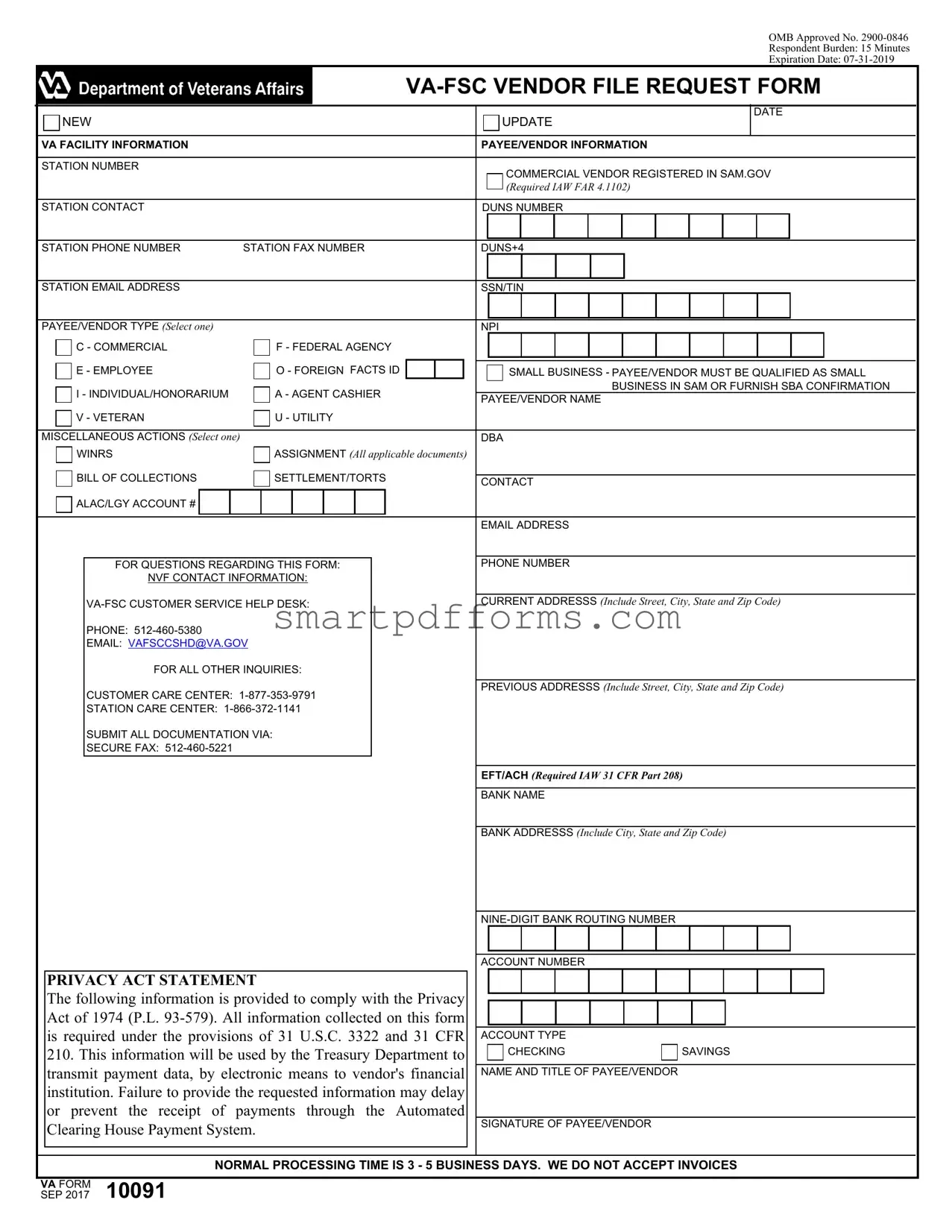

Blank Va 10091 PDF Template

The VA 10091 form stands as a crucial document within the realm of vendor management and payment processing by the Department of Veterans Affairs (VA). Officially known as the VA-FSC Vendor File Request Form, its primary aim is to facilitate the collection and updating of vendor information for the VA's Financial Services Center. This form encompasses various sections that require the vendor's detailed information, including the VA facility details, payee or vendor specifics like the type (Commercial, Federal Agency, Employee, etc.), the necessary banking information for Electronic Funds Transfer (EFT) or Automated Clearing House (ACH) payments, and compliance data with federal regulations such as the requirement to be registered in the System for Award Management (SAM.gov) and having a DUNS number. Furthermore, it outlines the Privacy Act of 1974 to inform vendors about the use of their information and contains essential points about the processing time, contact information for inquiries, and instructions for both new and updating vendors on how to properly submit the form to ensure a smooth transaction process. With its expiration date and OMB approval number clearly stated, the VA 10091 form underscores the government's commitment to efficiency, compliance, and security in its financial dealings with outside entities.

Preview - Va 10091 Form

OMB Approved No.

Respondent Burden: 15 Minutes

Expiration Date:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NEW |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UPDATE |

DATE |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

VA FACILITY INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

PAYEE/VENDOR INFORMATION |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

STATION NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMERCIAL VENDOR REGISTERED IN SAM.GOV |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Required IAW FAR 4.1102) |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

STATION CONTACT |

|

|

|

|

|

|

|

|

|

|

|

|

DUNS NUMBER |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATION PHONE NUMBER |

STATION FAX NUMBER |

|

|

|

DUNS+4 |

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATION EMAIL ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

SSN/TIN |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYEE/VENDOR TYPE (Select one) |

|

|

|

|

|

|

|

|

|

|

|

|

NPI |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

C - COMMERCIAL |

|

|

|

F - FEDERAL AGENCY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

E - EMPLOYEE |

|

|

|

O - FOREIGN FACTS ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SMALL BUSINESS - PAYEE/VENDOR MUST BE QUALIFIED AS SMALL |

|||||||||||||||||||||

|

|

|

|

|

|

I - INDIVIDUAL/HONORARIUM |

|

|

|

A - AGENT CASHIER |

|

|

|

|

|

|

|

|

|

|

BUSINESS IN SAM OR FURNISH SBA CONFIRMATION |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

PAYEE/VENDOR NAME |

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

V - VETERAN |

|

|

|

U - UTILITY |

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

MISCELLANEOUS ACTIONS (Select one) |

|

|

|

|

|

|

|

|

|

|

|

|

DBA |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

WINRS |

|

|

|

ASSIGNMENT (All applicable documents) |

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

BILL OF COLLECTIONS |

|

|

|

SETTLEMENT/TORTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT |

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALAC/LGY ACCOUNT # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMAIL ADDRESS |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

FOR QUESTIONS REGARDING THIS FORM: |

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

NVF CONTACT INFORMATION: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ADDRESSS (Include Street, City, State and Zip Code) |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

PHONE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

EMAIL: VAFSCCSHD@VA.GOV |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

FOR ALL OTHER INQUIRIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

CUSTOMER CARE CENTER: |

|

|

|

|

|

PREVIOUS ADDRESSS (Include Street, City, State and Zip Code) |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

STATION CARE CENTER: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

SUBMIT ALL DOCUMENTATION VIA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

SECURE FAX: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EFT/ACH (Required IAW 31 CFR Part 208) |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BANK NAME |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BANK ADDRESSS (Include City, State and Zip Code) |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCOUNT NUMBER |

|

|

|

|

|

|

|||||||||

PRIVACY ACT STATEMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following information is provided to comply with the Privacy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Act of 1974 (P.L. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

is required under the provisions of 31 U.S.C. 3322 and 31 CFR |

|

ACCOUNT TYPE |

|

|

|

|

|

|

|||||||||

210. This information will be used by the Treasury Department to |

|

|

|

CHECKING |

|

|

SAVINGS |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

transmit payment data, by electronic means to vendor's financial |

|

NAME AND TITLE OF PAYEE/VENDOR |

|

|

|

|

|

|

|||||||||

institution. Failure to provide the requested information may delay |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or prevent the receipt of payments through the Automated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clearing House Payment System. |

|

SIGNATURE OF PAYEE/VENDOR |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NORMAL PROCESSING TIME IS 3 - 5 BUSINESS DAYS. WE DO NOT ACCEPT INVOICES

VA FORM 10091

SEP 2017

Instructions for FMS Vendor File Request Form

1.NEW box option - Check box if you are a new vendor not in the FMS system.

2.UPDATE box option - Check box if you are an existing vendor in the FMS system.

VA Facility Information

3.Station # - This portion pertains to the VA Station submitting this form, provide your station 3 digit station number. FOR STATION USE

ONLY

4.Station Contact Name - VA Station employee. FOR STATION USE ONLY

5.Station Phone - VA Station employee direct number. FOR STATION USE ONLY

6.Station Fax Number - VA Station fax number. FOR STATION USE ONLY

7.Station Email - VA Station employee work email address. FOR STATION USE ONLY

Payee/Vendor Type - Check the appropriate Payee/Vendor Type box. REQUIRED

Miscellaneous Actions - Check the appropriate Payee/Vendor Type box, some additional documentation required.

OPTIONAL

·ALAC Vendors - USE ONLY IF ALAC include the 6 digit account number

·Assignment of Claims- USE ONLY IF ASSIGNMENT include Notice of Assignment & Instrument of Assignment

·Federal Vendors- USE ONLY IF FEDERAL AGENCY include the 2 digit Facts

·Foreign Vendors- USE ONLY FOR FOREIGN COUNTRY include W8Ben with foreign identification number

Payee/Vendor Information

8.Commercial Vendor Registered in SAM.gov - If you are registered in System of Awards Management & have a DUNS number check this box. OPTIONAL

9.DUNS # - Data Universal Numbering System (DUNS) is a unique

OPTIONAL

10.DUNS+4 - If you have more than one EFT account number for the same DUNS number and same physical location as defined by the DUNS address complete this section. OPTIONAL

11.SSN/TIN - The Social Security Number (SSN) is the

12.NPI - A standard 10 digit unique identifiers for health care providers, complete this section if applicable. OPTIONAL

13.Small Business - Check box if applicable OPTIONAL

14.Vendor Name - Provide legal name as it is on file with the IRS REQUIRED

15.DBA - Doing Business As name complete if applicable OPTIONAL

16.Contact - Name of Point of Contact if additional information is required OPTIONAL

17.Email - Point of Contact email address OPTIONAL

18.Phone - Point of Contact phone number OPTIONAL

19.Current Address - Provide your most current address, city, state & zip code REQUIRED

20.Previous Address - Provide previous address, city, state and zip code REQUIRED FOR ADDRESS CHANGES

EFT/ACH (REQUIRED IAW 31CFR Part 208)

21.US. Bank Name - provide financial institution name city, state & zip code. REQUIRED

22.US.

REQUIRED

23.US. Account # - Provide bank account number maximum 17 digits REQUIRED

24.Account Type - Check appropriate box that is associated with account number provide above REQUIRED

25.Name & Title of Payee/Vendor - REQUIRED

26.Signature of Payee/Vendor - REQUIRED

Please fax the completed form to

PRIVACY ACT NOTICE: The following information is provided to comply with the Privacy Act of 1974 (P.L.

RESPONDENT BURDEN: The Nationwide Vendor File Division needs this information to establish, modify/change your VA Vendor Record.

31 U.S.C. 3322 and 31 CFR 210, allow us to ask for this information. We estimate that you will need an average of 15 minutes to review the instructions, find the information, and complete this form. VA cannot conduct or sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if this number is not displayed. Valid OMB control numbers can be located on the OMB Internet Page at www.reginfo.gov/public/do/PRAMain.

Form Data

| Fact Name | Description |

|---|---|

| Form Number | VA Form 10091 |

| OMB Approval Number | 2900-0846 |

| Respondent Burden | 15 Minutes |

| Expiration Date | 07-31-2019 |

| File Request Type | New or Update Vendor Information |

| Registration Requirement | Commercial Vendor Registered in SAM.gov (Required IAW FAR 4.1102) |

| EFT/ACH Requirement | Required IAW 31 CFR Part 208 |

| Submission Method | Fax to 512-460-5221 |

| Privacy Act of 1974 Compliance | Information collected is required under 31 U.S.C. 3322 and 31 CFR 210 |

| Processing Time | Normal processing time is 3 - 5 business days |

Instructions on Utilizing Va 10091

Getting started with the VA Form 10091 can seem intricate at first glance, but with the right guidance, it can be a straightforward process. This form is primarily used to request a vendor file within the VA system, whether you're entering new information or updating existing details. This quick guide is designed to help you through each step, ensuring that your submission is successful and timely. Let's break down the process into manageable steps.

- NEW or UPDATE: Check the appropriate box at the very top to indicate whether you are creating a new vendor file or updating an existing one.

- VA Facility Information: This section is intended for VA use only. If you're a vendor, proceed to the next steps.

- Payee/Vendor Type: Select the type that best describes you or your business (e.g., Commercial, Federal Agency, Employee, etc.).

- Miscellaneous Actions: If applicable to you, check the appropriate box and include any required documentation.

- Commercial Vendor Registered in SAM.gov: If this applies to you and you have a DUNS number, check the box.

- Enter your DUNS # if available.

- If applicable, provide the DUNS+4 code.

- Enter your SSN/TIN. This is a required field for identification.

- If you have an NPI (National Provider Identifier), enter it in the designated space.

- Check the Small Business box if it applies to your vendor type.

- Provide the legal Vendor Name as it is officially recognized.

- If you operate under a DBA (Doing Business As), include that name.

- List a Contact Name, Email, and Phone Number for someone who can respond to inquiries about this form.

- Enter the Current Address and Previous Address (if applicable) for address changes.

- Under the EFT/ACH section, specify your bank's name, address, nine-digit routing number, and your account number. Choose between Checking or Savings for account type.

- In the spaces provided, print the Name and Title of the Payee/Vendor and ensure the form is signed by the Payee/Vendor.

Once all the information is accurately filled out, the form should be faxed to 512-460-5221 for processing. This form is an essential step for vendors working with the VA, facilitating the efficient processing of payments and ensuring all transactions are properly handled. Make sure to review your information for accuracy before submission to avoid any delays. Remember, providing complete and correct information helps streamline the process, getting you set up in the VA system as smoothly as possible.

Obtain Answers on Va 10091

What is the VA Form 10091 used for?

VA Form 10091 is designed for vendors to request to be added or to update their information in the Veterans Affairs Financial Services Center (VA-FSC) Vendor File. This form is necessary for the Treasury Department to process electronic payments to vendors’ financial institutions efficiently.

Who needs to complete the VA Form 10091?

Any vendor wishing to conduct business with the Veterans Affairs (VA) and receive payments electronically must complete this form. It applies to commercial vendors, federal agencies, individual/honorarium providers, employees, foreign vendors, and others categorized under the payee/vendor type in the form.

Is registration in SAM.gov necessary for all vendors using VA Form 10091?

While the form indicates that being registered in SAM.gov (System for Award Management) is required per Federal Acquisition Regulation (FAR) 4.1102 for commercial vendors, it is optional according to the form instructions. However, registration is highly recommended to streamline the process of doing business with the VA.

What information is required on the VA Form 10091?

Crucial information required includes the vendor’s name as filed with the IRS, Social Security Number (SSN)/Tax Identification Number (TIN), banking details (for Electronic Funds Transfer/ACH), and contact information. Optional details might include DUNS number, commercial vendor status, small business classification, and actionable miscellaneous information.

How long does it take to process the VA Form 10091?

The normal processing time is 3 - 5 business days from the receipt of the form by the VA-FSC.

Can updates to vendor information be made using VA Form 10091?

Yes, existing vendors can update their information by checking the "UPDATE" option and providing the new information that needs to be updated in the VA-FSC Vendor File.

What are the consequences of not providing the requested information on the VA Form 10091?

Failure to provide the complete and accurate information requested may result in delays or the inability to receive payments through the Automated Clearing House (ACH) Payment System.

What privacy protections are in place for information provided on the VA Form 10091?

The form complies with the Privacy Act of 1974, ensuring that collected information is used solely for transmitting payment data to the vendor's financial institution for payment processing. The information is necessary under the provisions of 31 U.S.C. 3322 and 31 CFR 210.

How should the completed VA Form 10091 be submitted?

The completed form should be faxed to the VA-FSC for processing at 512-460-5221. This is the secure fax number provided specifically for the submission of VA Form 10091.

Where can vendors find additional assistance or have questions answered regarding VA Form 10091?

Vendors can contact the VA-FSC Customer Service Help Desk at 512-460-5380 or email VAFSCCSHD@va.gov for questions related to the form. For all other inquiries, the Customer Care Center at 1-877-353-9791 or the Station Care Center at 1-866-372-1141 can provide assistance.

Common mistakes

Filling out forms can sometimes be overwhelming, especially when they are as crucial as the VA 10091 form for vendor file requests. Common mistakes can lead to delays in processing or, worse, the rejection of the application. Here are five typical errors to avoid:

Not registering in SAM.gov: Vendors often overlook the requirement to be registered in the System for Award Management (SAM) and to include a DUNS number. This step is mandatory per FAR 4.1102 for commercial vendors.

Omitting the payee/vendor type: The form provides options to select the type of payee/vendor. Not checking the appropriate box can lead to confusion and processing delays, as this information clarifies the nature of the vendor's business.

Incorrect or missing banking details: Providing accurate bank information is critical for the EFT/ACH process. Misentered bank routing or account numbers can prevent or delay payments. Always double-check these details against a bank statement or check.

Neglecting to sign the form: It may seem obvious, but forgetting to sign the form is a common mistake. A signature is required to process the form, serving as a validation of the information provided.

Incomplete address information: Both current and previous addresses are requested for address changes. Failing to include complete details, including street, city, state, and zip code, for each can result in processing delays.

To ensure a smooth process, take the time to review each section of the VA 10091 form carefully, provide all requested information accurately, and double-check details before submission.

Documents used along the form

When handling various administrative and financial transactions, particularly with the Veterans Affairs (VA), the VA 10091 form plays a pivotal role as a vendor file request form. It is not the only document required for transactions, especially for those involving vendors, contractors, or recipients of funds from the VA. Several other forms and documents often accompany the VA 10091 form to ensure compliance, accuracy in payment processing, and adherence to federal regulations. Here we will discuss seven such documents frequently used in conjunction with the VA 10091 form.

- W-9 Form: This form is critical for confirming the payee’s tax identification number and certification. It is often required for new vendors or in situations where vendor information is updated or verified.

- Direct Deposit Enrollment Form (SF 1199A): For vendors wishing to receive payments via electronic funds transfer (EFT), this form is essential to provide banking details securely to the Department of Treasury.

- Standard Form 3881 (ACH Vendor/Miscellaneous Payment Enrollment Form): Similar to the SF 1199A, this form is also used for setting up direct deposit for electronic payments but is specifically tailored to ACH (Automated Clearing House) payments.

- Notice of Assignment: When a vendor assigns the rights to receive payments to a third party, this document is required to inform the VA of the assignment and to ensure payments are directed accurately.

- W-8BEN Form: For foreign vendors, the W-8BEN form is necessary to establish foreign status and beneficial ownership, and to claim any applicable tax treaty benefits to reduce withholding tax.

- Contract or Purchase Order: This document outlines the specific goods or services being purchased, the agreed-upon prices, and other contractual obligations between the VA and the vendor.

- SAM.gov Registration Proof: Since registration in the System for Award Management (SAM) is a prerequisite for doing business with the federal government, documentation proving current registration is often requested.

Ensuring that each relevant document accompanies the VA 10091 form can significantly streamline the vendor payment process within the VA system. It not only facilitates compliance with federal guidelines but also minimizes delays in payment processing. For vendors, maintaining an updated file, inclusive of these documents, is beneficial for efficient and timely financial transactions with the Veterans Affairs.

Similar forms

The IRS W-9 Form: This form is used by businesses to officially request a taxpayer identification number (TIN) and certification from vendors, similar to how the VA 10091 form requests SSN/TIN to ensure proper reporting and payment processing. Both forms serve as a means for collecting necessary tax and identification information from entities receiving payments.

The Direct Deposit Signup Form (SF 1199A for federal agencies): Like the EFT/ACH section of the VA 10091 form, this form is used to collect banking information to enable electronic payments. Both documents are crucial for establishing the direct deposit setup, ensuring vendors or beneficiaries receive payments efficiently and securely.

The System for Award Management (SAM) Registration: While not a form per se, the process of registering in SAM.gov is required for commercial vendors on the VA 10091 form. Both SAM registration and the VA 10091 emphasize compliance with federal requirements, ensuring vendors are properly vetted and eligible to conduct business with the government.

DOD's Central Contractor Registration (CCR) Documents: Similar to the SAM.gov registration requirement in the VA 10091 form, CCR was the predecessor to SAM and served the same purpose. These documents are essential for identifying and validating vendor information, with a strong emphasis on security and fraud prevention.

The SBA Small Business Certification: This certification, similar to the small business designation option on the VA 10091 form, is used to verify a business's status as a "small business." Both identify eligible small businesses for special considerations and opportunities within federal contracting and payments.

The Assignment of Claims Form: Like the optional section for "Assignment of Claims" on the VA 10091 form, this document is used by vendors to assign their payment rights to a bank or other financial institution. It's crucial for managing financial arrangements and ensuring continuous cash flow for vendors or contractors.

The Vendor Information Pages (VIP) Verification Form for Veteran-Owned Businesses: This form, like the "Veteran" option under payee/vendor type on the VA 10091, identifies businesses as veteran-owned. Both are vital for supporting and giving preference to businesses owned by veterans in the procurement process.

The Foreign Bank Account Reporting (FBAR) Form FinCEN 114: Similar to the foreign vendor banking information requirement on the VA 10091 form, FBAR reports foreign financial accounts to the IRS. Both forms are crucial for compliance with U.S. laws governing foreign financial transactions and preventing money laundering activities.

Dos and Don'ts

When filling out the VA Form 10091, there are specific actions you should take to ensure the process is smooth and error-free. Here are four key things to do and to avoid:

Do:- Check registration on SAM.gov: If you are a commercial vendor, ensure you are registered on the System for Award Management (SAM) and have your DUNS number ready, if applicable.

- Include correct and complete information: Pay special attention to filling out your SSN/TIN, DUNS number (if applicable), legal name as on file with the IRS, and current address correctly. These are critical for accurately processing your form.

- Select the correct payee/vendor type: Make sure to check the appropriate box for your payee/vendor type, as this helps in categorizing your submission accurately.

- Sign and date the form: Your signature certifies that the information provided is accurate. This is a required step for processing.

- Use outdated information: Ensure all information, including your address and contact details, is current. Using outdated information can delay processing.

- Leave required fields blank: Fields marked as required, such as your SSN/TIN and the name and title of payee/vendor, must be completed. Incomplete forms may not be processed.

- Guess on details: If you’re unsure about what to enter for any field, seek clarification. Incorrect information can lead to processing delays or errors in your vendor file.

- Ignore privacy act notices: Take the time to read the Privacy Act statement. Understanding how your information is used and protected is important.

Misconceptions

When dealing with the VA Form 10091, it's crucial to clear up any misunderstandings to ensure accurate and effective handling. Here are seven misconceptions commonly associated with this form:

- Registration in SAM.gov is Mandatory for All Vendors: It’s a common misunderstanding that all vendors must be registered in SAM.gov to use the VA Form 10091. However, the form indicates it’s only required for commercial vendors in accordance with FAR 4.1102. For non-commercial vendors, such as individuals or federal agencies, this registration is not a prerequisite.

- DUNS Number is Always Required: Another misconception is that a DUNS (Data Universal Numbering System) number is always necessary. In reality, while useful for identification, the requirement of the DUNS number is optional and primarily pertains to those registered in SAM.gov or those needing to distinguish multiple EFT accounts tied to the same physical location.

- All Sections Must Be Completed: The form details several sections as "for station use only" or indicates certain fields as optional. Users often mistakenly believe every field must be filled out. Understanding the form’s instructions can save time and prevent unnecessary effort in completing non-applicable sections.

- Any Bank Account Type is Acceptable: A specific requirement exists for the type of bank account into which payments are made, mandating either a checking or savings account. The misconception that VA will accommodate other types of accounts can lead to payment delays or complications.

- Prior Address is Optional: While it might seem unnecessary, providing a previous address is crucial for addressing changes, contrary to the belief that it's only an optional detail. This information assists in ensuring the accuracy of the vendor's records and preventing misdirected payments.

- Signature Is Not Necessary: The misconception that the signature of the payee/vendor is optional underestimates the importance of this requirement. In fact, the signature is mandatory, serving as a finalization of the information provided and a confirmation of the request.

- Form Processing Is Immediate: Expectations for immediate processing of the VA Form 10091 are unfounded. The normal processing time is clearly stated as 3 to 5 business days. This timeline allows for verification and update of vendor details, which is essential for accurate transactions and payments.

Understanding and clarifying these misconceptions can significantly streamline the process of completing and submitting the VA Form 10091, facilitating more efficient interactions between vendors and the VA Financial Services Center.

Key takeaways

Understanding the VA Form 10091 is vital for vendors wishing to do business with the Veterans Administration (VA). Here are key takeaways about filling out and using the VA 10091 form:

- New and Update Box Options: Check the correct box to indicate whether you are a new vendor not in the Federal Management System (FMS) or updating existing information.

- VA Facility Information: This section is strictly for VA station use and includes station number, contact name, phone, fax number, and email address.

- Payee/Vendor Type Selection: Selecting the appropriate payee/vendor type from the options provided (Commercial, Federal Agency, Employee, etc.) is required.

- Registration and Identification Numbers: Indicate if your business is registered in SAM.gov and provide your DUNS number if available. Your Social Security Number (SSN) or Tax Identification Number (TIN) is required.

- NPI for Health Care Providers: If applicable, a standard 10-digit unique identifier for health care providers should be entered.

- Business Information: Provide your legal business name, DBA (Doing Business As), contact information, current and previous addresses.

- EFT/ACH Information: This section requires your banking information, including the name of the bank, account number, and routing number, for electronic funds transfers.

- Signatures and Privacy Act Compliance: The vendor's signature is required to process the form. The Privacy Act statement explains the use of this information and emphasizes the importance of providing accurate details to avoid delays in payment processing.

This form is essential for establishing or updating vendor information with the VA, ensuring the correct and timely processing of payments through electronic means. Vendors should ensure all information is current and accurate before submission.

Popular PDF Forms

Certificate of Membership Template - Clarifies the relationship between member investments and their entitlement to LLC ownership units.

4681 - Details on the exclusions from gross income for canceled debts under specific federal programs are included.