Blank Usa Patriot Independent PDF Template

In today's financial landscape, navigating compliance requirements is critical for businesses involved in money services. The USA PATRIOT Act Independent Review form embodies a comprehensive tool designed for such businesses to self-assess and ensure adherence to the stringent anti-money laundering (AML) laws and regulations laid down by federal authorities. The form mandates that the review cannot be conducted by the Business Compliance Officer, underlining the importance of an independent evaluation. It gathers detailed information about the business, including its name, whether it operates at multiple locations, and its MSB registration status, thereby setting the stage for a holistic review process. The document spans several critical areas including risk assessment, identifying whether a business is located in a high-risk area for money laundering or drug trafficking, as well as the types of products and services offered that might elevate its risk profile. It further delves into compliance officer duties, the business's compliance program, employee training on AML protocols, and the periodic independent reviews to monitor and maintain these programs, not to mention specific recording and monitoring requirements for money transfers and money orders. Emphasizing the necessity for valid, government-issued photo identification for transactions above specific thresholds, this form serves as a vital instrument for businesses to evaluate their practices against the backdrop of legal obligations to combat financial crimes.

Preview - Usa Patriot Independent Form

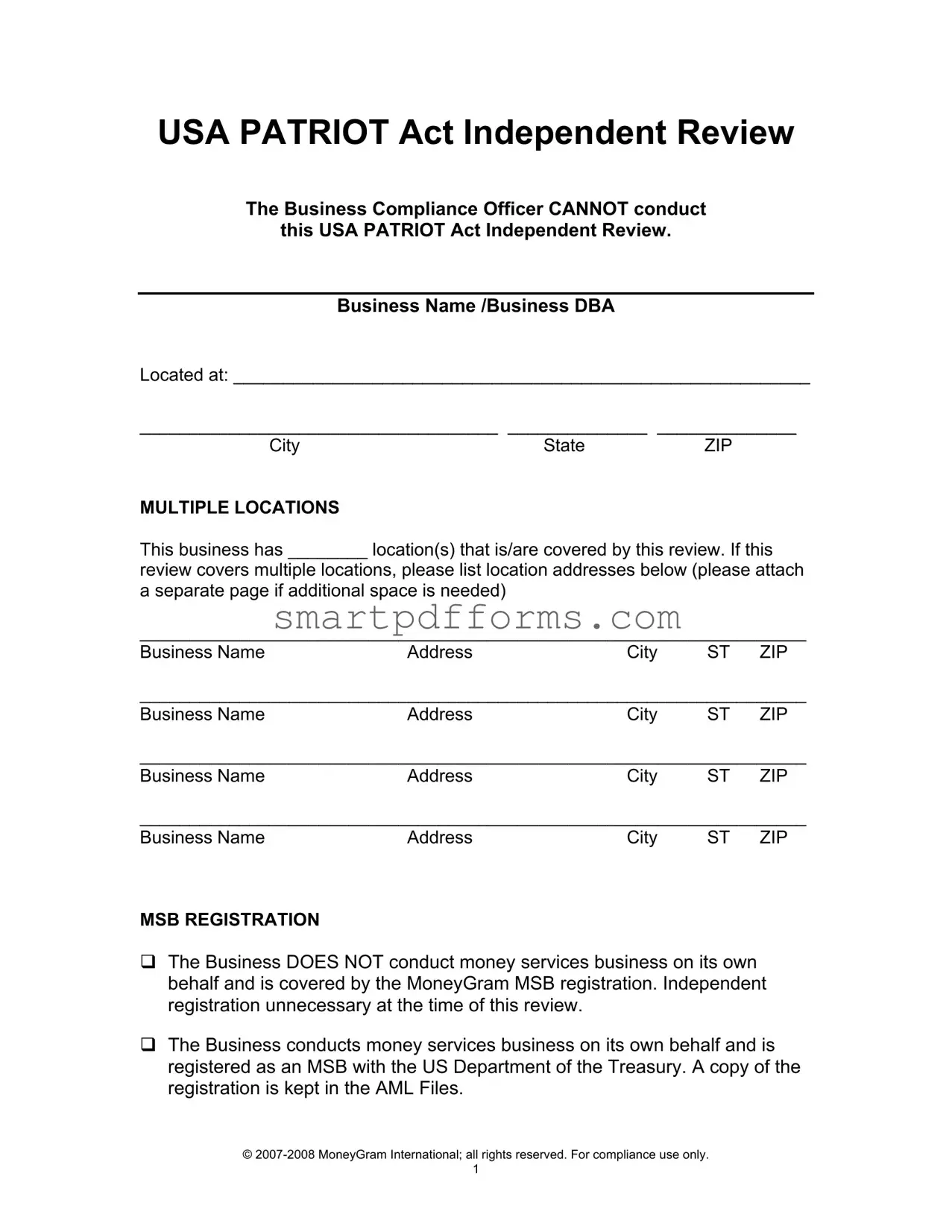

USA PATRIOT Act Independent Review

The Business Compliance Officer CANNOT conduct

this USA PATRIOT Act Independent Review.

Business Name /Business DBA

Located at: __________________________________________________________

____________________________________ ______________ ______________

CityState ZIP

MULTIPLE LOCATIONS

This business has ________ location(s) that is/are covered by this review. If this

review covers multiple locations, please list location addresses below (please attach a separate page if additional space is needed)

___________________________________________________________________

Business NameAddressCity ST ZIP

___________________________________________________________________

Business NameAddressCity ST ZIP

___________________________________________________________________

Business NameAddressCity ST ZIP

___________________________________________________________________

Business Name |

Address |

City |

ST ZIP |

MSB REGISTRATION

The Business DOES NOT conduct money services business on its own behalf and is covered by the MoneyGram MSB registration. Independent registration unnecessary at the time of this review.

The Business conducts money services business on its own behalf and is registered as an MSB with the US Department of the Treasury. A copy of the registration is kept in the AML Files.

©

RISK ASSESSMENT

All money services businesses (MSB) can be victimized by money launderers or other criminals. This risk increases based on the location of the Business, the number of financial services offered and / or with the number of providers.

Offering multiple products and / or services increases a money launderer or other criminal’s ability to structure transactions to avoid detection and recordkeeping requirements. If more than one (1) product or service is offered, the Independent Reviewer should more carefully review the compliance program.

Location Risk

Law enforcement agencies and government regulators have identified areas that are at higher risk for money laundering, related financial crimes, and drug trafficking. The appropriate websites are listed to help determine the correct response to the following questions.

The MSB is located in an area at high risk for money laundering or related financial crimes. (http://www.fincen.gov/hifcaregions.html)

The MSB is located in an area at high risk for drug trafficking. (http://www.whitehousedrugpolicy.gov/hidta/index.html)

The MSB transfers funds to

Product Risk

The Business offers the following products:

|

Money transfers / wire transfers |

|

Money orders |

|

Check cashing |

|

Currency exchange |

Stored value cards

Service Risk

The Business acts as an agent for more than one MSB provider.

Please list all MSB providers: ______________________________________

______________________________________________________________

______________________________________________________________

______________________________________________________________

©

COMPLIANCE OFFICER

The Business has designated a Compliance Officer.

Name of the Business Compliance Officer: ___________________________

The Compliance Officer fully understands and performs the duties and responsibilities of this position.

Briefly describe the Compliance Officer’s duties: _______________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

COMPLIANCE PROGRAM

The Business has adopted a written Compliance Program.

The Compliance Program includes written policies, procedures and internal controls designed to comply with the Bank Secrecy Act, including:

Customer identification

Filing Suspicious Activity Reports

Filing Currency Transaction Reports (CTR)

Recordkeeping and retention requirements

Response to law enforcement requests for information

The Compliance Program includes limits specific to the Business, such as a maximum send amount, a maximum receive amount or a maximum amount of money orders that may be purchased.

Briefly describe how these limits are enforced and monitored:

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

©

EMPLOYEE TRAINING

All employees that provide MSB services have received compliance training.

Employees are trained:

|

Daily |

|

Monthly |

|

|

|

Annually |

|

Every 18 months |

|

As necessary

Employee training includes reading the Compliance Program.

If NO, why not? _____________________________________________

Employees are trained to identify suspicious activity, including structuring.

Employees are tested to validate the employees’ understanding.

Training records and employee signatures are documented and maintained for a minimum of five (5) years.

Is training material thorough and current? Briefly describe the training content:

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

INDEPENDENT REVIEW

The Business conducts periodic Independent Reviews to monitor and maintain an adequate compliance Program.

An Independent Review is conducted:

|

|

Other: ______________________________

©

MONEY TRANSFERS

The Compliance Officer (or their designee) reviews the Send / Receive forms or Form Free receipts for accuracy and completeness.

Send/Receive forms or Form Free receipts are properly completed and maintained for transfers of $3,000 or more.

The Send/Receive forms or Form Free receipts are reviewed to determine if CTRs and / or

Day Week Month Other ________________

Send/Receive forms or Form Free receipts for transfers of $3,000 and more are maintained for a minimum of five (5) years)

MONEY ORDERS

Money order Logs are maintained for money order sales of $3,000 or more.

The Compliance Officer (or their designee) reviews daily activity to identify multiple transactions that may require a Money Order log to be completed.

Money order Logs are reviewed to determine if

Day Week Month Other ________________

Money order Logs are maintained for a minimum of five (5) years.

CUSTOMER IDENTIFICATION

The Compliance Officer (or their designee) periodically reviews the Money Order logs and / or the Send / Receive forms or Form Free receipts to ensure that the identification policy and procedures are being followed.

Valid, government issued, photo identification is recorded for money order sales of $3,000 or more.

Valid, government issued photo identification is recorded for MoneyGram money transfer transactions of $900 or more.

©

The Compliance Officer (or their designee) reviews transaction activity to look for structuring and to ensure that

Transaction activity is reviewed to determine if a SAR is needed, was filed or needs to be filed every:

Day Week Month Other ________________

________________________________________________________________

________________________________________________________________

Copies of

Blank

CTRs

The Compliance Officer (or their designee) reviews all daily MSB activity to identify transactions that either individually or combined may require a CTR to be filed.

Transaction activity is reviewed to determine if a CTR is needed or was filed every:

Day Week Month Other ________________

CTRs are accurately completed and filed on a timely basis for all transactions greater than $10,000, including fees. If “NO”, why not?

________________________________________________________________

________________________________________________________________

Copies of CTRs are maintained for a minimum of five (5) years.

Blank CTR forms are available for immediate use.

©

DATA ANALYSIS

In order to verify that transactions have been properly identified for record keeping and reporting requirements, the Independent Reviewer may choose to conduct a random test of a sample of transactions.

1. Money transfers of $900 and above must include the customer’s:

Name

Current residential address

Phone number

Type of ID provided, the ID number and the ID issuer

2. Money transfers of $3,000 and above must include the customer’s:

Name

Current residential address Phone number

Type of ID provided, the ID number and the ID issuer

Social security number (SSN) or tax identification number (TIN), if the customer is a citizen or authorized resident in the US

–A SSN or TIN is unnecessary if the customer lives and works outside of the US and presents a passport or other applicable photo ID issued by a foreign government.

Date of birth (DOB)

Specific occupation

Signature

3.Single or multiple money orders sold to one person in a single business day must include the customer’s:

Name

Current residential address Phone number

Type of ID provided, the ID number and the ID issuer

Social security number (SSN) or tax identification number (TIN), if the customer is a citizen or authorized resident in the US

–A SSN or TIN is unnecessary if the customer lives and works outside of the US and presents a passport or other applicable photo ID issued by a foreign government.

Date of birth (DOB)

Specific occupation

Signature

4.Aggregated transaction activity should be reviewed to determine if SARs and / or CTRs are needed or were filed as required.

©

Data Analysis was conducted. If “NO”, why not?

________________________________________________________________

________________________________________________________________

Briefly describe the results of the review and analysis:

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

Additional Comments (all unacceptable areas must be addressed):

©

Certification of Independent Review

An independent review of the compliance program of

__________________________________________________________

Name of Business

has been completed.

Among other things, this review focused on the requirements of the USA PATRIOT Act and the Bank Secrecy Act. The results of this review show this entity’s

Acceptable:

______________________________________________________________

Acceptable, but recommend the following enhancements:

Unacceptable for the following reasons:

Reviewer’s Name:_________________________________________

Reviewer’s Title:__________________________________________

Reviewer’s Company:______________________________________

Date of Review: __________________________________________

Reviewer Signature: ________________________________

©

Form Data

| Fact | Description |

|---|---|

| Role Restriction | The Business Compliance Officer is not allowed to conduct the USA PATRIOT Act Independent Review. |

| Multiple Locations | If the business has more than one location, all addresses need to be listed for the review. |

| MSB Registration | Businesses not conducting money services business on their own do not need independent registration if covered by MoneyGram's MSB registration. |

| Risk Assessment | The risk of being utilized for money laundering increases with the number of financial services offered and the business location. |

| Compliance Officer | A designated Compliance Officer is required, who must fully understand and perform the relevant duties effectively. |

| Compliance Program | The business must adopt a written Compliance Program that includes policies and limits complying with the Bank Secrecy Act. |

| Employee Training | All employees providing MSB services must receive compliance training at specified intervals. |

| Independent Review | Periodic Independent Reviews are required to maintain an adequate Compliance Program, which can be semi-annual or annual. |

| Customer Identification | Valid, government-issued, photo identification is recorded for certain transactions, with specific rules around money order sales and money transfers. |

Instructions on Utilizing Usa Patriot Independent

Filling out the USA PATRIOT Act Independent Review form is a necessary step for certain businesses to comply with anti-money laundering regulations. This guide provides step-by-step instructions to help you accurately complete the document. After you’ve filled out the form, it's important to review it for accuracy, then submit it to the designated compliance department or officer within your organization. This ensures that your business is aligned with legal requirements and helps in safeguarding against financial crimes.

- Start by entering the Business Name /Business DBA in the designated space.

- Fill in the address section with the business’s Location, including City, State, and ZIP code.

- If your business operates in MULTIPLE LOCATIONS, specify the number of locations covered by this review in the space provided. Then, list each location’s address. If more space is needed, attach a separate page with the additional addresses.

- Under the MSB REGISTRATION section, check the appropriate box to indicate whether your business conducts money services business on its own behalf. If it does, ensure that a copy of the MSB registration with the US Department of the Treasury is included in the AML Files.

- In the RISK ASSESSMENT section, thoroughly assess and mark the applicable risks associated with your business location, the products it offers, and the services it provides. Utilize the listed websites to determine if your business operates in high-risk areas for money laundering, financial crimes, or drug trafficking.

- Detail the products your business offers under Product Risk and list all MSB providers your business acts as an agent for under Service Risk.

- Appoint a Compliance Officer if one has not already been designated. Enter the Compliance Officer’s name and briefly describe their duties and responsibilities.

- Confirm that your business has an established Compliance Program. Check the corresponding boxes and provide brief descriptions of how your compliance program is implemented, including employee training, limits enforcement, and monitoring.

- Under EMPLOYEE TRAINING, indicate the frequency of compliance training received by employees. Specify whether they are trained to identify suspicious activities and how understanding is validated. Also, confirm the maintenance of training records.

- In the INDEPENDENT REVIEW section, specify the frequency of the reviews conducted to ensure the compliance program's adequacy.

- Check the boxes in the MONEY TRANSFERS and MONEY ORDERS sections to confirm the review and maintenance processes for Send/Receive forms, Form Free receipts, and Money Order logs.

- Finally, under CUSTOMER IDENTIFICATION, verify that your business follows the identification policy and procedures for transactions as specified.

Ensure all information provided on the form is accurate and reflective of the business’s compliance practices. Completing this form accurately is crucial for maintaining compliance with the USA PATRIOT Act and supporting efforts to prevent money laundering and financial crimes.

Obtain Answers on Usa Patriot Independent

FAQs About the USA PATRIOT Act Independent Review Form

- Who can conduct the USA PATRIOT Act Independent Review?

The Business Compliance Officer is not permitted to conduct the USA PATRIOT Act Independent Review. This review must be conducted by an individual or entity that does not have a conflict of interest, ensuring an unbiased process.

- What information is required for the Business Name/DBA section?

You need to provide the official name of the business as well as any doing business as (DBA) names. This section helps differentiate your business from others and identifies it properly for the review.

- How should multiple locations be handled?

If your business operates in more than one location, all addresses that are covered by this review need to be listed. If space provided is insufficient, you are encouraged to attach a separate page with the additional addresses.

- What is meant by MSB registration in the form?

The form distinguishes between businesses covered by MoneyGram’s Money Services Business (MSB) registration and those that conduct MSB activities independently and are thus registered directly with the US Department of the Treasury. It's important to clarify your business's status to ensure compliance.

- How is risk assessment conducted?

Risk assessment involves evaluating the business location, the number of financial services offered, and the number of providers for potential vulnerability to money laundering or related criminal activities. Businesses offering multiple services are at a higher risk and need a comprehensive review of their compliance program.

- What responsibilities does a Compliance Officer have?

A designated Compliance Officer is responsible for understanding and implementing the business's compliance program. This includes managing policies, procedures, and controls that comply with the Bank Secrecy Act and identifying and reporting suspicious activities.

- What should the compliance program include?

The compliance program must include written policies, procedures, and internal controls designed to meet the requirements of the Bank Secrecy Act. This encompasses customer identification, filing reports (SAR-MSB, CTR), recordkeeping, responding to law enforcement requests, and enforcing transaction limits.

- What is involved in employee training?

Employees providing MSB services must receive compliance training that covers identifying suspicious activities, including structuring. Training frequency can vary, and records of training should be kept for at least five years. The content must be thorough and current.

- What constitutes an Independent Review?

Periodic Independent Reviews are essential for monitoring and maintaining an adequate compliance program. The frequency of these reviews depends on the business’s assessment of risk but should at least be conducted annually to ensure continuous compliance.

Common mistakes

When filling out the USA PATRIOT Act Independent Review form, paying close attention to detail is crucial. Here are 10 common mistakes people often make that can easily be avoided:

- Not understanding the role of the Business Compliance Officer. It is important to remember that the Business Compliance Officer cannot conduct the USA PATRIOT Act Independent Review. This oversight often leads to a conflict of interest and does not comply with regulatory standards.

- Incomplete business names or DBAs (Doing Business As). It's critical to provide the full legal name and any DBA under which the business operates. An incomplete name can cause confusion and delay the review process.

- Incorrect or incomplete addresses. Always ensure that the complete and correct addresses are provided, especially for businesses with multiple locations. Omitting suite numbers, floor numbers, or providing incorrect ZIP codes can lead to inaccuracies in the review.

- Overlooking the MSB registration details. Whether the business conducts money services business on its own behalf and is registered as an MSB with the US Department of the Treasury is a vital detail that must be accurately reported. Skipping or inaccurately answering this section can cause significant compliance issues.

- Failing to properly assess risk. Underestimating the location, product, and service risk factors can significantly impact the effectiveness of the compliance program. It's essential to carefully consider each risk and check the appropriate boxes that reflect the business's actual risk levels.

- Omission of Compliance Officer information. A common mistake is not providing the full name and accurate description of the Compliance Officer’s duties. This section is crucial for understanding who is responsible for compliance and how they manage their responsibilities.

- Inadequate description of the Compliance Program. Simply checking the box that the business has adopted a written Compliance Program is not enough. An explanation of how the program is enforced and monitored, including examples of policies, procedures, and internal controls, is necessary for a complete review.

- Insufficient employee training details. The form requires specifics about the frequency, content, and verification of employee training. Neglecting to provide details or simply stating that training occurs without elaboration can be a red flag during the review process.

- Neglecting details of independent reviews. Indicating that independent reviews are conducted without specifying the frequency or findings lacks transparency and can question the integrity of the compliance program.

- Improper record maintenance. Failing to accurately complete the sections regarding money transfers and money orders, such as not keeping logs for transactions over certain amounts or not reviewing Send/Receive forms and Money Order logs as required, can result in non-compliance penalties.

Avoiding these common mistakes can enhance the accuracy and effectiveness of the USA PATRIOT Act Independent Review process, aiding businesses in maintaining compliance with regulatory requirements.

Documents used along the form

Ensuring compliance with the USA PATRIOT Act necessitates a comprehensive approach that combines various forms and documents to maintain adherence to regulations. This act significantly impacts financial institutions and businesses, demanding a meticulous review and documentation process to prevent financial crimes like money laundering and terrorist financing. Besides the USA PATRIOT Act Independent Review form, several other essential documents support the goal of maintaining regulatory compliance and strengthening internal controls. This article outlines additional forms and documents commonly utilized in conjunction with the USA PATRIOT Act Independent Review form.

- Customer Identification Program (CIP) Form: This form is critical for verifying the identity of customers engaging in financial transactions. It includes collecting identifiable information such as name, date of birth, address, and identification number.

- Suspicious Activity Report (SAR): Financial institutions use this document to report suspicious activities that might indicate money laundering, fraud, or other financial crimes to the Financial Crimes Enforcement Network (FinCEN).

- Currency Transaction Report (CTR): This document is necessary for recording and reporting cash transactions exceeding $10,000 in a single business day to FinCEN, as required under the Bank Secrecy Act (BSA).

- Foreign Bank and Financial Accounts Report (FBAR): U.S. persons must use this document to report a financial interest in or signature authority over foreign financial accounts if the aggregate value of those accounts exceeds $10,000 at any point during the calendar year.

- AML Risk Assessment: This document outlines the specific risks associated with money laundering and terrorist financing that a business faces. It includes evaluating customer base, geographic location, products, and services offered.

- Employee Training Records: Businesses must maintain records of anti-money laundering (AML) training provided to employees. This document confirms that employees understand their roles in preventing money laundering and are updated on new laws and regulations.

- Compliance Program Policies and Procedures: This comprehensive document details the internal policies, procedures, and controls designed to ensure compliance with the BSA and prevent the institution from being used for money laundering or terrorist financing.

- Independent Testing Report: An external party usually conducts an independent review or audit of the AML program and the effectiveness of its implementation. This report outlines findings and recommendations for improvement.

- Money Services Business (MSB) Registration: This form is filed with FinCEN by businesses providing money services, such as currency exchange or money transmission, to indicate their compliance with regulatory requirements.

- Office of Foreign Assets Control (OFAC) Compliance: Documentation proving the screening of transactions and customers against the OFAC list to ensure the business is not inadvertently facilitating transactions prohibited by the U.S. government.

The integration of these documents into the financial operations of a business complements the efforts initiated by the USA PATRIOT Act Independent Review form. They create a robust framework supporting the detection and prevention of financial crimes. Attention to detail and adherence to regulatory requirements reflected in these documents contribute significantly to promoting transparency, integrity, and accountability within the financial system.

Similar forms

The Bank Secrecy Act (BSA) Compliance Program Document: Similar in structure and purpose, this document obligates financial institutions to set up an effective anti-money laundering (AML) compliance program. The USA PATRIOT Act Independent Review form, like the BSA Compliance Program Document, includes requirements for creating and enforcing policies, procedures, and internal controls designed to detect and prevent money laundering activities.

FinCEN Registration Form: Financial institutions engaging in money services businesses (MSBs) must register with the Financial Crimes Enforcement Network (FinCEN). The USA PATRIOT Act Independent Review form notes the necessity for MSBs to register as such with the U.S. Department of the Treasury, paralleling the registration requirement outlined in the FinCEN Registration Form.

Customer Identification Program (CIP) Document: Both the USA PATRIOT Act Independent Review and the CIP Document place a high emphasis on accurately identifying customers. They require the recording of valid, government-issued photo identification for high-value transactions, thus playing crucial roles in the institution's broader effort to combat fraud and money laundering.

Suspicious Activity Report (SAR) Filing Procedures: The section within the USA PATRIOT Act Independent Review that discusses the filing of SARs shares similarities with documents designed to detail SAR filing procedures. These include guidelines for reviewing transactions for suspicious activity, criteria for filing SARs, and maintaining records of filed reports.

Anti-Money Laundering (AML) Training Materials: Institutions must provide AML training to their employees. The Independent Review form's emphasis on employee training, including the frequency and content of training sessions, aligns with the requirements outlined in AML Training Documentation that also focus on equipping employees with the knowledge to identify and report suspicious activities.

Currency Transaction Report (CTR) Procedures: Similar to documents outlining CTR filing requirements, the Independent Review form includes guidelines on reviewing transactions to determine if CTRs should be filed for cash transactions over a designated threshold, underscoring the form’s role in ensuring compliance with recordkeeping and reporting obligations.

Risk Assessment Documentation: The USA PATRIOT Act Independent Review form's section on risk assessment mirrors the content found in standalone risk assessment documents by evaluating the likelihood of money laundering or financial crimes occurring within specific products, services, or locations.

Independent Audit/Review Procedure Documents: The Independent Review mandates periodic audits to assess the effectiveness of the compliance program, similar to how independent audit documents delineate the scope, frequency, and procedures for conducting compliance audits. These audits ensure that the compliance program adheres to regulatory requirements and effectively mitigates risks associated with money laundering and terrorist financing.

Dos and Don'ts

When filling out the USA PATRIOT Act Independent Review form, there are essential actions to take and mistakes to avoid ensuring compliance and the effectiveness of your business's anti-money laundering (AML) efforts. Below is a guide that outlines nine critical do's and don'ts:

- Do thoroughly review the instructions and understand each section before starting.

- Do not hurry through the form without giving detailed attention to each question.

- Do ensure that the Business Compliance Officer, or the individual responsible for the AML compliance in your organization, is not the one conducting this independent review. The neutrality of the review process is vital.

- Do not overlook the importance of listing all business locations if the review covers more than one. The attached page for additional addresses must be used if the space provided is insufficient.

- Do accurately assess and indicate whether your business falls under the definition of conducting a money services business (MSB) on its own behalf. This will determine if independent registration with the U.S. Department of the Treasury is necessary.

- Do not skip over the risk assessment sections. Carefully consider your business's location, the services or products offered, and whether you act as an agent for other MSB providers. These factors significantly impact your risk level for money laundering and financial crimes.

- Do designate a compliance officer and ensure they fully understand and perform their duties related to the Bank Secrecy Act (BSA) compliance, including the implementation of your business's Compliance Program.

- Do not forget to regularly update and review the Compliance Program. It should include customer identification policies, filing procedures for Suspicious Activity Reports (SAR-MSB), and Currency Transaction Reports (CTR), as well as recordkeeping and retention requirements.

- Do ensure employee training is conducted regularly and includes all necessary elements of your Compliance Program. Employees should be trained to identify suspicious activity and the training should be documented.

By following these guidelines and carefully filling out the USA PATRIOT Act Independent Review form, businesses can better protect against involvement in illegal activities such as money laundering, thereby maintaining compliance with federal regulations.

Misconceptions

When discussing the USA PATRIOT Act Independent Review form, various misconceptions can arise due to its complex nature and the specific requirements it entails. It's important to clarify these misunderstandings to ensure compliance and the effective implementation of anti-money laundering (AML) efforts. Below are four common misconceptions about the form and explanations to correct them:

- The Business Compliance Officer can conduct the Independent Review. One common misconception is that the Business Compliance Officer is allowed to conduct the USA PATRIOT Act Independent Review. However, to maintain objectivity and ensure a thorough review, the form explicitly states that the Business Compliance Officer cannot conduct this review. It's crucial for the review to be performed by an independent party to provide an unbiased examination of the compliance program.

- All businesses need to register as a Money Services Business (MSB). Another misunderstanding is that every business must register as an MSB with the US Department of the Treasury. The form clarifies that registration is unnecessary if the business does not conduct money services business on its own behalf and is covered by the MoneyGram MSB registration. This distinction is vital for businesses to understand to avoid unnecessary registration processes.

- A one-size-fits-all compliance program is sufficient. Some might think that a standardized compliance program is enough to meet the requirements of the Bank Secrecy Act. However, the form emphasizes that the compliance program must include policies, procedures, and internal controls tailored to the specific risks and needs of the business. These include customer identification, filing of reports (Suspicious Activity Reports and Currency Transaction Reports), recordkeeping, and more. It highlights the necessity of a customized approach to effectively mitigate risks associated with money laundering and financial crimes.

- Employee training is a one-time requirement. It's a common misconception that once employees are trained in compliance protocols, no further training is needed. The form underscores the importance of ongoing employee training at specified intervals (e.g., annually, semi-annually) or as necessary, including reading the Compliance Program, understanding how to identify suspicious activity, and being tested on their knowledge. This ensures that all employees remain well-informed about compliance requirements and that the training content is thorough and current.

Dispelling these misconceptions is critical for businesses to accurately understand their obligations under the USA PATRIOT Act and to effectively implement and maintain a robust anti-money laundering compliance program.

Key takeaways

Filling out and using the USA PATRIOT Act Independent Review form requires careful attention to detail and an understanding of your business's compliance obligations under the Bank Secrecy Act and anti-money laundering (AML) regulations. Below are key takeaways to help guide you through the process:

- The independent review cannot be conducted by the Business Compliance Officer, emphasizing the need for unbiased assessment.

- It is crucial to clearly list all business locations covered by this review, including details if the business operates in multiple locations, to ensure comprehensive compliance across all operations.

- Businesses must accurately determine whether they conduct money services business (MSB) on their own behalf and if they are required to register as an MSB with the US Department of the Treasury, signifying the importance of understanding regulatory obligations.

- Risk assessment must consider location risk, product risk, and service risk, reflecting the multifaceted nature of potential money laundering and financial crime threats to MSBs.

- Designating a Compliance Officer and outlining their duties is mandatory, highlighting the importance of having a dedicated individual responsible for overseeing compliance efforts.

- Adopting a written Compliance Program that includes policies, procedures, and internal controls designed to meet Bank Secrecy Act requirements is essential for establishing a foundation for compliance.

- Employee training on compliance should be conducted regularly, with documentation maintained for at least five years, underscoring the role of ongoing education in maintaining compliance.

- Periodic Independent Reviews are required to monitor and maintain an adequate Compliance Program, with the frequency of these reviews specified to ensure ongoing vigilance.

- Specific attention must be paid to money transfers, money orders, and customer identification processes, with clear procedures for logging, review, and record-keeping that meets regulatory requirements.

Bearing in mind these key takeaways, businesses can better navigate the complexities of compliance with the USA PATRIOT Act, thus mitigating the risk of being exploited for money laundering or other financial crimes. It’s vital for businesses to regularly review and update their compliance programs in line with evolving regulations and industry best practices.

Popular PDF Forms

Dd 689 - Facilitates a systematic process for handling health-related incidents, from initial reporting to the determination of duty status and medical care.

Itinerary Builder - An informative tool for Drexel Club Sports planning travel, including specific sections on travel safety and policies.

What Is Asq Screening - Facilitates objective observation by providing clear criteria and examples for each developmental task.