Blank Truck Driver Expenses Worksheet PDF Template

For long haul and overnight truck drivers, the navigation through tax season is made significantly less arduous with the utilization of a comprehensive Truck Driver Expenses Worksheet form. This meticulously designed form serves a quintessential role in streamlining the organization of tax-deductible business expenses, ensuring that drivers do not miss out on any allowable deductions that can maximize their returns. It emphasizes the criterion for deductions, noting that expenses must be both "ordinary and necessary" within the driving profession to qualify. Drivers are cautioned against including any expenses reimbursed or covered under an employer's plan, as the deductibility of employee business expenses hinges on the process of itemizing deductions—a benefit that becomes tangible only when the sum of all miscellaneous itemized deductions surpasses 2% of the individual's adjusted gross income (AGI). From professional permits, travel expenses, to day-to-day necessities like meals or uniforms, the form covers a wide array of expenditures. In addition, it provides space for drivers to include any other pertinent expenses not pre-listed, ensuring a comprehensive capture of all potential deductions. The worksheet not only facilitates tax preparation but also underscores H&R Block's commitment through their Advantage document to enhancing clients' tax and financial situations by providing valuable insights and information in alliance with other trusted sources.

Preview - Truck Driver Expenses Worksheet Form

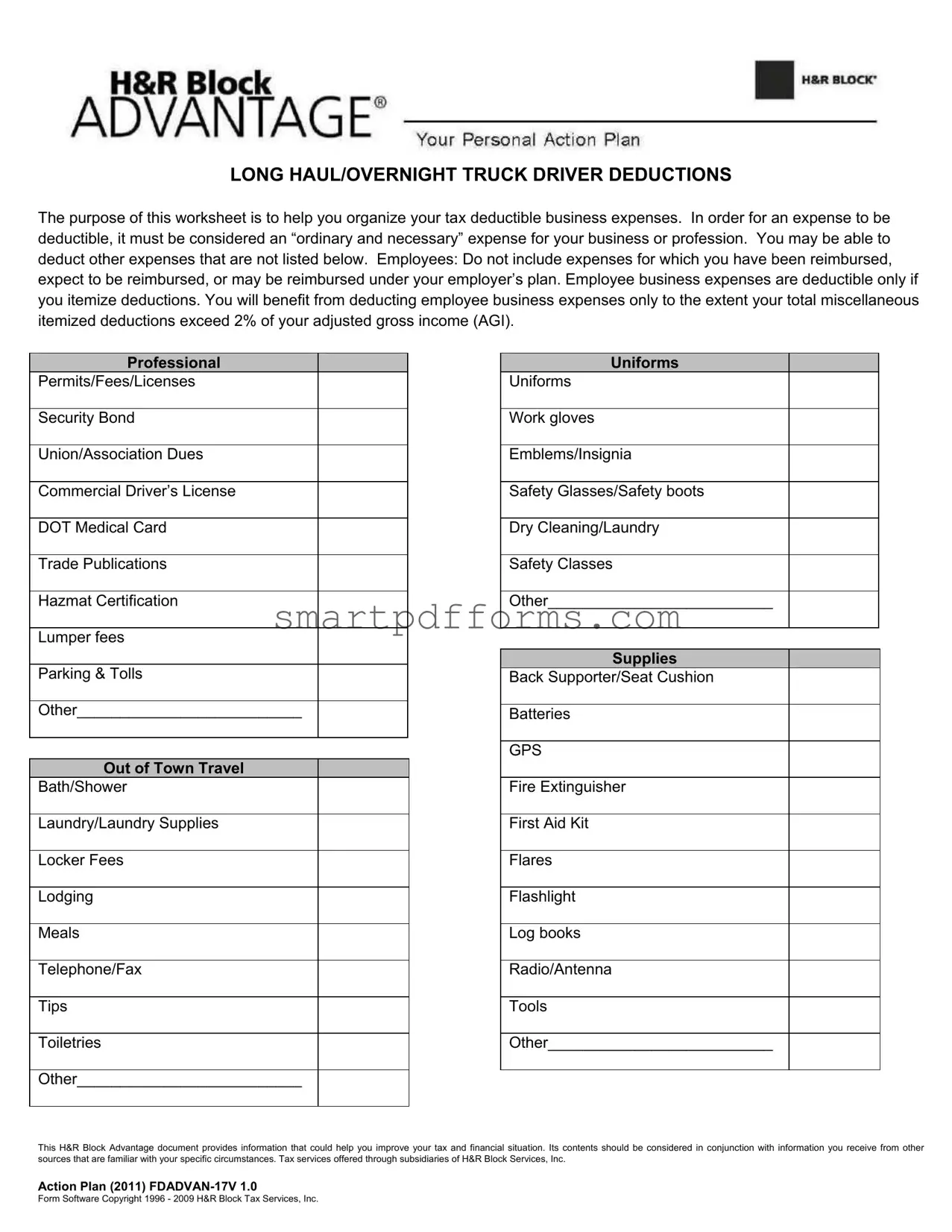

LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS

The purpose of this worksheet is to help you organize your tax deductible business expenses. In order for an expense to be deductible, it must be considered an “ordinary and necessary” expense for your business or profession. You may be able to deduct other expenses that are not listed below. Employees: Do not include expenses for which you have been reimbursed, expect to be reimbursed, or may be reimbursed under your employer’s plan. Employee business expenses are deductible only if you itemize deductions. You will benefit from deducting employee business expenses only to the extent your total miscellaneous itemized deductions exceed 2% of your adjusted gross income (AGI).

Professional

Permits/Fees/Licenses

Security Bond

Union/Association Dues

Commercial Driver’s License

DOT Medical Card

Trade Publications

Hazmat Certification

Lumper fees

Parking & Tolls

Other__________________________

Out of Town Travel

Bath/Shower

Uniforms

Uniforms

Work gloves

Emblems/Insignia

Safety Glasses/Safety boots

Dry Cleaning/Laundry

Safety Classes

Other__________________________

Supplies

Back Supporter/Seat Cushion

Batteries

GPS

Fire Extinguisher

Laundry/Laundry Supplies

First Aid Kit

Locker Fees

Flares

Lodging

Flashlight

Meals

Log books

Telephone/Fax

Radio/Antenna

Tips

Tools

Toiletries

Other__________________________

Other__________________________

This H&R Block Advantage document provides information that could help you improve your tax and financial situation. Its contents should be considered in conjunction with information you receive from other sources that are familiar with your specific circumstances. Tax services offered through subsidiaries of H&R Block Services, Inc.

Action Plan (2011)

Form Software Copyright 1996 - 2009 H&R Block Tax Services, Inc.

Form Data

| Fact Name | Details |

|---|---|

| Purpose | The form is designed to help long haul/overnight truck drivers organize their tax deductible business expenses. |

| Criteria for Deductibility | Expenses must be "ordinary and necessary" for the business or profession to be deductible. |

| Employee-specific Instructions | Employees are advised not to include expenses for which they have been reimbursed, expect to be reimbursed, or may be reimbursed under their employer’s plan. |

| Deductible Expenses Categories | Includes Professional Permits/Fees/Licenses, Out of Town Travel, Supplies, and more, with space to add other expenses. |

| Document Source | This is an H&R Block Advantage document, with copyright belonging to H&R Block Tax Services, Inc. (1996-2009). |

Instructions on Utilizing Truck Driver Expenses Worksheet

Filling out the Truck Driver Expenses Worksheet is a critical step for long-haul or overnight truck drivers looking to organize their tax-deductible business expenses effectively. This process ensures drivers don't miss out on potential deductions that can lower their tax liabilities. The worksheet is designed to capture a range of expenses deemed "ordinary and necessary" for the operation of their professional duties. Before proceeding, drivers should ensure they only include expenses not reimbursed or expected to be reimbursed by their employer, especially since employee business expenses are only deductible when itemizing deductions on the tax return. The following steps will guide through filling out the form, ensuring clarity and completeness.

- Start with the section titled Professional Permits/Fees/Licenses. List all applicable expenses, such as permits, security bonds, union dues, commercial driver’s license fees, DOT medical card fees, trade publication subscriptions, hazmat certification fees, and lumper fees. If there are expenses not covered in the predefined categories, add them under "Other".

- Proceed to the Parking & Tolls section, recording all amounts spent on parking fees and road tolls while on duty.

- In the Out of Town Travel section, include costs associated with travel away from home, such as bath or shower fees, and uniform-related expenses like purchase, emblem or insignia, safety glasses, safety boots, and associated dry cleaning or laundry expenses. Remember to add any safety class fees and other relevant expenditures not listed in the form under "Other".

- Move on to the Supplies section, entering costs for work-related supplies. This includes back supporters/seat cushions, batteries, GPS devices, fire extinguishers, first aid kits, locker fees, flares, flashlights, lodging (if not included in out-of-town travel), meals (keeping in mind IRS limits for deduction), telecommunication costs, tips given for services related to your work, tools, toiletries, and any other supplies needed for your job that are not listed specifically on the form.

- After completing all sections, review each entry to ensure accuracy and completeness. If you use the "Other" category, be specific about the nature of each expense to avoid confusion during later stages of tax preparation or in case of an audit.

- Finish by double-checking that no reimbursed expenses have been included. Employee business expenses are deductible only if you’ve not been compensated by your employer and only to the extent your miscellaneous itemized deductions exceed 2% of your adjusted gross income.

Once the worksheet is fully completed, it will serve as a detailed record of potentially deductible business expenses for the tax year. This organized approach not only simplifies tax preparation but also maximizes legitimate deductions, potentially reducing tax liability for truck drivers. It's important to complement this worksheet with personalized tax advice and cross-reference with the latest IRS guidelines, as tax regulations frequently change.

Obtain Answers on Truck Driver Expenses Worksheet

- What is the purpose of the Truck Driver Expenses Worksheet form?

- What qualifies an expense as "ordinary and necessary" for truck drivers?

- Can employees deduct expenses that have been reimbursed by their employer?

- Under what condition can employee business expenses be deducted?

- What are some examples of deductible expenses listed on the form?

- Professional Permits/Fees/Licenses

- Out-of-Town Travel Expenses such as lodging and meals

- Uniforms and Work Safety Equipment

- Tools and Supplies necessary for the job

- Can truck drivers deduct the cost of meals and lodging while traveling?

- Are there any limitations on the types of expenses that can be deducted?

- How should truck drivers record and report these expenses?

- Where can truck drivers find more information on deductible business expenses?

The Truck Driver Expenses Worksheet form is designed to assist long haul or overnight truck drivers in organizing their tax-deductible business expenses. Its goal is to ensure drivers can efficiently track expenses that are considered "ordinary and necessary" for their business or profession, ultimately aiding in the preparation of their taxes.

An expense is considered "ordinary and necessary" if it is common, accepted in the trucking industry, and appropriate for the business. This includes costs vital for the operations of a truck driver's profession, such as fuel, repairs, maintenance, and certain travel expenses.

No, employees cannot deduct expenses for which they have been reimbursed, expect to be reimbursed, or may be reimbursed under their employer's plan. Only unreimbursed expenses can be considered for deduction.

Employee business expenses are deductible only if the employee itemizes deductions on their tax return. Furthermore, these expenses will only provide a benefit if the total miscellaneous itemized deductions exceed 2% of the employee's adjusted gross income (AGI).

The worksheet lists several examples of potential deductible expenses including, but not limited to:

Yes, truck drivers may deduct the costs of meals and lodging when they are traveling out of town for work. These expenses are deemed necessary for the operation of their business, especially for long-haul or overnight drivers.

While many expenses are deductible, they must meet the criteria of being "ordinary and necessary". Expenses that are reimbursed or are lavish and extravagant in nature cannot be deducted. Additionally, personal expenses and certain commuting costs are typically not deductible.

Truck drivers should keep detailed records of all their deductible expenses, including receipts, logs, and any other relevant documentation. These records are crucial for accurately reporting expenses on tax returns and may be required for substantiation in case of an IRS audit.

Truck drivers seeking more information on deductible business expenses should consult the IRS guidelines or seek advice from a tax professional. They may also consider additional resources provided by employer associations or professional truck driving organizations.

Common mistakes

One common mistake is not understanding the difference between "ordinary and necessary" business expenses and personal expenses. An expense must be directly related to the operation of the trucking business to qualify.

Often, truck drivers include expenses for which they have been reimbursed, or expect to be reimbursed by their employer. These expenses should not be listed since they do not represent an out-of-pocket cost for the driver.

There is a failure to realize that only certain employee business expenses are deductible, and these only when itemizing deductions. This oversight can lead to an inflated expectation of deductions.

Drivers sometimes omit or improperly document their out-of-town expenses. Each entry needs proof, like receipts or logs, showing that each cost was a necessary expenditure in the service of their job.

Miscategorizing expenses under wrong heads can lead to confusion and possibly audits. Each type of expense has its place, and mixing them up can make it seem like there are expenditures without proper justification.

A common oversight is not keeping up with changes in tax laws that could affect what is deductible. What was deductible last year might not be this year, and failing to stay informed can cost drivers.

Lastly, many truck drivers miss out on deductions simply because they do not know all of their options. Beyond the listed items on the form, there may be additional, legitimate business expenses that can be deducted.

Maximizing tax deductions while adhering to the guidelines requires meticulous record-keeping and a thorough understanding of what constitutes a legitimate business expense. Missteps in filling out the Truck Driver Expenses Worksheet not only risk audits or penalties but also mean potentially overlooking substantial tax savings. A proactive approach—keeping detailed records of expenses, understanding tax deductions thoroughly, and seeking professional advice when unsure—can help truck drivers navigate these complexities successfully.

Documents used along the form

Managing the finances of a truck driving career entails organizing a multiplicity of forms and documents beyond just the Truck Driver Expenses Worksheet. This specific form is a pivotal tool in capturing and categorizing deductible business expenses, ensuring truck drivers don't miss out on valuable tax deductions. However, it's just the tip of the iceberg. Let's explore additional documents that often complement the Truck Driver Expenses Worksheet, each serving a unique purpose in the financial and tax preparation landscape for truck drivers.

- Income Statement: This document summarizes a truck driver's earnings and expenses over a certain period, offering a clear picture of their financial performance. It's crucial for understanding the bottom line and planning for taxes.

- Mileage Log: Essential for any truck driver, this log tracks the miles driven for business purposes. It supports deductions for vehicle expenses, either calculated using the standard mileage rate or actual expenses.

- Receipts for Fuel: These provide documentation for one of the most significant expenses truck drivers face. They're necessary for claiming deductions and for accurate record-keeping of operational costs.

- Vehicle Maintenance Records: Keeping detailed records of maintenance and repairs is important not only for ensuring the longevity of the truck but also for deducting these expenses at tax time.

- 1099-MISC Form or W-2: Depending on their employment status, truck drivers will receive either a 1099-MISC form (for independent contractors) or a W-2 form (for employed drivers) from their employer or clients, documenting their income for the year.

- Schedule C (Form 1040): This form is used by sole proprietors and single-member LLCs to report profits or losses from their business activities, which would apply to independent truck drivers.

- Form 4562: Truck drivers who purchase their truck or significant business equipment can use this form to claim depreciation, detailing the cost and life span of their assets.

- Insurance Documents: Documentation of insurance premiums for liability, cargo, and vehicle coverage is important not only for financial management but also for tax deductions relating to business expenses.

Navigating through the financial and regulatory aspects of truck driving demands meticulous record-keeping and a thorough understanding of applicable tax laws. The documents listed above, alongside the Truck Driver Expenses Worksheet, form a comprehensive toolkit. This toolkit empowers truck drivers to maximize their deductions, thereby optimizing their financial outcomes and ensuring compliance with tax laws. It's a testament to the complexity of managing a career in truck driving and the importance of staying informed and organized.

Similar forms

The Independent Contractor Expenses Worksheet is similar to the Truck Driver Expenses Worksheet in that both are designed to help individuals track and organize expenses that are tax deductible. Independent contractors, like long haul truck drivers, incur a variety of business expenses that can reduce their taxable income if properly documented and justified as ordinary and necessary for their work.

The Small Business Monthly Expense Report shares similarities with the Truck Driver Expenses Worksheet as it serves the purpose of recording monthly expenses related to the operation of a business. This document helps small business owners, including those owning and operating their trucking business, keep a detailed account of expenditures such as utilities, supplies, and travel, in order to accurately report them for tax purposes.

A Travel Expense Report is akin to the Truck Driver Expenses Worksheet, especially in the section dedicated to out-of-town travel expenses. For individuals who travel as part of their profession, tracking expenses for lodging, meals, and transportation is crucial for tax deductions. Both documents emphasize the importance of keeping detailed records of travel-related expenditures to ensure they meet the criteria of being ordinary and necessary for conducting business.

The Employee Business Expense Worksheet closely relates to the Truck Driver Expenses Worksheet in the context of employees identifying and documenting work-related expenses that are not reimbursed by their employer. This is particularly relevant for truck drivers employed by a company who need to itemize deductions related to their job, such as uniforms, work tools, and professional permits, to potentially lower their taxable income by demonstrating these costs exceed 2% of their adjusted gross income (AGI).

Dos and Don'ts

When preparing to fill out the Truck Driver Expenses Worksheet form, understanding the best practices can help ensure that your financial and tax situations are accurately represented and optimized. Below are key dos and don'ts to consider:

Do:- Verify that all expenses you list are "ordinary and necessary" for your truck driving profession, aligning with the requirement for deductibility.

- Keep meticulous records and receipts for all the expenses you intend to claim, ensuring you can substantiate these expenses if questioned.

- Itemize deductions carefully, especially if you are an employee, to determine if your miscellaneous itemized deductions exceed 2% of your AGI.

- Consult with tax professionals or utilize reliable tax preparation software, specifically tailored for H&R Block services, to ensure accuracy and compliance.

- Include all relevant expenses such as Professional Permits, Travel Costs, Supplies, and any other ordinary expenses incurred in your profession.

- Examine each category thoroughly to make sure you aren’t omitting any deductible expenses, especially those specific to long-haul truck driving that may not be top of mind.

- Include expenses for which you have been, expect to be, or may be reimbursed under your employer’s plan, as these are not deductible.

- Guess on amounts or the deductibility of expenses; ensure all claims are backed by documentation and fall within IRS guidelines.

- Overlook the importance of itemizing deductions to optimize the potential tax benefits, especially if these expenses significantly lower your taxable income.

- Ignore costs that might seem small or insignificant, such as laundry supplies or safety glasses. These can add up and contribute to your deductible expenses.

- Forget to consider other deductible expenses not explicitly listed but still qualify as "ordinary and necessary" for your truck driving business.

- Miss the opportunity to review your filled-out form with a tax professional who can provide insights specific to the trucking industry and IRS requirements.

By following these guidelines, you can ensure that your Truck Driver Expenses Worksheet form is completed accurately, making the most of your eligible tax deductions and minimizing issues with tax authorities.

Misconceptions

Truck driving, especially long haul, comes with a unique set of expenses. The Truck Driver Expenses Worksheet is a valuable tool for organizing these expenses for tax purposes. However, misconceptions about this worksheet can lead to either overlooking deductible items or misunderstanding what can be legitimately claimed. Here are ten common misconceptions explained.

Misconception: All expenses listed in the worksheet will automatically qualify for deductions.

Reality: Only expenses deemed as "ordinary and necessary" for the operation of the trucking business are deductible. Each driver's circumstances can affect whether an expense qualifies.

Misconception: Reimbursed expenses can still be deducted.

Reality: Any expense for which a driver has been, expects to be, or may be reimbursed by their employer cannot be deducted. This avoids a double benefit.

Misconception: Expenses for personal items are deductible if used during long hauls.

Reality: Only items strictly for business use, contributing to the safety and efficiency of operations, qualify. Personal items, even if used on the road, are typically not deductible.

Misconception: The worksheet includes every possible deductible expense for truck drivers.

Reality: The worksheet is a guide and not exhaustive. Drivers may have other deductible expenses not listed, as long as they are ordinary and necessary for their business.

Misconception: Employee business expenses don't need to be itemized to be deducted.

Reality: Employee business expenses are deductible only if itemized, and they are beneficial to the extent that they, along with other miscellaneous deductions, exceed 2% of the driver's adjusted gross income (AGI).

Misconception: Union dues and other professional expenses are not deductible.

Reality: Union dues, professional permits, fees, and licenses can be deductible if they are necessary for the driver's work as a truck driver.

Misconception: Meals are not deductible as a travel expense.

Reality: Meals can be deductible under travel expenses, but they are subject to limitations, such as only being 50% deductible.

Misconception: Costs for personal protective equipment or uniforms are entirely personal and not deductible.

Reality: If such items are required for the job and not suitable for regular wear outside of work, they can be considered deductible business expenses.

Misconception: Deductions do not apply to part-time truck drivers.

Reality: Part-time drivers can also deduct business expenses, provided they meet the criteria of being ordinary and necessary for their trucking activities.

Misconception: The worksheet itself must be submitted with the tax return.

Reality: The worksheet is a tool for organizing deductions. It is not submitted with the tax return, but the information it helps compile should be reflected in the driver's tax filings.

Understanding these points can help truck drivers accurately report their expenses and maximize their deductions, ultimately leading to a more favorable tax outcome. It is important for drivers to consult with tax professionals familiar with their specific situation and to keep thorough records of all expenses throughout the year.

Key takeaways

Understanding the Truck Driver Expenses Worksheet is crucial for long haul/overnight truck drivers looking to organize their tax deductible business expenses. Below are nine key takeaways to guide you through filling out and leveraging this form effectively:

- It is essential to identify expenses that are considered "ordinary and necessary" for the operation of your business or profession, as these are potentially deductible.

- Truck drivers should not include any expenses for which they have been reimbursed or expect to be reimbursed by their employer. These are not deductible as personal business expenses on their tax forms.

- If you are an employee, you can only deduct business expenses if you itemize deductions on your tax return. This is critical to understand when planning your tax strategy.

- Deductions for employee business expenses will only benefit you if your total miscellaneous itemized deductions exceed 2% of your adjusted gross income (AGI), highlighting the need to assess the potential tax benefit carefully.

- Expenses that may be deductible include professional permits, fees, licenses, union dues, out-of-town travel costs, uniforms, supplies like batteries, GPS devices, and more. This illustrates the range of expenses truck drivers may incur that could be tax-deductible.

- It’s important to keep detailed records and receipts for all potential deductions, including lodging, meals, tools, and safety equipment, to support your claims in case of an audit.

- Other expenses not explicitly listed on the form may also be deductible. Truck drivers should consider all aspects of their operation to identify additional deductible expenses.

- This document underscores the importance of integrating its guidance with information from other financial planning and tax advice sources, tailored to your specific circumstances.

- H&R Block's endorsement of the form as part of its Action Plan suggests leveraging professional tax services or software could be beneficial in maximizing your deductions accurately.

In summary, the Truck Driver Expenses Worksheet serves as a valuable tool for truck drivers to identify and organize deductible business expenses. Thorough documentation and an understanding of tax regulations are key to leveraging this form for optimal financial and tax planning.

Popular PDF Forms

Safety Patrol Awards - A lasting tribute to dedication, this certificate honors a Safety Patrol Sergeant for their exceptional role in maintaining a culture of safety and vigilance within the school.

Cpt 90694 - The inclusion of a section for emergency contact details underscores the careful consideration given to patient safety and well-being.