

Miles |

Miles |

Miles |

Miles |

Miles |

Miles |

|||

|

|

MONTHLY TOTALS:

MONTHLY TOTALS:

MONTHLY TOTALS

QUARTER TOTALS:

Form Data

| Fact Name | Detail |

|---|---|

| Form Purpose | Used to track mileage and fuel purchases for commercial vehicles. |

| Key Components | Company Name, Unit Number, Driver Name, Date, Mileage, Fuel Purchases, Trip Origin and Destination, Routes of Travel. |

| Usage | Essential for regulatory compliance, IFTA reports, and cost management. |

| Data Collection | Collects detailed trip information including jurisdiction miles and fuel consumption. |

| Documentation | Provides a comprehensive record of travel and expenses for auditing purposes. |

| Governing Laws | Must comply with the International Fuel Tax Agreement (IFTA) and applicable state laws. |

| Report Summary | Includes monthly and quarterly totals for miles driven and fuel purchased. |

Instructions on Utilizing Trip Sheet

After completing a journey, drivers or transport coordinators often need to account for the travel details. This process is streamlined with the Trip Sheet form, which ensures all relevant trip information is neatly compiled and accessible. This form captures details such as mileage, fuel purchases, and routes taken. It serves as a valuable record for both reimbursement and regulatory compliance purposes. The steps below guide you through the process of filling it out correctly.

- Start by entering the COMPANY NAME at the top of the form to identify the business or organization undertaking the trip.

- Fill in the UNIT NUMBER, which is the identifier for the vehicle used during the trip.

- Input the DRIVER NAME to document who was responsible for the vehicle during the travel period.

- Specify the Beginning and Ending or Trip Dates to establish the duration of the trip.

- Under Odometer Reading, record both the starting and ending readings to calculate the total miles driven.

- In the Jurisdiction Miles section, detail the miles traveled within each jurisdiction if the trip covered multiple areas.

- For each segment of the journey, note the Line Reading to keep track of distance covered between stops or checkpoints.

- Under MONTH and YEAR, enter the applicable time frame for the trip to categorize the record appropriately.

- Document any Fuel Purchases made during the trip, including the amount and location of purchase.

- Fill in both the Trip Origin and Trip Destination fields to note where the journey started and ended.

- Describe the Routes of Travel, specifying major roads or highways used, to provide a thorough travel log.

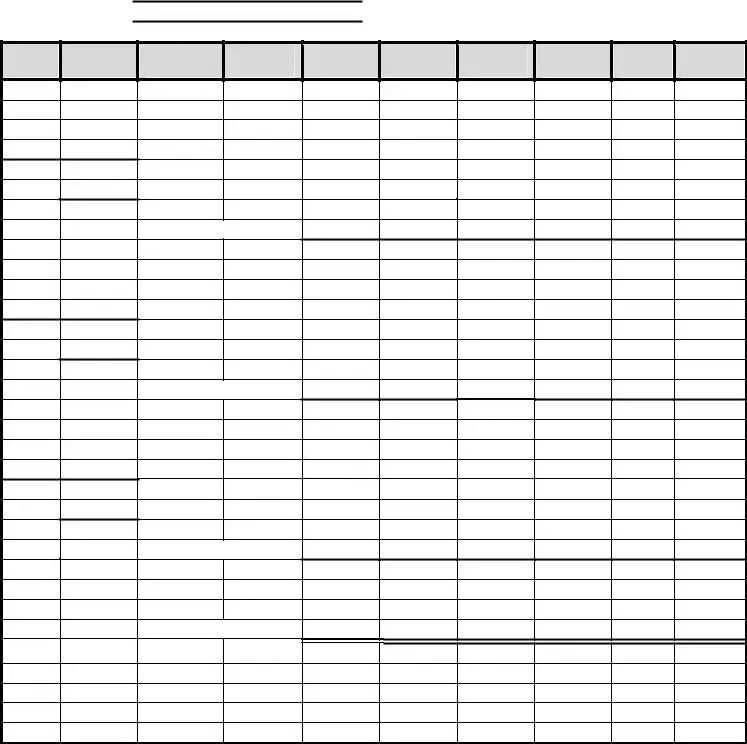

- In the MONTHLY TOTALS section, sum all the relevant miles and details for the month to consolidate the data.

- Lastly, compile the MILEAGE SUMMARY with beginning and ending readings and total miles for the month and quarter, if applicable, to finalize the form.

Once completed, the Trip Sheet form offers a comprehensive overview of the journey, ensuring all necessary information is recorded for future reference or analysis. This document then goes on to serve various organizational needs, from financial reimbursement to efficiency improvements in logistics planning.

Obtain Answers on Trip Sheet

-

What is a Trip Sheet form used for?

A Trip Sheet form is a document designed to record detailed information about vehicle trips made by drivers on behalf of a company. It tracks data such as mileage, dates, fuel purchases, trip origin and destination, and the routes traveled. This form is essential for companies to manage expenses, maintain accurate records for billing and reimbursements, and comply with jurisdictional reporting requirements for commercial vehicles.

-

How do I fill out the beginning and ending odometer readings?

To fill out these sections, note the odometer reading at the start of the trip and once again at the end. These readings help calculate the total miles driven for each trip accurately. It's crucial to ensure these readings are precise for mileage tracking and reporting purposes.

-

What should I include in the 'Jurisdiction' section?

In the 'Jurisdiction' section, list the states or regions through which the trip passes. This information is vital for tax purposes and for fulfilling state-specific reporting requirements related to commercial vehicle operations.

-

How do I record fuel purchases?

Under the 'Fuel Purchases' section, include all fuel purchases made during the trip. Record the date, location, amount of fuel bought, and the cost. Maintain detailed and accurate records; these are important for tax deductions and for tracking the vehicle’s fuel efficiency.

-

Can you explain how to document trip origin and destination?

In the fields for 'Trip Origin' and 'Trip Destination', precisely note down where each trip started and ended. This could be a city, a street address, or any significant landmark. This information is critical for analyzing trip lengths, planning efficient routes, and calculating travel expenses.

-

What details are needed in the 'Routes of Travel' section?

In this section, include the primary routes or highways taken during the trip. Detailing the routes of travel helps in assessing the efficiency of the path chosen and may also be necessary for jurisdictional reporting and auditing purposes.

-

How is the 'Monthly Totals' section used?

The 'Monthly Totals' section is for summarizing all trips made within a month. Here, consolidate the total miles driven, fuel purchased, and any other relevant monthly totals. This summary provides an overview of the vehicle's monthly usage and costs, aiding in budgeting and managerial oversight.

-

When should I update the Trip Sheet form?

Update the Trip Sheet form after each trip or at the end of each day, depending on your company’s policy. Regular updates ensure that the information remains current and accurate, facilitating timely reporting and decision-making.

Common mistakes

Accurately completing a Trip Sheet form is essential for several reasons, including ensuring accurate payment and maintaining compliance with legal and regulatory requirements. However, individuals often make mistakes when filling out these forms. Here are some of the common errors:

Not double-checking odometer readings: The beginning and ending odometer readings must accurately reflect the distance traveled. Errors in these figures can significantly impact mileage calculations.

Incorrectly listing jurisdiction miles: Each jurisdiction in which the vehicle travels should have the miles traveled recorded accurately. Misreporting can lead to compliance issues and incorrect fuel tax reporting.

Failing to provide detailed trip origin and destination information: Specific details about trip origins and destinations are often overlooked, leading to incomplete trip records.

Omitting fuel purchase records: All fuel purchases must be recorded, including the amount and location of purchase. Forgetting this information can affect fuel tax credits and rebates.

Not documenting routes of travel: Indicating the routes traveled is vital for verifying the accuracy of mileage and jurisdiction reporting, yet it’s frequently missing or inaccurately noted.

Skip recording MONTHLY and QUARTER TOTALS: These totals are critical for summaries and reviews, but are often miscalculated or overlooked.

Misreporting unit number and driver name: The unit number and driver name should match the records; discrepancies can cause issues with tracking and accountability.

Incorrectly calculating total miles: Total miles should be the sum of all jurisdiction miles plus any unlogged miles; errors here affect fuel tax calculations and operational expenses.

Neglecting to review the entire form for errors before submission: It's crucial to review all entries for accuracy, yet many individuals submit forms with unchecked mistakes.

To prevent these issues, it’s recommended to:

Verify all odometer readings and manually calculate mileage to ensure accuracy.

Diligently record each segment of the trip, including origins, destinations, and routes taken, to provide a clear and accurate travel log.

Keep detailed receipts and logs of fuel purchases and cross-reference these with trip records.

Regularly review and reconcile trip sheets with other operational documents to catch and correct errors promptly.

By addressing these common mistakes, drivers and fleet managers can ensure that Trip Sheets are filled out accurately and comprehensively, thereby supporting effective operations and compliance with regulatory requirements.

Documents used along the form

In the busy world of logistics and transportation, a Trip Sheet form is crucial for tracking the miles driven, fuel purchases, and the journey details for each trip. However, this document does not live in isolation; it is often accompanied by a variety of other forms and documents that play vital roles in ensuring smooth operations, compliance with regulations, and efficient fleet management. These additional documents help to provide a comprehensive view of the transportation activity, necessary for both operational efficiency and regulatory compliance.

- Vehicle Maintenance Log: This document tracks the maintenance history of each vehicle in the fleet. It includes information on regular check-ups, repairs, parts replacements, and servicing dates. This log is essential for ensuring that vehicles are in optimal condition, which helps to prevent breakdowns and extend the lifespan of the fleet.

- Fuel Log: Separate from the brief fuel purchase entries in the Trip Sheet, a detailed Fuel Log includes comprehensive records of all fuel transactions, including date, location, amount of fuel purchased, and cost. This document is critical for monitoring fuel efficiency and costs, and it can also be used for tax reporting purposes.

- Driver Log Book: This document records the hours a driver has worked, including driving hours and rest periods. It is vital for compliance with regulations regarding maximum driving times and mandatory rest periods to ensure driver safety and health.

- Incident Report Forms: Whenever there is an accident, near-miss, or any other safety-related incident, an Incident Report Form is filled out. It contains details of the event, including what happened, the parties involved, and any damages or injuries. These reports are crucial for insurance claims, regulatory compliance, and for implementing measures to prevent future incidents.

- Delivery and Cargo Manifests: These documents provide detailed descriptions of the goods being transported, including the type, quantity, and destination of the cargo. They are essential for inventory management, ensuring the correct loading and unloading of cargo, and for compliance with shipping and customs regulations.

The combination of these documents with the Trip Sheet form creates a robust framework for managing the details of transportation and logistics operations. Maintaining accurate and up-to-date records across these documents not only helps in operational efficiency but also in adhering to legal requirements and optimizing overall fleet performance. Together, they form the backbone of documentation necessary for a streamlined and compliant transportation operation.

Similar forms

Log Book Pages: Trip Sheets and Log Book Pages share a strong similarity as both are essential for documenting the specifics of each journey a driver makes. Such documentation includes start and end times, locations, mileage, and fuel consumption, crucial for compliance with regulatory tracking requirements.

Fuel Tax Reports: These reports, like Trip Sheets, meticulously record fuel purchases by jurisdiction to manage and report fuel taxes accurately. The detailed tracking of mileage and fuel purchases across different jurisdictions found in Trip Sheets assists in compiling precise Fuel Tax Reports.

Vehicle Maintenance Records: While focusing on different aspects, both these forms document specific details about a vehicle's use over time. Trip Sheets record the journey's operational aspects, while Maintenance Records track service history, repairs, and maintenance schedules, helping manage a vehicle's life cycle and efficiency on the road.

Expense Reports: Similar to Trip Sheets, Expense Reports are used to track and report costs incurred during business operations. Trip Sheets track specific travel-related expenses such as fuel, whereas Expense Reports cover a broader range of expenses, including lodging, meals, and other travel-related costs.

Driver’s Daily Logs: Both documents serve the purpose of recording the daily operations of commercial vehicles. Driver’s Daily Logs specifically focus on hours of service compliance, detailing a driver's work hours, rest periods, and on-duty times, in addition to the route information found in Trip Sheets.

Mileage Reimbursement Forms: These forms, comparable to Trip Sheets, are used for calculating and requesting reimbursement for miles traveled using a personal vehicle for business purposes. Both documents necessitate precise distance tracking to support their respective financial processes.

Dispatch Reports: Trip Sheets and Dispatch Reports both play a critical role in the logistical planning and execution of transport operations. While Trip Sheets record the specifics of each trip made, Dispatch Reports organize and assign loads, schedules, and route information in advance, ensuring efficient fleet management.

Freight Billing Statements: Similar in their financial orientation, both documents are integral to the economics of transport operations. Trip Sheets provide the necessary journey details that form the basis of Freight Billing Statements, which then itemize charges for the transport services provided, including mileage and fuel costs.

Delivery Schedules: These schedules and Trip Sheets both contribute to managing and documenting the timing and routing of shipments. While Delivery Schedules project the planned timing and routes for shipments, Trip Sheets record actual journey data, assisting in analyzing efficiency and punctuality.

Dos and Don'ts

When it comes to filling out the Trip Sheet form, being accurate and attentive can save you a lot of hassle down the line. Filling out this form accurately is crucial for ensuring proper mileage tracking, fuel tax reporting, and compliance with legal requirements. Here are seven dos and don'ts to keep in mind:

- Do double-check your vehicle's odometer readings at the start and end of each trip. This ensures the mileage is accurately captured.

- Do record all fuel purchases meticulously, including the date, amount, and jurisdiction. This information is critical for fuel tax calculations.

- Do note the trip origin and destination accurately. Providing clear addresses or locations helps in documenting the trip's purpose and routes.

- Do list all jurisdictions traveled. This is necessary for determining tax obligations in different states or territories.

- Don't rush through filling out the form. Taking your time to fill out each field correctly can prevent errors and potential legal issues.

- Don't guess any information. If you're unsure about a particular entry, verify the information before submitting the form. Guessing can lead to inaccuracies and potential fines.

- Don't overlook the importance of recording the month and year, as well as the unit number and driver name. This information is essential for record-keeping and identifying specific trips and vehicles.

Taking the time to fill out the Trip Sheet form correctly is not just about staying compliant; it's also about maintaining an accurate log of your travels for financial and operational efficiency. Keep these tips in mind, and you'll find the process smoother and more straightforward.

Misconceptions

There are several common misconceptions about the Trip Sheet form that require clarification. This document is essential for tracking mileage and fuel usage for transportation businesses. Understanding these misconceptions can help ensure accurate and efficient use of the form.

- Misconception 1: The Trip Sheet is only for large trucking companies.

This is not true. Any business, regardless of size, that uses vehicles for business purposes can benefit from maintaining Trip Sheets. They help with monitoring fuel efficiency and optimizing routes.

- Misconception 2: Digital Trip Sheets are not as reliable as paper forms.

In fact, digital Trip Sheets can offer greater accuracy and easier storage. They reduce the risk of losing information and simplify the process of calculating totals.

- Misconception 3: The Trip Sheet form is too complicated to fill out.

While the form contains several sections, each serves a specific purpose. With proper guidance, understanding how to complete each section becomes straightforward.

- Misconception 4: All the information on the Trip Sheet is related to mileage only.

Though mileage is a significant component, the form also tracks fuel purchases, routes of travel, and trip origins and destinations. This comprehensive data collection is crucial for operational and financial analysis.

- Misconception 5: There's no need to fill in the ‘Jurisdiction Miles’ if you don't cross state lines.

Even if your routes are within a single state, accurately recording jurisdiction miles is essential for local tax and reporting requirements.

- Misconception 6: Monthly totals are sufficient for reporting purposes.

Detailed entries, including trip dates and odometer readings, provide vital information for audits and operational reviews. This level of detail surpasses the insights gleaned from monthly summaries alone.

- Misconception 7: The Trip Sheet is only important for tax season.

Although it is essential for tax preparation, the Trip Sheet's utility extends to daily operations, planning, and performance evaluation throughout the year.

- Misconception 8: If you miss recording a trip, it's not a big deal.

Every trip contributes to the total mileage and fuel usage records. Omitting trips can lead to inaccuracies in expense tracking, tax reporting, and operational analysis.

- Misconception 9: The driver is the only person who needs to understand how to complete the Trip Sheet.

While drivers are responsible for recording data, administrative staff should also understand the form. This ensures accurate data entry and aids in cross-checking information for consistency.

- Misconception 10: The Trip Sheet form doesn't need to be updated regularly.

Regular updates ensure that the information reflects current operations. It's beneficial to review and revise the form to suit evolving business needs and compliance requirements.

Clarifying these misconceptions can dramatically improve the accuracy and utility of the Trip Sheet form for businesses that utilize vehicles for transportation purposes. This, in turn, can lead to better management decisions and compliance with legal and operational standards.

Key takeaways

Understanding how to properly fill out and utilize a Trip Sheet form is critical for accurate mileage and fuel tracking. Below are key takeaways to guide you through this process:

- Ensure the company name and unit number are accurately filled out to properly identify the vehicle within your fleet.

- The driver name should be clearly written to attribute the mileage and fuel data to the correct individual.

- Recording the beginning and ending odometer readings, along with the dates of the trip, offers a clear scope of the trip's duration and distance.

- When entering odometer readings, ensure to note any discrepancies or maintenance that may affect the accuracy of the readings.

- Jurisdiction miles are important for tax purposes and should reflect the miles traveled within each state or jurisdiction accurately.

- List all fuel purchases, including the date and location, to track fuel efficiency and costs.

- Accurately describe the trip origin and destination, as these details can be relevant for auditing and route optimization.

- Documenting the routes of travel helps in analyzing the most efficient paths and can be used for future planning.

- The monthly totals section is critical for summarizing the trip's overall metrics, such as total miles driven and total fuel purchased.

- Quarter totals provide a broader view of vehicle usage and expenses, important for budgeting and tax purposes.

By following these guidelines, individuals can ensure that the Trip Sheet form is filled out comprehensively and accurately, facilitating effective fleet management and regulatory compliance.

Popular PDF Forms

Florida Lottery Claim - Specifies the acceptable forms of identification needed to accompany the claim, ensuring the claimant's identity.

Bsa 680 001 - An extensive checklist covers a variety of health conditions, ensuring comprehensive evaluation and discussion of any potential risks.