Blank Verification Rent Mortgage PDF Template

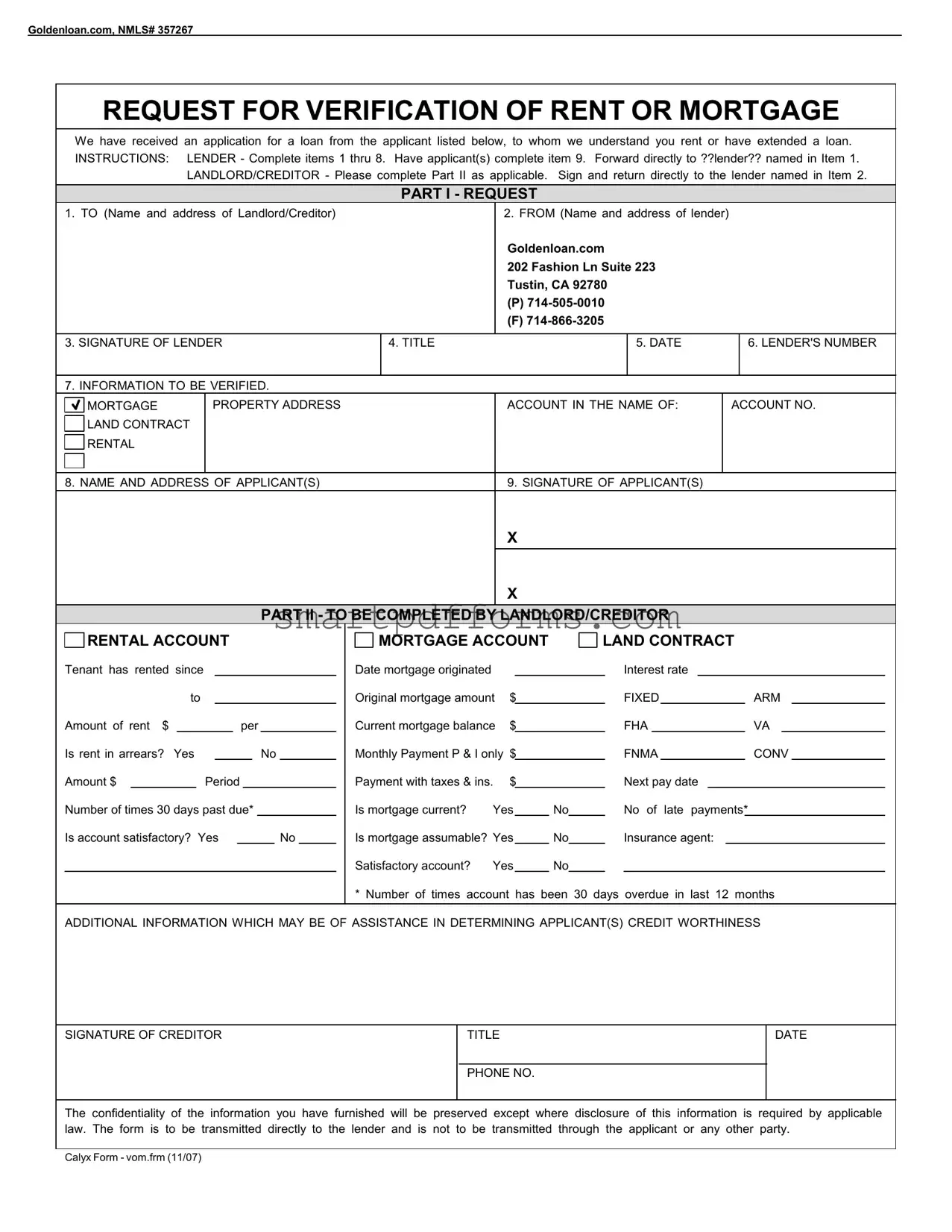

When applying for a loan, lenders must meticulously evaluate an applicant's creditworthiness, a process that involves assessing past financial behaviors, including rent or mortgage payment history. The Verification Rent Mortgage form, provided by GOLDENLOAN.COM and carrying the NMLS number 357267, functions as a critical tool in this evaluation. It divides into two main parts: the first for completion by the lender and the second by the landlord or creditor. The form requires detailed information about the applicant, specifically targeting their rental or mortgage payments. Landlords or creditors are asked to furnish specifics such as rental start dates, monthly rent amounts, any arrears, and the satisfaction status of the account, among others. For mortgage accounts, details like the original mortgage amount, current balance, and payment history are sought. This process not only aids in ensuring the applicant's financial reliability but also adheres to legal standards for privacy and direct communication between the requesting lender and the information provider. By doing so, it maintains the confidentiality of sensitive information, as mandated by law, except where disclosure is necessary under specific legal circumstances. This form is a vital step in securing a loan, signifying the lender’s diligence in confirming an applicant's fiscal responsibility and the potential risks involved in extending credit.

Preview - Verification Rent Mortgage Form

GOLDENLOAN.COM, NMLS# 357267

REQUEST FOR VERIFICATION OF RENT OR MORTGAGE

We have received an application for a loan from the applicant listed below, to whom we understand you rent or have extended a loan. INSTRUCTIONS: LENDER - Complete items 1 thru 8. Have applicant(s) complete item 9. Forward directly to ??lender?? named in Item 1.

LANDLORD/CREDITOR - Please complete Part II as applicable. Sign and return directly to the lender named in Item 2.

PART I - REQUEST

1. TO (Name and address of Landlord/Creditor)

2. FROM (Name and address of lender)

GOLDENLOAN.COM

202 FASHION LN SUITE 223 TUSTIN, CA 92780

(P)

(F)

3. SIGNATURE OF LENDER

4. TITLE

5. DATE

6. LENDER'S NUMBER

7. INFORMATION TO BE VERIFIED.

MORTGAGE |

PROPERTY ADDRESS |

ACCOUNT IN THE NAME OF: |

ACCOUNT NO. |

LAND CONTRACT |

|

|

|

RENTAL |

|

|

|

|

|

|

|

8. NAME AND ADDRESS OF APPLICANT(S) |

9. SIGNATURE OF APPLICANT(S) |

|

|

X

X

PART II - TO BE COMPLETED BY LANDLORD/CREDITOR

RENTAL ACCOUNT

Tenant has rented since |

|

|

|

|

|

||||||||

|

|

to |

|

|

|

|

|||||||

Amount of rent $ |

|

|

|

|

per |

|

|

|

|

||||

Is rent in arrears? Yes |

|

|

|

|

|

|

|

No |

|

||||

Amount $ |

|

Period |

|

|

|

|

|

||||||

Number of times 30 days past due* |

|

|

|

|

|

||||||||

Is account satisfactory? |

Yes |

|

|

|

No |

|

|||||||

MORTGAGE ACCOUNT

Date mortgage originated |

|

|

|

|

Original mortgage amount |

$ |

|

||

Current mortgage balance |

$ |

|

||

Monthly Payment P & I only $ |

|

|||

Payment with taxes & ins. |

$ |

|

||

Is mortgage current? |

Yes |

|

No |

|

Is mortgage assumable? Yes |

|

No |

||

Satisfactory account? |

Yes |

|

No |

|

LAND CONTRACT

Interest rate

FIXEDARM

FHAVA

FNMACONV

Next pay date

No of late payments*

Insurance agent:

* Number of times account has been 30 days overdue in last 12 months

ADDITIONAL INFORMATION WHICH MAY BE OF ASSISTANCE IN DETERMINING APPLICANT(S) CREDIT WORTHINESS

SIGNATURE OF CREDITOR

TITLE

PHONE NO.

DATE

The confidentiality of the information you have furnished will be preserved except where disclosure of this information is required by applicable law. The form is to be transmitted directly to the lender and is not to be transmitted through the applicant or any other party.

Calyx Form - vom.frm (11/07)

Form Data

| Fact Name | Detail |

|---|---|

| Purpose of Form | Requests verification of rent or mortgage for a loan application. |

| Who Completes the Form | Completed by both the lender (Part I) and the landlord or creditor (Part II). |

| Form Transmission | The form is sent directly to the lender named in Item 2 without going through the applicant or other parties. |

| Applicant's Involvement | The applicant(s) are required to sign the form as indicated in item 9. |

| Interests Protected | Confidentiality of provided information is safeguarded, barring required disclosures by law. |

| Governing Laws | Form mentions that disclosure of information might be required by applicable law without specifying which, implying that relevant state or federal regulations apply. |

Instructions on Utilizing Verification Rent Mortgage

Filling out the Verification of Rent or Mortgage form is a crucial step in processing a loan application through GOLDENLOAN.COM. This form helps in confirming the applicant's financial responsibility and history regarding rent or mortgage payments. To ensure accurate processing, it's important to follow the steps outlined below carefully. Once completed, the form should be sent directly to the lender, ensuring the privacy and accuracy of the information provided.

- Start by entering the Name and Address of the Landlord/Creditor in the designated area at the top of the form.

- Proceed to fill out the FROM section with GOLDENLOAN.COM's information, which is already provided:

- 202 FASHION LN SUITE 223 TUSTIN, CA 92780

- (P)714-505-0010

- (F)714-866-3205

- Under SIGNATURE OF LENDER, the authorized lender must sign the form.

- Fill in the TITLE of the lender signing the form.

- Enter the DATE when the form is being filled out.

- For LENDER'S NUMBER, input the unique identification number assigned by GOLDENLOAN.COM.

- In the section INFORMATION TO BE VERIFIED, specify the type of account being verified (Mortgage/Rental) and provide the requested details such as property address, account name, and account number.

- For mortgage verification, include the mortgage property address, account name, and account number.

- For rent verification, detail the rental property address, tenant's name, and rental account number.

- Under NAME AND ADDRESS OF APPLICANT(S), carefully input the applicant's information.

- The SIGNATURE OF APPLICANT(S) section should be completed by the applicant(s), requiring their signature.

- Part II must be filled out by the Landlord/Creditor, providing detailed information about the rental or mortgage account.

- This includes rental history, mortgage details, payment status, and any other pertinent credit information.

- Lastly, the Landlord/Creditor completes the form by signing at the bottom, providing their title, contact phone number, and the date.

The completed form, carrying both the applicant’s and creditor's or landlord's verifications, should then be forwarded directly to GOLDENLOAN.COM for further processing. This step is essential for maintaining the integrity of the application process and ensuring that all information is correctly verified, without passing through unauthorized hands.

Obtain Answers on Verification Rent Mortgage

What is a Verification of Rent or Mortgage form?

The Verification of Rent or Mortgage form is a document used by lenders to verify the rent or mortgage payment history of an applicant. This form is part of the underwriting process for a loan and helps lenders assess the creditworthiness and payment reliability of the applicant. It requires information from the applicant's current or previous landlord or mortgage lender, detailing the payment history and status of the account.

Why is the Verification of Rent or Mortgage form important?

This form plays a crucial role in the loan approval process, as it provides tangible evidence of the applicant's ability to consistently make timely payments. Lenders use this form to reduce the risk of default by ensuring the applicant has a history of fulfilling financial obligations. It can ultimately influence the decision on loan approval and the terms of the loan offered.

Who needs to complete the Verification of Rent or Mortgage form?

There are two parts to the form. The lender initiating the loan request completes the first part, which includes information about the loan application and the applicant's details. The second part must be completed by the landlord or creditor (the party receiving the rent or mortgage payments). This section requests detailed information on the payment history of the applicant.

What information does the landlord or creditor need to provide?

The landlord or creditor is required to fill out information regarding the rental or mortgage account, including the duration of the tenancy or mortgage, the amount of rent or mortgage payment, whether the rent or mortgage is in arrears, the number of times payments have been late, and overall account satisfaction. Additional details such as the original mortgage amount, current balance, and whether the mortgage is assumable may also be requested.

How should the form be submitted?

According to the instructions on the form, the completed document should be sent directly to the lender named in the form. It is important that the form is transmitted directly from the landlord/creditor to the lender, without passing through the applicant or any other party, to ensure the confidentiality and integrity of the information provided.

Is the information provided on the form confidential?

Yes, the information furnished on the Verification of Rent or Mortgage form is kept confidential. However, it is noted in the form that the information might be disclosed if required by applicable law. The intention is to preserve the applicant's privacy while still allowing the lender to obtain necessary financial information.

What happens if rent or mortgage payments are in arrears?

If it is reported that rent or mortgage payments are in arrears, this may negatively impact the applicant's loan application. Lenders view timely payments as an indicator of financial reliability and responsibility. Arrears may lead to further scrutiny of the application or could result in unfavorable loan terms or denial.

Can this form affect loan approval?

Yes, the information provided on this form can significantly affect the outcome of a loan application. Consistent and timely payments indicated on the form can positively influence the lender's decision, leading to better loan terms or easier approval. Conversely, a history of late payments or arrears can make loan approval more challenging.

What should I do if there are errors on the completed form?

If you notice errors on the form after it has been completed by the landlord or creditor, it is advisable to contact them directly for corrections. Accurate and truthful information is crucial for the loan application process. Ensure the corrected form is then directly submitted to the lender to avoid any processing delays or issues.

Common mistakes

When filling out the Verification of Rent or Mortgage form, individuals often overlook certain areas that are crucial for a successful application process. Paying close attention to these common mistakes can greatly improve the accuracy and efficiency of your application.

-

Not double-checking Part I information accuracy. The section requested by the lender needs careful attention to detail. Important elements include the correct name and address of both the landlord/creditor and the lender, as well as ensuring all signatures are in place. Omitting or incorrectly filling any of these details can delay the process.

-

Failing to properly detail the verification information in Part II. Whether it's for a rental or a mortgage account, accurately reporting dates, amounts, and statuses such as current or past due payments is essential. Overlooking or inaccurately reporting this information can misrepresent an applicant's creditworthiness.

-

Omitting additional relevant financial information. The section for additional information may seem optional, but it offers an opportunity to provide context or explanations that could be beneficial in assessing creditworthiness. Skipping this part could result in a lack of understanding of the applicant's financial situation.

-

Ignoring the instructions regarding the transmission of the form. The form stipulates that it should be sent directly to the lender and not through the applicant or any other party. Failure to comply with this instruction can compromise the confidentiality of the application process and potentially cause legal issues.

To avoid these mistakes, here are some straightforward steps:

- Before submitting, take the time to review every section of the form, ensuring all provided information is accurate and complete.

- Be thorough in detailing the account's rental or mortgage history, making sure all requested information is provided.

- Do not skip the additional information section; instead, use it to strengthen your application by providing any context that can positively impact your credit assessment.

- Always follow the specified instructions for the transmission of the form to ensure the process is carried out correctly and securely.

Adhering to these guidelines can streamline the application process, helping to present the most accurate and favorable view of your financial standing.

Documents used along the form

When individuals or businesses submit a Verification of Rent or Mortgage form, as outlined in the provided document by GOLDENLOAN.COM, they are often participating in a process that may require additional documentation to support their application. These documents play a vital role in providing a comprehensive view of the applicant's financial situation and credibility. Below is a list of forms and documents that are frequently used alongside the Verification of Rent or Mortgage form to ensure a thorough evaluation by the lender.

- Loan Application Form: This form is the initial step in the loan process, where the applicant provides personal information, employment history, income, debts, and assets. It gives lenders a snapshot of the applicant's financial health and their ability to repay a loan.

- Proof of Income: Documents such as recent pay stubs, tax returns, or W-2 forms serve as proof of the applicant's income. They help lenders assess whether the applicant has a stable source of income to cover mortgage payments or rent, in addition to other financial obligations.

- Credit Report Authorization Form: This form grants the lender permission to request the applicant's credit report. A credit report reveals the credit history of the applicant, including past loans, credit cards, payment history, and any financial legal issues such as bankruptcy or foreclosures.

- Bank Statements: Recent bank statements provide insight into the applicant's financial habits, including saving patterns, spending, and existing funds. They can strengthen the application by showing that the applicant manages their finances responsibly.

- Asset Documentation: Documents verifying ownership of significant assets (like other properties, investments, or savings accounts) can be crucial. They demonstrate additional security for the loan, showing that the applicant has resources beyond income to support loan repayment.

In the process of applying for a loan or establishing the credibility of rent/mortgage payments, these additional forms and documents support a Verification of Rent or Mortgage form. Each documents specific aspects of an applicant's financial background, contributing to a comprehensive understanding of their capacity to meet financial commitments. Combining these documents provides lenders with a complete financial profile of the applicant, enabling more informed and secure lending decisions.

Similar forms

Employment Verification Form - This document is similar because it is used to verify an applicant's employment history and income in a manner akin to how the Verification of Rent or Mortgage form confirms an applicant's rental or mortgage payment history. Both serve to validate aspects of an applicant's financial stability and reliability.

Loan Application Form - Similar to the Verification of Rent or Mortgage form, a Loan Application Form collects detailed personal and financial information from an applicant seeking a loan. Both forms are integral in the decision-making process of lenders by providing key financial details.

Credit Report Authorization Form - This document, which obtains the applicant’s consent to perform a credit check, parallels the Verification of Rent or Mortgage form in its aim to assess the creditworthiness of an applicant. Both are tools used by lenders to evaluate an applicant's financial responsibility.

Income Verification Form - Similar to the rent/mortgage verification, this form verifies an applicant's income sources and levels. Both are used by lenders to assess financial stability and the ability to meet financial obligations, such as loan repayments.

Rental Application Form - This form, used for applying to rent a property, collects similar personal and financial information from an applicant as the Verification of Rent or Mortgage form. Both are used by the concerned parties (landlords or lenders) to assess the reliability and financial soundness of the applicant.

Bank Verification Letter - It is a document provided by a bank outlining an account holder's current account balance and financial history. Like the Verification of Rent or Mortgage form, it serves as proof of financial stability and credibility for various transactions and applications.

Mortgage Pre-approval Letter - This letter is issued by lenders indicating a preliminary approval for a mortgage based on the applicant’s financial status. It is similar in context to the Verification of Rent or Mortgage form since both are steps in the process of assessing financial credibility for a mortgage or loan.

Property Appraisal Report - Although focusing on the value of property rather than an applicant's financial history, this document is related in the broader context of mortgage or loan approval processes, where both the applicant's ability to pay and the value of the collateral (the property) are assessed.

Co-signer Agreement - This document involves a third party to guarantee loan repayment, similar in its financial assurance purpose to the Verification of Rent or Mortgage form, which provides evidence of consistent rent or mortgage payments as part of financial evaluation.

Lease Agreement - As a contract outlining the terms and conditions between a landlord and tenant, it shares similarities in terms of financial commitments with the Verification of Rent or Mortgage form. Both document the financial obligations and history of payments or the agreement to pay, serving as evidence of the individual's financial behavior.

Dos and Don'ts

When you are tasked with filling out a Verification of Rent or Mortgage form, it is important to approach this task with attention to detail and accuracy to ensure a smooth verification process. Below are guidelines that should be followed to correctly complete the form:

Do:

- Verify all the information before you start filling out the form to make sure you have accurate and up-to-date details.

- Use black or blue ink if completing the form by hand to ensure the legibility of your entries.

- Include the complete name and address of both the landlord or creditor and the lender as required in the first part of the form.

- Ensure the applicant(s) sign item 9, as their signature is necessary for authorization purposes.

- Cross-check the account number and property address to prevent any inaccuracies in the information being verified.

- Be transparent about the account status, including any arrears or late payments, to provide a clear credit history to the lender.

- Return the completed form directly to the lender named in the form to maintain the confidentiality of the information shared.

Don't:

- Leave any part of the form incomplete; if a section does not apply, indicate this with “N/A” (Not Applicable) instead of leaving it blank.

- Allow the applicant or unauthorized individuals to fill in or handle the landlord/creditor section of the form to prevent any potential inaccuracies or bias.

- Use pencil or any other erasable writing tool that might make the information easy to alter.

- Forget to date and sign the form as the landlord or creditor; your signature attests to the validity of the information provided.

- Omit any additional information that may assist in determining the applicant's creditworthiness.

- Send the form through an intermediary; it should be sent directly to the lender to ensure the secure handling of personal and financial information.

- Ignore the instructions specified by the lender or on the form itself; they are there to guide you through the proper completion and submission process.

By following these dos and don'ts, the Verification of Rent or Mortgage form can be completed accurately and efficiently, contributing to a smoother loan application process for the applicant.

Misconceptions

When it comes to the Verification of Rent or Mortgage form, there are several misconceptions that can confuse both applicants and those who provide the requested information. Clarifying these misunderstandings can help streamline the process and ensure all parties comprehend their roles and responsibilities.

Misconception 1: The form can be submitted by the applicant. One common misunderstanding is the belief that the applicant for a loan can submit the Verification of Rent or Mortgage form themselves. This form is intended to be sent directly from the landlord or creditor to the lender, without passing through the hands of the applicant. This procedure helps in maintaining the integrity and confidentiality of the data provided, ensuring an unbiased verification process.

Misconception 2: All parts of the form must be completed by the lender. Another misconception is that the lender is responsible for filling out the entire form. In reality, the form is divided into two parts: the lender completes the first section (items 1 through 8), and the landlord or creditor fills out the second part. It's crucial for each party to complete their respective sections to provide a full picture of the applicant's financial responsibility.

Misconception 3: The form is only for verifying current rent or mortgage. While the primary purpose of the form is to verify the applicant's current living situation, it also seeks information regarding past rentals or mortgages if applicable. This comprehensive verification aims to assess the applicant's long-term reliability and creditworthiness by examining their history of payments.

Misconception 4: Electronic signatures are not acceptable. In today's digital age, the acceptance of electronic signatures on official documents has become widespread. However, there is a misconception that the Verification of Rent or Mortgage form must be signed in ink. As long as the electronic signature meets the legal requirements, it is just as valid as a traditional ink signature, thereby facilitating a quicker submission process.

Misconception 5: The form is only necessary for mortgage applications. Some people mistakenly believe that this verification form is required exclusively for mortgage loan applications. However, it can also be a critical component of applications for other types of loans where the applicant's housing situation and history are relevant to their financial stability and risk profile. Understanding the broad applicability of this form can help applicants better prepare for their loan application process regardless of the loan type.

Understanding these misconceptions can help all involved parties navigate the Verification of Rent or Mortgage process more effectively, ensuring that accurate and complete information is provided to lenders. This, in turn, facilitates a fair assessment of an applicant's creditworthiness and financial stability.

Key takeaways

When preparing to fill out and use the Verification of Rent or Mortgage form, it is essential to keep several key points in mind. These guidelines ensure that the form is completed accurately and efficiently, facilitating a smooth process for both the applicant and the lending or renting parties involved.

- Ensure Accuracy of Information: Double-check that all the details about the applicant, including name and address, are correct and match any supporting documents.

- Completing All Required Sections: Both the lender and the landlord/creditor must fill out their respective parts in full. Omissions may delay the verification process.

- Applicant's Participation: The applicant must sign item 9 before the form is sent. Their signature verifies their acknowledgment and consent to the information verification process.

- Direct Transmission to Lender: The completed form should be sent directly back to the lender named in item 2 by the landlord/creditor. This ensures confidentiality and reduces potential for fraud.

- Confirm Rent or Mortgage Status: Landlords and creditors need to provide accurate details about the rental or mortgage account, such as arrears status and payment regularity.

- Legal Compliance: Note that the form mentions the confidentiality of information provided, aligning with legal requirements. However, disclosure may be necessary if mandated by law.

- Assess Credit Worthiness: Additional information about the applicant’s payment history and account status can assist the lender in making an informed decision regarding the applicant's creditworthiness.

By following these guidelines, applicants, lenders, and landlords/creditors can ensure a comprehensive and compliant process when verifying rent or mortgage details, paving the way for informed lending decisions.

Popular PDF Forms

Fl 330 - It necessitates a declaration under penalty of perjury, ensuring all information presented is accurate and truthful.

Lawsuit Paper - Highlights whether there are any related civil actions arising from the same event, which could affect your case.