Blank Vehicle Payoff Authorization PDF Template

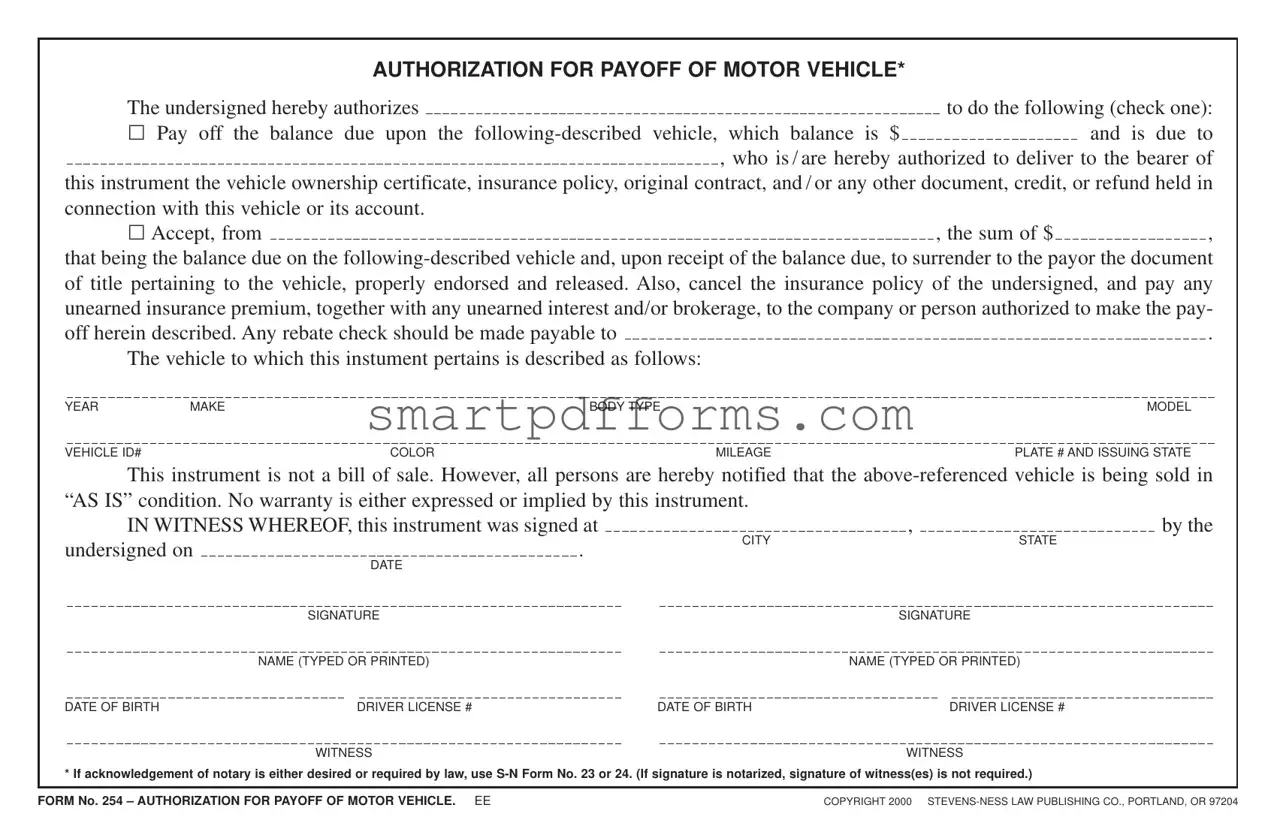

Understanding the Vehicle Payoff Authorization Form is crucial for anyone looking to finalize the sale or transfer of a vehicle where there is an outstanding balance owed. This document serves a dual purpose. Firstly, it authorizes the payoff of the balance due on the vehicle to the lienholder or financing company, thereby enabling the transfer of ownership to the buyer or new owner. Secondly, it outlines the specifics of the transaction, including the amount due, the vehicle's description (year, make, model, VIN, color, mileage, plate number, and issuing state), and the direction for handling any unearned insurance premiums, interest, or brokerage fees. It also makes provisions for the delivery of crucial documents such as the vehicle ownership certificate, insurance policy, and original contract upon the payoff. Furthermore, it addresses the cancellation of the existing insurance policy along with the payment of any unearned premiums. Significantly, it emphasizes that the vehicle is sold "AS IS," making it clear that no warranty is implied or expressed with the sale. This form necessitates the signatures of all parties involved, and in cases where legal acknowledgment is required or desired, notarization can replace the need for witnesses. The Vehicle Payoff Authorization Form thus plays an essential role in ensuring a smooth transition of vehicle ownership while protecting the interests of both the seller and buyer.

Preview - Vehicle Payoff Authorization Form

|

|

|

|

|

AUTHORIZATION FOR PAYOFF OF MOTOR VEHICLE* |

|

|

|

|

|

|

||||||||||||||||||

|

|

The undersigned hereby authorizes |

|

|

|

|

|

|

|

|

|

|

|

|

|

to do the following (check one): |

|||||||||||||

|

|

A Pay |

off the balance due upon the |

balance is $ |

and is due to |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

, who is / are hereby authorized to deliver to the bearer of |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

this instrument the vehicle ownership certificate, insurance policy, original contract, and / or any other document, credit, or refund held in |

|||||||||||||||||||||||||||||

connection with this vehicle or its account. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

A Accept, from |

|

|

|

|

|

|

|

|

|

|

|

|

, the sum of $ |

|

|

|

|

, |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

that being the balance due on the |

|||||||||||||||||||||||||||||

of title pertaining to the vehicle, properly endorsed and released. Also, cancel the insurance policy of the undersigned, and pay any |

|||||||||||||||||||||||||||||

unearned insurance premium, together with any unearned interest and/or brokerage, to the company or person authorized to make the pay- |

|||||||||||||||||||||||||||||

off herein described. Any rebate check should be made payable to |

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|||||||||||||||

|

|

The vehicle to which this instument pertains is described as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

YEAR |

MAKE |

BODY TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

|

MODEL |

|||||||||||||

VEHICLE ID# |

|

|

COLOR |

|

|

|

|

|

MILEAGE |

|

|

|

|

|

|

|

|

PLATE # AND ISSUING STATE |

|||||||||||

|

|

This instrument is not a bill of sale. However, all persons are hereby notified that the |

|||||||||||||||||||||||||||

“AS IS” condition. No warranty is either expressed or implied by this instrument. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

IN WITNESS WHEREOF, this instrument was signed at |

|

|

|

CITY |

|

|

, |

|

|

|

|

|

STATE |

|

|

by the |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

undersigned on |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

DATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

|

|

|

|

|

SIGNATURE |

|

|

|

|

|

|

||||||||||||

|

|

|

NAME (TYPED OR PRINTED) |

|

|

|

|

|

|

|

NAME (TYPED OR PRINTED) |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE OF BIRTH |

|

|

DRIVER LICENSE # |

|

|

DATE OF BIRTH |

|

|

|

|

|

|

DRIVER LICENSE # |

|

|

|

|

|

|

||||||||||

|

|

|

WITNESS |

|

|

|

|

|

|

|

|

|

WITNESS |

|

|

|

|

|

|

||||||||||

* If acknowledgement of notary is either desired or required by law, use |

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

FORM No. 254 – AUTHORIZATION FOR PAYOFF OF MOTOR VEHICLE. |

EE |

|

|

COPYRIGHT 2000 |

|||||||||||||||||||||||||

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form | This form authorizes the payoff of a motor vehicle's outstanding balance. |

| Options Available | The form allows for either the payoff of the vehicle balance or the acceptance of the payoff amount by the creditor. |

| Information Needed | Vehicle description, including year, make, model, body type, color, mileage, vehicle identification number (VIN), and plate number with issuing state. |

| Financial Details | States the balance due on the vehicle and addresses the cancellation of insurance policy and refund of any unearned premium or interest. |

| Document Delivery | The form authorizes the delivery of the vehicle's ownership certificate, insurance policy, original contract, and any other relevant documents or credits. |

| Legal Status | It clarifies that the form is not a bill of sale and indicates the vehicle is sold "AS IS" without any warranty. |

| Signature Requirements | Requires the signature of the undersigned and a witness. A notary acknowledgment can substitute for the witness if desired or required by law. |

| Notary Acknowledgment | If a notary acknowledgment is used, witness signatures are not required, referencing S-N Form No. 23 or 24. |

| Governing Law | Specific state law may dictate the need for a notary acknowledgment. |

| Publication Copyright | Copyright is held by Stevens-Ness Law Publishing Co., Portland, OR, with the document being Copyright 2000. |

Instructions on Utilizing Vehicle Payoff Authorization

Once the decision to sell or pay off a vehicle has been made, properly completing the Vehicle Payoff Authorization form is a critical step in the process. This form is a formal document that authorizes the payoff of the vehicle and facilitates the transfer of its title. It's important to fill out this form accurately to ensure that all parties involved have a clear understanding of the terms and that the process moves forward without any hitches. Below are the steps to properly fill out the form.

- Begin by reading the entire document to understand its contents and what is required of you.

- Check one of the two available options at the top of the form to indicate whether you are authorizing to pay off the balance due on the vehicle or to accept a sum towards the balance due, as specified in your situation.

- Fill in the balance due amount in the provided space next to the chosen option.

- Specify the full name of the entity or person due the balance in the space provided.

- For the part that requests the description of the vehicle, carefully enter the vehicle’s year, make, body type, model, vehicle identification number (VIN), color, mileage, plate number, and issuing state accurately.

- Read the disclaimer noting the sale is in "AS IS" condition with no warranties expressed or implied.

- In the signature section, indicate the city and state where the form is being signed.

- Enter the date on which the form is signed.

- Provide your signature, printed name, date of birth, and driver license number in the designated areas.

- If a witness is available and required, have them sign the form and provide their printed name. Note that if notarization is desired or required by law, the witness signature(s) may not be required if notary acknowledgment is obtained.

- Consult the S-N Form No. 23 or 24 for notary acknowledgment, if applicable.

After completing the Vehicle Payoff Authorization form, double-check all the details to ensure accuracy. This form should then be submitted to the appropriate party or institution responsible for handling the payoff. Keep a copy of the completed form for personal records. Moving forward, it is essential to communicate with the lienholder or financial institution who will process the payoff to confirm reception of the document and the forthcoming steps to complete the vehicle’s payoff and title transfer process.

Obtain Answers on Vehicle Payoff Authorization

FAQs about the Vehicle Payoff Authorization Form

What is a Vehicle Payoff Authorization Form?

This form is a document that gives permission to pay off the balance due on a vehicle and outlines the agreement for transferring ownership, documents, and any applicable refunds or credits related to the vehicle or its account.

Why do I need to use this form?

Using this form legally authorizes the transaction to pay off the vehicle loan balance and ensures the proper transfer of the vehicle's title and other related documents. It's a critical step for accurately completing the sale or transfer of a vehicle.

What does "AS IS" condition mean?

"AS IS" condition means that the vehicle is being sold in its current state, with no warranties implied or expressed. The buyer accepts the vehicle with all existing issues or defects.

What documents are transferred with this form?

The form specifies the transfer of the vehicle's ownership certificate, insurance policy, original contract, and any other documents, credits, or refunds associated with the vehicle or its account.

How do I complete the Vehicle Payoff Authorization Form?

To complete the form, fill in the required information about the vehicle, the amount due, the recipient of the payoff, and any other party receiving documents or payments. Sign and date the form, ensuring all information is accurate and complete.

Who should sign the Vehicle Payoff Authorization Form?

The vehicle owner or an authorized representative should sign the form. If notarization is desired or required by law, ensure the signature is notarized; if so, witness signatures are not required.

Is notarization required?

Notarization may be required depending on the local laws or the preferences of the parties involved. Check with your local motor vehicle department or consult a legal professional to determine if notarization is necessary for your transaction.

What happens after the form is completed?

Once the form is completed and signed, it should be presented to the party responsible for paying off the balance due on the vehicle. Upon receipt of payment, the necessary documents and payments (if any) should be released to the appropriate parties as outlined in the form.

Where can I find a Vehicle Payoff Authorization Form?

This form can be acquired from legal form providers, online resources, or possibly through the lending institution or motor vehicle department in your state. Ensure the form is current and complies with your state's requirements.

Common mistakes

Filling out the Vehicle Payoff Authorization form is a critical step in the process of paying off your vehicle. However, mistakes can happen. These mistakes can delay the payoff process, potentially cause legal issues, or result in incorrect amounts being paid. Here are four common mistakes to avoid:

- Not checking the correct authorization option. This form has two main options: one for paying off the balance and another for accepting the balance from another party. It's important to tick the right box that matches your intentions. Failing to make the correct selection can lead to confusion about the transaction's nature.

- Leaving financial details incomplete or inaccurate. The form requires detailed financial information, including the balance due and details about any unearned interest or insurance premiums. Inaccuracies in these fields can lead to incorrect payment amounts or mishandling of funds. It's crucial to double-check these numbers with your lender or financial advisor before submission.

- Incorrectly describing the vehicle. Providing a thorough and accurate description of the vehicle, including the year, make, model, VIN, color, mileage, and plate number, is critical. This information ensures that there are no discrepancies between what is being paid off and the vehicle described. Errors here can cause significant delays in processing the payoff.

- Forgetting to include necessary signatures or notarization, if required. The form must be signed by the party authorizing the payoff, and depending on your state's requirements, it may also need to be notarized. Skipping this step or not following your state's specific requirements for notarization can invalidate the document.

To ensure a smooth vehicle payoff process, always:

- Review your form thoroughly before submission.

- Verify all financial details with a second source.

- Ensure all descriptions match your vehicle's documentation.

- Follow your state's guidelines for signatures and notarization.

By avoiding these common mistakes, you make sure that your vehicle payoff authorization is processed efficiently and correctly.

Documents used along the form

When handling the sale, purchase, or payoff of a vehicle, the Authorization for Payoff of Motor Vehicle form is a crucial document, yet it is commonly accompanied by other forms and documents that serve varying purposes in the transaction process. These additional documents work in tandem to ensure that all aspects of the vehicle's ownership and financial obligations are addressed clearly and legally. Below is a list of documents often used in conjunction with the Vehicle Payoff Authorization form.

- Bill of Sale: This document acts as a record of the transaction between the buyer and seller, detailing the sale date, vehicle information, and agreed-upon price. It serves as proof of purchase and transfer of ownership.

- Odometer Disclosure Statement: This required form documents the vehicle's mileage at the time of sale and is essential for recording accurate mileage and preventing odometer fraud.

- Release of Liability: Completed by the seller and submitted to the state’s department of motor vehicles, this document releases the seller from liability for any damages incurred from the vehicle after the sale date.

- Title Application: A document submitted by the buyer to request a new vehicle title in their name, usually filed with the state's department of motor vehicles.

- Power of Attorney: If one party cannot be present to sign the necessary documents, a Power of Attorney may be used to grant authority to another individual to sign on their behalf.

- Lien Release: If the vehicle was financed and the lien is being paid off with the transaction, a lien release from the lender is required to remove the lienholder from the title and clear the title for transfer.

- Proof of Insurance: Most states require proof of insurance on the vehicle before processing the title transfer. This document verifies that the vehicle is insured according to state laws.

Completing a vehicle payoff and transfer of ownership involves a detailed process with numerous legal requirements. Each document serves its specific purpose, from establishing proof of sale and confirming the vehicle’s condition to ensuring the proper transfer of ownership and release of liability. The harmonious completion of these forms ensures a smooth and lawful transition for all parties involved.

Similar forms

Deed of Sale for Property: Similar to the Vehicle Payoff Authorization form, a Deed of Sale for Property serves as a critical document in transferring ownership, but in this case, of real estate rather than a vehicle. Both documents ensure that the seller is paid and that the buyer receives rightful ownership, including any necessary documents such as titles and, for vehicles, potentially insurance policies. Each aims to provide clear evidence of transfer and settlement of dues.

Loan Satisfaction Letter: This document resembles the Vehicle Payoff Authorization form in that it officially recognizes the payment and settlement of a debt. Specifically, a Loan Satisfaction Letter confirms full repayment of a loan, leading to the release of any claims from the lender over the collateral, which could be a vehicle in the case of auto loans. Both serve as formal acknowledgments that a financial obligation has been fulfilled, facilitating the transfer of clean titles to the borrower or new owner.

Release of Lien: A Release of Lien is similar to the Vehicle Payoff Authorization in function and purpose, primarily because it marks the satisfaction of a debt which allows for the release of a claim or hold on an asset, such as a vehicle. Once a lien is released, the owner can freely sell or transfer the vehicle. This document parallels the authorization form in facilitating clear shifts in ownership free from financial encumbrances.

General Power of Attorney for Asset Management: Although its scope can be broader, a General Power of Attorney for Asset Management can specifically allow an individual to manage another's assets, including the sale or payoff of vehicles. Its similarity to the Vehicle Payoff Authorization form lies in the permission granted to someone other than the owner to execute transactions involving the asset. It underscores the principal’s trust in the agent to manage affairs on their behalf, including handling documents and financial transactions needed to clear titles or transfer ownership.

Dos and Don'ts

When handling the Vehicle Payoff Authorization form, attention to detail is crucial for a seamless process. To ensure accuracy and compliance, here are some recommended practices to follow, as well as common mistakes to avoid.

Things you should do:

- Verify the accuracy of the vehicle information, including the year, make, model, vehicle identification number (VIN), color, mileage, and plate number.

- Ensure the payoff amount is clearly and correctly stated in the form.

- Clearly identify the party authorized to receive the vehicle's ownership certificate and any related documents or refunds.

- Complete all required sections of the form, including selecting the appropriate authorization option.

- Provide all pertinent personal information, such as name (typed or printed), date of birth, and driver license number, ensuring it matches other official documents.

- Check that the form is signed and dated by all necessary parties in the presence of any required witnesses or notaries.

- If a notary acknowledgment is required by law or desired for extra legal assurance, use the appropriate form and ensure it is properly notarized.

- Review the entire document for completeness and accuracy before submission.

- Retain a copy of the filled-out form for your records.

- Follow any specific instructions provided by the lending institution or party receiving the payoff for any additional requirements.

Things you shouldn't do:

- Avoid leaving any section of the form blank; if a section is not applicable, mark it as "N/A".

- Do not estimate vehicle information; always use exact and current details.

- Refrain from signing the form before all necessary information has been filled out accurately.

- Avoid using unofficial forms; always use the latest version provided by a reputable source.

- Do not forget to cancel the insurance policy as directed in the form, or to adjust it according to the payoff.

- Avoid making any unauthorized changes to the form after it has been signed and/or notarized.

- Do not ignore the requirement for witness signatures if notarization is not used.

- Refrain from relying solely on verbal agreements or understandings; ensure everything is documented in the form.

- Avoid neglecting to communicate with the lending institution or receiver about the submission of the form.

- Do not delay in submitting the form once all information has been properly filled out and verified.

Adhering to these guidelines will help ensure the Vehicle Payoff Authorization form is processed efficiently and accurately, facilitating a smooth transaction for all parties involved.

Misconceptions

When it comes to handling the payoff of a motor vehicle, the Vehicle Payoff Authorization form plays a crucial role. However, there are several misconceptions surrounding this document that can lead to confusion. Let's address some of the most common misunderstandings:

- The form acts as a bill of sale: Many believe the Vehicle Payoff Authorization form serves as a bill of sale. This is incorrect. The form itself explicitly states that it is not a bill of sale, but an authorization to pay off the balance due on a vehicle or to acknowledge receipt of payment and trigger the release of the vehicle's title.

- It provides a warranty: There's a misconception that this form offers a warranty on the vehicle being sold. However, it specifically mentions that the vehicle is being sold "AS IS," with no warranty either expressed or implied.

- It's only for the sale of vehicles: While the form is often used in the context of a vehicle sale, its primary function is to authorize the payoff of a loan or lien against the vehicle and to facilitate the transfer of title, which may not necessarily involve a sale.

- Signature notarization isn't important: Some might think notarizing the signature is a mere formality. On the contrary, the document advises that if notarization is desired or required by law, an appropriate form should be used, highlighting the importance of notarization in validating the document legally.

- Any rebate should always be payable to the undersigned: This is not accurate as the form clearly provides an option to specify to whom any rebate check should be made payable. This flexibility allows for different arrangements to be made according to the needs of the parties involved.

- A witness's signature is always necessary: While the presence of a witness can lend credibility to the signing of the document, the form stipulates that if the signature is notarized, the signature of witness(es) is not required, thus misunderstanding the necessity of a witness in every situation.

- The vehicle description is optional: Many might overlook the importance of detailing the vehicle, thinking it's optional. However, the form requires specific information about the vehicle, such as year, make, body type, model, vehicle ID number, color, mileage, and plate number and issuing state. This information is crucial for the accurate identification and processing of the authorization.

Understanding these misconceptions about the Vehicle Payoff Authorization form can streamline the process of paying off a vehicle loan or lien and ensure that all parties are accurately informed about what the document entails and what is required of them.

Key takeaways

Understanding the Vehicle Payoff Authorization form is crucial for those involved in the transfer of vehicle ownership, especially under circumstances requiring the payoff of an existing balance. This insight guides you through filling out and using the form effectively, ensuring a smooth transition of vehicle ownership.

- Clarity on Authorization: The form distinctly offers two options, authorizing either the payoff of the balance due on the vehicle or the acceptance of payment from a specified entity. It's essential to check the correct option to avoid potential misunderstandings or delays.

- Comprehensive Vehicle Description: Accuracy in detailing the vehicle is paramount. This includes the year, make, model, body type, vehicle identification number (VIN), color, mileage, and even the license plate number along with the issuing state. This precise information confirms the vehicle's identity, ensuring the correct application of the payment.

- Document Handling: The form enables the authorization of the transfer of crucial documents upon payoff. These include the vehicle's title, insurance policy, original contract, among others. It ensures that all legal and financial ties to the vehicle are properly resolved.

- Financial Matters: Besides the primary transaction, the form covers ancillary financial transactions such as the cancelation of the insurance policy and the reimbursement of unearned premiums and interest. It's essential to accurately fill in the details to ensure all financial adjustments are made correctly.

- No Warranty Implied: A vital aspect of the form is its declaration that the vehicle is sold in an "AS IS" condition, meaning no warranty is provided. This explicitly limits the seller's liability regarding the vehicle's condition post-sale.

The Vehicle Payoff Authorization form, despite its utility in simplifying vehicle transactions, requires a meticulous approach to its completion. It’s pivotal for all parties involved to review the form’s details thoroughly to ensure that all financial obligations are met and legal documentation is correctly processed. Furthermore, the acknowledgment that the vehicle is being sold "AS IS" shields the seller from future claims regarding the vehicle’s condition, making the form a critical document in vehicular transactions.

Popular PDF Forms

Oas Application Form Pdf - Shares how to properly prepare and send documentation to avoid delays in Old Age Security pension processing.

Salon Business - Let us help you reach your fullest potential in the beauty industry by applying to Serenity Salon & Spa.

Pa Mv 39 - A form used in Pennsylvania to notify the DMV about a change in vehicle title due to the owner's death.