Blank Uct 6491 PDF Template

Understanding the nuances and requirements of the UCT 6491 form is crucial for businesses navigating the complexities of reporting employment and business changes. This document, integral to ensuring compliance within the regulatory framework of the Unemployment Insurance Division of the Wisconsin Department of Workforce Development (DWD), serves as a conduit for communicating any alterations in a company's structure or operations. It is explicitly designed for businesses that have experienced changes that need to be reported to the DWD. The necessity to complete and return this form arises from occurrences such as a change in the legal name, address, trade name, contact information, or the cessation of business activities. Additionally, it encompasses reporting on the intricacies involved in the reorganization, sale, or transfer of the business. Businesses are also required to disclose plans of operating without employees or engaging independent contractors, thereby providing a comprehensive outline of the corporate adjustments that need to be transparently communicated to the government. Failure to update these details could lead to complications with the Unemployment Insurance system, underscoring the form’s significance in maintaining accurate and current records. This document, therefore, not only facilitates administrative accuracy but also aids in the smooth continuation of business operations within the legal ambit of Wisconsin's employment laws.

Preview - Uct 6491 Form

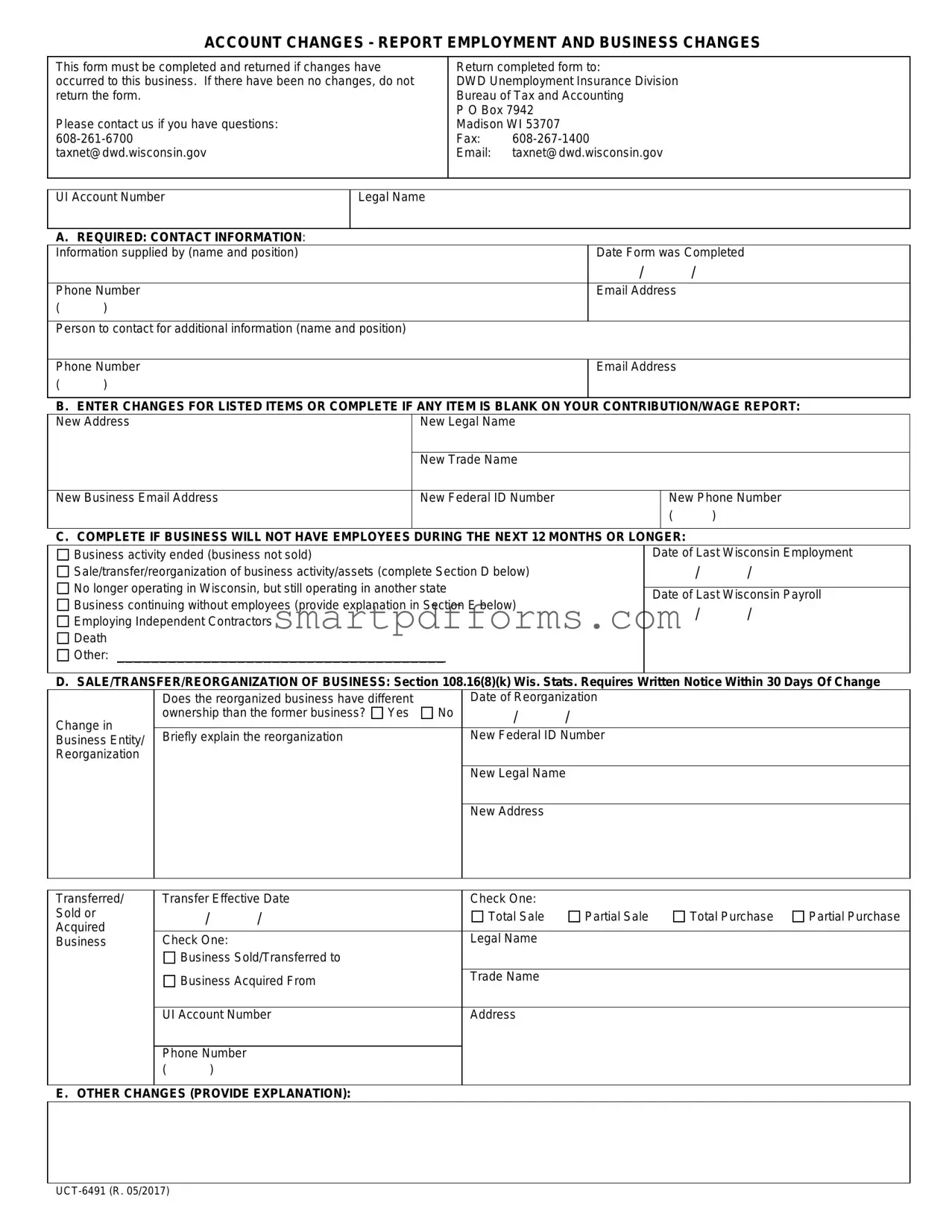

ACCOUNT CHANGES - REPORT EMPLOYMENT AND BUSINESS CHANGES

This form must be completed and returned if changes have occurred to this business. If there have been no changes, do not return the form.

Please contact us if you have questions:

Return completed form to:

DWD Unemployment Insurance Division Bureau of Tax and Accounting

P O Box 7942 Madison WI 53707

Fax:

Email: taxnet@dwd.wisconsin.gov

UI Account Number

Legal Name

A. REQUIRED: CONTACT INFORMATION: |

|

|

|

|

|

|

Information supplied by (name and position) |

|

Date Form was Completed |

||||

|

|

|

/ |

/ |

|

|

Phone Number |

|

Email Address |

|

|||

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Person to contact for additional information (name and position) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

Email Address |

|

|||

( |

) |

|

|

|

|

|

|

|

|

|

|

||

B. ENTER CHANGES FOR LISTED ITEMS OR COMPLETE IF ANY ITEM IS BLANK ON YOUR CONTRIBUTION/WAGE REPORT: |

||||||

New Address |

New Legal Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Trade Name |

|

|

|

|

|

|

|

|

|

||

New Business Email Address |

New Federal ID Number |

|

|

New Phone Number |

||

|

|

|

|

|

( |

) |

|

|

|

|

|

||

C. COMPLETE IF BUSINESS WILL NOT HAVE EMPLOYEES |

DURING THE NEXT 12 MONTHS OR LONGER: |

|

||||

|

Business activity ended (business not sold) |

|

|

Date of Last Wisconsin Employment |

||

|

Sale/transfer/reorganization of business activity/assets (complete Section D below) |

|

/ |

/ |

||

|

No longer operating in Wisconsin, but still operating in another state |

|

|

|

|

|

|

|

Date of Last Wisconsin Payroll |

||||

|

Business continuing without employees (provide explanation in Section E below) |

|

||||

|

|

/ |

/ |

|||

|

Employing Independent Contractors |

|

|

|||

|

|

|

|

|

|

|

|

Death |

|

|

|

|

|

|

Other: ______________________________________ |

|

|

|

|

|

D. SALE/TRANSFER/REORGANIZATION OF BUSINESS: Section 108.16(8)(k) Wis. Stats. Requires Written Notice Within 30 Days Of Change

|

Does the reorganized business have different |

|

Date of Reorganization |

|

Change in |

ownership than the former business? Yes |

No |

/ |

/ |

Briefly explain the reorganization |

|

New Federal ID Number |

||

Business Entity/ |

|

|||

Reorganization |

|

|

|

|

|

|

|

New Legal Name |

|

|

|

|

|

|

|

|

|

New Address |

|

|

|

|

|

|

Transferred/ |

Transfer Effective Date |

Check One: |

|

|

|

||

Sold or |

|

/ |

/ |

Total Sale |

Partial Sale |

Total Purchase |

Partial Purchase |

Acquired |

|

|

|

|

|

|

|

Business |

Check One: |

|

Legal Name |

|

|

|

|

|

|

Business Sold/Transferred to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Acquired From |

Trade Name |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

UI Account Number |

Address |

|

|

|

||

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

||

E. OTHER CHANGES (PROVIDE EXPLANATION): |

|

|

|

|

|||

|

|

|

|

|

|

|

|

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The UCT-6491 form is used for reporting employment and business changes. |

| 2 | This form should not be returned if there have been no changes to the business. |

| 3 | For questions regarding the form, contact can be made via phone at 608-261-6700 or email at taxnet@dwd.wisconsin.gov. |

| 4 | Completed forms are to be sent to the Department of Workforce Development's Unemployment Insurance Division in Madison, Wisconsin. |

| 5 | The form requires contact information to be updated or provided if it has changed or is missing. |

| 6 | Changes in business structure such as new address, legal name, or trade name need to be reported using this form. |

| 7 | If a business will not have employees for the next 12 months or longer, this form must be completed to reflect such changes. |

| 8 | Section 108.16(8)(k) of Wisconsin Statutes requires written notice of sale, transfer, or reorganization of business within 30 days. |

| 9 | Details of the sale or reorganization, including new federal ID numbers and legal names, must be provided if applicable. |

| 10 | A section for other changes is provided for details not covered elsewhere in the form. |

Instructions on Utilizing Uct 6491

Once an individual realizes changes have occurred in their business operations or structure, the next critical step involves ensuring all relevant details are updated with the appropriate state department. The UCT 6491 form serves as a necessary document to report employment and business changes in Wisconsin. For accuracy and compliance, it's essential to fill out this form attentively and return it to the Department of Workforce Development (DWD). Here's how to properly fill out the UCT 6491 form, ensuring the state has your most current business information.

- Start by entering your UI Account Number and Legal Name at the top of the form to identify your account correctly.

- In section A, provide the contact information required:

- Write the full name and position of the person supplying the information.

- Enter the date the form was completed.

- Fill in a contact phone number and email address for future communication.

- Include the name and position of an alternative contact person, along with their phone number and email address.

- For section B, update any changes to your business information, such as:

- New Address

- New Legal Name or Trade Name

- New Business Email Address

- New Federal ID Number

- New Phone Number

- If your business will not have employees for the next 12 months or longer, complete section C by selecting the right option that describes your situation and providing the necessary details, including the date of the last Wisconsin employment or payroll.

- Section D should be completed if there has been a sale, transfer, or reorganization of the business. Indicate whether the reorganized business has different ownership than the former business, the date of reorganization, and provide a brief explanation. Fill in details of the new Federal ID Number, the new legal name, new address, and the status of the sale or purchase.

- In section E, explain any other changes not previously covered in the form. This section allows for additional information that might be relevant to the Department of Workforce Development.

Once completed, return the UCT 6491 form to the DWD’s Unemployment Insurance Division via mail, fax, or email as provided on the form. Ensuring that this form is filled out accurately and returned promptly will help maintain compliance with state regulations and assist in the smooth operation of your business in Wisconsin.

Obtain Answers on Uct 6491

-

What is the UCT 6491 form used for?

The UCT 6491 form is a document required by the Department of Workforce Development (DWD), Unemployment Insurance Division, for businesses operating in Wisconsin. This form serves as a notification tool for the state to keep updated records on businesses regarding employment and business changes. It needs to be submitted if there have been changes in:

- Contact information

- Business address

- Legal or trade name

- Business email address

- Federal ID number

- Phone number

- Operational changes, such as a sale, transfer, or reorganization of the business

- Closure or continuation of the business without employees in the next 12 months

-

Who needs to fill out the UCT 6491 form?

Any business that has seen changes to its structure, contact information, or operational status, as outlined in the form, is required to complete and return the UCT 6491 form to the DWD Unemployment Insurance Division. If there have been no changes to the information previously provided or if the business has ceased operations and already notified the DWD, the form does not need to be returned. However, businesses operating in Wisconsin without employees for the next 12 months or longer must also fill out and submit this form.

-

How can the UCT 6491 form be submitted?

Businesses have multiple options for submitting the completed UCT 6491 form to ensure that the process is accessible and convenient for all. The form can be returned via mail, fax, or email to the addresses and numbers provided on the form. Specifically, submissions can be made to:

- Mail: DWD Unemployment Insurance Division, Bureau of Tax and Accounting, P.O. Box 7942, Madison, WI 53707

- Fax: 608-267-1400

- Email: taxnet@dwd.wisconsin.gov

It is important for businesses to ensure that the form is fully completed and accurately reflects the current status and information of the business to avoid delays in processing.

-

What information is required when a business is sold, transferred, or undergoes reorganization?

When a business experiences a sale, transfer, or reorganization, Section D of the UCT 6491 form must be completed. This section requires detailed information about the change, including:

- The date of the reorganization or transfer.

- A brief explanation of the reorganization.

- Whether the reorganized business has different ownership than the former business.

- New federal ID number, if applicable.

- New legal name and address.

- Details of the business entity involved in the transfer, including legal name, trade name, UI Account Number, and contact information.

Common mistakes

Filling out the UCT-6491 form correctly is crucial for businesses to report employment and business changes to the Department of Workforce Development (DWD) in Wisconsin. Mistakes on this form can lead to delays or incorrect processing of important information. Here are eight common mistakes people make when completing the UCT-6491 form:

Not updating contact information: It's essential to provide current contact details, including a phone number and email address, so the DWD can reach you if they have questions.

Leaving sections blank: If an item changes or if the original report was missing information, you must complete the relevant sections. Skipping sections can lead to incomplete records.

Inaccurate reporting of business changes: Failure to correctly report new addresses, legal names, trade names, email addresses, federal ID numbers, or phone numbers can lead to miscommunication and filing issues.

Forgetting to report the cessation of business activities: If your business will not have employees for the next 12 months or longer, it's crucial to report this change and provide a reason, ensuring your business is accurately classified.

Omitting details about sale, transfer, or reorganization: When a business undergoes significant changes, providing detailed information, including the nature of the change and the effective date, is vital for proper record-keeping and compliance.

Failure to provide a new Federal ID Number after reorganization: A change in the Federal ID Number is a critical update that needs accurate reporting if your business's ownership or structure changes.

Incorrect or incomplete reporting of acquired or transferred business details: When reporting the sale or transfer of a business, including both the legal and trade names, addresses, and contact information is essential for accurate records.

Leaving the explanation section for other changes empty: If your business undergoes changes not specifically listed on the form, providing a clear explanation in Section E ensures all pertinent information is communicated to the DWD.

It's important for businesses to double-check their responses on the UCT-6491 form to ensure all information provided is accurate and complete. This will help in avoiding delays or miscommunication with the DWD.

Documents used along the form

When managing or making changes to a business, particularly in relation to employment and taxation within the United States, it's paramount to be well-informed about the complete array of necessary documentation. The UCT-6491 form, vital for reporting employment and business changes to the Department of Workforce Development Unemployment Insurance Division, is often just one piece in the puzzle. Along with this critical document, various others play instrumental roles in ensuring compliance and facilitating smooth operations.

- IRS Form W-9: This form is required for gathering information from contractors or freelancers. It's essential for businesses when they hire independent contractors instead of traditional employees, aiding in the correct reporting of taxes to the IRS.

- IRS Form 941: Employers use this form to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks. Additionally, it reports the employer's portion of social security or Medicare tax, making it crucial for payroll reporting.

- Form W-2: This wage and tax statement must be provided to each employee and the Social Security Administration at the end of each year. It reports employee annual wages and the amount of taxes withheld from their paycheck.

- Form W-4: Employees provide this form to their employer to indicate their tax situation, such as filing status and number of dependents, which determines the withholding tax from their paycheck.

- IRS Form SS-4: This is the application for an Employer Identification Number (EIN), which is necessary for reporting taxes and other documents to the IRS. It's an essential initial form when starting a new business or making changes that require a new EIN.

- State-Specific New Hire Reporting Forms: Each state requires employers to report new hires to a designated state agency, assisting in the enforcement of child support orders. Although specifics vary by state, the obligation is nationwide.

- Articles of Incorporation or Organization: Depending on the structure of your business (corporation or LLC), these documents are filed with the state to legally form the entity. They might need updates in the event of significant changes like those reported on the UCT-6491.

- Business License Renewal Forms: Depending on the business's location and industry, various licenses and permits may need renewal. These documents are vital for legal operation and may be impacted by changes similar to those reported on the UCT-6491.

Each of these documents serves a unique purpose yet interconnects in ensuring a business's regulatory compliance and ongoing operations. Navigating through these requirements can indeed be challenging, but understanding the role and importance of each document can significantly ease the process. By staying informed and proactive in document management, businesses can continue to thrive and adapt in the always-evolving corporate landscape.

Similar forms

The IRS Form 8822-B is used to report a change in the address or business location, which is similar to the UCT 6491 form in that it also asks for updated contact information including new address details. Both forms are essential for ensuring that government records are updated to reflect current information for the purpose of communication and compliance.

The SS-4 Form, Application for Employer Identification Number (EIN), albeit primarily intended for requesting an EIN, also addresses changes in the reference information for a business, similar to updating the federal ID number as required on the UCT 6491 form. This similarity lies in the process of keeping governmental agencies informed about the current status of a business’s identification credentials.

Secretary of State Business Registration forms, which vary by state, are used for the initial registration of a business or updating business information like legal name or ownership changes. This mirrors the section of the UCT 6491 which requires updates on new legal names or reorganization of business, thus maintaining the state's records on businesses operating within its jurisdiction.

The BLS 3023, Survey of Business Ownership, collects detailed information on the ownership and operational status of businesses, echoing the UCT 6491's purpose in collecting updates regarding business structure changes, such as sale or reorganization events.

Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, requires reporting on changes to the business that could affect its tax responsibilities, drawing a parallel with UCT 6491's requirement for businesses to report changes that could impact their unemployment insurance obligations.

The Change of Registered Agent/Office forms, specific to each state, require updated information if the legal address or registered agent of a business changes, similar to the updating of contact information to ensure effective legal and official communication as required on the UCT 6491 form.

The PERA Employer Change Form, used by pension agencies, requires updates on employer information to properly manage pension contributions and obligations, akin to the UCT 6491’s role in updating employment and business changes for unemployment insurance purposes.

Form W-9, Request for Taxpayer Identification Number and Certification, though primarily used for certification of a taxpayer's identification number, can also involve updates if the business's TIN or legal name changes, resembling the type of updates related to federal ID numbers and legal names on the UCT 6491 form.

Dos and Don'ts

When completing the UCT 6491 form for reporting employment and business changes, there are several best practices to adhere to, as well as common pitfalls to avoid. Following these guidelines can ensure the process is handled efficiently and accurately.

Do:- Review all sections carefully before starting the form to ensure all applicable parts are understood.

- Provide accurate and current information to avoid processing delays or issues with your account.

- Use the contact information provided on the form if you have questions, ensuring clarity and correctness in your submission.

- Report any changes in address, legal name, trade name, business email address, Federal ID number, or phone number in the designated sections.

- Clarify if the business will not have employees for the next 12 months or longer, providing thorough explanations when necessary.

- Give detailed information regarding the sale, transfer, or reorganization of the business, including new ownership details, if applicable.

- Explain any other changes that don't fit neatly into the provided sections, ensuring full disclosure.

- Return the form if no changes have occurred to your business. This form is only necessary for reporting changes.

- Leave sections blank that require updates or are applicable to your business situation. Incomplete forms may result in processing delays.

- Forget to list the UI Account Number and your business's Legal Name at the beginning of the form; this information is crucial for identification purposes.

- Overlook providing a detailed explanation if your business is continuing without employees, employing independent contractors, or undergoing other significant changes.

- Delay the submission beyond the deadline, especially in cases of business reorganization, sale, or transfer, to avoid non-compliance issues.

- Submit information that is outdated or incorrect. Double-check all entries for accuracy before sending the form.

- Use this form for inquiries or questions. Contact the division directly using the information provided at the top of the form for assistance.

Adhering to these guidelines ensures your UCT 6491 form is filled out comprehensively and correctly, facilitating a smoother update process to your business's account with the Wisconsin Department of Workforce Development's Unemployment Insurance Division.

Misconceptions

Misconception 1: The UCT 6491 form is only for reporting changes in business ownership.

Many believe this form exclusively covers updates about business ownership changes. However, it serves a broader purpose, encompassing a wide range of alterations, such as new contact information, business address, trade name, federal ID number, and significant business events like cessation of operation in Wisconsin, reorganization, or operating without employees for an extended period. Therefore, the scope of the UCT 6491 form extends beyond merely ownership updates.Misconception 2: If there are no changes, the UCT 6491 form should still be submitted for records.

This is incorrect. The form explicitly states that it should not be returned if there have been no changes to the business. The directive is to only submit the form when actual updates or modifications need to be reported, thus ensuring the state has the most current information without being overloaded with unnecessary submissions.Misconception 3: The form can only be returned via mail.

While mailing is an option, it is not the only way to submit the form. Businesses have the flexibility to return the completed form through fax or email as well, facilitating a quicker and more convenient submission process depending on the sender’s preferences or the urgency of the updates.Misconception 4: Any business change requires a separate form submission.

It's a common misconception that each type of business change necessitates an individual form. In reality, the UCT 6491 form is designed to report multiple changes at once. Sections are allocated for various updates - from contact information to significant business transitions, allowing for efficient consolidation of information in a single submission.Misconception 5: Reporting the cessation of employing workers is unnecessary if the business is closing down.

Even if a business is ending operations altogether, reporting that it will not have employees for the next 12 months or longer is critical. This information keeps the state informed for unemployment insurance purposes and ensures that records accurately reflect the business’s status, preventing potential complications with state regulations.Misconception 6: Information on employing independent contractors is not pertinent on this form.

Contrary to this belief, the form specifically requests information if a business is transitioning to or continuing operations without employees by employing independent contractors. This data is essential as it affects the classification and responsibilities of the business under state unemployment insurance laws.

Key takeaways

Filling out and using the UCT 6491 form is vital for businesses undergoing changes. The form is designed to record changes related to employment and business details accurately. Properly completing and returning this form ensures your records with the Department of Workforce Development (DWD) remain current and correct. Here are key takeaways to guide you through the process:

- Report Timely: If your business experiences any changes, it's essential to fill out and return the UCT 6491 form promptly. Delay in reporting can lead to discrepancies in your records, potentially affecting your contributions or benefits.

- No Changes, No Submission: If there have been no changes in your business since the last report, you do not need to submit the form.

- Contact Information: Clearly provide the contact information of the person filling out the form and an additional contact for further questions. This includes names, phone numbers, and email addresses.

- Business Changes: The form allows you to report various types of changes such as new addresses, legal names, trade names, business email addresses, federal ID numbers, and phone numbers. Make sure to complete all relevant sections.

- No Employees: If your business will not have employees for the next 12 months or longer, detail this in the specified section. This includes business closures, operations moving out of Wisconsin, or transitioning to using independent contractors.

- Required Written Notice: For any sale, transfer, or reorganization of your business, Wisconsin Statutes require written notice within 30 days. Ensure this information is provided in detail in the form, including the date and nature of the change.

- Providing Explanations: The form includes a section for explaining any other changes not specifically listed. Utilize this section to ensure complete transparency about your business situation.

- Multiple Contact Methods: The form provides multiple submission options, including mail, fax, and email, making it convenient to send your information securely and swiftly.

- Access to Assistance: If questions or issues arise while filling out the form, the provided contact details, including a phone number and email address, offer direct lines to assistance from the DWD.

Accurately completing the UCT 6491 form is crucial for maintaining proper records with the Unemployment Insurance Division. Following these key takeaways ensures that your business complies with reporting requirements, potentially avoiding any negative impact on your operations or the calculation of your unemployment insurance contributions.

Popular PDF Forms

Texas Drivers Permit Rules - Decision-making regarding the issuance of a VOE rests solely with educational institutions, underscoring their role in monitoring students' academic and attendance records.

Cargo Manifest - By providing an estimated average time to complete, the form respects the respondent's time and resources.