Blank Valic PDF Template

Navigating the landscape of annuity accounts involves various processes and procedures, one of which includes managing cash distributions effectively. For those holding accounts with The Variable Annuity Life Insurance Company (VALIC), based in Houston, Texas, the process is streamlined through the use of a specific form designated for these transactions - the CASH DISTRIBUTION FORM. This comprehensive document caters exclusively to VALIC Annuity Accounts across all plan types, offering a structured approach to either withdrawing funds or fully surrendering the account. Account holders are required to provide detailed personal information, including Social Security or Tax ID numbers, alongside the specifics of the distribution request which could range from partial withdrawals to full account closures. The form further delves into the reason for distribution, with sections addressing tax withholding preferences and any special instructions that might pertain to the distribution process. Notably, the form encapsulates considerations for spousal consent and plan administrator approval, adhering to regulatory compliance and ensuring all facets of the distribution are meticulously covered. For added convenience, mailing instructions are also included, detailing how and where to send the completed form. This careful orchestration of information and requirements underlines the importance of precision and clarity in managing financial transitions within annuity accounts, providing a structured pathway for account holders to navigate their distribution requests efficiently.

Preview - Valic Form

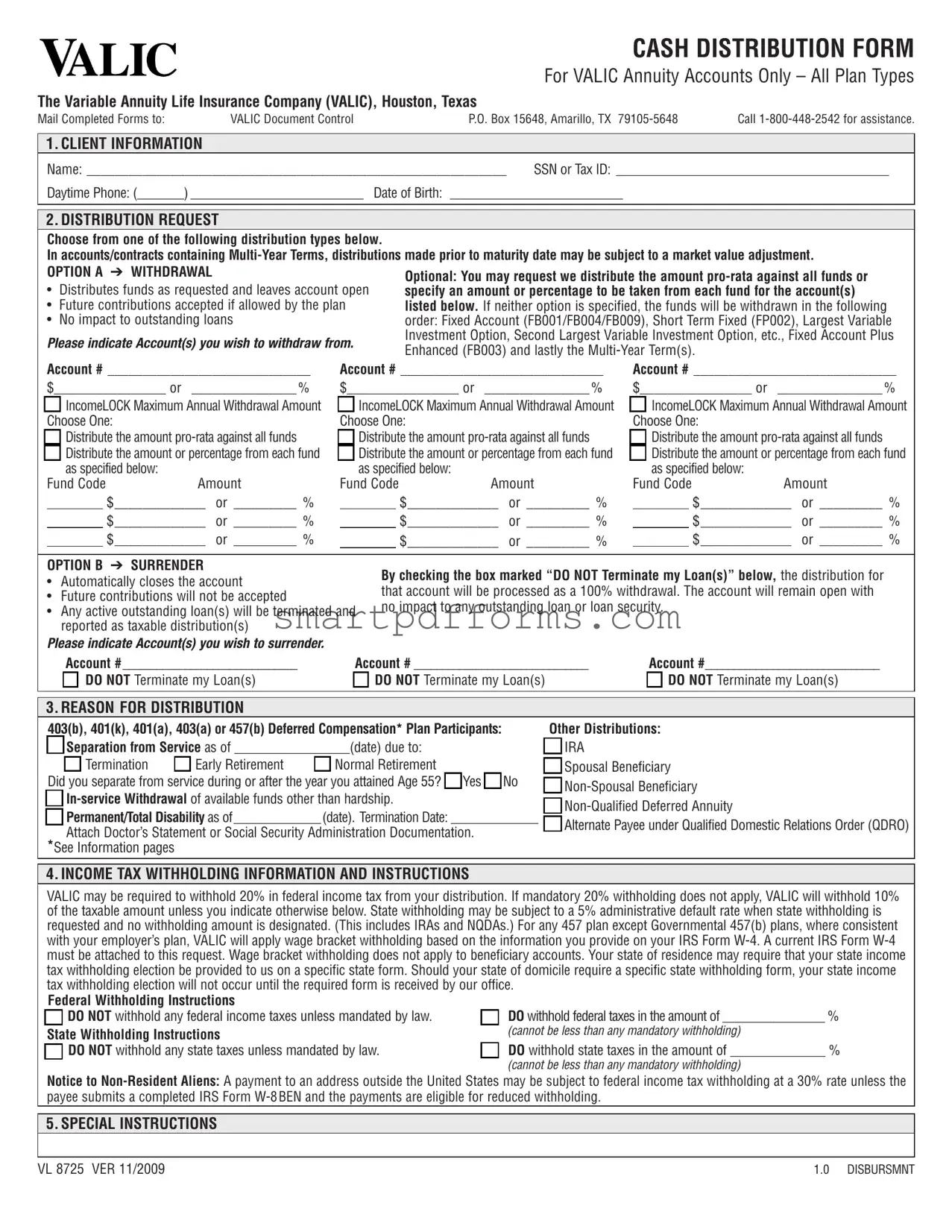

CASH DISTRIBUTION FORM

For VALIC Annuity Accounts Only – All Plan Types

The Variable Annuity Life Insurance Company (VALIC), Houston, Texas

Mail Completed Forms to: |

VALIC Document Control |

P.O. Box 15648, Amarillo, TX |

Call |

|

|

|

|

|

|

1. CLIENT INFORMATION |

|

|

|

|

Name: ____________________________________________________________ |

SSN or Tax ID: _________________________________________ |

|||

Daytime Phone: (_______) __________________________ |

Date of Birth: __________________________ |

|

||

|

|

|

|

|

2. DISTRIBUTION REQUEST

|

Choose from one of the following distribution types below. |

|

|

|

|

|

|

||||||

|

In accounts/contracts containing |

||||||||||||

|

OPTION A ➔ WITHDRAWAL |

|

|

|

|

|

|

|

|

|

|||

|

|

|

Optional: You may request we distribute the amount |

|

|||||||||

|

• |

Distributes funds as requested and leaves account open |

|

||||||||||

|

specify an amount or percentage to be taken from each fund for the account(s) |

|

|||||||||||

|

• |

Future contributions accepted if allowed by the plan |

listed below. If neither option is specified, the funds will be withdrawn in the following |

|

|||||||||

|

• |

No impact to outstanding loans |

|

|

|

order: Fixed Account (FB001/FB004/FB009), Short Term Fixed (FP002), Largest Variable |

|

||||||

|

Please indicate Account(s) you wish to withdraw from. |

Investment Option, Second Largest Variable Investment Option, etc., Fixed Account Plus |

|

||||||||||

|

Enhanced (FB003) and lastly the |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Account # _____________________________ |

Account # _____________________________ |

|

Account # _____________________________ |

|||||||||

|

$________________ or _______________ % |

$________________ or _______________ % |

|

$________________ or _______________ % |

|||||||||

|

|

IncomeLOCK Maximum Annual Withdrawal Amount |

|

IncomeLOCK Maximum Annual Withdrawal Amount |

|

|

|

IncomeLOCK Maximum Annual Withdrawal Amount |

|||||

|

Choose One: |

Choose One: |

|

Choose One: |

|||||||||

|

|

|

Distribute the amount |

|

|

|

Distribute the amount |

|

|

|

Distribute the amount |

||

|

|

|

|

|

|

||||||||

|

|

|

Distribute the amount or percentage from each fund |

|

|

|

Distribute the amount or percentage from each fund |

|

|

|

Distribute the amount or percentage from each fund |

||

|

|

|

as specified below: |

|

|

as specified below: |

|

|

|

as specified below: |

|||

Fund Code |

Amount |

Fund Code |

Amount |

Fund Code |

Amount |

||||||

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

|

|

|

|

|

|

|

|

|

|

OPTION B ➔ SURRENDER |

|

By checking the box marked “DO NOT Terminate my Loan(s)” below, the distribution for |

||||

• Automatically closes the account |

|

|||||

|

that account will be processed as a 100% withdrawal. The account will remain open with |

|||||

• Future contributions will not be accepted |

|

|||||

|

no impact to any outstanding loan or loan security. |

|||||

• Any active outstanding loan(s) will be terminated and |

||||||

|

|

|

||||

reported as taxable distribution(s) |

|

|

|

|

||

Please indicate Account(s) you wish to surrender. |

|

|

|

|

||

|

Account # _______________________________ |

Account # _______________________________ |

Account #_______________________________ |

|||

|

DO NOT Terminate my Loan(s) |

|

DO NOT Terminate my Loan(s) |

|

DO NOT Terminate my Loan(s) |

|

|

|

|

||||

3. REASON FOR DISTRIBUTION

403(b), 401(k), 401(a), 403(a) or 457(b) Deferred Compensation* Plan Participants: |

|

|

||||||||||||

|

|

Separation from Service as of _________________(date) due to: |

|

|

|

|||||||||

|

|

|

Termination |

|

Early Retirement |

|

Normal Retirement |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||||

Did |

you separate from service during or after the year you attained Age 55? |

|

Yes |

|

No |

|

||||||||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|||||||||

|

|

Permanent/Total Disability as of_____________ (date). Termination Date: _____________ |

|

|

|

|||||||||

|

|

|

||||||||||||

|

|

Attach Doctor’s Statement or Social Security Administration Documentation. |

|

|

|

|||||||||

|

|

|

|

|

||||||||||

*See Information pages

Other Distributions:

IRA

Spousal Beneficiary

Alternate Payee under Qualified Domestic Relations Order (QDRO)

4. INCOME TAX WITHHOLDING INFORMATION AND INSTRUCTIONS

VALIC may be required to withhold 20% in federal income tax from your distribution. If mandatory 20% withholding does not apply, VALIC will withhold 10% of the taxable amount unless you indicate otherwise below. State withholding may be subject to a 5% administrative default rate when state withholding is requested and no withholding amount is designated. (This includes IRAs and NQDAs.) For any 457 plan except Governmental 457(b) plans, where consistent with your employer’s plan, VALIC will apply wage bracket withholding based on the information you provide on your IRS Form

Federal Withholding Instructions |

DO withhold federal taxes in the amount of ________________ % |

DO NOT withhold any federal income taxes unless mandated by law. |

State Withholding Instructions

DO NOT withhold any state taxes unless mandated by law.

(cannot be less than any mandatory withholding)

DO withhold state taxes in the amount of ______________ %

(cannot be less than any mandatory withholding)

Notice to

5. SPECIAL INSTRUCTIONS

VL 8725 VER 11/2009 |

1.0 DISBURSMNT |

CASH DISTRIBUTION FORM

For VALIC Annuity Accounts Only – All Plan Types

The Variable Annuity Life Insurance Company (VALIC), Houston, Texas

Mail Completed Forms to: |

VALIC Document Control |

P.O. Box 15648, Amarillo, TX |

Call |

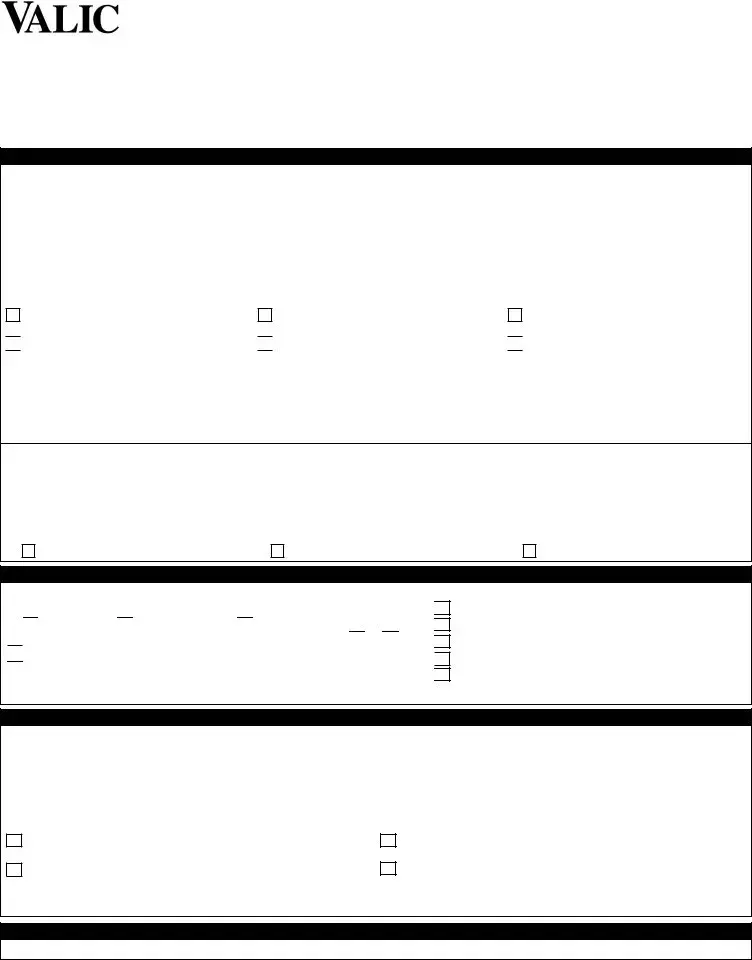

6. MAILING INSTRUCTIONS

The distribution will be mailed to your permanent address on record unless otherwise indicated below or unless your Plan requires that the check be returned to the employer:

___________________________________________________________ _____________________________ ___________ |

_______________ |

|||||||||

Street Address |

City |

|

|

State |

ZIP |

|||||

|

|

|

Check if the above is your new permanent address. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Send check by overnight delivery. I understand, by providing my credit card number below, that there will be a charge billed to my credit card for |

|||||||

|

|

|

this service and that a street address is required. If the credit card charge is not approved, the check will be sent by regular mail. |

|

|

|||||

|

|

|

|

|

|

|

Master Card |

|

|

Visa |

|

|

|

|

|

|

|

|

|

||

Card # __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ |

Expiration Date: ______________ |

|

|

American Express |

|

|

||||

|

|

|

||||||||

7. SPOUSAL CONSENT

REQUIRED FOR CLIENT: Client Marital Status |

|||||||

|

|

|

|

Not Married |

|

Married |

Legally Separated: Attach Court Order of Legal Separation (petition not acceptable) |

|

|

||||||

|

|

|

|

Missing Spouse: |

I |

hereby affirm |

that I have made reasonable attempts to locate my spouse and have not been able to do so. |

REQUIRED FOR SPOUSE: Spousal Consent

Under federal law for ERISA plans and the terms of some employer plans, as the spouse of the contract owner, you have the right to receive a survivor benefit of at least 50% of the amount in this contract if your spouse dies before you. As a result, your spouse must have written consent before making withdrawals from this contract. If you consent to the withdrawal, you will not receive a survivor benefit payment from VALIC for the amount withdrawn. If you agree to the withdrawal, please read and sign the statement below and have your signature witnessed.

•I have read and understand the Information pages and I agree to the payment of funds from the contract(s) listed in Section 2.

•I understand and agree that I am giving up my right to receive a survivor benefit payment from VALIC for the amount being paid and I release VALIC from all liability for making this payment.

Spouse’s Signature: ___________________________________ Date: _________________

SPOUSE’S SIGNATURE WITNESSED BY NOTARY PUBLIC

This section is only to be used for a Notary Public’s witnessing of the Spousal Consent in absence of the Plan Administrator’s Witness.

State of _________________ County of _____________ On this _____ day of _________________, year of _______

Before me personally appeared __________________________________ (name of spouse) known to me to be the person

who executed the SPOUSAL CONSENT and he/she acknowledged to me that he/she executed the same.

Notary Public __________________________________________________________

8. VESTING DETERMINATION FOR EMPLOYER CONTRIBUTION SOURCES

Vesting Information: To be completed by the employer sponsoring the plan if VALIC is NOT providing full plan administration services.

Employer Basic Vested ____________% Employer Supplemental/Matching Vested ____________%

All Employers: Indicate hours worked if Hours of Service is used by your plan to calculate benefits. Indicate months worked if Elapsed Time is used by your plan to calculate benefits. Any month in which an employee was compensated for one hour must be counted as a month worked.

Hours Worked ______________ or Months Worked _______________ or $ _______________

9. PLAN ADMINISTRATOR APPROVAL

To be completed where required under your employer’s plan.

•I approve this distribution in accordance with current plan provisions and all applicable laws and regulations.

•I verify that the information provided on this form for purposes of this distribution is correct to the best of my knowledge.

•If applicable, the client has established to my satisfaction that spousal consent is not required.

•I affirm that any signature of a client’s spouse in Section 7 of this form has been witnessed either by me or by a Notary Public.

Plan Administrator’s Signature: __________________________________________________________ Date: _______________________________

10. CLIENT APPROVAL

•I authorize the above distribution and certify that all statements, including marital statements, are complete and accurate to the best of my knowledge and belief.

•I have read and understand the information provided in the Information pages of this form, including IncomeLOCK Option if applicable, and acknowledge that distributions may be subject to surrender charges as provided in the contract and that this distribution may result in taxable income and penalties.

•I have read and understood the “Joint and Survivor Annuity and Qualified Annuity Benefit” section of the Information pages. By signing below I am agreeing to waive any benefit or right described in that section that would have been provided with respect to the amount that I am withdrawing. I also understand that I have the right to revoke any waiver if a distribution has not already been made.

•I understand that I will be responsible for providing evidence to the IRS, if required, to verify distribution reason.

•If this distribution will result in a total surrender of my account(s), I have attached my Contract/Certificate to this form, or alternatively, I certify that my Contract/ Certificate has been lost or destroyed. If my Contract/Certificate is not attached, I agree to indemnify VALIC against any claims that may be asserted on the basis of the Contract/Certificate being found and presented for payment.

Note: If you borrow, surrender, or withdraw any funds from your contract, the guaranteed elements,

Client’s Signature: ____________________________________________________________________ |

Date: _________________________________ |

|

|

VL 8725 VER 11/2009 |

1.0 DISBURSMNT |

CASH DISTRIBUTION FORM

For VALIC Annuity Accounts Only – All Plan Types

The Variable Annuity Life Insurance Company (VALIC), Houston, Texas

Mail Completed Forms to: |

VALIC Document Control |

P.O. Box 15648, Amarillo, TX |

Call |

|

|

|

|

INFORMATION

SPECIAL TAX NOTICE

You have the right to at least 30 days to consider your alternatives after receiving this notice. You may waive this review period. Your signature on this form will indicate that either you have had this

ELIGIBLE ROLLOVER DISTRIBUTIONS

The information in this notice applies to qualified plans,

Most withdrawals from

Roth 403(b) or 401(k) accounts may be rolled over only to another Roth account or to a Roth IRA. However, Roth IRAs may not be rolled over to a Roth 403(b) or Roth 401(k) account.

ROLLOVERS OF BENEFICIARY ACCOUNTS

Only (1) the participant, or (2) in the case of the participant’s death, the participant’s surviving spouse, or (3) in the case of a domestic relations order, the participant’s spouse or

of eligible retirement plans. The distribution must be transferred to the Beneficiary IRA in a direct

DISTRIBUTABLE EVENT

Generally a distributable event includes attainment of age 59½ (age 70½ for governmental 457(b) plans), separation from service, disability or death. However, the employer’s plan may place additional restrictions that must also be met prior to a distribution. If you have met a distributable event, you may request a rollover of funds to any eligible plan type or a transfer to a like plan type. If you wish to move funds from your VALIC 403(b) account to another 403(b) account via a rollover distribution, and have made contributions prior to

ROLLOVER/TRANSFER

Rollover Distributions: If you have met a distribute event on your eligible account(s) or plan you may roll directly to an eligible retirement plan with another carrier. The distribution will not be taxed but will be reported to the IRS. Rollover amounts due to a distributable event generally can remain free of withdrawal restrictions after moving to the receiving plan, unless the receiving plan applies restrictions to rollover amounts.

Transfers: Transfers to a like plan will not be taxed or reported to the IRS. Generally, transfers are allowed regardless of employment status. However, your employer’s plan may restrict you to authorized carriers. Transferred amounts generally become subject to the requirements of the plan receiving the transfer as though originally contributed to that plan. Exchanges of

EXAMPLES OF SOME POSSIBLE DIFFERENCES IN PLAN RESTRICTIONS

•The new plan may require spousal consent or plan administrator approval for distributions.

•The new plan may restrict distributions.

•Distributions from a governmental 457(b) deferred compensation plan are generally not subject to the 10% premature withdrawal penalty regardless of your age at the time of the distribution. If you roll your governmental 457(b) deferred compensation plan to another plan that is not a governmental 457(b) deferred compensation plan, or into an IRA, any subsequent distributions may be subject to a 10% premature withdrawal penalty.

•Eligible rollovers into a governmental 457(b) deferred compensation plan that were previously subject to a 10% premature withdrawal penalty will continue to be subject to that penalty at the time of withdrawal unless you are over age 59½ or some other exception applies.

•Amounts rolled over to a governmental 457(b) plan generally cannot be withdrawn prior to separation from service or attainment of age 70½ unless the plan allows.

ELIGIBLE ROLLOVER DISTRIBUTIONS PAID DIRECTLY TO YOU

You can request that we pay you directly. Except for IRA distributions, when we pay you directly, federal law requires us to withhold 20% for federal income taxes.

If a distribution is paid directly to you, you may subsequently roll over any

If your eligible rollover distribution is paid directly to you and not rolled over (including any amount withheld), the distribution will be taxable to you in the year you receive it. The distribution will not be taxable to the extent you roll other funds to replace the amount distributed and the amount withheld.

AMOUNTS NOT ELIGIBLE FOR ROLLOVER

Some amounts not eligible for rollover include these: amounts paid from a

If you direct us to pay the distribution to you, and it is not an eligible rollover distribution, we will apply 10% federal income tax withholding unless you indicate differently.

LOANS

If you request a total surrender of your

INCOMELOCK OPTION

If you have chosen the IncomeLOCK living benefit option, withdrawals from the contract will reduce the account value and all benefits of the IncomeLOCK

10% PENALTY

Unless an exception applies, the IRS may also assess a 10% federal tax penalty for early distributions if you are younger than age 59½.

VL 8725 VER 11/2009

CASH DISTRIBUTION FORM

For VALIC Annuity Accounts Only – All Plan Types

The Variable Annuity Life Insurance Company (VALIC), Houston, Texas

Mail Completed Forms to: |

VALIC Document Control |

P.O. Box 15648, Amarillo, TX |

Call |

|

|

|

|

SPECIAL TAX TREATMENT FOR CERTAIN

If you were born before January 1, 1936, and if your qualified plan distribution qualified as a

TAXATION OF ROTH IRAS AND ROTH ACCOUNTS

Contributions to Roth IRAs and Roth accounts are not deductible and therefore are distributed

*PRIVATE

Section 457(b) deferred compensation plans sponsored by private

QUALIFIED JOINT AND SURVIVOR ANNUITY AND QUALIFIED ANNUITY BENEFIT: FOR ERISA PLANS ONLY

This notice should be provided to you at least 30 days, but no more than 180 days, before your proposed distribution date.

If you are married, your retirement plan distributions will be paid to you in the form of a Qualified Joint and Survivor Annuity (“QJSA”) unless you elect a different form of distribution. Under your QJSA, if your spouse survives you, the plan will pay him or her at least 50% of the amount the plan had been paying to you, on the same frequency as the payments to you. If you are not married, your benefit will be paid monthly over your life and will end upon your death unless you elect a different form of distribution. This benefit is referred to as a Qualified Annuity Benefit (“QAB”).

The plan may satisfy the QJSA or QAB by using your vested account balance to purchase an annuity contract from an insurance company. The actual monthly payments made under the annuity contract will depend on the value of your account balance, annuity purchase rates used by the insurance company, your age, and if you are married, your spouse’s age at the time the distribution begins.

The following table reflects the relative values of monthly payments from a Joint and Survivor Annuity and a Life Annuity, assuming a vested account balance of $5,000 and an interest rate of 6%. This table is based on the Annuity 2000 Mortality tables. The table is hypothetical and does not reflect the value of your individual benefit or the actual payments you or your beneficiaries would receive. Please note that as the ages change, the payment amount will change. If none of the examples closely approximates your situation, you may obtain a more accurate value specific to your situation from your plan administrator or from your financial advisor.

Age at Benefit Starting Date

Annuitant |

70 |

65 |

60 |

55 |

50 |

45 |

40 |

35 |

Spouse |

65 |

70 |

55 |

60 |

45 |

50 |

35 |

40 |

Monthly Payment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annuitant Life |

|

|

|

|

|

|

|

|

Only |

39.62 |

35.35 32.38 |

30.27 |

28.75 |

27.61 |

26.76 |

26.13 |

|

Joint and |

|

|

|

|

|

|

|

|

50% Survivor |

35.47 |

33.65 30.21 |

29.26 |

27.53 |

26.99 |

26.07 |

25.76 |

|

|

|

|

|

|

|

|

|

|

Joint and |

|

|

|

|

|

|

|

|

75% Survivor |

33.71 |

32.86 |

29.23 |

28.78 |

26.95 |

26.70 |

25.73 |

25.58 |

This QJSA or QAB requirement may not apply to smaller account balances (generally below $5,000) and will not apply if you have elected another form of benefit. A partial withdrawal would be considered another form of benefit for this purpose. Other alternate forms of benefits that may be available under your employer’s plan and under your plan investments may include:

Annuity

An annuity can provide you with payments for your life or for your life and that of your beneficiary; payments for a specified period; payments for your lifetime with a minimum guaranteed period; or a continuation of payments to your surviving spouse that is different from the plan’s percentage of

the payments made to you. Generally, the more that the form of payment guarantees, such as a minimum period of payments, or payments to your surviving spouse or to another beneficiary, the more that specified benefit amount will cost. There are IRS rules that may limit the period during which payments may be made.

Lump Sum Distribution

If you elect a lump sum distribution, your benefit will be paid to you in one payment. The amount of your benefit is the vested portion of your account balance as of the valuation date used to calculate your distribution.

Installments

If you elect to receive your benefits in installments, you may specify the dollar amount and frequency of your payments. The period of time over which you receive these installments cannot be greater than your life expectancy or the joint life and last survivor expectancy of you and your designated beneficiary. There are other IRS rules that may further limit the period over which you receive payments.

In order to elect one of these alternative forms of benefits you must waive your right to the QJSA or QAB, and if you are married, your spouse must also consent in writing. In addition, this written consent must be witnessed by a Notary Public or by your Plan Administrator. You are entitled to 30 days (but no more than 180 days) within which to make this decision. Although you have at least 30 days to make this decision, under some circumstances, you may waive this minimum

The investment options available to you, the right to change investment options, and the fees imposed under the investment options will not be affected by your decision to defer distributions.

VL 8725 VER 11/2009

Form Data

| Fact Name | Detail |

|---|---|

| Purpose of Form | CASH DISTRIBUTION FORM For VALIC Annuity Accounts Only – All Plan Types |

| Issuer | The Variable Annuity Life Insurance Company (VALIC), Houston, Texas |

| Submission Address | VALIC Document Control P.O. Box 15648, Amarillo, TX 79105-5648 |

| Assistance Contact Number | Call 1-800-448-2542 for assistance. |

| Distribution Types | Option A: WITHDRAWAL Option B: SURRENDER |

| Market Value Adjustment Clause | In accounts/contracts with Multi-Year Terms, distributions made prior to maturity date may be subject to a market value adjustment. |

| Withdrawal Options | Funds can be distributed pro-rata across all funds or from specified amounts or percentages from each fund. |

| Surrender Consequences | Automatically closes the account, future contributions will not be accepted, and any active outstanding loans will be terminated and reported as taxable distribution(s). |

| Income Tax Withholding & Instructions | 20% federal income tax withholding is mandatory unless otherwise stated. State withholding may apply at a 5% administrative default rate when requested and no amount designated. |

| Special Tax Notice | Eligible rollover distributions and their tax implications are covered, including direct payment to individuals (subject to 20% federal withholding) and transfer options. |

Instructions on Utilizing Valic

Filling out the Valic Cash Distribution Form is an important step in managing your VALIC Annuity Accounts. It's essential to complete this form accurately to ensure that your distribution request is processed smoothly and according to your wishes. This form allows you to request either a partial withdrawal from your account, maintaining the account's active status for potential future contributions, or a full surrender of the account, which closes it. You'll also provide information regarding taxation and special instructions for the disbursement method. Follow these steps to fill out your form accurately:

- Start with the CLIENT INFORMATION section. Fill in your name, Social Security Number (SSN) or Tax ID, daytime phone number, and date of birth.

- In the DISTRIBUTION REQUEST section, choose either option A for withdrawal or option B for surrender. If selecting option A, specify whether you want the distribution to be pro-rata across all funds or from specific funds. Provide account numbers and the amount or percentage to be withdrawn. For option B, indicate which account(s) you wish to surrender completely.

- Under REASON FOR DISTRIBUTION, mark the reason that applies to you, such as separation from service, early retirement, normal retirement, etc. Specify the date and, if applicable, attach any required documentation.

- Complete the INCOME TAX WITHHOLDING INFORMATION AND INSTRUCTIONS section. Decide if you want federal and/or state taxes withheld according to the options provided, and fill in the appropriate percentage(s).

- In the SPECIAL INSTRUCTIONS section, if you have any, note down how you would like the distribution process to be handled uniquely.

- For the MAILING INSTRUCTIONS, indicate whether the distribution should be mailed to a different address than the one on record or if you prefer overnight delivery. Provide the relevant details.

- If applicable, fill in the SPOUSAL CONSENT section, which requires acknowledging your marital status and, if married, obtaining your spouse's consent for the distribution.

- The VESTING DETERMINATION FOR EMPLOYER CONTRIBUTION SOURCES section should be filled out if your employer does not provide full plan administration services. Your employer may need to complete this section.

- Have the PLAN ADMINISTRATOR APPROVAL signed and dated where necessary according to your employer’s plan requirements.

- Finally, sign and date the CLIENT APPROVAL section, indicating your authorization for the distribution, your understanding of the potential impacts, and if applicable, that your Contract/Certificate is either attached or lost/destroyed.

Once completed, review the form to ensure all information is accurate and complete. Mail the signed and dated form to the address provided at the top of the form. Remember to call the number provided on the form if you need assistance at any step of the process. Handling this form with care and attention to detail will help facilitate a smooth transaction for your VALIC Annuity Accounts.

Obtain Answers on Valic

What is the VALIC Cash Distribution Form used for?

This form is utilized specifically for requesting cash distributions from VALIC Annuity Accounts, suitable for all plan types. It allows account holders to dictate how they wish to receive funds, be it through withdrawal or complete surrender of the account, among other specified options.

How do I submit the VALIC Cash Distribution Form?

Completed forms should be mailed to VALIC Document Control at P.O. Box 15648, Amarillo, TX 79105-5648. Assistance can be availed by calling 1-800-448-2542.

What are the distribution options available on the VALIC form?

There are two primary options: OPTION A for withdrawals and OPTION B for complete surrender of the account. Withdrawals allow for partial disbursement of funds and the possibility of future contributions, whereas surrendering the account closes it and future contributions are not accepted.

Can I select how the withdrawal amount is distributed across different funds?

Yes, during a withdrawal request, you can specify whether the funds should be distributed pro-rata across all funds or from specific funds identified by their code along with the amount or percentage from each.

What considerations should be taken regarding outstanding loans when surrendering an account?

If you opt for account surrender, you can choose not to terminate existing loans. This means the account will be processed as a 100% withdrawal but will remain open to ensure any outstanding loans are preserved without being deemed as taxable distributions.

What are the possible reasons for distribution listed on the form?

- Separation from Service

- Early or Normal Retirement

- In-service Withdrawal

- Permanent/Total Disability

- And others, such as IRA, Spousal or Non-Spousal Beneficiary, etc.

How does income tax withholding apply to distributions?

VALIC may withhold 20% for federal income taxes by default, with possible variations depending on the type of plan. You can specify a different withholding percentage if desired. State withholding might also apply and can vary based on your state of residence.

What are special instructions and mailing instructions on the form?

Special instructions allow for any additional directions not covered by the form. Mailing instructions specify where and how you wish to receive the distribution, including options for changing your permanent address or expedited delivery.

Is spousal consent required for distribution?

For certain plan types, especially those covered under ERISA, indicating marital status and obtaining spousal consent are necessary for distributions. This ensures compliance with federal regulations regarding retirement benefits and the rights of spouses.

Common mistakes

Failing to specify distribution instructions: People often overlook specifying how they want their distributions made, such as pro-rata against all funds or from specific funds, leading the funds to be withdrawn in a default order that may not align with their preferences.

Incorrectly filling out client information: It's common for individuals to make errors in the client information section, particularly with their Social Security Number (SSN) or Tax ID. Such mistakes can delay the processing of the distribution request.

Omitting the required spousal consent form: For married individuals the form necessitates spousal consent for distributions in certain cases. Skipping this step can invalidate the request.

Overlooking tax withholding instructions: Individuals often neglect to indicate their preference for federal and state tax withholdings. This oversight can lead to automatic withholding at default rates, which might not be suitable for their tax situation.

Not attaching necessary documentation: Specific distribution reasons, like Permanent/Total Disability, require attaching proof such as a doctor’s statement or Social Security Administration documentation. Failure to attach these documents can lead to delays or denial of the distribution.

Choosing incorrect or unclear distribution types: Mistakes in selecting the correct distribution option or not clearly indicating the choice between a withdrawal and surrender can result in processing errors or unexpected closure of the account.

Ensuring accurate and complete form submissions is crucial for a smooth and efficient processing of any distribution request from VALIC annuity accounts. Taking time to review the form thoroughly before submission can help avoid these common mistakes.

Documents used along the form

When handling financial or retirement planning, it's common to encounter several forms and documents alongside the VALIC Cash Distribution Form. Each of these plays a crucial role in ensuring your financial transactions are executed smoothly and align with your goals and regulations. Let's briefly explore some of these often-used documents.

- Beneficiary Designation Form: This document allows you to designate or change the beneficiaries who will receive your account's value upon your demise. It's essential for ensuring that your financial assets are distributed according to your wishes.

- IRS Form W-4P: Necessary for determining the amount of federal income taxes to withhold from your pension or annuity payments. It's crucial for managing your tax obligations on distributions.

- IRS Form W-8BEN: Required for non-U.S. residents to certify their foreign status and claim any benefits under the tax treaty between their country and the United States, potentially reducing withholding tax rates.

- Rollover Form: Used when moving funds from one retirement plan to another (e.g., from a 401(k) to an IRA) without incurring immediate tax penalties. It's vital for maintaining the tax-deferred status of your retirement savings.

- Loan Application Form (for plans allowing loans): Required when you intend to borrow against the savings in your retirement account. It outlines the terms under which you can borrow and repay the loan.

- Spousal Consent Form: Needed in some retirement accounts for certain transactions if you're married. It ensures that your spouse agrees to decisions that might affect their rights to benefits from the account.

Understanding and accurately completing these forms can significantly impact your financial planning and legal obligations. Each document serves a purpose, whether it's about taxes, beneficiary management, or the transfer of funds between accounts. Handling these forms with care ensures that your financial decisions align with your goals, legal requirements, and tax obligations, helping to secure a stable financial future.

Similar forms

401(k) Distribution Form: Similar to the Valic form in structuring options for withdrawing or rolling over funds from retirement accounts. Both require client information, detail on distribution request, and provide instructions for tax withholding.

403(b) Transaction Request Form: Aligns closely with the Valic form by facilitating transactions such as loans, distributions, or rollovers within a retirement savings plan. It usually requires client identification, reason for distribution, and spousal consent if applicable.

IRA Distribution Form: Similar because it allows for the withdrawal of funds from an Individual Retirement Account, often requiring the account holder's information, tax withholding preferences, and understanding of potential penalties.

Annuity Withdrawal Form: This form mirrors the Valic form in function, offering an option to take money from annuity contracts. It would include personal identification, amount to withdraw, and tax information.

457 Plan Distribution Request: Closely related as it provides options for distributions from a 457 deferred compensation plan, including details on reason for distribution, tax considerations, and financial institution instructions.

Qualified Domestic Relations Order (QDRO) Distribution Form: While used for a specific purpose—to split retirement benefits upon divorce—it shares with the Valic form the necessity to detail account information, specify distribution amounts, and understand tax impacts.

Pension Plan Withdrawal Form: It's akin to the Valic form by guiding clients through withdrawing funds from pension plans, demanding details on the participant, choice of withdrawal, and insight into potential financial consequences.

Non-Qualified Deferred Compensation Distribution Form: Similar in that it facilitates withdrawals from a non-qualified plan, requiring disclosure of the participant's information, distribution reasons, and understanding of tax withholding requirements.

Spousal Consent Form for Retirement Distribution: Though more specific, this document parallels sections of the Valic form where spouse's approval is necessary for distribution, focusing on marital status verification, spousal acknowledgment, and consent procedures.

Rollover Certification Form: Comparable to parts of the Valic form dealing with rollovers, it ensures that funds being moved adhere to IRS regulations, necessitating client acknowledgment of the rollover implications and tax effects.

Dos and Don'ts

When filling out the Valic Cash Distribution Form for Annuity Accounts, it's crucial to approach the process with attention to detail and an understanding of what to do and what to avoid. Here are some guidelines to help ensure the form is completed accurately and efficiently:

- Do read the form thoroughly before starting to fill it out. Understanding each section will help in providing accurate information.

- Don't rush through the form. Take your time to ensure all information is correct and complete.

- Do have all necessary documents on hand before beginning, such as your Social Security Number, account information, and any other required financial documents.

- Don't guess on any answers. If you're unsure about a response, it's better to seek clarification than to provide incorrect information.

- Do consider consulting a financial advisor or tax professional, especially for sections related to distribution options and tax withholdings.

- Don't omit your signature and date at the end of the form. An unsigned form is incomplete and will not be processed.

- Do double-check your personal information, such as your address and phone number, to ensure VALIC can contact you if necessary.

- Don't forget to review the spousal consent section if it applies to you. This is especially important for ERISA-covered plans requiring spousal approval for distributions.

- Do mail the completed form to the correct address provided by VALIC to avoid any delays in processing your request.

By adhering to these guidelines, you can help ensure the process goes smoothly and that your distribution request is handled promptly and accurately.

Misconceptions

When dealing with the Valic Cash Distribution Form for Annuity Accounts, there are a number of misconceptions that can lead to confusion or errors in handling your distribution. Understanding the form correctly is crucial for making informed decisions about your retirement funds. Here are six common misconceptions explained:

- Withdrawal and Surrender are the Same: Many people believe that choosing a withdrawal (Option A) is the same as surrendering the account (Option B). However, a withdrawal simply reduces the account balance and may allow the account to remain open, while a surrender typically closes the account, stopping future contributions.

- Tax Withholding is Automatic: It's often thought that federal and state tax withholding will be automatically handled in a standard way for all distributions. In reality, Valic allows individuals to specify their withholding preferences, including opting not to withhold any taxes unless mandated by law.

- Loans Will Automatically Terminate: There's a misconception that any outstanding loans will automatically terminate upon distribution. However, the form offers an option specifically to keep loans intact (DO NOT Terminate my Loan(s)), allowing the account to remain open with no impact to loan security.

- All Distributions are Eligible for Rollover: Another common misunderstanding is that all distributions can be rolled over to another retirement account. The reality is that certain distributions, like hardship withdrawals, cannot be rolled over.

- Spousal Consent is Always Required: Couples often assume that spousal consent is needed for every distribution. This is not the case for all plan types. ERISA-covered and certain other employer plans require spousal consent, but others may not.

- Beneficiary Distributions are Limited: There's a belief that non-spousal beneficiaries have limited options. While it's true that non-spousal beneficiaries cannot roll inherited funds into their own IRA or plan, they can move it into a Beneficiary IRA through a direct trustee-to-trustee transfer.

Understanding these points can help you navigate the process of managing your Valic Annuity Account distributions more effectively. Always make sure to read the form carefully and seek advice if you're unsure about any of the options or requirements.

Key takeaways

Filling out and using the Valic cash distribution form for Valic Annuity Accounts requires attention to detail and understanding of the options available. Here’s what you need to know:

- Choice of Distribution: You have the option to choose between withdrawal and surrender for your distribution request. Withdrawal allows for the distribution of funds according to your specified allocations while keeping the account open and accepting future contributions if allowed. On the other hand, surrender results in the closure of the account, halting future contributions, and may affect any outstanding loans differently.

- Income Tax Withholding: Valic is required to withhold federal income tax from your distribution—20% for mandatory withholdings, or 10% if mandatory withholding does not apply. However, you do have the option to adjust this withholding percentage or opt out if not required by law. State income tax withholding may also apply, and its rate can vary depending on your state of residence and the specific instructions you provide on the form.

- Special Instructions: The form accommodates special instructions for the mailing of your distribution check, including overnight delivery options and charges to your credit card for this expedited service. It's vital to clearly specify any deviations from standard mailing to ensure your distribution reaches you according to your preferences.

- Spousal Consent and Plan Administrator Approval: For accounts under ERISA-covered and certain other employer plans, acknowledging your marital status and obtaining spousal consent (if married) are critical steps in the distribution process. This consent is necessary due to the potential impact on survivor benefits. Additionally, Plan Administrator approval may be required, affirming that your distribution is in line with plan provisions and laws.

The information provided in the form, including sections on client and spousal approvals, special instructions for dealing with taxes, and details surrounding the distribution request types, underscores the importance of reviewing each section carefully. Making informed choices and providing complete, accurate information ensures a smoother process in managing your Valic Annuity account distributions.

Popular PDF Forms

Texas 5506 Nar - Nurse aides are reminded to ensure all sections are signed and completed, emphasizing the importance of accuracy in the application process.

Can You Get a Title on a Car That Is Not Paid Off - A comprehensive tool for managing the payoff and document exchange process for vehicles under financial agreements.

Hsmv 82101 - Lost your vehicle title in the mail? The HSMV 82101 form is specifically designed for applying for a lost-in-transit title in Florida.