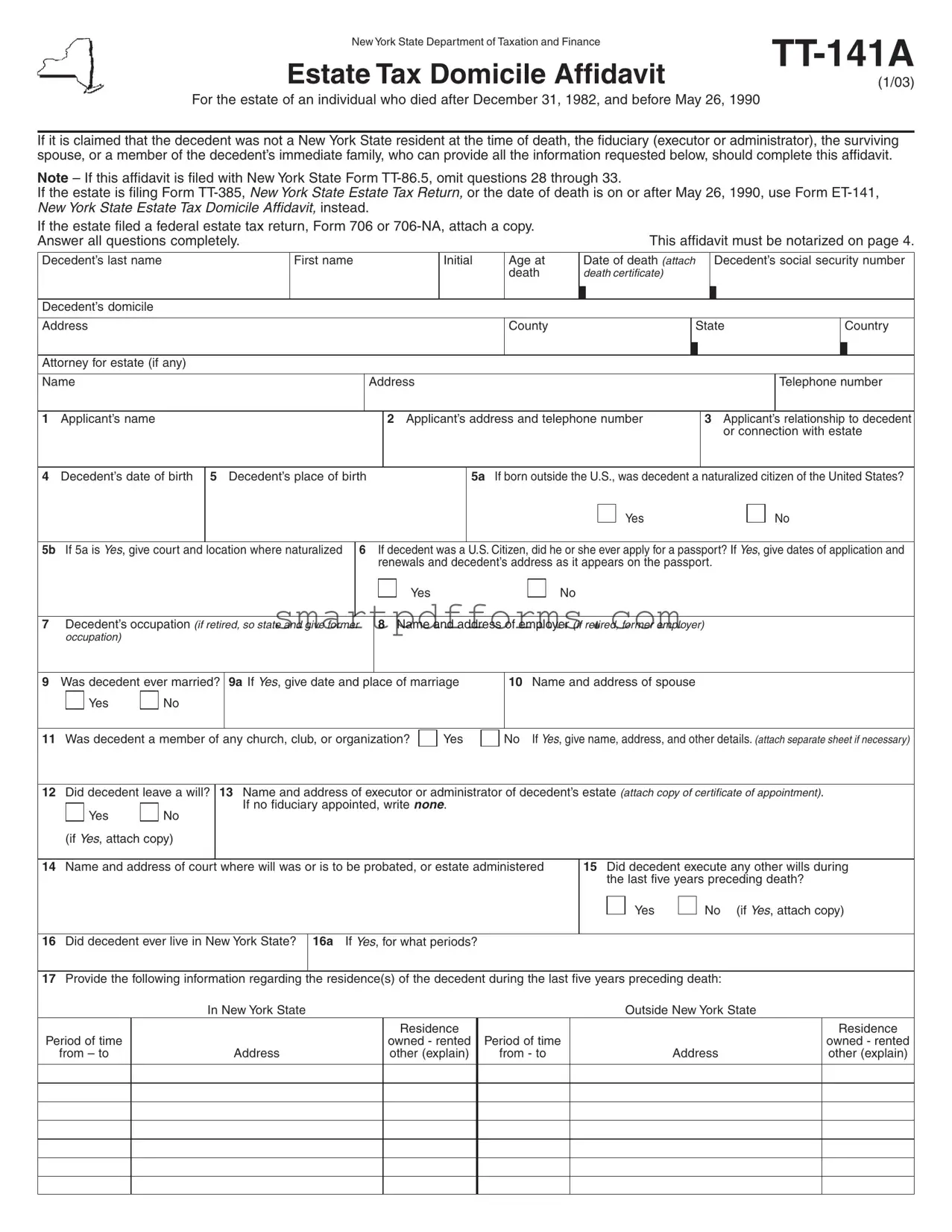

Blank Tt 141A PDF Template

Understanding the intricacies of estate management after a loved one's passing is a challenging process that embodies not just the emotional toll but also the complex web of legal responsibilities one must navigate. Central to this process, particularly for estates linked to New York State, is the TT-141A Estate Tax Domicile Affidavit. This document plays a crucial role for estates of individuals who passed away between December 31, 1982, and May 26, 1990, essentially serving to determine the deceased's state of residence at the time of death. It is specifically designed for cases where the decedent is claimed not to have been a New York State resident. This affidavit requires completion by the fiduciary, which could be an executor or administrator, the surviving spouse, or an immediate family member, provided they can supply all requested information. It outlines specific conditions under which alternative forms should be used and mandates the attachment of a federal estate tax return if filed. The form demands thorough replies to a myriad of questions concerning the decedent's personal history, property holdings, and affiliations, all while requiring notarization. Moreover, it includes sections for detailing property interests and taxable transfers that could impact the estate's tax responsibilities significantly. An understanding of TT-141A is vital for accurately assessing estate taxes and ensuring compliance with New York State Taxation and Finance regulations, offering a comprehensive guide through a process marked by its potential for complexity.

Preview - Tt 141A Form

New York State Department of Taxation and Finance |

||

Estate Tax Domicile Affidavit |

||

(1/03) |

For the estate of an individual who died after December 31, 1982, and before May 26, 1990

If it is claimed that the decedent was not a New York State resident at the time of death, the fiduciary (executor or administrator), the surviving spouse, or a member of the decedent’s immediate family, who can provide all the information requested below, should complete this affidavit.

Note – If this affidavit is filed with New York State Form

If the estate is filing Form

If the estate filed a federal estate tax return, Form 706 or

This affidavit must be notarized on page 4.

Decedent’s last name |

|

|

|

|

First name |

|

|

|

|

|

|

Initial |

|

|

Age at |

Date of death (attach |

Decedent’s social security number |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

death |

death certificate) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Decedent’s domicile |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County |

|

|

|

|

|

|

|

|

State |

|

Country |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attorney for estate (if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name |

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone number |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1 |

Applicant’s name |

|

|

|

|

|

|

|

|

|

|

|

|

2 Applicant’s address and telephone number |

|

|

|

3 |

|

Applicant’s relationship to decedent |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or connection with estate |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

4 |

Decedent’s date of birth |

5 |

Decedent’s place of birth |

|

|

|

|

|

|

|

5a If born outside the U.S., was decedent a naturalized citizen of the United States? |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

5b |

|

If 5a is Yes, give court and location where naturalized |

|

6 |

|

|

If decedent was a U.S. Citizen, did he or she ever apply for a passport? If Yes, give dates of application and |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

renewals and decedent’s address as it appears on the passport. |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

7 Decedent’s occupation (if retired, so state and give former |

|

|

8 Name and address of employer (if retired, former employer) |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

occupation) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

9 |

Was decedent ever married? |

9a If Yes, give date and place of marriage |

|

|

10 |

Name and address of spouse |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If Yes, give name, address, and other details. (attach separate sheet if necessary) |

||||||||||||||||||||||||||||||||||||

11 Was decedent a member of any church, club, or organization? |

|

Yes |

|

No |

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

12 |

|

Did decedent leave a will? |

13 Name and address of executor or administrator of decedent’s estate (attach copy of certificate of appointment). |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

Yes |

|

|

No |

|

If no fiduciary appointed, write none. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

(if Yes, attach copy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

14 Name and address of court where will was or is to be probated, or estate administered |

15 Did decedent execute any other wills during |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the last five years preceding death? |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

No |

(if Yes, attach copy) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

16 |

|

Did decedent ever live in New York State? |

16a |

If Yes, for what periods? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

17 Provide the following information regarding the residence(s) of the decedent during the last five years preceding death: |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

In New York State |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outside New York State |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residence |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residence |

|||||

Period of time |

|

|

|

|

|

|

|

|

|

|

|

|

|

owned - rented |

|

Period of time |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

owned - rented |

|||||||||||||||

|

from – to |

|

|

|

|

Address |

|

|

|

|

|

|

other (explain) |

|

|

from - to |

|

|

|

|

|

|

|

Address |

|

|

|

|

|

other (explain) |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

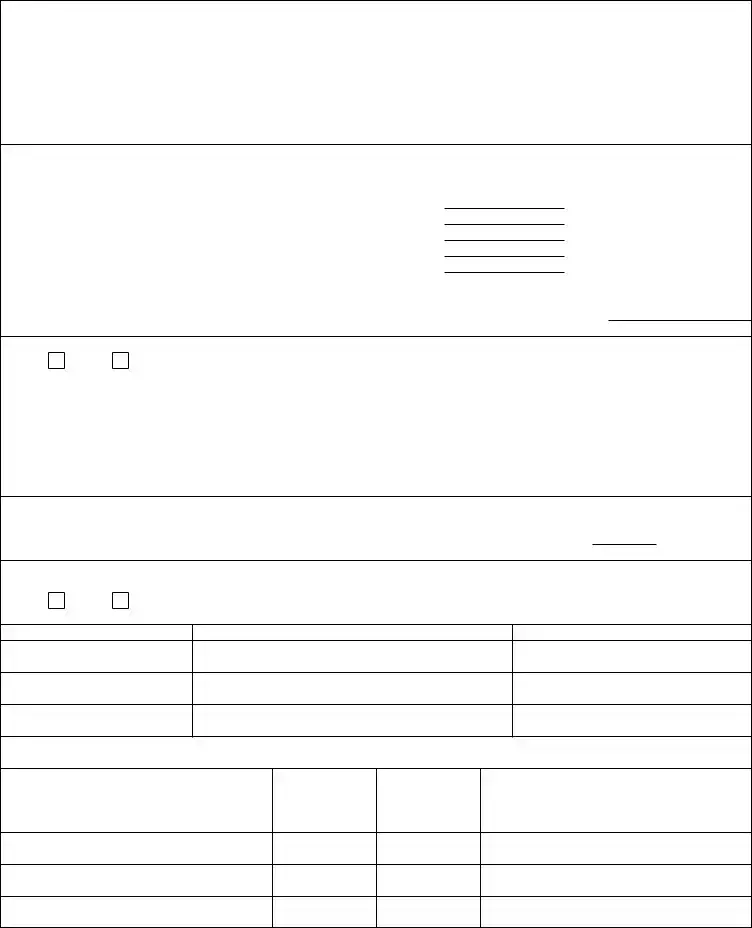

Page 2 of 4

18 |

Did decedent ever own real estate located in |

|

|

18a Period of time |

18b Address of property |

|

|

|

|

|||||||||||||||||||||||

|

New York State? |

|

|

|

|

|

|

|

|

|

from - to |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(If Yes, complete items 18(a) and (b)) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

19 |

In what state(s) did decedent vote or register to vote during the five years preceding death? (show latest year first) |

|||||||||||||||||||||||||||||||

|

|

|

|

|

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

20 |

If decedent did not vote in those five years, where did he last vote? |

|

|

|

|

|

|

|

|

20a When did decedent last vote? |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

21 |

Did decedent execute any trust indentures, deeds, mortgages, leases, or any other documents describing his residence during the last five years preceding death? |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

If so, attach copy |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

22 |

Did decedent own a safe deposit box |

22a |

If Yes, has it been inventoried? |

|

22b Name and address of bank where box is located. |

|||||||||||||||||||||||||||

|

located in New York State? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

If Yes, attach a copy |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

23 |

Was decedent a party to any legal proceedings in the state of New York during the last five years of his or her life? |

|||||||||||||||||||||||||||||||

|

If Yes, list the court or tribunal, or other forum, and the date, and type of action. |

|

|

|

|

|

Yes |

|

|

|

No |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

24 |

Did decedent have licenses to operate a business, practice a profession, or operate a motor vehicle, airplane, or boat? |

|||||||||||||||||||||||||||||||

|

If Yes, give information requested below. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

No |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

License number |

|

|

|

|

|

Type of license |

|

|

Date of issuance |

|

Name and location of issuing office |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

List the Internal Revenue Service Center, and the state, county, and municipality where decedent filed income tax returns and paid tax on income or |

|||||||||||||||||||||||||||||||

|

intangible personal property for the last five years preceding death. (Income tax returns (federal and state) may be required.) |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

Year |

|

|

|

|

|

Internal Revenue Service Center |

|

|

|

|

|

State, county, or municipality |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

26 |

Give detailed information about business activities (if any) engaged in by the decedent during the five years preceding date of death |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

In New York State |

|

|

|

|

|

|

|

|

|

Outside New York State |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

Dates |

|

|

|

Nature of business activities |

|

|

|

Dates |

|

|

Nature of business activities |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27What other information do you wish to submit in support of the contention that the decedent was not domiciled in the state of New York at the time of death?

28List below, at total value, any real property, tangible personal property, or intangible personal property wherever located in which the decedent had an interest at death, and taxable transfers made by the decedent within three years of decedent’s death (included in federal gross estate).

(amounts should be taken from federal Form 706)

Real property |

$ |

Tangible personal property |

$ |

Intangible personal property |

$ |

Transfers within three years of death |

$ |

Gift tax paid on gifts made after |

$ |

6/30/78 and within three years of death |

|

Total $

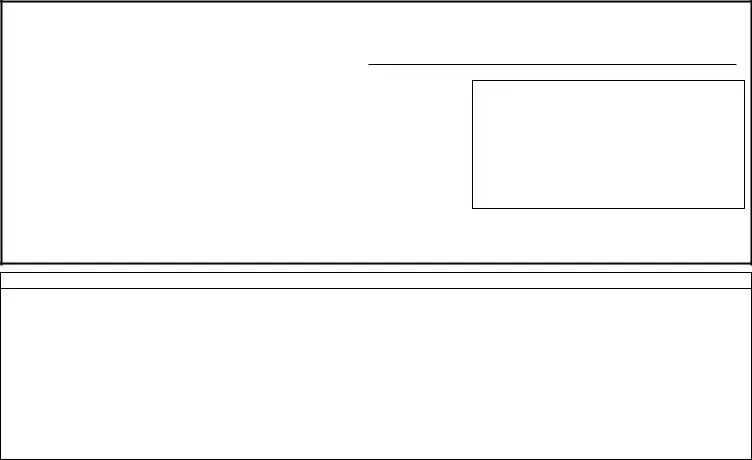

29 Did the decedent at time of death own, individually or jointly, any interest in real property in New York State?

Yes

No |

If Yes, and Release of Lien is desired, please supply the following information: |

|

(complete question 30 also) |

Book of Deeds or Liber No. |

|

|

|

at page no. |

|

|

map no. |

|

|

|||

section no. |

|

block no. |

|

lot no. |

|

|

|

|

|

|

||

Property address |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Street or road |

|

|

|

|

|

City, town, or village |

|

||

30Show assessed and market value (and balance owed on mortgage, if any), of real property described in question 29. (real estate appraisal may be required)

(a) Assessed value - $ |

|

(b) Market value - $ |

|

(c) Balance owed on mortgage, if any - $ |

|

|

|

|

(submit proof of indebtedness) |

31Did decedent own any tangible personal property, such as household furnishings, jewelry, coin collections, paintings, boats, automobiles, etc., having an actual situs in New York State?

Yes

No |

If Yes, describe in detail. |

Item

Address where item is located

Market value

$

$

$

32List below the securities, bank accounts, or other intangible property for which tax waivers are requested.

Name of bank; name of corporation or association issuing stocks and bonds; name of government issuing government bonds; name of insurance company

Amount of account; number of shares of stock; face value of bonds; amount of policy or annuity

Description of stocks or bonds; series of government bonds; kind of policy or annuity

Name(s) on bank account; name(s) on stocks or bonds; name and address of beneficiary or annuitant

(attach additional sheets, if necessary)

Page 4 of 4

Complete items 33, 34, and 35 only if decedent owned real or tangible personal property having an actual situs in New York State. (Affirmation section must be completed.)

33 Computation of New York gross estate and taxable estate |

|

|

|

|

35 Computation of nonresident tax |

|

|

|

|

||||||

(a) Federal gross estate* |

|

|

|

|

|

|

|

|

Items 30(b) + 31 |

× Item 34(f) = New York State |

|||||

|

|

|

|

|

|

|

|

|

|

Item 33(c) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

nonresident tax |

|||

(b) Less real + tangible personal |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

– |

|

|

|

|

|

|

|

|||||

property located outside NYS |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(complete Schedule I below) |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(c) New York State gross estate |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

Schedule I — Real and/or tangible personal property located outside |

||||||||

|

|

|

|

|

|

|

|||||||||

(d) Less: |

Funeral expense |

|

|

|

|

|

|

|

New York State. (Do not include bank accounts, stocks, bonds, etc.) (Complete this |

||||||

|

|

|

|

|

|

|

schedule if item 33, line (b), is used.) |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Mortgage (amount entered |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in item 30(c)**) |

|

|

|

– |

|

|

|

|

|

|

|

|||

|

Total |

|

|

|

|

|

|

|

|

|

|

||||

(e) New York adjusted gross estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(f) Less: |

New York marital deduction** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

New York charitable bequests** |

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

(g) New York taxable estate (enter in item 34(a)) |

|

|

|

|

|

|

|

|

|

|

|

||||

* A copy of federal Form 706 may be required. |

|

|

|

|

|

|

|

|

|

|

|

||||

** if applicable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: If additional adjustments to federal gross estate are necessary, e.g., |

||||||

34 Tax computation as if a resident |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

gifts made prior to 1983 or qualified terminable interest property included in |

||||||||

|

|

|

|

|

|

|

|

|

|||||||

(a) New York taxable estate (from item 33(g)) |

|

|

|

|

|

|

|

line 33(a), attach separate sheet showing such adjustments. |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Schedule II — Bequests, etc. to surviving spouse (complete this schedule if a |

||||||||

(b) Plus adjusted New York taxable gifts |

|

|

|

|

|

|

|

||||||||

+ |

|

|

|

|

|

|

marital deduction is claimed in item 33 line (f)) If entire estate passes to surviving |

||||||||

made after 1982 |

|

|

|

|

|

|

spouse, write entire estate. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||

(c) New York tentative estate tax base |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(d) New York tentative estate tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(compute on amount shown on line (c); see Table A) |

|

|

|

|

|

|

|

|

|

|

|

||||

(e) Less: Unified credit (see Table B) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

New York gift tax payable on |

+ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

amount shown on line (b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

||||

|

Total |

|

|

|

|

|

|

|

|

|

|

||||

(f) New York net estate tax, as if a resident |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The undersigned states that the foregoing sets forth all of the assets constituting the decedent’s gross estate, and the answers to the foregoing questions are each and everyone true in every particular, and that this affidavit is made to induce the Commissioner of Taxation and Finance to determine domicile, to give a waiver notice and/or release of lien required by the Tax Law of the State of New York.

Fiduciary or applicant — sign here

Sworn before me this |

|

day of |

|

, 20 |

|

, |

|||||

in the County of |

|

|

|

|

|

|

|

|

, |

||

in the State/Commonwealth/Province of |

|

|

|

|

|

|

|

. |

|||

Qualified in the County of |

|

|

. Commission expires on |

, 20 |

|

. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

(Notary Public, Commissioner of Deeds or Authorized New York State Department of Taxation and Finance employee)

• Attach authentication certificate if this affidavit is sworn to in a foreign country.

Note: Disclosure of social security number is required. Such numbers are used for tax administration purposes and as necessary pursuant to Education Law, sec. 663; Social Services Law, sec. 111b and 136a; and Executive Law, sec. 49; and Tax Law, sec 171b, and when the taxpayer gives written authorization to this department for another department, person, agency, or entity to have access, limited or otherwise, to information contained in his or her return.

Notice — Section 1811(b) of the Tax Law provides that any person who, with intent to evade taxation, files a false or fraudulent return, supplies false or fraudulent information, or withholds material information with intent to deceive, shall be guilty of a misdemeanor.

Table A – Tax table — If the amount with respect to which the tax is to be computed is:

Over |

|

But not over |

The tax is: |

|

|

|

||

|

|

|

|

|

|

|

|

|

$ |

0 |

$ |

50,000 |

|

|

|

2% of such amount |

|

|

50,000 |

|

150,000 |

$ |

1,000 |

+ |

3% of excess over $ |

50,000 |

|

150,000 |

|

300,000 |

|

4,000 |

+ |

4% of excess over |

150,000 |

|

300,000 |

|

500,000 |

|

10,000 |

+ |

5% of excess over |

300,000 |

|

500,000 |

|

700,000 |

|

20,000 |

+ |

6% of excess over |

500,000 |

For amounts over $700,000 refer to instructions |

|

|||||||

|

|

Table B – Unified credit — If the tentative tax is: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

Over |

|

But not over |

|

|

The credit is: |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0 |

$ |

2,750 |

|

|

the full amount of tax |

|

|

|

2,750 |

|

5,000 |

|

|

the amount by which $5,500 exceeds the tax |

||

|

5,000 |

|

|

|

|

$500 |

|

|

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | Used for estates of individuals who died between December 31, 1982, and May 26, 1990, to affirm non-New York State residency at time of death. |

| Who Should Complete | The fiduciary (executor or administrator), surviving spouse, or immediate family member knowledgeable about the decedent. |

| Accompanying Forms | Attach with Form TT-86.5 but omit questions 28-33. Use Form ET-141 for deaths on or after May 26, 1990. Attach a federal estate tax return, if filed. |

| Notarization Required | The affidavit must be notarized on page 4 to be considered valid. |

| Addressing Multiple Residences | Details of the decedent's residences in the last five years, both inside and outside New York State, must be provided. |

| Estate Tax Implications | Information provided affects the determination of domicile for New York State estate tax purposes. |

| Legal Proceedings and Licenses | Requires disclosure of the decedent's involvement in New York legal proceedings and any New York-issued licenses within the last five years of life. |

| Governing Law(s) | New York State Tax Law provides the legal basis for this form and its requirements. |

Instructions on Utilizing Tt 141A

Once someone passes away, their estate may go through various legal processes, one of which can involve establishing the deceased's domicile or main place of residence at the time of death. For estates of individuals who passed away between the end of 1982 and May 1990, and are considered not to be New York State residents, the TT-141A Estate Tax Domicile Affidavit is a necessary form. This affidavit, along with any required attachments, such as a federal estate tax return, provides crucial information helping to determine the deceased's domicile. Below you'll find a straightforward guide to completing the TT-141A form.

- Start with the decedent's full name, including last, first, and middle initial, their age at death, the date of death (attach the death certificate), and their social security number.

- Enter the address, county, state, and country of the decedent's domicile.

- If there's an attorney for the estate, include their name, address, and telephone number.

- Fill in the applicant's name.

- Provide the applicant's address and telephone number.

- State the applicant's relationship to the decedent or connection with the estate.

- Enter the decedent's date of birth and place of birth. If the decedent was born outside the U.S., indicate if they were a naturalized citizen, including the court and location of naturalization if applicable.

- If the decedent was a U.S. citizen who applied for a passport, provide the details of the application, renewals, and addresses as they appear on the passport.

- List the decedent's occupation. If retired, note the former occupation and employer's name and address.

- Indicate whether the decedent was ever married, including the date and place of marriage, and provide spouse details.

- State if the decedent was a member of any church, club, or organization.

- Mention whether the decedent left a will, the name and address of the executor or administrator, and the court where the will was or is to be probated.

- Include any previous wills executed in the last five years preceding death, if applicable.

- Answer whether the decedent ever lived in New York State and provide details on periods of residence.

- Describe all residences of the decedent during the last five years preceding death, both in and outside New York State, including periods of ownership or rental.

- Fill in details about any real estate owned by the decedent in New York State, including the period of time owned and the property address.

- List the state(s) where the decedent voted or registered to vote during the last five years preceding death, and if not, where and when they last voted.

- Provide information on any trust indentures, deeds, mortgages, leases, or other documents executed by the decedent describing their residence in the last five years preceding death.

- State if the decedent owned a safe deposit box in New York State and provide details if it has been inventoried and the bank's name and address.

- Indicate if the decedent was a party to any legal proceedings in New York in the last five years of their life.

- Detail any licenses the decedent had to operate a business, practice a profession, or operate vehicles, including license numbers, the type of license, date of issuance, and issuing office.

- List the Internal Revenue Service Center and the state, county, and municipality where the decedent filed income tax returns for the last five years preceding death.

- Give detailed information about any business activities the decedent engaged in both in and outside New York State during the last five years before their death.

- Provide additional information supporting the argument that the decedent was not domiciled in New York State at the time of death.

- List any real property, tangible personal property, or intangible personal property interests at the time of death, and any taxable transfers made within three years of death, including gifts made after June 30, 1978.

- If applicable, provide details of any interest in real property owned in New York State at the time of death, including deeds and valuation information.

- Describe any tangible personal property located in New York State and list securities, bank accounts, or other intangible property for which tax waivers are requested.

- Complete the computations for New York gross estate and taxable estate if the decedent owned real or tangible personal property in New York State.

- Sign the affidavit as the fiduciary or applicant, ensuring the form is notarized as required on page 4.

- Attach any additional documents as necessary, including a copy of federal Form 706 if a federal estate tax return was filed.

This meticulous process aids in the accurate assessment and processing of the estate, leading towards a conclusion whether a release of lien or a waiver notice is merited under New York State Tax Law. Remember, every detail counts in these forms; accuracy and completeness are key to streamlining this part of estate administration.

Obtain Answers on Tt 141A

What is Form TT-141A and when is it applicable?

Who needs to complete Form TT-141A?

Are there any attachments required with Form TT-141A?

What should be done if the affidavit is filed with New York State Form TT-86.5?

How is Form TT-141A notarized?

Form TT-141A, known as the Estate Tax Domicile Affidavit, is a document provided by the New York State Department of Taxation and Finance. It's designed for estates of individuals who passed away after December 31, 1982, and before May 26, 1990. This form is specifically used when it's claimed that the decedent was not a resident of New York State at the time of their death. The affidavit should be completed by the fiduciary (executor or administrator), the surviving spouse, or a member of the decedent’s immediate family, provided they can supply all the requested information.

The Estate Tax Domicile Affidavit must be filled out by an individual closely related to the decedent, such as the fiduciary (executor or administrator) of the estate, the surviving spouse, or a member of the decedent’s immediate family. The person completing this form should be able to provide comprehensive details about the decedent’s domicile and prove that the decedent was not a resident of New York State at their time of death.

Yes, when filing Form TT-141A, it's necessary to attach a copy of the decedent’s death certificate. Additionally, if the estate filed a federal estate tax return, either Form 706 or Form 706-NA, a copy of the appropriate form should also be included. Furthermore, if there are documents such as trusts, indentures, deeds, mortgages, or leases detailing the decedent’s residence in the last five years, copies of these should be attached as well.

If the affidavit is filed alongside New York State Form TT-86.5, it's important to skip questions 28 through 33 on Form TT-141A. This is because those specific queries are not applicable when filing with Form TT-86.5, which has its own set of requirements and instructions for completion.

The affidavit must be notarized to be considered complete and valid. This involves signing the document in the presence of a Notary Public, Commissioner of Deeds, or an Authorized New York State Department of Taxation and Finance employee on the designated page of the form. If the affidavit is sworn to in a foreign country, an authentication certificate must be attached. The act of notarization helps verify the identity of the signatory and adds a level of legal authenticity to the affidavit.

Common mistakes

When filling out the New York State Department of Taxation and Finance TT-141A Estate Tax Domicile Affidavit, it's crucial to pay attention to detail and understand the requirements thoroughly. Below are ten common mistakes individuals tend to make during the process:

Not attaching the death certificate: It's essential to include the decedent’s death certificate with the affidavit, as failing to do so can result in processing delays.

Omitting the decedent's social security number: This is a critical piece of information that is required for tax administration purposes. Leaving this blank can cause significant issues with the affidavit.

Skipping questions 28 through 33 when required: If this affidavit is filed alongside New York State Form TT-86.5, questions 28 through 33 should be omitted. However, missing these questions under other circumstances may result in an incomplete application.

Failing to attach a copy of the federal estate tax return: If the estate filed a federal estate tax return, Form 706 or 706-NA, it's necessary to attach a copy. Neglecting to do so can complicate the processing of the affidavit.

Incorrectly reporting the decedent's domicile: Properly documenting the decedent’s domicile address is key. This includes accurately reporting the county, state, and country, as mistakes here can affect the entire affidavit.

Not fully answering all applicable questions: Each question should be answered completely. Failure to do so might result in the need for further clarification, delaying the process.

Ignores providing detailed information on the decedent's occupation and employer: If applicable, including detailed information about the decedent’s occupation and employer(s) helps to paint a full picture of their residency status.

Leaving the relationship to decedent or connection with the estate section blank: The applicant's relationship to the decedent or their connection to the estate must be clearly mentioned for the affidavit to be properly evaluated.

Failing to notarize the affidavit on page 4: The affidavit must be notarized to be considered valid. Skipping this step can invalidate the entire document.

Neglecting to attach supporting documents: Supporting documents, which could include marriage certificates, membership details for churches, clubs, or organizations, or documentation of the decedent's business activities, are crucial for a thorough evaluation. Not including these can result in an incomplete application.

Addressing these mistakes carefully when filling out the TT-141A form ensures the smooth processing of the estate tax domicile affidavit, which is vital for determining the correct tax obligations of the decedent's estate.

Documents used along the form

Understanding the necessity of comprehensive documentation during estate planning and processing can ease the transition for those involved. Apart from the New York State Department of Taxation and Finance TT-141A Estate Tax Domicile Affidavit, there are several other crucial forms and documents often required to ensure legal compliance and smooth operations. Below is a brief overview of some of these important documents:

- Form TT-385, New York State Estate Tax Return: Used for estates filing within New York State, capturing details necessary for accurate estate tax computation.

- Form ET-141, New York State Estate Tax Domicile Affidavit: Required for decedents who died on or after May 26, 1990, to determine the domicile for estate taxation purposes.

- Form 706 or 706-NA, Federal Estate Tax Return: Forms for reporting the decedent's gross estate in the United States, determining federal estate tax liabilities.

- Will or Testament: A legal document outlining the decedent's final wishes regarding the distribution of their estate and care for minor children, if any.

- Trust Documents: Legal arrangements providing instructions on managing and distributing the decedent’s assets both during their lifetime and after death.

- Certificate of Appointment of Executor or Administrator: Official document appointing an individual to manage and distribute the decedent’s estate.

- Release of Lien Documents: Required to release claims or liens against the property of the decedent, ensuring clear title transfer.

- Real Estate Appraisal Reports: Professional valuation reports to determine the fair market value of real estate properties owned by the decedent.

- Bank Statements and Investment Accounts Records: Needed to establish the value of the decedent’s financial assets as part of the estate.

Each of these documents plays a unique role in detailing and processing aspects of the decedent's estate, from validating their last wishes to determining tax obligations and asset distributions. It is imperative for fiduciaries and family members to understand these requirements to fulfill both state-specific and federal legal obligations accurately and efficiently.

Similar forms

The Form TT-86.5, also known as the New York State Estate Tax Return for estates of individuals who died on or after May 26, 1990, shares a similarity with the TT-141A form in its focus on estate tax matters but differs in its applicable time frame and slightly in its purpose. While TT-141A is utilized for asserting a decedent's non-residency in New York State for specific dates, TT-86.5 is a broader estate tax return requirement for later dates, both ensuring compliance with state tax laws from an estate perspective.

Form ET-141, New York State Estate Tax Domicile Affidavit for deaths on or after May 26, 1990, mirrors the TT-141A in its purpose to establish the domicile of a deceased. However, ET-141 is applicable for dates post-May 26, 1990, emphasizing the need for such documentation in determining the tax obligations of an estate based on the decedent’s domicile, specifically within different time frames and regulatory requirements.

Form 706 or 706-NA, the United States Estate (and Generation-Skipping Transfer) Tax Return, is similar to TT-141A in that it also pertains to the financial affairs of a decedent's estate, focusing on the federal level. This document is crucial for estates that need to report to the federal government and may be required alongside state-specific forms like TT-141A to ensure full disclosure and proper tax assessment in line with both federal and state tax laws.

The New York State Resident Trust Tax Return, Form IT-205, while specifically for trusts, shares commonalities with the TT-141A form in terms of being related to the taxation of estates and trusts in New York State. The IT-205 form is used for fiduciary reporting of income, deductions, and tax liabilities of estates and trusts, paralleling the TT-141A's focus on affirming a decedent's domicile to determine estate tax obligations.

Form IT-2, Summary of W-2 Statements, though primarily used for individual income tax filings, intersects conceptually with TT-141A by involving documentation necessary for accurate tax reporting. The form aggregates information from W-2s for state tax purposes, similar to how TT-141A collects details pertinent to a decedent’s estate. Both forms contribute to ensuring transparency and compliance in the realm of tax obligations by providing detailed information relevant to the taxpayer's situation, albeit in different contexts.

Dos and Don'ts

When filling out the TT-141A form, certain practices should be followed to ensure accuracy and compliance. Below are seven do's and don'ts to consider:

- Do:

- Make sure to answer all questions completely, as requested on the form. Missing information can lead to delays.

- Attach a copy of the decedent's death certificate, as well as a copy of the federal estate tax return, Form 706 or 706-NA, if one was filed.

- Check that all annexures, such as details of the decedent's real estate or tangible personal property, are accurately compiled and attached.

- Ensure the form is notarized on page 4, as this is a compulsory requirement for the form to be considered valid.

- Provide detailed information about the decedent's residence and property owned, especially in New York State, to accurately determine domicile for estate tax purposes.

- Attach additional sheets if necessary, especially when providing detailed information on questions 9a, 11, 16a, 17, and 32, ensuring nothing is overlooked.

- Don't:

- Do not leave any questions unanswered. If a question does not apply, mark it as “Not Applicable” or “N/A” to indicate that it was reviewed but not skipped accidentally.

- Avoid guessing answers. If uncertain about specific information, it's better to research or verify before filling in the details.

- Do not file this form for decedents who died on or after May 26, 1990. The correct form for those decedents is Form ET-141.

- Do not overlook the instructions about omitting questions 28 through 33 if this affidavit is filed with New York State Form TT-86.5. This detail is crucial for proper processing.

- Do not attach documents that are not requested or relevant to the form's inquiries, as this could lead to confusion or processing delays.

- Do not falsify information or withhold material information with the intent to evade taxation, as this is illegal and subject to penalties.

Misconceptions

When it comes to the New York State Department of Taxation and Finance TT-141A Estate Tax Domicile Affidavit, there are several misconceptions that often arise. Understanding the true nature and requirements of this form is crucial for proper completion and submission. Here are six common misconceptions:

- Misconception 1: The TT-141A form applies to any estate tax situation in New York. In reality, the TT-141A form is specifically designed for the estates of individuals who passed away after December 31, 1982, and before May 26, 1990. For deaths occurring on or after May 26, 1990, the appropriate form is the ET-141, not the TT-141A.

- Misconception 2: Anyone related to the decedent can complete the affidavit. While it may seem like any family member can fill out the affidavit, it is actually required that either the fiduciary (executor or administrator), the surviving spouse, or a member of the decedent’s immediate family who is fully knowledgeable of the decedent's personal history and domicile status completes the form.

- Misconception 3: All sections of the form must be completed regardless of circumstances. This is not accurate. If the affidavit is filed along with New York State Form TT-86.5, questions 28 through 33 should be omitted. This illustrates the importance of reading instructions carefully to provide only the necessary information.

- Misconception 4: A federal estate tax return is optional when filing this affidavit. Contrary to this belief, if the estate filed a federal estate tax return, either Form 706 or 706-NA, a copy of the return must be attached. This requirement ensures that the state has all relevant federal tax information on record for the decedent’s estate.

- Misconception 5: The TT-141A form alone is sufficient for estate tax filing purposes. In actuality, this affidavit is just a part of the documentation needed when dealing with estate tax matters, specifically related to determining the decedent's domicile. Completing and submitting this form does not negate the need for other estate tax forms or requirements mandated by New York State law.

- Misconception 6: The notarization of the affidavit can be performed in any state or country without issue. While the form can indeed be notarized outside of New York State, an authentication certificate is required if it is sworn to in a foreign country. This detail underscores the importance of following specific procedural steps based on where the affidavit is being notarized.

Clearing up these misconceptions provides a more accurate understanding of the TT-141A Estate Tax Domicile Affidavit and its proper usage. It highlights the importance of reading form instructions carefully and ensuring that the correct form is used in accordance with the specific circumstances of the decedent's estate.

Key takeaways

- Filling out the TT-141A form is necessary for estates of individuals who passed away after December 31, 1982, and before May 26, 1990, if it's asserted that the deceased was not a New York State resident at the time of their death. The form should be completed by the fiduciary (executor or administrator), the surviving spouse, or a member of the decedent’s immediate family who can provide the requested information.

- For estates filing New York State Estate Tax Return Form TT-385, or for decedents who died on or after May 26, 1990, the appropriate form is Form ET-141, not the TT-141A. It's crucial to choose the correct form based on the date of death to ensure the proper processing of the estate's tax obligations.

- If the estate filed a federal estate tax return using Form 706 or 706-NA, a copy of that return must be attached to the TT-141A form. This requirement supports the submission by providing federal estate tax information relevant to the state tax authorities.

- All questions on the TT-141A form must be answered completely. Incomplete answers may delay processing or impact the determination of the decedent's domicile for tax purposes. The thoroughness of the information provided is essential for accurate and timely evaluation by the New York State Department of Taxation and Finance.

- The affidavit section on page 4 of the TT-141A form requires notarization. This legal acknowledgment ensures that the information provided is attested to by the fiduciary or applicant under oath, adding a level of formal verification to the document.

- Disclosure of the decedent’s Social Security number is mandated for tax administration purposes. This sensitive piece of information is protected by law but is crucial for identifying the estate correctly in the tax system. It also facilitates any necessary information sharing as permitted or required by law for administrative purposes.

Popular PDF Forms

What Is a 1099 B - Form 1099-B filing is obligatory for most brokers, and ignoring this responsibility can lead to legal complications.

Tax Returns - Mortgage interest adjustment for individuals who own homes is reported on Schedule 1.