Blank Va 21 509 PDF Template

The VA Form 21P-509, commonly referred to as the Statement of Dependency of Parents, is a critical document for veterans and the parents of deceased veterans who are seeking benefits due to dependency. This form serves multiple purposes; it not only helps establish parent(s)' dependency on the veteran for support but also assists in calculating the benefits due to the dependent parent(s) based on the veteran's service connection. It is meticulously designed to gather comprehensive information about the dependent parent(s)' net worth, income, and expenses, ensuring a fair assessment of their financial need for support. The form requires transparency regarding all sorts of income, including wages, social security benefits, and any other sources, while also taking into account the expenses related to health care, living costs, and any other significant outgoings. The importance of accurately completing this form cannot be overstated, as it directly influences the evaluation and determination of the dependent parent(s)' eligibility for benefits. Veterans or their parents need to provide detailed information about their financial situation, adhering closely to the thorough instructions given with the form to avoid any potential delays or issues in processing their claim. With its comprehensive approach to assessing dependency, VA Form 21P-509 plays an indispensable role in ensuring that those parents who are dependent on their veteran children for support receive the assistance they are entitled to under the law.

Preview - Va 21 509 Form

INSTRUCTIONS

FOR STATEMENT OF DEPENDENCY OF PARENT(S)

VA FORM

Note: Read very carefully, detach, and keep these instructions for your reference. Print all answers clearly. If an answer is "none" or "0," write that. Your answer to every question is important to help us complete your claim. If you do not know the answer, write "unknown." If additional space is necessary, please attach a separate sheet with your answer, and indicate the item to which the answer implies.

A. How can I contact VA if I have questions?

If you have questions about this form, how to fill it out, or about benefits, contact your nearest VA regional office. You can locate the address of the nearest regional office in your telephone book blue pages under "United States Government, Veterans" or call

B.What do I use VA Form

1.You are a veteran whose parents are dependent on you for support, and you are:

•Receiving compensation benefits based on a 30 percent or higher

•Receiving VA educational benefits based on enrollment of 1/2 time or more.

OR

2.You are the parent of a deceased veteran who:

•Died on active duty or as a result of

•Died on or after May 1, 1957, and before January 1, 1972, while a waiver of premiums of his/her U.S. Government Life Insurance was in effect.

C.What is meant by “Parent” on this form?

The term "Parent" includes a natural parent, a parent through adoption, and a foster parent (including stepparents who stood in the relationship of parent to the veteran).

Specific Instructions

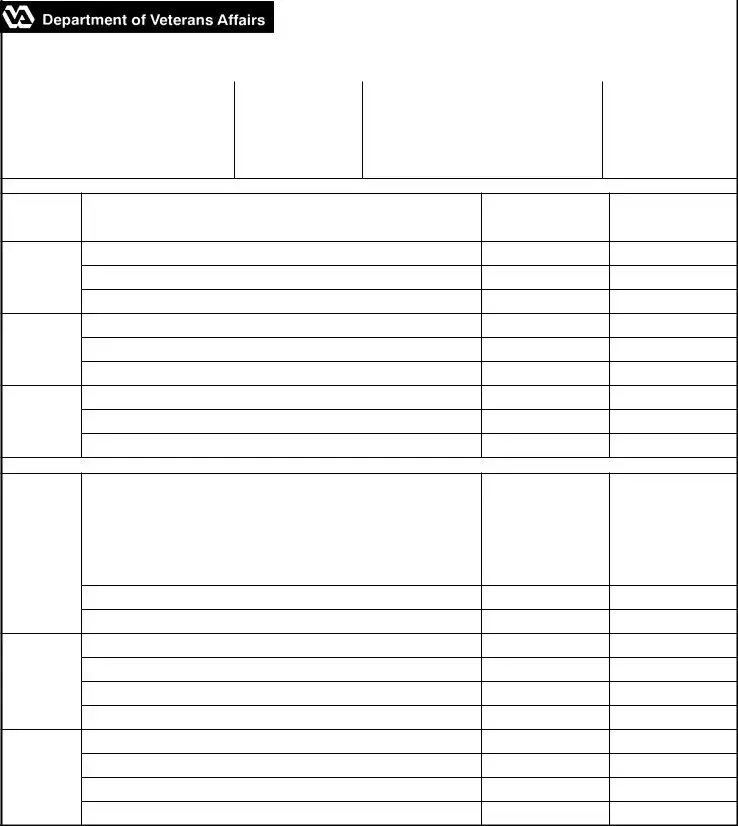

Net Worth of Parent(s) (Items 5A, 5B, and 5C)

Report the current value of all the interest and rights you (the parent(s)) have in any kind of property. This includes real estate, stocks, bonds and the amount of bank deposits, savings and loan accounts, and cash on hand. However, net worth

does not include your (the parent(s)) single family dwelling unit, reasonable lot area, and personal things you use every day like your vehicle, clothing, and furniture. If property is owned jointly by yourself and your spouse, report

the total value held jointly for each of you.

Income of Parent(s) (Items 6A, 6B, and 6C)

Report all income received for the 12 month period and for the calendar month immediately preceding the date of completing this form, and the sources of income.

VA FORM |

SUPERSEDES VA FORM |

Page 1 |

|

APR 2021 |

WHICH WILL NOT BE USED. |

The term "income" means payments and benefits received from sources such as:

•Wages or salary (before any deductions) earned by all members of the parent(s)' household, including minors

•Actual contributions to the family by adult members outside of the household

•Social Security benefits, retirement pay, allotments, and family allowances

•Pension, compensation or insurance benefits (other than those received from the Department of Veterans Affairs)

•Interest and dividends

•Rents, property, business, and farm operations

When reporting net income for a business, farm, etc. attach a separate sheet showing gross income and itemized expenses. Net income is gross income less the expenses of operating a rental property or a business or farm. Gross income includes both receipts in cash and the market value of goods or services received in lieu of cash. Expenses include cost of goods sold (for businesses), normal repairs, taxes, salary or wages of employees, insurance, interest on business debts (but not payment of principal), supplies purchased, and other similar expenses.

Expenses of Parent(s) (Items 7A, 7B, 7C, and 8)

Report the expenses for the 12 month period and for the calendar month immediately preceding the date of completing this form. Include expenses for rent (or housing), home repairs, maintenance, clothing, medical care, utilities, groceries, taxes, etc.

Dependents (Items 9A, 9B, 10A, 10B, 10C, and 10D)

Item 9A is to be completed by the parent(s) of a deceased veteran. Item 9B is to be completed by the veteran. Items 10A, 10B, 10C, and 10D are to be completed whenever the parent(s) have dependents residing with the parent(s).

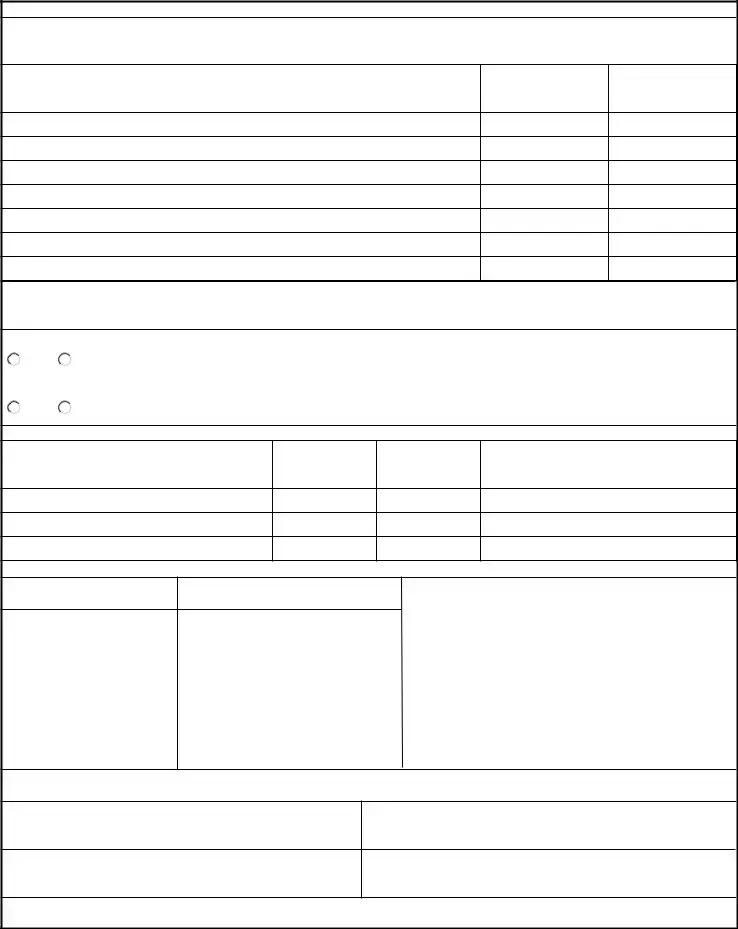

Note: Parent(s) must sign and date the form (Items 11A, 11B, 12A, and 12B). A veteran claiming his/her parent(s) as dependent(s) must also date and sign the form (Items 13A and 13B).

IMPORTANT: If you are certifying that you are married for the purpose of VA benefits, your marriage must be recognized by the place where you and/or your spouse resided at the time of marriage, or where you and/or your spouse resided when you filed your claim (or a later date when you became eligible for benefits) (38 U.S.C. § 103(c)). Additional guidance on when VA recognizes marriages is available at http://www.va.gov/opa/marriage/.

PRIVACY ACT NOTICE: VA will not disclose information collected on this form to any source other than what has been authorized under the Privacy Act of 1974 or Title 38, Code of Federal Regulations 1.576 for routine uses (i.e., civil or criminal law enforcement, congressional communications, epidemiological or research studies, the collection of money owed to the United States, litigation in which the United States is a party or has an interest, the administration of VA programs and delivery of VA benefits, verification of identity and status, and personnel administration) as identified in the VA system of records, 58VA21/22/28 Compensation, Pension, Education, and Vocational Rehabilitation and Employment Records - VA, and published in the Federal Register. Your response is required to obtain or retain benefits.

Giving us your SSN account information is mandatory. Applicants are required to provide their SSN under Title 38 USC 5101 (c) (1). VA will not deny an individual benefits for refusing to provide his or her SSN unless the disclosure of the SSN is required by Federal Statute of law in effect prior to January 1, 1975, and still in effect. The requested information is considered relevant and necessary to determine maximum benefits under the law. The responses you submit are considered confidential (38 U.S.C. 5701). Information that you furnish may be utilized in computer matching programs with other Federal or state agencies for the purpose of determining your eligibility to receive VA benefits, as well as to collect any amount owed to the United States by virtue of your participation in any benefit program administered by the Department of Veterans Affairs. Applicants are required to provide their SSN under Title 38 USC 5101 (c)

(1). VA will not deny an individual benefits for refusing to provide his or her SSN unless the disclosure of the SSN is required by Federal Statute of law in effect prior to January 1, 1975, and still in effect. The requested information is considered relevant and necessary to determine maximum benefits under the law. The responses you submit are considered confidential (38 U.S.C. 5701). Information that you furnish may be utilized in computer matching programs with other Federal or state agencies for the purpose of determining your eligibility to receive VA benefits, as well as to collect any amount owed to the United States by virtue of your participation in any benefit program administered by the Department of Veterans Affairs.

RESPONDENT BURDEN: We need this information to determine eligibility to benefits for dependent parents. Title 38, United States Code, allows us to ask for this information. We estimate that you will need an average of 30 minutes to review the instructions, find the information, and complete this form. VA cannot conduct or sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if this number is not displayed. Valid OMB control numbers can be located on the OMB Internet Page at www.reginfo.gov/public/do/PRAMain. If desired, you can call

VA FORM |

Page 2 |

|

|

|

|

|

OMB Approved No. |

|

|

|

|

|

Respondent Burden: 30 minutes |

|

|

|

|

|

Expiration Date: 04/30/2024 |

|

STATEMENT OF DEPENDENCY OF PARENT(S) |

||||

|

|

|

|

|

|

Important - Please read the attached instructions before completing this form. |

|

|

|

|

|

1. FIRST NAME - MIDDLE NAME - LAST NAME OF VETERAN |

|

2. VA FILE NUMBER |

|

||

|

|

|

|

|

|

3A. FULL NAME OF VETERAN'S PARENT |

3B. DATE OF BIRTH |

4A. FULL NAME OF VETERAN'S PARENT |

4B. DATE OF BIRTH |

||

|

(Mo, day, yr.) |

|

|

|

(Mo, day, yr.) |

|

|

|

|

|

|

|

3C. SOCIAL SECURITY |

|

|

|

4C. SOCIAL SECURITY |

|

NUMBER |

|

|

|

NUMBER |

5. NET WORTH

OWNER

A.

DESCRIPTION OF PROPERTY (Include location of real property)

B.

PRESENT

MARKET VALUE

(Dollar amount)

C.

ENCUMBRANCE ON PROPERTY

(Dollar amount)

PARENT

PARENT

PRESENT SPOUSE

OF PARENT

6. INCOME

MEMBER |

|

B. |

C. |

|

A. |

INCOME FOR LATEST |

|||

OF |

CALENDAR MONTH |

TOTAL FOR |

||

SOURCE FROM WHICH INCOME IS RECEIVED |

12 MONTHS |

|||

FAMILY |

FROM EACH SOURCE |

|||

|

(Dollar amount) |

|||

|

(Dollar amount) |

|||

|

|

|

||

|

|

|

|

|

VETERAN'S |

|

|

|

|

|

|

|

||

PARENT |

|

|

|

VETERAN'S

PARENT

PRESENT SPOUSE

OF PARENT

VA FORM |

SUPERSEDES VA FORM |

Page 3 |

|

APR 2021 |

WHICH WILL NOT BE USED. |

EXPENSES OF PARENT(S) (Including spouse if remarried)

INSTRUCTIONS - Enter below the expenses for you (the parent(s), including if remarried) for the 12 month period and for the calendar month immediately preceding the date of completing this form, and the purposes for which paid out. Include expenses for rent (or housing), home repairs, maintenance, clothing, medical care, utilities, groceries, taxes, etc.

7A. TYPE OF EXPENSE (List separately)

7B. EXPENSES FOR

LAST CALENDAR

MONTH

(Dollar amount)

7C. TOTAL FOR

12 MONTHS

(Dollar amount)

8. IF EXPENSES EXCEED INCOME, STATE FROM WHAT SOURCE SUCH EXPENSES ARE MET

9A. PARENTS ONLY - ARE THERE ANY PERSONS LIVING IN YOUR HOUSEHOLD DEPENDENT SOLELY UPON YOU FOR SUPPORT?

YES |

NO |

(If "YES," complete Items 10A, 10B, 10C and 10D) |

|

||

9B. VETERANS ONLY - ARE THERE ANY PERSONS LIVING IN YOUR PARENT(S)' HOUSEHOLD DEPENDENT SOLELY UPON YOU FOR SUPPORT? |

||

YES |

NO |

(If "YES," complete Items 10A, 10B, 10C and 10D) |

INFORMATION RELATING TO PERSONS SOLELY DEPENDENT UPON PARENT(S) (If additional space is needed use separate sheet)

|

10B. |

10C. |

|

|

10A. NAME OF DEPENDENT PERSONS |

RELATIONSHIP |

10D. REASON FOR DEPENDENCY |

||

DATE OF BIRTH |

||||

|

TO PARENT(S) |

|

||

|

|

|

I CERTIFY THAT the preceding statements are true and correct to the best of my knowledge and belief.

11A. DATE11B. SIGNATURE OF PARENT (Sign in ink) 11C. ADDRESS OF MOTHER 11E. EVENING PHONE NUMBER

12A. DATE |

12B. SIGNATURE OF PARENT (Sign in ink) |

12C. ADDRESS OF FATHER |

|

|

|

12D. DAYTIME PHONE NUMBER |

12E. EVENING PHONE NUMBER |

|

|

|

|

13A. DATE |

13B. SIGNATURE OF VETERAN (Sign in ink) |

13C. ADDRESS OF VETERAN |

|

|

|

13D. DAYTIME PHONE NUMBER |

13E. EVENING PHONE NUMBER |

|

WITNESSES - If you sign by (X), your mark must be witnessed by two persons who know you personally and the signature and address of the witnesses must be shown.

14A. SIGNATURE OF WITNESS (Sign in ink)

14B. ADDRESS OF WITNESS

15A. SIGNATURE OF WITNESS (Sign in ink)

15B. ADDRESS OF WITNESS

PENALTY - The law provides severe penalties, which include fine or imprisonment, or both, for the willful submission of any statement or evidence of a material fact, knowing it to be false, or for the fraudulent acceptance of any payment to which you are not entitled.

VA FORM |

Page 4 |

Form Data

| Fact | Detail |

|---|---|

| Form Name | VA Form 21P-509 |

| Supersedes | VA Form 21P-509, Jan 2018 |

| OMB Approval Number | 2900-0089 |

| Expiration Date | 04/30/2024 |

| Respondent Burden | 30 minutes |

| Purpose | To determine eligibility for benefits for dependent parents of veterans |

| Who Should Use This Form | Veterans with dependent parents or parents of deceased veterans meeting specific criteria |

| Contact Information for Questions | 1-800-827-1000 or visit http://www.vba.va.gov/benefits/address.htm |

Instructions on Utilizing Va 21 509

Completing the VA Form 21-509 is a crucial step for veterans or their parents to ensure that all dependency details are accurately communicated to the Department of Veterans Affairs. This form requires detailed information about the parents' dependency, including financial and personal data. Careful attention to detail and accuracy is important to avoid any delays or issues in the processing of the form. Below is a detailed guide to assist in filling out this form correctly.

- Start by entering the first, middle, and last name of the veteran at the top of the form.

- Fill in the VA file number associated with the veteran's file.

- For sections 3A and 4A, enter the full names of the veteran's parents, including their date of birth and social security numbers in sections 3B, 3C, 4B, and 4C respectively. If only one parent is to be listed, complete the sections applicable to that parent.

- Describe the net worth of the parent(s), including details of any property owned. This includes the type of property, its market value, and any encumbrances on it. Where property is jointly owned with a spouse, report only half of the total value.

- Detail the income of each parent under section 6, breaking down the source of the income, the income for the latest calendar month, and the total for the past 12 months. Be thorough and include income from all sources outlined in the form's instructions.

- Under section 7 and 8, list all expenses for the 12 month period and for the calendar month immediately prior to completing this form. Specify the type of expense, expenses for the last calendar month, and total expenses for 12 months. If expenses exceed income, explain how these are being met.

- Answer questions in sections 9A and 9B about dependents living in the household of the parent(s) or the veteran, respectively. If the answer is "Yes," complete the following section with details about those dependents.

- Complete the certification area with the date and signature of the parent(s) in sections 11A and 12B, providing their address and contact numbers.

- If applicable, the veteran must also date and sign the form in section 13A and 13B, including their address and phone numbers.

- If the parent is unable to sign their name, an (X) mark must be witnessed by two individuals who know the parent personally. Their signatures and addresses should be recorded in sections 14A, 14B, 15A, and 15B.

Next Steps: After carefully reviewing the form to ensure all information is accurate and complete, the form along with any necessary attachments should be submitted to the nearest VA regional office. The contact details for these offices can be found through the VA's official website or by calling the provided customer service numbers. It is advisable to keep a copy of the completed form and any correspondence for personal records. The processing time can vary, so it's important to allow sufficient time for the VA to process the claim. If there are any questions or further information is needed, the VA will reach out to the contact information provided on the form.

Obtain Answers on Va 21 509

When it comes to filling out the VA Form 21P-509, it’s understandable that you might have some questions. This form is used by veterans or their parents to establish dependency for VA benefits. Here's a handy FAQ section to guide you through the most common inquiries.

What is VA Form 21P-509 used for?

This form is primarily used in two scenarios: by veterans to claim their parents as dependents if the veteran is receiving compensation for a disability rated 30 percent or higher, or educational benefits for a course load of half-time or more; and by parents of a deceased veteran, where the veteran died on active duty, from service-connected injuries or diseases, or while a specific insurance waiver was in effect during certain periods.

Who is considered a "parent" for this form?

A “parent” includes biological parents, adoptive parents, and foster parents, including stepparents who have acted in the capacity of a parent to the veteran. This wide definition ensures that various parental figures can be recognized for dependency purposes.

How can I contact the VA if I have questions about filling out this form?

If you're unsure about any part of the form or need further assistance, you can reach out to the nearest VA regional office. You can find the address in your local telephone directory under “United States Government, Veterans”, or call 1-800-827-1000. There’s also a TDD line for those with hearing impairments, available through dialing 711. Additionally, the VA can be contacted via the internet for addressing specific questions or concerns.

What information is needed regarding income and assets?

You’ll be required to report the current value of all property owned, excluding your family’s primary residence, its reasonable lot size, and daily personal effects like vehicles and clothing. Also, all sources of income within the 12-month period leading up to the completion of this form must be detailed, including wages, benefits, and contributions from household members.

How should expenses be reported?

Expenses to be reported include those for rent or housing, home repairs, maintenance, clothing, medical care, groceries, utilities, taxes, and similar needs over the past 12 months and for the month immediately preceding the date of completing the form. If expenses exceed income, indicate how these expenses are being met.

What if I need more space to provide a complete answer?

If the space provided on the form isn’t sufficient for your answers, attach a separate sheet with the necessary information. Make sure to indicate which item your answer corresponds to, ensuring clarity for those reviewing your form.

Filling out the VA Form 21P-509 is an important step for veterans or their parents to establish recognized dependencies, thereby potentially enhancing their access to VA benefits. Always take your time to read the instructions carefully and provide detailed, accurate information to ensure a smooth process.

Common mistakes

Not providing clear and completed answers for each question. The instructions emphasize the importance of answering every question to assist in the completion of your claim. If an answer is "none" or "0," it must be written as such. Incomplete or unclear answers can delay processing.

Failure to report all sources of income for the parent(s), including the income of all household members. It's essential to include earnings from wages, social security benefits, pension, and any other sources as outlined in the form instructions. Leaving out sources of income can result in inaccurate determination of eligibility and benefits.

Incorrectly reporting the net worth by including exempt assets. The form clarifies that the net worth does not include the value of daily-used personal items like clothing, furniture, and the family vehicle, or the single-family dwelling and its reasonable lot area. Incorrectly including these can inflate the net worth, potentially affecting benefits.

Omitting additional sheets for explanations or details when the provided space is not sufficient. The instructions indicate that if more space is needed, applicants should attach separate sheets with their answer, specifying the item they refer to. Not doing so can lead to incomplete information being provided, hindering proper assessment.

Incorrect or missing signatures and dates. The form requires that both the veteran and the parent(s) sign and date the form (in specified sections) to certify that the statements provided are true and correct. Failing to properly sign and date the form can result in the rejection of the application.

Documents used along the form

Filing the VA Form 21P-509, Statement of Dependency of Parent(s), is an important step for veterans or their parents to establish dependency for VA benefits. This form alone, however, often requires the submission of additional documents and forms to fully support the claim. Understanding these supplementary documents can ensure that a claim is comprehensively and accurately presented to the VA, thereby facilitating a smoother benefits process.

- VA Form 21-686c: Declaration of Status of Dependents. This form is used to add eligible family members to a veteran's benefits package, which can impact the overall benefits received.

- VA Form 21-4502: Application for Automobile or Other Conveyance and Adaptive Equipment. This might be necessary if the dependent parent has mobility issues and the veteran is seeking assistance with transportation needs.

- VA Form 21-0781: Statement in Support of Claim for Service Connection for Post-Traumatic Stress Disorder. This form can be relevant if a veteran’s claim involves conditions related to PTSD that also impact the care or financial status of dependent parents.

- VA Form 21-4142: Authorization and Consent to Release Information to the Department of Veterans Affairs. It's required when the VA needs to obtain medical records from non-VA providers to support a claim.

- VA Form 21-2680: Examination for Housebound Status or Permanent Need for Regular Aid and Attendance. If a parent is dependent due to health reasons, this form can help establish the need for additional benefits.

- VA Form 21-0779: Request for Nursing Home Information in Connection with Claim for Aid and Attendance. This form is essential if a dependent parent resides in a nursing home and requires financial assistance for care.

- VA Form 10-10EZ: Application for Health Benefits. It's the form used by veterans to apply for medical benefits, which can indirectly affect dependent parents by ensuring the veteran's health needs are met.

- VA Form 21-0845: Authorization to Disclose Personal Information to a Third Party. Essential for veterans who wish to allow family members, including dependent parents, access to their VA records.

- VA Form 20-0995: Decision Review Request: Supplemental Claim. Needed if a veteran’s initial claim is denied, or if additional evidence is found to support the claim’s approval.

- Direct Deposit Enrollment Form: While not a VA-specific form, enrolling in direct deposit can expedite the receipt of benefits for both the veteran and their dependent parents.

When used in conjunction with VA Form 21P-509, these documents help in painting a complete picture of the dependency situation and ensure that all relevant information is considered by the VA. Given the complexities of the VA benefits system, it's advisable to carefully review each required document and form to ensure accuracy and completeness in submission. This preparation can significantly impact the outcome of a dependency claim.

Similar forms

The VA Form 21-526EZ, "Application for Disability Compensation and Related Compensation Benefits", shares similarities in structure and purpose with the VA Form 21P-509. Both forms are used by veterans or their family members to apply for benefits, requiring detailed personal, financial, and dependency information.

IRS Form 1040, "U.S. Individual Income Tax Return", relates to VA Form 21P-509 as both require the disclosure of income and dependents. Although serving different government functions, each collects financial data to assess eligibility for benefits or tax obligations.

The FAFSA (Free Application for Federal Student Aid) form, which gathers financial information to determine eligibility for student financial aid, mirrors VA Form 21P-509's collection of financial data to ascertain dependency and eligibility for benefits.

HUD-50058, "Family Report", used by the Department of Housing and Urban Development to collect family income and composition information for housing assistance, is similar to VA Form 21P-509 in its requirement for detailed household financial and dependency data.

SSA-1099, "Social Security Benefit Statement", while primarily a summary document, relates to the type of information reported on VA Form 21P-509, such as income and benefits received, which may affect the determination of dependency and benefits.

VA Form 21-686c, "Declaration of Status of Dependents", is akin to VA Form 21P-509 in its function to report dependent-related information for the purpose of adjusting veterans' benefits based on the number of dependents.

VA Form 21-4502, "Application for Automobile or Other Conveyance and Adaptive Equipment", while more specific in its scope, shares with VA Form 21P-509 the aspect of applying for VA benefits based on specific eligibility criteria, including information on dependents.

The VA Form 10-10EZ, "Application for Health Benefits", parallels the VA Form 21P-509 by requiring personal, financial, and dependency details to determine eligibility for VA health benefits.

SSI Application Forms from the Social Security Administration, which collect detailed financial, personal, and dependency information to assess eligibility for Supplemental Security Income, serve a similar purpose to VA Form 21P-509 in determining benefit eligibility based on financial need and dependency status.

Dos and Don'ts

When completing the VA Form 21-509, Statement of Dependency of Parent(s), there are certain practices to follow and avoid for a smooth process. Here are guidelines to assist you.

Do:

- Print answers clearly: Ensure all your responses are legible to prevent misunderstandings or processing delays.

- Report "none" or "0" when applicable: If any question does not apply to your situation or the answer is zero, explicitly write this down to confirm your situation has been fully considered.

- Write "unknown" for unanswered queries: If you do not know the answer to a question, indicate as "unknown" rather than leaving it blank.

- Attach additional sheets if necessary: In case you need more space to provide an answer, attach a separate sheet with your response, making sure to reference the relevant question.

- Contact VA for questions: Utilize the provided contact information to seek clarification or assistance with the form.

- Review before submitting: Double-check your entries for accuracy and completeness to ensure a smoother processing of your claim.

- Sign and date the form: Ensure the form is signed and dated by the required parties to validate the information provided.

Don't:

- Leave questions unanswered: An unanswered question could delay the processing of your form. Write "unknown" if you truly cannot provide an answer.

- Include everyday personal items in net worth: When calculating net worth, remember not to include items like your vehicle, clothing, and furniture.

- Overlook income sources: Be sure to report all income received, including minor contributions and benefits from sources outside the VA.

- Forget to report joint property correctly: If you own property jointly with a spouse, report only your portion (typically one-half of the total value).

- Misreport business or farm income: For business or farm owners, ensure gross income is clearly distinguished from net income after expenses.

- Underestimate the importance of accuracy: Providing inaccurate or incomplete information can lead to penalties, including fines or imprisonment.

- Send the form without checking marriage recognition: If certifying a marriage for VA benefits, confirm that your marriage is recognized by the jurisdiction where you reside or filed your claim.

Misconceptions

When dealing with the VA Form 21-509, Statement of Dependency of Parent(s), there are several common misconceptions that can lead to confusion. Understanding these myths can help in correctly filling out the form and ensuring that your claim is processed smoothly.

Myth 1: Only biological or adoptive parents can be claimed as dependents. Reality: The term "parent" on this form includes biological parents, adoptive parents, and even foster parents, including stepparents who have stood in the relationship of a parent to the veteran.

Myth 2: You can’t contact the VA for help with the form. Reality: Veterans and their families can indeed contact the VA for assistance by calling 1-800-827-1000 or consulting the VA website for guidance on completing the form.

Myth 3: The net worth section includes the value of everyday personal items. Reality: Net worth does not take into account the value of personal items used daily, such as your vehicle, clothing, and furniture.

Myth 4: You need to report the full value of jointly owned property as your net worth. Reality: If property is owned jointly with a spouse, only half the total value should be reported for each person.

Myth 5: Income information is only about the veteran’s earnings. Reality: The income section requires information on all sources of income received by the parent(s), not just earnings from the veteran.

Myth 6: Only income from employment should be included. Reality: All income sources must be reported, including Social Security benefits, retirement pay, and any other compensations or benefits.

Myth 7: You only need to fill out parts of the form that you think are applicable. Reality: All questions on the form are important and must be answered to ensure that your claim is accurately processed.

Myth 8: You cannot add additional pages to the form. Reality: If more space is needed for any answers, additional sheets can be attached, clearly indicating the item numbers they correspond to.

Myth 9: The form will be processed without your Social Security Number. Reality: Providing your SSN is mandatory, as it is required by law for the administration of VA benefits.

Myth 10: All marriages must be recognized by the VA for benefits purposes. Reality: A marriage must be recognized by the place where you and/or your spouse resided at the time of marriage or when you filed your claim, aligning with VA’s guidance on recognizing marriages.

It’s essential to approach the VA Form 21-509 with precise information and clear understanding to ensure a smooth process in claiming dependent parents. If uncertain, reaching out to VA representatives can help clarify any doubts.

Key takeaways

When veterans or their parents fill out the VA Form 21P-509, Statement of Dependency of Parent(s), certain critical points need to be observed to ensure accuracy and completeness. Here are key takeaways about the process and its requirements:

- This form is designed for veterans who have parents dependent on them for support and are receiving compensation benefits due to a service-connected disability rated at 30 percent or higher, or are receiving VA educational benefits based on at least half-time enrollment.

- It can also be used by the parent(s) of deceased veterans who died on active duty, as a result of service-connected injuries or diseases before specific dates, or while a waiver of premiums for U.S. Government Life Insurance was in effect.

- The definition of “Parent” on this form is broad, including natural parents, adoptive parents, and foster parents, which encompasses stepparents who have assumed the role of a parent to the veteran.

- All property interests, including real estate, stocks, bonds, and bank deposits, must be reported in the net worth section, except for the primary residence, the lot it sits on, and personal effects like vehicles, clothing, and furniture.

- Income information required includes all money received from various sources, including wages or salary, social security benefits, retirement pay, and other such income, before deductions, for the 12 months prior to completing the form and for the latest calendar month.

- Business or farm owners need to attach a separate sheet detailing gross income and operating expenses to accurately report net income.

- Expenditures for the past 12 months and the month immediately preceding the form’s completion must be detailed, including rent, repairs, utilities, groceries, and medical expenses.

- It is important to report any dependents living in the household who solely rely on the parent(s) for support, including their relationship and the reason for dependency.

- The form mandates the signature of the parent(s) and the veteran (if applicable), certifying the truthfulness and accuracy of the information provided. In cases where an “X” is used for a signature, it must be witnessed by two individuals who know the signer.

For assistance with completing the form or to address any queries, veterans and their parents are encouraged to contact their nearest VA regional office or utilize the provided VA contact resources. Understanding these key aspects ensures that the VA Form 21P-509 is filled out thoroughly, accurately representing the financial dependency situation and aiding in the accurate assessment of benefits eligibility.

Popular PDF Forms

Recognizance Vs Undertaking - The form highlights the importance of honest communication and cooperation with the bail bond provider to maintain the bond's validity and prevent forfeiture.

Total Value Vs Edward Jones Value - Your signature on the Edward Jones Account form is the key that unlocks a tailored, secure retirement plan.

Eoir33 - Mailing instructions for the EOIR 33 IC form are clear and require copies to be sent to both the Immigration Court and the DHS Office of the Chief Counsel.