Blank Uc 304 PDF Template

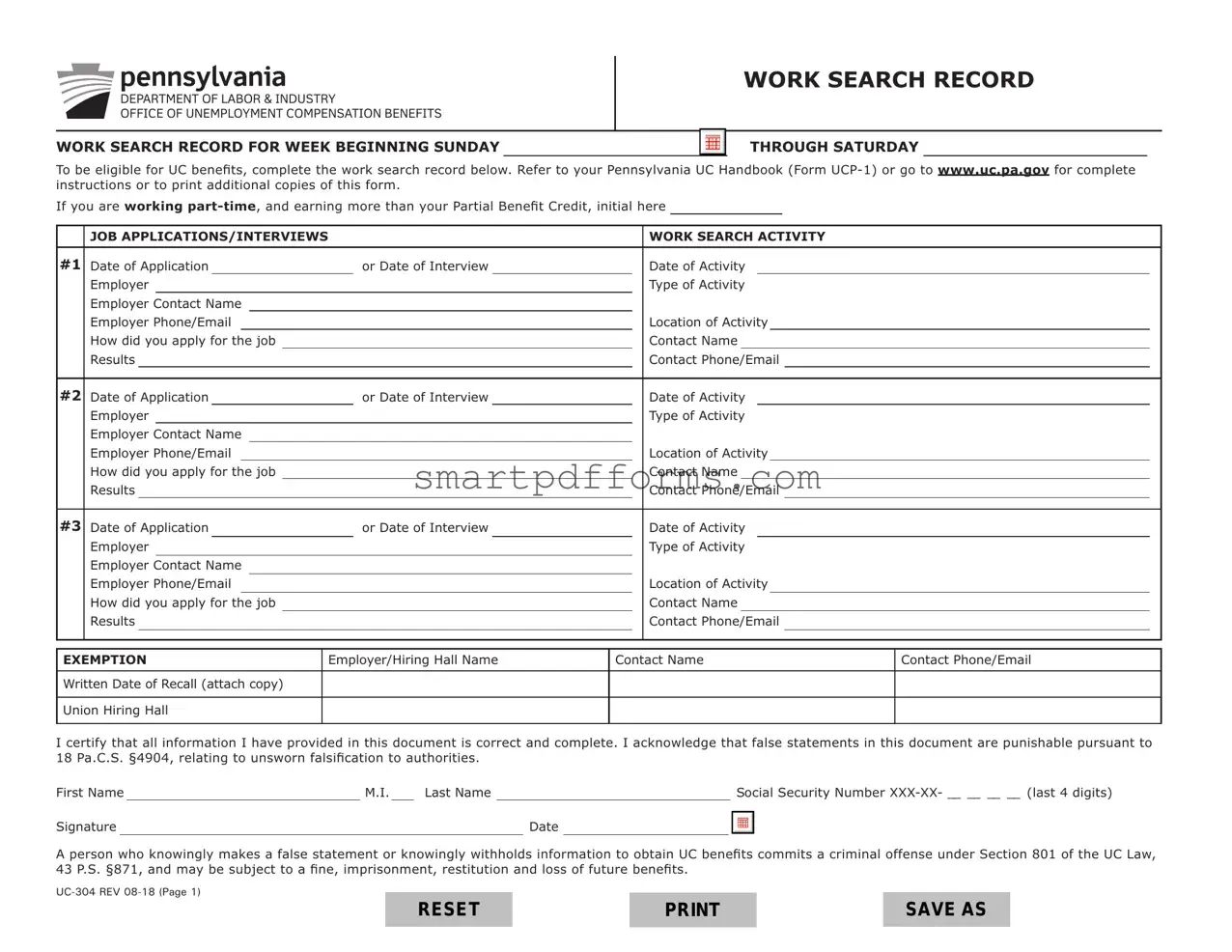

In the quest for unemployment compensation benefits, navigating the system and fulfilling its requirements is critical for individuals who find themselves out of work. Among the various documents and procedures that form part of this process, the UC 304 form plays a pivotal role. Issued by the Department of Labor & Industry Office of Unemployment Compensation Benefits, this form serves as a work search record for claimants. It meticulously documents each job application or interview conducted by an individual seeking unemployment compensation within a specified week, beginning Sunday and ending Saturday. Completing this form is a necessary step in proving that one is actively searching for employment, a key condition to remain eligible for unemployment benefits in Pennsylvania. Aside from listing detailed information about job applications and interviews, including dates, employer details, and the outcome of each application, the form also includes provisions for those working part-time but earning more than their Partial Benefit Credit. Moreover, it outlines clear consequences for any false statements or withheld information, emphasizing legal accountability and the seriousness of the documentation. Through precise instructions and requirements, the UC 304 form underscores the importance of a transparent and diligent approach to job searching, underscoring its role in the unemployment compensation benefits process.

Preview - Uc 304 Form

DEPARTMENT OF LABOR & INDUSTRY

DEPARTMENT OF LABOR & INDUSTRY

OFFICE OF UNEMPLOYMENT COMPENSATION BENEFITS

WORK SEARCH RECORD

WORK SEARCH RECORD FOR WEEK BEGINNING SUNDAY

THROUGH SATURDAY

To be eligible for UC benefits, complete the work search record below. Refer to your Pennsylvania UC Handbook (Form

If you are working

|

JOB APPLICATIONS/INTERVIEWS |

|

|

|

|

|

WORK SEARCH ACTIVITY |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#1 |

Date of Application |

|

|

or Date of Interview |

|

|

|

Date of Activity |

|

|

|

|||||||||

|

Employer |

|

|

|

|

|

|

Type of Activity |

|

|

||||||||||

|

Employer Contact Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Employer Phone/Email |

|

|

|

|

|

|

Location of Activity |

|

|

|

|||||||||

|

How did you apply for the job |

|

|

|

|

|

|

Contact Name |

|

|

|

|||||||||

|

Results |

|

|

|

|

|

Contact Phone/Email |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#2 |

Date of Application |

|

|

or Date of Interview |

|

|

|

Date of Activity |

|

|

|

|||||||||

|

Employer |

|

|

|

|

|

|

Type of Activity |

|

|

||||||||||

|

Employer Contact Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Employer Phone/Email |

|

|

|

|

|

|

Location of Activity |

|

|

|

|||||||||

|

How did you apply for the job |

|

|

|

|

|

|

Contact Name |

|

|

|

|||||||||

|

Results |

|

|

|

|

|

Contact Phone/Email |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#3 |

Date of Application |

|

|

or Date of Interview |

|

|

|

Date of Activity |

|

|

|

|||||||||

|

Employer |

|

|

|

|

|

|

Type of Activity |

|

|

||||||||||

|

Employer Contact Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Employer Phone/Email |

|

|

|

|

|

|

Location of Activity |

|

|

|

|||||||||

|

How did you apply for the job |

|

|

|

|

|

|

Contact Name |

|

|

|

|||||||||

|

Results |

|

|

|

|

|

Contact Phone/Email |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

EXEMPTION |

|

Employer/Hiring Hall Name |

Contact Name |

Contact Phone/Email |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Written Date of Recall (attach copy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Union Hiring Hall |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I certify that all information I have provided in this document is correct and complete. I acknowledge that false statements in this document are punishable pursuant to 18 Pa.C.S. §4904, relating to unsworn falsification to authorities.

First Name |

|

M.I. |

|

Last Name |

|

|

|

|

Social Security Number |

||||

|

|

|

|

|

|

|

|

|

|

||||

Signature |

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

A person who knowingly makes a false statement or knowingly withholds information to obtain UC benefits commits a criminal offense under Section 801 of the UC Law, 43 P.S. §871, and may be subject to a fine, imprisonment, restitution and loss of future benefits.

RESET |

SAVE AS |

Form Data

| Fact Name | Detail |

|---|---|

| Purpose | The UC 304 form is used for recording work search activities to remain eligible for Unemployment Compensation (UC) benefits. |

| Reference | Instructions and additional copies of the form can be found through the Pennsylvania UC Handbook (Form UCP-1) or the official website www.uc.pa.gov. |

| Governing Law | The form is regulated by Pennsylvania law, specifically under 18 Pa.C.S. §4904 for unsworn falsification to authorities, and Section 801 of the UC Law, 43 P.S. §871, regarding the penalties for fraudulent claims. |

| Penalties for False Statements | Submitting false information on the UC 304 can lead to fines, imprisonment, restitution, and the loss of future benefits under state law. |

Instructions on Utilizing Uc 304

If you're planning to file for Unemployment Compensation (UC) benefits, you'll need to demonstrate that you're actively seeking work. This involves completing the Work Search Record (UC-304 form) for each week you claim benefits. The form is essentially a log of your job application and interview activities. It's part of ensuring that you meet the requirements set forth by the Pennsylvania Department of Labor & Industry. Let's go through the steps to correctly fill out this form.

- Start by noting the week's beginning date (Sunday) and the end date (Saturday) at the top of the form. This records the specific week your search activities relate to.

- If you are working part-time and earn more than your Partial Benefit Credit, there's a space provided at the start of the form to initial.

- For each work search activity, enter the Date of Application or the Date of Interview under the respective headers for activities #1, #2, and #3.

- Fill in the Employer name and the Type of Activity (e.g., application submitted, interview) for each activity.

- Enter the Employer Contact Name, their Phone/Email, and the Location of Activity. This information is crucial should the Department need to verify your efforts.

- Describe How did you apply for the job (online, in-person, via email, etc.) for each activity listed. This shows the varied approaches you're taking in your job search.

- For the Contact Name, Results, and Contact Phone/Email sections, provide details about the person you communicated with regarding your application or interview, the outcome, or any feedback received, and how to contact them.

- If you have an Exemption (such as a recall date by an employer or union hiring hall), fill out the Employer/Hiring Hall Name, Contact Name, Contact Phone/Email, and the Written Date of Recall. Attach any required documentation as indicated.

- Review the document for accuracy. Remember, providing false information can have serious consequences, including fines or criminal charges.

- Finally, sign and date the form at the bottom, ensuring you've entered the last four digits of your Social Security Number correctly.

Once completed, you have a record of your job search activities ready for submission as required by your state's UC program. Keeping accurate and detailed records can help support your claim and ensure that you remain eligible for unemployment benefits while you seek new employment.

Obtain Answers on Uc 304

The UC-304 form, part of the unemployment benefits system in Pennsylvania, serves as a crucial document for recording work search activities. Understanding the requirements and how to properly complete this form can ensure compliance and avoid penalties. Below are detailed answers to frequently asked questions regarding the UC-304 form.

-

What is the purpose of the UC-304 form?

The UC-304 form is designed to document an individual's efforts to find employment while receiving unemployment compensation (UC) benefits. To maintain eligibility for these benefits, individuals must actively search for work and provide detailed records of their search activities. The form collects information about job applications, interviews, and other job search efforts conducted each week.

-

How do I complete the UC-304 form?

To accurately complete the UC-304 form, you should fill in details for each job search activity, including the date of the application or interview, the employer's name, the type of activity, employer contact information, and the results of the activity. It's important to list all activities separately and provide as much detail as possible to demonstrate a genuine effort in seeking employment. If working part-time and earning more than your Partial Benefit Credit, you are also required to acknowledge this on the form.

-

Where can I find additional copies of the UC-304 form?

If you need extra copies of the UC-304 form, they can be downloaded from the official Pennsylvania Unemployment Compensation website at www.uc.pa.gov. This site also provides additional resources and instructions related to unemployment benefits in Pennsylvania, including the Pennsylvania UC Handbook (Form UCP-1), which offers comprehensive guidance on UC benefits and work search requirements.

-

What are the consequences of providing false information on the UC-304 form?

It is critical to provide accurate and truthful information on the UC-304 form. Intentionally submitting false information or withholding information to receive UC benefits is considered a criminal offense under Section 801 of the UC Law, 43 P.S. §871. Individuals found guilty of such infractions may face a range of penalties, including fines, imprisonment, restitution, and the potential loss of future benefits. These measures underscore the importance of honest and precise record-keeping in the work search process.

Common mistakes

When filling out the UC-304 form, a vital document for Pennsylvania's Unemployment Compensation (UC) benefits, attention to detail makes all the difference. Here are 10 common mistakes people often make:

Not reading the instructions thoroughly: Before starting, it's crucial to understand the requirements by referring to the Pennsylvania UC Handbook (Form UCP-1) or visiting the official website. Overlooking this step can lead to errors in completing the form.

Forgetting to sign and date the form: The certification section at the bottom requires a signature and date to validate the form. Missing this step may render the submission invalid.

Misreporting work search activities: Each work search activity must be documented accurately, including dates of applications or interviews, employer contact information, and the results of these activities.

Omitting part-time work details: If you're working part-time and earning more than your Partial Benefit Credit, an initial is required in the designated area. Missing this could affect your benefit eligibility.

Entering incorrect contact information: Providing wrong or incomplete employer contact details can lead to issues in verifying your work search efforts. Double-check this information for accuracy.

Not attaching required documents: If claiming an exemption based on a recall to work, attaching a copy of the written date of recall is necessary. Failure to do so could disqualify your exemption claim.

Failing to list enough search activities: The UC requirements may specify a minimum number of job searches per week. Make sure to meet or exceed this number to maintain eligibility.

Using illegible handwriting: If the form is filled out by hand, ensure your handwriting is clear and readable. Illegible forms may not be processed correctly.

Not using the official form: Ensure you're using the most current UC-304 form by checking the revision date (REV 08-18) and obtaining it from the correct sources, like the official website.

Providing false information: Knowingly making a false statement or withholding information is a criminal offense. Accuracy and honesty are paramount.

Avoiding these mistakes can smooth the path to maintaining UC benefits eligibility. Always take your time, review your entries, and ensure all required documentation is complete before submission.

Documents used along the form

When applying for or receiving unemployment compensation benefits, various forms and documents may be required or useful in addition to the UC-304 form, the Work Search Record. Each of these documents plays a crucial role in ensuring applicants meet eligibility requirements, provide necessary details, and comply with state regulations to maintain their benefits or address specific situations related to their employment status.

- UCP-1 Pennsylvania UC Handbook: This handbook offers comprehensive guidance on unemployment compensation in Pennsylvania, including eligibility criteria, benefit rights, and responsibilities. It serves as a valuable resource for understanding how to properly complete the UC-304 and other related forms.

- UC-2: Employer’s Report for Unemployment Compensation. This form is filled out by employers to report wages paid to employees, which is essential for determining an individual’s eligibility for unemployment benefits.

- UC-28: Notice of Determination/Redetermination. This document provides individuals with the state’s decision regarding their eligibility for unemployment benefits, including any changes to benefit amounts.

- UC-44FR: Financial Determination. This form communicates the weekly benefit rate and maximum benefit amount to the claimant based on their past earnings.

- UC-45: Request to Modify Benefit Payment. Claimants can use this form to request changes to the way they receive benefit payments, such as opting for direct deposit instead of checks.

- UC-46B: Unemployment Compensation Appeal Form. This form is used by individuals wishing to appeal a decision made regarding their unemployment compensation.

- UC-1609P: Unemployment Compensation Handbook for Claimants. This document provides claimants with detailed information about maintaining eligibility, certifying for benefits, and more.

- LLC-25: Verification of Eligibility for Low Income Assistance. This document helps claimants who are applying for additional support programs due to low income while receiving unemployment benefits.

- PA 1000: Property Tax or Rent Rebate Claim form. While not directly related to unemployment benefits, individuals on unemployment might qualify for property tax or rent rebates and need this form to apply.

- SSA-821-BK: Work Activity Report - Social Security Disability Insurance. This form is for individuals receiving SSDI benefits to report any work activity, which might also be relevant for those navigating unemployment benefits simultaneously.

Utilizing these documents appropriately can significantly impact the management and outcome of an unemployment claim. They ensure that individuals not only receive the benefits to which they are entitled but also adhere to the guidelines necessary to maintain their eligibility over time. Accurate and timely completion and submission of required paperwork facilitate smoother interactions with unemployment systems and can help to avoid delays or complications with benefit distributions.

Similar forms

UC-1 Employer's Quarterly Contribution Report: Similar to the UC-304 form, the UC-1 form is used for unemployment compensation matters but focuses on the employer's financial contributions to the unemployment compensation fund. Both forms are key components in managing and supporting unemployment compensation systems.

I-9 Employment Eligibility Verification: Like the UC-304 form, the I-9 form is integral to employment in the United States. While the UC-304 tracks job search efforts for unemployment benefits, the I-9 verifies an employee's legal right to work in the U.S., ensuring compliance with federal laws.

W-4 Employee's Withholding Certificate: Similar in its association with employment, the W-4 form differs from the UC-304 by focusing on tax withholding preferences for newly hired employees. Both forms are critical at different employment stages, with the UC-304 being essential during unemployment.

940 Employer's Annual Federal Unemployment (FUTA) Tax Return: This form, akin to the UC-304, deals with unemployment taxes but from an employer's perspective. It reports annual federal unemployment taxes, while the UC-304 form documents an individual's job search activities to qualify for benefits.

W-2 Wage and Tax Statement: While the W-2 form provides an annual summary of wages and taxes withheld for employees, it indirectly relates to the UC-304, which is used by individuals to track job search efforts when they may no longer have W-2 income due to unemployment.

SSA-1099 Social Security Benefit Statement: The SSA-1099, representing social security benefits received, parallels the UC-304's role in financial support during unemployment, showcasing government-provided income support in different contexts.

1099-G Certain Government Payments: Similar to the UC-304 form, a 1099-G may be issued to individuals who have received unemployment compensation, representing another link between documentation for government benefit programs and the individual’s tax responsibilities.

Job Search Log: A job search log, often self-maintained by job seekers to track their application and interview activities, is directly mirrored by the UC-304 form. Both serve as a record of an individual’s efforts to find employment, although the UC-304 is a formal document required by unemployment compensation programs.

Dos and Don'ts

Filling out the UC 304 form, a critical document for claiming Unemployment Compensation (UC) benefits, requires attention to detail and honesty. Here are six dos and don'ts to guide you through the process:

Do:

- Read the instructions carefully before beginning. Understanding the requirements can help ensure that you fill out the form correctly, avoiding delays in receiving your benefits.

- Provide accurate information for every section. Whether it's your personal details, job applications, interviews, or work search activities, accuracy is key to processing your claim without complications.

- Document your job search activities thoroughly. Keeping detailed records can support your claim, demonstrating that you meet the work search requirements.

- Sign and date the form. Your signature certifies that all the information provided is correct and complete, making this step crucial.

- Use a black or blue pen if filling out the form by hand. This makes your answers legible and photocopy-friendly.

- Keep a copy for your records. Having a personal copy can be useful for future reference or in case questions arise about your job search activities.

Don't:

- Leave sections blank. If a section does not apply to you, fill in "N/A" (not applicable) rather than leaving it empty, to show that you didn't simply overlook it.

- Guess dates or details. If you're unsure about specific dates or details, it's better to look them up than to risk providing incorrect information.

- Use correction fluid or tape on the paper form. Mistakes are best crossed out neatly with a single line, and the correct information should be written clearly above or beside it.

- Include sensitive personal information beyond what is required, such as your full Social Security Number or personal financial details, to protect your privacy.

- Forge signatures or fabricate job search activities. Honesty is crucial, as false statements can result in criminal charges, fines, or loss of benefits.

- Delay submitting your form. Timely submission is essential to avoiding delays in receiving your benefits or potentially missing out on them altogether.

Misconceptions

There are several misconceptions surrounding the UC 304 form, a document vital for unemployment claimants in Pennsylvania. Understanding these misconceptions is crucial for individuals looking to accurately complete their work search records.

- Misconception 1: The UC 304 form is optional for unemployment benefits. In reality, completing the UC 304 form is a mandatory step for claimants to prove they are actively seeking employment to remain eligible for benefits.

- Misconception 2: All sections of the form must be filled out by every claimant. While it's essential to provide detailed work search activities, the section labeled "Exemption" is only for claimants meeting specific criteria, such as being temporarily laid off with a confirmed return-to-work date.

- Misconception 3: The form requires detailed personal information. The form requests only the last four digits of the Social Security number, not the full number, focusing on protecting claimant's personal information.

- Misconception 4: Part-time workers don't need to complete the form. Even individuals working part-time might need to fill out the UC 304 form if they are earning more than their Partial Benefit Credit, signifying their continued eligibility for some benefits.

- Misconception 5: Digital submissions are not accepted. Contrary to this belief, the form's final line with "RESET PRINT SAVE AS" options indicates that claimants can save and submit their records electronically, offering a convenient option beyond paper submissions.

- Misconception 6: Any type of job search activity counts. The form requires specific types of activities to be documented, such as direct applications or interviews, not just any job search-related activity.

- Misconception 7: False statements on the form carry light consequences. Making false statements or withholding information on this form can lead to severe penalties, including fines, imprisonment, restitution, and loss of future benefits, emphasizing the importance of honesty in the process.

Clarifying these misconceptions is crucial for ensuring that individuals seeking unemployment benefits understand the importance of accurately completing the UC 304 form. This understanding helps maintain eligibility and avoid potential penalties associated with misinformation or inaccuracies.

Key takeaways

Understanding the Importance of Accuracy on the UC 304 Form

Filling out the UC 304 form, a vital task for individuals seeking to validate their unemployment compensation (UC) benefits through job search activities, demands careful attention to detail. The form not only serves as a personal record but also as a legal document subject to verification by the Department of Labor & Industry, Office of Unemployment Compensation. Accurate and honest reporting of job search efforts is paramount, as any falsification of information can lead to severe penalties, including fines, imprisonment, restitution, and the loss of future benefits.

Comprehensive Job Search Record Keeping

- Documenting every job application or interview within the specified week, including the date of the activity, the employer's name, the nature of the activity, and contacts, is crucial. This comprehensive tracking demonstrates an ongoing and earnest effort to find employment, an essential requirement for UC eligibility.

- Maintaining a detailed record also assists individuals in managing their job search more efficiently, offering a clear overview of their efforts and progress.

Eligibility Requirements and Exemptions

The UC 304 form acknowledges that not everyone is subject to the same requirements. For individuals working part-time and earning more than their Partial Benefit Credit, a specific section must be initialed, indicating this circumstance. Moreover, exemptions such as recall by a previous employer or union hiring hall arrangements are recognized, provided there's attached evidence of a written recall date. Understanding these nuances ensures individuals accurately report their status, avoiding potential discrepancies that could affect their benefits.

Accessibility and Additional Resources

For anyone in need of further guidance or additional copies of the UC 304 form, the Pennsylvania UC Handbook (Form UCP-1) and the www.uc.pa.gov website offer comprehensive instructions and resources. These tools are designed to help individuals navigate the complexities of the unemployment compensation system, ensuring they meet all requirements to maintain their eligibility for benefits.

Popular PDF Forms

Proof of Income Bank Statement - A simple yet effective form for self-employed individuals to present their monthly earnings and expenditures to the Iowa DHS.

Nj Tdi - Space is provided for additional employers and supplemental information, allowing claimants with complex employment histories to fully detail their work background.