Blank Uia 1718 PDF Template

In today's complex workforce landscape, navigating unemployment benefits can be confusing, particularly when discrepancies arise between recorded wages and actual earnings. The State of Michigan's UIA 1718 form, central to resolving such discrepancies, serves as a crucial tool for claimants seeking to correct or update wage information tied to their unemployment claims. The process, governed by the Department of Labor and Economic Opportunity and outlined in the document, demands careful attention to detail. When a claimant's Monetary Determination - a summary of reported wages by employers - does not reflect accurate earnings, either due to underreporting or omission, this form becomes the remedy. By completing the UIA 1718, claimants provide a detailed account of their wages directly to the Unemployment Insurance Agency (UIA), thereby enabling a more accurate reassessment of their benefit eligibility and amounts. Specifically, the form requires information on employment details, quarterly wage data, and, crucially, substantiating evidence such as pay stubs or W-2s. The form not only underscores the importance of precision in unemployment insurance reporting by both employers and employees but also reflects the system's adaptability in correcting errors to ensure fair benefits distribution. Moreover, the requirement for claimants to certify the truthfulness of their submission underscores the balance between offering recourse for inaccuracies and deterring fraudulent claims. Through the lens of the UIA 1718, we glimpse the broader mechanisms at play in safeguarding the integrity and efficacy of unemployment insurance processes.

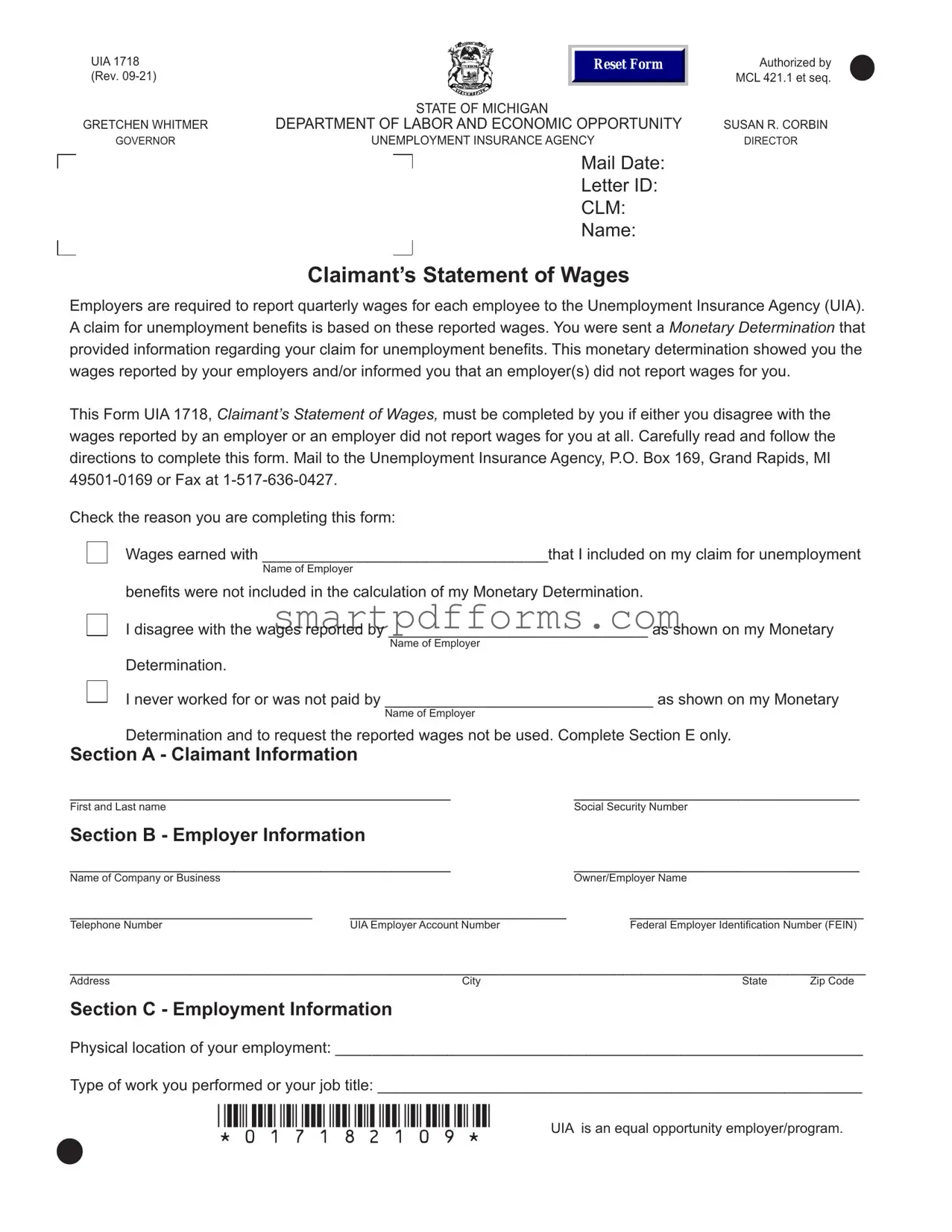

Preview - Uia 1718 Form

UIA 1718 |

|

|

|

Reset Form |

(Rev. |

|

|

|

|

|

|

|

STATE OF MICHIGAN |

|

GRETCHEN WHITMER |

DEPARTMENT OF LABOR AND ECONOMIC OPPORTUNITY |

|||

GOVERNOR |

UNEMPLOYMENT INSURANCE AGENCY |

|||

|

|

|

|

Mail Date: |

|

|

|

||

|

|

|

||

|

|

|

|

Letter ID: |

|

|

|

|

CLM: |

|

|

|

|

Name: |

Authorized by |

• |

MCL 421.1 et seq. |

|

SUSAN R. CORBIN |

|

DIRECTOR |

|

Claimant’s Statement of Wages

Employers are required to report quarterly wages for each employee to the Unemployment Insurance Agency (UIA). A claim for unemployment benefits is based on these reported wages. You were sent a Monetary Determination that provided information regarding your claim for unemployment benefits. This monetary determination showed you the wages reported by your employers and/or informed you that an employer(s) did not report wages for you.

This Form UIA 1718, Claimant’s Statement of Wages, must be completed by you if either you disagree with the wages reported by an employer or an employer did not report wages for you at all. Carefully read and follow the directions to complete this form. Mail to the Unemployment Insurance Agency, P.O. Box 169, Grand Rapids, MI

Check the reason you are completing this form:

Wages earned with _________________________________that I included on my claim for unemployment

Name of Employer

benefits were not included in the calculation of my Monetary Determination.

I disagree with the wages reported by ______________________________ as shown on my Monetary

Name of Employer

Determination.

I never worked for or was not paid by _______________________________ as shown on my Monetary

Name of Employer

Determination and to request the reported wages not be used. Complete Section E only.

Section A - Claimant Information

____________________________________________ |

_________________________________ |

|

First and Last name |

|

Social Security Number |

Section B - Employer Information |

|

|

____________________________________________ |

_________________________________ |

|

Name of Company or Business |

|

Owner/Employer Name |

____________________________ |

_________________________ |

___________________________ |

Telephone Number |

UIA Employer Account Number |

Federal Employer Identification Number (FEIN) |

____________________________________________________________________________________________

Address |

City |

State |

Zip Code |

Section C - Employment Information |

|

|

|

Physical location of your employment: _____________________________________________________________

Type of work you performed or your job title: ________________________________________________________ |

||

• |

*017182109* |

UIA is an equal opportunity employer/program. |

|

||

UIA 1718 (Rev.

How were you paid?

Cash Check

Direct deposit

Letter ID:

Other - explain: ____________________

Was there other remuneration (e.g. bonuses, commissions, 401K, room and board, etc.) in your wages?

No

Yes - explain:

Were deductions made from your pay (e.g. FICA, income taxes, etc.) in your wages? |

No |

||

Total gross wages during current calendar year: $____________________ |

actual |

||

Total gross wages during preceding calendar year: $__________________ |

actual |

||

Were there other employees? |

No |

Yes - how many? ______________ |

|

Is the employer still operating? |

No |

Yes |

|

Additional comments: |

|

|

|

Yes

estimated

estimated

Section D - Quarterly Wage Information

You must report the quarterly gross wages (before taxes) on the chart on the next page. There are four calendar quarters per year. The quarters are numbered and are the same from year to year. Each quarter contains three calendar months as follows:

1st Quarter |

January 1 |

through |

March 31 |

2nd Quarter |

April 1 |

through |

June 30 |

3rd Quarter |

July 1 |

through |

September 30 |

4th Quarter |

October 1 |

through |

December 31 |

The involved quarters are the same quarters that are shown on your Monetary Determination under the heading “Monetary Determination Calculations”. Label the chart on the next page with the same quarter dates.

•If you are completing this form because wages earned with an employer that you included on your claim were not used in the calculation of your Monetary Determination, complete all quarters that contained wages from that employer.

•If you are completing this form because you disagree with the wages reported by your employer, complete only the quarters that you disagree with.

If your address changes, it is important to update it with the Unemployment Insurance Agency.

If you have questions, you may contact us through your MiWAM account or by calling

UIA 1718 |

Letter ID: |

• |

|

||

(Rev. |

|

These quarterly charts allow you to enter wage information per week to help you determine your quarterly total wages. If you know your gross wages for each quarter, complete only the Total Quarterly Wage box for each involved quarter. Wages are reported in the quarter they are paid to you.

Example: You may have worked during the last week of March (1st quarter), but you were not paid until April (2nd quarter). These wages must be reported in the 2nd quarter (the quarter containing the date you were PAID).

You are required to send in clear, legible proof of wages to support the information you provide on this form. This can include check stubs,

Quarter ___ |

Year ______ |

Quarter ___ |

Year ______ |

Quarter ___ |

Year ______ |

Quarter ___ |

Year ______ |

Quarter ___ |

Year ______ |

|

WEEK PAID |

GROSS WAGES |

WEEK PAID |

GROSS WAGES |

WEEK PAID |

GROSS WAGES |

WEEK PAID |

GROSS WAGES |

WEEK PAID |

GROSS WAGES |

|

PAID |

PAID |

PAID |

PAID |

PAID |

||||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

TOTAL |

|

TOTAL |

|

TOTAL |

|

TOTAL |

|

|

Quarterly |

|

Quarterly |

|

Quarterly |

|

Quarterly |

|

Quarterly |

|

|

Wages |

|

Wages |

|

Wages |

|

Wages |

|

Wages |

|

|

|

|

|

|

|

|

|

|

|

|

Section E - Certification Statement

Certification: I certify that the information I have reported is true and correct. I understand that if I intentionally make a false statement, misrepresent facts or conceal material information, I may be required to pay damages and could be subject to criminal prosecution.

_____________________________________________________ |

_______________________ |

Signature |

Date |

• |

*017182109* UIA is an equal opportunity employer/program. |

|

Form Data

| Fact Name | Detail |

|---|---|

| Form Purpose | The UIA 1718 form is designed for claimants to report or dispute wages with the Unemployment Insurance Agency (UIA) in Michigan. This form is necessary if wages reported by an employer did not include in the calculation of your Monetary Determination or if you disagree with the wages reported. |

| Form Submission Information | Claimants can submit the completed UIA 1718 form via mail to the Unemployment Insurance Agency, P.O. Box 169, Grand Rapids, MI 49501-0169, or by fax at 1-517-636-0427. |

| Required Information | The form requires personal information, employer details, employment details, quarterly wage reporting, and a certification statement affirming the accuracy of the provided information. |

| Proof of Wages | Submitting clear, legible proof of wages is essential for the UIA to use the information provided. Acceptable forms of proof include check stubs, W-2s, payroll records, or a letter from the employer with payroll information. |

| Governing Law | The UIA 1718 form is authorized by MCL 421.1 et seq., underlining the legal framework governing unemployment insurance and claimant reporting in the State of Michigan. |

Instructions on Utilizing Uia 1718

Filling out the UIA 1718 form is a necessary step for individuals who find discrepancies in their reported wages for unemployment benefits claims in the state of Michigan. This process involves providing accurate employment and wage information to ensure rightful benefits. It's important to provide comprehensive details and attach any required documents to substantiate the claim. The following steps will guide you through completing the form accurately.

- Start with Section A - Claimant Information:

- Fill in your first and last name as it appears on your claim.

- Provide your Social Security Number next to your name.

- Move to Section B - Employer Information:

- Enter the Name of Company or Business and the Owner/Employer Name.

- Fill in the Telephone Number, UIA Employer Account Number, and Federal Employer Identification Number (FEIN).

- Provide the complete Address, including City, State, and Zip Code of the employer.

- Proceed to Section C - Employment Information:

- Indicate the Physical location of your employment.

- Describe the Type of work performed or your job title.

- Select how you were paid (Cash, Check, Direct deposit, Other) and specify if necessary.

- Answer if there was other remuneration in your wages and provide details if applicable.

- Indicate if deductions were made from your pay and list the total gross wages for the current and preceding calendar year, marking "actual" or "estimated" accordingly.

- Specify if there were other employees and if the employer is still operating, alongside additional comments if any.

- Fill in Section D - Quarterly Wage Information:

- Report the quarterly gross wages before taxes for each involved quarter, following the guide for the quarters given in the form.

- If you have clear totals for each quarter, you can directly fill in the "Total Quarterly Wage" box for each relevant quarter.

- Conclude with Section E - Certification Statement:

- Read the certification statement carefully.

- Sign and date the form to certify that the information provided is true and correct.

Once the form is completed, ensure to attach any necessary proof of wages such as check stubs, W-2s, payroll records, or a letter from the employer with payroll information. This documentation is crucial for the Unemployment Insurance Agency to use the information provided. Mail or fax the completed form and attachments according to the instructions provided on the form. This step is important in updating or correcting wage information to accurately reflect your entitlement to unemployment benefits.

Obtain Answers on Uia 1718

-

What is the UIA 1718 form?

The UIA 1718 form, also known as the Claimant’s Statement of Wages, is a document used by individuals in Michigan who are claiming unemployment benefits and either disagree with the wages reported by their employer or have wages that were not reported at all. This form allows individuals to provide accurate wage information to the Unemployment Insurance Agency (UIA).

-

Why do I need to complete the UIA 1718 form?

You need to complete the UIA 1718 form if the Monetary Determination letter you received from the UIA shows incorrect wage information or if an employer failed to report wages. Correcting this information is crucial for calculating your unemployment benefits accurately.

-

How do I obtain the UIA 1718 form?

The UIA 1718 form can be obtained through the Michigan Unemployment Insurance Agency’s website, or you may contact the UIA to request a paper copy be mailed to you. You can also check if local UIA offices or Michigan Works! Agencies have copies.

-

What information is needed to complete the form?

To complete the form, you will need your personal information, detailed employer information, employment information including job title, and how you were paid. Additionally, you must provide quarterly wage information and potentially, proof of wages such as check stubs or W-2s.

-

How do I submit the UIA 1718 form?

The completed UIA 1718 form can be submitted either by mailing it to the Unemployment Insurance Agency at P.O. Box 169, Grand Rapids, MI 49501-0169 or by fax at 1-517-636-0427.

-

What documentation is needed as proof of wages?

As proof of wages, you may include check stubs, payroll records, a W-2 form, or a letter from your employer listing your earnings. It is important that the documents are clear and legible to be accepted as valid proof.

-

Can I submit the UIA 1718 form online?

Currently, the UIA 1718 form must be submitted by mail or fax. There is no option to submit this form online. Always check the UIA's official website or contact them directly for the most current submission methods.

-

What happens if I intentionally provide false information on the form?

Providing false information on the UIA 1718 form is a serious offense. If found intentionally misleading the UIA with false statements or concealing material information, you could be required to repay benefits, pay fines, and potentially face criminal prosecution.

-

Who can I contact for help with the UIA 1718 form?

If you need assistance with filling out the UIA 1718 form or have questions, you can contact the UIA through your MiWAM account or by calling 1-866-500-0017. TTY service for the hearing impaired is available at 1-866-366-0004.

Common mistakes

When filling out the UIA 1718 form, a detailed and accurate completion is crucial for individuals disputing their wages with the Unemployment Insurance Agency (UIA). Unfortunately, errors can delay or affect the outcome of one's claim. Here are seven common mistakes to avoid:

-

Not providing complete claimant information: The form begins with a section for claimant details, including full name and Social Security Number. Leaving out any of these details can result in processing delays.

-

Forgetting to check the reason for submitting the form. You must specify why you're completing it, whether it's because wages from an employer were not included, you disagree with the reported wages, or wages were incorrectly attributed to an employer you never worked for.

-

Omitting employer details, such as the complete name and address of the company or business, their UIA Employer Account Number, and Federal Employer Identification Number (FEIN). These are critical for the UIA to verify and address your wage dispute accurately.

-

Leaving out employment information, including the kind of work performed and the physical location of your employment. This information is essential for validating your employment and the wages you claim to have earned.

-

Not accurately reporting how you were paid or any additional remuneration, like bonuses or commissions, and whether taxes were deducted from your pay. This affects the accuracy of your total gross wages calculation.

-

Failing to provide detailed quarterly wage information or incorrectly reporting your wages. The form divides the year into four quarters, and wages must be reported based on when they were paid, not earned. Neglecting to fill out this part accurately can lead to misrepresentation of your wage history.

-

Not including proof of wages: Submitting clear, legible proof of wages with the form is mandatory. Acceptable documents include check stubs, W-2s, payroll records, or letters from the employer. Failure to include these documents can result in the UIA being unable to use the information provided.

Submitting the UIA 1718 form correctly and completely is vital for the prompt and accurate resolution of wage disputes. Ensuring all sections are accurately filled out and attaching the necessary documentation helps the UIA process your claim efficiently. Avoiding the mistakes listed above can significantly streamline the process.

Documents used along the form

When dealing with unemployment claims, the Form UIA 1718, "Claimant's Statement of Wages," plays a crucial role in the accurate calculation of unemployment benefits. It ensures that all wages earned are properly accounted for, particularly when there is a discrepancy with the reported amounts or when an employer fails to report wages. Along with this essential document, several other forms and documents are often required to support or supplement the information provided, ensuring the claimant's details and wage data are comprehensive and accurate.

- Monetary Determination Letter: This document is sent to claimants by the unemployment agency and outlines the wages reported by their employers, as well as the basis for the benefits calculation. If there are any discrepancies, claimants can refer to this document when completing the UIA 1718 form.

- UIA 1028, Employer's Quarterly Wage/Tax Report: Employers use this form to report quarterly wages for their employees to the Unemployment Insurance Agency. This form is essential for verifying the information provided by claimants on the UIA 1718 form.

- W-2 Form: The W-2 form, issued by employers at the end of each year, details an employee's annual wages and the taxes withheld from them. This form can provide crucial wage information, especially if there is a need to contest the earnings recorded by an employer or reported on the Monetary Determination Letter.

- Check Stubs or Payroll Records: Providing copies of check stubs or payroll records can serve as proof of wages, supporting the information claimants must furnish on the UIA 1718 form. These documents are valuable, especially when there is a discrepancy or when an employer has not reported wages.

Together, these forms and documents form a comprehensive collection of evidence that supports the unemployment claims process. They ensure that all parties—the claimant, the employer, and the Unemployment Insurance Agency—have a clear and accurate record of the wages earned and reported, thus facilitating a fair determination of unemployment benefits. As part of the claims process, it is imperative for claimants to understand the significance of these documents and to provide them as accurately and promptly as possible.

Similar forms

The W-2 Form (Wage and Tax Statement) is similar to the UIA 1718 form as it provides detailed information about the wages earned, along with taxes withheld by an employer within a year. Just like the UIA 1718 form, the W-2 is crucial for verifying income for unemployment benefit claims.

The 1099 Form, particularly for independent contractors (1099-MISC), resembles the UIA 1718 form because it includes earnings from non-employment work. If discrepancies arise or reported earnings are missing, individuals may need to supply similar information to what UIA 1718 requires, albeit for unemployment claims.

The Paystub documents share a common purpose with the UIA 1718 form in that they both provide evidence of wages earned during a specific period. Paystubs are often used to reconcile differences in reported wages when filling out UIA 1718, just as the form itself may require detailed payroll records to validate a claim.

The Quarterly Federal Tax Return (Form 941) is similar to the UIA 1718 form in its requirement for employers to report wages paid. Although used for a different purpose of tax reporting, both forms deal with the detailed reporting of earnings over specific periods, critical for accurate unemployment benefit claims.

The State Unemployment Tax Act (SUTA) Reports closely resemble the UIA 1718 form because they involve periodic reporting of wages to state unemployment agencies. Like the UIA 1718, these reports influence the determination of unemployment benefits, focusing on wage verification from an employer's perspective.

The Employee's Claim for Wage and Hour Division (Form WH-60) bears resemblance to the UIA 1718 form as it is also used by employees to claim unpaid or disputed wages. Though utilized in different contexts, both forms require detailed wage information and validation of employment details.

Dos and Don'ts

When completing the UIA 1718 form, also known as the Claimant’s Statement of Wages, there are specific guidelines you should follow to ensure the process is completed accurately and effectively. Understanding what you should and shouldn't do can help prevent delays or issues with your claim for unemployment benefits.

Do:

- Review your Monetary Determination letter carefully to understand the wages reported by your employer(s).

- Complete all required sections (A-E) accurately, providing detailed employment and wage information.

- Include clear and legible proof of wages to support your claim, such as check stubs, W-2s, payroll records, or a letter from your employer.

- Report wages in the quarter they were paid to you, not the quarter in which the work was performed.

- Update your address with the Unemployment Insurance Agency if it changes after submitting the form.

Don't:

- Leave any sections incomplete, especially if they are relevant to your claim dispute or correction.

- Misrepresent facts or intentionally provide false information, as this could lead to penalties or criminal prosecution.

- Forget to sign and date the certification statement in Section E; this is required to process your form.

- Send in the form without attaching the necessary supporting documents for your wage claim.

Following these guidelines can help ensure that your UIA 1718 form is filled out correctly and that any necessary corrections to your monetary determination are made promptly. Accurate and complete submissions lead to a smoother process for all parties involved.

Misconceptions

There are several misconceptions regarding the Form UIA 1718, also known as the Claimant's Statement of Wages, which individuals frequently encounter when dealing with unemployment claims in Michigan. Addressing these misconceptions can aid in understanding the form's purpose and requirements more clearly.

- Misconception 1: The form is only for disputing incorrect wages.

- Misconception 2: Submission of this form guarantees immediate correction of wage errors.

- Misconception 3: Only W-2s are accepted as proof of wages.

- Misconception 4: You can only dispute wages from the current or most recent job.

- Misconception 5: The UIA 1718 form must be mailed for submission.

- Misconception 6: The form only pertains to full-time employment wages.

- Misconception 7: Completing the form does not require precise wage details for each quarter.

While the Form UIA 1718 is commonly used to dispute inaccuracies in reported wages, it also serves individuals whose employers failed to report any wages. This dual purpose is crucial for ensuring all claimants have the opportunity to correct or update their wage information to reflect their true earnings.

Submitting the Form UIA 1718 is the first step in the process of correcting wage information. However, the Unemployment Insurance Agency (UIA) requires clear, legible proof of wages for the information to be reviewed and possibly amended. This process can take time, and submission alone does not guarantee immediate action.

Although W-2 forms are commonly used as proof of earnings, the UIA accepts various documents to substantiate wage claims. Payroll records, check stubs, or even a letter from the employer can serve as acceptable proof, offering flexibility for claimants to verify their wage information.

The form allows claimants to dispute wages from any employer within the relevant base period for their claim, not just the most recent one. This ensures that all employment within the specified timeframe is accurately reflected in the claimant's monetary determination.

While mailing is an option, claimants can also fax the form to the UIA for convenience. This flexibility in submission methods accommodates different preferences and circumstances, ensuring claimants can choose the method that best suits their needs.

Form UIA 1718 encompasses all types of employment, including part-time, temporary, and seasonal positions. This inclusivity ensures that all earnings, regardless of the job type, are considered in the calculation of unemployment benefits.

Accuracy in reporting quarterly gross wages is paramount for the form’s purpose. Claimants must provide detailed wage information for each quarter in dispute or not reported, ensuring a thorough and accurate reassessment of their claim.

Correcting these misconceptions is vital for navigating the unemployment benefits process effectively. The Form UIA 1718 plays a critical role in ensuring that wage information is accurately reflected in a claimant's unemployment benefits eligibility and calculation.

Key takeaways

Understanding the UIA 1718 form is crucial for individuals seeking to correct or dispute wage information reported for unemployment benefits in the State of Michigan. Here are seven key takeaways to assist with the process:

- Accuracy is essential: The UIA 1718 form is designed for individuals to accurately report or dispute wages for unemployment benefit claims. It's important that all the information provided on the form is true and correct to avoid potential repercussions.

- Reason for submission: Before filling out the form, identify why you're completing it – whether it's due to wages not included in your Monetary Determination, a disagreement with the reported wages, or wages reported for a job you did not work. This will guide you on how to accurately complete the form.

- Comprehensive employer and wage details: The form requires detailed information about your employment, including the employer's name, their address, and specific wage details over the relevant quarters. Ensure this information is complete and precise.

- Proof of wages is mandatory: When disputing or correcting wage information, it's critical to include clear, legible proof of your wages. Acceptable documents include check stubs, W-2 forms, payroll records, or a letter from your employer verifying your wages.

- Quarterly wage reporting: The form demands reporting of quarterly gross wages before taxes. It's vital to report wages in the quarter they were paid, not earned, and to complete the section for all relevant quarters.

- Contact information: Keeping your contact information up to date with the Unemployment Insurance Agency is crucial, especially if your address changes after submitting the form. This ensures you receive all correspondences related to your claim.

- Certification of truthfulness: By signing the certification statement, you affirm that the information provided is accurate. False claims can lead to criminal prosecution or being required to pay damages, highlighting the importance of honesty throughout the process.

Filling out and submitting the UIA 1718 form is a critical step for individuals disputing or correcting wage information for unemployment benefits. Following these guidelines not only ensures compliance but also helps in the efficient processing of claims.

Popular PDF Forms

Do Brides Pay for Bridesmaids Hair and Makeup - Professional contract ensuring seamless makeup service from start to finish, including set-up and cleaning protocols.

Commission Disbursement Authorization - Encourages a smooth closing process by preemptively addressing the allocation of commission payments between selling and listing parties.