Blank Va 26 6381 PDF Template

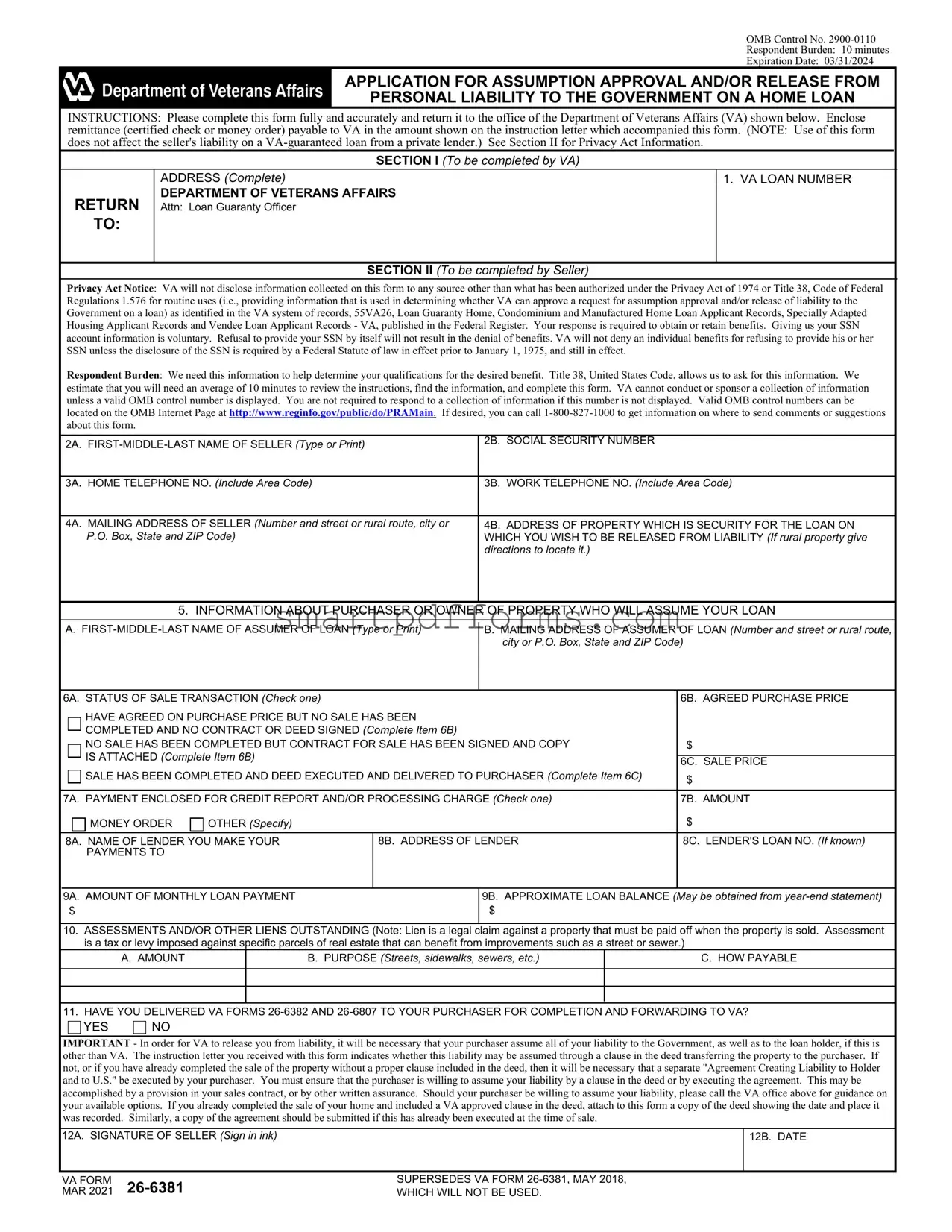

When individuals decide to transfer the responsibility of a VA-guaranteed home loan to another party, the VA Form 26-6381 becomes a crucial document in this process. Designed with the intent of streamlining the assumption approval and/or release from personal liability to the government on a home loan, this form encapsulates various essential components aimed at ensuring a smooth transition. It requires detailed information from the seller, including personal identification and the specifics of the loan to be assumed. Alongside, it mandates the disclosure of the purchaser’s details, signifies the status of the sale transaction, and outlines the financial obligations associated with the property in question. Emphasizing the importance of the transaction's legality and the seller's release from liability, the form underscores the necessity of compliance with the stipulated instructions and provision of comprehensive and precise information. The structure and content of the form reflect a synchronized effort to facilitate a significant but complex financial and legal process, balancing the interests of the seller, the purchaser, and the Department of Veterans Affairs.

Preview - Va 26 6381 Form

OMB Control No.

Respondent Burden: 10 minutes

Expiration Date: 03/31/2024

APPLICATION FOR ASSUMPTION APPROVAL AND/OR RELEASE FROM

PERSONAL LIABILITY TO THE GOVERNMENT ON A HOME LOAN

INSTRUCTIONS: Please complete this form fully and accurately and return it to the office of the Department of Veterans Affairs (VA) shown below. Enclose

remittance (certified check or money order) payable to VA in the amount shown on the instruction letter which accompanied this form. (NOTE: Use of this form does not affect the seller's liability on a

SECTION I (To be completed by VA)

RETURN

TO:

ADDRESS (Complete)

DEPARTMENT OF VETERANS AFFAIRS

Attn: Loan Guaranty Officer

1. VA LOAN NUMBER

SECTION II (To be completed by Seller)

Privacy Act Notice: VA will not disclose information collected on this form to any source other than what has been authorized under the Privacy Act of 1974 or Title 38, Code of Federal Regulations 1.576 for routine uses (i.e., providing information that is used in determining whether VA can approve a request for assumption approval and/or release of liability to the Government on a loan) as identified in the VA system of records, 55VA26, Loan Guaranty Home, Condominium and Manufactured Home Loan Applicant Records, Specially Adapted Housing Applicant Records and Vendee Loan Applicant Records - VA, published in the Federal Register. Your response is required to obtain or retain benefits. Giving us your SSN account information is voluntary. Refusal to provide your SSN by itself will not result in the denial of benefits. VA will not deny an individual benefits for refusing to provide his or her SSN unless the disclosure of the SSN is required by a Federal Statute of law in effect prior to January 1, 1975, and still in effect.

Respondent Burden: We need this information to help determine your qualifications for the desired benefit. Title 38, United States Code, allows us to ask for this information. We estimate that you will need an average of 10 minutes to review the instructions, find the information, and complete this form. VA cannot conduct or sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if this number is not displayed. Valid OMB control numbers can be located on the OMB Internet Page at http://www.reginfo.gov/public/do/PRAMain. If desired, you can call

2A. |

2B. |

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

|

3A. |

HOME TELEPHONE NO. (Include Area Code) |

3B. |

WORK TELEPHONE NO. (Include Area Code) |

|

|

|

|

|

|

4A. |

MAILING ADDRESS OF SELLER (Number and street or rural route, city or |

4B. |

ADDRESS OF PROPERTY WHICH IS SECURITY FOR THE LOAN ON |

|

|

P.O. Box, State and ZIP Code) |

WHICH YOU WISH TO BE RELEASED FROM LIABILITY (If rural property give |

|

|

|

|

directions to locate it.) |

|

|

5. INFORMATION ABOUT PURCHASER OR OWNER OF PROPERTY WHO WILL ASSUME YOUR LOAN

A.

B.MAILING ADDRESS OF ASSUMER OF LOAN (Number and street or rural route, city or P.O. Box, State and ZIP Code)

|

6A. STATUS OF SALE TRANSACTION (Check one) |

|

6B. AGREED PURCHASE PRICE |

|||||||

|

|

|

|

|

|

HAVE AGREED ON PURCHASE PRICE BUT NO SALE HAS BEEN |

|

|||

|

|

|

|

|

||||||

|

|

|

|

|

|

COMPLETED AND NO CONTRACT OR DEED SIGNED (Complete Item 6B) |

|

|||

|

|

|

|

|

||||||

|

|

|

|

|

|

NO SALE HAS BEEN COMPLETED BUT CONTRACT FOR SALE HAS BEEN SIGNED AND COPY |

$ |

|||

|

|

|

|

|

||||||

|

|

|

|

|

|

IS ATTACHED (Complete Item 6B) |

|

|

||

|

|

|

|

|

|

6C. SALE PRICE |

||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

SALE HAS BEEN COMPLETED AND DEED EXECUTED AND DELIVERED TO PURCHASER (Complete Item 6C) |

||||

|

|

|

|

|

|

$ |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

7A. PAYMENT ENCLOSED FOR CREDIT REPORT AND/OR PROCESSING CHARGE (Check one) |

7B. AMOUNT |

||||||||

|

|

|

|

|

|

MONEY ORDER |

|

OTHER (Specify) |

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|||||||

|

8A. NAME OF LENDER YOU MAKE YOUR |

8B. ADDRESS OF LENDER |

8C. LENDER'S LOAN NO. (If known) |

|||||||

|

|

|

|

|

|

PAYMENTS TO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9A. AMOUNT OF MONTHLY LOAN PAYMENT

$

9B. APPROXIMATE LOAN BALANCE (May be obtained from

$

10.ASSESSMENTS AND/OR OTHER LIENS OUTSTANDING (Note: Lien is a legal claim against a property that must be paid off when the property is sold. Assessment is a tax or levy imposed against specific parcels of real estate that can benefit from improvements such as a street or sewer.)

A. AMOUNT

B.PURPOSE (Streets, sidewalks, sewers, etc.)

C. HOW PAYABLE

11. HAVE YOU DELIVERED VA FORMS

|

YES |

|

NO |

|

|

IMPORTANT - In order for VA to release you from liability, it will be necessary that your purchaser assume all of your liability to the Government, as well as to the loan holder, if this is other than VA. The instruction letter you received with this form indicates whether this liability may be assumed through a clause in the deed transferring the property to the purchaser. If not, or if you have already completed the sale of the property without a proper clause included in the deed, then it will be necessary that a separate "Agreement Creating Liability to Holder and to U.S." be executed by your purchaser. You must ensure that the purchaser is willing to assume your liability by a clause in the deed or by executing the agreement. This may be accomplished by a provision in your sales contract, or by other written assurance. Should your purchaser be willing to assume your liability, please call the VA office above for guidance on your available options. If you already completed the sale of your home and included a VA approved clause in the deed, attach to this form a copy of the deed showing the date and place it was recorded. Similarly, a copy of the agreement should be submitted if this has already been executed at the time of sale.

12A. SIGNATURE OF SELLER (Sign in ink) |

12B. DATE |

|

|

|

|

|

|

VA FORM |

SUPERSEDES VA FORM |

||

MAR 2021 |

WHICH WILL NOT BE USED. |

||

Form Data

| Fact | Detail |

|---|---|

| Name of the Form | APPLICATION FOR ASSUMPTION APPROVAL AND/OR RELEASE FROM PERSONAL LIABILITY TO THE GOVERNMENT ON A HOME LOAN |

| OMB Control No. | 2900-0110 |

| Respondent Burden | 10 minutes |

| Expiration Date | 03/31/2024 |

| Governing Law(s) | Title 38, United States Code and Privacy Act of 1974 |

| Purpose | To determine qualifications for assumption approval and/or release from personal liability on a home loan to the Government. |

| Key Sections | Information about seller, purchaser, payment details, and instructions for transferring the property and releasing liability |

Instructions on Utilizing Va 26 6381

Completing the VA 26-6381 form is a crucial step for individuals seeking assumption approval and/or release from personal liability for a home loan. This process is instrumental in ensuring that all responsibilities and obligations are adequately transferred, providing peace of mind for the seller. To assist with this, it is essential to follow the instructions carefully and provide accurate, detailed information throughout the form. Here are the steps you need to take to ensure the form is filled out correctly.

- Locate the section titled SECTION I (To be completed by VA). Note that this section will be filled out by the Department of Veterans Affairs. Therefore, proceed to the next section.

- In SECTION II (To be completed by Seller), start with your personal details:

- For item 2A, enter your full name: FIRST-MIDDLE-LAST NAME OF SELLER.

- For item 2B, provide your SOCIAL SECURITY NUMBER.

- In items 3A and 3B, input your HOME and WORK TELEPHONE NO., including Area Codes.

- Under item 4A, write your MAILING ADDRESS (Number and street or rural route, city or P.O. Box, State, and ZIP Code).

- For item 4B, specify the ADDRESS OF PROPERTY WHICH IS SECURITY FOR THE LOAN that you wish to be released from liability.

- Detail information about the purchaser or new owner who will assume your loan under item 5:

- 5A requires the FIRST-MIDDLE-LAST NAME OF ASSUMER OF LOAN.

- 5B asks for the MAILING ADDRESS OF ASSUMER OF LOAN.

- In item 6A, check the STATUS OF SALE TRANSACTION that applies to your situation and fill in the agreed purchase price under 6B or the sale price under 6C, as applicable.

- For item 7A and 7B, provide details regarding PAYMENT ENCLOSED FOR CREDIT REPORT AND/OR PROCESSING CHARGE, including the amount.

- Items 8A to 8C request information about your lender:

- 8A: NAME OF LENDER you make your payments to.

- 8B: ADDRESS OF LENDER.

- 8C: LENDER'S LOAN NO., if known.

- Item 9A and 9B concern your loan specifics, including the AMOUNT OF MONTHLY LOAN PAYMENT and APPROXIMATE LOAN BALANCE.

- In item 10, detail any ASSESSMENTS AND/OR OTHER LIENS OUTSTANDING including the amount, purpose, and payment method.

- Item 11 inquires whether you have delivered VA forms 26-6382 and 26-6807 to your purchaser for completion and forwarding to VA. Check YES or NO.

- Finally, sign and date the form under items 12A and 12B respectively, to authenticate the application.

Once completed, review the form for accuracy and completeness. Include any required remittance and relevant documentation, such as a copy of the deed or agreement if the sale has been completed. Forward the form and all attachments to the Department of Veterans Affairs at the address provided in Section I. It’s imperative to ensure all instructions have been followed and every necessary detail has been included to facilitate a smooth approval process.

Obtain Answers on Va 26 6381

What is the VA Form 26-6381 used for?

The VA Form 26-6381 is an application that allows sellers of a property secured by a VA-guaranteed home loan to apply for assumption approval and/or release from personal liability to the government on that loan. It is a necessary step for sellers looking to be freed from liability after the sale or transfer of their property.

Who needs to fill out VA Form 26-6381?

Sellers who are interested in having another party assume their VA home loan and wish to be released from personal liability to the government must fill out this form. It is an essential document for ensuring that the seller can transfer their obligations to the purchaser legally and officially.

What information do I need to provide in the VA Form 26-6381?

Applicants need to provide personal details (including social security number), contact information, details of the property, information about the purchaser or owner assuming the loan, current loan payment details, and any outstanding assessments or liens. Additionally, sellers are required to indicate whether they have provided necessary VA forms to the purchaser for completion.

Is there a fee associated with VA Form 26-6381?

Yes, applicants are required to enclose remittance for a credit report and/or processing charge. The exact amount should be specified in the instruction letter accompanying the form.

Where do I send the completed VA Form 26-6381?

The completed form should be returned to the Department of Veterans Affairs at the address provided in the instructions or the letter accompanying the form. It is critical to ensure that the form is sent to the correct office for processing.

How long does it take to complete VA Form 26-6381?

The estimated time to review the instructions, gather the necessary information, and complete the form is about 10 minutes. However, the actual time may vary depending on the individual's access to the required information.

What happens if I don't provide my Social Security Number on VA Form 26-6381?

Providing your Social Security Number (SSN) is voluntary, and refusal to supply it will not by itself result in the denial of benefits. However, an SSN is often necessary for the processing and administration of your application, as it helps the VA to accurately identify individuals and process claims.

What should I do if I already completed the sale of my property?

If you have already completed the sale and included a VA-approved clause in the deed or executed a separate "Agreement Creating Liability to Holder and to U.S.", you must attach a copy of the deed or agreement to VA Form 26-6381. This documentation is necessary for the VA to release you from liability.

Can I complete VA Form 26-6381 online?

While the form itself does not specify online completion, applicants should check the VA’s official website or contact the VA directly to see if an online submission option is available or if there are digital versions of the form that can be submitted electronically. The availability of online services may vary.

What if the purchaser is not willing to assume my liability?

It is crucial for the seller to ensure that the purchaser is willing and able to assume liability, either through a clause in the deed or by executing an agreement. If the purchaser is unwilling, it may not be possible to proceed with the transfer of liability, and you should contact the VA office for further guidance on your available options.

Common mistakes

Filling out the VA Form 26-6381 incorrectly can delay the process of assumption approval and/or release from personal liability on a home loan. Here are ten common mistakes to avoid:

- Not completing every section of the form. Each section is important for the VA to have a full understanding of your situation.

- Entering incorrect information about the seller, such as a misspelled name or wrong social security number. Double-check these details as they are crucial for identifying your records.

- Forgetting to include contact information, including both home and work telephone numbers. The VA may need to reach you for clarifications or additional information.

- Providing an incomplete address for the mailing or property location. If your property is in a rural area, detailed directions are needed to locate it.

- Omitting details about the purchaser or owner of the property who will assume the loan. This includes their full name and mailing address.

- Skipping the status of the sale transaction or not attaching required documents, such as the contract for sale, if applicable.

- Leaving out payment information for the credit report and/or processing charge. Remember to check the appropriate box and specify the amount enclosed.

- Not specifying the name, address, and loan number of the lender to whom you make your payments. This information helps the VA communicate with the right parties.

- Ignoring information about the monthly loan payment and approximate loan balance. This financial information is key to the assumption process.

- Forgetting to answer whether you have delivered VA Forms 26-6382 and 26-6807 to your purchaser. This is critical for releasing you from liability.

In summary, carefully filling out the VA Form 26-6381 ensures that your request for assumption approval and/or release from personal liability to the government on a home loan is processed efficiently. Pay special attention to detail, provide all requested information, and double-check your entries before submission. This will help avoid unnecessary delays and complications in the approval process.

Documents used along the form

When processing a VA Form 26-6381, which is used for assumption approval and/or release from personal liability on a home loan, several other forms and documents are commonly required to ensure a smooth transaction and adherence to VA loan regulations. These documents work together to provide a comprehensive overview of the borrower's financial situation, the property details, and the terms of the loan assumption. Understanding the purpose and requirements of each document can significantly ease the submission process.

- VA Form 26-6382: This form, titled "Credit Statement of Prospective Purchaser," is used by the buyer assuming the loan. It collects detailed credit information about the buyer to determine their creditworthiness.

- VA Form 26-6807: Known as the "Financial Statement," this document provides a snapshot of the buyer's financial situation, including assets, liabilities, income, and expenses, to assess their ability to assume the loan.

- VA Form 26-1820: The "Report and Certification of Loan Disbursement" is essential for documenting the disbursement of loan proceeds, ensuring that funds have been appropriately allocated.

- Copy of the Property Deed: A certified copy of the deed to the property is required to verify ownership and the legal description of the property being transferred or assumed.

- Credit Report: A current credit report for the buyer assuming the loan is necessary to evaluate their credit history and scores, pivotal in the assumption approval process.

- Appraisal Report: An appraisal of the property ensures that it meets the VA's requirements and that the loan amount is appropriate for the property's value.

- Title Insurance Policy: This policy protects against financial loss from defects in title to real property and from the invalidity or unenforceability of mortgage liens.

- Statement of Account: A recent mortgage statement providing details about the loan balance, monthly payment amount, and payment history.

- Homeowners Insurance Policy: Evidence of current homeowners insurance is required to ensure that the property is adequately insured.

- Agreement Creating Liability to Holder and to U.S.: If applicable, this agreement is needed when the assumption does not automatically release the seller from liability, outlining the terms under which the buyer agrees to assume both the loan and the seller's liability to the lender and the government.

Collectively, these documents support and streamline the process of transferring a VA loan from the seller to the buyer, ensuring all legal, financial, and regulatory requirements are met. Individuals involved in a VA loan assumption should gather these documents as early as possible to expedite the approval process and avoid potential delays. Each document plays a crucial role in providing comprehensive information to the Department of Veterans Affairs, thereby facilitating a successful transition of loan responsibility and property ownership.

Similar forms

The VA Form 26-6381, Application for Assumption Approval and/or Release from Personal Liability to the Government on a Home Loan, shares similarities with several other documents related to mortgage and loan processes. Here are six documents that are similar to the VA Form 26-6381 and an explanation of how they are alike:

- Mortgage Application Form (Uniform Residential Loan Application): Just like the VA Form 26-6381, a Mortgage Application Form collects detailed information about the applicant(s), the property being purchased, the type of loan, and financial details essential for the loan approval process. Both forms are integral in assessing the qualifications of the borrower for the desired loan.

- Loan Assumption Agreement: This document is closely related to the VA Form 26-6381 because both involve a process where a new borrower is vetted and approved to take over the loan obligations from the current borrower. The assumption process is critical in transferring liability from one party to another without refinancing the property.

- Deed of Trust or Mortgage: Similar to Section II of the VA Form 26-6381, which must be completed by the seller, Deed of Trust or Mortgage documents also contain crucial information about the borrower, lender, and the property being used as security for the loan. These documents establish the legal framework for the mortgage and outline the conditions under which the property can be foreclosed if the loan is not repaid.

- Release of Liability Form: Like the specific request for release from personal liability in the VA Form 26-6381, a Release of Liability Form is used in various contexts to absolve one party of legal claims from another. In the mortgage context, it specifically relates to releasing a borrower from further responsibility for the loan upon fulfilling certain conditions, such as loan assumption by another party.

- Notice of Default and Intent to Foreclose: While this form serves a different purpose, it is related in the sense that it’s involved in the loan lifecycle and could be a subsequent step if the process outlined in VA Form 26-6381—such as assuming the loan—is not successfully completed. It notifies the borrower of default and the lender’s intent to proceed with foreclosure actions.

- HUD-1 Settlement Statement: Although used at the closing of a property sale, the HUD-1 Settlement Statement parallels the VA Form 26-6381 by detailing financial transactions and obligations. It itemizes the services and fees charged to the borrower and seller during the real estate transaction process, similar to how the VA form tracks transaction statuses and financial details relevant to the loan assumption and liability release processes.

Dos and Don'ts

When you're filling out the VA 26-6381 form for assumption approval and/or release from personal liability on a home loan, there are key dos and don'ts to keep in mind. Staying informed and attentive to these details can make the process smoother and help avoid common pitfalls.

Things you should do:

- Complete all sections accurately: Ensure that every piece of information you provide on the form is accurate and fully completed. Double-check details like the VA loan number, your personal information, and any financial amounts listed.

- Provide current contact information: It's essential that you list your current mailing address and both your home and work telephone numbers. This helps the Department of Veterans Affairs (VA) communicate with you efficiently throughout the process.

- Include necessary documents: If your home sale has been completed, or an agreement creating liability has been executed, attach copies of the relevant deeds or agreements to the form before submitting.

- Submit the form to the correct VA office: Pay close attention to the return address provided in Section I of the form. Sending your form to the right office ensures it is processed without unnecessary delays.

Things you shouldn't do:

- Leave sections incomplete: Failing to fill out any part of the form can lead to delays in the processing of your application. If a section does not apply to you, clearly mark it as "N/A" (not applicable).

- Forget to enclose the remittance: If a processing charge or credit report fee is required, make sure to include the appropriate remittance with your application. Check the instruction letter for details on the amount and accepted payment forms.

- Overlook the purchaser’s information: Make sure all information regarding the purchaser or owner of the property who will assume your loan is complete and accurate. This includes their full name, mailing address, and the details of the sale transaction.

- Submit outdated forms: Use the most current version of VA Form 26-6381, as outdated forms might not be accepted. Check the expiration date at the top of the form to ensure its validity.

Misconceptions

When dealing with the VA Form 26-6381, Application for Assumption Approval and/or Release from Personal Liability to the Government on a Home Loan, many misconceptions can arise. Clarifying these can help applicants navigate the process more smoothly.

- Misconception 1: Completing this form automatically releases a seller from all loan liabilities.

In reality, the form is an application for the release from liability. Approval from the VA is necessary for the release to be official.

- Misconception 2: The form affects the seller's liability with the private lender.

The form does not impact the seller's obligations to a private lender; it is specific to liabilities to the government.

- Misconception 3: Personal information provided is shared widely.

Information collected is subject to privacy protections under the Privacy Act of 1974 and is only shared for routine uses related to home loan benefits.

- Misconception 4: The Social Security Number (SSN) is mandatory.

While providing the SSN can facilitate the process, benefits will not be denied solely for refusing to provide it, unless mandated by law.

- Misconception 5: It takes a long time to complete the form.

The estimated time to finish the form is around 10 minutes, contrary to the belief that it is overly time-consuming.

- Misconception 6: A valid OMB control number is not crucial.

A valid OMB control number is necessary for the form's collection of information and should be displayed on the form.

- Misconception 7: There's a fee to submit the form.

The form itself does not require a fee for submission, though it mentions enclosing remittance for specific processing charges.

- Misconception 8: The form alone is enough for assumption approval.

Other documents and conditions, such as the purchaser's willingness and capability to assume liability, are required.

- Misconception 9: Sellers can't inquire about the form's process over the phone.

Sellers are encouraged to call the VA for information or clarification, as indicated in the form.

- Misconception 10: Any sale agreement works for assumption approval.

The form specifies that a proper clause in the deed or a separate agreement is necessary for a purchaser to assume liability.

Understanding the correct processes and requirements of the VA Form 26-6381 can significantly streamline the assumption approval and liability release processes for sellers and purchasers alike.

Key takeaways

When dealing with the VA Form 26-6381, it's important to recognize its role in the process of transferring responsibility and liability of a VA-guaranteed home loan from one individual to another. This task, although seemingly straightforward, encompasses several key takeaways for a thorough understanding and accurate completion of the form.

- The primary purpose of the VA Form 26-6381 is to request approval for the assumption of a home loan and/or to obtain release from personal liability to the government for a VA home loan. It's a crucial step for sellers who are transferring their property under a VA loan to ensure they are no longer financially responsible for the loan once it's assumed by the buyer.

- Completeness and accuracy are imperative when filling out this form. The Department of Veterans Affairs emphasizes that all sections of the form should be filled out fully and accurately to avoid delays or denial of the request. This includes personal information, details about the loan, and specifics about the property and sale transaction.

- There is a respondent burden of approximately 10 minutes indicated on the form, which suggests that it should not take a significant amount of time to complete. However, this estimated time frame assumes that the seller has all the necessary information at hand, including loan numbers, personal information, property details, and specifics of the sale.

- The requirement for a certified check or money order payable to the VA for processing charges underscores the formal and financial commitments involved in transferring loan assumption responsibilities. This fee covers the cost of processing the assumption request and is a prerequisite for the form’s submission.

- Privacy and the secure handling of personal information are assured through the Privacy Act Notice. Veterans and their families can be assured that the information provided on the form will be used solely for the purpose of determining eligibility for the assumption approval and/or release from liability. This includes controlled disclosure in alignment with federal records and regulations, ensuring that respondents' data are protected.

Understanding the intricacies of VA Form 26-6381 not only facilitates a smoother transaction for all parties involved but also safeguards the seller's financial interests. Proper completion and submission of this form are key steps in the process of property transfer under a VA loan, highlighting the combined efforts of the government and individuals to support veterans in managing their home loans effectively.

Popular PDF Forms

Var Forms - Specifies conditions under which loan fees and costs are to be paid, clarifying who bears the costs of financing.

How to Get Highschool Transcript - Helps a new school build a complete picture of a student’s educational history, including any special psychological assessments.

Acha Healthcare - Sections dedicated to referring and primary care physicians’ details, promoting a collaborative approach to patient care.