Blank Usda Ratio Waiver PDF Template

In navigating the complexities of securing a USDA loan, applicants might encounter situations where their debt-to-income ratios exceed the standard limits set by the USDA. This is where the USDA Ratio Waiver Form comes into play, serving as a critical tool for those who find their housing expense ratios (PITI) exceeding 29% and their total debt ratios (TD) surpassing 41%. Designed to cater to circumstances where payment shock is 100% or higher, or the applicant lacks a prior rental history, this form facilitates a request for a debt ratio waiver by meticulously documenting compensating factors that mitigate perceived lending risks. Compensating factors include but are not limited to a consistent rental history comparable to the new PITI, minimal increases in housing expenses, stable employment of over two years, potential for increased earnings, and substantial post-closing cash reserves. The form demands a detailed accounting of the applicant and co-applicant’s creditworthiness through a careful deliberation of credit scores, stable income evidences, and potential future earning capabilities, alongside other factors that support the applicant's ability to manage the new mortgage payments. Moreover, it underscores the lender and underwriter's roles in meticulously evaluating these compensating factors to justify the approval of deviations from standard lending ratios, all while ensuring adherence to USDA lending guidelines.

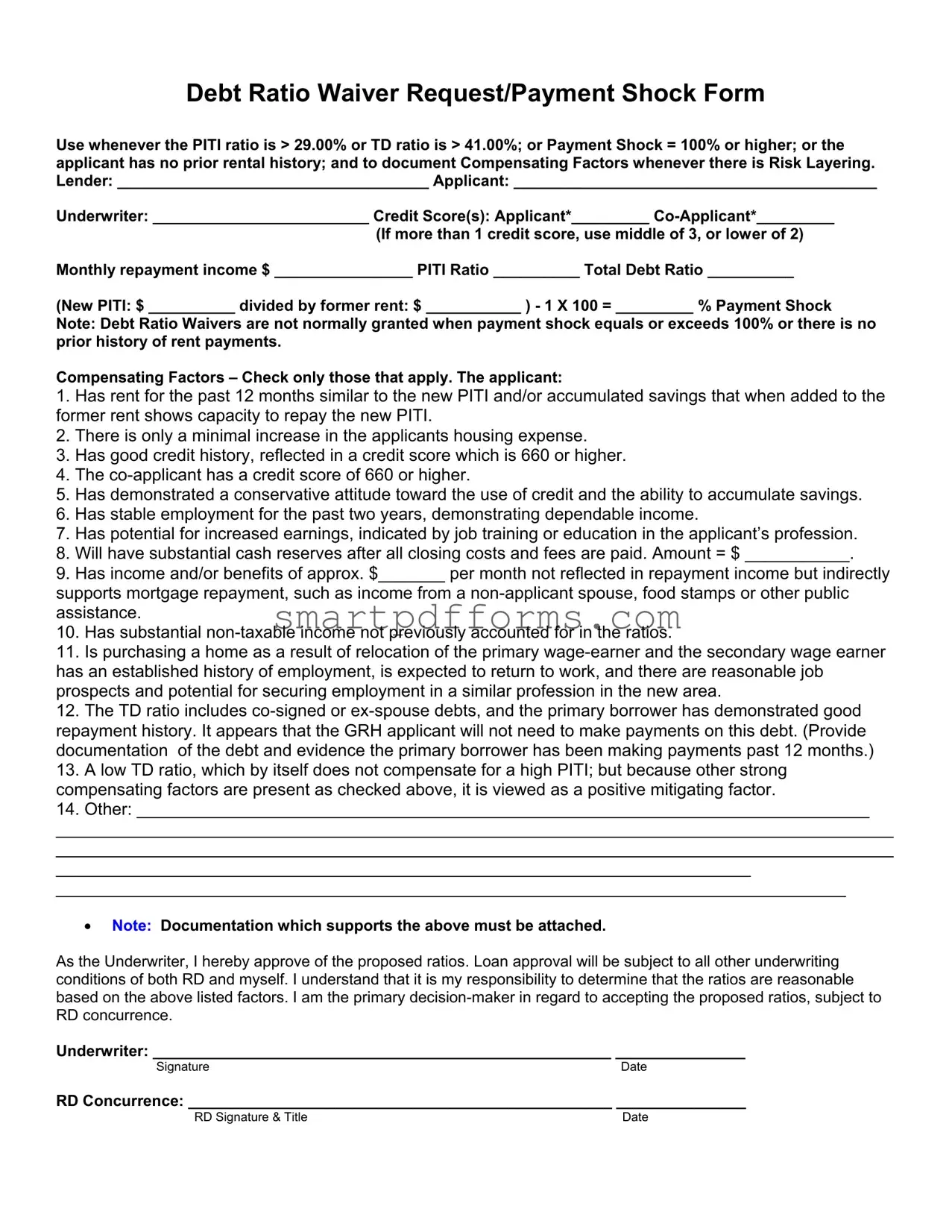

Preview - Usda Ratio Waiver Form

Debt Ratio Waiver Request/Payment Shock Form

Use whenever the PITI ratio is > 29.00% or TD ratio is > 41.00%; or Payment Shock = 100% or higher; or the applicant has no prior rental history; and to document Compensating Factors whenever there is Risk Layering. Lender: ____________________________________ Applicant: __________________________________________

Underwriter: _________________________ Credit Score(s): Applicant*_________

(If more than 1 credit score, use middle of 3, or lower of 2) Monthly repayment income $ ________________ PITI Ratio __________ Total Debt Ratio __________

(New PITI: $ __________ divided by former rent: $ ___________ ) - 1 X 100 = _________ % Payment Shock

Note: Debt Ratio Waivers are not normally granted when payment shock equals or exceeds 100% or there is no prior history of rent payments.

Compensating Factors – Check only those that apply. The applicant:

1.Has rent for the past 12 months similar to the new PITI and/or accumulated savings that when added to the former rent shows capacity to repay the new PITI.

2.There is only a minimal increase in the applicants housing expense.

3.Has good credit history, reflected in a credit score which is 660 or higher.

4.The

5.Has demonstrated a conservative attitude toward the use of credit and the ability to accumulate savings.

6.Has stable employment for the past two years, demonstrating dependable income.

7.Has potential for increased earnings, indicated by job training or education in the applicant’s profession.

8.Will have substantial cash reserves after all closing costs and fees are paid. Amount = $ ___________.

9.Has income and/or benefits of approx. $_______ per month not reflected in repayment income but indirectly supports mortgage repayment, such as income from a

10.Has substantial

11.Is purchasing a home as a result of relocation of the primary

12.The TD ratio includes

13.A low TD ratio, which by itself does not compensate for a high PITI; but because other strong compensating factors are present as checked above, it is viewed as a positive mitigating factor.

14.Other: _____________________________________________________________________________

________________________________________________________________________________________

________________________________________________________________________________________

_________________________________________________________________________

___________________________________________________________________________________

•Note: Documentation which supports the above must be attached.

As the Underwriter, I hereby approve of the proposed ratios. Loan approval will be subject to all other underwriting conditions of both RD and myself. I understand that it is my responsibility to determine that the ratios are reasonable based on the above listed factors. I am the primary

Underwriter: _____________________________________________________ _______________

SignatureDate

RD Concurrence: _________________________________________________ _______________

RD Signature & Title |

Date |

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | Used for requesting a debt ratio waiver when the PITI ratio is greater than 29%, the total debt (TD) ratio is over 41%, payment shock equals or exceeds 100%, or the applicant has no prior rental history. |

| Target Audience | Lenders and underwriters who are evaluating loan applications for USDA Rural Development. |

| Criteria for Use | Applicable when documenting compensating factors in the presence of risk layering in an applicant's financial profile. |

| Compensating Factors | Includes having rent similar to the new PITI, good credit history, stable employment for two years, and potential for increased earnings, among others. |

| Payment Shock Calculation | Defined as the new PITI divided by former rent minus 1, then multiplied by 100 to get the percentage. It is a measure of how much the borrower’s housing expenses will increase. |

| Documentation Requirement | All claims regarding compensating factors and adjustment of ratios must be supported by proper documentation. |

| Underwriter Responsibility | The underwriter is the primary decision maker regarding the acceptance of proposed ratios, subject to RD (Rural Development) concurrence. |

| Governing Law(s) | This form is governed by USDA Rural Development regulations and directives, which may vary slightly between states to accommodate local laws and requirements. |

Instructions on Utilizing Usda Ratio Waiver

Filling out the USDA Ratio Waiver form is a critical step in applying for a loan that could greatly assist in purchasing a home, especially under conditions where the standard debt-to-income ratios are exceeded or other specific criteria are met. This process ensures that all necessary information is provided, potentially leading to a waiver that could facilitate loan approval. By carefully following each step, applicants and lenders can accurately present their case for a waiver, backed by relevant financial information and compensating factors.

- Start with the Lender section by filling in the official name of the lending institution.

- In the Applicant field, write the full name of the person applying for the loan.

- Complete the Underwriter space with the name of the individual responsible for reviewing and making decisions on loan applications.

- For the Credit Score(s), enter the credit scores of the applicant and, if applicable, the co-applicant. Use the middle score if there are three available, or the lower score if there are two.

- Under Monthly repayment income, list the total income available each month for repaying the loan.

- Determine both the PITI Ratio and the Total Debt Ratio, filling in the respective fields.

- Calculate the Payment Shock by dividing the new PITI by the former rent, subtracting one, and then multiplying by 100 to express as a percentage. Enter this value.

- For the section on Compensating Factors, check all that apply to the applicant's situation from the provided list. This includes aspects such as a good credit history, stable employment, potential for increased earnings, among others.

- If there are other relevant compensating factors not listed, describe them thoroughly under the item labeled "Other."

- Ensure that all supportive documentation for the checked compensating factors is attached as noted at the bottom of this section.

- At the end of the form, the Underwriter must sign and date, indicating approval of the proposed ratios based on the listed factors. This is an acknowledgment of taking primary responsibility for the decision, pending RD concurrence.

- Finally, the section for RD Concurrence should be completed by the relevant RD authority, including signature, title, and date, to indicate agreement with the waiver request.

Upon completing the form and attaching all necessary documentation, the application can then proceed through the remaining steps of the loan approval process. It's important to follow up with the lending institution and Rural Development (RD) office to ensure all requirements have been met and to address any further questions or needs they might have regarding your application.

Obtain Answers on Usda Ratio Waiver

What is the USDA Ratio Waiver form and when is it used?

The USDA Ratio Waiver form is a document utilized in the context of securing a loan through the United States Department of Agriculture (USDA). It's specifically employed when an applicant's payment-to-income (PITI) ratio exceeds 29.00%, their total debt (TD) ratio surpasses 41.00%, they experience a payment shock equal to or greater than 100%, or they lack a prior rental history. Additionally, it serves to document compensating factors in scenarios involving risk layering. The form requires information about the lender, applicant, and underwriter, along with various financial metrics and potential compensating factors that might justify the waiver of typical debt ratio requirements.

What constitutes a "Payment Shock" and how is it calculated?

Payment shock refers to the difference in an applicant's current housing expense compared to the anticipated monthly expense (PITI) of a new mortgage, expressed as a percentage increase. It signals a significant increase in the borrower's housing costs. The calculation is straightforward: ((New PITI - Former Rent) / Former Rent) x 100. A payment shock of 100% or higher typically raises concerns about the borrower's ability to cope with the increased financial burden, impacting the consideration for a debt ratio waiver.

Who can apply for a USDA Ratio Waiver?

Applicants for a USDA-guaranteed loan who find themselves outside the standard qualifying debt ratios (PITI ratio over 29.00% or total debt ratio over 41.00%), those experiencing a payment shock of 100% or more, or those without a prior history of rent payments may seek a USDA Ratio Waiver. Additionally, the form is applicable when documenting compensating factors that might mitigate perceived lending risks.

What are compensating factors, and how do they affect the USDA Ratio Waiver?

Compensating factors are positive financial or personal aspects that offset the risk posed by not meeting standard debt ratio guidelines. They include, but are not limited to, a history of rental payments comparable to the new PITI, minimal increase in housing expense, a strong credit history, stable employment, potential for increased earnings, and significant cash reserves post-closing. By presenting these factors, an applicant can demonstrate their capacity to manage the loan effectively despite initial ratio concerns or payment shock, enhancing their eligibility for a waiver.

How is the underwriter involved in the USDA Ratio Waiver process?

The underwriter plays a critical role in the USDA Ratio Waiver process. They are responsible for reviewing the application, including all compensating factors and financial metrics, to decide whether the proposed debt ratios are reasonable and justifiable. The underwriter’s approval is a crucial step in the process, confirming that the loan meets the criteria for a waiver based on the presented evidence. This approval is subject to further concurrence from the USDA, making the underwriter's judgment pivotal in the decision-making framework.

Is documentation necessary to support compensating factors listed in the waiver request?

Yes, thorough documentation is vital to support the compensating factors listed in the waiver request. This documentation provides evidence of the applicant’s financial stability, creditworthiness, and overall capability to manage the new mortgage payments. Effective documentation includes payment histories, bank statements, employment verification, and any other relevant materials that substantiate the applicant’s claim of financial readiness and stability. The requirement for documentation ensures that each waiver request is evaluated fairly and comprehensively, based on verifiable information.

Common mistakes

When filling out the USDA Ratio Waiver Form, it's important to avoid common mistakes to ensure the application process is smooth and successful. Here are nine common errors:

Incorrectly calculating the PITI (Principal, Interest, Taxes, Insurance) ratio. This is a crucial number that needs precise calculation. Overlooking the correct method - dividing the new PITI by the former rent - can lead to inaccuracies in the application.

Failure to accurately report the Total Debt Ratio. This requires including all debt obligations in the calculation, not just the new mortgage. Missing any can give an incomplete financial picture.

Overlooking the Payment Shock calculation, especially if it exceeds 100% or if there's no prior history of rent payments. This can automatically disqualify the request.

Not checking the appropriate compensating factors that apply to the applicant's situation. Each checked item needs to be backed up with proper documentation.

Misstating the credit score(s) or misunderstanding which score to use. Remember, if there are more than one score, use the middle of three, or the lower of two.

Omitting details about compensating factors, such as stable employment, potential for increased earnings, good credit history, etc., that can strengthen the application.

Forgetting to document and attach proof for compensating factors. Each factor checked off on the application needs corresponding documentation for verification.

Ignoring the specific conditions under which debt ratios might be deemed reasonable by the underwriter. Understanding these conditions is pivotal for submitting a convincing waiver request.

Incorrectly completing or not signing the underwriter and RD concurrence sections. The form is incomplete without these essential endorsements.

By avoiding these mistakes and carefully preparing the USDA Ratio Waiver Form, applicants can improve their chances of approval. Each step of the form should be approached with attention to detail and an understanding of the requirements.

Documents used along the form

When working with the USDA Ratio Waiver form, used for handling cases where debt ratios exceed standard guidelines or where payment shock is significantly high, it's important to have a comprehensive understanding of other forms and documents that are often required to support a waiver request. This form plays a critical role in documenting exceptions to the usual debt ratio requirements and in showcasing an applicant’s ability to handle a new mortgage payment, despite what the raw numbers might suggest. The listed compensating factors serve as the backbone of a waiver request, emphasizing the applicant's financial responsibility and readiness for homeownership.

- Uniform Residential Loan Application: This is a standard form used across the mortgage industry for applicants to provide their financial information, including employment history, income, assets, and liabilities. It gives lenders a detailed overview of the applicant's financial status.

- Credit Report: It's a comprehensive record of an applicant’s credit history, including past and present debts, payment records, and an overall credit score. This document is vital for underwriters to assess creditworthiness and identify potential risks.

- Employment Verification: This document confirms the applicant's current employment status and income levels. It is essential for verifying the stability and dependability of the income listed in the loan application.

- Bank Statements: These statements reflect the applicant’s financial health by showing recent transactions, current balances, and any overdraft occurrences. They're crucial for demonstrating the ability to save and manage finances effectively.

- Appraisal Report: An appraisal report provides an independent assessment of the property’s market value. Lenders require this to ensure the loan amount requested does not exceed the property's worth.

- Property Tax Estimate: This document offers an estimate of the annual property taxes for the home. It's used to calculate the overall affordability and monthly payment obligations of the potential homeowner.

In preparation for a USDA Ratio Waiver request, the aforementioned documents collectively paint a detailed picture of an applicant's financial situation and readiness for home ownership. It’s this ensemble of information that underwriters and lenders review to make informed decisions on granting waivers. Understanding each document’s purpose and ensuring their accuracy and completeness can significantly impact the outcome of the waiver process, potentially leading to successful loan approvals for homes that otherwise might seem financially out of reach.

Similar forms

Loan Application Form: Similar to the USDA Ratio Waiver form, a loan application form collects vital financial information from the applicant, including income data and existing debts. Both forms play a crucial role in evaluating an applicant’s ability to manage new financial obligations.

Credit Report Authorization Form: This form authorizes the lender to obtain an applicant’s credit history from credit bureaus, much like how the USDA Ratio Waiver form requires the applicant’s credit scores. Both documents help lenders assess credit risk and make informed decisions.

Employment Verification Form: Just as the USDA Ratio Waiver form examines the applicant’s stable employment for the past two years as a compensating factor, an employment verification form confirms the applicant’s employment status and income, contributing to the evaluation of the applicant’s repayment capacity.

Mortgage Assistance Application: Similar to the USDA Ratio Waiver form, which aims to assist applicants facing challenges in meeting standard debt-to-income ratios, a mortgage assistance application seeks to identify qualifying hardships or factors that may warrant a modification of loan terms, thereby aiding those in need of special consideration to maintain their homeownership.

Asset Declaration Form: This form requires applicants to list their savings and other assets, akin to the USDA Ratio Waiver form, which considers the applicant’s ability to accumulate savings and have substantial cash reserves after closing as compensating factors. Both documents assess the applicant’s financial health beyond income and debt.

Dos and Don'ts

When filling out the USDA Ratio Waiver form, there are specific guidelines that should be followed to ensure the submission is complete, accurate, and reflects the applicant's financial situation in a truthful manner. Here are six things you should and shouldn't do:

- Do thoroughly review all the sections of the form before beginning to fill it out, to understand the kind of information you will need to provide.

- Do gather all the necessary documents and information, such as credit scores, monthly income, and detailed expenses, to accurately fill out the form.

- Do use the correct numerical values when calculating ratios and ensure that percentages are accurately represented to reflect your financial situation correctly.

- Don't leave any fields blank; if a section does not apply to you, indicate with "N/A" to show the question has been considered and answered to the best of your ability.

- Don't provide inaccurate or misleading information in an attempt to improve the chances of the waiver being granted. All information must be truthful and verifiable.

- Don't forget to check off the appropriate compensating factors that apply to your situation, and ensure you attach all required documentation to support your claims.

Remember, the key to a successful Ratio Waiver Request is providing complete, accurate, and honest information about your financial situation. This will allow the underwriter to assess your request correctly and make a fair determination. Always double-check your entries and calculations before submitting the form.

Misconceptions

There are several misconceptions about the USDA Ratio Waiver form. Understanding these can help both lenders and applicants navigate the process more effectively. Here are five common misunderstandings:

- The waiver is automatically granted if the debt ratios exceed USDA limits. In reality, the waiver is not automatically granted. Lenders must document specific compensating factors that justify the waiver, and the underwriter must agree that these factors sufficiently offset the higher ratios.

- Having a high credit score ensures approval of the waiver. While a credit score of 660 or higher is listed as a compensating factor, the waiver's approval depends on a combination of factors, not just credit scores. Applicants must demonstrate overall financial stability and the ability to handle the new debt.

- Payment shock is irrelevant as long as the debt ratios are within acceptable limits. This misconception overlooks the form's guidelines that waivers are generally not granted when payment shock equals or exceeds 100%, or the applicant lacks a prior history of rent payments. Payment shock is a significant consideration in the waiver process.

- The waiver is only for first-time homebuyers or those with no rental history. Although one of the criteria mentions applicants with no prior rental history, the waiver is available to any eligible borrower facing high debt ratios or significant payment shock, provided they can demonstrate compensating factors that mitigate the risk.

- All listed compensating factors need to be present for a waiver to be granted. The form allows for the waiver to be granted based on the presence of any applicable compensating factors, not necessarily all. Lenders and applicants should focus on thoroughly documenting any factors that apply to their situation.

Understanding these misconceptions can help applicants and lenders accurately assess eligibility for a USDA Ratio Waiver and prepare their application effectively. It is essential to provide comprehensive documentation that supports the need for a waiver, focusing on the compensating factors that strengthen the application.

Key takeaways

Understanding the USDA Ratio Waiver Form is essential for those seeking flexibility on their loan requirements due to certain financial situations. Here are key takeaways concerning the process of filling out and utilizing this form:

- The USDA Ratio Waiver Form is designed for applicants whose Payment-to-Income (PITI) ratio exceeds 29% or Total Debt (TD) ratio is above 41%, face a payment shock of 100% or higher, or have no established rental history. It's also used to document compensating factors when there is risk layering in the loan application.

- Compensating factors are crucial for the waiver request; they include a history of rent similar to the new PITI, minimal increase in housing expense, credit scores of 660 or higher, stable employment of at least two years, substantial cash reserves post-closing, and potential non-taxed income supporting mortgage repayment. These factors help in demonstrating the applicant's capacity to manage the new housing expenses effectively.

- Documentation is key. Every compensating factor checked on the form should be substantiated with appropriate documentation. This could include bank statements showing savings, employment verification for stable job history, or evidence of non-taxable income. Failure to provide required documentation can lead to denial of the waiver request.

- The underwriter plays a pivotal role. While the USDA provides these waivers to assist applicants in qualifying for loans under special circumstances, the underwriter is the primary decision-maker. Their approval is based on the justification provided through the compensating factors and the accompanying documentation. The loan approval, however, remains subject to other underwriting conditions set by both RD (Rural Development) and the underwriter themselves.

Overall, the USDA Ratio Waiver Form is a vital tool for applicants who do not meet specific financial criteria but can demonstrate their ability to afford a new mortgage payment effectively through other means. Accurate completion of the form and provision of supporting documents play a critical role in the success of these waiver requests.

Popular PDF Forms

Mass State Id - Encouragement for early renewal for those turning 21 offers practical advice for young drivers aiming for the convenience of a horizontal license.

New Jersey Realtors® Standard Form of Residential Lease - Addresses the handling of insurance, ensuring tenants understand their obligations to cover personal property and liability.

Contract for Deed Vs Owner Financing - Provides a structured process for buying and selling property in Texas, outlining payment and maintenance requirements.