Blank Va 10 10Ec PDF Template

Navigating the complexities of healthcare can often be a daunting task, particularly for veterans who require extended care services. The VA Form 10-10EC, officially known as the Application for Extended Care Services, serves as a critical tool within this landscape, helping veterans to estimate their monthly copayment obligations for such services provided by the VA. Designed to ensure that veterans have access to the extended care they need, the form requires detailed information on income, assets, and expenses from both the veteran and their spouse if applicable. Whether the services are provided directly by the VA or paid for by them, this form stands as a cornerstone in planning and accessing essential healthcare services. Given its importance, the assistance of the Social Work staff at local VA medical facilities is invaluable in understanding and completing the VA Form 10-10EC. Their guidance helps in comprehensively filling out sections that cover everything from general and insurance information to detailed financial data, meaning veterans and their families are better positioned to manage their healthcare needs efficiently. Moreover, with no copayment for the first 21 days of extended care in any 12-month period and a structured process to report any changes affecting copayment amounts, the VA Form 10-10EC underscores the VA’s commitment to offering accessible and financially manageable care to those who have served the nation.

Preview - Va 10 10Ec Form

OMB Number:

Estimated Burden: 90 min.

Expiration Date: 06/30/2021

INSTRUCTIONS FOR COMPLETING APPLICATION FOR

EXTENDED CARE SERVICES (VAF

STEP 1. Before You Start. . . .

What is VA Form

To determine the estimated amount of your monthly copayment obligations for extended care services provided to you by VA, either directly by VA or paid for by VA. There is no copayment for the first 21 days of extended care services that VA provides to you in any 12 month period. You must report any changes that might affect the copayment amount to your local VA medical facility within 10 calendar days of the change.

Where can I get help filling out the form?

Contact the Social Work staff at your local VA medical facility for assistance on understanding the information and financial data needed to complete VA Form

What will I need to know in order to complete the form?

Current income of both veteran and spouse (can report monthly or annual income).

Current deductible expenses (can report monthly or annual expenses). For example property taxes may be reported as an annual amount.

Value of fixed and liquid assets of both veteran and spouse. See Section IV of these instructions for further information regarding the reporting of assets.

All health insurance information covering you even if it is through your spouse (a copy of your insurance card). Medicare information (Part A & Part B) (a copy of your Medicare card).

Spousal/Dependent information (including spouse's social security number, dependents date of birth).

STEP 2. Completing the application . . . .

Section I - General Information. Include your name and full social security number.

Section II - Insurance Information. Include information for Medicare and all health insurance companies that cover you. It is important that we obtain all health insurance coverage for you (including coverage through a spouse). Please make a copy of your Medicare card and all health insurance cards and include them with this completed application.

Section III - Spouse/Dependent Information. In order to determine if a veteran must pay an extended care copayment amount, it is necessary to identify spousal and/or dependent information and whether they are residing in the community (not institutionalized). A spouse or dependent is considered institutionalized if they are residing in a nursing home or hospital setting. A dependent other than spouse would be son, daughter, stepson, or stepdaughter. Provide address and phone number of spouse or dependent if different from the veteran. Report current marital status. Do not include spousal information if you and spouse are legally separated or divorced. If you are certifying that a person is your spouse for the purpose of VA benefits, your marriage must be recognized by the place where you and/or your spouse resided at the time of marriage, or where you and/or your spouse reside when you file your claim (or at a later date when you become eligible for benefits) (38 U.S.C. 103(c)). Additional guidance on when VA recognizes marriages is available at http://www.va.gov/opa/marriage/.

Section IV - Fixed Assets. Used only in the determination of the extended care copayment amount when a veteran reaches 181 days or more of institutional (inpatient) extended care services.

Report real property minus any outstanding lien or mortgage.

Exclude burial plots, veteran's primary residence and veteran's vehicle (if the veteran is receiving institutional (inpatient) extended care services this is the primary residence and vehicle of the spouse or dependents).

Section V - Liquid Assets. Used only in the determination of the extended care copayment amount when a veteran reaches 181 days or more of institutional (inpatient) extended care services.

Report cash, stocks, dividends received from IRA, 401K's and other tax deferred annuities, bonds, mutual funds, retirements accounts (e.g. IRA, 401Ks, annuities), art, rare coins, stamp collections, and other collectibles.

Exclude household and personal items such as furniture, clothing and jewelry if the veteran has a spouse or dependents residing in the community.

If the veteran has a spouse residing in the community (not institutionalized), the spousal resource protection amount may be applied to reduce the value of liquid assets.

VA FORM |

|

|

JAN 2017 |

EXISTING STOCK OF VA FORM |

Section VI - Current Gross Income of Veteran and Spouse. Do not include income from dependents.

Report wages, bonuses, tips, severance pay and accrued benefits

Report income from a business (minus business expenses)

Report cash gifts, inheritance amounts, intrest income, and the standard dividend income from non tax deferred annunities.

Report retirement income and pension income.

Report unemployment payments, worker's compensation payments, black lung payments, tort settlement payments, social security payments, and court mandated payments.

Report payments from VA or any other Federal programs, and any other income.

Exclude income of the Veteran's dependents.

Section VII. Expenses. Not used in the determination of the extended care copayment amount when a veteran reaches 181 days or more of institutional (inpatient) extended care services and does not a have a spouse or dependents residing in the community (not institutionalized).

Report basic subsistence (living) expenses.

Include any educational expense incurred by the veteran, spouse or dependent.

Include any funeral or burial expenses for your spouse or dependent as well as any prepaid funeral or burial arrangements for yourself, spouse, or dependent.

Include rent or mortgage payment for primary residence only.

Include amount paid for utilities (electricity, gas, water or phone). You can calculate the amount by using the average monthly expenses during the past year for your utilities.

Include car payment for one vehicle only.

Include amount spent for food for veteran, spouse or dependent.

Include

Include court ordered payments such as alimony or child support.

Include insurance premiums such as automobile and homeowners. Exclude life insurance premiums.

Include taxes paid on property and average monthly expense for taxes paid on income over the past 12 months.

STEP 3. Submitting your application

What do I do when I have finished my application?

1.Read Section VIII, Consent for Assignment of Benefits, Section IX, Consent to Agreement to Make Copayments, and Section X, Privacy Act and Paperwork Reduction Act Information.

2.In Section VIII and Section IX, you or an individual to whom you have delegated your Power of Attorney must sign and date.

3.Attach any documentation such as copies of Medicare and other health insurance cards, and your Power of Attorney documents to your application.

4.Return the original form and supporting documentation to the Social Work staff at your local VA medical facility.

STEP 4. Finding out what my Extended Care Copayment Amount will be.

Once the VA Form

VA FORM

JAN 2017

OMB Number:

Estimated Burden: 90 min.

Expiration Date: 06/30/2021

APPLICATION FOR EXTENDED CARE SERVICES

Federal law provides criminal penalties, including a fine and/or imprisonment, for any materially false, fictitious, or fraudulent statement or representation. (See 18 U.S.C. 287 and 1001)

SECTION I - GENERAL INFORMATION

1.VETERAN'S NAME (Last, First, MI)

2. SOCIAL SECURITY NUMBER

SECTION II - INSURANCE INFORMATION

ANSWER YES OR NO WHERE APPLICABLE (OTHERWISE PROVIDE THE REQUESTED INFORMATION)

3. ARE YOU ELIGIBLE FOR MEDICAID? |

3A. ARE YOU ENROLLED IN MEDICARE PART A (Hospital Insurance) |

3B. EFFECTIVE DATE (If "Yes") |

|||||||||

|

|

YES |

|

NO |

|

|

YES |

|

NO |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

4. NAME OF INSURANCE COMPANY |

4A. ADDRESS OF INSURANCE COMPANY |

4B. PHONE NUMBER OF INSURANCE COMPANY |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

4C. NAME OF POLICY HOLDER

4D. RELATIONSHIP OF POLICY HOLDER

4E. POLICY NUMBER

4F. GROUP NAME AND/OR NUMBER

SECTION III - SPOUSE/DEPENDENT INFORMATION

5. CURRENT MARITAL STATUS (Check one)

|

LEGALLY SEPARATED |

|

MARRIED |

|

|

|

|

WIDOWED |

|

|

|

|

|

NEVER MARRIED

DIVORCED

5A. SPOUSE'S NAME (Last, First, MI)

5B. SPOUSE RESIDING IN THE COMMUNITY? (Provide address and phone number if different from veteran)

YES

5C. SPOUSE'S SOCIAL SECURITY NUMBER

6. DEPENDENT'S NAME (Last, First, MI)

6A. DEPENDENT'S DATE OF BIRTH

6B. DEPENDENT'S SOCIAL SECURITY NUMBER

6C. DEPENDENT RESIDING IN THE COMMUNITY? (Provide address and phone number if different from veteran)

YES

7. DEPENDENT'S NAME (Last, First, MI)

7A. DEPENDENT'S DATE OF BIRTH

7B. DEPENDENT'S SOCIAL SECURITY NUMBER

7C. DEPENDENT RESIDING IN THE COMMUNITY? (Provide address and phone number if different from veteran)

YES

We need to collect information regarding income, assets and expenses for you and your spouse. If you do not wish to provide this information you must sign agreeing to make copayments and will be charged the maximum copayment amount for all services. See the top of page 2, read, sign and date.

VA FORM |

|

|

|

JAN 2017 |

EXISTING STOCK OF VA FORM |

PAGE 1 |

APPLICATION FOR EXTENDED CARE SERVICES, CONTINUED

VETERAN'S NAME

SOCIAL SECURITY NUMBER

I do not wish to provide my detailed financial information. I understand that I will be assessed the maximum copayment amount for extended care services and agree to pay the applicable VA copayment as required by law.

SIGNATURE (Sign in ink) |

DATE |

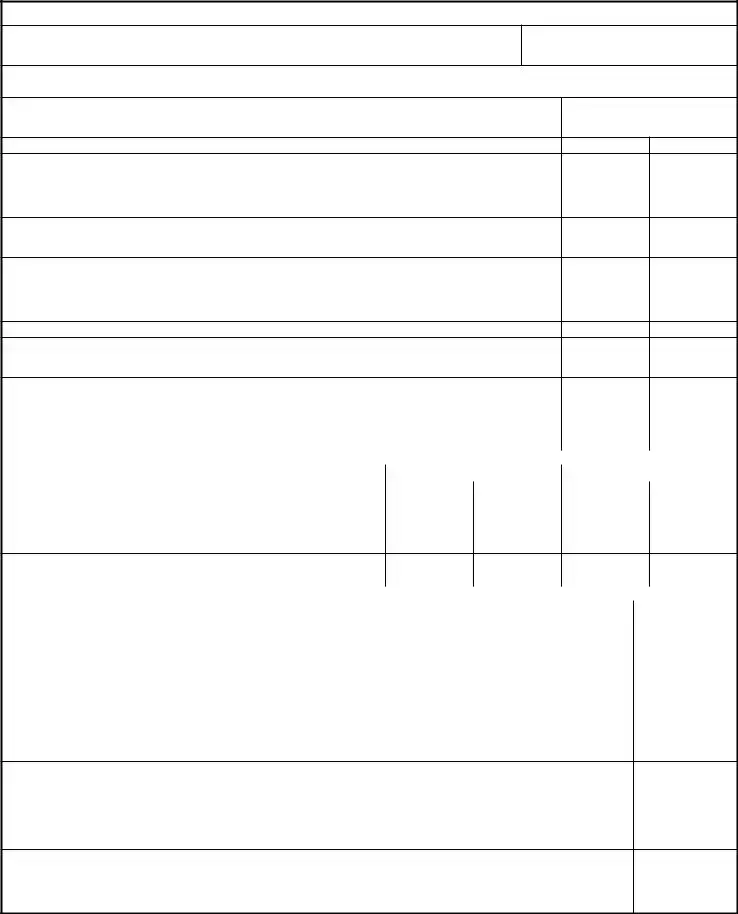

SECTION IV - FIXED ASSETS (VETERAN AND SPOUSE) |

VETERAN |

SPOUSE |

1.Primary Residence (Market value minus mortgages or liens. Exclude if veteran receiving only non- institutional extended care services or spouse or dependent residing in the community). If the veteran and spouse maintain separate residences, and the veteran is receiving institutional (inpatient) extended care

services, include value of the veteran's primary residence.) |

$ |

$ |

2.Other Residences/Land/Farm or Ranch (Market value minus mortgages or liens. This would include a second

home, vacation home, rental property.) |

$ |

$ |

|

3.Vehicle(s) (Value minus any outstanding lien. Exclude primary vehicle if veteran receiving only non- institutional extended care services or spouse or dependent residing in community. If the veteran and spouse maintain separate residences and vehicles, and the veteran is receiving institutional (inpatient) extended care

services, include value of the veteran's primary vehicle.) |

$ |

$ |

SECTION V - LIQUID ASSETS (VETERAN AND SPOUSE)

1.Cash, Amount in Bank Accounts (e.g., checking and savings accounts, certificates of deposit, individual

retirement accounts, stocks and bonds). |

$ |

$ |

|

2.Value of Other Liquid Assets (e.g., art, rare coins, stamp collections, collectibles) Minus the amount you owe on these items. Exclude household effects, clothing, jewelry, and personal items if veteran receiving only

|

$ |

$ |

||||

SUM OF ALL LINES FIXED AND LIQUID ASSETS |

|

TOTAL ASSETS |

$ |

$ |

||

SECTION VI - CURRENT GROSS INCOME OF VETERAN AND SPOUSE |

|

|||||

|

|

|

|

|||

CATEGORY |

|

VETERAN |

SPOUSE |

|||

|

|

|

|

|

||

HOW MUCH |

HOW OFTEN |

HOW MUCH |

HOW OFTEN |

|||

|

||||||

|

|

|

|

|

|

|

1. Gross annual income from employment (e.g., wages, bonuses, tips, |

|

|

|

|

|

|

severances pay, accrued benefits) |

$ |

|

|

$ |

|

|

2. Net income from your farm/ranch, property or business. |

$ |

|

|

$ |

|

|

|

|

|

|

|||

3.List other income amounts (e.g., social security, Retirement and pension,

interest, dividends) Refer to instructions. |

$ |

$ |

|

|

|

SECTION VII - DEDUCTIBLE EXPENSES |

|

|

|

|

|

|

|

|

|

ITEMS |

|

|

AMOUNT |

|

|

|

|

|

1. |

Educational expenses of veteran, spouse or dependent (e.g., tuition, books, fees, material, etc.) |

|

$ |

|

|

|

|

|

|

2. |

Funeral and Burial (spouse or child, amount you paid for funeral and burial expenses, including prepaid arrangements) |

$ |

||

|

|

|

|

|

3. |

Rent/Mortgage (monthly amount or annual amount) |

|

|

$ |

|

|

|

|

|

4. |

Utilities (calculate by average monthly amounts over the past 12 months) |

|

|

$ |

|

|

|

|

|

5. |

Car Payment for one vehicle only (exclude gas, automobile insurance, parking fees, repairs) |

|

$ |

|

|

|

|

|

|

6. |

Food (for veteran, spouse and dependent) |

|

|

$ |

|

|

|

|

|

7.

health insurance, hospital and nursing home expenses) |

$ |

|

|

|

|

8. |

$ |

|

|

|

|

9. |

Insurance (e.g., automobile insurance, homeowners insurance) Exclude Life Insurance |

$ |

|

|

|

10.Taxes (e.g., personal property for home, automobile) Include average monthly expense for taxes paid on income over the

past 12 months. |

|

$ |

|

|

|

|

TOTALS |

$ |

|

|

VA FORM |

|

|

JAN 2017 |

PAGE 2 |

APPLICATION FOR EXTENDED CARE SERVICES, CONTINUED

SECTION VIII - CONSENT FOR ASSIGNMENT OF BENEFITS

I understand that pursuant to 38 U.S.C. Section 1729 and 42 U.S.C. 2651, the Department of Veterans Affairs (VA) is authorized to recover or collect from my health plan (HP) or any other legally responsible third party for the reasonable charges of nonservice- connected VA medical care or services furnished or provided to me. I hereby authorize payment directly to VA from any HP under which I am covered (including coverage provided under my spouse's HP) that is responsible for payment of the charges for my medical care, including benefits otherwise payable to me or my spouse. Furthermore, I hereby assign to the VA any claim I may have against any person or entity who is or may be legally responsible for the payment of the cost of medical services provided to me by the VA. I understand that this assignment shall not limit or prejudice my right to recover for my own benefit any amount in excess of the cost of medical services provided to me by the VA or any other amount to which I may be entitled. I hereby appoint the Attorney General of the United States and the Secretary of Veterans' Affairs and their designees as my

SIGNATURE (Sign in ink)

DATE

VETERANS NAME

SOCIAL SECURITY NUMBER

SECTION IX - CONSENT TO AGREEMENT TO MAKE COPAYMENTS

Completion of this form with signature of the Veteran or veteran's representative is certification that the veteran/representative has received a copy of the Privacy Act Statement and agrees to make appropriate copayments.

l declare under penalty of perjury that the foregoing is true and accurate to the best of my knowledge and I agree to make the applicable copayment for extended care services as required by law. I understand that any materially false, fictitious, or fraudulent statement or representation, made knowingly, is punishable by a fine and/or imprisonment pursuant to title 18, United States Code, Sections 287 and 1001.

SIGNATURE (Sign in ink)

DATE

SECTION X - PRIVACY ACT AND PAPERWORK REDUCTION ACT INFORMATION

The VA is asking you to provide the information on this form under Title 38, United States Code, sections 1710, 1712, 1722 and 1729 for VA to determine your eligibility for extended care benefits and to establish financial eligibility, if applicable, when placed in extended care services. Obligation to respond is voluntary. The information you supply may be verified through a

ADDITIONAL COMMENTS:

VA FORM |

|

|

JAN 2017 |

PAGE 3 |

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The VA Form 10-10EC is used to determine the estimated monthly copayment obligations for extended care services provided by the VA. |

| No Copayment Period | There is no copayment for the first 21 days of extended care services provided by the VA in any 12-month period. |

| Assistance in Filling Out | Assistance for filling out the form is available from the Social Work staff at local VA medical facilities. |

| Information Needed | Current income, deductible expenses, value of assets, health insurance information, Medicare information, and spousal/dependent information are required. |

| Asset Reporting for Copayment Determination | Fixed and liquid assets are considered for copayment determination when a veteran receives 181 days or more of institutional extended care services. |

| Governing Law | The form and process are governed by various sections of the United States Code, notably 38 U.S.C. 103(c) for marriage recognition, and 18 U.S.C. 287 and 1001 regarding penalties for false statements. |

Instructions on Utilizing Va 10 10Ec

When dealing with VA Form 10-10EC, often known as “Application for Extended Care Services,” the primary objective is for individuals to accurately report their financial status. This process helps in determining the potential monthly copayments for extended care services provided by or paid for by the VA. Veterans and their spouses, if applicable, need to report income, expenses, assets, and insurance coverage. It's a step to ensure that the services are fairly allocated and that any copayment obligations are based on actual financial capability. Assistance from Social Work staff at local VA medical facilities is available and recommended for those who need help completing the form or understanding the required information.

- Before Starting:

- Prepare all relevant financial information including income, deductible expenses, and assets for both the veteran and their spouse, if applicable.

- Gather information on all health insurance policies covering the veteran, including Medicare and policies through the spouse, along with copies of insurance cards.

- Have spousal and dependent information ready, including social security numbers and dates of birth.

- Filling out the Application:

- In Section I, enter the veteran's name and full social security number.

- In Section II, provide details of Medicare and all health insurance coverage. Attach copies of all health insurance cards.

- In Section III, detail spouse/dependent information. Include current marital status, and do not add spousal information if legally separated or divorced.

- The Sections IV and V require listing fixed and liquid assets respectively. Remember to exclude primary residences, vehicles used by veterans or dependents, and personal items unless the veteran has no spouse or dependents in the community.

- In Section VI, report the current gross income for both the veteran and the spouse, not including dependents’ income.

- Section VII focuses on deductible expenses, such as educational expenses, non-reimbursed medical expenses, and living costs. Calculate monthly averages for utility and tax expenses based on the last year's expenses.

- Submitting the Application:

- Review and sign Sections VIII and IX, consenting for assignment of benefits and agreement to make copayments.

- Attach any required documentation, including insurance cards and Power of Attorney documents, if applicable.

- Submit the original form along with all supporting documentation to the Social Work staff at your local VA medical facility.

- After Submission: The Social Work staff will review the completed form and counsel the veteran or their representative on the estimated monthly copayment obligations for the requested extended care services.

This detailed process ensures that each veteran's application for extended care services through the VA is handled with care, ensuring that their financial capabilities are accurately assessed for copayment purposes. Assistance from the VA's Social Work staff is available throughout the process to provide clarity and support as needed.

Obtain Answers on Va 10 10Ec

Frequently Asked Questions about VA Form 10-10EC:

- What is VA Form 10-10EC and what is its purpose?

VA Form 10-10EC, officially titled "Application for Extended Care Services," is used by veterans to apply for extended care services provided by the VA, including both direct services and those paid for by the VA. Its primary purpose is to help determine the veteran's estimated monthly copayment obligations for these services. Notably, there is no copayment for the first 21 days of extended care services provided by the VA in any 12-month period.

- Where can I get assistance with filling out VA Form 10-10EC?

Assistance with completing VA Form 10-10EC is available from the Social Work staff at your local VA medical facility. They can provide guidance on the financial data and other information necessary to accurately complete the form.

- What information do I need to complete VA Form 10-10EC?

- Current income for both the veteran and their spouse.

- Current deductible expenses.

- Value of fixed and liquid assets for both the veteran and their spouse.

- All health insurance information, including Medicare.

- Spousal/Dependent information.

- What happens after submitting VA Form 10-10EC?

After submission, the Social Work staff at your local VA medical facility will review your application. They will provide counseling regarding your estimated monthly copayment obligations for the extended care services requested. This counseling ensures veterans understand their potential financial responsibilities before receiving services.

- Is there a penalty for not providing financial information on the VA Form 10-10EC?

Yes, if you choose not to provide detailed financial information on VA Form 10-10EC, you will be assessed the maximum copayment amount for extended care services. Agreeing to make copayments and choosing to be assessed the maximum copayment must be indicated by signing and dating the form where specified.

Common mistakes

Not gathering all necessary financial documents before starting to fill out the form, leading to inaccuracies or incomplete information. This includes current income data for both the veteran and their spouse, as well as detailed information about assets.

Overlooking the need to report all health insurance coverage, including Medicare and any insurance through a spouse, which can lead to incorrect determination of copayment obligations.

Failing to accurately report the value of fixed and liquid assets which can affect the estimated monthly copayment obligations. Some individuals mistakenly include the value of their primary residence and vehicle, which should not be included if the veteran is receiving extended care services.

Incorrectly reporting income by either not including all sources of income or by inaccurately calculating the net income from a business after expenses.

Omitting spousal or dependent information which is critical for determining the veteran's extended care copayment amount, especially if the spouse or dependents are residing in the community.

Not providing a copy of the Medicare card and all health insurance cards. This documentation is vital for verifying the health coverage information provided in the application.

Skipping the consent sections (VIII and IX) or not signing these sections, which is essential for processing the application. The consent for assignment of benefits and agreement to make copayments are critical parts of the application process.

Inaccurately detailing deductible expenses which can lead to an incorrect estimation of copayment obligations. Basic living expenses, educational expenses, and non-reimbursed medical expenses are examples of deductible expenses that are often incorrectly reported.

Not attaching required documentation such as copies of health insurance and Medicare cards, or failing to attach Power of Attorney documents, if applicable, which can delay processing.

Misunderstanding the purpose of providing detailed financial information and opting to not provide this information, leading to being charged the maximum copayment amount for services.

It's important for individuals filling out the VA Form 10-10EC to approach the task carefully and ensure that all provided data is accurate and complete. Assistance from a VA medical facility’s Social Work staff can help avoid these common mistakes.

Documents used along the form

When applying for Extended Care Services through VA Form 10-10EC, applicants are often required to provide additional documents and forms to complete their application process effectively. These documents play a crucial role in ensuring that the Department of Veterans Affairs has all the necessary information to determine eligibility and accurately assess the applicant's financial situation for copayment obligations. Below is a list of documents and forms that are frequently used in conjunction with VA Form 10-10EC.

- VA Form 21-0845: Authorization to Disclose Personal Information to a Third Party - This form is used when an applicant wants to allow the VA to share their personal information with a designated individual or organization.

- VA Form 21-4142: Authorization and Consent to Release Information to the Department of Veterans Affairs - This form authorizes the release of medical records from non-VA health care providers to the VA.

- VA Form 10-10EZ: Application for Health Benefits - This form is the primary application for VA health care benefits, serving as a prerequisite for specific services, including extended care services.

- Proof of Income: Documentation such as recent pay stubs, social security benefits statements, or tax returns, which provide verification of income for the veteran and, if applicable, their spouse.

- Proof of Medical Expenses: Receipts or statements related to ongoing or recent medical expenses that have not been reimbursed and might affect the copayment calculation.

- Power of Attorney (POA) Documents: Legal documents that grant an individual the authority to make decisions on behalf of the veteran can be crucial in the application process.

- Marriage Certificate: If spousal information is relevant to the application, a copy of the marriage certificate might be required to verify marital status.

- Medicare Card: A copy of the Medicare card is needed if the applicant is enrolled in Medicare to ensure all potential coverages are considered.

Each of these documents provides critical information that impacts the determination of benefits and services a veteran may be eligible for through the VA. Providing complete and accurate information helps to streamline the application process, ensuring veterans receive the benefits and services tailored to their needs in a timely manner. It is always recommended to check with the local VA medical facility or a VA representative to ensure all necessary documentation is submitted alongside VA Form 10-10EC.

Similar forms

The VA Form 10-10EZ, Application for Health Benefits, is similar to the VA Form 10-10EC as both forms are used to establish eligibility for benefits provided by the VA, including the collection of personal, insurance, and financial information to determine benefits and copayment responsibilities.

The IRS Form 1040, U.S. Individual Income Tax Return, parallels the VA Form 10-10EC in terms of requiring detailed financial information, including income, deductible expenses, and specific personal information to assess the individual’s financial status.

The Medicaid Application Form is akin to the VA Form 10-10EC as it collects detailed personal, financial, and health insurance information to determine eligibility for medical assistance based on income and assets.

The SSA-8000-BK, Application for Supplemental Security Income (SSI), resembles the VA Form 10-10EC since it gathers comprehensive financial and personal details to establish eligibility for SSI payments, which are determined based on financial need.

The Federal Student Aid Application (FAFSA) shares similarities with the VA Form 10-10EC in its requirement for detailed financial information from applicants and their families to determine eligibility for federal student aid, including grants, loans, and work-study programs.

The HUD Section 8 Application, which is used to apply for housing assistance, is similar to the VA Form 10-10EC as both require applicants to provide personal, financial, and household information to determine eligibility based on income levels and other criteria.

The Life Insurance Application Forms from private insurers require detailed personal, health, and sometimes financial information to assess risk and determine premium rates, similar to how the VA Form 10-10EC evaluates financial information to determine copayment obligations.

The Medicare Enrollment Application collects personal and health insurance information to determine eligibility and enroll individuals in Medicare, similar to how the VA Form 10-10EC is used to assess eligibility for extended care services and associated copayments.

Dos and Don'ts

When filling out VA Form 10-10EC, it's crucial to take the necessary steps to ensure you're providing the most accurate and comprehensive information. Below are five things you should do and five things you shouldn't do to help navigate this process more effectively.

Things You Should Do:

- Collect all necessary documentation before starting: Gather recent financial statements, health insurance information, Medicare details, and any documentation regarding your spouse or dependents. This preparation makes filling out the form smoother.

- Review the entire form first: Understanding what information is required can help prevent mistakes and ensure you have all the needed details ready.

- Report accurate financial information: Include all current income and deductible expenses for both you and your spouse, if applicable. This includes wages, retirement income, and non-reimbursed medical expenses.

- Include a copy of Medicare and health insurance cards: This is critical for the VA to obtain all health insurance coverage information. Make copies of these cards to attach with your application.

- Check your application for completeness and accuracy: Before submitting, review your application to ensure all sections are filled out correctly. Missing or inaccurate information can delay the processing of your application.

Things You Shouldn't Do:

- Don't leave sections blank: If a section does not apply to you, write "N/A" or "Not Applicable." Blank sections can cause unnecessary delays in processing.

- Avoid guessing on financial figures: Estimate your income and assets as closely as possible. Inaccurate reporting can affect the determination of your copayment obligations.

- Don't forget to sign and date the application: Your signature is required in multiple sections. Failing to sign and date the form can result in it being returned to you.

- Don't include irrelevant personal items: When reporting assets, exclude household and personal items like clothing and jewelry, unless specifically instructed to include them.

- Don't disregard instructions for attaching additional documentation: If the form asks for additional documents, such as a copy of your Medicare card, make sure to include them with your application.

Misconceptions

Understanding the VA Form 10-10EC, the Application for Extended Care Services, is crucial for veterans seeking extended care services through the VA. There are several misconceptions about this form and its requirements. Clarifying these misconceptions is important for ensuring that veterans can effectively navigate the application process and access the benefits they are entitled to. Here are ten common misconceptions:

- Misconception #1: The VA Form 10-10EC is only for veterans with no health insurance.

This is not true. The form is used to calculate copayments for extended care services for all applying veterans, regardless of other health insurance coverage.

- Misconception #2: Completing the form guarantees immediate approval of extended care services.

Submission of the form is the first step. Approval depends on various factors, including eligibility and need for services.

- Misconception #3: Only the veteran’s income is considered.

In fact, the form requires information on both the veteran's and their spouse's income and assets to determine copayment amounts.

- Misconception #4: All assets must be reported, without exceptions.

The form excludes the primary residence and vehicle of the veteran or their spouse from the asset calculation for inpatient services.

- Misconception #5: You need to include your dependents’ income.

Dependents' income is not required for the assessment of copayment amounts on the VA Form 10-10EC.

- Misconception #6: Reporting of health insurance is optional.

All health insurance coverage, including Medicare and insurance through a spouse, must be reported to accurately calculate potential copayments.

- Misconception #7: Legal separation or divorce does not affect spousal information reporting.

Actually, if you are legally separated or divorced, you should not include spousal information on the form.

- Misconception #8: The form is too complicated to fill out without professional help.

Assistance is available from Social Work staff at local VA medical facilities, making it manageable for many veterans to complete the application on their own or with minimal help.

- Misconception #9: It's okay to wait until you need services to submit the form.

To avoid delays in receiving services, it is advisable to submit the form before you need extended care services. This ensures that your copayment obligations are determined in advance.

- Misconception #10: Once submitted, the information on the form cannot be updated.

Changes in financial status, marital status, or other relevant information should be reported to the VA as soon as possible to ensure accurate calculation of copayments.

Correcting these misconceptions is crucial for a smooth application process for VA extended care services. Veterans and their families are encouraged to seek assistance from their local VA medical facility should they have questions or need help with their VA Form 10-10EC.

Key takeaways

Filling out the VA Form 10-10EC is crucial for veterans seeking extended care services through the Department of Veterans Affairs (VA). Here are 10 key takeaways about the form and its use:

- The VA Form 10-10EC is designed to assess a veteran's financial situation to determine their monthly copayment obligations for extended care services.

- No copayment is required for the first 21 days of extended care services in any 12-month period, highlighting the VA's commitment to accessible care.

- Veterans must report any changes affecting their copayment amount to their local VA medical facility within 10 days, emphasizing the importance of accurate and current financial information.

- Assistance with completing the form is available from Social Work staff at local VA medical facilities, offering veterans needed support in navigating the process.

- Information necessary for completing the form includes current income, deductible expenses, asset values, health insurance, Medicare, and spousal/dependent information, ensuring a comprehensive financial assessment.

- The form requires details about insurance coverage, emphasizing the importance of understanding and reporting all health insurance benefits, including Medicare and spousal coverage.

- Dependent and spousal information must be provided unless the veteran is legally separated or divorced, underlining the relevance of family status in the financial assessment.

- Assets reported include both fixed (e.g., real property) and liquid assets (e.g., bank accounts, stocks), but exclude the veteran's primary residence and vehicle under certain conditions, reflecting a focus on significant financial resources.

- Submission of the form involves a review of consents and agreements, including consent for the assignment of benefits and agreement to make copayments, underscoring the legal and financial responsibilities of the veteran.

- The process concludes with submitting the form and any required documentation to the Social Work staff at a local VA medical facility, stressing the importance of official review and counseling on estimated copayments.

Understanding these key points about the VA Form 10-10EC can help veterans navigate the process more effectively, ensuring they fulfill their obligations while accessing the care services they need. Veterans and their families are encouraged to seek assistance from VA representatives to complete and submit the form accurately.

Popular PDF Forms

Sales License Renewal - Includes a section for certification by the dealer, ensuring the applicant's employment and acknowledging responsibility.

Va Travel - Veterans fill out this form to formally initiate the process of determining their suitability for participation in vocational rehabilitation programs.