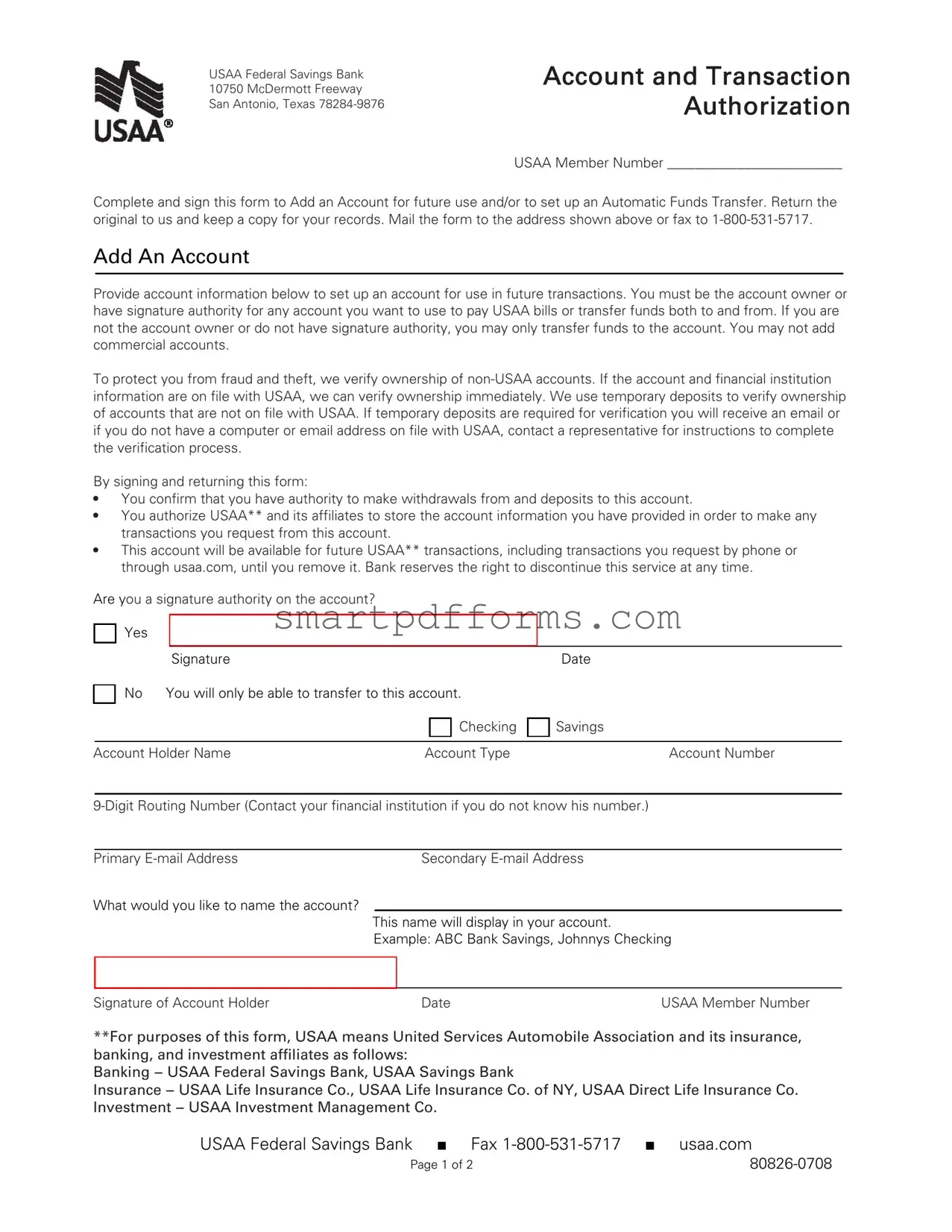

Blank Usaa Transfer PDF Template

Managing finances and ensuring seamless transactions is crucial for members of the USAA Federal Savings Bank. The USAA Transfer Form serves as a key instrument, facilitating members in adding accounts for future use and setting up automatic funds transfers with ease and security. Located at the heart of San Antonio, Texas, USAA provides a structured form that requires members to fill in their member number, account details, and specify whether the account is for adding a new one or for automatic funds transfer. It emphasizes the need for the account holder’s signature authority, ensuring transactions are authorized and secure. The form also outlines the verification process for non-USAA accounts, involving temporary deposits to confirm ownership, thereby protecting members from potential fraud. By completing and submitting this form, members authorize USAA and its affiliates to initiate requested transactions, which could range from bill payments to deposits, making it a versatile tool for financial management. Additionally, the form clarifies the operational aspects of automatic funds transfers, including scheduling, frequency, and compliance with US laws, ensuring members are fully informed of the procedures and their implications. This introductory overview encapsulates the form's comprehensive nature, designed to streamline financial transactions for USAA members while prioritizing security and compliance.

Preview - Usaa Transfer Form

USAA Federal Savings Bank

10750 McDermott Freeway

San Antonio, Texas

Account and Transaction Authorization

USAA Member Number _________________________

Complete and sign this form to Add an Account for future use and/or to set up an Automatic Funds Transfer. Return the original to us and keep a copy for your records. Mail the form to the address shown above or fax to

Add An Account

Provide account information below to set up an account for use in future transactions. You must be the account owner or have signature authority for any account you want to use to pay USAA bills or transfer funds both to and from. If you are not the account owner or do not have signature authority, you may only transfer funds to the account. You may not add commercial accounts.

To protect you from fraud and theft, we verify ownership of

By signing and returning this form:

•You confirm that you have authority to make withdrawals from and deposits to this account.

•You authorize USAA** and its affiliates to store the account information you have provided in order to make any transactions you request from this account.

•This account will be available for future USAA** transactions, including transactions you request by phone or through usaa.com, until you remove it. Bank reserves the right to discontinue this service at any time.

Are you a signature authority on the account?

Yes

|

Signature |

|

Date |

|

No You will only be able to transfer to this account. |

|

|

|

|

Checking |

Savings |

|

|

|

|

Account Holder Name |

Account Type |

Account Number |

|

Primary |

Secondary |

What would you like to name the account?

This name will display in your account. Example: ABC Bank Savings, Johnnys Checking

Signature of Account Holder |

Date |

USAA Member Number |

**For purposes of this form, USAA means United Services Automobile Association and its insurance, banking, and investment affiliates as follows:

Banking

Insurance

USAA Federal Savings Bank ■ Fax |

■ usaa.com |

Page 1 of 2 |

Automatic Funds Transfer Request

Provide account information below to set up automatic funds transfers on a schedule you establish. You must be the account owner or have signature authority for the account you want to transfer funds from.

By signing and returning this form:

•You confirm that you have authority to make withdrawals from and deposits to these accounts.

•You authorize USAA** to initiate electronic transactions to, from, or between the accounts listed below, including transactions that may be necessary to correct any errors.

•You understand that ACH (Automated Clearing House) transactions must comply with US laws.

•You understand that this authorization will remain in effect until you cancel it and USAA** has time to act.

$

Amount |

Start Date |

|

End Date |

|

||

|

|

Weekly |

Every 2 Weeks |

Monthly |

1st & 15th |

Every 2 Months |

|

|

|

|

|

|

|

Frequency |

|

|

|

|

||

FROM: |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Account Number |

Routing Number |

|

|

|

|

|

|

|

|

Checking |

Savings |

|

|

|

|

|

|

|

|

|

Account Holder |

|

|

Bank Account Type |

|

TO: |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Account Number |

Routing Number |

|

|

|

|

|

|

|

|

Checking |

Savings |

|

|

|

|

|

|

|

|

|

Account Holder |

|

|

Bank Account Type |

|

Automatic funds transfers scheduled for a holiday or weekend will generally occur on the previous business day. We will not complete your first transfer until we have completed the account verification process. Transactions involving

Signature of Account Holder |

Date |

USAA Member Number |

**For purposes of this form, USAA means United Services Automobile Association and its insurance, banking, and investment affiliates as follows:

Banking

Insurance

USAA Federal Savings Bank ■ Fax

Page 2 of 2 |

Made Fillable by eForms |

|

Form Data

| Fact | Detail |

|---|---|

| Form Purpose | Complete and sign this form to add an account for future use and/or to set up an automatic funds transfer. |

| Submission Methods | Returned by mail to USAA Federal Savings Bank or faxed to 1-800-531-5717. |

| Account Verification | Verification of ownership for non-USAA accounts involves either immediate verification if information is on file, or by using temporary deposits. |

| Authorization | Signing the form authorizes USAA and its affiliates to store provided account information for future transactions. |

| Service Continuation | The account will be available for future USAA transactions until the owner removes it, with a note that the Bank reserves the right to discontinue service anytime. |

| ACH Transactions Compliance | All ACH (Automated Clearing House) transactions must comply with US laws. |

| Transaction Timing | Transfers scheduled for holidays or weekends typically occur on the previous business day, with verification required before the first transaction. |

Instructions on Utilizing Usaa Transfer

When it comes time to manage your finances, ensuring smooth transitions between accounts can feel like a daunting task. The USAA Transfer Form is a tool designed to simplify this process, whether you're looking to set up automatic transfers or add an account for future transactions. In the following steps, you'll see exactly how to fill out this form correctly. Remember, the accuracy of this information is crucial for the seamless execution of your financial operations.

- Begin by locating your USAA Member Number and write it in the provided space at the top of the form.

- If you're adding an account, fill in the account holder's name, account type (checking or savings), account number, and the 9-digit routing number. If you're unsure of the routing number, contact your financial institution.

- Include your primary and secondary email addresses in the designated fields. These will be used for verification purposes and to keep you informed about the status of your request.

- Decide on a distinctive name for the account you're adding, something that will make it easy to identify in the future, and write it down in the provided space. For example, "John's Savings".

- Indicate whether you are a signature authority on the account by selecting 'Yes' or 'No'. Remember, if "No" is selected, you'll only be able to transfer funds to this account, not from it.

- Sign and date the bottom of the Add An Account section to authorize the addition and usage of the account for USAA transactions.

- For setting up an Automatic Funds Transfer, specify the amount, start date, end date, and frequency (weekly, every 2 weeks, monthly, 1st & 15th, or every 2 months) of the transfers.

- Provide the account information for both the 'From' and 'To' sections, including the account numbers, routing numbers, and account types (checking or savings), along with the respective bank account holder names.

- Sign and date the bottom of the Automatic Funds Transfer Request section to authorize electronic transactions as specified.

- Double-check all the information entered for accuracy to prevent any delays or issues with your request.

- Mail the original completed form to USAA Federal Savings Bank, 10750 McDermott Freeway, San Antonio, Texas 78284-9876, or fax it to 1-800-531-5717. Keep a copy for your records.

By following these steps carefully and providing accurate information, your financial operations with USAA will become easier and more efficient. Whether you're setting up a new account for payments or arranging regular transfers, this form is your first step toward streamlined financial management.

Obtain Answers on Usaa Transfer

FAQs about the USAA Transfer Form

- How do I add an account to use for future transactions with USAA?

To add an account, complete the "Add An Account" section of the USAA Transfer Form by providing the required account and financial institution information. You must be an account owner or have signature authority to add the account for paying bills or transferring funds to and from USAA.

- What types of accounts can I add for use with USAA transactions?

You can add personal checking or savings accounts for which you are the owner or have signature authority. Commercial accounts cannot be added.

- How does USAA verify ownership of non-USAA accounts?

USAA verifies ownership through temporary deposits for accounts not on file. If required for verification, you'll receive guidance via email or, if not available, through a representative.

- What happens after I sign and return the USAA Transfer Form?

By signing and returning the form, you authorize USAA and its affiliates to store your account info for making requested transactions. The account will remain available for future transactions unless removed by you. USAA also reserves the right to discontinue this service at any time.

- Can I set up automatic funds transfers?

Yes, the "Automatic Funds Transfer Request" section allows you to establish a schedule for automatic transfers between specified accounts, provided you're an owner or have signature authority over the account from which funds are drawn.

- What information is required to set up automatic funds transfers?

You'll need to detail both the source and destination accounts, including account numbers, routing numbers, and the type of accounts (checking or savings). Additionally, you should specify the amount and frequency of the transfers.

- How are transfers affected by holidays or weekends?

Automatic funds transfers scheduled on a holiday or weekend will generally occur on the preceding business day.

- What if I need to change or cancel an automatic funds transfer?

This authorization remains in effect until you cancel it. To change or cancel, allow ample time for USAA to process your request.

For more information or assistance, visit usaa.com or call 1-800-531-5717.

Common mistakes

Filling out the USAA Transfer form requires attention to detail. However, individuals often make mistakes that can cause delays or errors in processing their requests. Understanding these common pitfalls can help ensure a smoother transaction process.

- Not verifying account ownership or signature authority: Before adding an account for future transactions or setting up automatic funds transfers, one must confirm they are the account owner or have signature authority. Failing to verify this can lead to unauthorized transactions or the inability to add the account successfully.

- Incomplete or incorrect account and financial institution information: The form requires precise account and financial institution details, including the account number and 9-digit routing number. Misinformation can cause transactions to be routed incorrectly, resulting in delays or failed transactions.

- Forgetting to choose the account type: The form asks whether the added account is a checking or savings account, and this choice impacts how transactions are processed. Overlooking this step can cause confusion and processing errors.

- Omitting the signature and date: The signature of the account holder is mandatory to authorize transactions and confirm the accuracy of the provided information. Not signing or dating the form renders it invalid and non-processable.

- Neglecting to specify a transaction schedule for automatic transfers: When setting up automatic funds transfers, it's crucial to define the amount, frequency, and start and end dates. Without this information, USAA cannot implement the requested transactions correctly.

- Failure to account for transaction delays: The form notes that transactions involving non-USAA accounts may take up to 2 business days to apply, and automatic transfers scheduled for holidays or weekends will occur on the previous business day. Ignoring these details can lead to unexpected delays in funds availability.

By avoiding these common mistakes, individuals can ensure their USAA Transfer forms are filled out correctly and processed efficiently, facilitating smooth and timely transactions.

Documents used along the form

When dealing with the complexities of managing your finances, especially when transferring funds between accounts or setting up automatic transfers, it's important to have all the necessary paperwork in order. Beyond the USAA Transfer form, which facilitates the addition of an account for future use and the setup of automatic funds transfer, there are several other forms and documents that individuals might need to complete or provide. These documents can range from simple identification forms to more intricate financial statements. Understanding each one will ensure that the process goes smoothly and without unnecessary delays.

- Driver's License or Government-Issued ID: Used to verify the identity of the account holder. It's a standard requirement for most financial transactions.

- Social Security Card: Sometimes required for verification of the account holder’s Social Security Number (SSN). It's especially pertinent when opening a new account.

- Utility Bill: Often needed to prove the account holder's current address. This document must be recent, typically within the last two to three months.

- Bank Statement: Used to verify the existence of the current account and ensure the accuracy of the account details provided. It can also serve as proof of address.

- Direct Deposit Form: For individuals wishing to set up a direct deposit to or from a USAA account, a direct deposit form from the employer or the depositing party is necessary.

- Voided Check: Required for setting up automatic payments or transfers, a voided check provides the necessary bank routing and account numbers.

- Power of Attorney Documentation: If the transactions are being conducted on behalf of the account holder, legal documentation proving the authority to act is mandatory.

- Loan Agreement or Payoff Statement: If the transfer involves the payoff of a loan, the relevant documentation detailing the loan terms or payoff amounts is needed.

- Financial Hardship Letter: For situations involving hardship requests, such as loan modifications or account changes due to financial difficulties, a letter explaining the circumstances and request is essential.

- Credit Report: In some cases, especially for new account openings or major transactions, a current credit report may be requested to assess creditworthiness.

In conclusion, while the USAA Transfer form is a crucial document for setting up account transfers and automatic payments, it's often just one piece of the puzzle. Being prepared with the additional documents listed can help ensure a seamless process, whether you're managing routine finances or making significant changes to your accounts. Always verify with USAA or the other financial institutions involved to confirm which documents are required for your specific transactions, as requirements can vary.

Similar forms

Direct Deposit Authorization Forms similarly require the account holder's name, bank information such as account number and routing number, and a signature to authorize the transaction. These forms enable employers to deposit funds directly into employees' bank accounts, just as the USAA Transfer form authorizes USAA to make transactions to and from accounts.

Automatic Payment Authorization Forms are used to set up recurring payments from a bank account for expenses like mortgages or utilities. Much like the USAA Transfer form, they require account details and a signature to authorize the automated transfers, ensuring bills are paid on schedule.

Bank Account Opening Forms necessitate personal and account information, including the type of account being opened (checking or savings), much like the section of the USAA Transfer form dedicated to adding an account for future transactions.

ACH Credit Authorization Forms allow businesses to deposit funds into a bank account, requiring the account holder's consent and bank details similar to the USAA form which facilitates automatic funds transfers through ACH transactions.

Wire Transfer Request Forms authorize the one-time or occasional transfer of funds from one account to another, specifying account numbers and routing numbers, akin to the specifics required for setting up automatic funds transfers with the USAA Transfer form.

Change of Address Forms for financial institutions often require verification and authorization to ensure security and prevent fraud, paralleling the USAA Transfer form's verification process to protect account ownership.

Bank Draft Authorization Forms permit businesses to pull funds from a customer's bank account, usually for recurring payments, needing similar information and authorizations about bank details as found in the USAA Transfer form for ongoing transactions.

Investment Account Transfer Forms facilitate the transfer of assets between brokerage firms or accounts, requiring comprehensive account information and authorization, similar to how the USAA form governs the flow of funds between accounts for investment transactions.

EFT (Electronic Funds Transfer) Authorization Forms permit the digital transfer of funds between accounts, with terms and conditions akin to those outlined in the USAA Transfer form, including authorization by the account holder to initiate and sometimes terminate the transfers.

Dos and Don'ts

When filling out the USAA Transfer form, paying close attention to both the required information and accuracy ensures that your transactions are processed smoothly. Here are several dos and don'ts to guide you through this process:

- Do ensure that you have the authority to make deposits and withdrawals on the account you are adding or transferring funds to. This is crucial for both actions to be authorized and processed.

- Do verify the accuracy of the account and financial institution information. It's essential for immediate verification and to avoid delays in the process.

- Do contact your financial institution to obtain your 9-digit routing number if you are unsure. This is a critical piece of information needed for any kind of funds transfer.

- Do provide a primary and a secondary email address if possible. This ensures you receive all necessary communication regarding your account verification and transfer requests.

- Do return the original signed form to USAA to complete your request, either by mailing it to the provided address or faxing it to 1-800-531-5717.

- Don't attempt to add commercial accounts, as they are not eligible for this service. This restriction is in place to protect against fraud and theft.

- Don't forget to sign and date the form. Your signature is a necessary confirmation of your authority over the accounts involved and your agreement to the terms of the transfer.

- Don't leave any fields incomplete, especially those that are mandatory such as account numbers, routing numbers, and account types. This could delay the processing of your form.

- Don't overlook the importance of naming the account you're adding. This helps in easily identifying the account for future transactions.

Adhering to these guidelines will help facilitate a seamless process when setting up accounts for future use or arranging automatic funds transfers with USAA. Remember, accurate and complete information coupled with following the specified instructions is key to ensuring that your financial transactions are executed without any issues.

Misconceptions

Common Misconceptions About the USAA Transfer Form

Understanding the USAA Transfer Form is crucial for those looking to manage their finances effectively. Below are nine common misconceptions that often arise regarding this document:

- All bank accounts can be added for transfer purposes: Only personal checking and savings accounts for which you have ownership or signature authority can be added. Commercial accounts are not eligible for addition to this service.

- Account verification is always immediate: While USAA can immediately verify ownership for accounts and financial institutions already on file, accounts not on file require a verification process that includes temporary deposits. This process can take additional time.

- Email is the only way to receive verification instructions: If temporary deposits are necessary for verification and an email address is not on file with USAA, alternate instructions can be provided by contacting a USAA representative.

- The form grants unlimited authority over added accounts: By signing the form, you confirm you have the authority to make deposits and withdrawals, but USAA also reserves the right to restrict or discontinue service at any time.

- Added accounts are immediately available for transactions: The account will be available for future transactions after the verification process is complete, not immediately upon submission of the form.

- Automatic funds transfers start immediately: USAA will not execute the first transfer until after the account verification process is complete, which could delay the initiation of the first scheduled transfer.

- Signature authority enables all transfer types: Having signature authority for an account only allows transfers to it and does not enable transfers from it unless explicitly authorized as the account owner.

- Weekends and holidays affect transfer schedules: Automatic funds transfers scheduled on weekends or holidays are processed on the previous business day, which may require planning ahead for timely transfers.

- All changes to transfers and accounts require a new form: Adjustments to the transfer schedule or modifications to account information may be made through other channels besides submitting a new form, including online adjustments or phone requests.

By addressing these misconceptions, USAA members can more effectively use the USAA Transfer Form for their banking and transferring needs, ensuring smoother transactions and better financial management.

Key takeaways

When dealing with financial transactions, understanding the intricacies of forms like the USAA Transfer form is essential for ensuring all transfers proceed smoothly and securely. Here are five key takeaways from the USAA Transfer form to assist in navigating this process with confidence.

The requirement of being the account owner or having signature authority is paramount for setting up and using accounts for USAA transactions. This stipulation guarantees that transactions are authorized and reduces the likelihood of unauthorized account use.

Verification of account ownership is a critical step to protect against fraud. USAA employs methods like temporary deposits or immediate verification if the account information is already on file. Either process aims to authenticate ownership securely before initiating any transfers, ensuring that only legitimate transactions are processed.

By signing the form, one authorizes USAA to store provided account information for future transactions. This consent facilitates ease of future transactions, allowing for a smoother, streamlined process when managing funds across accounts affiliated with USAA.

Understanding the rules around Automated Clearing House (ACH) transactions is crucial. ACH transactions must comply with US laws, affirming the legal framework within which USAA operates. This compliance helps safeguard the interests of all parties involved in the transfer process.

The authorization for automatic funds transfers remains in effect until explicitly canceled. It’s important to recognize that initiating a cancellation will require a reasonable amount of time for USAA to process. This provision underscores the importance of planning and communicating intentions regarding automatic transfers to ensure they align with one’s current financial management objectives.

In summary, the USAA Transfer Form is an instrumental document designed to facilitate secure and efficient fund transfers for its members. It's important to carefully review and understand these key takeaways to ensure that one's financial transactions are managed in accordance with the established procedures and legal requirements. Proper attention to and compliance with these guidelines can provide peace of mind and contribute to a hassle-free financial management experience.

Popular PDF Forms

Boe Sales Tax - A timely filed Consumer Use Tax Return avoids penalties and interest, enforcing the importance of meeting the submission deadline indicated on the form.

Volleyball Rotation Sheet - The form acts as an official record, holding teams accountable to their listed lineup and serving order, thus upholding the integrity of the game.

Colorado Med 9 Form - This form enables medical professionals to provide detailed information about an individual's disability, which is essential for determining eligibility for financial benefits under the AND program in Colorado.