Blank Va 21P 4706B PDF Template

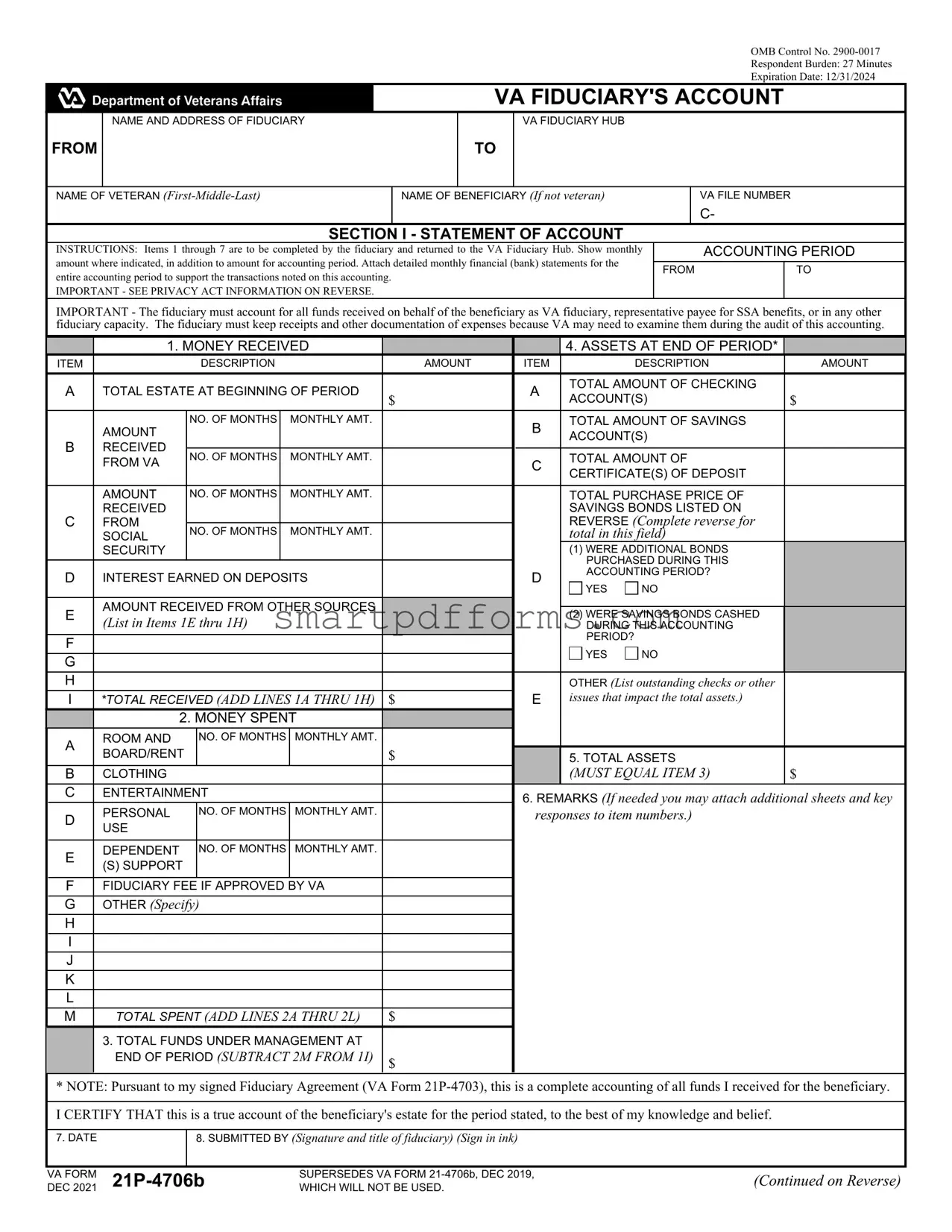

The VA 21P-4706B form plays a critical role in the administration of benefits for veterans and their beneficiaries, serving as a fiduciary's accounting report to the Department of Veterans Affairs. Through this document, fiduciaries, who are appointed to manage the financial affairs of veterans unable to do so themselves, are required to provide a detailed account of how the beneficiary's funds have been received, managed, and expended over a specified accounting period. The form mandates the inclusion of all monetary transactions and the maintenance of financial records to support these transactions, ensuring transparency and accountability in the management of the beneficiary's estate. Additionally, it encompasses sections for the fiduciary's personal criminal and credit background, asserting the integrity and reliability of the fiduciary. With the OMB Control No. 2900-0017 and a respondent burden of 27 minutes, this form underlines the importance of meticulous financial stewardship and the VA's commitment to safeguarding the interests of its beneficiaries. Its structured format, requiring detailed monthly financial statements and supporting documentation for all noted transactions, guides fiduciaries in fulfilling their responsibilities, while its provisions regarding privacy and the requirement for honest reporting emphasize the significance of trust in the fiduciary relationship.

Preview - Va 21P 4706B Form

|

|

|

|

|

|

|

|

OMB Control No. |

||

|

|

|

|

|

|

|

|

Respondent Burden: 27 Minutes |

||

|

|

|

|

|

|

|

|

Expiration Date: 12/31/2024 |

||

|

|

|

|

VA FIDUCIARY'S ACCOUNT |

||||||

|

NAME AND ADDRESS OF FIDUCIARY |

|

|

|

VA FIDUCIARY HUB |

|

|

|

|

|

FROM |

|

|

TO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF VETERAN |

NAME OF BENEFICIARY (If not veteran) |

|

|

VA FILE NUMBER |

||||||

|

|

|

|

|

|

|

|

C- |

||

|

SECTION I - STATEMENT OF ACCOUNT |

|

|

|

|

|

||||

INSTRUCTIONS: Items 1 through 7 are to be completed by the fiduciary and returned to the VA Fiduciary Hub. Show monthly |

|

|

ACCOUNTING PERIOD |

|

||||||

amount where indicated, in addition to amount for accounting period. Attach detailed monthly financial (bank) statements for the |

|

|

|

|

|

|||||

FROM |

|

TO |

||||||||

entire accounting period to support the transactions noted on this accounting. |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|||

IMPORTANT - SEE PRIVACY ACT INFORMATION ON REVERSE. |

|

|

|

|

|

|

|

|

||

IMPORTANT - The fiduciary must account for all funds received on behalf of the beneficiary as VA fiduciary, representative payee for SSA benefits, or in any other fiduciary capacity. The fiduciary must keep receipts and other documentation of expenses because VA may need to examine them during the audit of this accounting.

|

1. MONEY RECEIVED |

|

|

|

4. ASSETS AT END OF PERIOD* |

|

||||||

ITEM |

|

|

DESCRIPTION |

|

|

AMOUNT |

ITEM |

|

DESCRIPTION |

AMOUNT |

||

A |

TOTAL ESTATE AT BEGINNING OF PERIOD |

|

A |

TOTAL AMOUNT OF CHECKING |

|

|||||||

$ |

ACCOUNT(S) |

$ |

||||||||||

|

|

|

|

|

|

|

|

|||||

|

AMOUNT |

NO. OF MONTHS |

|

MONTHLY AMT. |

|

B |

TOTAL AMOUNT OF SAVINGS |

|

||||

B |

|

|

|

|

|

|

ACCOUNT(S) |

|

||||

|

|

|

|

|

|

|

|

|||||

RECEIVED |

NO. OF MONTHS |

|

MONTHLY AMT. |

|

|

TOTAL AMOUNT OF |

|

|||||

|

FROM VA |

|

|

C |

|

|||||||

|

|

|

|

|

|

|

CERTIFICATE(S) OF DEPOSIT |

|

||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

AMOUNT |

NO. OF MONTHS |

|

MONTHLY AMT. |

|

|

TOTAL PURCHASE PRICE OF |

|

||||

C |

RECEIVED |

|

|

|

|

|

|

|

SAVINGS BONDS LISTED ON |

|

||

FROM |

|

|

|

|

|

|

|

REVERSE (Complete reverse for |

|

|||

|

SOCIAL |

NO. OF MONTHS |

|

MONTHLY AMT. |

|

|

total in this field) |

|

||||

|

SECURITY |

|

|

|

|

|

|

|

(1) WERE ADDITIONAL BONDS |

|

||

|

|

|

|

|

|

|

|

|

PURCHASED DURING THIS |

|

||

|

|

|

|

|

|

|

|

|

|

|||

D |

INTEREST EARNED ON DEPOSITS |

|

D |

ACCOUNTING PERIOD? |

|

|||||||

|

YES |

NO |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|||

E |

AMOUNT RECEIVED FROM OTHER SOURCES |

|

|

|

|

|

||||||

|

|

(2) WERE SAVINGS BONDS CASHED |

|

|||||||||

(List in Items 1E thru 1H) |

|

|

|

|

|

|||||||

|

|

|

|

|

DURING THIS ACCOUNTING |

|

||||||

F |

|

|

|

|

|

|

|

|

PERIOD? |

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

|

||

G |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

H |

|

|

|

|

|

|

|

|

OTHER (List outstanding checks or other |

|

||

I |

*TOTAL RECEIVED (ADD LINES 1A THRU 1H) |

$ |

E |

issues that impact the total assets.) |

|

|||||||

|

2. MONEY SPENT |

|

|

|

|

|

|

|||||

A |

ROOM AND |

|

NO. OF MONTHS |

MONTHLY AMT. |

|

|

|

|

|

|

||

BOARD/RENT |

|

|

|

|

|

$ |

|

5. TOTAL ASSETS |

|

|||

|

|

|

|

|

|

|

|

|||||

B |

CLOTHING |

|

|

|

|

|

|

|

(MUST EQUAL ITEM 3) |

$ |

||

C |

ENTERTAINMENT |

|

|

|

6. REMARKS (If needed you may attach additional sheets and key |

|||||||

D |

PERSONAL |

|

NO. OF MONTHS |

MONTHLY AMT. |

|

responses to item numbers.) |

|

|||||

USE |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

E |

DEPENDENT |

|

NO. OF MONTHS |

MONTHLY AMT. |

|

|

|

|

|

|||

(S) SUPPORT |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

FFIDUCIARY FEE IF APPROVED BY VA

G OTHER (Specify)

H

I

J

K

L

M |

TOTAL SPENT (ADD LINES 2A THRU 2L) |

$ |

|

3. TOTAL FUNDS UNDER MANAGEMENT AT |

|

|

END OF PERIOD (SUBTRACT 2M FROM 1I) |

$ |

* NOTE: Pursuant to my signed Fiduciary Agreement (VA Form

I CERTIFY THAT this is a true account of the beneficiary's estate for the period stated, to the best of my knowledge and belief.

7. DATE |

|

8. SUBMITTED BY (Signature and title of fiduciary) (Sign in ink) |

|

|

|

|

|

|

|

VA FORM |

SUPERSEDES VA FORM |

(Continued on Reverse) |

||

DEC 2021 |

WHICH WILL NOT BE USED. |

|||

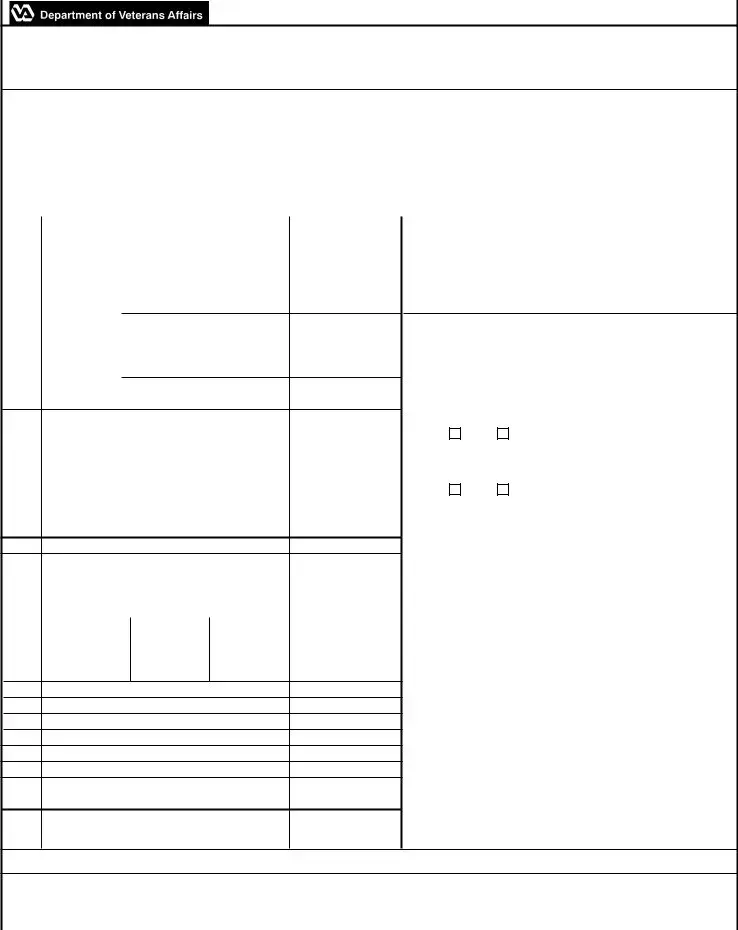

9. BACKGROUND INFORMATION

Answer the questions below if you are an individual appointed to serve as fiduciary for the beneficiary named on the reverse side of this form. The questions pertain to your personal criminal and credit history. Failure to provide a response may impact your ability to serve as a VA fiduciary.

You are not required to respond to these questions if you are serving as VA fiduciary in one of the following capacities for the beneficiary named on the reverse:

•administrator of a facility

•company or corporation

•

I certify that during this accounting period, I have not been convicted of any offense under Federal or State law, which resulted in imprisonment for more than one year. I understand the Department of Veterans Affairs may obtain my criminal background history to verify my response. Initial the box below to certify and acknowledge this information.

I certify that during this accounting period, I did not default on a debt, was not the subject of collection action by a creditor and did not file bankruptcy. To the best of my knowledge, no adverse credit information was reported to a credit bureau because I was unable to meet my personal financial obligations. I understand the Department of Veterans Affairs may obtain my credit history report to verify my response. Initial the box below to certify and acknowledge this information.

10. EXPLANATION OF BACKGROUND INFORMATION (If necessary)

LINE |

SERIAL NUMBER |

DATE OF |

PURCHASE |

LINE |

SERIAL NUMBER |

DATE OF |

PURCHASE |

|

NO. |

PURCHASE |

PRICE |

NO. |

PURCHASE |

PRICE |

|||

|

|

|||||||

|

|

|

|

|

|

|

|

|

1. |

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

10. |

|

|

|

SECTION II - CERTIFICATION OF U.S. SAVINGS BONDS

I CERTIFY THAT the savings bonds listed above are the property of the estate of the beneficiary and are in my custody and control.

SIGNATURE OF FIDUCIARY (Sign in ink)

DATE

PRIVACY ACT INFORMATION: The VA will not disclose information on the form to any source other than what has been authorized under the Privacy Act of 1974 or Title 5, Code of Federal Regulations 1.526 for routine uses (i.e. request from Congressman on behalf of a beneficiary) as identified in the VA system of records, 37VA27, VA Supervised Fiduciary/Beneficiary and General Investigative Records, published in the Federal Register. You are required to respond (38 U.S.C. 5701) to obtain or retain benefits. The information will be used to ensure the proper administration of the beneficiary's income and estate. Failure to furnish the requested information may result in the suspension of payments and/or the appointment of a successor fiduciary.

RESPONDENT BURDEN: We need this information to ensure proper administration of the beneficiary's estate. Title 38, United States Code allows us to ask for this information. We estimate that you will need an average of 27 minutes to review the instructions, find the information, and complete this form. VA cannot conduct or sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if this number is not displayed. Valid OMB control numbers can be located on the OMB Internet Page at https://reginfo.gov/public/do/PRAMain.

VA FORM

Form Data

| Fact | Detail |

|---|---|

| Form Number | VA Form 21P-4706b |

| Supersedes | VA Form 21-4706b, Dec 2019 |

| OMB Control No. | 2900-0017 |

| Respondent Burden | 27 Minutes |

| Expiration Date | 12/31/2024 |

| Purpose | Accounting by VA Fiduciaries |

| Audience | VA Fiduciaries |

| Governing Law(s) | Title 38, United States Code |

Instructions on Utilizing Va 21P 4706B

When filling out the VA Form 21P-4706B, you are undertaking a significant responsibility. This document is essential for accurately reporting the financial management of a beneficiary's estate. Each section and item needs your careful attention to reflect the true state of affairs regarding the incomes, expenditures, and assets managed on behalf of the beneficiary. Here's a straightforward guide to help you complete the form accurately.

- Start by entering the Fiduciary's Account Name and Address at the top of the form where indicated.

- In the section labeled VA Fiduciary Hub, fill in the ‘From’ and ‘To’ dates to represent the accounting period covered by this report.

- Under Name of Veteran, enter the full name of the veteran. If the beneficiary is not the veteran, fill in the Name of Beneficiary section accordingly.

- Enter the VA File Number to ensure the form is matched to the correct records.

- For Section I - Statement of Account, record all money received and spent within the accounting period:

- Item 1: List all sources of income received on behalf of the beneficiary.

- Item 2: Detail all expenditures made from the beneficiary's funds for their care and well-being.

- For Assets at the End of Period, provide a current valuation of the beneficiary's estate.

- This includes checking and savings account balances, certificates of deposit, and savings bonds, among others.

- Answer if any additional bonds were purchased or cashed during the accounting period under items designated for those queries.

- Calculate the Total Funds Under Management at End of Period by subtracting the total spent from the total received.

- In Section II – Certification of U.S. Savings Bonds, list any U.S. Savings Bonds that are part of the estate and confirm they're in your custody.

- At the end of the form, sign and date under the certification to confirm the accuracy of the information provided.

- For Background Information, answer the questions regarding your personal criminal and credit history to comply with the fiduciary's requirements.

Make sure to attach detailed monthly financial statements for the entire accounting period to support the transactions noted. Keeping meticulous records is essential as the VA may request to examine documents, receipts, and other supporting evidence during their audit process. With thorough and accurate completion of this form, you ensure the beneficiary’s estate is managed in their best interest.

Obtain Answers on Va 21P 4706B

What is the purpose of VA Form 21P-4706B?

The VA Form 21P-4706B is designed for fiduciaries managing the financial affairs of a veteran or a beneficiary. Its primary function is to provide a detailed accounting of the financial transactions made on behalf of the veteran or beneficiary. This includes money received and spent within a specified accounting period, assets at the beginning and end of the period, and any changes to savings bonds. The form ensures the Veterans Affairs (VA) can monitor and verify the appropriate management of funds, safeguarding the financial interests of the beneficiaries.

Who needs to complete VA Form 21P-4706B?

This form must be completed by individuals appointed as fiduciaries by the VA. This encompasses those managing funds for veterans or beneficiaries under the capacity of VA fiduciaries, representative payees for Social Security Administration benefits, or any other fiduciary role. It is not required for fiduciaries serving as administrators of facilities, companies, corporations, or those who are court-appointed and concurrently appointed by the VA.

What information is needed to fill out VA Form 21P-4706B?

To accurately complete VA Form 21P-4706B, fiduciaries must gather comprehensive financial information. This includes total amounts of money received on behalf of the beneficiary, detailed expenditures for the accounted period, assets at both the start and end of the period, and specific details about U.S. Savings Bonds, including purchases and cash-ins. Fiduciaries should also attach detailed monthly bank statements for the entire accounting period to support their transactions.

Are there any sections related to the fiduciary’s personal history required on the form?

Yes, the form includes a section for the fiduciary to certify their personal criminal and credit history within the accounting period. This includes affirming that they have not been convicted of offenses resulting in imprisonment for over a year, haven’t defaulted on debts, were not subject to collection actions by creditors, nor filed for bankruptcy. These responses help the VA determine the fiduciary’s eligibility and credibility to manage the beneficiary's affairs.

How is the privacy of information on VA Form 21P-4706B protected?

Information provided on VA Form 21P-4706B is protected under the Privacy Act of 1974 and Title 5, Code of Federal Regulations 1.526. The VA restricts disclosure of form information to authorized sources only, as identified in the VA system of records. This ensures the confidentiality and security of the beneficiary’s financial information and the fiduciary's personal data.

What happens if the requested information on VA Form 21P-4706B is not furnished?

Failing to provide the requested information or completing the form inaccurately may lead to suspension of payments to the beneficiary or the appointment of a successor fiduciary. The VA relies on accurate, thorough information to ensure the beneficiary’s estate is properly managed. Therefore, fiduciaries must ensure all sections are filled out comprehensively to avoid potential consequences.

Is there an expiration date for the VA Form 21P-4706B?

Yes, the current version of VA Form 21P-4706B is set to expire on December 31, 2024. It is important for fiduciaries to use the most current version of the form to comply with VA requirements. Updated forms can typically be found on the VA website or obtained directly from the VA Fiduciary Hub.

Common mistakes

Filling out VA Form 21P-4706B, which is crucial for those acting as fiduciaries for veterans or beneficiaries, is a responsible task. However, some common mistakes can complicate or delay the process. Understanding these mistakes helps ensure accurate completion and timely processing.

Not attaching detailed bank statements: One common mistake is failing to attach monthly bank statements for the entire accounting period. These statements are essential as they support the transactions noted on the accounting and provide a transparent record of financial management.

Incomplete information on assets: It's important to accurately report all assets at the beginning and end of the period, including checking accounts, savings accounts, certificates of deposit, and savings bonds. Leaving out details or providing inaccurate information can raise questions about the fiduciary's management of the beneficiary's estate.

Incorrect calculation of the total funds under management: This number should reflect the total received minus the total spent. Mistakes in arithmetic or misunderstanding the categories can lead to reporting errors, affecting the beneficiary's financial wellbeing and compliance with VA requirements.

Omitting explanations for expenses or income: The form requires the fiduciary to account for all funds received and spent. Not providing explanations for certain expenses or sources of income can appear suspicious and may require further clarification, delaying the process.

Forgetting to certify the accounting period: The fiduciary must certify that the account is a true reflection of the beneficiary's estate for the stated period. Failure to sign or date this certification can invalidate the submission, necessitating resubmission and further delays.

Neglecting the background information section: This section is vital for individual fiduciaries, as it pertains to their criminal and credit history. Skipping these certifications or failing to initial the acknowledgment boxes can impact their ability to serve as a fiduciary.

By avoiding these errors, fiduciaries can better serve the interests of the veterans or beneficiaries in their care, ensuring that their financial management meets the VA's standards for accountability and transparency.

Documents used along the form

Managing the affairs of a veteran or beneficiary under the Department of Veterans Affairs (VA) fiduciary program requires meticulous attention to detail and a comprehensive understanding of the paperwork involved. The VA Form 21P-4706B, a fiduciary's account document, is just one of several forms and documents that are often used in conjunction to ensure the lawful and efficient handling of a beneficiary's estate. These documents play a vital role in safeguarding the interests of the beneficiary, ensuring that every transaction is accurately accounted for and that the estate is administered in accordance with VA regulations.

- VA Form 21P-4703: Fiduciary Agreement. This form establishes the agreement between the fiduciary and the VA, detailing the fiduciary’s responsibilities and the terms of their appointment. It is a critical document that outlines the scope of authority granted to the fiduciary in managing the beneficiary's affairs.

- VA Form 21-0845: Authorization to Disclose Personal Information to a Third Party. This form allows the VA to release personal information about the veteran or beneficiary to a designated third party, as specified by the veteran or beneficiary. It is often necessary for fiduciaries who need to communicate with other agencies or organizations on behalf of the beneficiary.

- VA Form 21P-4706c: Court Appointment for Veteran's Fiduciary. Required when a fiduciary has been appointed by a court rather than the VA, this form verifies the court's appointment and the fiduciary's authority to act on behalf of the veteran or beneficiary.

- VA Form 21-4138: Statement in Support of Claim. Frequently used to provide additional evidence or clarification pertaining to the fiduciary account or other aspects of the fiduciary's duties, this form allows the fiduciary to submit a written statement supporting actions taken or decisions made.

- VA Form 21-686c: Declaration of Status of Dependents. This form is used to update the VA on the status of the veteran’s or beneficiary’s dependents, which can affect benefit payments and the management of the estate.

- VA Form 21P-0969: Income and Expense Statement. This form helps to provide a detailed overview of the beneficiary's income and expenses, offering a snapshot of financial health that can assist in the fiduciary's management decisions.

- VA Form 21P-530: Application for Burial Benefits. While not directly related to the day-to-day management of a beneficiary's estate, this form may be necessary for fiduciaries to know about, as they may assist in its completion in the unfortunate event of the beneficiary's death.

Together, these forms and documents provide a framework for the comprehensive management and oversight of a beneficiary's estate under the VA fiduciary program. Each plays a unique role in ensuring that the beneficiary's financial affairs are handled with the utmost care and in accordance with all applicable laws and regulations. By staying informed and properly utilizing these resources, fiduciaries can execute their duties effectively, promoting the well-being and financial security of those they have been entrusted to protect.

Similar forms

The SSA-623 (Social Security Administration's Representative Payee Report) is quite similar to the VA 21P 4706B form. Both require fiduciaries or representatives to report on the financial status of the beneficiary, including income received and expenses paid on their behalf. The SSA-623 also requires the representative payee to account for savings and expenditures to ensure the beneficiary's needs are met, akin to the VA form's requirement for fiduciaries to detail financial activities.

The Form 1041 (U.S. Income Tax Return for Estates and Trusts) shares similarities with the VA 21P 4706B form. Both involve the accounting of income and the management of assets within a specified period. While Form 1041 focuses on the tax implications of the estate or trust's income, the VA form is concerned with ensuring that the fiduciary properly manages the beneficiary's estate.

The HUD-1 Settlement Statement used in real estate transactions, although designed for a different purpose, parallels the VA 21P 4706B form in structure. It itemizes receipts and disbursements related to the purchase of property. Like the VA form, the HUD-1 ensures transparency and accountability for financial transactions, detailing the flow of funds between parties involved.

Form 56 (Notice Concerning Fiduciary Relationship) filed with the IRS is conceptually related to the VA 21P 4706B form. It notifies the IRS of a fiduciary's responsibility for an individual or entity, similar to how the VA form records a fiduciary's accountability for a veteran's or beneficiary's assets. Both forms serve to officially recognize the fiduciary relationship and its associated responsibilities.

The Annual Guardianship Report required by many state courts resembles the VA 21P 4706B form in purpose and content. Guardians must detail the financial status of their wards, similar to how fiduciaries report on the veteran's or beneficiary's financial situation to the VA. Both documents are tools for oversight bodies to monitor the well-being and financial management of those under guardianship or fiduciary care.

Trustee's Accounting Report, common in trust management, mirrors the VA 21P 4706B form’s objectives. Trustees are required to present a detailed account of trust activities, including income received and expenses paid, ensuring that trust assets are managed in the best interest of the beneficiaries. This is conceptually aligned with the VA form's aim of ensuring fiduciaries manage veterans' benefits responsibly.

Dos and Don'ts

When completing the VA Form 21P-4706b, accuracy and attention to detail are essential for ensuring the proper management of a veteran's or beneficiary's financial affairs under the fiduciary program. The guidelines below can assist fiduciaries in filling out the form accurately and effectively:

- Do:

- Review the form and its instructions thoroughly before starting, to ensure that you understand all requirements.

- Include detailed monthly financial statements for the entire accounting period to support all transactions noted in the accounting.

- Keep all receipts and documentation relating to the expenses and purchases made on behalf of the beneficiary, as these may be requested for review during the audit process.

- Ensure that all funds received and spent on behalf of the beneficiary are accounted for, including VA benefits, SSA benefits, and any other sources of income or expenses.

- Complete the certification section accurately, signaling that all information provided is true to the best of your knowledge and belief.

- Answer the background information questions if applicable, as failing to do so could impact your ability to serve as a VA fiduciary.

- Sign the form in ink to validate the submission, as electronic or unstamped signatures may not be accepted.

- Don't:

- Leave any sections incomplete unless specifically instructed, as missing information can delay the processing of the form.

- Forget to attach supporting documentation for financial transactions and assets, as this is crucial for the VA's review of the account.

- Include estimates or round off numbers; provide exact amounts to ensure the accuracy of the accounting.

- Omit the details of any changes in the assets, such as new purchases or sale of savings bonds, since this information is crucial for the annual accounting.

- Ignore the need to report any significant financial issues, such as defaulting on debts or filing for bankruptcy, as these can affect your standing as a fiduciary.

- Sign the form before ensuring all information is correct and that all necessary supporting documents are attached, to avoid having to submit corrections later.

- Misplace the form or delay its submission beyond the deadline, as timeliness is critical in maintaining the beneficiary's financial health and benefits.

Following these guidelines will help ensure that the VA Form 21P-4706b is filled out comprehensively and accurately, facilitating the effective management and oversight of a beneficiary's estate in accordance with VA standards.

Misconceptions

When it comes to managing the finances and assets of a beneficiary, especially for veterans and their families, the VA 21P-4706B form plays a crucial role. However, there are several misunderstandings about this form that can lead to confusion. Let's clear up some of these misconceptions.

Only financial information needs to be reported: A common misconception is that the VA 21P-4706B form solely focuses on financial transactions. While it's true that the form requires detailed accounting, including receipts and expenditures, it also necessitates information on assets at the beginning and end of the accounting period, changes in assets, and even details on the beneficiary’s personal property if applicable. This comprehensive accounting ensures the VA can fully assess the fiduciary's management of the beneficiary's estate.

The form is a one-time submission: Another misunderstanding is the belief that once submitted, there’s no need to fill out the form again. However, the VA requires fiduciaries to submit this form periodically to provide ongoing accountability for the management of a beneficiary’s estate. The frequency of submission can vary depending on the VA's requirements or if there are significant changes in the beneficiary's financial situation.

Background information is optional: Some people think that the background information section is optional or only for first-time fiduciaries. In reality, this section is crucial for maintaining the integrity of the fiduciary role. Fiduciaries need to report any criminal or financial issues that occurred during the accounting period, ensuring they remain suitable for their responsibilities. This information is critical for the VA’s decision to continue entrusting the fiduciary with the beneficiary's assets.

No need to keep receipts once the form is submitted: There's a false assumption that once the VA 21P-4706B form is completed and submitted, all documentation, such as receipts or bank statements, can be discarded. In actuality, fiduciaries must keep these records for a period, as the VA may request them for audit purposes or to resolve any discrepancies in the reported information. This documentation supports the fiduciary's accounting and ensures transparency in the management of the beneficiary's funds.

Understanding these aspects of the VA 21P-4706B form ensures that fiduciaries can accurately and effectively manage the affairs of veterans and their beneficiaries, adhering to the obligations set forth by the VA.

Key takeaways

Filling out the VA 21P-4706b form, required by the Department of Veterans Affairs (VA), involves a precise and comprehensive approach. This form serves as the fiduciary account statement, crucial for managing the finances of a veteran or beneficiary under VA care. Below are seven key takeaways to guide fiduciaries in accurately completing and utilizing this form:

- The form requires personal information about both the fiduciary and the beneficiary, including names and addresses, to ensure clear identification and communication lines.

- It is imperative to report all money received throughout the fiduciary period. This encompasses all income from VA benefits, Social Security, and any other sources on behalf of the beneficiary.

- The fiduciary must include a detailed account of money spent during the accounting period, categorizing expenses such as room and board, clothing, and personal items to maintain transparency and accountability.

- Accurate record keeping is crucial as this form mandates attaching monthly financial statements. These serve as evidence for the transactions reported and support the overall financial management of the beneficiary’s estate.

- All assets at the end of the period need to be declared. This includes checking and savings account balances, certificates of deposit, and savings bonds, providing a complete picture of the beneficiary’s financial status.

- The form acts as a legal document, with the fiduciary certifying that all information provided is true and complete to the best of their knowledge. This emphasizes the importance of honesty and diligence in the role of a fiduciary.

- It includes sections for background information on the fiduciary, addressing any potential legal or financial issues that could affect their ability to manage the beneficiary’s affairs effectively. This ensures that fiduciaries meet the VA’s integrity standards.

Understanding and correctly completing the VA 21P-4706b form is a fundamental responsibility of a VA fiduciary. It ensures the proper management and protection of a veteran's or beneficiary's finances, aligning with the VA's commitment to their well-being.

Popular PDF Forms

Police Vehicle Inspection Form Template - Set the foundation for a successful shift by confirming the presence and condition of all required equipment, from the EZ pass to the first aid kit.

How Do I Get Tsa Precheck Status - Form 2812, along with Form 2811, allows TSA to assess suitability for security-sensitive positions through a detailed check of your history.