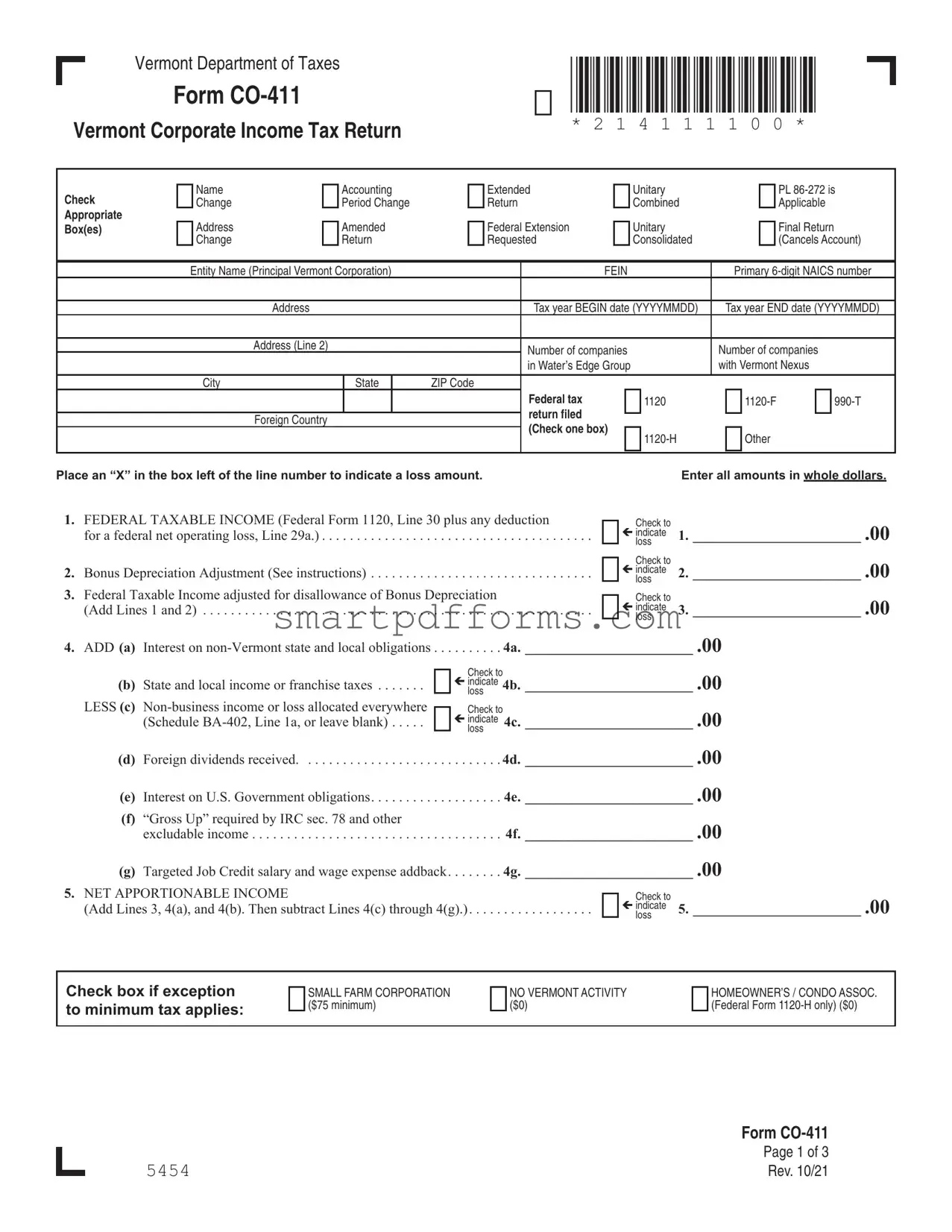

Blank Vt Co 411 PDF Template

The Vermont Department of Taxes requires corporate entities operating within the state to file the Form CO-411, Vermont Corporate Income Tax Return, which serves as a comprehensive report of a corporation's income tax obligations for a specific tax year. This detailed form demands accurate information regarding the company's federal taxable income, accounting for adjustments such as bonus depreciation, and enumerates adjustments specific to Vermont law, including interest on non-Vermont obligations and state and local income taxes. Additionally, it addresses the need for apportioning income according to Vermont's rules, which can include deductions for net operating losses and allocations for foreign dividends, culminating in the determination of net Vermont income. The form also outlines the tax computation schedule, providing clear guidelines based on net income and gross receipts for calculating the owed state corporate income tax. Essential for both the corporation and the tax authorities, this document offers a clear framework for compliance, ensuring corporations fulfill their tax responsibilities while taking advantage of allowable deductions and credits to accurately reflect their financial activities within the state.

Preview - Vt Co 411 Form

|

|

|

Vermont Department of Taxes |

|

|

|

|

|

|

|

*214111100* |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

Form |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Vermont Corporate Income Tax Return |

|

|

* 2 1 4 1 1 1 1 0 0 * |

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Check |

|

|

Name |

|

|

Accounting |

|

|

Extended |

|

|

|

Unitary |

|

|

|

|

PL |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

Change |

|

|

Period Change |

|

|

Return |

|

|

|

Combined |

|

|

|

|

Applicable |

|

|

|||||||||

|

Appropriate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box(es) |

|

|

Address |

|

|

Amended |

|

|

Federal Extension |

|

|

|

Unitary |

|

|

|

|

Final Return |

|

|

||||||||

|

|

|

|

|

Change |

|

|

Return |

|

|

Requested |

|

|

|

Consolidated |

|

|

|

|

(Cancels Account) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entity Name (Principal Vermont Corporation) |

|

|

|

|

|

FEIN |

|

|

|

Primary |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

Address |

|

|

|

|

|

Tax year BEGIN date (YYYYMMDD) |

|

Tax year END date (YYYYMMDD) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (Line 2) |

|

|

|

|

|

Number of companies |

|

|

Number of companies |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

in Water’s Edge Group |

|

|

with Vermont Nexus |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal tax |

|

|

1120 |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

return filed |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

Foreign Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

(Check one box) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Place an “X” in the box left of the line number to indicate a loss amount. |

|

|

|

|

|

|

|

|

Enter all amounts in whole dollars. |

||||||||||||||||||||

1. FEDERAL TAXABLE INCOME (Federal Form 1120, Line 30 plus any deduction

for a federal net operating loss, Line 29a.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Bonus Depreciation Adjustment (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Federal Taxable Income adjusted for disallowance of Bonus Depreciation

(Add Lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Check to |

|

ç indicate |

1. ________________________ .00 |

loss |

|

Check to |

|

ç indicate |

2. ________________________ .00 |

loss |

|

Check to |

|

ç indicate |

3. ________________________ .00 |

loss |

|

4. ADD (a) |

Interest on |

||

|

|

|

Check to |

|

|

|

|

(b) |

State and local income or franchise taxes |

|

ç indicate 4b. ________________________ .00 |

LESS (c) |

|

loss |

|

|

|||

|

Check to |

||

|

|||

|

(Schedule |

|

ç indicate 4c. ________________________ .00 |

|

|

|

loss |

|

|

|

|

(d)Foreign dividends received. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4d. ________________________ .00

(e) |

Interest on U.S. Government obligations |

4e. |

________________________ .00 |

(f) |

“Gross Up” required by IRC sec. 78 and other |

|

________________________ .00 |

|

excludable income |

4f. |

|

(g) |

Targeted Job Credit salary and wage expense addback |

4g. |

________________________ .00 |

5. NET APPORTIONABLE INCOME |

|

Check to |

|

|

|||

(Add Lines 3, 4(a), and 4(b). Then subtract Lines 4(c) through 4(g).) |

|

ç indicate |

5. ________________________ .00 |

|

|

loss |

|

|

|

|

|

Check box if exception to minimum tax applies:

SMALL FARM CORPORATION ($75 minimum)

NO VERMONT ACTIVITY ($0)

HOMEOWNER’S / CONDO ASSOC. (Federal Form

Form

|

Page 1 of 3 |

5454 |

Rev. 10/21 |

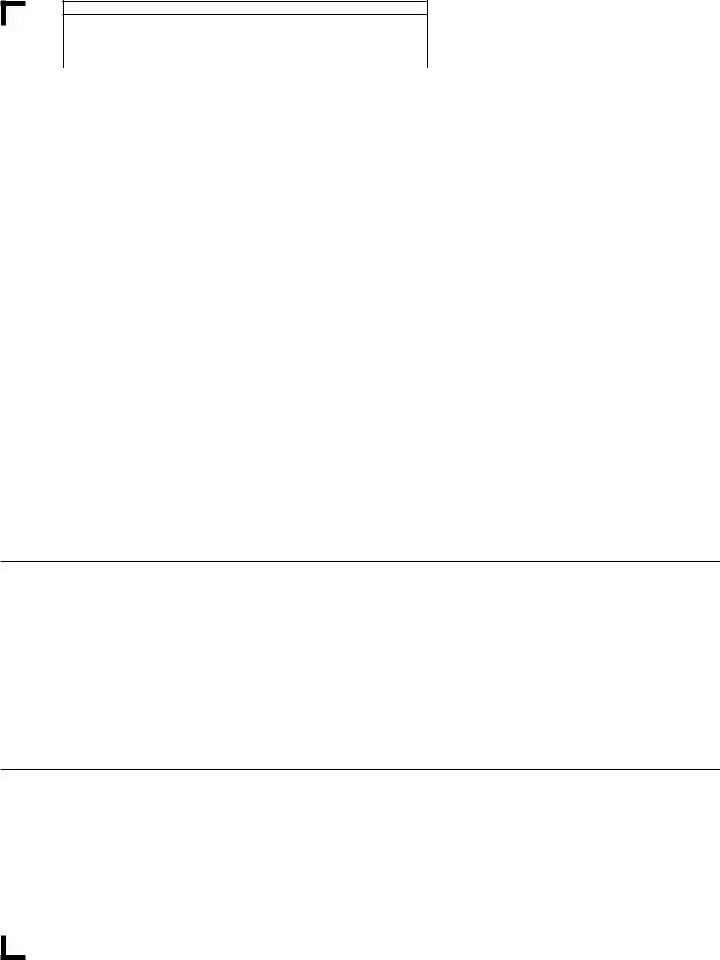

Entity Name

FEIN |

Fiscal Year Ending (YYYYMMDD) |

|

|

*214111200*

* 2 1 4 1 1 1 2 0 0 *

6.Vermont Percentage (100% or amount from Schedule

|

Calculate percentage to six places to the right of the decimal point |

. . . |

. . . . . . . |

. 6. |

__________ . ______________% |

|

|

|

Check to |

|

|

|

|

|

|

||

7. |

Apportionable Income (from Form |

|

ç indicate |

7. |

________________________ .00 |

|

loss |

||||

|

|||||

|

|

|

Check to |

|

|

|

|

|

|

||

8. |

Income Apportioned to Vermont (Multiply Lines 6 and 7) |

|

ç indicate |

8. |

________________________ .00 |

|

loss |

||||

|

|||||

|

|

|

Check to |

|

|

|

|

|

|

||

9. |

Income Allocated to Vermont (Schedule |

|

ç indicate |

9. |

________________________ .00 |

|

loss |

||||

|

|||||

10. |

Foreign Dividends Allocated to Vermont (Schedule |

. . . |

. . . . . . . |

10. |

________________________ .00 |

11. |

Net Vermont Income Allocated and Apportioned to Vermont |

|

Check to |

|

|

|

|

||||

|

(Add Lines 8, 9, and 10.) |

|

ç indicate |

11. |

________________________ .00 |

|

|

loss |

|||

|

|

||||

12. |

Vermont Net Operating Loss deduction applied (Attach schedule) |

. . . |

. . . . . . . |

12. |

________________________ .00 |

|

|

|

Check to |

|

|

|

|

|

|

||

13. |

Vermont Net taxable income for this entity (Line 11 minus Line 12) |

|

ç indicate |

13. |

________________________ .00 |

|

loss |

||||

|

|||||

14. |

Vermont Tax. Apply Vermont Tax Rates (below) to amount on Line 13 |

. . . |

. . . . . . . |

14. |

________________________ .00 |

15. |

Credits (Schedule |

. . . |

. . . . . . . |

15. |

________________________ .00 |

16. |

Use Tax for taxable items on which no sales tax was charged, including online purchases . . |

. . . |

. . . . . . . |

16. |

________________________ .00 |

17. |

Tax Due for this entity (Subtract Line 15 from Line 14. To that result, add Line 16) |

. . . |

. . . . . . . |

17. |

________________________ .00 |

18. |

Gross Receipts (For purpose of minimum tax calculation. See instructions) |

. . . |

. . . . . . . |

18. |

________________________ .00 |

TAX COMPUTATION SCHEDULE

(Effective for taxable periods beginning January 1, 2012)

IF VERMONT NET INCOME IS |

|

TAX IS |

$10,000 or less |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . .6.00% |

$10,001 - $25,000 |

$600 plus 7.00% of excess over $10,000 |

|

$25,001 and over |

$1,650 plus 8.50% of excess over $25,000 |

|

IF VERMONT GROSS RECEIPTS ARE |

MINIMUM TAX IS |

|

$2,000,000 or less |

. . . . . . . . . . . . . . . . . . . . . . . . |

$300 |

$2,000,001 - $5,000,000 |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . $500 |

$5,000,001 and over |

. . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . $750 |

File the return on the due date required under the Internal Revenue Code, unless extended.

Pay by the due date required under the Internal Revenue Code, even if the return is extended.

Corporations with liabilities over $500, see instructions for estimated payments on Vermont Form

Form

|

Page 2 of 3 |

5454 |

Rev. 10/21 |

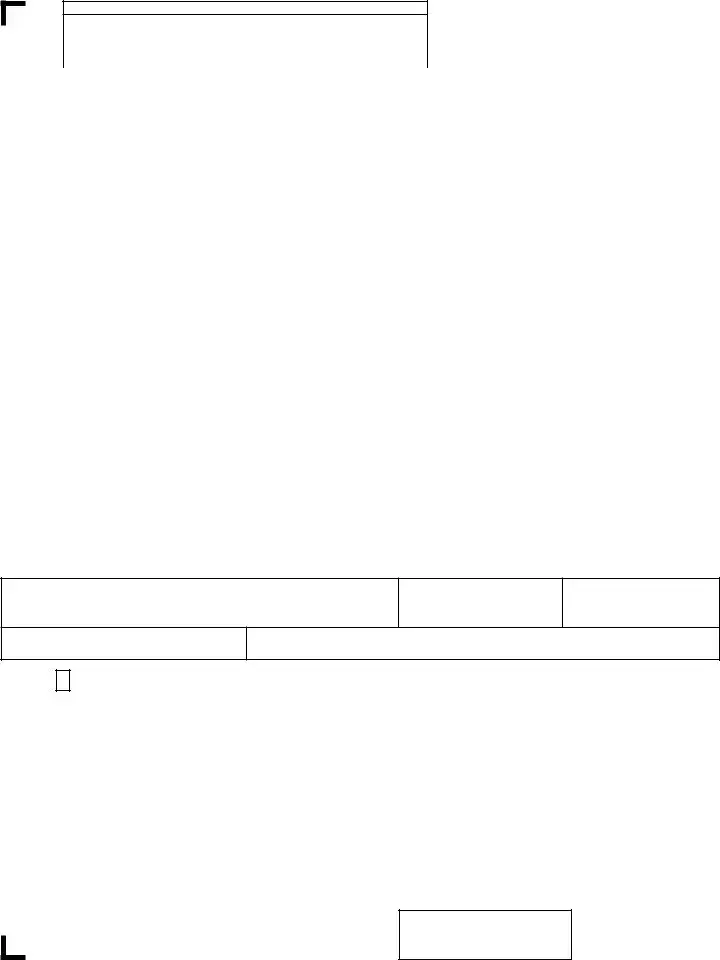

Entity Name

FEIN |

Fiscal Year Ending (YYYYMMDD) |

|

|

Amount from Line 17_____________________________

*214111300*

* 2 1 4 1 1 1 3 0 0 *

19. Total Tax Due (Add Line 17 plus Line 13 of all attached Schedules |

19. ________________________ .00 |

20.Payments

20a. |

Estimated Payments |

20a. |

________________________ .00 |

20b. |

Payment with Extension |

20b. |

________________________ .00 |

20c. |

Nonresident Estimated Payments (Form |

20c. |

________________________ .00 |

20d. |

Real Estate Withholding Payments (Form |

20d. |

________________________ .00 |

20e. |

Prior Year Overpayment Applied |

20e. |

________________________ .00 |

20f. Total Payments (Add Lines 20a through 20e) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . 20f. ________________________ .00 |

|

21.Balance Due. If Line 19 is more than Line 20f, subtract Line 20f from Line 19.

|

Make checks payable to Vermont Department of Taxes |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

21. ________________________ .00 |

22. |

Payment submitted with this return |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

22. ________________________ .00 |

23. |

Overpayment. If Line 20f is more than Line 19, Subtract Line 19 from Line 20f |

23. ________________________ .00 |

|

24. |

Overpayment to be applied to next tax year |

24. ________________________ .00 |

|

25. |

Overpayment to be refunded (Subtract Line 24 from Line 23) |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

25. ________________________ .00 |

|

|

|

|

I hereby certify that I am an officer or authorized agent responsible for the taxpayer’s compliance with the requirements of Title 32 of the Vermont Statutes and that this return is true, correct, and complete to the best of my knowledge. If prepared by a person other than the taxpayer, this declaration further provides that under 32 V.S.A. § 5901, this information has not been and will not be used for any other purpose, or made available to any other person, other than for the preparation of this return unless a separate valid consent form is signed by the taxpayer and retained by the preparer.

Signature of Responsible Officer

Date (MMDDYYYY)

Daytime Telephone Number

Printed Name

Email Address

Check if the Department of Taxes may discuss this return with the preparer shown.

Paid Preparer’s Signature |

|

Date (MMDDYYYY) |

Preparer’s Telephone Number |

||

|

|

|

|

|

|

Preparer’s Printed Name |

Email Address (optional) |

|

|

|

|

|

|

|

|

|

|

Firm’s Name (or yours if |

|

EIN |

Preparer’s SSN or PTIN |

||

|

|

|

|

|

|

Firm’s Address (or yours if |

|

|

|

||

|

|

|

|

|

Check if |

|

|

|

|

|

|

Send return |

Vermont Department of Taxes |

and check to: |

133 State Street |

|

Montpelier, VT |

5454

For Department Use Only

Ck. Amt. |

Init. |

Form

Page 3 of 3

Rev. 10/21

Form Data

| Fact Name | Detail |

|---|---|

| Form Purpose | The VT Form CO-411 serves as the Vermont Corporate Income Tax Return, used by corporations to report their income, calculate taxes owed, and file for tax returns within the state of Vermont. |

| Governing Law | This form is governed by Title 32 of the Vermont Statutes, which outlines the legal requirements for state taxation and compliance for corporations operating within Vermont. |

| Due Date | Corporations must file Form CO-411 by the due date required under the Internal Revenue Code, even if the return is extended. Payments are also due by this federally mandated date, with specific provisions for corporations with liabilities over $500. |

| Adjustments and Credits | The form allows for various adjustments to federal taxable income, such as bonus depreciation adjustment, and provides a section to claim tax credits and determine net Vermont taxable income after applying Vermont tax rates and credits. |

Instructions on Utilizing Vt Co 411

Filing the Vermont Corporate Income Tax Return, Form CO-411, is a crucial step for corporations operating within Vermont to comply with state tax obligations. This form helps entities report their income, calculate taxes due, and identify any payments or overpayments. Below is a guided walkthrough to complete this form accurately.

- Begin by entering the Entity Name and FEIN (Federal Employer Identification Number) at the top of the form.

- Specify the Primary 6-digit NAICS number to classify your corporation’s industry.

- Enter the Tax year BEGIN and END date using the format YYYYMMDD.

- Fill in the corporate Address, including Line 2 if necessary, and the City, State, and ZIP Code.

- Indicate the number of companies and the number of companies in the Water’s Edge Group with Vermont Nexus.

- Check the appropriate box(es) at the top of the form for specific filing situations such as amended return, federal extension, or consolidated filing.

- Report the FEDERAL TAXABLE INCOME on line 1, taking the figure from Federal Form 1120, Line 30.

- Adjust the federal taxable income for disallowance of bonus depreciation if applicable and enter on line 2, then calculate and enter the adjusted federal taxable income on line 3.

- Complete lines 4a through 4g to make additions for certain non-Vermont state and local obligations, franchise taxes, and other specific adjustments, then calculate the NET APPORTIONABLE INCOME on line 5.

- For corporations eligible, check if the small farm corporation minimum tax or no Vermont activity applies.

- Enter the Vermont Percentage on line 6, derived from Schedule BA-402, Line 22.

- Calculate the Apportionable Income (line 7), Income Apportioned to Vermont (line 8), and other allocated incomes to determine the Net Vermont Income Allocated and Apportioned to Vermont on line 11.

- Deduct any Vermont Net Operating Loss on line 12 and compute the Vermont Net Taxable Income for this entity on line 13.

- Apply the Vermont Tax Rates to the net taxable income to calculate the Vermont tax on line 14.

- Detail any credits from Schedule BA-404 on line 15 and calculate the total tax due.

- Complete the payment section, including estimated payments, payment with extension (if applicable), nonresident payments, real estate withholding payments, and any prior year overpayment applied.

- Calculate the Balance Due or Overpayment, indicating the amount to be applied to the next tax year or to be refunded.

- Ensure an officer or authorized agent of the corporation signs and dates the form, including a daytime telephone number and email address. If a paid preparer completes the form, their information must also be included.

- Mail the completed form and any payment due to the Vermont Department of Taxes at the provided address.

Completing the Form CO-411 accurately ensures compliance with Vermont's tax laws and aids in the timely processing of your corporate income tax obligations. Always refer to the latest instructions provided by the Vermont Department of Taxes to capture any updates or changes to filing procedures.

Obtain Answers on Vt Co 411

What is Form CO-411?

Form CO-411 is the Vermont Corporate Income Tax Return used by Vermont corporations to report their corporate income tax to the Vermont Department of Taxes. It includes various sections for reporting federal taxable income, making necessary adjustments, calculating Vermont net income, and determining the tax owed or refund due to the state.

Who needs to file Form CO-411?

Any corporation operating in Vermont with a tax liability or presence must file Form CO-411. This includes entities doing business within the state, generating income from Vermont sources, or otherwise required to file under Vermont tax laws.

When is Form CO-411 due?

The form is due on the same date as the federal tax return, including any extensions granted by the Internal Revenue Service (IRS). Corporations should consult their calendar year or fiscal year-end to determine the specific due date.

What is the minimum tax for corporations filing the CO-411 form?

The minimum tax is based on Vermont gross receipts: $300 for receipts of $2,000,000 or less; $500 for receipts between $2,000,001 and $5,000,000; and $750 for receipts over $5,000,001.

Are there specific credits or deductions that can be claimed on Form CO-411?

Yes, corporations can claim certain credits and deductions such as the Vermont Net Operating Loss Deduction and credits from Schedule BA-404. Specific adjustments are also made for items like interest on non-Vermont state and local obligations and foreign dividends.

How do corporations calculate their taxable income on Form CO-411?

Taxable income is calculated by starting with federal taxable income, making adjustments for bonus depreciation and other Vermont-specific additions or subtractions, apportioning income to Vermont, and then applying any allowable deductions and credits.

What happens if a corporation discovers an error after filing Form CO-411?

If errors are found after filing, corporations should file an amended return. To indicate an amended return, check the "Amended Return" box at the top of Form CO-411 and include any corrected information or additional documentation.

Can Form CO-411 be filed electronically?

While the Vermont Department of Taxes encourages electronic filing for efficiency and faster processing, corporations should check the current electronic filing options and requirements directly with the department or through their tax professional.

Are there any penalties for filing Form CO-411 late?

Yes, corporations filing late may face penalties and interest on any unpaid tax. Specific penalty rates and interest calculations are outlined in the Vermont tax regulations and depend on the amount of tax overdue and the length of the delay.

What should be attached with Form CO-411 when filing?

When filing Form CO-411, corporations need to attach any relevant schedules, such as Schedule BA-402 for apportionment calculations, any federal return forms referenced on CO-411, and documentation for credits claimed. Ensure to review the form instructions for a complete list of required attachments.

Common mistakes

When completing the Vermont Department of Taxes Form CO-411, which pertains to Vermont Corporate Income Tax Return, individuals often encounter a variety of pitfalls. Understanding these common mistakes can significantly streamline the process and ensure the accuracy of the submission. Below are seven frequent errors to be aware of:

- Incorrect Financial Information: Transposing numbers or entering inaccurate financial data from Federal Form 1120, such as mistakes in federal taxable income (Line 1) or bonus depreciation adjustment (Line 2), can lead to substantial discrepancies in calculated taxes.

- Failure to Indicate Losses Appropriately: Neglecting to mark the boxes next to line numbers to indicate a loss amount, as required in several sections of the form, can result in an incomplete or incorrect tax calculation.

- Overlooking Addbacks and Deductions: Omitting necessary addbacks (e.g., interest on non-Vermont state and local obligations or targeted job credit salary addbacks) and deductions can lead to an inaccurate net apportionable income figure.

- Incorrect Apportionment Calculation: Misunderstanding how to correctly calculate the Vermont percentage (Line 6) and consequently misapplying it to determine the income apportioned to Vermont (Line 8) is a common error that can affect the tax owed.

- Not Checking Applicable Boxes: Forgetting to check the applicable boxes for specific conditions that affect tax calculations, such as claiming exceptions to minimum tax, can lead to inaccuracies in the determination of tax liabilities or benefits.

- Misunderstanding Payment and Overpayment Sections: Errors in calculating the total tax due (Line 19), estimated payments (Line 20a), or accurately reporting overpayments to be applied to the next tax year (Line 24) can affect the financial outcome and lead to discrepancies.

- Incorrect or Incomplete Identification Information: Failing to provide or incorrectly providing vital identification details such as the Entity Name, FEIN, and the primary 6-digit NAICS number can lead to processing delays or even the return being rejected.

It is essential for individuals responsible for preparing and filing Form CO-411 to review these areas carefully and ensure all information is complete and accurate before submission. This will help in avoiding potential fines, penalties, or delays in processing.

Documents used along the form

When businesses prepare their Vermont Corporate Income Tax Return using Form CO-411, several additional forms and documents may need to be completed and included, depending on the specific financial activities and status of the business. These documents play a crucial role in providing a comprehensive overview of the company's tax situation to the Vermont Department of Taxes. Here is a list of other forms and documents that are often used in conjunction with Form CO-411:

- Form CO-414 – This form is used for estimating and making quarterly tax payments. It's necessary for corporations that expect to owe more than $500 in taxes for the year.

- Schedule BA-402 – Allocates and apportions income to Vermont. This schedule is essential for determining the amount of income that should be taxed by the state.

- Form BA-404 – Used for claiming tax credits. These credits can reduce the total amount of taxes owed and are crucial for businesses eligible for specific Vermont tax incentives.

- Form WH-435 – Related to nonresident estimated income tax payments. Companies with nonresident employees need to complete this form to comply with withholding requirements.

- Form RW-171 – Necessary for reporting real estate withholding tax. This applies to businesses involved in real estate transactions in Vermont.

- Federal Form 1120 – The U.S. Corporation Income Tax Return. It's the foundational document that Vermont Form CO-411 builds upon, adjusting federal taxable income for state-specific items.

- Financial Statements – Balance sheets, income statements, and other financial documents must often accompany tax forms, providing a detailed view of the company's financial health.

- Documentation of Estimated Tax Payments – This includes bank statements or receipts proving that estimated tax payments were made throughout the year, helping to reconcile total amounts due or overpaid.

Together, Form CO-411 and these related documents enable businesses to accurately report their income, calculate taxes due, and take advantage of eligible tax credits and deductions. They collectively ensure compliance with Vermont tax laws while helping businesses understand their tax obligations. It's essential for companies operating in Vermont to familiarize themselves with these forms to ensure thorough and accurate tax reporting.

Similar forms

The Form 1120, U.S. Corporation Income Tax Return, bears resemblance to the Vermont Corporate Income Tax Return (Form CO-411) mainly in its purpose and structure. Both forms are designed for entities filing income taxes, Form 1120 for the federal level and Form CO-411 for the state of Vermont. These forms require similar information regarding the corporation's income, deductions, and credits to calculate the tax owed or refund due.

Form 1120-F, U.S. Income Tax Return of a Foreign Corporation, is similar to Form CO-411 in that it addresses the income tax responsibilities of corporations, but specifically those that are foreign. The similarity lies in the comprehensive detail both forms demand about the income, losses, and operational financial data of the companies to accurately assess their tax obligations within their respective jurisdictions.

The Form 990-T, Exempt Organization Business Income Tax Return, shares common ground with Form CO-411 through its purpose of reporting income and calculating taxes owed, but for exempt organizations. Much like Form CO-411, Form 990-T requires details on revenues, deductions, and potentially taxable activities, illustrating how organizations, not traditionally subject to income taxes, still have specific tax liabilities to report.

Form 1120-H, U.S. Income Tax Return for Homeowner Associations, is paralleled with the Vermont Corporate Income Tax Return in its targeted demographic and tax treatment for specialized entities. Though Form 1120-H is specifically for homeowner associations, and Form CO-411 serves a broader corporate audience, both forms accommodate entities with unique tax considerations, offering specific lines and regulations that reflect their operational differences.

Form CO-414, Estimated Tax Payments for Corporations, functions in conjunction with Form CO-411 similar to how federal estimated tax forms work with Form 1120. Form CO-414 is for pre-paying expected state tax liability throughout the year. This proactive approach in tax planning enables corporations to manage cash flow and avoid underpayment penalties, paralleling the logic and intent behind Form CO-411's final tax calculation and payment sections.

Dos and Don'ts

Completing the Vermont Corporate Income Tax Return (Form CO-411) requires attention to detail and an understanding of your organization's financial and operational status throughout the fiscal year. Below is a list of essential do's and don'ts to guide you through the process effectively:

- Do ensure that all information matches the documentation provided in federal tax filings to maintain consistency and accuracy.

- Do verify the correct selection of boxes at the top of the form, especially concerning the type of return being filed, to avoid processing errors or delays.

- Do use whole dollar amounts when entering figures into the form. This simplifies calculations and is a standard requirement.

- Do check all arithmetic for accuracy. Errors in calculation can lead to incorrect tax amounts being reported, which might result in penalties or additional scrutiny.

- Do carefully review the Tax Computation Schedule to accurately determine your tax liability based on Vermont net income and gross receipts.

- Don't overlook the need to sign and date the return. An unsigned return is considered incomplete and can delay processing.

- Don't ignore the specific instructions for deductions and adjustments, such as the Bonus Depreciation Adjustment. Incorrect adjustments can significantly affect your tax liability.

- Don't submit the form without reviewing it for completeness and correctness. Missing information can lead to processing delays and potential for inaccuracies.

- Don't hesitate to consult with a tax professional if there are aspects of the form or instructions that are unclear. This can prevent mistakes and ensure compliance with Vermont tax laws.

By following these guidelines, organizations can complete Form CO-411 with confidence, ensuring compliance with Vermont's tax regulations and contributing to a smooth processing experience.

Misconceptions

There are several misconceptions surrounding the Vermont Corporate Income Tax Return, Form CO-411. Clarifying these can help ensure accurate and efficient filing for corporations.

Misconception 1: The CO-411 form is optional for businesses operating in Vermont. Contrarily, this form is a requirement for all corporations doing business in Vermont to report their income and calculate their state corporate income tax accurately.

Misconception 2: Filing a federal tax return eliminates the need for Form CO-411. This is incorrect. Even though information from federal tax returns is used in completing the CO-411, corporations must still file it separately with the Vermont Department of Taxes to comply with state tax regulations.

Misconception 3: All sections of the form apply to every corporation. This isn't the case. Certain sections of the form apply only to specific situations, such as consolidated returns, federal extensions, and changes in accounting periods. Corporations should carefully review the form to determine which sections they need to complete based on their circumstances.

Misconception 4: The form is too complex for a layperson to complete without professional help. While the form can be complex, the Vermont Department of Taxes provides instructions and resources to assist filers. Many corporations are able to accurately complete and file Form CO-411 with the assistance of these resources, though professional advice can be beneficial.

Misconception 5: Electronic filing of Form CO-411 is not allowed. On the contrary, the Vermont Department of Taxes encourages electronic filing for efficiency and faster processing. Electronic filing is available and often preferred for its convenience and environmental benefits.

Misconception 6: The primary purpose of Form CO-411 is to assess penalties against corporations. The main goal of Form CO-411 is not to penalize corporations but to determine the correct amount of state income tax owed by a corporation operating in Vermont. While penalties can be assessed for late or incorrect filings, the form's intention is to ensure each corporation pays its fair share of taxes.

Understanding the purpose and requirements of Form CO-411 can mitigate these misconceptions, aiding corporations in their compliance with Vermont tax laws.

Key takeaways

When preparing and filing the Form CO-411, Vermont Corporate Income Tax Return, it's crucial to understand several key aspects to ensure accuracy and compliance. Below are important takeaways to consider:

- Check the correct boxes at the top of the form to indicate specific circumstances such as name or address changes, accounting period adjustments, and if the filing is for an amended, final, or consolidated return.

- Accurately report the Federal Taxable Income from Federal Form 1120, adjusting for any net operating loss deductions and other specific adjustments like bonus depreciation as specified in the form instructions.

- Understand and apply the adjustments for non-Vermont state and local obligations, state and local income or franchise taxes, and specific deductions like foreign dividends received, targeted job credits, and interest on U.S. Government obligations.

- Ensure the correct calculation of Net Apportionable Income by adding and subtracting the necessary amounts as directed in the form instructions, considering all income sources and applicable adjustments.

- Apportionable and allocated income must be accurately calculated, including Vermont-specific adjustments and allocations, to determine the correct taxable income attributed to Vermont operations.

- Utilize the Vermont Percentage from Schedule BA-402 correctly to apportion income to Vermont, ensuring to calculate the percentage to six decimal places for precision.

- Correctly calculate the Tax Due, understanding the Vermont tax rates and minimum tax calculations based on Vermont Gross Receipts, to ensure the correct amount of tax is paid.

- Accurately report payments made and calculate the balance due or overpayment, considering estimated payments, payment with extension, and any withholding or overpayments from the prior year. Also, indicate clearly the action to be taken with any overpayment, whether it is to be refunded or applied to the next tax year.

Filing the Form CO-411 accurately is essential for meeting Vermont's corporate income tax requirements. Adhering to these key points helps avoid common errors and ensures compliance with state tax laws. Always consult the form instructions or a tax professional for guidance specific to your situation.

Popular PDF Forms

Wv Sales Tax Form - Highlights exemptions for inter-corporate purchases when entities are part of the same controlled group.

Nyc Corp Tax Rate - It acts as a bridge for corporations to manage their franchise tax responsibilities without compromising on accuracy or timeliness.