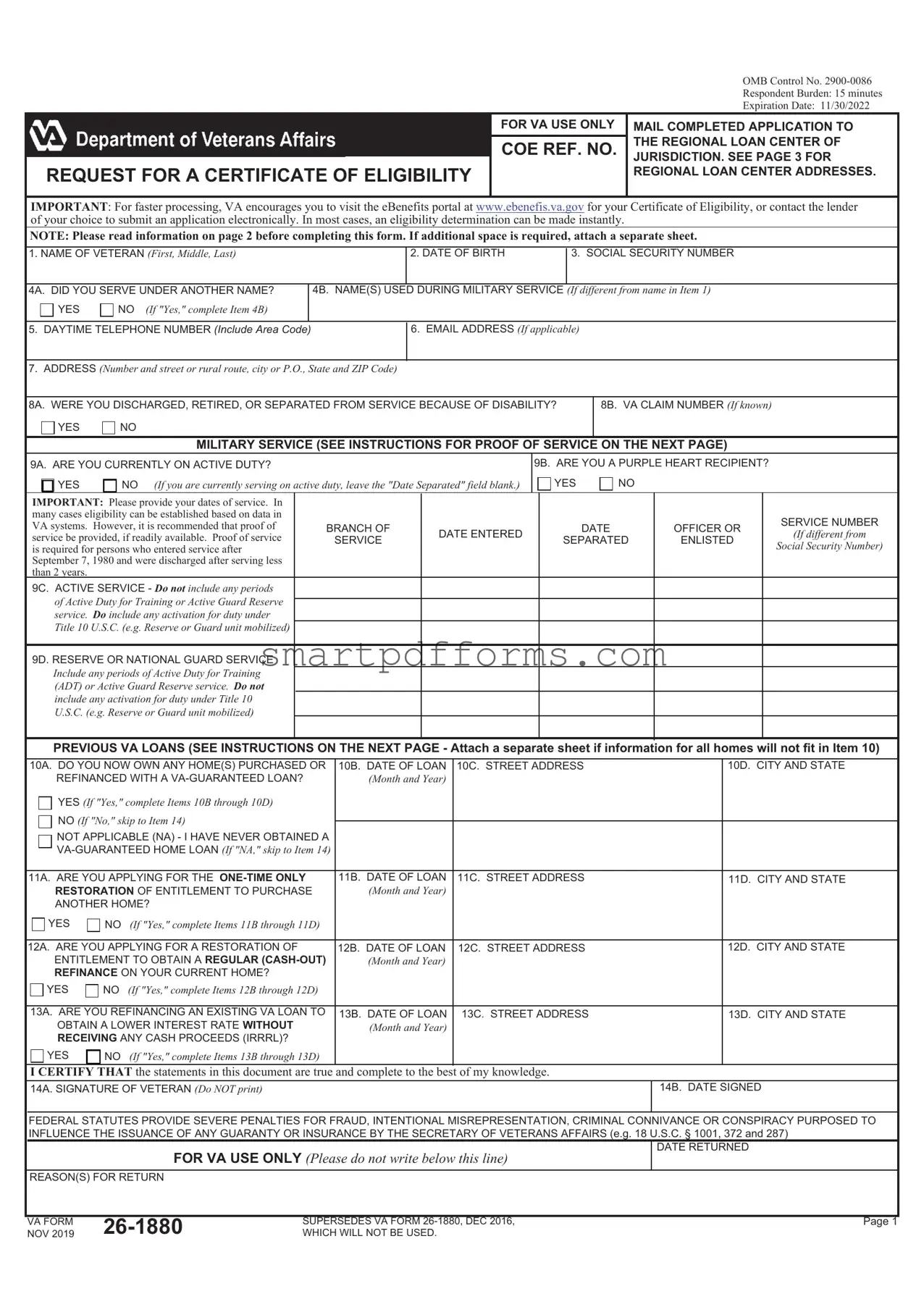

Blank VBA VA 26-1880 PDF Template

Embarking on the journey of homeownership can be both exhilarating and daunting, especially for veterans and service members who have dedicated a significant portion of their lives to serving our country. Navigating the complexities of the housing market requires a reliable compass, and for many in the military community, this guidance comes in the form of the VBA VA 26-1880 form. This pivotal document stands as the gateway to accessing the VA Loan program—a benefit earned through service, offering advantages such as no down payment, competitive interest rates, and no private mortgage insurance. The form itself serves as an application for a Certificate of Eligibility (COE), which is a key step in qualifying for these benefits. It requires detailed information about one's military service, thereby requiring applicants to thoroughly document their service history and status. Understanding the nuances of the VA 26-1880 form is not only about comprehending a piece of paperwork; it's about unlocking the door to homeownership opportunities that honor the sacrifices made by veterans and active service members.

Preview - VBA VA 26-1880 Form

OMB Control No.

REQUEST FOR A CERTIFICATE OF ELIGIBILITY

FOR VA USE ONLY

COE REF. NO.

MAIL COMPLETED APPLICATION TO THE REGIONAL LOAN CENTER OF JURISDICTION. SEE PAGE 3 FOR REGIONAL LOAN CENTER ADDRESSES.

IMPORTANT: For faster processing, VA encourages you to visit the eBenefits portal at www.ebenefis.va.gov for your Certificate of Eligibility, or contact the lender of your choice to submit an application electronically. In most cases, an eligibility determination can be made instantly.

NOTE: Please read information on page 2 before completing this form. If additional space is required, attach a separate sheet.

1. NAME OF VETERAN (First, Middle, Last) |

|

2. DATE OF BIRTH |

3. SOCIAL SECURITY NUMBER |

||

|

|

|

|

|

|

4A. DID YOU SERVE UNDER ANOTHER NAME? |

4B. NAME(S) USED DURING MILITARY SERVICE (If different from name in Item 1) |

||||

YES |

NO (If "Yes," complete Item 4B) |

|

|

|

|

|

|

|

|

|

|

5. DAYTIME TELEPHONE NUMBER (Include Area Code)

6.EMAIL ADDRESS (If applicable)

7.ADDRESS (Number and street or rural route, city or P.O., State and ZIP Code)

8A. WERE YOU DISCHARGED, RETIRED, OR SEPARATED FROM SERVICE BECAUSE OF DISABILITY? |

8B. VA CLAIM NUMBER (If known) |

|

YES |

NO |

|

MILITARY SERVICE (SEE INSTRUCTIONS FOR PROOF OF SERVICE ON THE NEXT PAGE)

9A. ARE YOU CURRENTLY ON ACTIVE DUTY?

YES |

|

NO |

(If you are currently serving on active duty, leave the "Date Separated" field blank.) |

9B. ARE YOU A PURPLE HEART RECIPIENT?

YES |

NO |

IMPORTANT: Please provide your dates of service. In |

|

|

|

|

|

many cases eligibility can be established based on data in |

|

|

|

|

SERVICE NUMBER |

VA systems. However, it is recommended that proof of |

BRANCH OF |

|

DATE |

OFFICER OR |

|

service be provided, if readily available. Proof of service |

SERVICE |

DATE ENTERED |

SEPARATED |

ENLISTED |

(If different from |

is required for persons who entered service after |

|

|

|

|

Social Security Number) |

September 7, 1980 and were discharged after serving less |

|

|

|

|

|

than 2 years. |

|

|

|

|

|

9C. ACTIVE SERVICE - Do not include any periods |

|

|

|

|

|

of Active Duty for Training or Active Guard Reserve |

|

|

|

|

|

|

|

|

|

|

|

service. Do include any activation for duty under |

|

|

|

|

|

Title 10 U.S.C. (e.g. Reserve or Guard unit mobilized) |

|

|

|

|

|

|

|

|

|

|

|

9D. RESERVE OR NATIONAL GUARD SERVICE |

|

|

|

|

|

Include any periods of Active Duty for Training |

|

|

|

|

|

(ADT) or Active Guard Reserve service. Do not |

|

|

|

|

|

include any activation for duty under Title 10 |

|

|

|

|

|

U.S.C. (e.g. Reserve or Guard unit mobilized) |

|

|

|

|

|

|

|

|

|

|

|

PREVIOUS VA LOANS (SEE INSTRUCTIONS ON THE NEXT PAGE - Attach a separate sheet if information for all homes will not fit in Item 10)

10A. DO YOU NOW OWN ANY HOME(S) PURCHASED OR |

10B. DATE OF LOAN |

10C. STREET ADDRESS |

10D. CITY AND STATE |

REFINANCED WITH A |

(Month and Year) |

|

|

YES (If "Yes," complete Items 10B through 10D) |

|

|

|

NO (If "No," skip to Item 14) |

|

|

|

|

|

|

NOT APPLICABLE (NA) - I HAVE NEVER OBTAINED A

11A. ARE YOU APPLYING FOR THE |

11B. DATE OF LOAN |

11C. STREET ADDRESS |

11D. CITY AND STATE |

|

RESTORATION OF ENTITLEMENT TO PURCHASE |

(Month and Year) |

|

|

|

ANOTHER HOME? |

|

|

|

|

YES |

NO (If "Yes," complete Items 11B through 11D) |

|

|

|

|

|

|

|

|

12A. ARE YOU APPLYING FOR A RESTORATION OF |

12B. DATE OF LOAN |

12C. STREET ADDRESS |

12D. CITY AND STATE |

|

ENTITLEMENT TO OBTAIN A REGULAR |

(Month and Year) |

|

|

|

REFINANCE ON YOUR CURRENT HOME? |

|

|

|

|

YES |

NO (If "Yes," complete Items 12B through 12D) |

|

|

|

|

|

|

|

|

13A. ARE YOU REFINANCING AN EXISTING VA LOAN TO |

13B. DATE OF LOAN |

13C. STREET ADDRESS |

13D. CITY AND STATE |

|

OBTAIN A LOWER INTEREST RATE WITHOUT |

(Month and Year) |

|

|

|

RECEIVING ANY CASH PROCEEDS (IRRRL)? |

|

|

|

|

YES |

NO (If "Yes," complete Items 13B through 13D) |

|

|

|

I CERTIFY THAT the statements in this document are true and complete to the best of my knowledge.

14A. SIGNATURE OF VETERAN (Do NOT print)

14B. DATE SIGNED

FEDERAL STATUTES PROVIDE SEVERE PENALTIES FOR FRAUD, INTENTIONAL MISREPRESENTATION, CRIMINAL CONNIVANCE OR CONSPIRACY PURPOSED TO INFLUENCE THE ISSUANCE OF ANY GUARANTY OR INSURANCE BY THE SECRETARY OF VETERANS AFFAIRS (e.g. 18 U.S.C. § 1001, 372 and 287)

FOR VA USE ONLY (Please do not write below this line)

REASON(S) FOR RETURN

DATE RETURNED

NOV 2019 |

WHICH WILL NOT BE USED. |

|

|

VA FORM |

|

SUPERSEDES VA FORM |

Page 1 |

INSTRUCTIONS FOR VA FORM

PRIVACY ACT NOTICE - VA will not disclose information collected on this form to any source other than what has been authorized under the Privacy Act of 1974 or Title 38, Code of Federal Regulations 1.576 for routine uses (for example: the authorized release of information to Congress when requested for statistical purposes) identified in the VA system of records, 55VA26, Loan Guaranty Home, Condominium and Manufactured Home Loan Applicant Records, Specially Adapted Housing Applicant Records, and Vendee Loan Applicant Records - VA, published in the Federal Register. Your response is required in order to obtain or retain benefits. Giving us your SSN account information is voluntary. Refusal to provide your SSN by itself will not result in the denial of benefits. VA will not deny an individual benefits for refusing to provide his or her SSN unless the disclosure of the SSN is required by Federal Statute of law in effect prior to January 1, 1975, and still in effect.

RESPONDENT BURDEN - This information is needed to help determine a veteran's qualifications for a VA guaranteed home loan. Title 38, U.S.C., section 3702, authorizes collection of this information. We estimate that you will need an average of 15 minutes to review the instructions, find the information, and complete this form. VA cannot conduct or sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if this number is not displayed. Valid OMB control numbers can be located on the OMB Internet Page at www.reginfo.gov/public/do/PRAMain.

A. YOUR IDENTIFYING INFORMATION

Item 1 - Tell us your complete name, as you would like it to appear on your Certificate of Eligibility (COE).

Item 4B - If you served under another name, provide the name as it appears on your discharge certificate (DD Form 214).

Item 8B - In most cases, your VA claim number is the same as your Social Security Number. If you are not sure of your VA claim number, leave this field blank.

B. MILITARY SERVICE

Item 9 - NOTE - Cases involving other than honorable discharges will usually require further development by VA. This is necessary to determine if the service was under other than dishonorable conditions.

Item 9A - If you are currently serving on regular active duty, eligibility can usually be established based on data in VA systems. However, in some situations you may be asked to provide a statement of service signed by, or by direction of, the adjutant, personnel officer, or commander of your unit or higher headquarters. The statement may be in any format; usually a standard or bulleted memo is sufficient. It should identify you by name and social security number, and provide: (1) your date of entry on your current active duty period and (2) the duration of any time lost (or a statement noting there has been no lost time). Generally this should be on military

letterhead.

Item 9B - The VA funding fee may not be collected from a member of the Armed Forces who is currently serving on active duty and has been awarded the Purple Heart. You may be asked to provide evidence of having been awarded the Purple Heart.

Item 9C - Active Service (not including Active Duty Training or Active Guard Reserve service) - the best evidence to show your service is your discharge certificate (DD Form 214) showing active duty dates and type of discharge. If you were separated after October 1, 1979, the DD214 was issued in several parts (copies). We are required to have a copy showing the character of service (Item 24) and the narrative reason for separation (Item 28). We prefer the

Item 9DC - National Guard Service: You may submit NGB Form 22, Report of Separation and Record of Service, or NGB Form 23, Retirement Points Accounting, or their equivalent. We are required to have a copy showing character of service.

Selected Reserve Service (Including Active Duty Training and Active Guard Reserve) - You may submit a copy of your latest annual retirement points statement and evidence of honorable service. There is no single form used by the Reserves similar to the DD Form 214 or NGB Form 22. The following forms are commonly used, but others may be acceptable:

Army Reserve |

DA FORM 5016 |

Naval Reserve |

NRPC |

Air Force Reserve |

AF 526 |

Marine Corps Reserve |

NA VMC 798 |

Coast Guard Reserve |

CG 4174 or 4175 |

If you are still serving in the Selected Reserves or the National Guard, you must include an original statement of service signed by, or by the direction of, the adjutant, personnel officer, or commander of your unit or higher headquarters showing your date of entry and the length of time that you have been a member of the Selected Reserves. At least 6 years of honorable service must be documented.

C. PREVIOUS LOANS

Items 10 through 14. Your eligibility is reusable depending on the circumstances. Normally, if you have paid off your prior VA loan and no longer own the home, you can have your used eligibility restored for additional use. Also, on a

Item 11A.

Item 12A. Regular

Item 13A. Interest Rate Reduction Refinancing Loan (IRRRL). You may refinance the balance of your current VA loan in order to obtain a lower interest rate or convert a VA adjustable rate mortgage to a fixed rate. The new loan may not exceed the sum of the outstanding balance on the existing VA loan, plus allowable fees and closing costs, including VA funding fee and up to 2 discount points. You may also add up to $6,000 of energy efficiency improvements into the loan.

VA FORM |

Page 2 |

If you live in: |

Please send your completed application to: |

|

|

Georgia, North Carolina, South |

Department of Veterans Affairs |

Carolina, Tennessee |

Atlanta Regional Loan Center |

|

P.O. Box 100023 |

|

Decatur, GA |

Connecticut, Delaware, Indiana, |

Department of Veterans Affairs |

Maine, Massachusetts, Michigan, |

Cleveland Regional Loan Center |

New Hampshire, New Jersey, New |

1240 East Ninth Street |

York, Ohio, Pennsylvania, Rhode |

Cleveland, OH 44199 |

Island, Vermont |

|

|

|

Alaska, Colorado, Idaho, Montana, |

Department of Veterans Affairs |

Oregon, Utah, Washington, |

Denver Regional Loan Center |

Wyoming |

Box 25126 |

|

Denver, CO 80225 |

Hawaii, Guam, American Samoa |

Department of Veterans Affairs |

Commonwealth of the Northern |

VA Regional Office |

Marianas |

Loan Guaranty Division (26) |

|

459 Patterson Road |

|

Honolulu, HI 96819 |

Arkansas, Louisiana, Oklahoma, |

Department of Veterans Affairs |

Texas |

Houston Regional Loan Center |

|

6900 Almeda Road |

|

Houston, TX |

Arizona, California, New Mexico, |

Department of Veterans Affairs |

Nevada |

Phoenix Regional Loan Center |

|

3333 N. Central Avenue |

|

Phoenix, AZ |

District of Columbia, Kentucky, |

Department of Veterans Affairs |

Maryland |

Roanoke Regional Loan Center |

Virginia, West Virginia |

210 Franklin Road, S.W. |

|

Roanoke, VA 24011 |

Illinois, Iowa, Kansas, Minnesota, |

Department of Veterans Affairs |

Missouri, Nebraska, North Dakota, |

St. Paul Regional Loan Center |

South Dakota, Wisconsin |

1 Federal Drive, Ft. Snelling |

|

St. Paul, MN |

Alabama, Florida, Mississippi, |

Department of Veterans Affairs |

Puerto Rico, U.S. Virgin Islands |

St. Petersburg Regional Loan Center |

|

9500 Bay Pines Blvd. |

|

St. Petersburg, FL 33744 |

|

|

VA FORM |

Page 3 |

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The VBA VA Form 26-1880 is used by veterans to apply for a Certificate of Eligibility for a VA home loan. |

| Eligibility Criteria | Applicants must be veterans, service members, reservists, or select surviving spouses to qualify for a Certificate of Eligibility. |

| Required Information | Applicants must provide personal information, military service details, and, if applicable, previous VA loan information. |

| Submission Method | The form can be submitted online through the VA's eBenefits portal or mailed to the appropriate VA Regional Loan Center. |

| Governing Law | The VA home loan program is governed by federal law, specifically Title 38 of the United States Code. |

Instructions on Utilizing VBA VA 26-1880

Once you've taken the decision to apply for a VA home loan, the VBA VA 26-1880 form is a crucial step in that journey. This form is your request for a Certificate of Eligibility, which is essential for moving forward in securing your home loan. Accuracy and attention to detail will ensure a smooth process, avoiding any unnecessary delays. The following steps are designed to guide you in filling out the form correctly.

- Start by providing your full name and social security number at the top of the form.

- For questions 1a through 1d, fill in your personal details, including your date of birth, place of birth, and contact information.

- Question 2 asks for your military service details. Enter the branch of service, service number(s), and dates of service.

- In section 3, if applicable, detail any previous VA loans, including the loan number and status of the loan (paid in full, active, etc.).

- Item 4 requires you to indicate your marital status. If you are married, you will also need to provide your spouse's information, as requested in the form.

- For question 5, disclose your dependents by listing their names, relationship to you, and dates of birth.

- Question 6 deals with your current residential address. Be sure to provide a complete address where you currently reside.

- Item 7 asks whether you own the property at your current address and, if so, whether you have a mortgage or other liens.

- In section 8, provide information regarding your previous addresses over the last two years if you have lived somewhere other than your current address during that time.

- For question 9, authorize the release of your information to the VA as indicated by signing and dating the bottom of the form.

After completing the VBA VA 26-1880 form, review it thoroughly to ensure all information is accurate and complete. Misinformation or missing details can lead to delays in processing. Once satisfied, submit the form as directed by the VA's instructions. This step brings you closer to obtaining your Certificate of Eligibility and moving forward with your VA home loan application.

Obtain Answers on VBA VA 26-1880

-

What is the VBA VA 26-1880 form, and why is it important?

The VBA VA 26-1880 form is officially known as the Request for a Certificate of Eligibility for VA Home Loan Benefits. This document is crucial for veterans, service members, and certain spouses who are interested in taking advantage of the VA home loan program. By filling out this form, individuals are taking the first step towards securing a loan backed by the U.S. Department of Veterans Affairs, which often comes with beneficial terms such as no down payment and no private mortgage insurance requirement.

-

Who is eligible to submit the VBA VA 26-1880 form?

Eligibility to submit the VBA VA 26-1880 form extends to:

- Veterans who served in the active military, naval, or air service and who were discharged under conditions other than dishonorable,

- Current members of the military,

- Reservists and members of the National Guard who have been activated by the federal government,

- Surviving spouses of service members who died in the line of duty or as a result of a service-related disability.

It is important to consult the specific eligibility criteria as laid out by the U.S. Department of Veterans Affairs as there are detailed conditions that apply.

-

How can I obtain a VBA VA 26-1880 form?

The VBA VA 26-1880 form can be obtained through multiple channels for convenience. It can be downloaded directly from the U.S. Department of Veterans Affairs website. Alternatively, one can visit a local VA office where the form can be requested in person. For those who prefer or require assistance, calling the VA’s toll-free number allows for the option to have the form mailed directly to an individual’s address. It’s beneficial to consider which method suits your needs and availability best.

-

What information and documents are needed to complete the VBA VA 26-1880 form?

Completing the VBA VA 26-1880 form requires both personal and service-related information. Applicants should be prepared to provide:

- Full legal name, Social Security Number, and contact information,

- Details of military service, including dates and types of service,

- Documents that verify military service, such as a DD214 or equivalent,

- For active duty members, a current statement of service signed by, or by the direction of, the adjutant, personnel officer, or commander of the unit or higher headquarters.

Gathering these documents in advance can greatly expedite the process.

-

Where do I submit the completed VBA VA 26-1880 form?

Once the VBA VA 26-1880 form has been completed, it can be submitted through several means. The form can be mailed directly to the VA’s loan eligibility center. Alternatively, individuals may choose to bring the form to a local VA office for submission. Some may find it convenient to work with a lender who participates in the VA Home Loan program, as these lenders can often submit the form on an applicant's behalf. It’s advisable to retain a copy of the form and any accompanying documents for personal records.

Common mistakes

Filling out the VBA VA 26-1880 form, required for veterans to obtain a Certificate of Eligibility for a VA loan, can sometimes be more complicated than one might expect. It's not uncommon for applicants to make errors that could delay the processing of their application or impact their eligibility. To ensure a smoother process, it's important to be aware of and avoid the following mistakes:

Not checking eligibility criteria first: Many applicants start filling out the form without confirming if they meet the VA's service requirements. This leads to unnecessary time spent on an application that may not be acceptable from the start.

Failing to provide accurate service information: It's crucial to enter precise details about service dates, branch, and type of service. Any discrepancy can cause delays or result in a denial of the application.

Omitting previous VA Loan information: If an applicant has used a VA Loan before, those details must be included. Forgetting to include this information can affect one's current entitlement and eligibility.

Incorrect Social Security Number: A simple mistake like entering a wrong Social Security Number can lead to significant delays in processing the application. It's one of the most common errors that can be easily avoided by double-checking the entered information.

Not signing the form: Skipping over the signature part might seem like a minor oversight, but it renders the application incomplete. An unsigned form will not be processed.

Leaving required fields blank: Every field in the form is important. Leaving required areas unfilled can lead to an outright rejection or requests for additional documentation, thereby delaying the process.

Using outdated forms: The VA periodically updates its forms. Using an outdated version can mean the submission is not accepted, and the applicant will need to complete the form again, potentially under a tighter time constraint.

Beyond these common mistakes, here are additional tips to ensure a successful application:

Always use a black or blue pen if filling out the form by hand.

Ensure all photocopies of required documents are clear and legible.

Before submitting, review the entire form to confirm all information is accurate and complete.

By attentively preparing and reviewing the VBA VA 26-1880 form, applicants can avoid unnecessary setbacks. A thoughtful approach to the application process not only speeds up the attainment of a Certificate of Eligibility but also moves one step closer to securing a VA loan.

Documents used along the form

The VBA VA 26-1880 form is crucial for veterans and service members seeking to obtain a Certificate of Eligibility for a VA home loan. This document is a stepping stone towards homeownership, offering access to the benefits of VA loans, including no down payment and private mortgage insurance, lower interest rates, and more. However, to complete the application process efficiently and effectively, several additional forms and documents are often required. These support documents provide the necessary evidence of eligibility, financial stability, and other vital information needed to process a VA loan application.

- DD Form 214: This document serves as the certificate of release or discharge from active duty. It's essential for proving military service and is one of the primary documents reviewed during the eligibility determination for a VA loan.

- VA Form 26-8937: Also known as Verification of VA Benefit-Related Indebtedness, this form is used if the applicant has a disability related to service which might afford them certain VA loan exemptions.

- Statement of Service: Required for active duty military personnel, this document acts as evidence of current military service, detailing the individual's full name, Social Security Number, birth date, entry date on active duty, duration of any lost time, and the name of the command providing the information.

- VA Form 22-1990: Application for Education Benefits. While not directly related to the VA home loan application, this form is crucial for individuals planning to use or transfer GI Bill benefits to dependents, which can influence their overall financial situation.

- Pay Stubs and W-2 Forms: These documents prove the applicant's current employment and income status, providing vital information for assessing their ability to repay the mortgage.

- Personal Tax Returns: Recent tax returns, usually for the last two years, are often required to provide a complete picture of the applicant's financial history and stability.

- Credit Report Authorization: While not a form, permission to pull a credit report is necessary for lenders to evaluate the applicant's creditworthiness and determine eligibility for a VA loan.

- Bank Statements: Lenders typically request the last two months of bank statements to assess the applicant's current financial situation, including savings, checking, and investment accounts.

- Loan Application: A comprehensive form that captures personal information, employment history, income, debts, and assets, tailored specifically to the requirements of the VA loan program.

The journey to homeownership for veterans and service members, though facilitated by the VA loan program's unique benefits, requires careful preparation and documentation. By understanding and gathering these essential forms and documents in advance, applicants can streamline the application process for the VBA VA 26-1880 and move closer to securing a VA home loan. It is advisable to consult with a VA loan specialist or lender who can provide guidance specific to individual circumstances.

Similar forms

The FHA Loan Application is similar to the VBA VA 26-1880 form because both are used by individuals to apply for mortgage loans, but with different government backing; the former by the Federal Housing Administration, and the latter by the Department of Veterans Affairs. They both collect financial and personal information necessary for loan approval.

The Uniform Residential Loan Application shares similarities with the VBA VA 26-1880 form as they both serve as comprehensive applications for mortgage loans, requiring detailed information about the borrower's employment, income, assets, and liabilities. This form is a standard in the mortgage industry, utilized by those not necessarily seeking government-backed loans.

The IRS Form 4506-T, Request for Transcript of Tax Return, is akin to the VBA VA 26-1880 form in that it's often used in the process of applying for a home loan to verify a borrower's income and tax filing status with the Internal Revenue Service. Though not a loan application form, it is critical in the approval process, similar to how the VA form is used to establish eligibility for VA loan benefits.

HUD/VA Addendum to Uniform Residential Loan Application, is closely related to the VBA VA 26-1880 form as it is specifically designed for those applying for VA (or FHA) loans. It supplements the standard loan application form with additional details required by the VA or HUD, highlighting the need for veteran-specific information in the loan process.

The Request for Certificate of Eligibility (COE) for VA Home Loan Benefits, often thought to be the formal title for the VBA VA 26-1880 form, precisely replicates its function by enabling veterans, service members, and surviving spouses to demonstrate their eligibility for VA home loan benefits. This form is the primary step in obtaining a VA loan, essentially serving the same purpose under a different name.

Dos and Don'ts

Filling out the VBA VA 26-1880 form, also known as the Request for a Certificate of Eligibility for a VA loan, is a crucial step for veterans, active duty service members, reservists, and certain members of the National Guard looking to buy or build a home through the VA's loan guaranty program. Approaching this form correctly ensures a smoother process in securing your eligibility for a VA home loan. Here's a concise guide on the dos and don'ts to help you along the way:

- Do gather all necessary documents before you start. This includes proof of military service and any documents regarding your credit and financial status.

- Do thoroughly read the instructions. Each section of the form has specific requirements, and understanding them can save you time and errors.

- Do use a blue or black ink pen if you're filling out a paper copy. This ensures your information is legible and can be processed without delay.

- Do double-check your Social Security number and service details. These are key elements of your application and must be correct.

- Do sign and date the form. An unsigned form is incomplete and will be returned to you, causing unnecessary delays.

- Don't leave any fields blank. If a section doesn't apply to you, write "N/A" (not applicable) so the reviewer knows you didn't overlook anything.

- Don't guess or estimate dates and figures. Inaccuracies can lead to processing delays or even impact your eligibility.

- Don't use correction fluid or tape. If you make a mistake, it's better to start over on a new form to ensure your application is clean and readable.

Accurately completing the VBA VA 26-1880 form is your first step towards utilizing the VA loan benefit earned through your service. Detailed attention to the process not only honors the commitment you've made but also enhances your journey to homeownership. Embrace the process with care, and you'll set the foundation for a successful home-buying experience.

Misconceptions

Many people have misconceptions about the Veterans Affairs (VA) Form 26-1880, which is crucial for obtaining a Certificate of Eligibility for a VA home loan. It is important to understand the facts to navigate the process effectively.

Only combat veterans are eligible to apply: A common misconception is that only those who have served in combat can apply with the VA Form 26-1880 for a Certificate of Eligibility. In reality, eligibility for a VA loan is based on the length of service, not whether the service was in combat. Members who served in peacetime or in support roles may also be eligible.

You can only use the form once: Some believe that the VA Form 26-1880 can only be submitted once. This is not the case. Veterans can use this form to apply for a Certificate of Eligibility multiple times throughout their lives, whenever they are considering purchasing or refinancing a home with VA benefits.

The process is too long and not worth the effort: While obtaining a Certificate of Eligibility is an additional step in the home buying process, it's a misconception that the process is overly long or not worth pursuing. The process has been streamlined, and assistance is available to help veterans through it efficiently.

You must have perfect credit to be approved: Another misconception is the need for perfect credit to be approved for a VA loan using Form 26-1880. Although lenders do consider credit scores, the VA loan program has more flexible credit requirements compared to traditional loans.

Using the form locks you into a loan: Finally, some think that submitting VA Form 26-1880 commits them to a VA loan. This is not true. The form is simply the first step to determine eligibility for the VA loan benefits. Veterans are encouraged to explore all their options and choose the best one for their situation.

Key takeaways

Understanding how to properly complete the VBA VA 26-1880 form is crucial for veterans seeking to obtain a Certificate of Eligibility (COE) for VA home loan benefits. Here are key takeaways to ensure the process is handled accurately:

- Personal information must be precisely reported. This includes full legal names, Social Security numbers, and dates of birth. Errors in this section can cause unnecessary delays.

- Service details require thorough accuracy. Veterans should clearly detail their period(s) of service, ensuring to include exact dates and type of service. This is vital for establishing eligibility.

- Evidence of service is mandatory. Veterans should attach proof of service, such as DD214 or equivalent documentation, to verify the information provided. This evidence supports the application's validity.

- Joint loans with a spouse or another veteran are permitted. Applicants must indicate their intention to apply with a co-borrower and provide the necessary information for all parties.

- For applicants still in active service, a statement of service signed by the personnel officer or commander of the unit is required. This document should confirm the current active duty status and service dates.

- Details of previous VA loans, if any, must be disclosed. This includes information on any VA loans previously obtained, including whether they are paid off or if there was a foreclosure or short sale.

- Address history for the past two years is needed. Applicants should list all places of residence from the last two years, helping the VA confirm stability and traceability of the applicant.

- Accuracy and completeness of the form are essential. Before submission, veterans should review the entire form to ensure all information is correct and no required sections are left blank. This reduces the risk of rejection or the need for resubmission.

By meticulously following these guidelines, veterans can navigate the process of obtaining their COE with greater ease and confidence, bringing them one step closer to achieving their home ownership goals through the VA home loan program.

Popular PDF Forms

How Many Sick Days Without Certificate - Ensures the strict confidentiality of patient information, unless disclosure is authorized by law, maintaining trust and privacy.

How Much Does It Cost to Change Your Last Name in Colorado - Applicants must signify their marital status and provide details about all household members.

Jdf1101 - State your case clearly in Colorado's legal system for a divorce or separation by using the JDF 1101 petition form.