Blank Va Land Record Cover Sheet PDF Template

In the Commonwealth of Virginia, the Virginia Land Record Cover Sheet serves as an essential document distinguishing the fine details of property transactions within the state. Mandated under Virginia Code §§ 17.1-223, -227.1, -249, this form ensures that every transaction related to land, whether it's buying, selling, or otherwise, is meticulously recorded. The form is methodically divided into sections that include pertinent information such as the instrument date and type, the number of parcels involved, and detailed grantor and grantee information. It also addresses the tax status and provides fields for the recording of existing debts, actual value or assumed value, and any prior instrument details critical for accurate record-keeping. This importance is further exemplified by specifying details for additional grantors or grantees and parcels, making it comprehensive. The use of this form contributes significantly towards ensuring transparency, accuracy, and the facilitation of record-keeping and retrieval within the circuit courts, whether the land transaction occurs in a city or county jurisdiction. Evidently, this form stands as a cornerstone in the process of land transactions in Virginia, underlining the state's commitment to maintaining rigorous standards in real estate documentation and legal compliance.

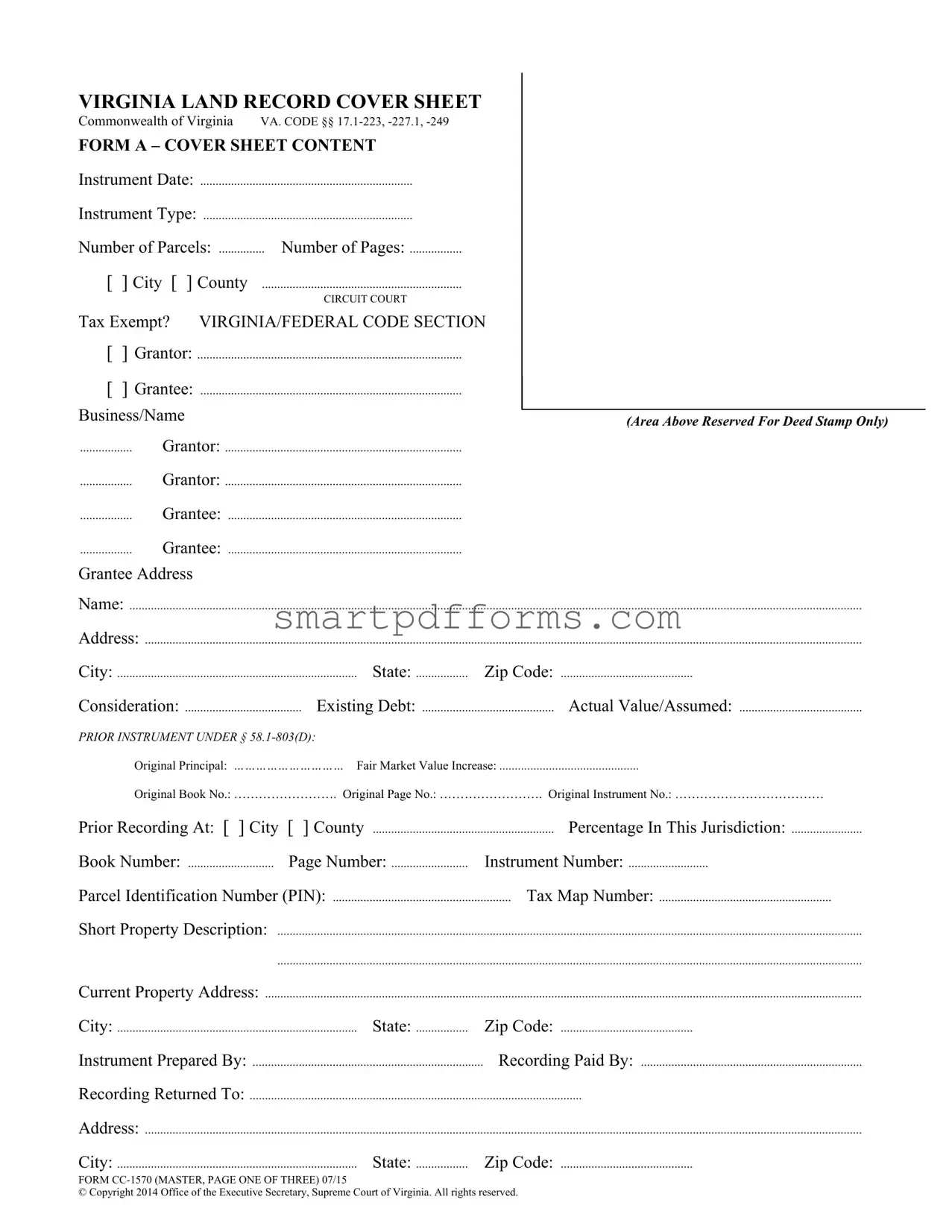

Preview - Va Land Record Cover Sheet Form

VIRGINIA LAND RECORD COVER SHEET

Commonwealth of Virginia VA. CODE §§

FORM A – COVER SHEET CONTENT

Instrument Date:

Instrument Type:

.....................................................................

....................................................................

Number of Parcels: |

Number of Pages: |

||

[ |

] City [ |

] County |

|

|

|

|

CIRCUIT COURT |

Tax Exempt? |

VIRGINIA/FEDERAL CODE SECTION |

||

[ |

] Grantor: |

||

[ |

] Grantee: |

||

Business/Name |

(Area Above Reserved For Deed Stamp Only) |

|

|

................. Grantor: |

|

.................

.................

Grantor:

Grantee:

.............................................................................

............................................................................

................. Grantee: |

............................................................................ |

|

Grantee Address |

|

|

Name: |

|

|

Address: |

|

|

City: |

State: |

Zip Code: |

Consideration: |

Existing Debt: |

Actual Value/Assumed: |

PRIOR INSTRUMENT UNDER §

Original Principal: ………………………… Fair Market Value Increase: .............................................

Original Book No.: ……………………. Original Page No.: ……………………. Original Instrument No.: ………………………………

Prior Recording At: [ |

] City [ ] County |

Percentage In This Jurisdiction: |

Book Number: |

Page Number: |

Instrument Number: |

Parcel Identification Number (PIN): |

Tax Map Number: |

|

Short Property Description: ..............................................................................................................................................................................................

|

.............................................................................................................................................................................................. |

|

Current Property Address: |

.................................................................................................................................................................................................. |

|

City: |

State: |

Zip Code: |

Instrument Prepared By: |

Recording Paid By: |

|

Recording Returned To: |

|

|

Address: |

|

|

City: |

State: |

Zip Code: |

FORM

© Copyright 2014 Office of the Executive Secretary, Supreme Court of Virginia. All rights reserved.

VIRGINIA LAND RECORD COVER SHEET

Commonwealth of Virginia VA. CODE §§

FORM B – ADDITIONAL GRANTORS/GRANTEES

Instrument Date: |

|

|

Instrument Type: |

|

|

Number of Parcels: |

Number of Pages: |

|

[ ] City [ ] County |

|

|

|

CIRCUIT COURT |

|

Grantor Business/Name |

|

|

................. Grantor: |

|

|

................. Grantor: |

|

|

|

|

|

................. Grantor: |

(Area Above Reserved For Deed Stamp Only) |

|

|

||

................. Grantor: |

|

|

................. Grantor: |

|

|

................. Grantor: |

|

|

................. Grantor: |

|

|

................. Grantor: |

|

|

Grantee Business/Name |

|

|

................. Grantee: |

|

|

................. Grantee: |

|

|

................. Grantee: |

|

|

................. Grantee: |

|

|

................. Grantee: |

|

|

................. Grantee: |

|

|

................. Grantee: |

|

|

................. Grantee: |

|

|

FORM

© Copyright 2014 Office of the Executive Secretary, Supreme Court of Virginia. All rights reserved.

VIRGINIA LAND RECORD COVER SHEET

Commonwealth of Virginia VA. CODE §§

FORM C – ADDITIONAL PARCELS

Instrument Date: |

|

Instrument Type: |

|

Number of Parcels: |

Number of Pages: |

[ ] City [ ] County |

|

|

CIRCUIT COURT |

Parcels Identification or Tax Map

Prior Recording At:

[ ] City [ |

] County |

|

|

Percentage In This Jurisdiction: |

|

|

|

|

(Area Above Reserved For Deed Stamp Only) |

||

|

|

|

|

Book Number: |

............................ Page Number: |

|

|

Instrument Number: |

|

|

|

Parcel Identification Number (PIN): |

|

|

|

Tax Map Number: |

|

|

|

Short Property Description: |

|

||

|

........................................................................................................................................................................... |

||

Current Property Address: |

|

||

City: |

State: |

Zip Code: |

|

Prior Recording At: |

|

|

|

[ ] City [ |

] County |

|

|

Percentage In This Jurisdiction: |

|

|

|

Book Number: |

............................ Page Number: |

|

|

Instrument Number: |

|

|

|

Parcel Identification Number (PIN): |

|

|

|

Tax Map Number: |

|

|

|

Short Property Description: |

|

||

|

........................................................................................................................................................................... |

||

Current Property Address: |

|

||

City: |

State: |

Zip Code: |

|

FORM

© Copyright 2014 Office of the Executive Secretary, Supreme Court of Virginia. All rights reserved.

Form Data

| Fact Name | Description |

|---|---|

| Governing Laws | The Virginia Land Record Cover Sheet is governed by VA. CODE §§ 17.1-223, -227.1, -249. |

| Purpose | The form serves as a standardized cover sheet for land records to ensure consistent documentation and filing in Virginia's Circuit Courts. |

| Instrument Date and Type | The form requires specifying the date of the instrument and the type of land record instrument being filed. |

| Parcel and Pages Count | Filers must indicate the number of parcels involved and the total number of pages of the document. |

| Tax Exemption Status | It's necessary to declare whether the transaction is tax exempt under specific Virginia or Federal code sections. |

| Grantor and Grantee Information | Details about the grantor(s) and grantee(s) including names and addresses are required on the form. |

| Financial Information | The form asks for financial details such as consideration, existing debt, actual value/assumed, among others. |

| Prior Instrument Reference | Information about any prior instrument related to the property must be provided, including original book and page numbers. |

| Parcel Identification | Parcel Identification Number (PIN) and Tax Map Number need to be included for each parcel involved. |

| Recording Information | The form requires details about who prepared, paid for, and where to return the recorded instrument. |

Instructions on Utilizing Va Land Record Cover Sheet

Completing the Virginia Land Record Cover Sheet form is a crucial step in the documentation process for individuals involved in land transactions within the state of Virginia. This form ensures accurate recording and tracking of the transaction in the public record, helping to maintain a clear history of property ownership and changes over time. The following are step-by-step instructions to accurately fill out the form.

- Start with FORM A – COVER SHEET by entering the Instrument Date, which is the date the legal document becomes effective.

- Select the Instrument Type from the provided list that best describes the legal document you are recording.

- Indicate the Number of Parcels involved and the Number of Pages the document contains.

- Choose either City or County under the CIRCUIT COURT section, depending on the location of the property.

- If applicable, mark Tax Exempt? Yes or No and provide the relevant VIRGINIA/FEDERAL CODE SECTION.

- Under Grantor(s) and Grantee(s), fill in the business/name of each party. If there are additional grantors or grantees, use FORM B – ADDITIONAL GRANTORS/GRANTEES to list them.

- Fill in the Grantee Address including Name, Address, City, State, and Zip Code.

- Enter the Consideration amount, which is the value of the trade in the transaction, Existing Debt, and Actual Value/Assumed.

- Under PRIOR INSTRUMENT, provide details of the original transaction including Original Principal, Fair Market Value Increase, and original book and page numbers.

- Fill in the Percentage In This Jurisdiction, if applicable, along with the Book Number, Page Number, and Instrument Number.

- Provide the Parcel Identification Number (PIN) and Tax Map Number.

- Write a Short Property Description and the Current Property Address.

- Complete the section on who prepared the instrument, who paid for the recording, and to whom the recording should be returned, including their complete addresses.

- If there are additional parcels involved, move to FORM C – ADDITIONAL PARCELS and repeat the process for each parcel.

- Ensure all information is accurate and complete. Sign where required and submit the form as per the local circuit court's submission guidelines.

Once you have completed filling out the form with the necessary details, your next steps involve reviewing the form for accuracy and submitting it to the relevant local government office or circuit court for recording. This process places the information into the public record, further securing legal rights to the property and ensuring all transactions are documented in accordance with Virginia state law.

Obtain Answers on Va Land Record Cover Sheet

What is the Virginia Land Record Cover Sheet?

Why is it necessary to use this cover sheet?

What types of information are required on the cover sheet?

Are there different forms within the Virginia Land Record Cover Sheet?

- Form A – Cover Sheet Content

- Form B – Additional Grantors/Grantees

- Form C – Additional Parcels

How do I determine if a transaction is tax-exempt under this form?

What is meant by "Instrument Type" on the form?

Can more than one grantor or grantee be listed on the cover sheet?

What should be done if the property involved spans multiple parcels?

Who is responsible for preparing and submitting this cover sheet?

Where can I obtain the Virginia Land Record Cover Sheet?

The Virginia Land Record Cover Sheet is a document required by the Commonwealth of Virginia for recording various types of land records in the Circuit Court. This form includes essential details about the transaction, such as the type of instrument, the parties involved (grantor and grantee), property description, and financial considerations.

It is mandated under VA. CODE §§ 17.1-223, -227.1, -249 for the organized and consistent recording of land records. It helps in the efficient processing and retrieval of records within the state's legal system. This cover sheet ensures that all necessary data are systematically captured at the time of recording.

The cover sheet requires various details including, but not limited to, the type and date of the instrument, the number of parcels and pages, information about the grantor(s) and grantee(s), property description, consideration value, existing debt, and related tax information.

Yes, there are three forms within the cover sheet document:

To determine tax exemption, refer to the VIRGINIA/FEDERAL CODE SECTION provided on the form. This section helps identify if a transaction qualifies for exemption based on federal or state law. It is advisable to consult with a legal professional or the local tax office for accurate classification.

"Instrument Type" refers to the kind of legal document being recorded, such as a deed, mortgage, lease, lien, etc. This categorization helps in identifying the nature of the transaction and assists in the proper filing and indexing of the document within the land records system.

Yes, Form B is specifically designed to list additional grantors or grantees if there are more than provided spaces on Form A. This ensures that all parties involved in the transaction are adequately recorded.

If the transaction involves multiple parcels, Form C should be used to list additional parcel information. This includes parcel identification numbers, tax map numbers, and descriptions for each parcel involved.

The cover sheet is typically prepared by the party or their legal representative who is submitting the land record for recording. The form clearly asks for the preparer's information, indicating responsibility for accurate and complete submission.

The form can be downloaded from the website of the Office of the Executive Secretary, Supreme Court of Virginia, or picked up in person at your local Circuit Court's office. Additionally, legal professionals often have access to these forms and can assist in their preparation and submission.

Common mistakes

Filling out the Virginia Land Record Cover Sheet correctly is an important step in the recording process, ensuring that land records are properly indexed and searchable. Common mistakes can delay this process, potentially affecting the legal standing of property transactions. Below are ten common errors individuals make while filling out this form:

-

Incorrect Instrument Date: Not providing the exact date on which the instrument was prepared can lead to indexing issues, making the document harder to find in future searches.

-

Failing to specify the Instrument Type clearly, such as whether it's a deed, mortgage, lease, etc., which is crucial for categorizing documents in public records.

-

Overlooking the Number of Parcels field by either leaving it blank or miscounting can result in incomplete record-keeping, affecting the legal clarity of property boundaries.

-

Misidentifying the property’s location as either City or County can lead to the document being filed in the wrong jurisdiction, potentially invalidating the recording.

-

Tax Exemption status not correctly identified, which can have financial implications and affect the validity of tax assessments for the property.

-

Confusing Grantor and Grantee names or failing to include all necessary parties, especially in transactions involving multiple stakeholders, thus muddling the ownership trail.

-

Entering incomplete or incorrect address information for either the Grantor or Grantee, which can delay or misdirect correspondence related to the property.

-

Omission of the Consideration amount, i.e., the sale price or value of the transaction, which is necessary for tax assessments and for public record completeness.

-

Failing to provide Prior Instrument details such as the original book and page number, which are essential for tracing the history of property transactions.

-

Inaccurate Parcel Identification Number (PIN) or Tax Map Number entries can misassociate property records, complicating searches and legal identifications of parcels.

Avoiding these mistakes not only ensures that your documents are recorded in a timely and accurate manner but also upholds the integrity of legal and public property records. Taking the time to double-check entries for accuracy before submission can save time, reduce confusion, and prevent unnecessary legal complications in the future.

Documents used along the form

When working with the Virginia Land Record Cover Sheet form, several other documents often play a crucial role throughout the transaction or process. Whether you're buying, selling, or simply managing property, understanding these accompanying forms can make navigating legal procedures much simpler. Here's a list of important forms and documents you might need alongside the Virginia Land Record Cover Sheet.

- Deed of Sale: This document officially transfers ownership of property from the seller (grantor) to the buyer (grantee). It includes details such as the date of sale, a description of the property, and the terms and conditions of the transfer.

- Mortgage Agreement: If the property purchase involves financing, this agreement outlines the loan details. It specifies the loan amount, interest rate, repayment schedule, and the property itself as collateral.

- Title Search Report: A title search is conducted to uncover any claims, liens, disputes, or other issues with the property's title. This report ensures the buyer receives a clear title free from encumbrances.

- Property Survey: This document provides a detailed map of the property's boundaries and dimensions. It may also highlight any encroachments or zoning issues.

- Closing Statement (HUD-1): A critical document for real estate transactions, the HUD-1 outlines all the costs and fees charged to the buyer and seller. It ensures transparency in the financial aspects of the deal.

- Home Inspection Report: Usually requested by the buyer before finalizing the purchase, this report details the condition of the property. It highlights any repairs or maintenance issues that may need attention.

- Homeowner's Insurance Policy: This insurance protects against potential damage to the property. Proof of insurance is often required by lenders before they'll approve a mortgage.

Each document listed plays a vital part in the process of recording land transactions, providing protections and clarity for all parties involved. Understanding these documents and how they complement the Virginia Land Record Cover Sheet will help ensure a smoother, more secure transaction.

Similar forms

The Virginia Land Record Cover Sheet form is a critical document in the realm of real estate and legal transactions within Virginia. This form, by nature, shares similarities with various other documents utilized in real estate and legal proceedings. Each of these documents serves as an essential tool for ensuring accuracy, legality, and clarity in transactions and recordings. Here are nine documents similar to the Virginia Land Record Cover Sheet form and how they are alike:

- Deed of Sale: Like the cover sheet, a Deed of Sale records a transfer of property from one party to another. It includes information on the grantor, grantee, property description, and transaction details, ensuring legal ownership is documented and transferred correctly.

- Mortgage Agreement: This document outlines the terms of a property loan between a borrower and a lender. Similar to the cover sheet, it includes detailed information about the property, the involved parties, and the conditions under which the loan is to be repaid. Both documents play pivotal roles in property transactions and their legal recording.

- Title Insurance Policy: The Title Insurance Policy protects against losses due to title defects. It shares similarities with the cover sheet by providing detailed information about the property, including the legal description and ownership history, to ensure the title's validity.

- Quitclaim Deed: A Quitclaim Deed transfers property ownership without warranties. It requires details about the grantor, grantee, and property, much like the land record cover sheet, to record the change in ownership officially.

- Warranty Deed: This document guarantees a property's clear title, free from liens or claims. Both the warranty deed and the cover sheet include comprehensive details about the property and parties involved in the transaction to ensure legal clarity.

- Trust Deed: A Trust Deed secures a loan on real property by transferring the property's legal title to a trustee. It parallels the cover sheet in documenting detailed information about the transaction, property, and parties involved, safeguarding interests.

- Assignment of Mortgage: This document transfers a mortgage from one party to another. Like the cover sheet, it involves recording details like the parties' names, property description, and transaction specifics to ensure the mortgage's legal standing is maintained during the transfer.

- Lease Agreement: Although primarily about property use rather than ownership, a Lease Agreement, similar to the cover sheet, details the involved parties, property description, and terms of use—ensuring clear terms of the property's occupancy and use rights.

- Release of Lien: This document is filed to show that a previously claimed lien on a property has been cleared. It resembles the cover sheet by necessitating detailed recording of the property, involved parties, and specifics of the lien to affirm the property's clear title.

Each of these documents serves to ensure that real estate transactions are conducted with the required legal certainty, protecting the interests of all parties involved. While their purposes may vary, their role in documenting and validating property transactions creates a common thread that links them closely to the Virginia Land Record Cover Sheet form.

Dos and Don'ts

When filling out the Virginia Land Record Cover Sheet form, it's important to remember that accuracy and thoroughness are key to ensuring your document is processed smoothly by the Circuit Court. Below are essential do's and don'ts to guide you through this process:

Do's:

Double-check the Instrument Date and Type: Make sure the dates are accurate and the instrument type correctly represents the transaction.

Accurately Report Parcel and Page Numbers: Incorrect information can lead to processing delays or misfiling, so ensure the number of parcels and pages accurately reflects your documentation.

Clearly Identify All Parties Involved: Both grantors and grantees should be listed with their full business names or personal names to prevent any confusion about the parties involved in the transaction.

Provide Complete Property Descriptions: The short property description and current property address must be complete and accurate to ensure there are no ambiguities regarding the property in question.

Don'ts:

Leave Blank Spaces: Failing to complete any section of the form can lead to processing delays. If a section does not apply, consider marking it as "N/A" (not applicable).

Misstate the Tax-Exempt Status: Incorrectly indicating the tax-exempt status can lead to legal and financial complications. Verify the Virginia/Federal code section if the transaction is claimed to be tax exempt.

Forget to Include Previous Instrument Information: If your transaction builds upon a previous one, providing the original book and page number, along with the instrument number, is crucial for establishing a clear chain of title.

Omit Contact Information for Recording and Returns: Ensure the 'Instrument Prepared By,' 'Recording Paid By,' and 'Recording Returned To' sections are filled out with up-to-date contact information to prevent any delays in receiving recorded documents.

By following these guidelines, parties can help facilitate a smoother transaction process and avoid common pitfalls associated with the Virginia Land Record Cover Sheet form. Remember, when in doubt, consult with a legal professional to ensure compliance with all legal requirements.

Misconceptions

When dealing with the Virginia Land Record Cover Sheet form, it’s easy to encounter misconceptions. It’s essential to understand these documents accurately to ensure proper handling and filing.

It's only for selling property: A common misunderstanding is that this cover sheet is exclusively used when property is being sold. However, it's necessary for various types of transactions, including leases, easements, and mortgages, not just the sale of land. Its purpose is to provide a standardized format for presenting details of the transaction to the circuit court.

It can be submitted without a fee: Another misconception is that there's no cost to submit this form. In reality, recording fees must be paid upon submission. These fees cover the cost of recording the document and vary depending on factors such as the number of pages and the type of transaction.

Personal information is not required: People sometimes believe that personal details, such as names and addresses of the grantor and grantee, aren't needed. This form, however, requires comprehensive information, including the business/name of both parties, their addresses, and a detailed description of the property involved to ensure accurate record-keeping and to facilitate future property searches.

One form fits all transactions: It’s wrongly assumed that a single type of cover sheet can be used for every transaction. The Virginia Land Record Cover Sheet comes in different formats: Form A for the main details, Form B for additional grantors/grantees, and Form C for additional parcels. Selecting the correct form is essential, depending on the specifics of the transaction.

Understanding and dispelling these misconceptions is crucial for anyone involved in property transactions in Virginia. The accurate completion and submission of the Virginia Land Record Cover Sheet ensure timely and correct recording of property transactions, safeguarding the interests of all parties involved.

Key takeaways

Filling out the Virginia Land Record Cover Sheet requires careful attention to detail to ensure accuracy in the land records. It acts as a key document in the land transaction process, encapsulating crucial details about the property, transaction, and the parties involved. Here are four key takeaways about filling out and using this form:

- The form captures essential information, including the date of the instrument, type of instrument, number of parcels involved, and specifics about the grantor and grantee. This systematic approach ensures that all pertinent details are recorded for legal and administrative purposes.

- Accuracy in filling out the form is paramount. This includes correctly listing the full names of the grantor(s) and grantee(s), the precise addresses, and the property description. Misinformation or errors can lead to complications in property ownership records and potential legal disputes.

- Every transaction involving the property requires a new cover sheet. This includes changes in ownership, liens, easements, and other legal instruments. By consistently updating the cover sheet with each transaction, the state maintains accurate and up-to-date land records.

- The form is required by Virginia law under VA. CODE §§ 17.1-223, -227.1, -249, underscoring its legal importance in the documentation and recording of land transactions. This mandate ensures the integrity of land records and facilitates the efficient administration of property rights.

Understanding and meticulously completing the Virginia Land Record Cover Sheet is essential for all parties involved in land transactions within the state. It serves not only as a requirement but also as a safeguard for accurate record-keeping and the protection of property rights.

Popular PDF Forms

Eviction Forms California - Requires a formal acknowledgment of the filed complaint's truth and legality, sworn before a notary public or justice court clerk.

Empire Today Coupons - Utilize the Empire Referral Form for streamlined authorization of healthcare services, excluding specific services outlined in our guidelines.

Funeral Contract Sample - Discover the emphasis on clear communication through the listing of complete contact information for the contract buyer, beneficiary, funeral home, and financial institution.