Blank Ui 5G PDF Template

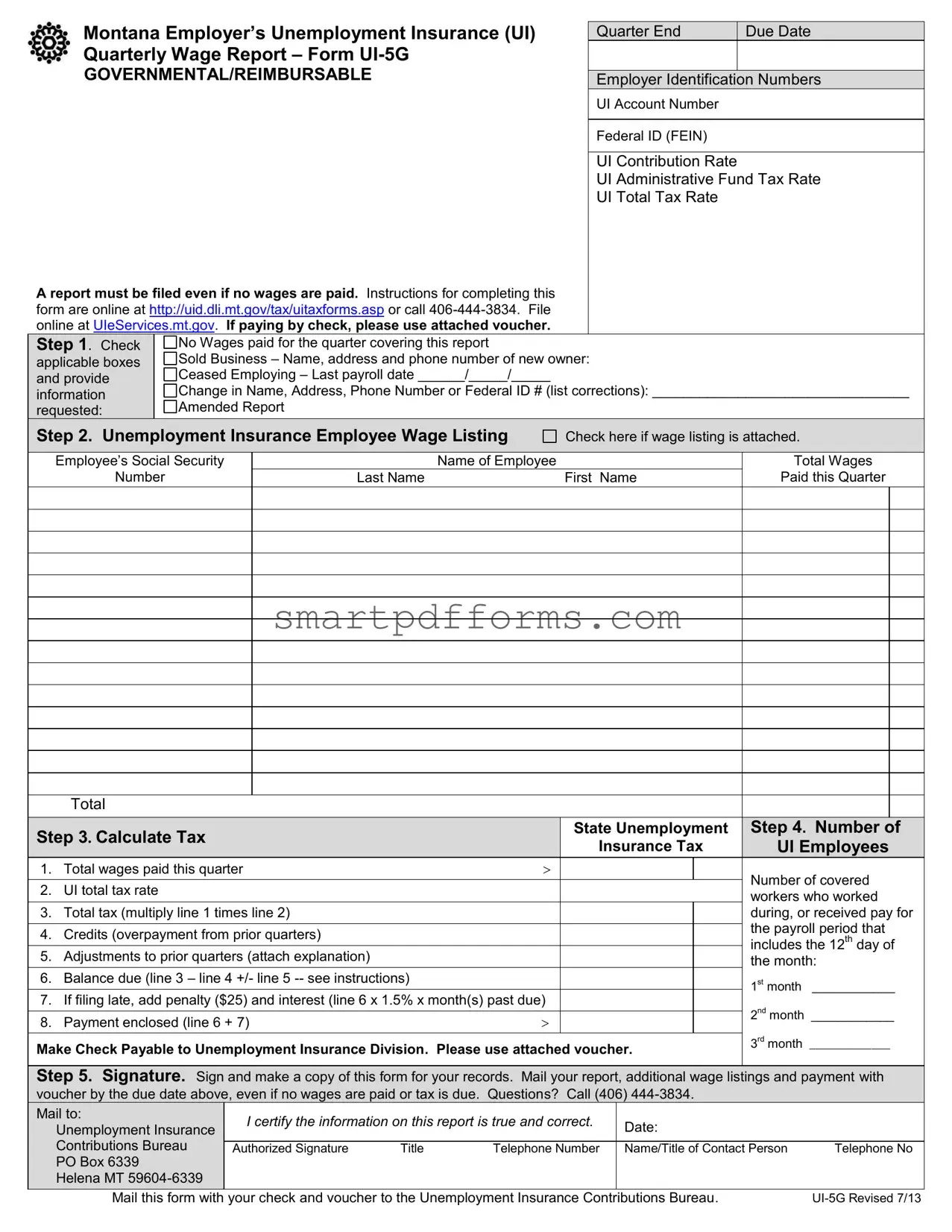

The Montana Employer’s Unemployment Insurance (UI) Quarterly Wage Report, Form UI-5G, plays a critical role in sustaining the integrity and functionality of unemployment insurance systems for employers operating within Montana. This form serves as a pivotal tool for reporting wages paid, calculating taxes due, and articulating changes in business status, including sales or closures, for the specific reporting quarter. Employers are required to provide detailed information such as UI Account Number, Federal ID (FEIN), applicable tax rates, and a comprehensive listing of employee wages. Additionally, it is paramount that this report is submitted even in scenarios where no wages were disbursed during the quarter, highlighting the importance of this form in maintaining accurate and up-to-date records for governmental and reimbursable employers alike. The process of completing the UI-5G form is facilitated by step-by-step instructions available online, alongside options for online filing or submission via mail with an attached payment voucher for those opting to pay by check. This requirement underscores the commitment of businesses to compliance with state regulations, ensuring the sustainability of unemployment benefits for workers who find themselves without employment. Therefore, the UI-5G form is not merely an administrative task but a fundamental element of a larger, socially responsible employer obligation towards the workforce and the state’s economic health.

Preview - Ui 5G Form

Montana Employer’s Unemployment Insurance (UI) |

|

|

Quarter End |

Due Date |

|

Quarterly Wage Report – Form |

|

|

|

|

|

GOVERNMENTAL/REIMBURSABLE |

|

|

|

|

|

|

|

Employer Identification Numbers |

|

||

|

|

|

UI Account Number |

|

|

|

|

|

|

|

|

|

|

|

Federal ID (FEIN) |

|

|

|

|

|

|

|

|

|

|

|

UI Contribution Rate |

|

|

|

|

|

UI Administrative Fund Tax Rate |

|

|

|

|

|

UI Total Tax Rate |

|

|

A report must be filed even if no wages are paid. Instructions for completing this form are online at http://uid.dli.mt.gov/tax/uitaxforms.asp or call

No Wages paid for the quarter covering this report

Sold Business – Name, address and phone number of new owner: Ceased Employing – Last payroll date ______/_____/_____

Change in Name, Address, Phone Number or Federal ID # (list corrections): _________________________________

Amended Report

|

Step 2. Unemployment Insurance Employee Wage Listing |

|

Check here if wage listing is attached. |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee’s Social Security |

|

Name of Employee |

|

Total Wages |

|||||

|

|

Number |

|

Last Name |

|

First Name |

|

Paid this Quarter |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 3. Calculate Tax |

|

|

State Unemployment |

|

Step 4. Number of |

|

||||

|

|

|

|||||||||

|

|

|

Insurance Tax |

|

UI Employees |

|

|||||

|

|

|

|

|

|

|

|

||||

1. |

Total wages paid this quarter |

|

|

|

|

|

Number of covered |

||||

|

|

|

|

|

|

|

|

|

|||

2. |

UI total tax rate |

|

|

|

|

|

|||||

|

|

|

|

|

workers who worked |

||||||

|

|

|

|

|

|

|

|

|

|||

3. |

Total tax (multiply line 1 times line 2) |

|

|

|

|

|

during, or received pay for |

||||

|

|

|

|

|

|

|

|

|

the payroll period that |

||

4. |

Credits (overpayment from prior quarters) |

|

|

|

|

|

|||||

|

|

|

|

|

includes the 12th day of |

||||||

|

|

|

|

|

|

|

|

|

|||

5. |

Adjustments to prior quarters (attach explanation) |

|

|

|

|

||||||

|

|

|

|

the month: |

|||||||

|

|

|

|

|

|

|

|

|

|||

6. |

Balance due (line 3 – line 4 +/- line 5 |

|

|

|

|

1st month ____________ |

|||||

7. |

If filing late, add penalty ($25) and interest (line 6 x 1.5% x month(s) past due) |

|

|

|

|||||||

|

|

|

2nd month ____________ |

||||||||

|

|

|

|

|

|

|

|

|

|||

8. |

Payment enclosed (line 6 + 7) |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

3rd month |

||

|

Make Check Payable to Unemployment Insurance Division. Please use attached voucher. |

|

|||||||||

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Step 5. Signature. Sign and make a copy of this form for your records. Mail your report, additional wage listings and payment with voucher by the due date above, even if no wages are paid or tax is due. Questions? Call (406)

|

|

|

|

|

|

|

|

|

Mail to: |

|

I certify the information on this report is true and correct. |

Date: |

|

||

|

Unemployment Insurance |

|

|

||||

|

|

|

|

|

|

||

|

Contributions Bureau |

|

|

|

|

|

|

|

|

Authorized Signature |

Title |

Telephone Number |

Name/Title of Contact Person |

Telephone No |

|

|

PO Box 6339 |

|

|

|

|

|

|

|

Helena MT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail this form with your check and voucher to the Unemployment Insurance Contributions Bureau. |

Form Data

| Fact Name | Detail |

|---|---|

| Form Content | Montana Employer’s Unemployment Insurance (UI) Quarterly Wage Report – Form UI-5G. |

| Information Required | Employer Identification Numbers (UI Account Number, Federal ID), UI Rates, and Employee Wage Listing. |

| Submission Method | Can be filed online at UIeServices.mt.gov or via mail with attached voucher if paying by check. |

| Governing Law | Guided by Montana state laws relating to Unemployment Insurance. |

Instructions on Utilizing Ui 5G

Filling out the Montana Employer's Unemployment Insurance (UI) Quarterly Wage Report, Form UI-5G, is an essential step for employers to ensure compliance with state requirements. This guide simplifies the process, breaking down each step to help you complete the form accurately and efficiently. Properly reporting your employee wages and calculating due taxes are important to maintaining your good standing and avoiding unnecessary penalties. Remember, accurate and timely submission of this form reflects your commitment to your employees and to maintaining the integrity of the unemployment insurance system.

- Check applicable boxes and provide the information requested: Begin by identifying the nature of your report. Choose from options such as governmental/reimbursable employer, if no wages were paid during the quarter, changes in business ownership, cessation of employing, changes in business name, address, phone number, or Federal ID, and if this is an amended report. Ensure to fill in your Employer Identification Numbers including UI Account Number and Federal ID (FEIN) as well as your UI Contribution Rate, UI Administrative Fund Tax Rate, and UI Total Tax Rate.

- Unemployment Insurance Employee Wage Listing: If you have a wage listing to attach, mark the appropriate box. List each employee's social security number, last name, first name, and the total wages paid this quarter. Ensure that all information is accurate and legible to avoid processing delays.

- Calculate Tax: Begin with recording the total wages paid this quarter. Then, document the number of covered workers who worked or received pay for the payroll period that includes the 12th day of each month. Calculate the total tax by multiplying the total wages by the UI total tax rate. Add any credits for overpayments from prior quarters and make necessary adjustments for prior quarters' reports. The balance due is determined by subtracting any credits and adjustments from the total tax. If filing late, calculate and add the penalty and interest to the balance.

- Final Steps: Number of UI employees and payment details - Fill in the average number of employees for each month of the quarter. Determine if there is a balance due, and calculate any late fees if applicable. Ensure the attached voucher is used if making a payment by check.

- Signature: After reviewing the form for accuracy, sign and date the form, providing your title and contact information. Making a copy of the completed form for your records is recommended.

- Finally, mail your report, any additional wage listings, and payment with the attached voucher to the specified address by the due date to avoid any penalties.

After submitting Form UI-5G, your diligent attention to these details ensures that your business remains compliant with Montana's unemployment insurance reporting requirements. Keep a record of your submission and monitor for any correspondence from the Unemployment Insurance Contributions Bureau to promptly address any follow-up or clarification requests.

Obtain Answers on Ui 5G

Frequently Asked Questions about the UI-5G Form:

-

What is the purpose of the UI-5G form?

The UI-5G form is designed for Montana employers to report quarterly wages for Unemployment Insurance (UI). This crucial document facilitates the process by which employers contribute to the state's Unemployment Insurance, ensuring that they meet their legal obligations. It's used not only for reporting wages paid but also for documenting any changes like sold business details, cessation of employment, and amendments to employer information such as name, address, or Federal ID number.

-

Do I need to file the UI-5G form if no wages were paid during the quarter?

Yes, it is mandatory to file a UI-5G report for every quarter, even if no wages were paid during that period. Filing this report is essential as it keeps the Unemployment Insurance Contributions Bureau updated on your business status and workforce dynamics. Neglecting to file this form might lead to penalties or issues with your UI account status.

-

How can I calculate the total tax due using the UI-5G form?

The tax calculation involves a few straightforward steps. First, tally the total wages paid during the quarter. Then, apply the UI total tax rate provided to you by the Unemployment Insurance Contributions Bureau to these wages to find out the initial total tax amount. If you have any credits from overpayments in prior quarters or adjustments, factor these in to determine your balance due. Remember to add penalties and interest if you are filing late, calculating these additions based on the instructions provided on the form.

-

Where and how do I submit the completed UI-5G form and payment?

Once you've filled out the UI-5G form and computed your tax due, you have options for submission. Preferably, you can file online at UIeServices.mt.gov, which is fast and secure. If you choose to mail your report, ensure that your report, any additional wage listings, and payment with the attached voucher are sent to the Unemployment Insurance Contributions Bureau at PO Box 6339, Helena MT 59604-6339. Make your check payable to Unemployment Insurance Division and include it with your mailed submission. Always keep a copy of the form for your records.

Common mistakes

When filling out the Montana Employer's Unemployment Insurance (UI) Quarter End Due Date Quarterly Wage Report, also known as Form UI-5G, there are common errors that people often make. These mistakes can result in processing delays, incorrect payment amounts, or other complications with the Unemployment Insurance Contributions Bureau. It's crucial to approach this form with attention to detail to ensure accuracy and compliance with Montana's UI requirements.

Not checking the appropriate boxes at the beginning of the form, which includes indicating whether the employer is governmental/reimbursable, can lead to confusion about the types of benefits or payments required.

Failing to provide all necessary identification numbers such as the UI Account Number, Federal ID (FEIN), and UI Contribution Rate, could result in the form being returned or processing delays.

Omitting to report even when no wages are paid for the quarter. This is a common oversight that can lead to discrepancies in an employer's account.

Neglecting to update the UI Contributions Bureau on changes such as sold business information, ceased employing, or any changes in name, address, phone number, or Federal ID, which are essential for accurate records.

Forgetting to attach a wage listing or not correctly filling in the employee wage section, thus not accurately reporting the total wages paid this quarter.

Miscalculating the Total Tax due by incorrectly applying the UI total tax rate or making mathematical errors in the calculations.

Overlooking credits or adjustments from prior quarters that could affect the balance due, leading to an incorrect payment amount.

Failing to include penalties and interest if filing the form late, which will result in an underpayment and possibly more penalties.

Not using the attached voucher when making a payment by check, which can cause processing delays and misapplication of funds.

Failing to sign the form or include the correct mailing address, which is critical for authentication and proper processing of the form.

To avoid these errors, it is strongly recommended to review the instructions provided online and to ensure that all sections of the form are completed accurately. Additionally, double-checking calculations and keeping a copy of the form for personal records before mailing it can help mitigate potential issues. Remember, careful attention to detail can save significant time and effort in managing unemployment insurance contributions and benefits.

Documents used along the form

Completing the Montana Employer's Unemployment Insurance (UI) Quarterly Wage Report, Form UI-5G, is just one step in fulfilling your reporting and compliance duties as an employer. Various other forms and documents are often required to ensure accurate and complete financial and employment records. Understanding these documents helps streamline the process, ensuring that you meet all legal and procedural requirements efficiently.

- Form UI-2/2T – Employer’s Quarterly Contribution/Wage Report: This form is used to report quarterly wages and contributions for businesses. It helps calculate the amount of unemployment insurance tax owed.

- Form UI-1 – Report to Determine Liability: Employers use this form to determine whether they are liable under the Montana Unemployment Insurance Law to pay taxes for their employees.

- Form W-4 – Employee's Withholding Certificate: This IRS form is used by employees to indicate their tax withholding preferences to the employer.

- I-9 Form – Employment Eligibility Verification: Every employer must ensure proper completion of Form I-9 for each individual they hire for employment in the United States. This form verifies the identity and employment authorization of the employee.

- Form W-2 – Wage and Tax Statement: Annually provided to employees, this document reports an employee's annual wages and the amount of taxes withheld from their paychecks.

- Form W-9 – Request for Taxpayer Identification Number and Certification: Used to request the taxpayer identification number of a U.S. person, including a resident alien, and to request certain certifications and claims for exemption.

- Form 941 – Employer's Quarterly Federal Tax Return: Employers use this form to report income taxes, social security tax, or Medicare tax withheld from employee's paychecks and to pay the employer's portion of Social Security or Medicare tax.

- Form UI-4 – Quarterly Wage Adjustment Report: This form allows employers to make adjustments to previously filed quarterly wage and tax reports.

- Form UI-10 – Employer's Quarterly Transfer Report: Used by employers to request a transfer of funds between their unemployment insurance accounts, often following a reorganization or acquisition.

- New Hire Reporting Form: Employers must report newly hired and re-hired employees to a state directory within 20 days of their hire or rehire date. This aids in the enforcement of child support orders.

Understanding each of these forms and when they must be used is crucial for maintaining compliance with both state and federal regulations. Keeping accurate and timely records not only helps manage financial liabilities but also supports a transparent and accountable employment practice. Whether dealing with hiring processes, tax withholding, or unemployment insurance, being proactive and informed will facilitate smoother operational practices.

Similar forms

The UI-5G form is similar to the Federal Unemployment Tax Act (FUTA) Tax Return. Both forms require employers to report wages paid and calculate taxes due for unemployment insurance. Just as the UI-5G form asks for an employer's identification numbers, contribution rates, and total tax rate, the FUTA Tax Return also requires similar employer identification details and calculations of owed unemployment taxes based on the wages paid to employees.

Another similar document is the State Withholding Tax Form. Like the UI-5G form, state withholding forms require employers to report total wages paid to their employees and calculate the taxes owed to the state government. Both forms are crucial for compliance with tax obligations and ask for detailed employer and employee information.

Comparable to the UI-5G form is the Form W-2, Wage and Tax Statement. This form is used by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. Both the UI-5G form and the Form W-2 collect detailed wage information for each employee, although their purposes differ, with the UI-5G focusing on unemployment insurance contributions and the W-2 on income tax obligations.

The Quarterly Federal Tax Return Form 941 shows similarities with the UI-5G form. It is used by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks. Moreover, both forms require reporting the total number of employees and wages paid. The requisite calculation of taxes and adjustments for prior quarters or overpayments is a common feature in both forms.

Similar to the UI-5G, the Employer's Quarterly State Unemployment Tax Form of other states mandates employers to report wages paid and calculate unemployment tax due. Each state has its version, but the core requirement to report on wage details and calculate unemployment insurance contributions remains consistent across states, mirroring the UI-5G form's requirements.

The New Hire Reporting Form also shares similarities with the UI-5G form. While its primary function is different—aiming to report newly hired or rehired employees to a state directory for child support enforcement—it requires employers to provide detailed employee information such as social security numbers and wages, akin to the information requested in the UI-5G form.

Dos and Don'ts

When filling out the Montana Employer’s Unemployment Insurance (UI) Quarterly Wage Report – Form UI-5G, it's crucial to adhere to guidelines that ensure the accuracy and completeness of your submission. Here are some recommended do's and don'ts:

Do:

- Review the instructions available online carefully before beginning the form to ensure you understand the requirements.

- Check all applicable boxes in Step 1 and provide all the requested information accurately to avoid delays or issues with processing.

- Ensure the Employee Wage Listing is complete and attached if necessary, as outlined in Step 2, including all employee Social Security Numbers and total wages paid.

- Correctly calculate the UI tax in Step 3 by following the formula provided, making sure to include any credits or adjustments from previous quarters.

- Sign and date the form in Step 5, verifying that all the information provided is accurate and true.

- Make a copy of the form for your records before mailing it to the Unemployment Insurance Contributions Bureau with the appropriate payment and voucher.

- File and make payment by the due date indicated to avoid penalties and interest for late filing.

Don't:

- Overlook checking boxes for changes in your business status such as sold business, ceased employing, or changes in name, address, phone number, or Federal ID in Step 1.

- Forget to attach the wage listing if you have employees, as failing to provide this information can result in processing delays.

- Miscalculate the UI total tax rate or fail to account for any credits or adjustments to prior quarters that may apply to your tax dues.

- Leave the signature section incomplete in Step 5. An authorized signature is necessary for the form to be processed.

- Miss the filing and payment deadline, which can lead to unnecessary penalties and interest charges.

- Send the form without double-checking all entered information for accuracy and completeness to avoid potential errors.

- Ignore the option to file online at UIeServices.mt.gov, which could simplify and speed up the submission process.

Adhering to these guidelines can help ensure that the process of completing and submitting Form UI-5G is as smooth and error-free as possible. Remember to always verify the most current form version and requirements, as they may be subject to change.

Misconceptions

There are several misconceptions regarding the Montana Unemployment Insurance Quarter End Due Date Quarterly Wage Report, known as Form UI-5G, that need to be addressed. Common misunderstandings can lead to errors in filing, potentially affecting an employer's compliance with state laws. Here, we demystify some of the most common errors:

- Only businesses with employees need to file: This is incorrect. As stated in the instructions, a report must be filed even if no wages were paid during the quarter. This ensures that the Unemployment Insurance Division has accurate records of your business's employment activities.

- Online filing is optional: While it may seem like a preference, the state of Montana highly encourages employers to file online via UIeServices.mt.gov. This method is not only more efficient but also reduces the risk of errors in data entry and processing.

- The form is only for reporting wages: The UI-5G form serves multiple purposes beyond just reporting wages. It is also used for notifying the Unemployment Insurance Division of critical changes such as selling the business, ceasing employment, changes in name, address, or Federal ID number, and more.

- Amendments to previously filed reports require a new form: The form includes a section for amended reports. This means that if an employer needs to correct information submitted in a past quarter, they can do so on this form without needing to submit a completely new report.

- Payment is only required if taxes are due: Alongside tax calculations, employers might also need to include overpayment credits or adjustments to prior quarters. These elements could affect the final balance due, occasionally resulting in a balance even when initial calculations suggest otherwise.

- Penalties are flat fees: If a report is filed late, the penalty is not a simple flat fee. The form details that late filings incur a $25 penalty plus an interest charge calculated as 1.5% per month on the balance due. This means the longer the delay, the greater the penalty.

- All employees must be listed on the form itself: While the form does request an Unemployment Insurance Employee Wage Listing, it provides a section to check if this listing is attached separately. Large employers, in particular, may need to attach detailed wage listings as supplementary documents rather than listing all employees directly on the form.

Understanding these aspects of the UI-5G form is crucial for compliance and accurate reporting. Employers are encouraged to read the instructions carefully and reach out to the Unemployment Insurance Division with any questions.

Key takeaways

When engaging with the process of completing and submitting the Montana Employer's Unemployment Insurance (UI) Quarterly Wage Report, Form UI-5G, there are several key aspects employers must adhere to for accuracy and compliance. Here are the vital takeaways:

- Familiarize Yourself with the Form: Before attempting to fill out the form, accessing the instructions online or calling the provided number for guidance ensures accurate and complete submissions.

- Completeness Is Critical: Even if no wages were paid during the quarter, a report must still be filed, highlighting the importance of submitting this form under all circumstances to stay in compliance with state requirements.

- Accurate Employer Information: Accurately provide all requested employer identification numbers and tax rates, as inaccuracies here could lead to improper tax calculations or delays in processing.

- Employee Wage Details: Ensure the attachment of a detailed wage listing for each employee, including their social security number, name, and total wages paid, emphasizing the importance of privacy and accuracy in reporting employee information.

- Calculating Taxes Correctly: Take special care in calculating the total state unemployment insurance tax due, using the total wages paid and the UI total tax rate. It's crucial to get these numbers right to avoid under or overpaying.

- Documentation of Changes: Any modifications to business details, such as sold business information, ceased employment, or changes in name, address, phone number, or Federal ID must be meticulously documented and reported on this form.

- Timely Filing and Payment: Adhere to the quarterly due dates, and remember to include the late penalty and interest if applicable. Making a copy for your records before mailing the completed form with any applicable payment and additional wage listings is prudent for record-keeping and future reference.

By maintaining attention to these essential aspects, employers can ensure their compliance with Montana's UI tax requirements, thereby minimizing potential administrative complications and fostering a responsible business environment.

Popular PDF Forms

Ssa-1099 Form 2022 - The SSA-1099 form is a Social Security Benefit Statement used to report social security benefits received.

Resale Certificate in California - Holders of this certificate need a valid seller’s permit number, issued by the California Department of Tax and Fee Administration.